Конвергенция учетных систем через призму теории бухгалтерского учета и парадигм гармонизации

Автор: Аксентьев А.А.

Журнал: Вестник Пермского университета. Серия: Экономика @economics-psu

Рубрика: Региональная и отраслевая экономика

Статья в выпуске: 3 т.19, 2024 года.

Бесплатный доступ

Введение. В современных исследованиях в области международного бухгалтерского учета отсутствует связь положений, составляющих фундамент бухгалтерской науки, с главной целью учетной системы - способствовать эффективному распределению капитала за счет представления надежной и актуальной информации. Это привело к тому, что «инфраструктура» бухгалтерского учета стала служить не общественным целям, а интересам транснациональных компаний, разработчиков бухгалтерских стандартов и в целом региональным зонам, которые используют идею глобальной конвергенции ради получения личных выгод.

Международный бухгалтерский учет, экологический детерминизм, мсфо, учетная система, конвергенция, теория бухгалтерского учета

Короткий адрес: https://sciup.org/147246920

IDR: 147246920 | УДК: 657, | DOI: 10.17072/1994-9960-2024-3-300-325

Текст научной статьи Конвергенция учетных систем через призму теории бухгалтерского учета и парадигм гармонизации

В настоящее время в области международного бухгалтерского учета в качестве ведущего научного направления выступают исследования, посвященные глобальной гармонизации «режимов» 1 бухгалтерского учета. Однако авторы многих из них в центр ставят международные стандарты финансовой отчетности (МСФО) и уже относительно них определяют, насколько та или иная страна с точки зрения практики бухгалтерского учета согласуется или не согласуется с требованиями международных стандартов.

В качестве допущения принято, что МСФО имеют прямые и косвенные преимущества, которые получит государство, в том числе компании, зарегистрированные на его территории, вследствие внедрения такого набора стандартов.

Бывший председатель Совета по международным стандартам финансовой отчетности D. Ph. Tweedie аргументировал необходимость международного единообразия стандартов бухгалтерского учета тем, что они способны обеспечить эффективное распределение капитала между странами и интеграцию мировых рынков, а также повысить сопоставимость финансовой информации [1, с. 15].

В эмпирических исследованиях содержатся крайне противоречивые доказательства преимуществ, получаемых в результате внедрения МСФО [2–5].

В частности, K. Ahmed и соавторы провели метаанализ исследований, посвященных получаемым от внедрения МСФО выгодам, и пришли к выводу, что из всех преимуществ статистическую значимость имеет такой фактор, как «качество прогнозов аналитиков» [4, с. 211]. В свою очередь, внедрение МСФО не влияет на сокращение дискреционных начислений; аналогично обстоит дело со связью балансо- вой и рыночной стоимости, которая сохраняется как до, так и после внедрения МСФО в стране [Там же].

P. Brown путем всестороннего анализа научной литературы обобщил, какие именно преимущества можно получить в результате внедрения МСФО, и пришел к выводу, что «потенциальные выгоды для страны и ее народа от принятия международных стандартов финансовой отчетности проявляются по-разному. В совокупности они действительно могут быть очень большими, хотя для их реализации требуется нечто большее, чем просто принятие МСФО» [5, с. 281].

В научном сообществе активно продвигается позиция, согласно которой наличие единого глобального органа, устанавливающего стандарты, не повысит эффективность распределения капитала [2, с. 268], поскольку Совет по международным стандартам финансовой отчетности делает акцент на достижении сходства в практике, а не на «качестве» стандартов. Необходимо подчеркнуть, что в данном ключе S. P. Kothari , K. Ramanna и D. J. Skinner рассматривают конкурентный режим разработки стандартов как способ повышения их «качества». Аналогичную позицию занимают K. Jamal и S. Sunder , подчеркивая, что при монопольном режиме будут отсутствовать инновации в бухгалтерском учете [6, с. 382]. Несмотря на это, они согласны с тем, что при монопольном режиме достигается наилучшая «координация» (между разработчиком стандартов и экономическими субъектами, их применяющими) и краткосрочная эффективность [Там же, с. 373].

Если исходить из рассуждений S. Kothari и соавторов [2], P. Brown [5], K. Jamal и S. Sunder [6], можно прийти к выводу, что стандарты финансовой отчетности должны ставить акцент не на их как таковом использовании

«всеми», а на качестве правил и норм, применение которых приведет к более обоснованным решениям и, как следствие, к эффективному распределению капитала.

В связи с этим МСФО рассматривается как товар, который Совет по международным стандартам финансовой отчетности стремится выгодно продать путем пропагандирования «гармонизации». Последнее логично, поскольку разработчик получит возможность привлекать финансирование за счет взносов новых участников, а также продажи им своих публикаций [7, с. 259–260].

На этом фоне выделяется американский регулятор FASB – разработчик стандартов бухгалтерского учета в США ( US GAAP ). Причинами отказа США от «конвергенции» национальной модели в сторону МСФО часто называют следующие [8, с. 80–81; 7; 9; 10, с. 229]:

– стандарты МСФО не являются качественными в сравнении с US GAAP ;

– США никогда не признают господство другой группы над ними;

– переход США на МСФО приведет к необходимости платить, в том числе за прохождение аттестации бухгалтеров, не национальным институтам (например, AICPA 1 ), а «зарубежным» (например, ACCA 2 ), что подрывает суверенитет США;

– США стремятся влиять на весь мир, а конвергенция с МСФО может подорвать их доминирование;

– другие аспекты.

Исходя из изложенного, можно сказать, что акцент ставится на конвергенции учетной модели в пользу, как правило, МСФО и, за редким исключением, US GAAP . Вопросы дивергенции учетной системы в научной литературе не рассматриваются и не раскрываются.

