Investment process financing in Russian business: assessment, trends, problems

Автор: Kormishkina Lyudmila Aleksandrovna, Yulenkova Irina Borisovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 3 (33) т.7, 2014 года.

Бесплатный доступ

In modern conditions the provision of investment process financing is the most important task of state economic policy aimed at achieving sustainable growth and dynamic development of the Russian economy in general. This problem solution requires further theoretical consideration and development of appropriate methodological, methodical and practical recommendations. Financing of investment activity development should be based on the systemic approach, which considers this process as an element of the financial support system of the state innovation development. It is necessary to conduct research in order to expand the financial component of this support, encourage the investment process development, enhance financial relations in the sphere of forming and using the intellectual property objects and develop a complex of measures to study the innovations implementation possibilities. Although economic science pays a lot of attention to various aspects of the issue, there is currently no research work, devoted to the study of sources of the investment process financing...

Investment process, investment climate, business, intensification, profit, source of financing, investment costs, regression model, indices, dynamics, investment operations, investment activity, level of taxation

Короткий адрес: https://sciup.org/147223590

IDR: 147223590 | УДК: 658.14/.17:336.531.2(470+571) | DOI: 10.15838/esc/2014.3.33.9

Текст научной статьи Investment process financing in Russian business: assessment, trends, problems

The investment climate in each country is formed due to active participation of the state. It determines domestic and foreign policies; introduces taxes; sets interest rates, varying them in accordance with the economic situation and curbing their growth by means of special economic methods; affects the level of tax collection; actively engages in the development of legislative acts, creating economic, political and legal conditions that determine the functioning of enterprises.

“The study of theoretical and methodological foundations of sustainable economic growth concludes that investment plays a key role in the solution of this problem” [1, p. 48]. Due to the so-called mechanism of reducing investment activity, functioning in the Russian economy in 1999 and 2007, the decline of social production was replaced by a more severe economic crisis in the form of recession reproduction [2, pp. 38-39]. With the reproduction decline, the input of the active part of fixed assets either lags far behind its output or does not compensate the latter. The main reason is the 48% depreciation of fixed assets [3, p. 345]. It should be taken into account that the economic development is possible only with the extended reproduction being ensured, which implies greater renewal of the main elements of productive forces and their qualitative improvement.

Since 2000 the national economy has managed to overcome such a negative trend when the output of the fixed assets in use advances over their input. However, if we take into account economic security and national economic tasks to modernize production capacities and job places, we can say that the volume of the input equipment remains inadequate. For comparison, in 1970, in the so-called “period of stagnation”, the coefficient of renewal was 10.2% and the coefficient of output – 1.7%, i.e. the fixed assets renewal was several times faster than in 2011, when the coefficients of their renewal and output amounted to 4.6 and 0.8%, respectively [3, p. 345]. So, the trend of their wear and tear remained the same due to such dynamics of fixed assets renewal.

“Russian fiscal policy does not lead to the solution of the problem to invest in the economy modernization. The system of state regulation in this sphere requires significant upgrade. According to the ISEDT RAS research, the increase in tax collection and a number of unpopular measures, especially in big business, would attract 8–13 trillion rubles per year to the budget system of the country. However, no practical steps have been made in this direction yet. What is more, nowadays the potent financial assets such as funding of the Reserve Fund and the National Wealth Fund do not participate in the solution of priority tasks of socio-economic development” [1, p. 56].

This situation is hazardous for the national economy, since the ability to innovation development is reducing significantly. The mechanism to decrease investment activity in the production and to encourage economic growth in the Russian modern economy predetermines that the national economy is unable to overcome the current situation and to ensure sustainable economic development. This requires a complex of state regulation measures and huge costs in order to intensify investment activities. Another option is to attract foreign capital, which ultimately leads to the threat to the country’s economic security.

As a result, the modern Russian economy is still characterized by the multilateral (total) financial crisis. Its basic forms are unprofitability, decrease in fixed capital, insolvency, criminalization of financial management, conscious concealment of financial flows from accounting, taxation, theft of financial and other resources.

It must be emphasized that the tax base formation and the enterprises’ ability to pay taxes are inseparably connected with the financial situation of the latter.

Undoubtedly, the researchers’ conclusion that the high level of taxation in Russia jeopardizes its investment activity makes sense.

In conditions of modern market economy, boosting enterprises’ investment activity is connected first of all with the search of sources and types of financial resources, which should ensure the balance between investment costs and financial capabilities.

