Financial situation in regional energy supply

Автор: Chaika Larisa Viktorovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 3 (45) т.9, 2016 года.

Бесплатный доступ

It is important to monitor the financial condition of energy supply organizations in regional management and development of energy infrastructure. This condition depends on economic factors, tariff regulation and budget subsidies. The article presents indicators of aggregated financial statistics on energy supply in the regions of Russia's European North. For the purpose of comparative analysis, the author formed a comprehensive indicator of financial stability and evaluated trends in the dynamics of past due debt and profitability. The analysis shows the following sectoral and regional characteristics: the financial situation in the electric power sector is relatively stable, but it is unsatisfactory in heat supply; the increase in negative trends, such as the decrease in repayment ability, low and negative profitability, and the accumulation of considerable arrears. Financial instability becomes a system-wide characteristic of heat supply. It is necessary to introduce a multi-step process of financial recovery of the industry as a whole...

Regional energy policy, regions of the european north of Russia, energy supply, financial situation, stability, financial results, coefficients

Короткий адрес: https://sciup.org/147223849

IDR: 147223849 | УДК: 620.9:336.6(470.1/.2) | DOI: 10.15838/esc.2016.3.45.5

Текст научной статьи Financial situation in regional energy supply

Sustainable financial situation in industrial enterprises is a necessary factor in successful development, and it is achieved through effective management and favorable economic situation. Financial flows in energy supply in the regions of Russia’s European North (REN)1 depend very much on the regional public administration due to the direct effect of tariff regulation and budgetary subsidies. Therefore, in the framework of the regional energy policy, considerable importance is attached to the monitoring and analysis of financial and economic indicators of energy supply activities for the purpose of identifying negative trends and adjusting regional management efforts.

Tariff policy is a key factor that influences economic indicators of energy companies (in both the regulated and liberalized parts of the energy market since they have systemic ties), and the tasks to improve this policy remain critical [3, 10, 14]. The range of issues concerning the financial situation and institutional organization of public utilities and energy in Russia is covered in the research of domestic economic scientists [7, 13, 15]. The methodology for financial stability, integrated assessment and financial analysis tools are developed in the works [1, 8, 16]. In the framework of the research described in the present paper, the author tested various techniques to determine the level of financial stability, solvency (D.

Durand), and assess the risk of bankruptcy (E. Altman, etc.) of enterprises [2, 12, 18], but the use of aggregated sectoral indicators in the econometric models of firms may not be quite accurate, therefore, the financial situation was assessed according to the recommendations [5, 9].

Relative financial ratios are used for analyzing financial stability and solvency. Their values, dynamics and comparison by groups of related enterprises are used for the integral assessment of the financial situation [5, 6, 9, 11]. The autonomy coefficient, the coefficient of provision with own capital, and current liquidity coefficients characterize the structure of the balance. If the value of these ratios is below their recommended values, then the balance structure is unsatisfactory, and the enterprise – insolvent [11].

The autonomy coefficient characterizes the independence of the financial situation from borrowed sources and determines the share of own funds in the total amount of assets that are advanced in production activity. An enterprise is considered to be financially independent, if the share of equity capital in its total amount is not less than 30% and normally – not less than 50%. Aggregate indicators of electric power industry in REN regions (tab. 1) comply with this criterion of financial independence; as for the heat industry, it depends considerably on borrowed capital (excluding Nenets Autonomous Okrug (NAO)).

Table 1. Financial stability indicators

|

Type of economic activity, region |

Financial ratios 2014/2015*, their recommended values, % |

Calculated integrated indicator of financial stability ( I fs ) |

||

|

autonomy ( C aut ) |

provision with own working capital ( C owc ) |

current liquidity ( R cl ) |

||

|

not less than 30 (norm is 50) |

not less than 10 (norm is 50) |

not less than 150 (norm is 200) |

not less than 0.5 (norm is 1.0) |

|

|

Generation, transmission and distribution of electricity, Russian Federation |

71/69 |

-8/-44 |

185/136 |

0.7/0.4 |

|

Including: Arkhangelsk Oblast (without NAO) |

34/27 |

14/8 |

128/117 |

0.5/0.4 |

|

Karelia Republic |

34/42 |

7/8 |

187/167 |

0.6/0.8 |

|

Komi Republic |

62/51 |

33/30 |

158/155 |

0.9/0.8 |

|

Murmansk Oblast |

76/73 |

63/58 |

298/272 |

1.4/1.3 |

|

NAO |

91/90 |

75/79 |

463/472 |

1.9/1.9 |

|

Generation, transmission and distribution of heat energy in the Russian Federation: |

