Использование будущих денежных потоков для финансовой политики: модель мобилизации финансовых ресурсов путем секьюритизации

Автор: Мохаммед Имад Абдулазез

Журнал: Informatics. Economics. Management - Информатика. Экономика. Управление.

Статья в выпуске: 3 (4), 2024 года.

Бесплатный доступ

Это исследование фокусируется на секьюритизации, которая включает выпуск ценных бумаг, обеспеченных активами, долгами, ипотечными кредитами, будущей дебиторской задолженностью или будущими денежными потоками. В частности, оно изучает секьюритизацию будущих потоков, важную область секьюритизации, которая хорошо подходит для инвесторов в развивающихся странах из-за ее механизма и природы. Этот тип секьюритизации основан на будущих денежных потоках корпораций, что позволяет выпускать долговые инструменты корпорациям, частным лицам и даже странам. Эти инструменты, такие как облигации, погашаются за счет будущей дебиторской задолженности проектов, финансируемых в рамках этого процесса. Исследование рассматривает предметную литературу и теоретическую основу, а затем применяет модель к учреждениям здравоохранения в Ираке. Цель состоит в том, чтобы разработать модель, которая позволит этим учреждениям или любой другой организации удовлетворять свои финансовые потребности для будущего расширения или других целей. Исследование завершается несколькими выводами и рекомендациями. Целью исследования является определение характера и объемов денежных потоков и предложение механизмов для учреждений, чтобы получить необходимое финансирование для будущих расширений, новых проектов или других целей. Исследование включает ряд выводов и рекомендаций.

Обеспеченные ценные бумаги, потоки секьюритизации, учреждения здравоохранения, будущие расширения и денежные потоки

Короткий адрес: https://sciup.org/14131360

IDR: 14131360 | DOI: 10.47813/2782-5280-2024-3-4-0201-0217

Текст статьи Использование будущих денежных потоков для финансовой политики: модель мобилизации финансовых ресурсов путем секьюритизации

DOI:

Faced with the dilemma of resource availability, individuals, institutions, and countries often struggle to secure the necessary financing for investment and development operations. This lack of financing can hinder many plans and projects, preventing entrepreneurial ideas from becoming actual projects and stopping individuals from realizing their dreams and bringing their ideas to life. To confront this dilemma, financial institutions, markets, governments, and individuals continuously work on innovating tools and financial products. These innovations aim to provide new, diverse, and creative sources of financing to supply the business, production, and investment sectors (both financial and real) with the necessary resources to fund their activities. One modern method in this field is the activity of securitization. Securitization is based on the issuance of loan bonds guaranteed by assets or future cash flows. These bonds are marketed and sold to the public to gather the necessary savings for financing, creating new financing sources, boosting market liquidity, and enhancing the ability of facilities to obtain the required financing. This research delves into this topic by exploring one type of securitization, which is based on the securitization of future cash flows and the issuance of bonds guaranteed by these flows, then selling them to the public to fund proposed projects. The researchers will conduct a field study in the healthcare services sector to examine its actual cash flows and the possibility of using these flows as a guarantee for issuing debt bonds to finance proposed projects. The research will address the theoretical aspects of securitization, review previous experiments in the field, and apply these concepts in a field study to produce results that support the research idea.

MATERIALS AND METHODS

Problem statement

This research addresses the challenge of providing the necessary resources to fund new plans and projects. Securing the required financing to establish such projects is one of the most significant problems faced by individual investors, business institutions, and countries. In today's world, it is rare to find an investor, business institution, or nation without new plans and projects for development or ideas awaiting implementation. Conversely, a fundamental obstacle to transforming entrepreneurial ideas into reality is the lack of finance, its unavailability, or the difficulty in obtaining it. Financial institutions are continuously working to provide innovative financial services and products to meet the market's need for financing across various sectors. Securitization is one of the leading tools that has significantly contributed to offering new financial resources for markets. However, traditional securitization practices typically require high-value actual assets to back or guarantee the financial instruments issued through this mechanism. This research aims to explore the role that securitization, particularly the securitization of future cash flows, can play in addressing the challenge of providing necessary financial resources to fund investment and development activities. It will examine how this innovative approach can facilitate financial support for business organizations and public entities, thereby helping to overcome the obstacles that hinder investment and development projects.