S. M. Saudagaran и G. D. Joselito характеризуют регулирование бухгалтерского учета стран ACEAH3 в контексте двух парадигм – глобальной и региональной [11]. Соответственно поднимается вопрос, одинаковы ли выгоды от внедрения разных режимов стандартов (МСФО или US GAAP) в рамках глобальной и региональной парадигм, на который в настоящее время нет однозначного ответа, что также остается научным пробелом.

Актуальность исследования указанных процессов объясняется противоречиями, изложенными в начале работы. Продолжающиеся дискуссии по поводу преимуществ и недостатков от внедрения МСФО, необходимости изменения модели разработки стандартов говорят о важности переосмысления «механизма» 4 движения национальных учетных систем.

В данной работе поставлена цель раскрыть сущность конвергенции учетных систем через призму теории бухгалтерского учета, а также совместить эти процессы с глобальной и региональной парадигмами гармонизации.

Научная новизна работы состоит в рассмотрении механизма конвергенции учетной системы через призму отдельных аспектов бухгалтерской теории и парадигм гармонизации.

УТОЧНЕНИЕ ПОНЯТИЙ «ГАРМОНИЗАЦИЯ» И «КОНВЕРГЕНЦИЯ»

Для начала отметим, что в современной научной литературе понятия «гармонизация» и «конвергенция» часто используются как синонимы, что не является верным.

В России понятия «гармонизация» и «конвергенция» в существенной степени охарактеризованы специалистами в области права, в связи с чем имеет смысл раскрыть их точку зрения. Так, Ю. С. Безбородов определяет гармонизацию как метод конвергенции в области международного права [12]. Автор приводит следующую аргументацию: с помощью гармонизации устраняются разногласия между системами и их элементами, благодаря чему достигается функциональное равновесие, дающее возможность развиваться системе в заданном направлении [Там же, с. 8]. О. Д. Третьякова определяет термин «конвергенция» как сближение, сведение в единое [13, с. 777], дополняя, что юридическая конвергенция – «один из двух путей к образованию единого глобального права (наряду с его искусственным созданием)» [Там же, с. 778]. Она также считает, что гармонизация выступает методом конвергенции [Там же, с. 780]. С помощью гармонизации достигается согласованность требований, преодолеваются противоречия и недостатки, сближаются системы и их элементы [Там же]. Д. А. Толченкин и М. Э. Толчен- кина под правовой конвергенцией понимают «исторически обусловленный объективный, закономерный, необратимый добровольный и (или) принудительный процесс унификации, универсализации, стандартизации, гармонизации и экспансии права национальных правовых систем государств и правовых семей» [14, с. 108].

Исходя из представленных определений, можно сделать вывод, что конвергенция представляет собой переход системы из одного состояния в другое, а гармонизация является методом, с помощью которого указанный переход может быть осуществлен.

Интересно отметить, что в исследованиях по международному бухгалтерскому учету понятия «гармонизация» и «конвергенция» имеют свои оттенки (табл.).

Трактовка понятий «гармонизация» и «конвергенция» в работах по международному бухгалтерскому учету Interpretation of the concepts “harmonization” and “convergence” in international accounting papers

|

Автор, источник |

Гармонизация Конвергенция |

|

S. M. Saudagaran, G. D. Joselito [11, с. 2] |

Процесс сокращения различий в учете между двумя или более странами с помощью опре- – деленных форм вмешательства |

|

T. S. Doupnik, S. B. Salter [15, с. 41] |

Сокращение различий в практике бухгалтерского учета в разных странах, что в конечном счете приводит к созданию набора междуна- – родных норм, которым необходимо следовать во всем мире |

|

P. Chand, C. Patel [16, с. 83] |

Процесс сокращения противоречащих друг Процесс, приводящий другу правил бухгалтерского учета с целью в итоге к принятию повышения международной сопоставимости МСФО финансовой отчетности |

|

A. Jaafar, S. Mcleay [17, с. 157] |

Движение к единообразию – |

|

S. L. Taylor [18, с. 159] |

Поиск консенсуса – |

|

L. G. van der Tas [19, с. 157] |

Координация, настройка двух или более объектов |

|

J. S. W. Tay, R. H. Parker [20, с. 73] |

Гармонизация как процесс подразумевает уход от разнообразия практики |

|

C. Chen, E. Lee, G. J. Lobo, J. Zhu [21, с. 2] |

Добровольное принятие МСФО |

Источник : составлено автором.

В свою очередь, конвергенция – это переход режима учетной системы из первоначальной точки (т. е. из состояния, как предполагается, дисгармонизированного) в новую точку (т. е. в состояние, как предполагается, гармонизированное).

Понятие «гармонизация» напрямую связано с понятием «гармония». Так, по мнению S. M. Saudagaran и G. D. Joselito , гармонизация представляет собой линейный процесс [11, с. 5], который можно представить следующим образом (рис. 1).

Полная дисгармония

Региональная гармония

Глобальная гармония

Источник : разработано в исследовании [11]; переведено автором.

Рис. 1. Уровни гармонии бухгалтерского учета по S. M. Saudagaran и G. D. Joselito

Fig. 1. Levels of accounting harmony according to S. M. Saudagaran and G. D. Joselito

J. S. W. Tay и R. H. Parker считают, что гармония – это состояние, при котором группа компаний сосредоточена вокруг одного или нескольких доступных методов [20, с. 73]. При этом авторы в противовес понятию «гармонизация» предлагают использовать термин «стандартизация», т. е. «движение к единообразию (состоянию)» [Там же].

Свою позицию J. S. W. Tay и R. H. Parker аргументируют следующим образом (рис. 2).

С их точки зрения, гармония (нижняя линия на рис. 2) – это конкретная точка между двумя состояниями двух систем (полного разнообразия и полного единообразия). В данном случае авторы, исходя из трактовки «гармонии», подразумевают, что она достигается тогда, когда компании останавливаются на применении конкретных методов бухгалтерского учета. И этот выбор может осуществляться в отношении большего количества методов (левая часть рис. 2). Но с помощью механизма стандартизации (верхняя линия на рис. 2) можно сдвигать некоторое статичное состояние из левой части (нижняя линия на рис. 2) в правую сторону (к единообразию), где условно будет применяться один метод (одна практика) бухгалтерского учета.