As the result of privatization, the enterprises’ own funds are known to have been the key source of investment activity financing. Their share in Russia in 2011 accounted to almost 70% of the total investment. These funds are formed mainly at the expense of the enterprise’s profit and depreciation ( tab. 1 ).

Profit is the main internal source of the enterprise’s financial resources, ensuring its development. The higher the level of profit generation in the process of economic activity is, the less the need to attract funds from external sources is and, ceteris paribus, the higher the self-financing level and the competitive position in the market are. However, unlike some other internal sources, profit is a reproducible source and its reproduction is carried out in conditions of successful management on the extended basis. Table 1 indicates that the enterprises’ own funds in fixed capital investment have a substantial share (42.7%), the enterprises’

Table 1. Sources of the fixed capital funding in the Russian economy, % to the total

|

Indicator |

Year |

|||||||||||

|

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|

|

Investment in fixed capital |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

|

Including the financing sources: own funds |

47.5 |

49.4 |

45.0 |

45.2 |

45.4 |

44.5 |

42.1 |

40.4 |

39.5 |

37.1 |

41.0 |

42.7 |

|

Of them: - profit remaining at the disposal of the enterprise (the Fund) |

23.4 |

24.0 |

19.1 |

17.8 |

19.2 |

20.3 |

19.9 |

19.4 |

18.4 |

16.0 |

17.1 |

17.2 |

|

- depreciation |

18.1 |

18.5 |

21.9 |

24.2 |

22.8 |

20.9 |

19.2 |

17.6 |

17.3 |

18.2 |

20.5 |

21.6 |

|

- attracted funds |

52.5 |

50.6 |

55.0 |

54.8 |

54.6 |

55.5 |

57.9 |

59.6 |

60.5 |

62.9 |

59.0 |

57.3 |

|

Of them: - banks |

2.9 |

4.4 |

5.9 |

6.4 |

7.9 |

8.1 |

9.5 |

10.4 |

11.8 |

10.3 |

9.0 |

7.7 |

|

- budget funds |

22.0 |

20.4 |

19.9 |

19.6 |

17.8 |

20.4 |

20.2 |

21.5 |

20.9 |

21.9 |

19.5 |

18.8 |

Compiled by: Promyshlennost' Rossii 2012: stat. sb. [The 2012 Russian Industry: Statistics Digest]. Rosstat, Moscow, 2012. 445 p.

profit amounts to 17.2 % approximately. This is almost the depreciation amount, intended for reproduction of fixed capital.

At the same time it is necessary to consider the overall economic value of enterprises’ profit in the provision of financial resources for sustainable economic growth.

The correlation-regression analysis in this study helps to evaluate the impact of the main fixed capital sources on the investment index in the Russian Federation, which determines its value and dynamics due to their economic nature.

The index of investment in fixed capital in the Russian Federation is selected as a resultant variable ( Y ) and is laid in the basis of research as the most informative and most fully reflecting the investment development in the country. Factor variables ( X ), influencing the dynamics of the studied indicator, are the following:

X1 – an index of accumulation funds in the Russian Federation, % to the previous year;

X2 – an index of depreciation in the Russian Federation, % to the previous year;

X3 – an index of funds raised by banks, % to the previous year.

The initial data for the correlationregression analysis is presented in table 2 .

Table 2. Initial data for the regression analysis of the degree of the formation sources influence on the index of investment in fixed capital in the Russian Federation, % to the previous year

Year Index of investment in fixed capital in the Russian Federation Index of accumulation funds in the Russian Federation (X1) Index of depreciation in the Russian Federation (Х2) Index of funds raised by banks (Х3) 2001 126.8 129.8 129.8 191.3 2002 109.0 86.7 128.9 145.4 2003 125.4 117.0 138.2 136.5 2004 123.1 133.2 116.1 151.8 2005 128.8 135.9 118.3 133.5 2006 131.7 129.3 120.5 154.5 2007 137.0 133.0 126.1 149.4 2008 128.5 122.3 126.2 145.6 2009 90.1 78.0 94.8 78.5 2010 109.7 117.3 123.4 95.9 2011 116.2 117.5 122.4 99.7 Compiled by: Rosstat data. Available at:

The study of the correlation between the phenomena begins with indicating its closeness by means of the correlation analysis. The basis for the correlation measurement is a matrix of pair correlation coefficients. This matrix reveals the closeness of factors with the resultant variable and between themselves. The pair correlation coefficients are calculated as follows:

r = X ( x - x )( y - y ) , (1) X ( x - x )2( y - y )2

where x e y are average values of the resultant variable and the corresponding factor.