The significance of this research lies in its focus on the contemporary and pioneering field of finance, specifically the securitization of future cash flows. This approach could serve as a practical entry point for providing financing to facilities aimed at implementing investment plans, new projects, or expanding existing ones, particularly in developing countries that lack substantial infrastructure and valuable assets needed to secure traditional securitization bonds. The key advantage of this type of securitization is that it does not require high-cost real estate or actual assets as collateral, unlike other forms of securitization. Instead, it relies on the cash flows generated by the financed project as a guarantee for the bonds issued to fund it. Therefore, this form of securitization is highly valuable as it is well-suited for pioneering projects and the implementation of innovative ideas, especially in developing countries.

Research objectives

The objective of this research is to elucidate the dimensions, goals, and importance of the theme of future cash flow securitization. Securitization has become a favored approach for many investors, business institutions, and researchers, especially in the aftermath of the global financial crisis of 2008, which was primarily caused by excessive securitization activities that ignored basic standards.

Assumptions

The research will be based on the main hypothesis: that the future cash flows of projects represent a reliable guarantee for issuing financing bonds for those projects.

Research sample

The eligibility of Sunday hospitals in Salah al-Din Governorate has been chosen as a research sample to conduct applied studies and implement the practical aspect of the research.

Research limits

-

A. Spatial Limits: Health institutions in Salah al-Din Governorate.

-

B. Time Limits: The year 2022.

Literature review and related work

The literature related to the theoretical aspect will be reviewed through books, theses, research papers, and the international network. For the practical aspect, data will be collected to support the theoretical findings and test the assumptions.

CONCEPT SECURITIZATION

Securitization is a financial process where debt obligations are pooled together and converted into securities that are then issued and traded in financial markets. This process adds liquidity to assets that typically have low liquidity, such as banking debts. In essence, securitization involves transforming financial claims from the original borrower to other parties, often through specialized financial companies [11].

The concept of securitization involves converting existing assets or debts into guaranteed financial securities issued by a specialized institution. This process allows the original borrower to obtain needed funds by transferring the financial claims to the institution [7]. Securitization also includes transforming bank assets and debts into a new financing mechanism that offers a guarantee for payment and benefits even if the borrower faces non-payment risks [6]. Moreover, securitization can involve creating homogeneous pools of real estate loans and redistributing these loans to investors in the form of fixed-return bonds. Investors in these bonds receive periodic interest payments and the bond principal at maturity [12].

Elements main for process securitization

Securitization involves the synergy of several parties and the formation of necessary elements to complete the process. These parties are:

-

1. The Facility or Bank: This is the institution that wants to securitize its assets. It is, in fact, the original borrower and holds loans, debts, or financial obligations. Its role in securitization is to transfer these assets to a securitization company. The facility may

-

2. The Securitization Company: This company converts the assets from the facility into financial papers. It issues these finance papers at their value and operates through a Special Purpose Vehicle (SPV), a private entity created for this purpose. The SPV commits to paying the facility an amount less than the original value and issues papers with a value equal to the assets, earning the difference and guaranteeing payment on the securities.

-

3. The Debtor: This is the party involved in the securitization of debts.

-

4. The Investor: This individual or entity buys the financial papers issued to subscribe to the findings.

sell or move these assets to the securitization company and might receive additional funds from the operation.

Types of securitization

The securitization consists of the following types:

-

1. Classification of Securitization into Two Essential Types: A. Classification by Type of Security: This is divided into two types:

-

a. Securitization with Guaranteed Fixed Assets, such as pawned real estate and notarized debts.