L. G. van der Tas дополняет, что с помощью механизма гармонизации можно координировать различные объекты системы [19, с. 157], что позволит повысить уровень гармонии [Там же, с. 167]. С его точки зрения, несколько компаний в своих финансовых отчетах могут использовать разные методы раскрытия информации, оценки объектов и прочих данных, в связи с чем с помощью гармонизации можно прийти к тому, что «пределы различий между финансовыми отчетами» [Там же, с. 157] снизятся.

-

A. Jaafar и S. Mcleay состояние гармонии (вероятно, имеется в виду самая правая точка на рис. 2, в которой достигается полная гармония) называют несостоятельным «допущением» [17, с. 158], поскольку все фирмы, применяющие один набор методов, автоматически следуют идентичной стратегии диверсификации [Там же].

Гармонизация (стандартизация) как процесс

Полное

Единообразие разнообразие

Состояние гармонии и (или) большее единообразие

Источник : разработано в исследовании [20, с. 73]; переведено автором.

Рис. 2. Процесс гармонизации и уровень гармонии по J. S. W. Tay и R. H. Parker

Fig. 2. Harmonization process and level of harmony according to J. S. W. Tay and R. H. Parker

V. Sutton считает, что цель движения гармонизации (движение слева направо на рис. 2) состоит в достижении сопоставимости финансовой отчетности [22, с. 177]. Ученый, ссылаясь на J. S. W. Tay и R. H. Parker , подчеркивает различие между гармонизацией и стандартизацией: гармонизация – это процесс как такового ухода из состояния полного разнообразия, тогда как с помощью стандартизации это движение осуществляется в сторону единообразия [20, с. 73; 22, с. 177].

S. Saudagaran и G. Joselito в свою очередь нижнюю линию на рис. 2 фактически разделяют на три этапа (см. рис. 1), где [11, с. 5]:

-

1) полная дисгармония – полное разнообразие практик бухгалтерского учета;

-

2) региональная гармония (скорее всего, это состояние около середины нижней линии на рис. 2) – промежуточный этап к достижению глобальной гармонии, когда согласованность в практике бухгалтерского учета достигается внутри одной группы (страны) или нескольких групп (стран), но не соответствует «международной» практике;

-

3) глобальная гармония – все страны игнорируют региональную гармонию в пользу полной согласованности практики бухгалтерского учета.

S. Saudagaran и G. Joselito также подчеркивают «ограничения» модели, изображенной на рис. 2 [11, с. 5]: 1) она является описательной и 2) неявно предполагает, что гармонизация бухгалтерского учета есть следствие достижения политических целей. Позиция исследователей состоит в том, что если нижнюю линию на рис. 2 разложить на этапы, приведенные на рис. 1, то «линейность» механизма движения от полного разнообразия к единообразию сводится к измерению уровня «гармонии» или «дисгармонии», т. е. того, в какой точке находится объект системы.

Второе ограничение связано с политическими целями как центральной причиной гармонизации на национальных уровнях [11, с. 6].

-

B. Das и соавторы считают, что конвергенция – это «не самоцель, а средство достиже-

- ния цели [23, с. 79]; чтобы достигнуть конвергенции, «необходимо прийти к соглашению относительно центральной цели финансовой отчетности» [Там же, с. 82]. В этом случае авторы подходят к рассмотрению вопроса конвергенции более тонко. Иными словами, целью является или использование, например МСФО, всеми странами, или же применение во всем мире качественных стандартов, которые приведут к эффективности распределения капитала. Как показывает анализ научной литературы, исследователи в области международного бухгалтерского учета согласны с тем, что без явной цели конвергенция не будет достигнута [11, с. 5; 22, с. 177; 23, с. 82].

Отметим, что в определении цели мнения исследователей расходятся. Так, V. Sutton считает, что цель гармонизации – сопоставимость финансовой отчетности [22, с. 177]. Позиции, что процесс гармонизации представляет собой результат осознанного политического выбора, придерживаются S. Saudagaran и G. Joselito [11, с. 5]. В то же время L. G. van der Tas рассматривает, как гармонизация финансовой отчетности стран Европейского союза согласуется с целями Римского договора [24].

Следует обратить внимание, что L. G. van der Tas говорит о региональной гармонизации. Группа стран образовала Европейский союз, государства которого обозначили конкретные цели такого объединения: отмена таможенных пошлин, количественных ограничений на импорт и экспорт, устранение препятствий для свободного передвижения людей, услуг и капитала [24, с. 471]. В этом контексте ученый прямо рассматривает гармонизацию как инструмент для достижения целей Европейского союза [24]. Однако последний не есть весь мир и не попадает под «глобальную парадигму».

Исходя из этого, когда мы начинаем «подниматься» по рис. 1, возникает закономерный вопрос: какова цель глобальной гармонизации? Иначе говоря, в рамках региональной и глобальной парадигм цели гармонизации (конвергенции) могут различаться и вступать в противоречие друг с другом.

Сейчас принято считать, что МСФО основаны на принципах, в связи с чем являются более гибкими в сравнении со стандартами US GAAP , которые основаны на правилах. Однако в 2009 г. FASB кодифицировал все свои стандарты, которые внешне почти перестали отличаться от МСФО. То есть возникает вопрос: чьи стандарты «взойдут на пьедестал» глобальной парадигмы? Здесь речь идет о борьбе двух региональных регуляторов.

Ввиду отсутствия четких целей, структуры, фундамента глобальной парадигмы речи о том, что МСФО являются мировыми стандартами, идти не может 1 .