By means of AP “Statistica” we have calculated the matrix of pair correlation coefficients, used for the analysis of the impact of the main fixed capital sources on the investment index in the Russian Federation (tab. 3). In addition to the obtained correlation coefficients the matrix also indicates the probability of the hypothesis of their insignificance (p), established within 0.1 (or 10%) in the framework of this research.

The value of the calculated correlation coefficients gives us an opportunity to estimate the degree of the factor variables impact on the resultant variable; the polarity (“+” or “–”) of the correlation coefficients indicates a direct or reverse impact type. All the calculated correlation coefficients have positive values, thus the indices of accumulation funds ( X 1) and indices of funds raised by banks ( X 3) have the greatest impact on the index of investment in fixed capital ( Y ), i.e. the increase in the values of these indices results in the growth of the index of investment in

Table 3. Matrix of pair correlation coefficients

|

Y |

X 1 |

Х 2 |

Х 3 |

|

|

Y |

1 - |

0.8812 р = 0.000 |

0.6117 р = 0.045 |

0.7252 р = 0.012 |

|

X 1 |

0.8812 р = 0.000 |

1 – |

0.4076 р = 0.213 |

0.5496 р = 0.080 |

|

Х 2 |

0.6117 р = 0.045 |

0.4076 р = 0.213 |

1 – |

0.5677 р = 0.069 |

|

Х З |

0.7252 р = 0.012 |

0.5496 р = 0.080 |

0.5677 р = 0.069 |

1 – |

fixed capital. The depreciation index ( X2 ) has a noticeable, but still less impact on the resultant variable. The coefficient of its correlation with the resultant variable has the lowest value ( rYX2 =0.6117), its rise also promotes the growth of the index of investment in fixed capital.

The important stage of the regression analysis is the selection of factor variables for further inclusion in the multiple regression equation. The complexity of its model construction is that factor variables often depend on each other, i.e. they are multicollinear. In practice, the identification of multicollinearity cases is based on the matrix of pair correlation coefficients. The indicator is a correlation coefficient value that is r > 0.8.

The analysis of the matrix of pair correlation coefficients (see tab. 3) indicates the absence of multicollinearity between factor variables X1, X2 and X3, and therefore there is no need to exclude or replace any of them. Therefore, all three selected factor variables should be included in the further process of the regression analysis. What is more, they have a significant direct impact on the resultant variable value: in our opinion, the probability of including all of them in the regression model is quite high.

Let us calculate the regression model. This mathematical task is formulated as follows: it is required to find an analytical expression of the dependence of the economic phenomena on its defining factors, that is why it is necessary to calculate the function

Y = f ( X 1, X 2, ... , X k). (2)

The aim is to reveal the character and degree of impact of the arguments on the function. The regression analysis indicates how the dependent value changes in average when one or more independent variables change and the unrecorded factors have the fixed value. What is more, the study of pair correlation between the function and one of the arguments is usually ineffective, as economic phenomena are, as a rule, multifactorial, and there are also complex correlations between the factors.

The regression analysis process consists of a sequence of stages:

– construction of the regression equation;

– check of significance of the regression equation coefficients;

– check of significance of the regression equation;

– calculation of the regression characteristics.

The regression analysis result is the regression equation:

Y = 21.496 + 0.466 X 1 + 0.247 X 2 +

+ 0.103 X 3, (3)

where Y is an estimated value of the resultant variable.

The significance of the regression equation is checked by the F-test, the estimated value is calculated by the following formula:

D 2

Fрасч. = d2 ., ост.

The total variance D 2бщ is calculated by the following formula:

D 2 = Z (y - У )2

Dобщ. k+1 ’ where k is a number of factors;

( k +1) is a number of studied factors plus a free term in the regression equation a0;

is an average of resultant variable levels.

Residual variance D is calculated by the function:

D 2 = Х 1 у -П2 . (6)

ост . n - k - 1

The calculated value of the F-indicator is compared to the table one, got at a given significance level p and degrees of freedom ( k + 1) and ( n – k – 1). If the estimated value is more than the table value, then the hypothesis of the regression equation insignificance is rejected. Hence, it can be interesting to calculate the significance of individual regression coefficients by means of the Student’s t-test:

aj taj Saj ' <7>

Where S aj is a standard deviation of the equation coefficients aj.

О y ( y - .y )2

where Sa = is a standard deviation n - k -1

of random errors;

b ij is diagonal elements of the matrix ( XTX )-1.

