Impact of remittances on inflation in Nigeria

Автор: Atoyebi E.O., Ogede J.S., Adegboyega S.B., Odusanya I.A.

Журнал: Вестник Волгоградского государственного университета. Экономика @ges-jvolsu

Рубрика: Мировая экономика

Статья в выпуске: 3 т.25, 2023 года.

Бесплатный доступ

International remittances have emerged as an indispensable financial resource for development. However, despite remittances’ growing relevance in overall foreign financial flows in Nigeria, the consumption-oriented nature of the economy of the country presents an intriguing opportunity to consider the connection between foreign remittances and inflation within the country. This study investigates the influence of foreign remittances on inflation in Nigeria from 1990 to 2021. The autoregressive distributed lag technique was employed to scrutinize the long-term behavior of inflation and remittances. The empirical findings indicate that foreign remittances exhibit a negative and statistically insignificant correlation with inflation in Nigeria. The money supply has a satisfactory impact on inflation and is statistically substantial. According to statistical analysis, the exchange rate and economic growth have a negative correlation with inflation, while the exchange rate of the national currency remains stable. Additionally, economic growth has a significant impact on inflation, whereas no correlation has been found between remittances and inflation in the short run. The study argues that in order to ensure price stability, it is important to establish and maintain a mechanism that effectively controls the growth of the money supply and aligns it with economic development goals. This mechanism should promote interaction between financial and fiscal authorities to establish a coherent structure that adjusts monetary policy based on government spending, stimulates sustainable economic growth to reduce inflation, and encourages the creation of jobs and production zones to accelerate economic growth. This may lower inflation by increasing the supply of goods and services. It is necessary to support these efforts by regularly monitoring exchange rate changes and their implications for inflation. Nigeria can maintain economic stability and low inflation by balancing domestic and foreign financial flows.

Remittances, inflation, economic growth, money supply, autoregressive distributed lag

Короткий адрес: https://sciup.org/149144533

IDR: 149144533 | УДК: 338(100):336.74 | DOI: 10.15688/ek.jvolsu.2023.3.11

Текст научной статьи Impact of remittances on inflation in Nigeria

DOI:

Foreign remittances play a pivotal role in driving the economic progress of developing nations [Rahman et al., 2019]. Africa is the leading contributor to the global stream of workers’ remittances [World Bank ... , 2019]. The increasing potential presented by the African diaspora has resulted in significant economic prospects, both inside and outside the borders of Africa. Nigeria, being the most populous nation on the African continent, has encountered a substantial prevalence of poverty, which is notably severe. Approximately 62% of the country’s population resides in conditions characterized by extreme poverty. When individuals experience low living standards and limited prospects for advancement, they often opt to emigrate from their country of residence in pursuit of more favorable prospects [Castelli, 2018]. Individuals who migrate transfer financial resources from their destination country back to their country of origin. Remittances are money transfers made by migrants overseas and remitted to people in their home country [Seddon et al., 2002]. Based on the findings of the World Bank (2015), 0.6% of Nigerians migrated from Nigeria in 2015. In the year 2022, Nigeria saw remittance inflows amounting to around US$21 billion, which accounted for 0.4% of the country’s gross domestic product (here and after – GDP). The Nigerian Diaspora community has contributed a total remittance of $168.33 billion to the nation over the last eight years [World Bank ... , 2022].

Clearly, as a result, remittances to Nigeria serve as a substantial contributor to the country’s foreign currency reserves. The potential for remittances to stimulate economic growth can be realized through a range of macroeconomic and microeconomic mechanisms [Dao et al., 2018]. For instance, the existence of foreign exchange reserves resulting from remittances not only mitigates current account deficits and reliance on external debt but also facilitates countries’ recovery from the impacts of unfavorable global events such as oil price shocks, the COVID-19 outbreak, and financial crises [Chowdhury et al., 2021]. Furthermore, whether remitted funds are allocated towards consumption or investment, they have a significant influence on economic progress. At the microeconomic level, remittances play a crucial role in assisting households in alleviating poverty and enhancing income distribution in favor of those who are economically disadvantaged [Howell, 2017; Vacaflores, 2018]. Remittances have helped developing countries diversify their economies by reflecting and supplying their capital outsourcing policies [Adekunle et al., 2020; Enderwick et al., 2011], alleviate credit limitations by increasing the amount of domestic capital necessary for investments and savings [Dash, 2020; Delgado-Wise, 2016], mitigate poverty through dependency, and many other influential means [Kumar, 2019; Azam et al., 2016; Brown et al., 2014; Masron et al., 2018]. The alleviation of credit and liquidity constraints has the potential to increase both household consumption and investment levels. Remittances serve as a means of self-insurance for recipient households during periods of uncertainty.

In recent times, inflation has been a prominent issue for Nigerians, notably in 2018. During this period, the nation saw a notable increase in prices, with inflation jumping at a rate of over 12%, marking the highest rate in a decade. This surge was mostly attributed to the rise in food costs. However, in 2015, Nigeria was identified as the world’s third fastest-growing economy, exhibiting an estimated growth rate of 7%. This ranking placed Nigeria behind Qatar, which experienced a rate of growth of 7.1%, and China, which recorded a rate of growth of 7.3% [He et al., 2015]. Afterward, the financial system in Nigeria experienced various instances of crises [Mordi, 2010]. Apart from the recently redesigned currency, as asserted by the Central Bank of Nigeria (CBN), purported to address the issue of money laundering before the recently concluded 2023 general election, facilitate the transition of the West African nation towards a cashless economy, and combat the prevailing inflation rate of 21%, which stands as the highest in the past 17 years, the tremendous influence of this phenomenon on the economy precipitated the occurrence of the financial crisis.