47/47 |

-29/-31 |

101/101 |

0.3/0.3 |

|

Including: Karelia Republic |

-13/-28 |

-55/-76 |

69/64 |

-0.3/-0.6 |

|

Arkhangelsk Oblast (without NAO) |

4/17 |

-47/-41 |

77/88 |

-0.2/-0 |

|

Murmansk Oblast |

10/3 |

-48/-46 |

91/93 |

-0.2/-0.1 |

|

Komi Republic |

16/14 |

-10/-9 |

98/98 |

0.2/0.2 |

|

NAO |

87/86 |

71/67 |

549/310 |

2.0/1.5 |

The coefficient of provision with own working capital assesses the ability of an enterprise to pay its short-term obligations, implementing all of its current assets. This indicator is defined as the ratio of own working capital to the value of current assets, its normal value should not be less than 10%, its recommended value – about 50%. A negative index of own working capital characterizes the organization’s financial situation extremely negatively. The table shows that heat supply enterprises in

REN regions (except for NAO) experience a significant deficit of own working capital.

The current liquidity ratio is an indicator of the solvency of enterprises, and an indicator of short-term financial stability. It is defined as the ratio of the value of current assets to the most urgent obligations of the enterprise. It follows from the table that heat supply of the regions (except for NAO) does not have enough current assets to pay current liabilities, the situation is different in electric power supply.

For the purposes of comparative analysis, a comprehensive indicator of financial stability, taking into account the normalized values of financial ratios was formed (similar to [5]):

Ifs = 1/3(Caut/50 + Cowc /50+Rcl /200) , where Ifs – calculated integrated indicator of financial stability;

Caut – coefficient of autonomy;

Cowc – coefficient of provision with own working capital;

Rcl – current liquidity ratio.

The calculation results are presented in the table: financial stability is satisfactory in the electric power industry in the regions, the integrated indicator is within the recommended range, the best performance indicators are observed in the Murmansk Oblast and Nenets Autonomous Okrug; the situation in heat supply (except for NAO) is unsatisfactory. Comparison of the indicators for 2014 and 2015 shows a slight change, but mostly not in the direction of improvement.

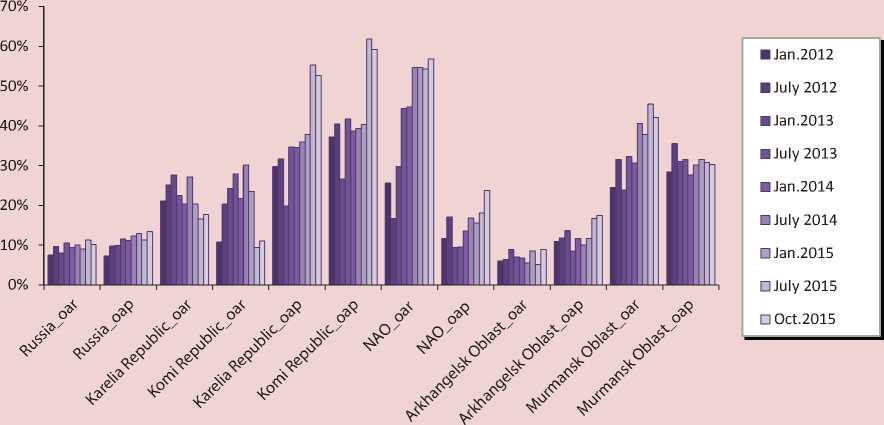

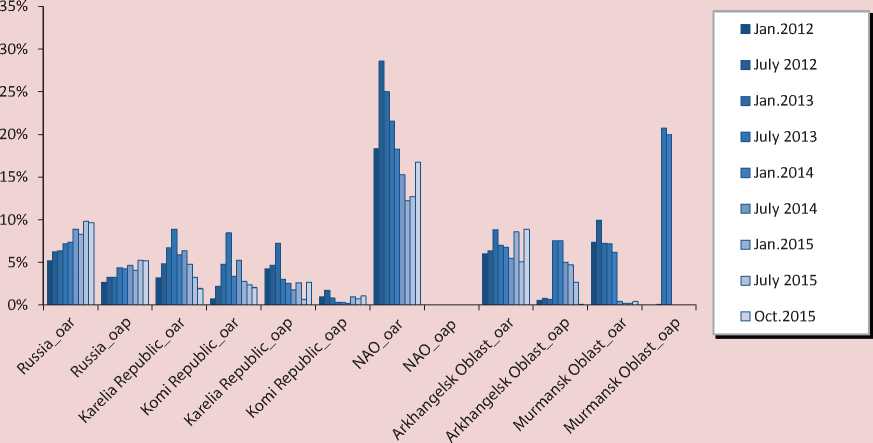

Statistics of the aggregated financial results in the energy supply of REN regions reflected in the indicators of debt and profitability demonstrates the unfavorable situation and negative dynamics, especially in heat supply (tab. 2, fig. 1, 2) .

