Integration of artificial intelligence into accounting as a tool for optimization and risk management

Автор: Nurdinova K.

Журнал: Бюллетень науки и практики @bulletennauki

Рубрика: Социальные и гуманитарные науки

Статья в выпуске: 12 т.10, 2024 года.

Бесплатный доступ

This article examines the integration of artificial intelligence (AI) into accounting as a tool for process optimization and risk management. The benefits of AI, such as automation of routine operations, increased data accuracy, improved reporting transparency, and support in risk management, are discussed. Particular attention is paid to how AI contributes to predictive analytics and error prevention, which reduces the likelihood of financial losses. The challenges associated with the implementation of AI are also analyzed, including high financial costs, data protection requirements, and staff adaptation.

Artificial intelligence (ai), accounting, optimization, risk management, automation, data accuracy, machine learning (ml)

Короткий адрес: https://sciup.org/14131742

IDR: 14131742 | УДК: 657:004.8 | DOI: 10.33619/2414-2948/109/52

Текст научной статьи Integration of artificial intelligence into accounting as a tool for optimization and risk management

Бюллетень науки и практики / Bulletin of Science and Practice

UDC 657:004.8

With the development of various technologies, the use of artificial intelligence (AI) is becoming an important part of the digital transformation of many industries, including accounting. Against the backdrop of increasing volumes of data and complex financial transactions, companies are faced with the need to improve efficiency and reduce operational risks. Integrating AI into accounting allows you to automate routine processes, reduce errors, and increase data transparency, which can significantly improve the quality of financial management and reporting.

The potential of AI to optimize accounting processes and manage risks goes far beyond the traditional approach. Machine learning (ML), predictive analytics, and data monitoring systems help in the early detection of anomalies, which prevents fraud and improves internal controls. However, with all the benefits, there are also challenges associated with the implementation of AI, including the need to adapt employees and ensure the reliability of the system. The goal of this research is to evaluate the impact of AI on optimization processes and risk management in accounting.

Main part. Aspects of optimization in accounting processes with AI

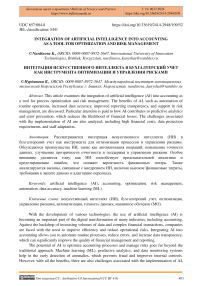

Modern accounting faces a number of challenges, that includes the need to process large volumes of data, requirements for accuracy, and the need to provide timely reporting. Various AI technologies open up new opportunities to optimize processes, minimize errors, and improve the productivity of accounting operations. According to 2024 report [1], most accountants are using AI to compose emails and refine their writing tone, and nearly a third are utilizing AI to automate their workflows (Figure 1).

Figure 1. Current utilization of AI in worldwide accounting practices in 2024, %

In this regard, one of the key aspects of using AI in accounting is the automation of routine operations. Tasks such as invoice processing, payment control, and reporting can be significantly simplified and accelerated using AI. These systems can automatically recognize and process invoices and receipts, reducing the time spent on manual data entry and minimizing the likelihood of errors. It also reduces personnel costs and allows resources to be focused on more analytical tasks, such as planning and budget management.

The use of AI to automate processes also expands the capabilities of companies in the field of self-service for customers. Built-in bots or AI platforms can automatically process requests for data updates, requests for changes in payment terms, etc. These systems free employees from routine duties and allow them to focus on more important aspects of the business (Table).

The use of AI helps to improve data accuracy by using ML algorithms that recognize and prevent anomalies in data. It can automatically match transactions and identify potential discrepancies in reporting. In addition, AI can perform complex calculations such as assessing tax liabilities, forecasting cash flows, and analyzing cost effectiveness with minimal error. Processed data can also be combined into a single system, ensuring the integrity and consistency of information [3].

Automation and implementation of AI in accounting help reduce costs associated with operational activities. By reducing the need for manual labor, a company can direct resources to developing other key areas of the business. In addition, optimizing processes with AI helps reduce the time spent on daily tasks, such as reporting and data verification. This contributes to more efficient use of human resources and allows teams to work more productively. The use of AI also reduces the costs associated with auditing and financial reviews, as the system of automatic monitoring and data analysis ensures a higher degree of accuracy and reliability of reporting.

