Influence of capital and costs on the evaluation of transfer prices

Автор: Gisin Lev Mikhailovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Young researchers

Статья в выпуске: 1 (25) т.6, 2013 года.

Бесплатный доступ

The present article deals with the methodology for defining the optimal transfer price in commercial structures. The paper contains the examples and analysis of assessing transfer prices taking into account the specifics and characteristics of organization’s costs and capital. The novelty of the work consists in the fact that it analyzes approach methods based on a detailed classification of expenditures with a purpose of practical implementation of the transfer pricing system.

Banking, profitability, fixed and variable costs, opportunity costs, value of capital, transfer price

Короткий адрес: https://sciup.org/147223429

IDR: 147223429 | УДК: 336.717

Текст научной статьи Influence of capital and costs on the evaluation of transfer prices

The era of globalization is characterized by the formation of single information, economic, cultural, political and legal space. Globalization produces new opportunities, positive as well as negative, connected with the change of established systems and relations. The expansion of financial market, along with increasing number and volume of transactions, leads to the change of its conditions and manifold increase of financial risks.

Under these conditions, commercial multidivisional banking structures, having representative offices in local markets, are becoming more competitive. The stability of such large structures depends on their interdivisional commercial activities, transfers of banking products and services. The study of transfer pricing and the practical experience of its application proves that, at present, transfer pricing, which is, in fact, an outcome of globalization, is a necessary prerequisite for the successful development of large multidivisional commercial banks. Practical research also proves that the introduction of transfer pricing is relevant for any international commercial structures, in particular, in the sector of industry and services [1] .

Therefore, a fundamental goal, faced by top managers of modern commercial multidivisional banking structures, consists in practical definition of an optimal transfer price and introduction of a transfer pricing system among its divisions. This objective implies the solution of certain tasks.

These include, firstly, the allocation of structural units, generating profits of the whole structure, the so-called profit centres, which were first identified and subsequently studied by P. Drucker [2, 3]. It should be noted that a profit centre of the structure can be a specific division, as well as its products and services, or a structural unit specially created on the basis of available resources.

Secondly, the proper determination of an optimal transfer price, as a rule, requires the use of mathematical modeling.

In addition, the implementation of a transfer pricing system and establishment of an optimal transfer price requires a thorough analysis and consideration of actual market conditions, market prices and the multitude of factors and costs that affect the structure’s income.

The present article considers the influence of costs on the determination of an optimal transfer price.

Assessment of a transfer price with regard to fixed and variable costs

Costs are cash expenditures emerging in the process of production and circulation of a product or service due to the consumption of various economic resources (raw materials, labour, fixed assets, services, financial resources). Costs are one of the most important economic factors of any commercial organization, since they have direct influence on profits maximization in creating and selling competitive products or services. At present, the growth of costs can be found in almost all types of business. The banking sector witnessed a significant increase of operational costs, including administrative and manpower costs. A considerable growth of expenses is conditioned by the necessity of introducing new technologies.

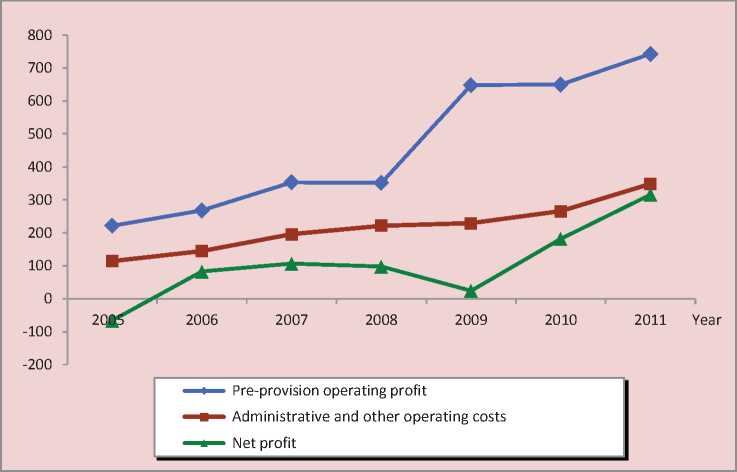

The information (official statements according to International Financial Reporting Standards – IFRS) on operating costs of Sberbank, which includes both variable costs and fixed (administrative and other operating profit), as well as net profit and pre-provision operating profit (fig. 1) .