In the period under consideration that covers 2012–2014, heat supply of REN regions was a financially unprofitable activity (see tab. 2): we observe persistently

Table 2. Financial performance of energy supply activity*, %

|

Production, transmission and distribution of electric power |

Production, transmission and distribution of heat power |

|||||||||

|

Product profitability** |

Return on assets,*** 2014 |

Share of unprofitable organizations, as of January 01, 2015 |

Product profitability |

Return on assets, 2014 |

Share of unprofitable organizations, as of January 01, 2015 |

|||||

|

2012 |

2013 |

2014 |

2012 |

2013 |

2014 |

|||||

|

Murmansk Oblast |

0 |

-8 |

0 |

-1 |

54 |

-5 |

-6 |

-3 |

-2 |

71 |

|

Karelia Republic |

6 |

5 |

4 |

5 |

25 |

-8 |

-5 |

-4 |

-10 |

66 |

|

Arkhangelsk Oblast |

1 |

1 |

0 |

0 |

19 |

-4 |

-7 |

-11 |

-7 |

63 |

|

NAO |

-2 |

-2 |

-6 |

-3 |

100 |

1 |

8 |

-26 |

-16 |

67 |

|

Komi Republic |

3 |

4 |

4 |

8 |

29 |

-3 |

2 |

-7 |

-6 |

72 |

|

Russian Federation |

4 |

3 |

3 |

1 |

26 |

-4 |

-6 |

-8 |

-5 |

60 |

Notes: *Calculated according to EMISS Rosstat data. Available at: databases/emiss/

** The ratio of profit before tax to the total cost price (including distribution and administrative expenses).

*** The ratio of net profit to assets.

Figure 1. Dynamics of overdue accounts receivable (OAR) and overdue accounts payable (OAP) of heat supply organizations (in % to the annual volume of heating services in the regions)

Figure 2. Dynamics of overdue accounts receivable (OAR) and overdue accounts payable (OAP) of electricity supply organizations (in % to the annual volume of electricity supply services in the regions)

negative values of profitability of products and assets; the share of unprofitable organizations in each region is high; all in all, according to Rosstat, as of January 01, 2015, out of 116 heat supply organizations in REN, 77 are unprofitable. In electric power supply, the aggregated financial results are better, with the exception of NAO, electricity industry in general has low profitability, 34% of organizations are unprofitable (16 out of 47).

Total overdue accounts receivable (OAR) in REN, as of November 01, 2015, reached 21 billion rubles in heat supply and 2.9 billion rubles in power supply. The amount of overdue accounts payable (OAP) was 19.5 billion rubles in heat supply and 0.7 billion rubles in electricity supply. Among the regions, the bulk of overdue debts is formed in the Komi Republic and Murmansk Oblast. In comparison with the cost of production released in 2014, it is more than 60 billion rubles for thermal energy and 85 billion rubles for electric power. A critically high debt burden has been formed in heat supply; moreover, during the entire period of 2012, this burden was growing, while the volume of debt in heat supply was considerably lower, and the situation in the dynamics improved. This trend is due to the existing measures of a more strict payment discipline in the wholesale and regional electricity markets (collateral, prepayment, etc.), and also due to a smaller share of housing and utilities consumption payment in the total amount of energy consumption (about 10%) in comparison with the thermal energy market (above 50%).

Comparison of the situation in the regional markets with regard to the relative volumes of OAR and OAP (in % to the annual volume of production of products and services of the relevant type of activity in the region) clearly shows the scale of non-payment issues. The dynamics of debt burden in heat supply in 2012–2015 (see fig. 1) has the following specific features: the share of overdue debts in the total value of the market is significantly above the national average level; the most critical situation is observed in NAO, in the Komi Republic and Murmansk Oblast; over the entire period, thee was a considerable increase in ODR (a growing trend and critically high values – over 40% of the value of the annual production volume); the situation in Karelia was improving at a moderate pace, and the relatively low values of the indicators were achieved in the Arkhangelsk Oblast. The growth of OAR leads to the shortage of financial resources of heat supply organizations for the repayment of their debt obligations, which is demonstrated by the autocorrelation of the time series.

