Improvement of the analysis of period costs in construction organizations

Автор: Khalilov Sherzod

Журнал: Бюллетень науки и практики @bulletennauki

Рубрика: Экономические науки

Статья в выпуске: 8 т.7, 2021 года.

Бесплатный доступ

There is a growing need to attract foreign investment in the construction industry, to determine the effectiveness of ongoing construction work, to form information on the financial and economic activities of construction companies. It also requires an analysis of the period costs of construction organizations by origin, by analyzing information related to operational activities. In this article, an author’s approach has been developed by studying the approaches to the costs of the period in the scientific and educational works of local and foreign economists. Theoretical and methodological aspects of the analysis of the factors influencing the change in administrative costs and the origin of period costs in construction organizations were studied by comparative analysis of international and domestic experience and recommendations were developed. The use of these recommendations allows the identification of factors influencing changes in administrative costs and their control.

Analysis, period costs, administrative costs, operating activities

Короткий адрес: https://sciup.org/14120679

IDR: 14120679 | УДК: 330+004 | DOI: 10.33619/2414-2948/69/29

Текст научной статьи Improvement of the analysis of period costs in construction organizations

Бюллетень науки и практики / Bulletin of Science and Practice

UDC 330+004

Introduction. In the context of economic liberalization, a full understanding of the economic content of current expenditures, accurate reflection and analysis is one of the most pressing issues. Due to the fact that the concept of recurrent costs has not entered our economy for a long time and, by its nature, does not fully reflect the fixed costs, today there are different interpretations of this cost element among economists. Period costs are a new concept that has entered the economy of our country in connection with the transition of production to the system of "direct costing", which is widely used in world practice. In practice, it is observed that many new items of expenditure that are emerging with the development of the economy are reflected in the structure of period costs. Given that this will be offset by financial results and the expansion of the tax base, it will have a significant impact on the reduction of profits of general economic activity and the increase of the tax base.

Today, there are very few pages in the literature and scientific works on accounting and economic analysis in our country, devoted to the "Period costs", its content, processes of formation and accounting, which, in our opinion, cover only some aspects of the subject. In our opinion, it is necessary to pay more attention to the concept of "Period costs" in the literature of the newly created industry on the basis of the requirements of the modern economic system. The fact that it also includes the costs that are added to the tax base requires a deeper understanding of the essence of this concept. The diversity of ideas that express the content of a concept in some literatures indicates that not all aspects of it have yet been fully elucidated.

In accordance with the "Regulations on the production and sale of goods (work, services)" approved by the Cabinet of Ministers of the Republic of Uzbekistan dated February 5, 1999 No 54, the costs associated with the financial and economic activities of the business entity are divided into four groups:

-

- costs included in the cost of production;

-

- expenses included in current expenses;

-

- expenses on financial activities;

-

- emergency damages.

The definition of period costs from the cost groups listed in the Regulation is as follows: period costs are costs and expenses that are not directly related to the production process: management costs, product sales costs and other costs of general economic significance [1].

From the definition given in the statute, we can see that period costs consist of costs and expenses that are not directly related to the production process. Scientists of our country, including A. V. Vahobov, A. T. Ibrogimov, N. F. Ishankulov, M. K. Pardaev, J. I. Isroilov, B. I. Isroilov, T. Q. Qudratov, M. M. Ibragimov, Z. H. Karimova, M. E. Rakhimov, N. N. Kalandarova conducted research on the costs of the period, and it is noted that the views expressed by them are the costs and expenses that are not directly related to the production process. According to Z. Sagdillaeva, I. Choriev, A. Mahmudov, U. Yuldasheva, period costs are a new indicator in the system of enterprise costs, which includes costs not directly related to the production process, such as management costs, sales costs, other general economic costs [2].

In turn, in the scientific work carried out by local scientists and researchers, there is a perception that the cost items in the structure of direct current expenses are the main activities. In particular, AS Boltaev emphasizes that sales costs in supply organizations should be considered as the main activity costs [3].

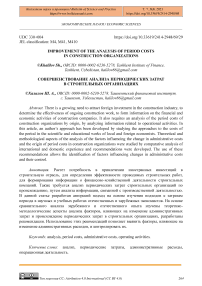

Foreign scientists including Ch. T. Hongren, S. M. Datar, J. M. Foster describe as follows: period costs are expenses that are included in the income statement in addition to the expenses that constitute the cost of goods sold [4]. K. Ebbecken, L. Poster and M. Ristea argue that period costs should be understood as non-capitalized costs that relate to a certain period and have nothing to do with inventory [5]. We consider it appropriate to approach based on the following opinion of T. Sutton: the total cost estimate consists of costs that can be capitalized and not capitalized in the cost of the product [6]. It can be seen that this idea, expressed by T. Sutton, is approached by the method of "Absorption costing" in the calculation of the cost of products (works, services). The costs included in the cost of goods (works, services) are the costs that are capitalized in the cost of the product as part of the total cost. Period costs are non-capitalized expenses that are reflected in the statement of financial performance. Period costs are not capitalized in the production of the finished product. Period costs items are reflected in the financial statements as they arise (Figure 1).