Nevertheless, it is essential to acknowledge the detrimental effects that remittances may have on the economy. Remittances may cause Dutch disease [Acosta et al., 2009], diminished work incentive and moral hazard [Ngoma, Ismail, 2013], and environmental pollution [Islam, 2022]. Remittances contribute to the valuation of the native currency by augmenting the availability of foreign currencies, so diminishing the competitiveness of the traded goods industry has resulted in a state of economic stagnation [Mawutor et al., 2023; Javaid, 2017].

Significantly, the inflationary pressures may be influenced by the aggregate demand resulting from remittances. Remittances have the potential to augment the money supply and stimulate the consumption of goods and services. Demand-pull inflation is a phenomenon characterized by an escalation of prices due to a rise in demand [Machlup, 1960; Nisar et al., 2013]. Nevertheless, due to the adverse impact it has on the economy, stabilization efforts have historically focused on addressing inflation. The escalation of business expenses serves as a deterrent to the accumulation of savings and investments. The act of consumption experiences a decline, resulting in a decrease in purchasing power for those with low incomes and those reliant on fixed incomes. The influence of remittances on inflation, which runs against the objective of maintaining price stability, has necessitated a deeper examination of their relationship in Nigeria. This urgency is heightened by the country’s elevated inflation levels and the critical role played by remittances.

Theoretical explanations suggest that international remittances might potentially contribute to inflation either by stimulating local demand or by expanding the money supply. Foreign remittances, conversely, can have a deflationary impact by increasing the supply of products or services, given that remittances are allocated towards productive sectors. Nevertheless, the current state of affairs in Nigeria remains an unresolved inquiry that needs more investigation. Based on the available literature, no prior research related to this study has been identified. However, other countries have conducted research on this topic. Therefore, this study aims to address this gap in knowledge. The auto regressive distributed lag (here and after – ARDL) bound estimation methods were utilized in this work to investigate the presence of cointegration between remittances, inflation, exchange rate, money supply, and growth in the Nigerian economy. This research aims to provide an accurate assessment of the dynamic linkages between remittances and inflation in Nigeria and to provide valuable insights to the academic community and policymakers. The study will help policymakers in the developing African economy formulate future policies and make informed decisions on the current economic issue of inflation. The subsequent portion of the research is structured as follows: Section 2 provides an overview of the existing literature; Section 3 outlines the materials and techniques; Section 4 centers on the presentation and analysis of data; and Section 5 serves as the concluding section of the study.

Literature review

Numerous studies have extensively explored the influence of remittances on inflation worldwide, in direct correlation with this phenomenon. An increasing number of academic studies are being conducted on this topic across international boundaries. For instance, Nisar analyzes the effects of remittances on inflation, specifically focusing on its several categories, including textile inflation, footwear inflation, food inflation, and housing and construction inflation [Nisar, 2013]. The formulation of a set of four vectors was undertaken to comprehensively capture the factors of overall inflation as well as its many categories, with a specific emphasis on the influence of remittances. The research used the Johansen [Johansen, 1990] and Johansen and Juselius [Johansen et al., 1990] to examine the presence of a long-term association with regard to remittances and inflation. The vector error correction approach is used to assess the magnitude and path of the association between variables and to assess the stability of models. The discoveries revealed that there is a single cointegrated vector present in all equations. Furthermore, it has been seen that remittances, real per capita income, and the money supply have a favorable influence on inflation and its many classifications. The findings indicate that remittances have a greater impact on food inflation compared to other inflation categories, whereas construction and housing inflation are least affected by remittances. The budget deficit has a crucial role in mitigating inflation, particularly in the footwear and textile sectors. In contrast, trade openness is efficacious in diminishing various forms of inflation to an equal extent and level of potency. In the same vein, research was conducted Rivera and Tullao [Rivera et al., 2020] considering the relationship between inflation and money transfers sent to the Philippines. The findings indicate that an upsurge in inflation might lead to an increase in the number of remittances sent by migrant relatives in the near term. Research has shown that remittances do not always contribute to inflation. Other internal elements of greater prominence may potentially induce inflationary pressures.

Azer Dilanchiev, Aligul Aghayev, and Md. Hasanur Rahman examine the effects of remittance inflows on the inflation rate in Georgia, employing quarterly data from 2000 to 2018

[Dilanchiev et al., 2021]. The findings of the study indicate that all explanatory factors exert an influence on the long-term inflation rate. Specifically, there is a positive correlation between the leading regressor variable, remittance, and long-term inflation. However, no significant relationship is seen in the short term between inflation and remittance. The study determined that the yearly adjustment level of inflation to its equilibrium is 12%.