The graph shows, that as the bank develops, its expenditures increase in general with the increase in its operating profit, therefore, it is most relevant to estimate the types of costs properly when determining the transfer price.

As for 2009, the fall of net profit was the result of increased allowances for loan loss provisions. This event does not contradict the correlation between the increase of the bank’s expenditures and profit in the context of transfer pricing and cost optimization, and refers to the sphere of credit risk.

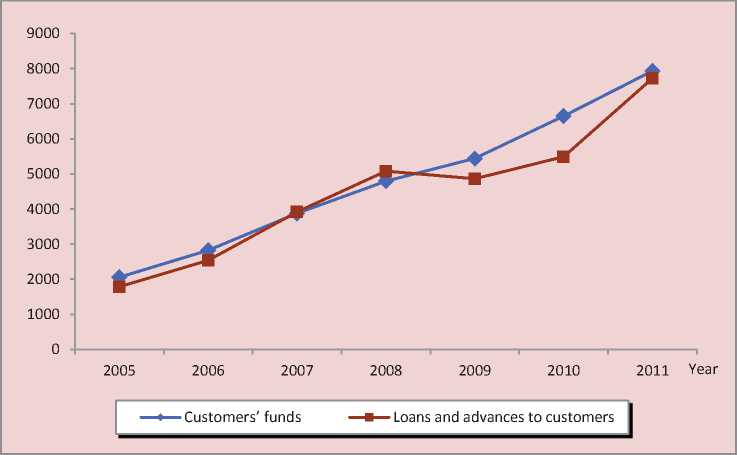

To illustrate the correlation mentioned above, let us consider a graph of balance sheets of two main products of a commercial bank on the example of Sberbank, on the basis of its official statements according to IFRS (fig. 2) .

The graph shows that the growth of expenses over time indicates their dependence on the increasing volume of rendered services.

Let us consider a model of a basic business structure, existing in various countries. As mentioned above, any such structure contains profit centres – structural divisions, which gain profit on their own, being an independent source of a specific part of the whole structure’s total profit; and cost centres – structural divisions, which are a source of costs and which support other units of a company [4].

The whole company’s activities are aimed at profit maximization, which can be expressed analytically as the solution of a standard linear problem of profit maximization and the creation of a system, in which the structures’ owners will gain the greatest possible profit.

Solving the problem of profit maximization implies that an analyst, who faces the task of simulating a transfer pricing system and determining an optimal transfer price, can make up a mathematical representation of the function of profit and costs. But it is very difficult to implement in practice.

Essentially, the company’s managers either focus on the state of variable and fixed costs for assessing transfer prices, or just use market prices without solving the problem of profit optimization.

When considering fixed and variable costs in practice, one mainly focuses on two areas:

-

1) comparison of specific costs with the particular type of goods;

Figure 1. Sberbank’s financial performance indicators in 2005 – 2011

Figure 2. Dynamics of Sberbank customers’ funds, loans and advances in 2005 – 2011

-

2) clear differentiation between fixed and variable costs, proceeding from the fact that fixed costs do not depend on changes in the volume of production, and variable costs change in proportion to this volume [4].

Some companies prefer to regard costs as the items attached to a certain type of activity (for example, an advertising campaign for the group of goods), rather than to a certain type of goods. The implementation of this approach results in certain difficulties when attempting to make a clear distinction between variable and fixed costs. In this case, costs can be viewed as the values of elements in a set, which cannot be divided on a temporal basis (variable or fixed).

It should be noted that under this approach the variance of costs (as a statistical measure of dispersion of their values) from the viewpoint of their division by the type of goods increases, since the elements of the set vary depending on the type of activity, rather than the type of goods. Furthermore, there are other problems in costs accounting with regard to the determination of transfer prices. They are caused by the differences in understanding of the costs contained in transfer pricing models, as well as the costs described in accountancy.