Revenue from sales

Administrative costs;

Sales costs;

Other operating

Administrative costs;

Sales costs;

Other operating

according to origin

Other operating expenses

Revenue from operating activities

Figure 1. The effect of production and operating costs on revenue from operating activities (Developed by the author because of research)

As a result of the study of foreign experience, selling costs, administrative costs and other operating expenses are presented as separate items of expenses depending on the origin of the items of period costs, without using the term “Period costs” in the income statement. Research and development costs are shown separately from other operating expenses in the statement of comprehensive income. This approach is important for users to easily understand, analyze and make management decisions regarding financial reporting data.

In our opinion, in order to attract foreign investment to the country, for the further development of the production and services sector, the forms of financial statements, including financial results, should be understandable to foreign investors. We believe that expenses, administrative and other operating expenses should be shown as separate expense items.

Analysis and results

In construction organizations, the structure of operating expenses in the structure of operating expenses is also divided into administrative expenses, sales expenses and other operating expenses.

Table-1 shows that in 2017, the cost of construction works and services performed by JSC "Elektrqishloqqurilish" amounted to 71.8% of operating activities expenses or 40821006 thousand sums, and period costs — 28.2% or 16102201 thousand sums. In 2018, the cost of construction works and services amounted to 73.0% or 70881741 thousand sums, and period costs — 27% or 26135027 thousand sums. In 2019, the cost of construction works and services performed by JSC "Elektrqishloqqurilish" amounted to 78.2% or 108485647 thousand sums, and period costs amounted to 21.8% or 30237499 thousand sums. The share of period costs in operating activities expenses decreased by 1.2% in 2018 compared to 2017 and by 6.4% in 2019. Such a change can be positively assessed.

Table 1 THE SHARE OF CURRENT EXPENSES OF JSC "ELEKTRQISHLOQQURILISH" IN EXPENSES OF OPERATING ACTIVITIES DEVELOPED BY THE AUTHOR AS A RESULT OF RESEARCH

|

№ |

Cost item |

2017 |

% |

2018 |

% |

2019 |

% |

|

1 |

Cost of goods, works and services sold |

40821006 |

71,8 |

70881741 |

73,0 |

108485647 |

78,2 |

|

2 |

Period costs |

16102201 |

28,2 |

26135027 |

27,0 |

30237499 |

21,8 |

|

Total operating activities expenses |

56923207 |

100 |

97016768 |

100 |

138723146 |

100 |

|

40 |

4 28,2 , 27 |

|

20 |

21,8 |

|

0 |

2017 2018 2019 |

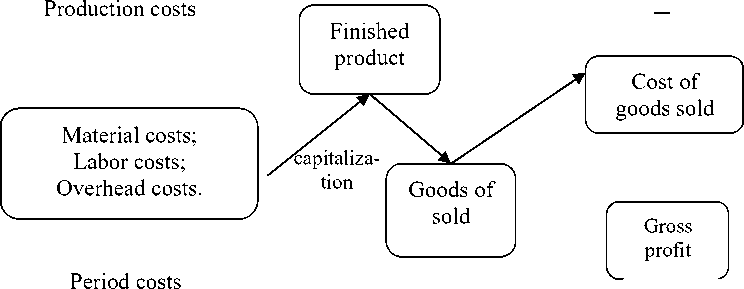

Figure 2. Changes in the share of period costs of JSC "Elektrqishloqqurilish" in the structure of operating activities expenses Developed by the author as a result of research

S. J. Peterson points out that in construction organizations, sales costs have a lower share than administrative costs and other operating costs [7].

Table 2

ANALYSIS OF CURRENT EXPENSES OF JSC "ELEKTRQISHLOQQURILISH" BY ORIGIN (IN THOUSAND SUMS) DEVELOPED BY THE AUTHOR AS A RESULT OF RESEARCH

|

Content of period costs |

2016 |

% |

2017 |

% |

2018 |

% |

2019 |

% |

|

Selling costs |

195428 |

1,6 |

1841778 |

11,4 |

1247811 |

4,7 |

864504 |

2,8 |

|

Administrative costs |

5206693 |

42,1 |

7799688 |

48,5 |

13200179 |

50,5 |

19071869 |

63,1 |

|

Other operating expenses |

6973815 |

56,3 |

6460735 |

40,1 |

11687037 |

44,8 |

10301126 |

34,1 |

|

Total |

12375936 |

100 |

16102201 |

100 |

26135027 |

100 |

30237499 |

100 |

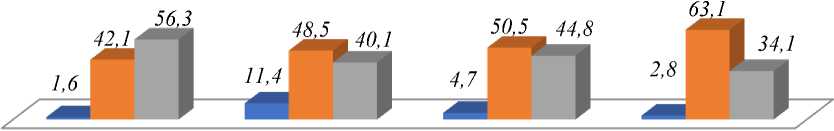

The data in Table-2 show that in the analysis of cost items on the origin of period costs the share of selling costs is lower than the period costs, the share of salling costs in 2016 was 1.6%, 11.4% in 2017, 4.7% in 2018 and 2019. and 2.8% in the previous year.

