Foreign Direct Investment in Algeria: Between Reality and Challenges

Автор: Elahcene M.

Журнал: Science, Education and Innovations in the Context of Modern Problems @imcra

Статья в выпуске: 2 vol.8, 2025 года.

Бесплатный доступ

This paper aims to shed light on the reality of foreign direct investment (FDI) in Algeria. In order to address and understand various aspects of the subject and reach a correct and accurate answer to the proposed issue, we relied on the descriptive analytical methodology that suits this type of study. The descriptive methodology is evident through our discussion of the theoretical aspect of foreign direct investment, while the analytical methodology appears through our analysis of the reality of foreign direct investment in Algeria. We also relied on the case study methodology, which is reflected in our presentation of Algeria's experience in the field of foreign direct investment. This research paper concluded with a number of results, the most prominent of which is that foreign direct investment in Algeria still registers modest rates, which is attributed to the existence of constraints and challenges that limit the expansion and enhancement of FDI in Algeria.

Investment, foreign investment, foreign direct investment, challenges

Короткий адрес: https://sciup.org/16010423

IDR: 16010423 | DOI: 10.56334/sei/8.2.32

Текст научной статьи Foreign Direct Investment in Algeria: Between Reality and Challenges

Foreign direct investment (FDI) has played an important role in supporting the growth of the economies of developing countries, especially during the past two decades, which saw a significant increase in investment flows. The overall changes that occurred in the structure of the global economy are largely explained by the shift towards a market economy in most developing countries, the liberalization of trade and investment systems, as well as the increasing contribution of these countries to global economic integration. FDI has provided a significant boost to global integration by contributing to linking capital markets, labor markets, increasing wages, and capital productivity in host countries. Algeria, like other countries, strives hard to encourage foreign direct investment.

Research Problem:

Based on the above, the following research problem can be posed: What are the features of foreign direct investment in Algeria? What are the main challenges it faces? What preventive measures have the Algerian authorities taken to reduce these challenges?

Importance of the Study:

The importance of this study lies in addressing the reality of foreign direct investment in Algeria by exploring the nature of foreign investment, its determinants, diagnosing its current status in Algeria, understanding the various incentives provided for it, as well as identifying the challenges and difficulties hindering its enhancement.

Objectives of the Study:

The objectives of the study are reflected in the following key points:

-

• Defining foreign investment, its importance, and its objectives.

-

• Identifying the determinants of foreign direct investment.

-

• Diagnosing the reality of foreign direct investment in Algeria.

-

• Identifying the key incentive measures that Algeria has taken to enhance FDI.

-

• Identifying the difficulties and obstacles hindering the expansion and enhancement of foreign direct investment in Algeria.

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Methodology of the Study:

To address and understand the various aspects of the topic and reach a correct and sound answer, we relied on the descriptive analytical methodology and the case study methodology. The descriptive analytical methodology is evident through our discussion of the theoretical aspect of foreign direct investment and the analysis of the reality of foreign direct investment in Algeria. The case study methodology is reflected in our analysis of Algeria's situation from 1980 to 2023 through our analysis of foreign direct investment inflows into Algeria.

Chapter One: Theoretical Framework of Foreign Direct Investment

Foreign direct investment is one of the most important types of foreign investments that countries place great importance on, especially for the host country.

First: Definition of Foreign Direct Investment

The Organisation for Economic Co-operation and Development (OECD) defines foreign direct investment as: Any natural person, public or private institution, government, or group of natural persons who have relationships among themselves, or any group of institutions with legal personality connected among themselves, is considered a foreign direct investor if they have an institution for direct investment.

The International Monetary Fund (IMF) defines foreign direct investment as the acquisition of a fixed share in a project executed in another economy. This interest involves a long-term relationship between the investor and the project, where the investor has the right to participate in the management of the project. The investor is referred to as the direct investor, and the project is called a foreign direct investment project.

It involves the movement of foreign capital for investment abroad in the form of industrial, financial, construction, agricultural, or service units. Profit motive is the main driving force behind these foreign direct investments.

Investment involves a long-term relationship reflecting a permanent interest from a resident entity in one economy (the foreign direct investor or parent

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA company) in an entity residing in another economy (the foreign direct investment or subsidiaries of the foreign company).