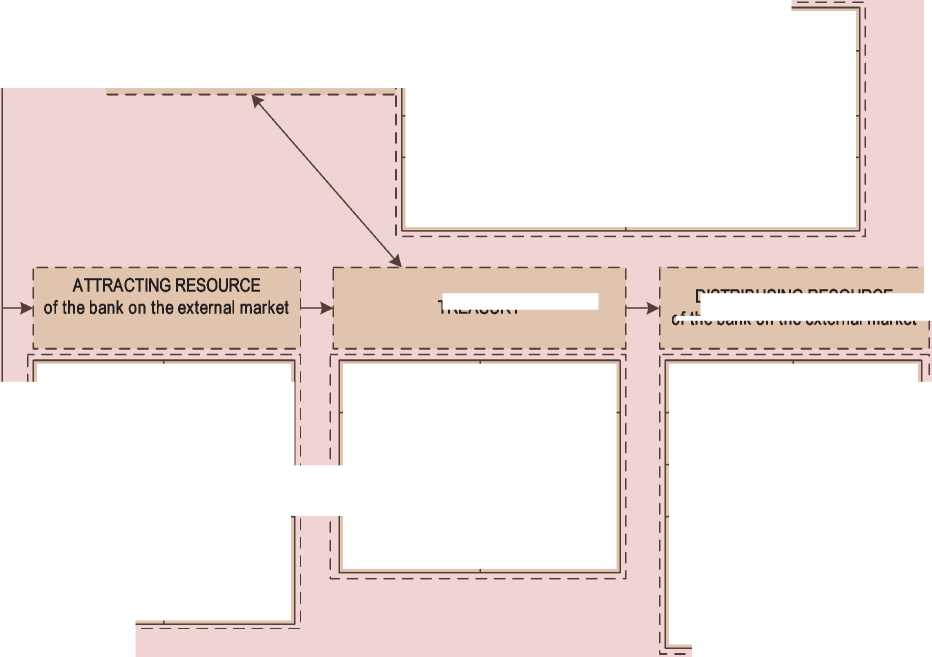

In the banking sphere, the treasury is most frequently the centre of inner market among the divisions of a structure (fig. 3) [5].

The treasury not only manages the bank’s liquidity, providing an optimal assets/liabilities ratio, but also purchases the resources from attracting structural divisions and sells them to distributing divisions.

In large banks, working with a wide range of financial products and tools, carrying out internal control and accounting, the treasury is the profit centre of the entire organization, it defines buying and selling transfer prices for its structural divisions, taking into account market prices and costs.

In the absence of an internal accounting system in small banks, where the asset and liability management is carried out on the basis of their portfolio grouping, the treasury

Figure 3. Cooperation between the treasury and structural resources of the bank

I---------------

I ATTRACTING AND DISTRIBUSING

J RESOURCE of the bank on the external market

|

External profit |

External cost |

|

Banking and brokerage commission profit |

Banking and brokerage commission expenses |

|

Internal profit |

Internal cost |

|

Transfer profit from the selling of resources to the treasury |

Transfer cost for the purchase of resources of the treasury |

|

External profit |

External cost |

|

interest on deposits |

|

|

Internal profit |

Internal cost |

|

Transfer profit from the selling of resources to the treasury |

TREASURY

|

Internal profit |

Internal cost |

|

Transfer profit |

Transfer cost for |

|

from the selling of |

the purchase of |

|

resources to the |

resources from |

|

distributing |

the attracting |

|

resource |

resource |

DISTRIBUSING RESOURCE of the bank on the external market

|

External profit |

External cost |

|

interest on loans |

|

|

Internal profit |

Internal cost |

|

Transfer profit from the selling of resources to the treasury |

Transfer cost for the selling resources to the treasury |

sets transfer rates for each type of assets or liabilities with regard to urgency and currency denomination, but it does not have its own profit and it is the centre of costs. Its profits-expenditures item on the redistribution of bank resources is determined by the difference between the revenues from sales and expenditures on purchasing the bank’s resources, without redistribution for the centre of the bank’s profits and without affecting the total financial performance of the bank as a whole.

Evaluation of a transfer price with regard to opportunity costs and the cost of capital

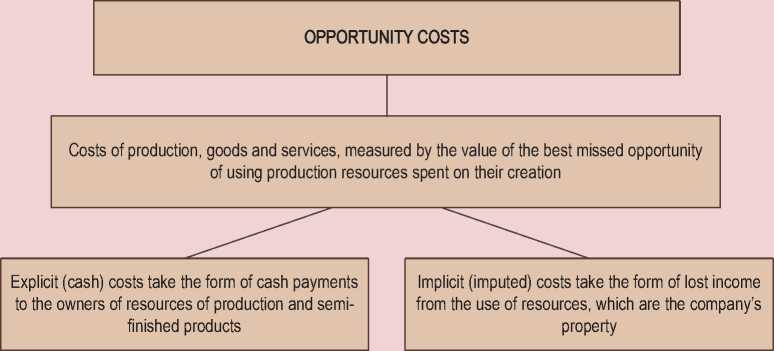

In this context, one should consider opportunity costs and the cost of capital separately. Alternative costs in a broad economic sense (and with respect to the simulation of transfer pricing systems in particular) can be represented as a profit that was lost due to the disuse of economic resources in the most profitable of all possible types of activity. For example, for the owners of the company described above, opportunity costs are the maximum salaries, which they could get, working for hire.