The dynamics of debt burden in electricity supply (see fig. 2) shows that, in contrast to the energy market of Russia as a whole, three regions of REN showed a downward trend and by October 2015 they reached relatively low values (under 5%).

A consistently negative profitability in regional heat supply (see tab. 2) results mainly from writing-off significant amounts of irrecoverable debt and from the “restricting” tariff regulation when the provision of compensatory subsidies is insufficient. In many parts of REN, especially in rural areas, the prices of heat energy set by its producers exceed manifold the regional average cost of heating services and the purchasing power of consumers; therefore, applying preferential tariffs is socially feasible. In case when the regional regulator sets the tariffs below an economically justified level, the imbalance of revenues and expenditures is covered by budgetary subsidies. Every year, significant budget funds are allocated to heat supplying organizations as a compensation for their revenues that they have not received as a result of tariff regulation (in the Murmansk Oblast – about 2 billion rubles, in the Arkhangelsk Oblast and the Republic of Komi – 1.3–1.5 billion rubles, in NAOs and Karelia – 0.4 billion rubles)[17]. This practice is planned by the regional government programs and for the future period up to 2020. Along with this, is necessary to note the deficit of the budgets in REN regions, which naturally leads to a maximum possible reduction of all costs, including the costs on the maintenance of current activities and development of energy infrastructure.

Generally speaking, the comparison of financial performance in electricity and heat supply shows that the most unfavorable situation and negative tendencies are formed in the heat business. In accordance with recommendations of the Federal State Statistics Service [9], the financial situation in heat supply activities in all the regions of REN is required to be evaluated as “unsatisfactory”. As for the electric power industry, the structure of the balance and its solvency are relatively better, but the presence of outstanding debts and a low profitability do not allow us to assess the financial situation as satisfactory.

The combination of low values of liquidity ratios, chronic shortage of working capital, high proportion of overdue accounts receivable is an evidence of significant financial difficulties, including bankruptcy [11].

For a long time, the considerable amounts of non-payments in the regional heat supply markets indicated the lack of effective mechanisms to ensure payment discipline and the need to introduce special measures at the level of the federal law and regional governance. In 2016, Federal Law 307-FZ of November 03, 2015 entered into force; it aims to strengthen payment discipline of energy resources consumers and imposes penalties and sets out requirements for the provision of financial guarantees. However, energy supplying companies have already noted the need to supplement it in terms of eliminating unsecured intermediaries and significant cash shortages, etc.

Thus, on the one hand the non-payment, tariff imbalances and insufficient or delayed their budget subsidies – exogenous factors, which minimize the flow of financial resources in the heat supply. These conditions are forcing utility companies to increase accounts payable or involve costly loans to ensure the operational activities that lead to critical increase in liabilities and the threat of bankruptcy. On the other hand, the heat are not fully engaged internal technological and economic reserves of increase of efficiency, due to the lack of incentive to reduce costs of tariff regulation and strict control over the efficiency of operating and investment activities that often there is a regional audit bodies on the facts of irrational use of allocated budget funds.

The heat supply required a multi-step process of financial recovery of the industry as a whole: in the first place – the elimination of the external conditions of insolvency and financial instability, then – ensuring financial balance in the long period. Since the main causes of the poor financial condition consist in external factors such as imbalances of tariff regulation and lack of payment discipline, it is important to generate corrective institutional conditions. In the strategic plan a stable financial and economic condition of industrial enterprises is impossible without technological modernization and innovative development [4]. This statement fully applies to the energy infrastructure, in which over half of production funds need expedited replacement. Low efficiency of outdated technologies, depreciation of equipment and networks, excessive losses are the reasons for the high cost of useful energy release. But with the current poor financial condition of the heat supply necessary technological modernization cannot be realized at the expense of own or borrowed funds. Therefore the first priority of the regional energy policy is to create conditions for financial recovery of heat supply activities by tightening payment discipline, the competent tariff regulation and control, elimination of the practice of tariff imbalances, the implementation of state investment in technological upgrading.