Narayan analyzes the factors that influence inflation in the short-term and long-term periods for a sample of 54 evolving nations [Narayan et al., 2011]. The analysis is conducted using a panel dataset covering the years 1995 to 2004. This research aims to analyze the effects of remittances and institutional factors on inflation. The use of the Arellano and Bond panel dynamic estimator, as well as the Arellano and Bover and the Blundell and Bond system generalized technique of moments estimator, reveals empirical data suggesting that remittances in developing countries have a helpful association with inflation. The impact of remittances on inflation becomes increasingly significant over an extended period. Furthermore, it is seen that features such as debt, current account deficits, the agriculture sector, openness, and the short-term U.S. interest rate have a favorable impact on inflation. Furthermore, it has been determined that enhancements in democratic governance have a mitigating effect on inflation.

Abdul-Mumuni and Quaidoo discovered a substantial long-term bearing of foreign remittances on inflation by investigating the relationship between inflation and international remittances in Ghana between 1979 and 2013 [Abdul-Mumuni et al., 2016]. This was achieved by introducing remittances as an exogenous variable into the conventional inflation function. The research utilizes the limits testing technique and finds empirical evidence suggesting that foreign remittances have a statistically noteworthy impact on inflation over the long term. Nevertheless, in the immediate term, there is no discernible correlation between these two factors.

Important [Manzoor et al., 2013] scrutinize the influence of international remittances on inflation in Pakistan within the time frame of 1980 to 2012. The present research used the Johansen cointegration approach to examine the long-term behavior of inflation. Additionally, the study utilizes the vector error correction model to assess the short-term dynamics. The findings indicate that overseas remittances have a substantial and favorable influence on inflation [Olubiyi, 2014]. They observed a causal association between remittances and three economic indicators: GDP, exports, and imports. Using a vector error correction model and the Granger causality approach, it was shown that imports and remittances had a strong Granger causal effect on GDP in the near term, based on data collected from 1980 to 2012. Additionally, it is worth noting that there were reverse causal relationships from GDP to both exports and imports. This suggests that the export-led growth hypothesis is applicable in the context of Nigeria. Moreover, a unidirectional causal relationship was observed, indicating that remittances have a substantial influence on GDP and are hence relevant for fostering economic development. However, given that the impact mostly originated from the demand side, it has the potential to generate inflationary pressures.

Laniran and Adeniyi analyze the features that influence the inflow of remittances to Nigeria [Laniranet al., 2015]. The study conducted econometric model testing on key macroeconomic factors that have the theoretical ability to influence the volume of remittances received. Time series data from 1980 to 2013 was used, and the findings suggest that the amount of remittances received is mostly affected by portfolio considerations rather than other macroeconomic variables.

Method

Data

This study utilizes annual time series data from 1990 to 2021 in Nigeria. The choice to focus on Nigeria for this research is driven by the aim of capturing the most densely populated black country in Africa. It is worth noting that Nigeria also boasts the continent’s biggest economy. Furthermore, Nigeria was chosen due to the availability of reliable and accessible data. The Consumer Price Index (here and after – CPI), utilized by Gallagher and Taylor [Gallagher et al., 2002], evaluates inflation levels. Measuring the money supply relative to GDP is achieved by examining broad money, denoted as M2, as detailed in [Gatawa et al., 2017]. Remittances are measured by personal remittances received (% of GDP) denoted by REM, as in [Meyer et al., 2017].

GDP per capita growth (% per year) denoted by RGDP was estimated for economic growth in the country, using [Kaidi et al., 2019], [Nasir et al., 2019], and [Steenblik et al., 2012] as references. Money supply (M2) and exchange rate (EXCH) were used as control variables. Data on inflation and exchange rates were converted into natural logarithms to attain stationarity in variance. Table 1 contains the descriptions and sources of the variables evaluated in the study.

Model

The model for the influence of remittances on inflation is as stated:

CPI = F(REM, M2, EXCH, GDP) (1)

where GDP is the gross domestic product (a proxy for economic growth), inflation is measured by the CPI, β0 is the constant term, β1, ..., β4 are the coefficients of the model, and εt1 represents the error term. M2 represents money supply, REM represents remittances, GDP is the GDP per capita growth rate (%), and EXCH is the exchange rate.

The utilized empirical strategy involves the estimation of the baseline equation through the autoregressive distributed lag (here and after – ARDL) method. ARDL models have been extensively used in the field of econometrics for a considerable period. However, their utilization has seen a surge in popularity in recent years, mostly due to their efficacy in analyzing and cointegrating connections. Two important contributions in this regard are [Pesaran et al., 2001] and [Pesaran et al., 1998]. The authors contend that ARDL models possess distinct advantages due to their capacity to effectively address cointegration while exhibiting resilience against any inaccuracies in the definition of integration orders for pertinent variables. The dynamic relationship is specified as

CPIt = β0 + β1REMt + β2Mt + +β3EXCH + β4GDPt + εt1 (2)

Empirical strategy

The study aimed to account for the dynamic connections between inflation and remittances in Nigeria. The data were analyzed using descriptive statistics to effectively display, describe, and summarize the information. Furthermore, the research aimed to assess the normality of the data by assessing their means and Jarque-Bera values. The aforementioned citation by [Gujarati et al., 2009] is presented. We proceed with the estimation of the unit root test to determine the stationarity of the variables. The Augmented Dickey-Fuller (ADF) and Philip Perron Tests were utilized to conduct a stationarity analysis. The unit root test for time series relies on estimations of:

AYt = ai + ny^ + S t + £ k = i 9(k)Ay t—k + S t

Et~idN(0,9 2 ) = 1,2,.......N,t = 1,2......T (3)

The variable yt represents the observed y value for N entities over T periods, while the operator A denotes the difference. The unit root test entails the formulation of a null hypothesis, denoted as H_0 : p _i=0 V i, and an alternative hypothesis, denoted as

H_A: p _i= p <0 V i.