In economics, the concept “opportunity costs” is used in the analysis of resource allocation efficiency. So, in the example above, when evaluating the efficiency only on the basis of business profits, a company can be considered efficient only if its income exceeds the highest alternative earnings of its owners. Business accounting regards costs as actual and clearly identifiable expenses and in its essence it cannot deal with opportunity costs.

The following diagram (fig. 4) provides an overview of the types and characteristics of opportunity costs.

Let us consider the second example, in which we will examine the cost of capital. In itself, the term “capital” has many definitions. In order to define the capital accounting methodology, it is necessary to understand and define the main concepts and terms, which characterize capital and its components [6].

Capital, as the aggregate sources of property forming organization’s assets, can be determined by the fundamental equation of accounting: Assets is Aggregate capital . Sources of the organization’s property, which should be presented in the assets of accounting, may include both its own sources, and the sources equivalent to them, as well as borrowed funds.

At the same time, the notion “capital” has a different meaning in market economy, since any borrowed capital in the market conditions is considered as a liability. In this case, the notion of capital may include only equity capital

Figure 4. Opportunity costs

– the owner’s capital. International financial reporting standards adhere to market-based understanding of capital, which is reflected in the Russian edition of IFRS in the section Principles of compiling financial statement s. Here capital is defined as part of a company’s assets remaining after deducting all of its liabilities. Then the fundamental accounting equation takes the following form: Assets is Obligations plus Equity capital .

The normative system regulating accountancy in the Russian Federation does not provide a clear definition of the term under consideration. The concept of accounting in Russia’s market economy defines “capital” as “investments of owners and profit, accumulated for all the period of organization’s activities” [7].

Therefore, given the fact that the term “capital” has many meanings, one can observe that at present there are certain differences between accounting and models used in economics to estimate transfer prices. In order to measure the expected cost of new (or borrowed) capital, it is necessary to use market-based valuation of each of the components, rather than the data of accounting statements, which can significantly differ from the market ones.

In addition, accounting lacks a formal permanent rate of payments on shares, and the assessment of transfer prices requires the calculation of the weighted average cost of capital, which is represented by the weighted average cost of debt obligations and shares of a company’s owners. In short, the calculation of transfer prices requires permanent accounting of the clearly specified percentage indicative of dividend payments on equity shares.

Weighted average cost of capital allows companies’ owners to evaluate the attractiveness of certain investments, comparing the yield rate of investments to the weighted average cost of capital. An investment can be considered profitable, if the rate of its return exceeds the weighted average cost of capital.

Weighted average cost of capital (WACC) takes into account the cost of equity and borrowed funds, and can be calculated as follows:

WACC= Re(E/V) + Rd(D/V)(1 - tc), where:

Re – rate of profitability of equity (joint stock) capital, calculated, as a rule, with the use of Capital Asset Pricing Model;

E – market value of equity (joint stock) capital; it is calculated as the product of the number of equity shares of a company and the price per share;

D – market value of borrowed capital, which in practice is often determined according to the financial statements as the amount of the company’s loans (if these data are not available, one can use the available information on the ratio of equity capital to borrowed capital of similar companies);

V = E + D – aggregated market value of company’s loans and its equity capital;

Rd - rate of return of the company’s borrowed capital (the costs for raising debt funds), such costs are interests on bank loans and corporate bonds of a company; in this case the value of borrowed capital is adjusted with regard to profit tax rate (the adjustment lies in the fact that the interest on credits and loans servicing is referred to the cost of products, thereby the tax base for profit tax is reduced);

tc – profit tax rate [8].

If the capital includes preferred shares with their own value, then the formula should include additional components for each source of capital. Other, more rare sources of funding, such as convertible bonds, convertible preferred shares, etc. will be additionally included in the formula only in case, if they are present in significant volumes, since the cost of such financing is usually different from the value of standard bonds and shares [9].