The regression coefficient is recognized as significant, if the calculated value of the

Table 4. Results of the regression analysis on the basis of three factor variables

|

Correlation coefficient R = 0.9416. Determination coefficient RI = 0.8867 |

||||

|

Value F (3.7) = 18.259, р < 0.00109 |

||||

|

β -coefficient |

Equation parameters |

Value of the Student’s t-test (l) |

Significance level р |

|

|

Invariable |

21.496 |

1.056 |

0.326 |

|

|

X 1 |

0.664 |

0.466 |

4.317 |

0.003 |

|

Х 2 |

0.202 |

0.247 |

1.292 |

0.238 |

|

Х 3 |

0.246 |

0.103 |

1.441 |

0.093 |

Student’s t-test is greater than the table value. All factor variables, which regression coefficients have proved to be insignificant, are eliminated from the regression equation; the model-construction process is repeated. The regression analysis equation is set up only on the basic of independent variables, with their coefficients being significant. Then the significance of the regression equation and its coefficients is checked again. The process is repeated until there are significant coefficients in the equation.

With the probability being 0.90, the significant regression coefficients of the multifactorial model are only factor variables X 1 and X 3, as the probability of accepting the reverse hypothesis does not exceed 0.1. The probability of accepting the reverse hypothesis for factor variable X 2 (the depreciation growth index) was more than 0.238 ( tab. 4 ).

Let us eliminate the factor variable X 2 from the analysis and repeat the process again, i.e. set up the regression equation only on the basis of independent variables, with their coefficients being considered as significant ( X 1 and X 3) (tab. 5) .

As a result we get the regression equation with two significant factors:

Y = 43.785 + 0.485 Х 1 + 0.144 Х 3. (9)

The F-test and Student’s t-test indicate statistical significance of the equation and its factor variables at the significance level of 90%.

The determination coefficient, revealing what part of the total variation of the dependent variable is determined by the factors included in the statistical model, is calculated by the following formula:

Я2 = 2(У-У) х100о/о (10) Е(у-у)

The determination coefficient equal to 0.8597 indicates that the dynamics of the index of investment in fixed capital are due to the included indices X 1 and X 3 by 85.97%, and the level of residual variation is 14.03%. Consequently, the rate of investment in fixed capital in the Russian Federation is influenced by two investment formation sources, such as accumulation funds and the amount of raised funds.

Table 5. Results of the regression analysis on the basis of two factor variables

|

Correlation coefficient R = 0.9272. Determination coefficient RI = 0.8597 |

||||

|

Value F (2.8) = 24.507, р < 0.00039 |

||||

|

β -coefficient |

Equation parameters |

Value of the student's t-test (l) |

Significance level р |

|

|

Invariable |

43.785 |

3.896 |

0.005 |

|

|

X 1 |

0.692 |

0.485 |

4.363 |

0.002 |

|

Х 2 |

0.345 |

0.144 |

2.177 |

0.061 |

This conclusion confirms the value of the multiple correlation coefficient equal to 0.9271, indicating high correlation between the indicator and the factors included in the regression model.

The equation coefficients demonstrate the factors’ impact on the resultant variable level and characterize the degree and type of each factor’s impact on the analyzed parameters. Their interpretation results in a conclusion that the index of investment in fixed capital ( Y ) rise when the indices of accumulation funds ( X 1) and funds raised by banks ( X 3) increase. According to the obtained data, the growth in the funds accumulation index by 1% leads to the increase in the index of investment in fixed capital by 0.485%, while the growth in the index of raised funds by 1% – to the increase by 0.144%.

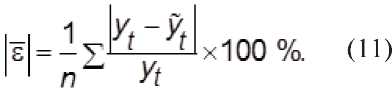

The model quality is characterized by a relative approximation error kl , calculated on the basis of the difference between actual levels of the resultant variable y and its calculated levels S, i.e. levels, calculated by the regression dependency

In our case, the relative approximation error is about 3.64% at the rate of 10–12%.

Hence, profit is the most important financial resource of investment activity of a modern enterprise. In relation to gross domestic product, total (gross) profit of enterprises amounts to 12–15% and to almost 20% in most favorable years. Unprofitable enterprises can not only reduce the economic and financial potential of the country, but, in fact, can not pursue any policy in the field of economic development, investment and innovation. The share of unprofitable organizations in the Russian Federation (in % of their total number) in 2011 was 30.0 % in the economy as a whole. It should be noted that such a high level remains the same throughout the period of the national economy modernization, although the 15–16% level was considered invalid. Only the radical solution of this problem can boost enterprises’ competitiveness and create favorable conditions for investment and innovation development of the economy. The loss ratio does not only violate the reproductive process of an enterprise, but also jeopardizes the reproduction of the entire national economy and payment relations, thus resulting in the chain of anomalies in the current economic system.