Subsequently, we undertake the ARDL estimation technique to incorporate the variables’ cointegration.

Table 1. Description of variables

|

Abbreviation |

Description |

Source |

|

CPI |

Inflation |

World Development Indicator |

|

M2 |

Money supply |

World Development Indicator |

|

REM |

Remittances |

World Development Indicator |

|

EXCH |

Exchange Rate |

World Development Indicator |

|

GDP |

Economic growth |

World Development Indicator |

Source. Authors’ Compilations, 2023.

Result and discussion

Descriptive statistics

Table 2 shows the outcomes of the descriptive statistics analysis. The findings show that all of the variables’ mean and median values are within the bounds of their lowest and maximum values. This implies that for each of the variables, namely, inflation, remittances, money supply, exchange rate, and economic growth, there is a strong likelihood of a normal distribution. Based on the Jarque-Bera statistics, it can be inferred that the series conforms to a normal distribution. This is supported by the lack of statistical significance at the 5% level for all series’ p-values. Consequently, this indicates the validation of the alternative hypothesis positing that every variable conforms to a normal distribution.

A correlation matrix was computed to assess the presence of multicollinearity among the predictor variables (inflation, money supply, remittances, exchange rate and economic growth). Table 3 lists the correlation matrices. The analysis indicates that there is no link between the variables, thereby rendering the outcomes highly dependable.

Table 3 presents the outcome of the correlation matrix, which indicates that the variables exhibit positive correlation coefficients.

We can conclude that there is no multicollinearity among the variables on the basis of the fact that the correlation coefficient is less than 0.95 as per [Baltagi et al., 2015; Wooldridge, 2007]. The correlation between money supply and inflation was positive, with a coefficient of 0.738. Remittances are positively correlated with inflation (0.705), the exchange rate is positively correlated with inflation (0.343), and GDP per capita is positively linked with inflation (0.027).

The results of the ADF and PP confirmatory tests are presented in Table 4.

The results show that the variables exhibit stationarity at the first difference, except for the inflation and economic growth variables, which only demonstrate stationarity at the level and first difference. The empirical results revealed both the nonstationary characteristics of the variables and the covariance structure of the analyzed dataset. We employ an ARDL model to estimate the association between the variables of interest. The selection of the estimation strategy is crucial in this study, as it aligns with the observed patterns in the data.

The determination of an appropriate lag length for each of the underlying variables in the ARDL model is of utmost importance in order to ensure the presence of Gaussian error terms. The determination of the most suitable lag duration

Table 2. Descriptive satistics

|

Variables/Stat. |

CPI |

M2 |

PREM |

EXC |

GDP |

|

Mean |

3.909952 |

17.93508 |

3.370600 |

4.609198 |

4.320114 |

|

Median |

4.156723 |

15.84434 |

3.819301 |

4.607684 |

4.430627 |

|

Maximum |

5.870133 |

27.37879 |

8.333830 |

5.609506 |

15.32916 |

|

Minimum |

0.881225 |

9.063329 |

0.018522 |

3.907539 |

-2.035119 |

|

Std. Dev. |

1.357786 |

6.071568 |

2.349521 |

0.384134 |

4.017196 |

|

Skewness |

-0.681180 |

0.082702 |

0.179289 |

0.700699 |

0.435426 |

|

Kurtosis |

2.723739 |

1.374326 |

1.880561 |

3.661978 |

3.286568 |

|

Jarque-Bera |

2.576457 |

3.560233 |

1.842295 |

3.202845 |

1.120671 |

|

Probability |

0.275759 |

0.168619 |

0.398062 |

0.201610 |

0.571017 |

|

Observations |

32 |

32 |

32 |

32 |

32 |

Source. Authors’ Compilation, 2023. Test of Multicollinearity.

Table 3. Correlation matrix

|

Variables |

CPI |

M2 |

REM |

EXCH |

GDP |

|

LCPI |

1 |

||||

|

M2 |

0.738 |

1 |

|||

|

REM |

0.705 |

0.602 |

1 |

||

|

EXCH |

0.343 |

0.029 |

0.014 |

1 |

|

|

RGDP |

0.027 |

0.165 |

0.005 |

0.194 |

1 |

Source. Authors’ Compilations, 2023.

is accomplished by using Schwartz information criteria. This involves obtaining the lag length value that minimizes the information criterion, specifically the Schwartz criterion (SC), while ensuring that the model does not exhibit autocorrelation. The optimal lag lengths are presented in Table 5. The optimal lag length can be determined by examining the results presented in Table 5, which indicate that a lag length of one minimizes the SC. After determining the optimal lag length, we conduct a test to establish the existence of a long-term relationship between the variables.