Modern AI technologies can significantly simplify and optimize accounting processes, while making them more accurate, transparent and cost-effective. The introduction of AI in accounting allows companies to reduce time and financial costs, increase the level of automation and transparency.

Table

OVERVIEW OF AI-DRIVEN TASKS AND BENEFITS IN ACCOUNTING PROCESSES [2]

|

AI application |

Aspects |

Included tasks |

Benefits |

|

Automated bookkeeping |

Transaction recording |

Automatically categorizing and recording financial transactions from bank feeds, credit card statements, and invoices into the appropriate accounts. |

Reduces the time spent on manual data entry and reconciliation. Minimizes human errors, leading to more |

|

Expense management |

Tracking and categorizing expenses, and even attaching receipts to transactions. |

accurate financial records. Lowers the cost of bookkeeping |

|

|

Reconciliation |

Matching transactions recorded in the accounting system with bank statements, ensuring that records are accurate and up-to-date. |

services by reducing the need for manual labor. |

|

|

Automated auditing processes |

Data analysis |

Automating the analysis of large datasets to identify trends, anomalies, and areas of risk. |

Allows auditors to analyze a larger volume of data, providing a more comprehensive audit. |

|

Sampling |

Using statistical methods to select representative samples for audit. |

Reduces the time required to perform audits. Improves the |

|

|

Risk assessment |

Identifying high-risk areas that require more in-depth audit procedures. |

accuracy of audits by minimizing human error. |

AI for risk management and error prevention

The use of AI in risk management is becoming one of the key factors for companies who seek to ensure data accuracy and minimize errors in financial transactions. Implemented AI reduces the likelihood of human error and also analyzes vast amounts of data to identify potential risks at the earliest stages [4].

These technologies provide new opportunities for predictive analytics, which is especially useful in the area of risk management. ML models can analyze historical data and identify patterns that indicate potential risks. An AI system can determine that certain transactions have a higher risk of errors. It allows the accounting department to prevent unwanted consequences in advance. Risk prediction also help companies to more carefully plan its financial strategies and prevent potential losses. Such systems can analyze changes in data behavior, identify anomalies, and predict potential problems based on trends and patterns. This approach is especially useful for large companies working with huge amounts of data, where AI helps quickly identify deviations and take preventive measures to minimize risks.

Implementing AI to detect errors in accounting processes significantly reduces the likelihood of human error. Various ML algorithms can analyze large amounts of data and automatically identify potential errors or discrepancies. This is especially important for companies where a significant portion of transactions are carried out in real time, and errors can lead to large financial losses. If the system detects anomalies in calculations, it can automatically alert responsible employees who can make changes before the transactions are completed. This approach helps avoid double payments and other discrepancies, making the accounting process more accurate and reliable.

Technologies driven on AI also play a major role in fraud detection and prevention. Financial fraud such as invoice fraud, false transactions, and accounting manipulation can cause significant losses to companies and damage their reputation. These systems can analyze behavior patterns and identify suspicious transactions, allowing potential fraud to be quickly detected and addressed [5].

Various AI technologies can detect unusual employee behavior or abnormal actions, which are often signs of financial fraud. For example, the system can detect a transaction that does not correspond to the company’s normal operations and immediately notify the responsible persons about it. This proactive approach allows companies to minimize financial risks and ensures a high level of financial security.

Modern AI technologies improve internal control over a company’s operations, which increases transparency and reduces errors and fraud. These AI systems can monitor every stage of a financial transaction, providing a high degree of transparency and allowing control over all financial processes. This is especially important in the context of strict reporting standards, where even small errors can cause problems with audit and regulatory authorities. Embedded AI algorithms help maintain compliance with internal and external accounting standards, reducing the likelihood of regulatory violations. Automatic error detection and correction, as well as proactive risk management, make the internal control process more efficient and secure.

Challenges and limitations of AI implementation in accounting

The integration of AI into accounting offers great opportunities for optimization and efficiency, but it also comes with certain challenges and limitations. Understanding these issues allows companies to prepare for potential difficulties in advance and manage the AI integration process more effectively.

One of the main obstacles to the implementation of AI remains high financial costs. Investments in AI technologies include not only the initial costs of developing and setting up the system, but also long-term costs of training employees, technical support and software updates [6]. This issue is especially acute for small and medium-sized enterprises, for which such investments may be too significant.