СООТНОШЕНИЕ

ГЛОБАЛЬНОЙ И РЕГИОНАЛЬНОЙ ПАРАДИГМ ГАРМОНИЗАЦИИ БУХГАЛТЕРСКОГО УЧЕТА

-

S. Saudagaran и G. Joselito рассматривают глобальную парадигму бухгалтерского учета с точки зрения «безграничной среды», где лю-

- бая бухгалтерская информация является сопоставимой и доступной для всех стран [11, с. 4]. Региональная парадигма, напротив, предполагает, что гармонизация осуществляется между географически близкими странами [Там же].

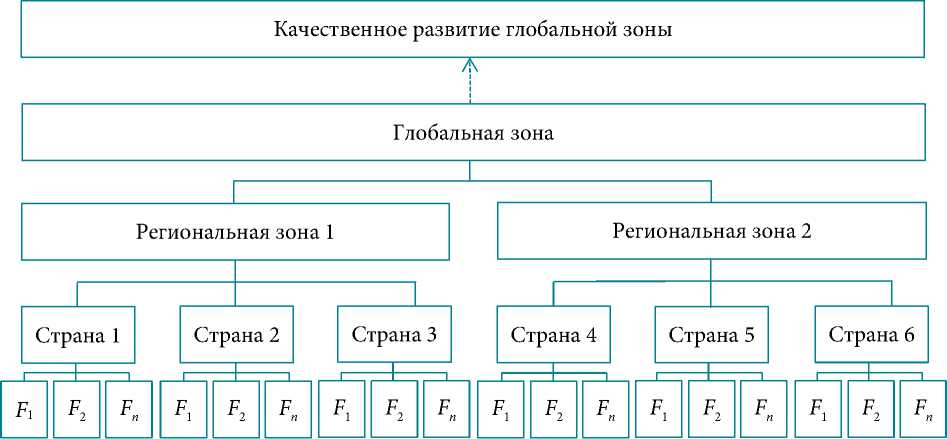

Мы считаем такую интерпретацию не совсем корректной. Изложим свою позицию схематично (рис. 3).

На рис. 3 показано, что существуют страны с набором экологических факторов ( F ), составляющих и характеризующих систему бухгалтерского учета. Таких факторов может быть n -е количество, и необязательно, что все страны имеют одинаковый набор детерминант. В рамках данного теоретического примера предполагается, что страны 1–3 и страны 4–6 схожи (но не абсолютно) по своим экологическим факторам и объединяются в региональную зону. С этой точки зрения региональная гармонизация предполагает, что группа стран, например с помощью стандартизации, достигает единообразия в практике бухгалтерского учета с определенной целью.

Источник : разработано автором.

Рис. 3. Теоретическая схема движения бухгалтерских учетных систем к глобальной парадигме

Fig. 3. A theoretical framework for the shift of accounting systems toward a global paradigm

Однако S. Saudagaran и G. Joselito указывают, что «одним из главных сторонников глобальной парадигмы является Международный комитет по стандартам бухгалтерского учета (МПК 1 ) – организация, которая видит свою роль в разработке и продвижении международного набора приемлемых стандартов бухгалтерского учета» [11, с. 4]. Не говорит ли это о том, что фактически IASB не переходит на стадию «глобальной зоны», а просто борется с другим регулятором (с FASB или США в целом) за страны-участники? Гармонизация в таком случае представляет собой инструмент, с помощью которого набор экологических факторов одной страны меняется (или «настраивается») согласно набору факторов региональной зоны и в интересах этой зоны .

На рис. 3 мы специально не показываем, что и региональной, и глобальной зонам тоже должен быть свойственен «базовый» набор факторов, которому будут следовать страны-участники. В этом и заключается не только научная, но и общественная проблема, поскольку фактически детерминанты не определены.

В начале данной работы и в исследованиях, на которые мы ссылаемся, речь, как правило, всегда идет о практике бухгалтерского учета, в том числе с точки зрения сопоставимости стандартов. При рассмотрении гармонизации исключительно с позиции сближения правил допускается ошибка, а именно не учитывается, что правила (набор национальных стандартов) – это лишь один из n -ого количества набора факторов. Факторы (детерминанты) учетной системы являются объектом изучения теории экологического детерминизма ( environmental determinism theory ). Ими могут быть [25; 26]:

– уровень развития экономики страны;

– уровень бухгалтерского образования в стране;

– особенности национальной культуры;

– уровень развития фондового рынка;

– размерность фирм и др.

Исходя из этого, сформулируем вопрос: насколько теоретически обосновано исследовать гармонизацию «практики бухгалтерского учета» с акцентом только на стандартах или их применении организациями? На аналогичную проблему указывают, но не решают ее S. Saudagaran и G. Joselito : «Может ли гармонизация правил бухгалтерского учета также повысить качество нормативно-правовой базы в АСЕАН путем включения в национальные требования стандартов “наилучшей практики”, разработанных в других странах?» [11, с. 14].

Даже если в ближайшем будущем все страны перейдут на МСФО или US GAAP , это не приведет к эффективному распределению капитала, поскольку не будут «гармонизированы» другие элементы учетной системы. Более того, даже если будут гармонизированы и элементы учетной системы, нельзя говорить о том, что повысится эффективность распределения капитала, поскольку не определено, как на это влияют детерминанты учетной системы в новом состоянии.

В связи с этим мы предлагаем с концептуальной точки зрения рассматривать конвергенцию (как факт перехода системы из одного состояния в другое, где система меняет «один набор факторов» на «набор факторов», определяемый парадигмой) так, как показано на рис. 4.

Такая цель, как сопоставимость финансовой отчетности, может быть приемлема для инвесторов, рынка капитала и т. д. Однако как «сопоставимость» согласуется с эффективностью распределения капитала в целом и «качеством» этой же финансовой отчетности?