Bounds test

This study employs the bound-testing procedure proposed by M.H. Pesaran [Pesaran et al., 2001] to inspect the existence of long-term relationships among the variables. The F-test is utilized to assess the assumption of the absence of co-movement among the variables in comparison to the hypothesis of its presence, which is represented as H0: β 1 = β 2 = β 3 = β 4 = β 5 = β 6 = 0, i.e., there is no cointegration among the variables.

H1: β 1 ≠ β 2 ≠ β 3 ≠ β 4 ≠ β 5 ≠ β 6 ≠ 0, that is, there is cointegration among the variables.

By looking at Table 6, we recommend comparing the F-statistic with Pesaran’s critical value at typical significance levels. According to Narayan’s (2005) observations, Pesaran’s critical values [Pesaran et al., 2001] do not apply to small sample sizes. This is because these values are based on the assumption of the availability of large sample sizes. Narayan (2005) presented a collection of crucial values for sample sizes, which varied from 30 to 80 observations. The observed values fall within the intervals of 2.2–3.09 for a significance level of 10%, 2.56–3.49 for a significance level of 5%, and 3.29–4.37 for a significance level of 1%. The null hypothesis was accepted based on an F-statistic of 12.16470, which exceeded both the lower- and upper-bound critical values. This leads to the conclusion that there is a long-term co-movement among all variables in the model in Nigeria.

Table 7 shows that the explanatory variables of the model account for 88.18% of the variation in the dependent variable over an extended period. The remaining 11.82% of the variation was because of factors outside the model. At a 5% significance level, the F-statistic (51.89) confirmed the statistical significance of the model. The Durbin-Watson statistic (2.194), which is not within

Table 4. Unit root test

|

Variables |

Intercept |

Trend & |

intercept |

Intercept |

Trend & |

Intercept |

||

|

ADF |

PP |

ADF |

PP |

ADF |

PP |

ADF |

PP |

|

|

LCPI |

-3.874** |

-2.975** |

-7.256** |

-2.934 |

-2.041 |

-2.305 |

-2.464 |

-2.824 |

|

M2 |

-1.088 |

-0.900 |

-2.209 |

-1.897 |

-4.486** |

-6.012** |

-4.414** |

-6.030** |

|

REM |

-2.117 |

-2.031 |

-2.436 |

-2.510 |

-5.793** |

-7.241** |

-5.760** |

-8.086** |

|

EXCH |

-2.365 |

-2.560 |

-2.378 |

-2.600 |

-4.836** |

-4.805** |

-4.763** |

-4.726** |

|

GDP |

-3.683** |

-3.809** |

-3.597** |

-3.732** |

-9.338** |

-19.557** |

-9.119** |

-20.784** |

Source. Authors’ Compilation, 2023. Lag Selection Criteria.

Table 5. Lag length selection

|

Lag Length |

SC |

|

0 |

18.95382 |

|

1 |

12.64716* |

|

2 |

12.91940 |

Source. Authors’ Compilation, 2023.

Table 6. Bound test result

|

F-Statistics |

1% |

5% |

10% |

|||

|

12.16470 |

Lower bound |

Upper bound |

Lower bound |

Upper bound |

Lower bound |

Upper bound |

|

3.29 |

4.37 |

2.56 |

3.49 |

2.2 |

3.09 |

|

Source. Authors’ Compilation, 2023.

the established range of 1.5–2.5, shows that the model had a positive serial correlation issue [Dufour et al., 1985; Durbin, 1960].

The findings suggest that over an extended period, the money supply has a favorable impact and is statistically substantial at a 5% level of significance. This suggests that an increase in money by a certain percentage will result in a corresponding 0.097 percent increase in inflation in Nigeria. Furthermore, the remittances exhibit an adverse and statistically insignificant correlation at the 5% level. The aforementioned statement suggests that a rise in remittances by a certain percentage will lead to a reduction of 0.001 percent in inflation within the Nigerian economy. The statistical analysis reveals that both the exchange rate and economic growth exhibit a negative correlation with inflation, but while the exchange rate is insignificant, economic growth has significant effects at a 5% level of significance.

Table 8 shows how inflation, remittances, money supply, economic growth, and exchange rate relate to each other in Nigeria in the short term. Money supply and inflation have a negative relationship in the short run at a 10% level of significance.

In Nigeria, the exchange rate and inflation have a negative relationship, although it is not significant at a significance level of 5%. This suggests that a rise in economic growth will reduce inflation by 0.06 percent. Again, the coefficient of the error correction term exhibits a negative and is found to be statistically substantial at 5%. This proposes that the disequilibrium within the economic system in Nigeria would be restored to an equilibrium level of -0.0621% (-6.21). This further implies that there is one-way Granger causality among the variables of interest in Nigeria.