At the same time, according to statistics agencies, the share of profitable enterprises is very low.

In 2000–2011 net and gross profits were very unstable in the Russian economy. The annual rate ranged from the 30.9% decline to the 75.7% increase in net profit within the period. What is more, even profitable enterprises had a very unstable financial situation. Gross profit decreased in some years (in 2001 – by 15.6%, in 2008 – by 16.5%), and in 2010–2011, in the economic recovery period, increased by 26% and 20%, respectively. So, the innovation and investment policy of most Russian enterprises did not have a sustainable resource base.

Taking into account the important role of profit in the corporate sector’s assets, it is necessary to note the recent significant decrease in its share in the total amount of financial resources. On the one hand, the number of unprofitable enterprises is decreasing (if in 2003 there were 54839 of them, in 2011 – 22837), and on the other hand, the enterprises’ loan debt totaled 1654030 million rubles in 2011.

Despite the trend of reducing the number of unprofitable enterprises in the Russian economy, the maintenance of the low level of profitability means the absence of a tax base for a number of taxes, especially for income tax. “Rationally developed profit tax is a tax on return from capital invested in the corporate sector and, what is more, a tax on additional risk-adjusted return from investment, i.e., profit tax is in fact a preliminary part of tax on comprehensive (gross) income of the individual” [4, p. 122].

Investments, especially in the innovation activity, are becoming more compliant to after-tax profit when the economy is growing. It becomes impossible for the government to exploit fix investments of previous periods further in order to gain profit in the long term. For the same reason nowadays developed economies tend to reduce the effective rate of profit tax and optimize taxation.

The above correlation-regression analysis, indicating the impact of gross profit on enterprises’ investment activity, confirms that profit tax can cause undesirable distortions in the use of production factors (labor and capital), leading to an inefficient combination of these factors, thereby discouraging innovation and investment activity.

In this situation the specific task of effective tax policy is to develop profit tax rate in the most stimulating form, taking into account the Laffer effect. Moreover, it is necessary to ensure the correspondence of the levels of nominal and real tax burden of enterprises. It is not clear at what level of GDP or added value such compliance can be achieved. However, there is a range of possible values of the nominal tax burden (for current taxes), which varies in the range of 30–40% of GDP, according to the experience of foreign countries. Moreover, if the level of taxation is 30 % of GDP (according to the U.S. experience), it provides faster economic development and tax revenues growth in the future; the 40 % level involves heavy budget receipts at a lower pace of economic development.

The tax mechanism, ensuring a favorable economic climate for the investment activity development, should be in compliance with credit and banking policy, interest rates. It should provide certain benefits to enterprises that use long-term loans for investment purposes.

The logic of economic development is that interest rates should be below the average profit level. Only under these conditions entrepreneurs can use borrowed funds. In turn, the interest rates of commercial banks should be higher than the refinancing rate and deposit interest rates, otherwise banks can not operate effectively. Finally, all participants in the credit market should have real interest yield, i.e. the level of nominal interest rates should be higher inflation.

Nowadays the Russian economy is in quite an unfavorable state: the average profitability level is relatively lower that the level of average weighted interest rates. This correlation between the profitability of the Russian economy’s real sector and interest rates discloses many problems of the national economy, connected with the lack of investment and capital outflow in the speculative operations and its outflow abroad. So, when the efficiency of investment projects is higher and the interest rate is lower, the investment and entrepreneurial activity are more intensive. When credit resources are more expensive, there are less efficient business projects and less investors’ demand.

High interest rates on advances hinder the movement of credit resources to the real sector and determine its technological degradation, thus making the Russian market unattractive for investors. Russian entrepreneurs get more profit, investing abroad, where the real sector provides an opportunity to gain it by means of credit resources, allocated at reasonable rates.

Recently the world practice has been applying a number of specific financial tools, aimed at the state’s participation in the division of credit and investment risks when investment projects are being implemented. It has also been using mechanisms, such as the provision of enterprises with state guarantees for long-term loans from private lending institutions, the state’s equity joint participation in the formation of venture capital funds and investment business, protection of domestic producers from foreign competitors and others.