Second: Advantages of Foreign Direct Investment

Foreign direct investment has a number of advantages for both host countries and investing countries. These include:

-

1- Advantages for the Host Country:

-

• It covers the shortage in local savings, which compensates for the lack of internal financing caused by weak local investment.

-

• Consumers benefit from increased competition in the local market, which encourages local producers to improve their production efficiency, creating a suitable work environment for national capital.

-

• It ensures the entry of capital in the short term, leading to significant opportunities for encouraging additional or complementary investments affecting other sectors like basic industries and various production sectors. This generally complements national and private investments.

-

• It helps acquire greater production capacity while reducing costs for some local investments, thereby providing certain production requirements.

-

• Foreign investment acts as a means of transferring technology, resulting in the establishment of investment projects with advanced technical standards and the acquisition of new production techniques and other technological knowledge, leading to greater added value.

-

• It contributes to achieving social benefits by enabling the foreign investor to build roads leading to their project and connect water, sewage, and electricity networks.

-

• It attracts skilled labor and large investors, allowing for scientific organization and effective economic relationships, leading to the efficient use of resources and operational techniques.

-

• It creates new jobs, reduces unemployment, and contributes to the development and utilization of human resources in developing countries.

-

2- Advantages of Foreign Direct Investment for the Investing Countries:

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

-

• It guarantees the entry of capital in the medium and long term, in the form of profits achieved in the host countries, which are transferred to the source countries.

-

• It improves the balance of payments of the countries.

-

• It exploits the available raw materials in the host countries, especially in developing countries, ensuring supply and meeting needs, thus supporting their economies.

-

• It utilizes cheap labor instead of expensive labor (wages and salaries) in the investing countries.

-

• It benefits from the natural environment for production, while also capitalizing on the opportunity to expand market size in the host countries, which will be monopolized and controlled due to the absence of local competition in the short and medium term, as represented by multinational corporations.

-

• Obtaining the incentives provided by host countries that have financial resources or concessional loans, which helps overcome the obstacles and various barriers that may hinder the realization of investment.

Third: The Importance of Foreign Direct Investment.

The importance of foreign direct investment can be summarized in the following points: Foreign direct investment is a source of compensating for the deficit in local savings and achieving an increase in growth rates. One of the main objectives of attracting foreign capital is to establish productive projects in all industrial, agricultural, and service fields. Investment is considered the main driver of the export process, which helps establish an export sector, reflected in increased exports of goods and services, attracting new investments, which in turn leads to addressing the balance of payments deficit and increasing the foreign currency reserves. Foreign investment brings modern technology and new management and marketing expertise. Modern technology helps in developing products and reducing production costs.

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Chapter Two: Forms and Determinants of Foreign Direct Investment. First: Forms of Foreign Direct Investment.

Foreign direct investment takes the following forms:

Establishing an Institution or Branch: This means creating new production or marketing units from scratch, fully controlled by the investor (100%). This form was dominant until the 1970s, when large companies refused to engage in projects unless they owned them entirely. This form began to decline in favor of other forms due to changes in economic relations, the international market, and technology.

Acquiring Ownership: This refers to gaining control by acquiring at least 50% of the capital of the acquired institution or holding the acceptable percentage in the host country. This method allows the acquiring company to gain or regain the marketing networks of the executed company, its production facilities, technology, and the trained labor that accompany it. These are essential elements in reducing costs and efforts since the foundation of the project is already in place and what remains is to develop or transform it.

Joint Ventures: This refers to the collaboration of two or more institutions to create a partnership, resulting in a relatively independent new institution with its own capital and production policy. Partners share in all aspects of its formation, such as financing, equipment, technical research, and management, and they also share profits and losses.

Second: Determinants of Foreign Direct Investment.

The determinants of foreign direct investment are reflected in the following key points:

Political Determinants:

These determinants mainly involve the need for a stable political environment without political restrictions on investors. Political security is of paramount importance to foreign investors in deciding whether or not to invest in a certain country. Political instability and the emergence of partisanship and conflicts negatively affect the economic interests of foreign investors.

Economic Determinants:

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

The availability of natural resources, competencies, and labor is not enough to create a sound economic environment; other incentives related to economic development, per capita income, inflation, and other factors must also be present. The most important factors include:

Market Size: Market size does not refer to its area but is determined by other factors such as population size, national income, per capita income, and the nature of the investment goods. A small market does not encourage investment. A large market helps trading companies achieve economies of scale.