В работах, исследующих влияние МСФО на экономику принявших их государств, часто подчеркивается и эмпирически подтверждается (см. [27; 28]), что средняя стоимость привлечения капитала может снизиться.

|

Бухгалтерское образование (состояние i ) |

---^ Бухгалтерское образование (состояние j ) |

|

Модель регулирования системы |

Модель регулирования системы |

|

(состояние i ) |

(состояние j ) |

|

Практика бухгалтерского учета |

Практика бухгалтерского учета |

|

(состояние i ) |

(состояние j ) |

|

Другие экологические факторы |

Другие экологические факторы |

|

(состояние i ) |

(состояние j ) |

Система i -------------------------------------► Система j

Источник : составлено автором.

Рис. 4. Конвергенция учетной системы в состояние нового набора факторов, определяемого региональной или глобальной парадигмой

Fig. 4. Convergence of the accounting system to the state of a new set of factors determined by a regional or global paradigm

Однако из виду упускается важный вопрос, а именно «Что делать?», если в результате внедрения более качественного набора стандартов (пусть теоретически они будут лучше МСФО или US GAAP ) окажется, что в «среднем» эффективность хозяйственной деятельности компаний в экономике существенно ниже, чем при использовании, например, МСФО. Очевидно, что, владея такой информацией, инвесторы, кредиторы начнут менять свое поведение, в том числе увеличивая стоимость капитала. Этим мы хотим сказать, что снижение стоимости капитала нельзя рассматривать в качестве ведущей «положительной» характеристики, оправдывающей внедрение МСФО в стране.

P. Collett рассматривает этот вопрос с этической точки зрения, подчеркивая, что «стандарты должны быть разработаны таким образом, чтобы гарантировать, что зависимые пользователи не будут несправедливо введены в заблуждение отчетами, которые не являются репрезентативно достоверными» [29, с. 28]. Фактически свою позицию автор подкрепляет цитатой K. MacNeal : «Принципы бухгалтерского учета основаны скорее на целесообразности, чем на истине» [Там же, с. 29], соглашаясь с тем, что разработчики бухгалтерских стандартов должны быть освобождены от «экономических последствий» своих решений.

В данном случае речь идет о противоречии между «заинтересованными сторонами» (инвесторами, кредиторами) и реальной «целью» финансовой отчетности. Противоречие состоит в том, что в настоящее время на регуляторах лежит ответственность по учету влияния их решений на заинтересованные стороны. Например, если новый стандарт приведет к обвалу цен на акции и (или) к экономической рецессии, то такой стандарт не должен быть принят (или он не будет принят по политическим мотивам, когда заинтересованные стороны окажут давление на чиновников, а последние отменят решение бухгалтерского регулятора [29, с. 25; 30, с. 278]). Аналогичную позицию занимает R. Königsgruber , который делает вывод, что «Европейский союз и США имеют одинаковую с точки зрения политического процесса модель регулирования бухгалтерского учета, зависимую от интересов лоббистов» [30, с. 282]. Более того, R. Königsgruber утверждает, что «скрытой целью Европейского союза при введении МСФО было противодействие гегемонии США в установлении стандартов бухгалтерского учета» [Там же, с. 280] (со ссылкой на [31]).

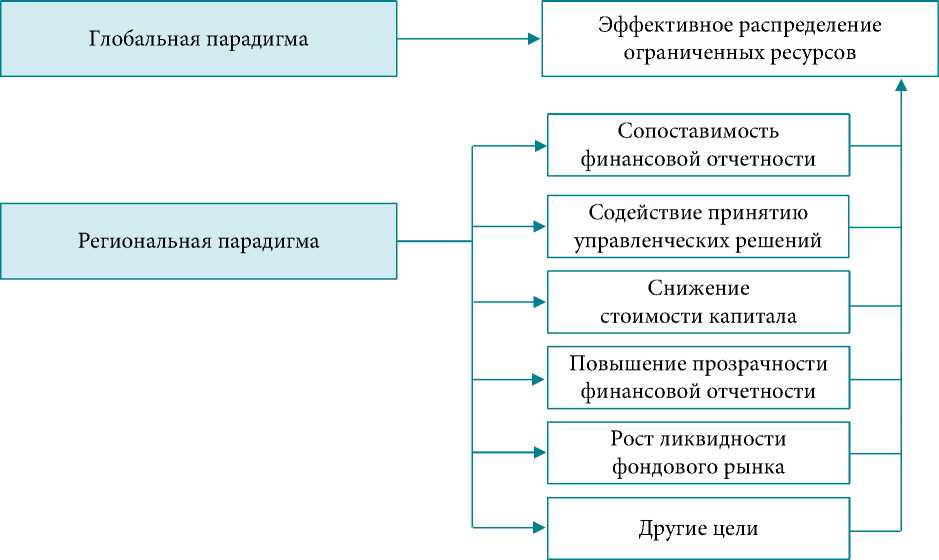

Если взять за основу результаты P. Collett, то ключевой характеристикой новой «глобальной парадигмы» должна стать не гибкость финансовых стандартов, не сопоставимость финансовой отчетности, а «истина», способствующая эффективному распределению ограниченных ресурсов. Поэтому автор и говорит о проблеме «этики», когда с разработчика стандартов нужно снять ответственность перед «составителями отчетности», которые не должны оказывать влияния на процесс установления стандартов [29, с. 24, 28].

S. P. Kothari и соавторы согласны с тем, что цель национальных GAAP – способствовать эффективному распределению капитала, однако такая цель в настоящее время интерпретируется «узко», поскольку акценты ставятся на «информационную» направленность [2, с. 247]. Они говорят о том, что разработчики бухгалтерских стандартов действительно заявляют, что их цель состоит в содействии эффективному распределению капитала, однако «фактически их действия и принимаемые решения направлены на достижение других целей» , например политических [Там же, с. 249]. Поэтому неявно позиция S. Kothari и соавторов согласуется с тем, что в настоящее время бухгалтерские регуляторы «прикрываются» целью «глобальной парадигмы», но по факту достигают своих преимуществ в рамках региональной зоны (как это делают Европейский союз и США). Ученые строят свое исследование, отталкиваясь от «позитивной теории GAAP » [Там же], которая не является предметом настоящей работы. Однако некоторые их выводы нуждаются в обсуждении.