Another major challenge is data security. Since accounting handles sensitive information, companies need to ensure that data is protected from leaks and cyberattacks [7]. The integration of AI requires strict security measures and compliance with legal requirements, such as compliance with personal data protection standards. This is especially important to maintain customer trust and protect confidential information.

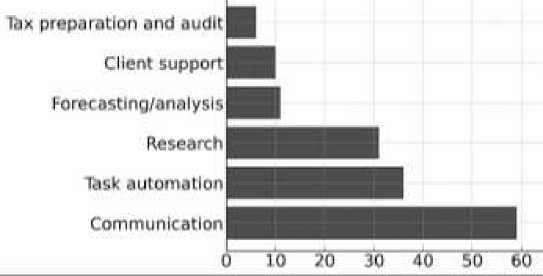

In addition, companies face difficulties in adapting employees to new technologies. Working with AI requires specific knowledge and skills that accounting employees do not always have. Training, as well as change management in the company, can take a significant amount of time and require additional resources, which also creates barriers to the effective implementation of AI. According to 2024 statistics [8], the human factor remains the main obstacle to the integration of AI in accounting, gaining the maximum value among all categories (Figure 2).

Those challenges include a lack of clear AI strategy that aligns with overall organizational objectives, insufficient attention and support from executive leaders along the AI journey, and failure to determine priorities and reallocate organizational resources to ensure a successful AI transformation.

Implementing AI in accounting is a complex process that requires not only financial and technical resources, but also a careful approach to security and staff adaptation. Overcoming these obstacles will help a company successfully integrate AI and get the most out of its capabilities while minimizing risks and limitations.

Figure 2. Challenges in adopting AI within the worldwide accounting sector in 2024, %

Conclusion

The integration of AI into accounting represents an important step towards streamlining financial processes and improving risk management. This technology enables automation of routine tasks, improved data accuracy, and increased transparency of accounting reports, which is especially valuable in dynamic and complex business environments. The use of AI helps reduce the likelihood of errors, speed up work, and improve the overall quality of reports, making it a powerful tool for modern companies.

However, implementing AI in accounting requires taking into account many factors, including financial costs, data protection, and staff training. Overcoming these limitations is the key to successfully integrating AI and getting the most out of its capabilities. With the right approach and effective change management, companies will be able to not only increase their competitiveness but also ensure stable development in the context of digital transformation.

Список литературы Integration of artificial intelligence into accounting as a tool for optimization and risk management

- The State of AI in Accounting 2024: Emerging Trends, Challenges & Opportunities. A Karbon Report. 2024. 18 p.

- Farea M., Al-Ifan B., Al-Dubai M., Ahmad A., Mohamed R., Hatamleh.Intelligent automation in accounting and financial reporting // Journal of Tianjin University Science and Technology. 2024. V. 57(06). P. 463-480. DOI: 10.5281/zenodo.12516114

- Abdullah A. A. H., Almaqtari F. A. The impact of artificial intelligence and Industry 4.0 on transforming accounting and auditing practices // Journal of Open Innovation: Technology, Market, and Complexity. 2024. V. 10. №1. P. 100218. DOI: 10.1016/j.joitmc.2024.100218 EDN: GAMAOJ

- Пшиченко Д. В. Роль искусственного интеллекта в управлении кризисными ситуациями в экономике // Тенденции развития науки и образования. 2024. №112(3). С. 117-122. EDN: VFATMG

- Wu X. Research on Accounting Risk Based on AI // Journal of Physics: Conference Series. - IOP Publishing, 2021. V. 1915. №2. P. 022052. DOI: 10.1088/1742-6596/1915/2/022052

- Yi Z., Cao X., Chen Z., Li S. Artificial intelligence in accounting and finance: Challenges and opportunities // IEEE Access. 2023. V. 11. P. 129100-129123. EDN: QDUQYA

- Ponomarev E. Analysis of the impact of using mobile applications for bill payments on the timeliness of payments and financial discipline of users // Холодная наука. 2024. №5. P. 5-14. EDN: MUCCBE

- The impact of artificial intelligence on accounting and finance: a global perspective. Institute of Management Accountant. 2024. 23 p.