Economic and Financial Policies: This refers to the necessary credit and banking facilities for production and marketing activities, availability of foreign currency through a free monetary market, which increases the competitiveness of projects by lowering interest rates and stabilizing exchange rates.

A Homogeneous Economic Environment: This is achieved through codified economic legislation that allows free movement and performance so that multinational companies can operate efficiently and profitably. This includes the freedom to enter and exit goods and capital.

Labor Efficiency and the Ability to Absorb Unemployment: This primarily concerns the level of work and production efficiency required to achieve profit, along with the need to balance performance and achievement rates, in addition to absorbing unemployment. This is achieved when multinational companies enter the labor market, and the economy must be capable of absorbing unemployment by creating other investment areas.

Legal Determinants:

Investments mainly depend on the existence of laws and regulations that guarantee incentives, customs and tax exemptions, as well as protections against non-economic risks, such as nationalization and expropriation risks. Additionally, investors have the right to transfer their profits to any country at any time. Countries compete to issue investment laws that provide greater incentives than other countries, as long as these incentives do not lead to the loss of national resources or infringe upon the sovereignty and position of the host country.

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Third: Legislative Amendments Made to Promote Foreign Direct Investment in Algeria.

Algeria began paying attention to encouraging investment since the 1980s, when laws regulating foreign investment were established. Among these laws, we mention the following:

-

• Law of August 21, 1982 related to private economic investment. This was the first law that opened the door to creation and innovation through investment aimed at strengthening the country's productive capacities and creating jobs.

-

• Law 90/10 (Law on Currency and Credit), issued on April 14, 1990, which expanded the scope of investment, particularly in foreign partnerships, by removing the distinctions between foreign and local investors. It also established system No. 90-03, dated September 8, 1990, which outlined the conditions for the entry and exit of capital.

-

• Law 93-12, issued on October 5, 1993, related to promoting investment. It worked on removing all obstacles that prevented investment freedom, consolidating some basic principles, notably the principle of investment freedom and equality between local and foreign investors, as well as providing investment with a set of legal guarantees such as the possibility of resorting to international commercial arbitration. The legislator also activated tools aimed at promoting and developing investment through Decree No. 03-01, issued on August 20, 2001, concerning investment development. This decree granted full freedom to investors by simplifying procedures and reducing them to the maximum extent, establishing a specialized agency to oversee investment development, called the National Investment Development Agency.

-

• Law 16-09, issued on August 3, 2016, related to promoting investment. It brought a qualitative leap in terms of the advantages and guarantees provided to foreign investors. Article 21 of this law states that: "Foreign natural and legal persons receive fair and equitable treatment regarding their rights and obligations related to their investments." This law marked a retreat from the 51% rule for local investors and 49% for foreign investors, which had somewhat hindered foreign direct investment in Algeria, even though it did not prevent it entirely.

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Chapter Three: The Reality of Foreign Direct Investment in Algeria.

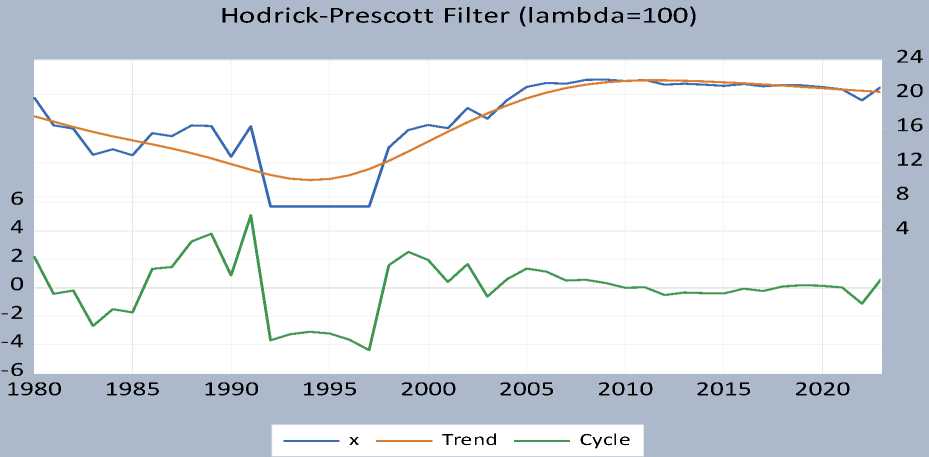

In this section, we will analyze the reality of foreign direct investment in Algeria during the period from 1980 to 2023 and identify the various challenges that act as barriers to it, along with proposing preventive and corrective measures aimed at improving its levels and indicators.