Например, S. P. Kothari с коллегами подчеркивают, что «конкуренция между FASB и IASB , вероятно, повысит степень удовлетворения правил GAAP экономическим требованиям режима, при котором эти органы сотрудничают, как фактически происходит в рамках текущей модели “конвергенции”» [Там же, с. 268], и что «единый глобальный орган, устанавливающий стандарты, такой как Совет по МСФО, вряд ли добьется успеха, если его целью является достижение сходства в практике бухгалтерского учета во всем мире» [Там же].

R. Lambert не согласился с выводами авторов предыдущего исследования в части того, что «“руководящая” роль бухгалтерского учета доминирует над “оценочной” ролью» [3, с. 294], отдавая предпочтение их согласованности друг с другом. По его мнению, бухгалтерский учет является «многоцелевым» по своей природе [Там же, с. 288], что обусловлено способностью информации содействовать принятию управленческих решений. Исследователь также поднимает вопрос, должны ли разработчики стандартов в качестве доминирующей цели заявлять «руководящую» роль [Там же] (имеется в виду, что стандарты способствуют заключению контрактов и управленческому контролю). При этом на практике финансовые отчеты «предназначены для информирования акционеров о том, как обстоят дела с их инвестициями» [Там же]. Другими словами, различные «роли» бухгалтерского учета необязательно должны согласовываться с целями разработчиков стандартов. Эту позицию можно представить схематически (рис. 5).

Так, S. Kothari с соавторами и R. Lambert как спорный вопрос, возникший в результате конвергенции, рассматривают использование оценки по справедливой стоимости и ее соотношения с консерватизмом. С одной стороны, внедрение справедливой стороны приводит к неблагоприятным последствиям для аудиторов [3, с. 290], с другой стороны, она позволяет более достоверно оценить эффективность деятельности фирмы и менеджеров и передать эту информацию рынку [2, с. 255]. Однако насколько в этом случае достигается цель «оценки»? По мнению R. Lambert , использование оценки по справедливой стоимости – это всего лишь инструмент, содействующий оценке [3, с. 290]. Перефразировать рассматриваемую проблему можно следующим образом: в какую сторону мы направляем оценку? С теоретической точки зрения можно поставить цель оценить «все»: не только «физическое» имущество организации, но и, например, человеческий капитал, вред, наносимый окружающей среде, и т. д.

Источник : составлено автором.

Рис. 5. Цели региональной и глобальной парадигмы в привязке к роли учетной системы

Fig. 5. Objectives of regional and global paradigms in relation to the role of the accounting system

Переход от консерватизма к атрибуту рыночной «проверяемости» – это лишь частичный концептуальный сдвиг, сдерживаемый рамками действующих «принципов (правил)» бухгалтерского учета. И чтобы выйти за эти рамки, необходимо четко понимать цель. Ирония же заключается в том, что эта цель есть (см. рис. 5) и заключается она в эффективном распределении ограниченных ресурсов.

S. Kothari и соавторы видят решение проблемы в «инновациях», которые возможны благодаря наличию конкуренции между разработчиками бухгалтерских стандартов: «Прекращение проекта конвергенции между FASB и IASB и принуждение этих двух органов к конкуренции, вероятно, будет наиболее практичным средством достижения правил GAAP , способствующих эффективному распределению капитала» [2, с. 280].

В свою очередь R. Lambert говорит о том, что возникшее противоречие между консерватизмом и справедливой стоимостью в конечном счете позволит определить «новый»

желательный атрибут бухгалтерского учета и именно этот атрибут скажет, какие объекты должны включаться в учет [3, с. 294].

Следовательно, возрастает важность переосмысления не только «границ» бухгалтерского учета, но и того, как инновации будут способствовать достижению выбранной цели.

Соотношение между справедливой стоимостью и консерватизмом, правилами и принципами, выбор модели регулирования (монопольное или конкурентное) – инструменты, благодаря которым, по нашему мнению, возможно продвижение в сторону глобальной парадигмы:

– развитие оценки способствует более качественному пониманию объектов бухгалтерского учета внешними пользователями;

– более качественная информация, раскрываемая в отчетности благодаря применению новой оценки, приведет к более эффективным решениям;

– эффективные решения приведут к более рациональному приложению капитала и т. д.

P. Collett имеет в виду то же самое, когда говорит о необходимости «обеспечения правдивости отчетов» [29, с. 24]. Разработчики бухгалтерских стандартов должны бороться за «истину» подобно тому, как физики или биологи пытаются понять устройство нашего мира, а не продавать свой «товар» ради увеличения собственного благосостояния.

Эта проблема приводит к новому академическому вопросу: как добиться этой «правды»? Какие действия нужно предпринять, чтобы система из одной точки сдвинулась в более совершенное положение (см. рис. 3 и 4)?

ПЕРСПЕКТИВЫ РАЗВИТИЯРЕГИОНАЛЬНОЙ ПАРАДИГМЫ

S. Zeff , обсуждая «экономические последствия» от внедрения стандартов FASB , подчеркивает: «Утверждение о том, что любые существенные экономические последствия должны быть изучены правлением ( FASB. – прим. А. А. ), не значит, что принципы бухгалтерского учета и достоверное представление информации должны быть отвергнуты в качестве основного руководящего фактора при принятии решения правлением» [32, с. 63].

В этом контексте важно заострить внимание на «принципах» бухгалтерского учета; по мнению S. Zeff , именно они, а не политические цели, экономические и социальные последствия и другие факторы должны лежать в основе решений бухгалтерских регуляторов.