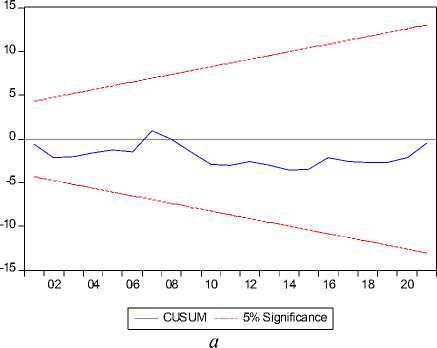

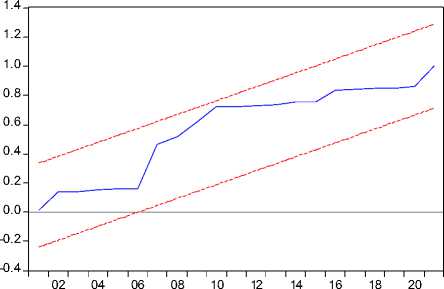

The results depicted in Figure, a demonstrate that the CUSUM line falls within the critical bounds of the 5% level of significance, suggesting that the model exhibits structural stability. In addition, Figure, b displays that the CUSUM of Squares line falls within the critical bounds of 5 percent significance, suggesting that the model exhibits structural stability.

Conclusion and implications

The relationship between remittances and economic growth, the determinant of remittances has been discussed along various dimensions in Nigeria, but the implication of remittances on inflation remains grossly understudied. This study employed an Autoregressive Distributed Lag estimation procedure to estimate the cointegration

Table 7. ARDL Long-Run Estimate on the relationship between Remittances and Inflation in Nigeria. Dependent variable: CPI

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

M2 |

0.097795 |

0.033325 |

2.934539 |

0.0079 |

|

REM |

-0.001037 |

0.096377 |

-0.010757 |

0.9915 |

|

EXC |

-1.307639 |

0.849653 |

-1.539027 |

0.1387 |

|

GDP |

-0.156576 |

0.072115 |

-2.171210 |

0.0415 |

|

C |

10.72819 |

4.787533 |

2.240860 |

0.0360 |

|

R-squared |

0.894046 |

|||

|

Adjusted R-squared |

0.881820 |

|||

|

Durbin-Watson stat |

2.194393 |

|||

|

F-statistic(Prob) |

51.89 |

Source. Authors’ Compilation, 2023.

Table 8. ARDL Short-Run Estimates on the relationship between Remittances and Inflation in Nigeria. Dependent variable: CPI

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

D(LCPI(-1)) |

0.310530 |

0.075399 |

4.118462 |

0.0005 |

|

D(M2) |

-0.006190 |

0.003336 |

-1.855446 |

0.0776 |

|

D(LEXCH) |

0.019173 |

0.028314 |

0.677140 |

0.5057 |

|

CointEq(-1)* |

-0.062138 |

0.006537 |

-9.506120 |

0.0000 |

Source. Authors’ Compilation, 2023.

among variables; data were sourced from World Development Indicator (World Bank) for the period from 1991 to 2021.

The remittances exhibit an adverse and statistically insignificant correlation with inflation at the 5% level. The aforementioned statement suggests that a rise in remittances by a certain percentage will lead to a reduction of 0.001 percent in inflation within the Nigerian economy. The statistical analysis reveals that both the exchange rate and economic growth exhibit a negative correlation with inflation, but while the exchange rate is insignificant, economic growth has significant effects at a 5% level of significance. The remittances-inflation nexus result was related to the findings from [Rivera et al., 2020].

The statistical analysis also reveals that both the exchange rate and economic growth exhibit a negative correlation with inflation, but while the exchange rate is insignificant, economic growth has significant effects at a 5% level of significance.

This information can be useful for policymakers as a factor contributing to the converse link between remittances and inflation, which may be the ability of remittances to circumvent conventional banking systems and flow via informal channels. Policymakers need to accord high priority to financial literacy initiatives aimed at educating both migrants and receivers on the significance of using legitimate financial channels. Directing remittances via regulated financial institutions, such as banks or digital payment platforms, may minimize the potential adverse effects of uncontrolled liquidity injection into the economy, decreasing the likelihood of inflation. To enhance the potential benefits of remittances for economic stability, it is also advisable for policymakers to promote the allocation of remittance money towards productive investments rather than immediate consumption among receivers. The provision of incentives might accomplish the aim of encouraging investment in several areas, including but not limited to small and medium-sized enterprises (SMEs), education, healthcare, and infrastructure. Diversification of investment portfolios serves to mitigate the vulnerability of the economy to inflationary pressures that may occur as a result of excessive spending.

The findings underscore the necessity for additional investigation to comprehend the fundamental factors that contribute to the unanticipated adverse correlation between remittances and inflation. Subsequent research helps investigate the underlying mechanisms involved, considering variables such as the caliber of institutions, regulatory measures in the financial sector, and the impact of specific industries on both remittances and inflation. The conduct of further research can furnish policymakers with significant insights and aid in developing a more nuanced comprehension of the correlation between remittances and inflation in Nigeria.

It is essential to emphasize the enhancement of domestic monetary management, as empirical evidence has shown its substantial impact on inflationary dynamics. To ensure price stability, it is necessary to establish and enforce mechanisms

CUSUM of Squares 5% Significance b

Figure. CUSUM and CUSUM of Square Stability Tests Source. Author’ Compilations, 2023.

that effectively govern the increase of the money supply in alignment with economic development objectives. It is crucial to foster coordination between monetary authorities to establish a cohesive framework that aligns monetary policy with government expenditures.