First: Analysis of Foreign Direct Investment Flows in Algeria from 1980 to 2023. The table below shows the development of foreign direct investment flows in Algeria during the period from 1980 to 2023.

Table No. 01: Development of Foreign Direct Investment Flows in Algeria from 1980 to 2023.

|

ears |

Value of Foreign Investment |

ears |

Value of Foreign Investment |

ears |

Value of Foreign Investment |

|

980 |

348,669,038 |

995 |

1,000 |

010 |

2,300,369,124 |

|

981 |

13,207,259.4 |

996 |

1,000 |

011 |

2,571,237,025 |

|

982 |

-53,569,192.6 |

997 |

1,000 |

012 |

1,500,402,453 |

|

983 |

417,641.163 |

998 |

1,000,000 |

013 |

1,691,886,708 |

|

984 |

802,668.874 |

999 |

7,600,000 |

014 |

1,502,206,171 |

|

985 |

397,788.297 |

000 |

13,700,000 |

015 |

-537,792,921 |

|

986 |

5,316,528.38 |

001 |

9,300,000 |

016 |

1,638,263,954 |

|

987 |

3,711,537.9 |

002 |

98,570,000 |

017 |

1,230,243,451 |

|

13,018,265 |

28,320,630 |

1,466,116,068 |

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

|

ears 988 |

Value of Foreign Investment |

ears 003 |

Value of Foreign Investment |

ears 018 |

Value of Foreign Investment |

|

989 |

12,091,646.8 |

004 |

245,449,810 |

019 |

1,381,200,050 |

|

990 |

334,914.564 |

005 |

1,156,000,000 |

020 |

1,143,918,160 |

|

991 |

11,638,686.5 |

006 |

1,841,000,000 |

021 |

869,194,073 |

|

992 |

1,000 |

007 |

1,686,736,540 |

022 |

240,013,321 |

|

993 |

1,000 |

008 |

2,638,607,034 |

023 |

1,215,776,627 |

|

994 |

1,000 |

009 |

2,746,930,734 |

Source: Prepared by the researchers based on the World Bank report.

Figure No. 01: Test for Detecting the Trend Component of Foreign Direct

Investment Series.

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(X)

Method: Least Squares

Date: 12/23/24 Time: 00:58

Sample (adjusted): 1981 2023

Included observations: 43 after adjustments

|

Variable |

Coefficient |

Std. Error |

t-Statis tic |

Prob. |

|

X(-1) |

-0.220605 |

0.084595 |

-2.607768 |

0.0127 |

|

C |

2.064914 |

1.174436 |

1.758218 |

0.0864 |

|

@TREND("1980") |

0.075807 |

0.033112 |

2.289379 |

0.0274 |

Source: Prepared by the researchers based on the outputs of Eviews 12.

It is clear from the above table that the value of the trend component is statistically significant at the 5% level of significance, meaning that there is an impact of the time element on the series of foreign direct investment in Algeria. Therefore, we can say that the series contains a trend component with a negative sign, indicating that the series is decreasing over time. The reason for the decline in direct investment flows in Algeria is due to the weakness of the legislative and legal environment that stimulates foreign direct investment in Algeria, as well as the absence of incentive procedures related to foreign investment and tax incentives.

Second: Incentives Granted to Foreign Investors in Algeria.

Algeria has worked on offering incentives to attract foreign direct investments, both within the framework of investment laws and complementary laws, and under international agreements, as outlined below:

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Domestic Incentives:

Foreign investors are granted a set of tax incentives in two phases (the implementation phase and the exploitation phase) based on the following two systems:

General System: According to Ordinance 06-08 dated August 10, 2001, amending and supplementing Ordinance 01-03, the general system during the implementation phase stipulates several measures, which can be summarized as follows:

-

• Exemption from customs duties for goods that are exempt and directly involved in the investment.

-

• Exemption from ownership transfer tax on real estate purchases made as part of the investment.