-

b. Securitization with Guaranteed Receipts (future cash flows) [5].

-

2. Classification of Securitization According to Its Nature:

-

a. Transmission of Findings via Sale: This involves the sale of true property certificates and the distribution of financial flows according to specific classes. Here, financial papers are used to achieve this goal.

-

b. Transmission of Findings in the Form of Debt Administration: This involves issuing numerous financial bonds. These vary based on their category, repayment speed, and the possibility of seasonal payments based on benefits

Advantages of securitization

Freedom from Restrictions Imposed by Balance Sheet Rules, Financial and accounting rules impose restrictions on the balance sheet, including the principle of capital adequacy. Providing provisions to meet doubtful debts naturally reduces the bank’s ability to finance and decreases capital turnover, which reduces profitability. Thus, the bank’s securitization of its debts makes them liquid assets. Additionally, conducting securitization operations outside the budget, meaning that they do not affect budget items, enables the bank to achieve high profits without depleting its financial capabilities.

-

1. Reduced borrowing costs: Securitization reduces borrowing costs and frees up new capital for the purposes of reinvestment, improving asset management, and managing liabilities and risks by transferring them to new parties.

-

2. Attractive returns: Securitized assets offer an attractive range of returns, especially when investment opportunities with higher returns than the returns of securitized assets are available.

-

3. Diversification and liquidity: Loan structuring enhances the process of diversifying assets and maximizes financial market liquidity by offering a new and innovative variety of financial market instruments.

-

4. Distinct alternatives to borrowing: Securitization provides suitable and distinct alternatives to borrowing.

-

5. Reducing risks of financing retail customers: Banks deal with retail clients who constantly resort to borrowing, collateralized by assets sold at retail. In the event of securitization of these debts, the bank benefits from distributing the risks of financing these clients among different sectors of investors. These investors have confidence in the ease of liquidating these guarantees, benefit from the returns on commercial debt instruments until the maturity date of these debts, and enjoy the possibility of an increase in the market value of these instruments after subscribing, along with tax benefits and exemptions granted to investors in securities.

-

6. Relevance between assets and responsibilities: A bank that mortgages assets is obligated to service and guarantee them until the maturity dates of the corresponding debts. Since mortgages for housing are long-term, if the bank securitizes these debts, it will get rid of the service of its guaranteeing assets as quickly as possible.

-

7. Eliminating limits of national bank financing: Through banks collecting their assets in the form of pools, they can obtain higher credit ratings upon securitization, which allows them to access better financing conditions pools to obtain the highest credit ratings upon securitization, they were able to obtain certificates from international credit rating agencies [2].

The procedures

The procedures for securitization involve forming homogeneous groups from real estate loans and converting them into self-returning fixed bonds. Investors receive periodic benefits in addition to the principal amount of the bond. For this, it is necessary to ensure that the payment dates of the bonds and their returns correspond with the payment dates of the debt instalments and their benefits. This process creates what is called a secondary market for real estate or bond markets, which may represent demand from insurance companies, financial and investment institutions, insurance companies, and individual investors who seek additional revenues.

Banks or real estate companies can benefit from the money resulting from the sale of financial papers on the stock exchange, where they can then employ it for granting new loans or similar recruitment.

The procedures for securitization by the banker are represented in the following steps:

-

1. Securitization: The bank securitizes its assets when it needs to increase capital or cash liquidity instead of issuing shares to raise capital or borrowing from another bank. In this case, the bank issues debt bonds, which may involve granting creditors the right to a mortgage on some of its property.

-

2. Sale of secured assets: The bank sells some of its secured assets at a low price to a specialized entity, often in the form of a Special Purpose Vehicle (SPV). These assets are most often debt securities secured by mortgages or ownership rights with the bank, which is always a creditor to a group of debtor borrowers.