The potential for sustainable economic development can also be a mechanism to mitigate inflation. The aim is to encourage investment in industries that foster employment generation and efficiency, thus bolstering total economic production. Expanding the supply of products and services has the potential to mitigate inflationary pressures. To enhance these endeavors, it is important to monitor currency rate fluctuations regularly, considering their intricate effects on inflation. Nigeria has the potential to cultivate a stable economic environment characterized by controlled inflation by implementing a well-rounded strategy that considers both internal and global issues.

The enhancement of remittance inflows may be facilitated by using official channels and ensuring the preservation of macroeconomic and financial stability. These factors are crucial prerequisites for the effective implementation of remittance-related policies, particularly when inflation is well managed. The substantial percentage of remittances that are sent via unofficial channels necessitates immediate measures to enhance the attractiveness of official channels in terms of efficacy, security, affordability, and confidentiality.

Список литературы Impact of remittances on inflation in Nigeria

- Abdul-Mumuni A., Quaidoo C. Effect of International Remittances on Inflation in Ghana Using the Bounds Testing Approach. Business and Economic Research, 2016, vol. 6 (1), p. 192. DOI: https://doi.org/10.5296/ber.v6i1.8635

- Acosta P.A., Lartey E.K., Mandelman F.S. Remittances and the Dutch Disease. Journal of International Economics, 2009, vol. 79 (1), pp. 102-116.

- Adekunle I.A., Williams T.O., Omokanmi O.J., Onayemi S.O. Mediating Roles of Institutions in the Remittance-Growth Relationship: Evidence from Nigeria. AGDI Working Paper., No. WP/20/, 2020.

- Azam M., Haseeb M., Samsudin S. The Impact of Foreign Remittances on Poverty Alleviation: Global Evidence. Economics and Sociology, 2016, vol. 9 (1), pp. 264-281. DOI: https://doi.org/10.14254/2071-789X.2016/9-1/18

- Baltagi B. Econometric Analysis of Panel Data. Vasa, 2005.

- Brown R.P.C., Connell J., Jimenez-Soto E.V. Migrants’ Remittances, Poverty and Social Protection in the South Pacific: Fiji and Tonga. Population, Space and Place, 2014, vol. 20 (5), pp. 434-454. DOI: https://doi.org/10.1002/psp.1765

- Castelli F. Drivers of Migration: Why Do People Move? Journal of Travel Medicine, 2018, vol. 25 (1), pp. 1-7. DOI: https://doi.org/10.1093/jtm/tay040

- Chowdhury M.B., Chakraborty M. The Impact of COVID-19 on the Migrant Workers and Remittances Flow to Bangladesh. South Asian Survey, 2021, vol. 28 (1), pp. 38-56.

- Dao T.H., Docquier F., Parsons C., Peri G. Migration and Development: Dissecting the Anatomy of the Mobility Transition. Journal of Development Economics, 2018, vol. 132, pp. 88-101.

- Dash R.K. Impact of Remittances on Domestic Investment: A Panel Study of Six South Asian Countries. South Asia Economic Journal, 2020, vol. 21 (1), pp. 7-30.

- Delgado-Wise R. Demystifying the Dominant Discourse on Migration and Development.

- Valday Discussion Club, 2016. URL: https://valdaiclub.com/a/Highlights/Demystifying-the-Dominant-Discourse-on-Migration-A/

- Dilanchiev A., Aghayev A., Rahman Md. H., Ferdaus J., Baghirli A. Dynamic Analysis for Measuring the Impact of Remittance Inflows on Inflation: Evidence From Georgia. International Journal of Financial Research, 2021, vol. 12 (1), p. 339.

- Enderwick P., Tung R.L., Chung H.F.L. Immigrant Effects and International Business Activity: An Overview. Journal of Asia Business Studies, 2011, vol. 5 (1), pp. 6-22. DOI: https://doi.org/10.1108/15587891111100778

- Gallagher L.A., Taylor M.P. The Stock Return–Inflation Puzzle Revisited. Economics Letters, 2002, vol. 75 (2), pp. 147-156.

- Gatawa N.M., Abdulgafar A., Olarinde M.O. Impact of Money Supply and Inflation on Economic Growth in Nigeria (1973–2013). OSR Journal of Economics and Finance, 2017, vol. 8 (3), pp. 26-37.

- Gujarati D., Porter D.C. Basic Econometrics. New York, McGraw-Hill/Irwin, 2009. 946 p.

- He W., Goodkind D., Kowal P. An Aging World: 2015. Washington DC, United States Census Bureau, 2016.

- Howell A. Impacts of Migration and Remittances on Ethnic Income Inequality in Rural China. World Development, 2017, vol. 94, pp. 200-211.

- Manzoor K., Shaheen S., Waqas M. Nexus Between Foreign Remittances and Poverty Reduction: Empirical Evidence from Pakistan. Pakistan Journal of Social Research, 2022, vol. 4, no. 3, pp. 872-880. DOI: 10.52567/pjsr.v4i03.964

- Islam M.S. Do Personal Remittances Cause Environmental Pollution? Evidence from the Top Eight Remittance-Receiving Countries. Environmental Science and Pollution Research, 2022, vol. 29 (24), pp. 35768-35779.

- Javaid W. Impact of Remittances on Consumption and Investment: Case Study of Tehsil Sargodha, Punjab, Pakistan. Journal of Finance and Economics, 2017, vol. 5 (4), pp. 156-163.