Considering the practical application of WACC rate in the formation of a transfer price of capital, one should bear in mind that there is no standardized model of their relationship. Essentially, the company’s top managers decide upon the use of WACC as a transfer price of capital if the borrowed capital can’t be definitely associated with a specific set of financial products on the side of assets. In practice, this means that borrowed capital has been used, for instance, for investing in the bank’s infrastructure rather than for granting loans. Thus, the issue of “who will pay” for capital, is settled by dividing the balance of capital (debt and joint-stock) at the WACC interest rate between the bank’s profit-centres.

The highest share will be allocated to the profit-centre that has the most urgent demands for the infrastructure, mentioned above. In the second place, attention will be paid to the motivation issues of employees, whose incomes on management accounting are small because, when allocating the capital to the profit-centre, the management deliberately underestimates EBIT of this profit-centre, which is not always in the interests of management, as the staff will start losing motivation because of a formally poor performance of their department. The question arose: why the joint-stock capital rather than debt capital was considered when using WACC as a transfer price of capital. The answer lies in the fact that, in practice, joint-stock capital can’t be definitely bound to specific assets – in the notion of the bank’s management it is a basic buffer, which performs, among other things, mandatory regulatory requirements and for which, as a consequence, all the profit centres of the bank “pay” in the proportions established by the management. Thus, if the debt capital is nonetheless allocated to specific assets, then the separate transfer rate of debt capital (not WACC) will be paid for it by the profit-centres that own these assets, and the profit-centres of the bank in general will receive only the distributed joint-stock capital at the rate of joint-stock capital (not WACC) in the proportion specified by the bank’s management.

Accounting methods of determining transfer prices

Let us consider the various methods developed from the viewpoint of accounting in order to estimate the optimal transfer price in a commercial structure. Their classification is given by Kaplan and Atkinson [10]. We shall study in greater detail some types of costs and their impact on the transfer pricing system.

Marginal costs in the transfer price evaluation. Marginal costs include the expenditures for producing one additional unit of production.

If the transfer price is chosen so that it corresponds to the marginal costs (optimal transfer price. – L.G. ), this helps the company reach economic self-sufficiency and allows all the departments to participate in the production and sale of goods to the necessary extent. If the transfer price is set above the value of marginal costs, then it increases the motivation of the producing department to produce as many goods as possible and sell them to the selling department, because the marginal profit of the producing department will exceed the marginal costs of the goods production.

If the transfer price is set below the value of marginal costs, it reduces the motivation of the producing department to sell goods to the selling department, but it can increase the motivation to sell the same goods in the foreign market, if the external price exceeds the transfer price.

One should also take into account the fact that purchasing and selling departments can turn their attention to the external market. If the transfer price exceeds the average market price, then the heads of the selling department will be more eager to bring the transfer price closer to the market one, and the producing department will strive to optimize marginal costs with a purpose of their reduction.

Marginal costs exist mainly in financial institutions along with fixed expenses, which are allocated to departments according to reporting periods. This allows accountants to assess the distribution of profit by the departments and justify the decrease in profit of one department in favor of another.

Variable costs in the transfer price evaluation . Variable costs are operational expenses, which change in direct proportion to the change of production or sales volume, capacity utilization or other kinds of activity, e.g. consumed materials, direct labor expenditures, production electricity, as well as sales commissions.

Accounting, according to Kaplan and Atkinson, makes a clear distinction between transfer pricing systems, based on marginal and variable costs. In fact, the difference between the two approaches consists in the practical complexity of distinguishing between fixed and variable costs.

For example, some types of expenditures may be fixed in the short term, but variable in the long term. Some of the costs, e.g. manpower costs, can be hanged depending on the volume of production only with the consent of the company management. In general, the number of types of variable costs exceeds the number of marginal costs and includes the types of costs, which are considered fixed from the viewpoint of marginal costs. The advantages of transfer pricing systems, based on marginal costs, can be described in the framework of a simple mathematical model. The transfer pricing system, based on variable costs, will lead to optimal transfer prices only if marginal costs are equivalent to variable costs.

Total costs in the transfer price evaluation. Transfer pricing systems based on total costs imply the accounting of all the expenses of a company for determining the transfer price. The transfer price is defined as the aggregate total costs of a company, divided by the quantity of goods produced. This approach is characterized by a greater degree of randomness in the distribution of costs according to the types of goods, if there are goods of more than one type.