-

3. Issuance of securities: The facility with a private loan issues securities, often bonds with an issuance premium and a value equivalent to these debts that are the subject of the securitization, in order to obtain cash liquidity that enables it to purchase debt securities.

-

4. Investor: The investor who buys securities issued by special purpose entities aims to obtain the interest these securities generate without caring about the credit of the bank selling the debt bonds.

-

5. Bank’s financing capacity: Separating the bank initiating the securitization process through debt bonds from these bonds always enables it, quickly and before the maturity dates of the original debtors, to increase its financing capacity at a low cost through what the bank issues (SPV) of more securities than if the bank was the one that issued these securities.

-

6. Reconciliation: The bank initiating the securitization must agree specifically on reconciling the maturity dates of cash receipts from debtors and the dates investors are entitled to interest on their debts. The parties to the securitization deal must be careful to reconcile the interest stipulated on the original debts with the interest on the securities held by the investors [8].

Securitization of future flows, as indicated in paragraph three, securitization is of two types: securitization by guaranteeing fixed assets and securitization by guaranteeing future cash flows. Given that the first type is the earliest in terms of its emergence and better known for its ubiquity, securitization of future flows is not widely known. However, its advantages, characteristics, and simplicity of procedures compared to traditional securitization have led to increased interest in it by investors and business institutions. Securitization of future flows involves the advance sale of receipts in foreign currency that will occur in the future regarding operations and activities of exporters of goods and services [13]. Securitization of future flows is based on the same basic idea and principles as securitization. However, it goes beyond providing traditional mortgages and offers a new type of financing with broad possibilities and reduces the procedures that accompany the traditional method of securitization [3]. It differs from ordinary securitization in that the investor examines, analyzes, and evaluates the securitized assets recorded and shown on the balance sheet, whereas here, the focus is on the possibility of realizing future cash flows. The collateral for the securitization process will not be assets, real estate, or mortgages, but rather the future cash flows of the securitized project. Thus, it is a mechanism that allows organizations to borrow in a new way that is distinct from traditional methods and at a lower cost than traditional financing methods. This type of securitization is considered one of the most exciting methods of securitization, especially for emerging markets. In several Latin American and African countries, this type of securitization is attractive because it is considered a means of free borrowing without restrictions.

The distinctive aspect of this type of securitization is that the asset transferred from the originator is not an obligation on a specific debtor but rather a future obligation on a future debtor. In other words, the obligation has not yet been fulfilled by a debtor who has not yet been identified. Examples include export proceeds, hotel revenues, proceeds from sports activities, future revenues, tax revenues, etc. It is also characterized by the fact that there is no direct link between the amount of the issued securitization transaction and the amount of future cash flows, as is the case in the securitization of assets secured by a real estate mortgage [1]. The majority of future securitizations are conducted by originators from emerging markets who are able to borrow freely ('offshore borrowings') due to their countries' low credit ratings. In this case, securitization of future flows enables them to overcome this obstacle and obtain the required financing at lower costs and larger amounts. For example, TelMex, a Mexican telecom company, was the first to practice cash flow securitization in 1987. Thus, Mexico is the first country where the process of securitization of future flows was practiced. The experiment then moved to South Africa. Even developed European countries have practiced this process. In Italy, the National Health Care Service in Lazio implemented several financial innovations to confront the lack of revenues and maintain the quality of health services provided to the public [4-9]:

-

• Issuing asset-backed bonds (ordinary securitization).

-

• Securitization of rents arising from the sale and leaseback of hospitals.

-

• Securitizing future receipts for services provided by hospitals and other health units.

This department used a financial institution such as an SPV (Special Purpose Vehicle) to manage receipts. These securitization operations have helped suppliers by:

-

• Collecting their payments immediately, which provided a legitimate and appropriate alternative to the process of discounting their transfers with banks.