- Kaidi N., Mensi S., Ben Amor M. Financial Development, Institutional Quality and Poverty Reduction: Worldwide Evidence. Social Indicators Research, 2019, vol. 141 (1), pp. 131-156. DOI: https://doi.org/10.1007/s11205-018-1836-0

- Kim D.H., Lin S.C., Suen Y.B. Dynamic Effects of Trade Openness on Financial Development. Economic Modelling, 2010, vol. 27 (1), pp. 254-261. DOI: https://doi.org/10.1016/j.econmod.2009.09.005

- Kumar B. The Impact of International Remittances on Poverty Alleviation in Bangladesh. Remittances Review, 2019, vol. 4 (1), pp. 67-86.

- Laniran T.J., Adeniyi D.A. An Evaluation of the Determinants of Remittances: Evidence from Nigeria. African Human Mobility Review, 2015, vol. 1, no. 2, pp. 179-203.

- Lartey E.K., Mandelman F.S., Acosta P.A. Remittances, Exchange Rate Regimes and the Dutch Disease; A Panel Data Analysis. Review of International Economics, 2012, no. 2, pp. 377-395.

- Machlup F. Another View of Cost-Push and Demand-Pull Inflation. The Review of Economics and Statistics, 1960, pp. 125-139.

- Masron T.A., Subramaniam Y. Remittance and Poverty in Developing Countries. International Journal of Development Issues, 2018, vol. 17 (3), pp. 305-325. DOI: https://doi.org/10.1108/IJDI-04-2018-0054

- Mawutor J.K.M., Sogah E., Christian F.G., Aboagye D., Preko A., Mensah B.D., Boateng O.N. Foreign Direct Investment, Remittances, Real Exchange Rate, Imports, and Economic Growth in Ghana: An ARDL Approach. Cogent Economics & Finance, 2023, vol. 11 (1), art. 2185343.

- Mordi C.N.O. The Nigerian Financial Crisis: Lessons, Prospects and Way Forward, 2010, vol. 34 (3), pp. 1-28.

- Narayan P.K., Narayan S., Mishra S. Do Remittances Induce Inflation? Fresh Evidence from Developing Countries. Southern Economic Journal, 2011, vol. 77 (4), pp. 914-933. DOI: https://doi.org/10.4284/0038-4038-77.4.914

- Nasir M.A., Duc Huynh T.L., Xuan Tram H.T. Role of Financial Development, Economic Growth & Foreign Direct Investment in Driving Climate Change: A Case of Emerging ASEAN. Journal of Environmental Management, 2019, vol. 242, pp. 131-141. DOI: https://doi.org/10.1016/j.jenvman.2019.03.112

- Ngoma A.L., Ismail N.W. Do Migrant Remittances Promote Human Capital Formation? Evidence from 89 Developing Countries. Migration and Development, 2013, vol. 2 (1), pp. 106-116.

- Nisar A., Tufail S. An Analysis of Relationship Between Remittances and Inflation in Pakistan. Zagreb International Review of Economics & Business, 2013, vol. 16 (2), pp. 19-38.

- Nisar A. An Analysis of Relationship Between Remittances and Inflation in Pakistan, 2013, vol. 16 (2), pp. 19-38.

- Olubiyi E.A. Trade, Remittances and Economic Growth in Nigeria: Any Causal Relationship? African Development Review, 2014, vol. 26 (2), pp. 274-285. DOI: https://doi.org/10.1111/1467-8268.12081

- Pesaran H.H., Shin Y. Generalized Impulse Response Analysis in Linear Multivariate Models. Economics Letters, 1998, vol. 58 (1), pp. 17-29. DOI: https://doi.org/10.1016/s0165-1765(97)00214-0

- Pesaran M.H., Shin Y., Smith R.J. Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics, 2001, vol. 16 (3), pp. 289-326. DOI: https://doi.org/10.1002/jae.616

- Rahman M.M., Rana R.H., Barua S. The Drivers of Economic Growth in South Asia: Evidence from a Dynamic System GMM Approach. Journal of Economic Studies, 2019, vol. 46 (3), pp. 564-577.

- Rivera J.P.R., Tullao T.S. Investigating the Link Between Remittances and Inflation: Evidence from the Philippines. South East Asia Research, 2020, vol. 28 (3), pp. 301-326. DOI: https://doi.org/10.1080/0967828X.2020.1793685

- Seddon D., Adhikari J., Gurung G. Foreign Labor Migration and the Remittance Economy of Nepal. Critical Asian Studies, 2002, vol. 34 (1), pp. 19-40.

- Steenblik R.P., Jones D., Lang K. Subsidy Estimation: A Survey of Current Practice. SSRN Electronic Journal, 2012. DOI: https://doi.org/10.2139/ssrn.1650554

- Vacaflores D.E. Are Remittances Helping Lower Poverty and Inequality Levels in Latin America? The Quarterly Review of Economics and Finance, 2018, vol. 68, pp. 254-265.

- Wooldridge J.M. Econometric Analysis of Cross Section and Panel Data. Booksgooglecom, 2002. World Bank. Record High Remittances Sent Globally in 2018. World Bank Group, 2019, Apr. 10.