Неслучайно R. Lambert задает вопрос «Какие силы привели к недавнему всплеску заявлений, требующих использования справедливой стоимости?» [3, с. 289]. Здесь автор рассуждает о том, что если изменения в стандартах в пользу применения концепции справедливой стоимости ошибочны, то «позитивная теория GAAP » смогла бы объяснить, какие «силы» (например, политические) привели к такому исходу.

Несмотря на это, мнение R. Lambert следует перевести в контекст позиции S. Zeff: если оценка по справедливой стоимости соответст- вует «принципам» бухгалтерского учета и приводит к представлению более качественной информации, способствующей принятию более эффективных решений (даже если это приведет к росту стоимости капитала в экономике), насколько обоснованно говорить об «ошибочности» решений бухгалтерских регуляторов?

Мы должны искать ответ не в том, как стандарты бухгалтерского учета повлияют на благосостояние других экономических субъектов, а в том, будут ли новые правила и методы приводить к «истинному» понимаю дел этих же экономических субъектов.

Бухгалтерский учет, подобно математике, является языком, описывающим объект своей науки. Если бы математики каждый раз думали, приведут ли их научные открытия к «экономическим проблемам», имеющиеся бы сегодня разработки отсутствовали. В связи с этим должны ли мы тратить усилия на то, чтобы каждый раз «определять», приведет ли новый стандарт к каким-либо негативным последствиям? Из-за этого теория бухгалтерского учета стоит на месте и не развивается. В данной работе мы не доказываем последнюю точку зрения, но можем привести пример с такими стандартами, как IAS 12 “Income Taxes” , IAS 20 “Accounting for Government Grants and Disclosure of Government Assistance” , IFRS 13 “Fair value measurement” :

– с точки зрения налогов на прибыль – «бухгалтерская» сущность налогов на прибыль, в том числе отложенных налогов, остается необоснованной более 80 лет (за допущение было принято, что они являются расходами и обладают всеми характеристиками активов и обязательств), гипотеза о стационарном состоянии не доказана с 1958 г., методики учета инвестиционного налогового кредита (вычета) не раскрыты;

– с точки зрения справедливой стоимости – IFRS 13 закладывает множество «концептуальных» правил, которые впоследствии отвергаются в других стандартах (например, в стандарте IAS 36 “Impairment of assets” в п. 53А устанавливается, что ценность использования отличается от справедливой стоимости, при этом если ценность использования является возмещаемой суммой актива, то именно она будет представлена в балансе (п. 59 IAS 36); но подумаем, является ли возмещаемая стоимость «справедливой»?)1;

– государственная помощь не была в достаточной степени рассмотрена в научной литературе, а FASB в качестве общепринятых принципов разрешил использовать IAS 20 (см. FASB ASC 832 “Government Assistance” : в п. 83210-05-1 указано: «Общепринятые принципы бухгалтерского учета ( GAAP ) не обеспечивают всеобъемлющего руководства по признанию и оценке многих форм государственной помощи, получаемой хозяйствующими субъек-тами» 2 , а п. 832-10-15-4 разрешает пользоваться моделями МСФО).

Указанные проблемы, по существу, являются академическими. Об аналогичной проблеме говорил S. Zeff в работе [34]: «До 1970-х гг. в американских журналах и книгах преобладали обычные (нормативные. – прим. А. А.) исследования, но начиная с 1960-х гг. они… сильно сместились в сторону эмпирической работы, а нормативным исследованиям, соответственно, уделялось гораздо меньше внимания» [34, с. 44]. S. A. Zeff прямо заявляет, что если раньше бухгалтерские стандарты базировались на «научном» фундаменте, который строили бухгалтеры (как ученые, так и практики), то после 1960-х гг. эта роль сместилась на второй план3 [34–38]. Он также подчеркивает: «Что касается разработчиков стандартов, то APB выпустил важные нормативные рекомендации в период с 1967 г. по начало 1970-х гг. и выпустил бы еще больше, если бы не вмешалось политическое лоббирование» [34, с. 47].

Возвращаясь к инвестиционному налоговому кредиту, отметим, что методические разработки, опубликованные APB в 1962 и 1964 гг. 4 , мало того что не были пересмотрены, они оказались кодифицированы в FASB ASC 740 “Income Taxes” в качестве нескольких правил (п. 74010-45-26–740-10-45-28 FASB ASC 740 5 ). В свою очередь, разработчик МСФО вовсе не знает, как должны учитываться инвестиционные налоговые льготы.

С аналогичной проблемой столкнулись R. Barker и A. McGeachin, которые изучили противоречия в бухгалтерском учете «обязательств» в соответствии с МСФО. Они пришли к выводу, что «пороговые значения распознавания [обязательств] в рамках концептуальных основ сформулированы неправильно» [39, с. 585]. Авторы также обратили внимание на тот факт, что разработчики МСФО неверно смотрят на проблемы «оценки» и «измерения» обязательств, неадекватно применяют принципы бухгалтерского учета, непоследовательны и неточны в собственных же формулировках [39, с. 583–585]. В качестве ключевой причины, почему разработчики регламентируют такие правила, R. Barker и A. McGeachin называют отсутствие «нормативной теории консерватизма» [39, с. 581].

J. Forker и S. Green прямо пишут, что «вопрос учета безвозмездных трансфертов, в частности государственных грантов, используется для иллюстрации снижения релевантности, надежности и сопоставимости финансовой отчетности в результате неспособности дать концептуальное определение эффективности на уровне операционной прибыли» [40, с. 375]. Авторы изучили проблему учета государственной помощи и пришли к выводу, что IAS 20 искажает показатели эффективности финансовохозяйственной деятельности организаций [40]. С этим соглашаются C. Stadler и C. W. Nobes , подчеркивая, что «выбор «отложенного дохода» ухудшает оценку кредитного плеча [41].