It also helped local health authorities by:

-

• Deferring customer payments, eliminating interest payments (in the case of borrowing from banks), eliminating legal follow-ups for suppliers, and reducing cases of payment delays.

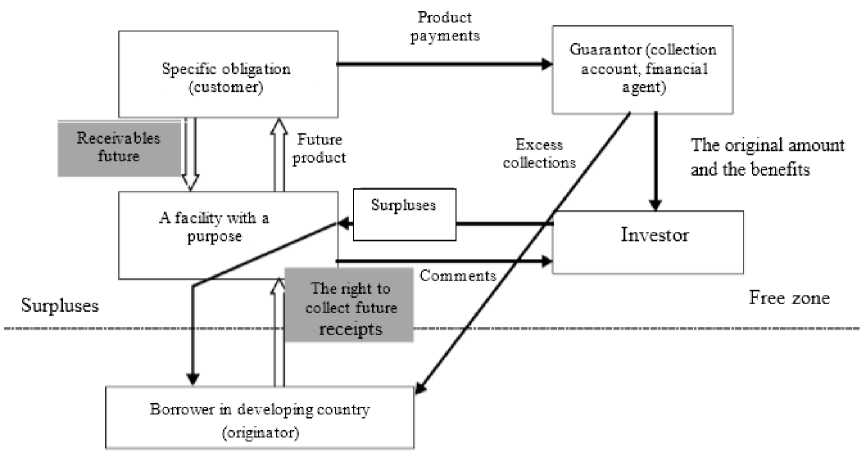

The establishment in the developing country sells its future receipts, directly or indirectly, to a free special purpose entity (offshore). They issue a debt instrument (the bond), and the debtors (those obligated to pay in the future) are directed to pay for future goods or services into a free account (offshore). This account is managed by a guarantor or collection agency that makes payments or reimbursements to lenders (bondholders) when these bonds mature.

Figure 1. Explains the structure of the securitization process of future flows.

Рисунок 1. Структура процесса секьюритизации будущих потоков.

Source: Prepared by the authors (2024). Prepared by www.tashreaat.comLegal studies L pages / view – news studies aspx ? std – id = 42.

RESULTS AND DISCUSSION

For the purpose of testing the possibility of using securitization of cash flows as a means of obtaining a financing source in an environment such as the Iraqi environment, one of the private hospitals in Salah al-Din Governorate was chosen as a sample for the research, and data was collected about it for the purpose of testing the possibility of securitizing its future cash flows. The details of its revenues for the year 2022 are as follows:

Table 1. Revenues generated from performing surgical operations.

Таблица 1. Доходы, полученные от проведения хирургических операций.

|

T |

Type of surgery |

Number of operations |

The cost of performing the operation (Dinar) |

The total amount (Dinar) |

|

1 |

Inguinal hernia |

62 |

750000 |

46650000 |

|

2 |

Lifting bitterness |

22 |

950000 |

20900000 |

|

3 |

Epigastria hernia |

2 |

950000 |

1900000 |

|

4 |

Double hernia |

10 |

950000 |

9500000 |

|

5 |

Appendix |

80 |

400000 |

32000000 |

|

6 |

Anal fungus |

20 |

250000 |

5000000 |

Информатика. Экономика. Управление// Informatics. Economics. Management [(cc) ©J 2024; 3(4)