As for the exploitation phase, the exemptions last for 5 years after the project has been inspected, and these exemptions include:

-

• Exemption from corporate profit tax.

-

• Exemption from professional activity tax.

In order to benefit from the above-mentioned advantages, a new condition was set, which is the creation of 100 jobs, according to the provisions of the supplementary finance law of 2009.

Exceptional System:

In regard to this system, and according to Ordinance 01-03, advantages have been granted for investments made in areas requiring special development contributions from the state, in addition to investments that are of special importance to the national economy. These investments benefit from the following during the implementation phase:

-

• Exemption from property rights for all real estate purchases made as part of the investment.

-

• A fixed registration fee of 2% for foundation contracts and increases in capital.

-

• Partial or full state coverage of expenses after evaluation concerning works related to basic tax facilities for investment implementatio n.

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

International Incentives:

As a complement to the set of tax advantages stipulated by the investment law and its complementary laws, the Algerian authorities have granted international tax incentives through international agreements in the field of taxation to avoid international tax evasion.

Third: Difficulties and Barriers to Foreign Direct Investment in Algeria. The goal of introducing foreign direct investment in Algeria has not been satisfactorily achieved for the national economy. Although foreign businesspeople's statements about Algeria are positive, the economic, political, and social realities tell a different story. The views of major foreign investors regarding the positive factors for direct investment in Algeria were surveyed, and it became clear that negative factors outweigh the positive ones. Therefore, these obstacles can be summarized as follows:

Economic Barriers: These include several elements, such as:

-

• Real Estate Issues: Real estate has been the most raised issue in investment areas and represents a barrier to investors, despite the issuance of legal texts that facilitated its acquisition and the establishment of industrial zones. However, disputes still exist between investors and those claiming to be the original owners of the land.

-

• Size of the Domestic Market: The local market is small compared to other markets, and its absorptive capacity is narrow, which negatively affects foreign investor attraction compared to European and Asian markets. This also relates to the low average purchasing power of citizens, leading to a lack of demand for these investment products.

-

• Banking Deficiencies: This is subject to state control over banks and financial institutions and their failure to be liberated from state influence. Other factors include:

o Limited banking legislation both technically and legally.

o Bank employees' inability or lack of training in managing loans.

o Failure to keep up with modern management, electronic, and digital methods.

EX

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA o Poor financial market performance.

-

• Algeria's Economy Is Less Open to the Outside World: Many countries have strengthened their global economic openness by signing multiple agreements to increase trade volume. Failure of developing countries to open up to the outside world deprives them of foreign capital and stalls the national economy, including foreign direct investment.

-

• Problems of the Algerian Private Sector: The private sector must be capable of undertaking investment operations and participation, but it has not reached this level, even though its activity represents 44% of national activity. This is compounded by a lack of training and experience in the sector.

Administrative Environment:

This refers to the administration, bodies, and organizations responsible for implementing policies and decisions made by the political system. Since the late 1980s, the legislative framework in Algeria has undergone constant changes, sometimes leading to deep stagnation, which has affected the credibility of the state both nationally and internationally. Algerians were described as uncertain about their direction, which is why foreign investors and citizens hesitate to invest in Algeria.

Political and Security Issues:

The security aspect plays a significant role in attracting foreign direct investment, as security risks affect investment climate programs, leading to the withdrawal of investors from the country. The security instability during 1993, 1994, and 1995 led to a lack of investment and distorted Algeria's economic image, to the extent of destroying several economic institutions and increasing unemployment. Algeria was ranked among the countries with a very high risk, and in general, the security problem became an international issue for these investments.

Conclusion:

From our processing of this research paper, it became clear that foreign direct investment plays a crucial role in the economy, as it seeks to achieve returns that

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA benefit both the foreign investor and the host country. This paper has concluded several results.

Conclusions Reached: Some of the main conclusions reached are: Recommendations: Based on the results obtained, the following recommendations can be made:

-

• The necessity of enacting new laws and regulations related to foreign direct investment in Algerian legislation.

-

• Creating a legal and legislative environment that encourages and stimulates foreign direct investment.

-

• Adopting a tax policy that incentivizes foreign direct investment in Algeria.

-

• Giving priority to foreign direct investment by preparing training courses aimed at raising awareness of foreign direct investment and the advantages it entails.