The difference between this approach and the approach, which takes into account vari- able prices, lies in the fact that in case when full costs are considered, fixed costs will be definitely taken into account. Marketing activity of a sales department can be an example of fixed costs that are connected with production. The study of external market is a company’s function, which is not related to the number and, sometimes, the type of goods and, consequently, it is an independent item of fixed costs.

Transfer pricing systems, based on full costs, are, in fact, a borderline case of transfer pricing systems, and the more complex the business, the worse the performance of one of the main functions of such systems, which is the reflection of objective analytical data on centres of profit and costs.

In case of choosing such an approach, top management will not be able to assess objectively the efficiency of individual departments. Despite the lack of support on the part of scientific community for this type of transfer pricing systems, many companies choose it, since it is easy to implement and is designed for simple structures. It is obvious that the simpler the company’s structure, the more objective this approach. Some scientists consider it the best [11].

Variable costs in view of markups in the assessment of transfer prices. This type of transfer pricing is a special case of transfer pricing systems that are based on variable costs. The difference from the standard approach in this case consists in the addition of a fixed markup to transfer prices. This increases the profit of a producing department, but reduces the profit of a selling department. This method is suitable for the company, in which its producing department produces goods with a low level of variable costs (in comparison with the average market price. – L.G.). In order to show the margin that the company saves due to the activities of this department, one can put together the transfer price and the value that doesn’t exceed the difference between the market transfer price and the level of variable costs of the producing department. The situation being directly opposite, namely, in case when variable costs exceed average market prices, a markup can be set as a negative value in order to reflect the efficiency of the selling department correctly. In this case, its efficiency is considered to be the profit, which the selling department will be able to make with regard to the average market price. Obviously, in this case the producing department will suffer constant losses from the viewpoint of transfer pricing. But it is justified, because, in fact, the producing department is non-competitive in the market.

Agreed transfer prices . Transfer prices can be set by the company’s management with or without regard to the approaches described above. This forced decision may be conditioned by special market conditions and the management’s desire to shift motivation from one department to another.

Conclusions concerning banking structures

The present article studies the influence of various costs and capital on the determination of an optimal transfer price for a structure, consisting of producing and selling departments. Such structure can comply with the banking structure if we draw the analogies:

-

1) between the producing department and profit centre for the attraction of monetary funds;

-

2) between the selling department and profit centre for the allocation of monetary funds.

The task of profit optimization can be solved mathematically by establishing transfer prices equal to marginal costs. This decision is applicable to any business structure, as it leads to its self-repayment.

But in practice, the accounting system in banks is the most detailed and developed in comparison with other business systems.

The accountants working in banking structures are much more pragmatic and closer to reality in their assessments than economists. In the vast majority of cases, the former rely on approved and acknowledged practical methodologies in contrast to the latter who rely mainly on a variety of abstract approaches.

Therefore, banking structures should take into consideration, first of all, an accounting point of view on the bank’s costs. This will promote the introduction of the most efficient models of transfer pricing.

Список литературы Influence of capital and costs on the evaluation of transfer prices

- Atkinson A.A. Intra-firm cost and resource allocations: theory and practice. Toronto, 1987.

- Drucker P.F. Management challenges for the 21st century. M.: Williams, 2000.

- Druker P.F. The practice of management. New York: Harper and Row, 1954.

- English-Russian dictionary of economics. Available at: http://economy_en_ru.academic.ru.

- Ashkinadze A., Knyazhechenko Ye. Technology of accounting of the actual execution of the budget of a commercial bank. Banks and technologies. 2001. P.5

- Khabarova L.P. Capital in the accounting reports of organizations. Accounting bulletin. 2008.

- Concept of accounting in Russia’s market economy, i.7.4.

- Sinadskiy V. Calculation of the discount rate. Financial director. 2003. No. 4.

- Brealey R., Myers S. Principles of corporate finance. Library “Troika-Dialog”, 2012.

- Atkinson E.A., Bunker R.D, Kaplan R.S., Young M.S. Management accounting. Publishing house “Williams”, 2005.

- McAulay L., Tomkins C. A Review of the contemporary transfer pricing literature with recommendations for future research. British journal of management. 1992. No. 3.