|

45 |

Abdominal skin beautification |

4 |

750000 |

3000000 |

|

46 |

Foreign body in the back |

1 |

1000000 |

1000000 |

|

47 |

Install KiWire |

8 |

750000 |

6000000 |

|

48 |

Shoulder dislocation |

2 |

750000 |

1500000 |

|

49 |

External fixation of the thigh |

4 |

750000 |

3000000 |

|

50 |

External fixation of the leg |

2 |

750000 |

1500000 |

|

51 |

Platinum thigh lift |

2 |

750000 |

1500000 |

|

52 |

Groin bunion lift |

2 |

750000 |

1500000 |

|

53 |

Internal fixation of the humerus |

2 |

750000 |

1500000 |

|

54 |

Vaginal fistula |

2 |

500000 |

1000000 |

|

55 |

Caesarean births |

220 |

750000 |

165000000 |

|

56 |

Cervical ligation |

15 |

750000 |

11250000 |

|

57 |

Kurtage |

10 |

750000 |

7,500,000 |

|

58 |

Modification of the uterine wall |

2 |

1000000 |

2000000 |

|

59 |

Ovarian cyst |

15 |

750000 |

11250000 |

|

60 |

Sewing injured |

10 |

100000 |

1000000 |

|

61 |

manufacturing |

8 |

750000 |

6000000 |

|

62 |

Lifting the uterine knot |

13 |

1000000 |

13000000 |

|

63 |

Cauterize the cervix |

2 |

500000 |

1000000 |

|

64 |

Liposuction |

2 |

750000 |

1500000 |

|

65 |

Open an abscess |

2 |

100000 |

200000 |

|

66 |

sample |

2 The Total |

500000 |

1000000 544550000 |

Source: Prepared by the authors (2024). Prepared by [10].

The other medical services revenues; these include, for example, emergency services, ticket prices, and exceptionally supplied medicines: The total amount: (75000000) Dinar. Additional revenue: It includes outpatient clinic fees, as the hospital provided buildings that were rented as private clinics for doctors, rented other facilities and buildings as private pharmacies, and rented other buildings as laboratories, etc. The total amounts collected amounted to (143000000) Dinar as showing in table (2).

Table 2. Total revenue.

Таблица 2. Общий доход.

|

T |

Statement |

Amount |

|

1 |

Surgical revenues |

544550000 |

|

2 |

Medical services revenues |

75000000 |

|

3 |

Additional revenue |

143000000 |

|

Total summation |

762550000 |

Source: Prepared by the authors (2024). Prepared by [14].

Accordingly, and based on the estimated annual revenues, bonds can be issued to finance the planned expansion of the hospital, which includes the establishment of a new advanced wing equipped with modern medical equipment for performing precise laser surgeries, as well as scanners, magnetic resonance imaging, and other devices. The cost of this expansion is expected to exceed 10 billion dinars. To provide this amount without resorting to banks or other financing bodies, the appropriate option is to issue bonds guaranteed by the expected future annual cash flows according to the above estimates. Bonds will be issued in the amount of 10 billion dinars for a period of five years, with a variable interest rate according to the rates of the Central Bank of Iraq. The repayment process will begin after the five years according to one of the following methods:

-

1. Payment at the end of the period: when the bonds mature after five years.

-

2. Payment in fixed installments beginning after the end of five years.

-

3. Payment in decreasing installments.

-

4. Purchasing bonds from the secondary market according to the hospital’s desire and ability.

-

5. Issuing bonds according to the callable bond formula.

-

6. Issuing bonds according to the formula of bonds convertible into shares.

CONCLUSION

Based on the results of the presented research, we will make a number of conclusions and recommendations.

-

1. Securitization of future flows has become an important financing method and is spreading in Third World countries.

-

2. This type of securitization is characterized by its simplicity and suitability for developing countries.

-

3. This type of securitization does not require large guarantees, as is the case with bank loans or traditional types of securitizations.

-

4. Various institutions in Iraq can carry out securitization operations for their future flows and obtain the financing they need to fund their plans.

-

5. Carrying out this type of securitization requires the availability of appropriate institutions that undertake this financing process.

Recommendations

-

1. It is necessary to study and approve this type of financing for use by our various institutions to provide them with the necessary funding.

-

2. It is important to provide the appropriate legislative environment to ensure the sound practice of securitizing future flows.

-

3. Establishing institutions that guarantee the process are capable of conducting it, providing them with the necessary expertise, and offering the necessary guarantees for it, similar to countries that have previously practiced this type of securitization.