Guaranteed loans provide an opportunity to support high-tech projects, related to credit risks that are high or difficult to assess. The current practice presupposes that the third party (guarantor) participates in the investment process; it assumes full responsibility for fulfilling the borrower’s obligations to the lender. Thus, borrowers can borrow money that they can not get in other conditions.

Another common form to reduce investment risks is the state’s equity shareholding in projects as a partner with limited liability.

The mechanisms of state guarantees promote public-private partnership by means of sharing risks between private investors and state organizations that provide such guarantees. The result is not only an increase in the private capital inflow, but also a more efficient use of limited budgetary resources.

Equity financing stimulates accumulation of large financial resources for perspective innovation projects implementation by means of sharing stocks among unlimited number of investors (borrowing money from the shares buyers for an indefinite period). The securities issue can help to move from investment credit to market debt obligations, thus optimizing the structure of financial resources invested in the innovation project.

Evidently no investor wants to risk alone, he/she feels more confident if supported by a public authority.

In our opinion, good risk insurance is joint participation of public and private capital that are equally interested in not only recovering money, but also in gaining profit.

The efforts to stimulate investment activity should focus on the underlying causes of the business’ lack of interest in long-term projects. The most important issues that require priority development of state regulation of investment processes are the following:

-

• support and development of new forms of investment projects crediting in the Russian Federation;

-

• proposals on conditions of state guarantees provision with regard to loans attracted into the investment sphere;

-

• development of the mechanisms to consolidate financial resources of publicprivate sectors in order to implement

priority research and technology tasks, contributing to the creation and management of the public-private sectors’ activities;

-

• development of mechanisms to estimate public investment programs and share the results of this estimation with business and expert communities;

-

• promotion of international and regional technological strategic alliances.

It becomes more evident that ensuring high and sustainable development rates in Russia is impossible without a mutually beneficial partnership of the state and municipal authorities, commercial banks and business representatives. The economic strategies and programs, focused only on the use of budgetary funds and based on the orthodox neoclassical doctrine, are insufficient for “the development of innovation economy that lays the basis for the country’s high competitiveness. State-business interaction in the investment process financing should be based on the development of a parity-partner relations that involve mutually beneficial cooperation and provide necessary conditions for the formation of a qualitatively new state, capable of implementing the national development plan and meeting many complicated geopolitical challenges” [5, p. 6]. To sum it up, we should note that only the implementation of the proposed measures will boost the investment process in the Russian Federation.

Sited works

-

1. Ilyin V.A., Povarova A.I. Public Administration Efficiency. The Fiscal Crisis of the Regions. Vologda: ISERT RAN, 2013. 128 p.

-

2. Kormishkina L.A., Koloskov D.A. Deformation of Social Reproduction: Causes, Analysis, Counteraction. Saransk , 2011. 144 p.

-

3. Russian Statistical Yearbook. Rosstat, Moscow, 2012. 786 p.

-

4. Problems of the Russian Tax System: Theory, Experience, Reform . Ed. by M. Alekseev, S. Sinel’nikova: in 2 volumes. Moscow: In-t ekonomiki perekhod. perioda, 2000. Vol. 1. 606 p.

-

5. Fedorov E.A. Private Business is a Priority of State Partnership. Public-Private Partnership. Ways of Legislative Base Betterment . Under general editorship of A.A. Zverev. Moscow, 2009. 238 p.

Список литературы Investment process financing in Russian business: assessment, trends, problems

- Promyshlennost' Rossii 2012: stat. sb. . Rosstat, Moscow, 2012. 445 p.

- Ilyin V.A., Povarova A.I. Problemy effektivnosti gosudarstvennogo upravleniya. Byudzhetnyi krizis regionov . Vologda: ISERT RAN, 2013. 128 p.

- Kormishkina L.A., Koloskov D.A. Deformatsii obshchestvennogo vosproizvodstva: prichiny, analiz, protivodeistvie . Saransk, 2011. 146 p.

- Rossiiskii statisticheskii ezhegodnik . Rosstat, Moscow, 2012. 786 p.

- Problemy nalogovoi sistemy Rossii: teoriya, opyt, reforma . Ed. by M. Alekseev, S. Sinel'nikova: in 2 volumes. Moscow: In-t ekonomiki perekhod. perioda, 2000. Vol. 1. 606 p.

- Fedorov E.A. Za chastnym biznesom -prioritet v gosudarstvennom partnerstve . Gosudarstvenno-chastnoe partnerstvo. Puti sovershenstvovaniya zakonodatel'noi bazy . Under general editorship of A.A. Zverev. Moscow, 2009. 238 p.