Список литературы Financial situation in regional energy supply

- Abdukarimov I.T., Ten N.V. Effektivnost' i finansovye rezul'taty khozyaistvennoi deyatel'nosti predpriyatiya: kriterii i pokazateli, ikh kharakterizuyushchie, metodika otsenki i analiza . Sotsial'no-ekonomicheskie yavleniya i protsessy , 2011, no. 5-6, pp. 11-21. .

- Analiz finansovoi ustoichivosti . Available at: http://investment-analysis.ru/analysis-financial-statements.html. .

- Antonov N.V., Tatevosova L.I. Tarif razvitiya i investirovanie teplosnabzheniya munitsipal'nykh obrazovanii . Problemy prognozirovaniya , 2006, no. 4, pp. 98-111.

- Balychev S.Yu., Bulava I.V., Mingaliev K.N. Analiz finansovogo sostoyaniya predpriyatiya i vnutrennie mekhanizmy ego ozdorovleniya . Ekonomicheskii analiz: teoriya i praktika , 2009, no. (160), pp. 18-25. .

- Bespalov M.V. Kompleksnyi analiz finansovoi ustoichivosti kompanii: koeffitsientnyi, ekspertnyi, faktornyi i indikativnyi . Finansovyi vestnik: finansy, nalogi, strakhovanie, bukhgalterskii uchet , 2011, no. 5, pp. 10-18. .

- Bespalov M.V. Metodika provedeniya analiza likvidnosti i platezhesposobnosti organizatsii . Finansy: planirovanie, upravlenie, kontrol' , 2011, no. 3. .

- Boldyreva I.A. Optimizatsiya sistemy upravleniya finansami v zhilishchno-kommunal'noi sfere kak faktor dostizheniya ekonomicheskoi bezopasnosti . Finansovaya analitika: problemy i resheniya , 2011, no. 47 (89), pp. 51-55. .

- Krylov S.I., Reshetnikova O.E. Metodicheskie aspekty analiza i prognozirovaniya finansovogo sostoyaniya promyshlennogo predpriyatiya . Finansovaya analitika: problemy i resheniya , 2010, no. 8 (32), pp. 2-8. .

- Metodologicheskie rekomendatsii po provedeniyu analiza finansovo-khozyaistvennoi deyatel'nosti organizatsii: utv. Goskomstatom Rossii 28.11.2002 . Konsul'tantPlyus . .

- O situatsii s teplosnabzheniem v Rossiiskoi Federatsii: otchet Fonda energeticheskogo razvitiya . Available at: http://www.energofond.ru/novosti/otchet_o_situatsii_s_teplosnabgeniem_v_rossiyskoy_federatsii. .

- Orekhov S.A. Metodologiya finansovogo analiza i puti ukrepleniya finansovogo sostoyaniya predpriyatiya . Innovatsionnaya ekonomika: informatsiya, analitika, prognozy , 2010, no. 1, pp. 87-90. .

- Platezhesposobnost' (metodika D. Dyurana) . Available at: http://investment-analysis.ru/metodFSA2/duran-solvency.html. .

- Ryakhovskaya A.N. Osnovy stabil'nogo funktsionirovaniya predpriyatii zhilishchno-kommunal'nogo khozyaistva . Vestnik finansovogo universiteta , 2014, no. 4, pp. 33-40. .

- Strategiya razvitiya teplosnabzheniya i kogeneratsii v Rossiiskoi Federatsii na period do 2020 goda: Proekt. 2-ya versiya ot 01.02.2016 g. . Developers: NP “Energoeffektivnyi gorod”, NP “Rossiiskoe teplosnabzhenie”. Available at: http://www.energosovet.ru/teplo_strateg.php. .

- Fomin D.A. Finansovye aspekty zhilishchno-kommunal'nogo vosproizvodstva v RF . Problemy prognozirovaniya , 2015, no. 2, pp. 43-55. .

- Khotinskaya G.I. Finansovye indikatory dinamiki razvitiya zhilishchno-kommunal'nogo kompleksa . Finansovaya analitika: problemy i resheniya , 2013, no. 45 (183), pp. 2-8. .

- Chaika L.V. Problemy razvitiya teplosnabzheniya v regionakh Evropeiskogo Severa Rossii . Sever i rynok: formirovanie ekonomicheskogo poryadka , 2015, no. 3, pp. 75-83. .

- Yakovleva I.N. Kak sprognozirovat' risk bankrotstva kompanii . Available at: http://www.cfin.ru/finanalysis/risk/bankruptcy.shtml. .