The share of administrative costs was 42.1% in 2016, 48.5% in 2017, 50.5% in 2018, and 60.3% in 2019. The share of other operating expenses in period costs was 56.3% in 2016, 40.1% in 2017, 44.8% in 2018 and 34.1% in 2019.

Selling costs Administrative costs Other operating expenses

2016 2017 2018 2019

Figure 3. Analysis of JSC "Elektrqishloqqurilish" on the origin of period costs (in thousands of sums

Table 3

ANALYSIS OF THE DYNAMICS OF ADMINISTRATIVE COSTS OF JSC "ELEKTRQISHLOQQURILISH" (THOUSAND SUMS) DEVELOPED BY THE AUTHOR AS A RESULT OF RESEARCH

|

Administrative costs |

2016 |

2017 |

2018 |

2019 |

Absolute change for 2019 (+, -) |

Percentage change for 2019 (+, -) |

||

|

Compared to 2016 |

Compared to 2018 |

Compared to 2016 |

Compared to 2018 |

|||||

|

Mariat worker staff salary costs |

2855413 |

4798837 |

8385219 |

11986421 |

+9131008 |

+3601202 |

+319,8 |

+42,9 |

|

Material costs for administration |

248334 |

497889 |

582085 |

968745 |

+720411 |

+386660 |

+290,1 |

+66,4 |

|

Business trip expenses |

552736 |

794445 |

1096783 |

1484523 |

+931787 |

+387740 |

+168,6 |

+35,4 |

|

Long-term asset storage and operating costs |

1185137 |

1596885 |

1987692 |

2876970 |

+1691833 |

+889278 |

+142,8 |

+44,8 |

|

Maintenance and operating costs of service vehicles |

98329 |

139672 |

196345 |

307981 |

+209652 |

+111636 |

+213,3 |

+56,9 |

|

Fire protection and security costs |

34456 |

45579 |

83971 |

128376 |

+93920 |

+44405 |

+272,6 |

52,9 |

|

Expenses for licensing, legal and information services |

18790 |

21988 |

52982 |

98937 |

+80147 |

+46855 |

+426,6 |

+86,7 |

|

Other expenses |

213498 |

619393 |

815102 |

1219916 |

+1006418 |

+404814 |

+371,4 |

+37,7 |

|

Total administrative costs |

5206693 |

7799688 |

13200179 |

19071869 |

+13865176 |

+5871690 |

+266,3 |

+44,5 |

|

Compared to the base period of total administrative costs |

100 |

149,9 |

253,6 |

366,3 |

x |

X |

x |

x |

|

Chain change of total administrative costs, in percent |

100 |

149,9 |

169,3 |

144,5 |

x |

X |

x |

x |

As can be seen from Table-3 we can see that the total amount of administrative expenses in JSC "Elektrqishloqqurilish" in 2019 amounted to 19071869 thousand sums, an increase over 2016 by 266.3%. Under this change, the administration incurs the costs of staff salaries, long-term asset maintenance and operation costs, service travel costs, maintenance and operation costs of service vehicles, fire protection and security costs, licensing, legal and information services costs, and other administrative costs. such as an increase in cost items.

Conclusion

When we analyze the change in the total amount of administrative expenses compared to 2018, we can see that in 2019 it increased by 44.5% compared to 2018 or 5871690 thousand sums. Based on this, cost items such as staffing costs, long-term asset storage and operating costs, and material costs incurred by the administration were affected.

The analysis of the chain change of administrative costs in JSC "Elektrqishloqqurilish" in 2019 compared to 2016 shows an upward trend in the total amount of administrative expenses. The main reasons for this are the increase in the amount of basic calculations, the physical obsolescence of fixed assets and the need for their repair, the increase in inflation.

Список литературы Improvement of the analysis of period costs in construction organizations

- "Об утверждении положения о составе затрат по производству и реализации продукции (работ, услуг) и о порядке формирования финансовых результатов" от 5 февраля 1999 г. №54 // Собрание постановлений Правительства Республики Узбекистан, 1999, №2, ст. 9.

- Вахобов А. В., Ибрагимов А. Т., Исанкулов Н. Ф. Финансовый и управленческий анализ. Ташкент, 2005. 164 с.

- Кудратов Т. К., Иброхимов М. М., Каримова З. Х. Экономический анализ. Ташкент, 2005. 106 с.

- Сагдиллаева З., Чориев И., Максмудов А., Юлдашева Ю. Экономический анализ. Ташкент. 2007. 211 с.

- Horngren C. T., Foster G., Datar S. M. Contabilidad de costos un enfoque gerencial. Pearson educación, 2007.

- Ebbeken K., Possler L., Ristea M. Calculation and cost management. 2000.

- Sutton T. Corporate financial accounting and reporting. Pearson Education, 2004.