Мы согласны с позицией S. Zeff и также утверждаем, что из-за отсутствия нормативных исследований в области бухгалтерского учета нельзя построить состоятельный фундамент бухгалтерских стандартов. Нет развития теории – нет качественного развития стандартов.

Однако последний вопрос стал рассматриваться через призму критики соотношения «принципов (правил)», что стало отдельной научной темой среди исследователей. Так, после 2002 г. в США Закон Сарбейнса–Оксли (англ. Sarbanes–Oxley Act , SOX ) потребовал «от SEC изучить возможность перехода к более “основанной на принципах” системе финансовой отчетности» [42]. В связи с этим в указанный период развернулись научные дискуссии по поводу приемлемости такого перехода.

M. W. Nelson считает, что «все стандарты можно рассматривать как основанные на принципах и вопрос заключается в постепенном влиянии на поведение, когда стандарты включают относительно более сложные правила» [42]. Далее автор сразу подчеркивает: «Одна из причин, по которой относительно молодые режимы установления стандартов, такие как IAS , кажутся более основанными на принципах, заключается в том, что у них было не так много времени для выработки правил» [42].

В целом вопрос как таковой необходимости наличия «правил» сместился в сторону защиты поведения в первую очередь аудиторов. С этим согласен R. Lambert , который утверждает: «Система, основанная на принципах, потребует от аудиторов большего суждения и отстаивания интересов своих клиентов в гораздо большей степени, чем это, по-видимому, происходит сейчас» [3, с. 294].

Некоторые исследователи согласились, что огромное количество правил появляется тогда, когда принцип, заложенный стандартом, или не работает, или не дает возможности четко оценить факт хозяйственной жизни. Например, C. Nobes рассмотрел различные аспекты бухгалтерского учета аренды, государственной помощи, финансовых инструментов, и пришел к выводу, что «некоторые правила в существующих стандартах возникают потому, что стандарт основан на плохом принципе или в нем отсутствует (подходящий. – прим. А. А. ) принцип» [43]. Решение «проблемы» выбора надлежащего соотношения «принципов (правил)» C. Nobes видит в необходимости «принять более подходящий» принцип, применение которого позволит четко и ясно выбрать конкретное правило для учета объекта бухгалтерского наблюдения в рамках одного стандарта.

K. Schipper обосновывает наличие правил в стандартах так [44, с. 67–69]:

– они повышают сопоставимость финансовой отчетности;

– снижают возможность манипулировать прибылью;

– повышают проверяемость финансовой отчетности;

– позволяют предусмотреть исключения из сферы применения стандарта;

– снижают издержки аудиторов, в том числе судебные (во-первых, в части того, что аудиторам проще достигнуть консенсуса в отношении выбранного организацией способа оценки; во-вторых, в случае судебного разбирательства аудитор будет ссылаться на конкретное правило, что подтвердит правомерность выбора того или иного метода учета).

Ключевой вывод состоит в том, что «чем большего суждения требует принцип бухгалтерского учета, тем сложнее воплотить его в стандарт без большего количества указаний и, возможно, исключений» [45, с. 185]. В этом контексте мы согласны с G. J. Benston и соавторами в части того, что бухгалтерским стандартам необходима четкая концептуальная база с ясной иерархией принципов [45].

Однако концептуальная база должна быть «нормативно» настроена . Если американские стандарты, как подчеркивал S. Zeff , долгое время развивались благодаря усилиям бухгалтеров [36], то МСФО в этом смысле даже при наличии «концептуальных основ» сталкиваются с проблемой «передачи экономической сущности компании в рамках этого режима» [45, с. 184].

S. Kothari с соавторами прямо говорят, что «рабочие “правила” и регулирующие “принципы” являются двумя сторонами одной медали» [2, с. 277].

С теоретической и исторической точек зрения эту проблему рассматривал профессор Я. В. Соколов через призму цепочки «постулаты – принципы – правила – процедуры – стандарты» 1 , которая предполагает «последовательное восхождение от абстрактного к конкретному, от теории к практике» 2 . Несмотря на это, в научном сообществе не сложилось общепринятого представления, как принципы бухгалтерского учета должны определять суть бухгалтерии. Данная проблема остается нерешенной.

Из-за того что «принципиальный фундамент» бухгалтерского учета не определен, последнее и порождает наличие правил, являющихся руководством к действиям (индуктивный подход). Поэтому M. Nelson употребляет такое слово, как «коммуникация», акцентируя внимание на том, что правила бухгалтерского учета передают информацию о том, как и с какой целью применять те или иные учетные методы, практикующим специалистам [42].

Однако, как отмечалось нами, разработчики сами не понимают, на чем должно быть основано правило, ввиду отсутствия «нормативных» ориентиров.

S. Kothari и соавторы указывают, что широкий выбор бухгалтерских методов ограничивается в стандартах или конкретными правилами, или принципами [2, с. 276], разница состоит в масштабе такой границы . Когда в основе стандарта лежат принципы, то неявно предполагается более широкий выбор, а наличие правил просто сужает его. Избавление от правил или их минимизация не приведет к созданию единообразной «концептуальной структуры» GAAP , что автоматически не сможет повысить эффективность распределения капитала [Там же].

L. Spacek крайне негативно высказывался в отношении двух исследовательских проектов Отдела бухгалтерских исследований AICPA : “The basic postulates of accounting” [46] (подготовлен M. Moonitz ) и “A tentative set of broad accounting principles for business enterprises” [47] (подготовлен R. T. Sprouse и M. Moonitz ).

Так, ученый в рецензии на первый проект указал, что «важнейшей предпосылкой для создания прочной основы теории бухгалтерского учета должно быть четкое определение целей и задач бухгалтерского учета» и что «основным постулатом, лежащим в основе принципов бухгалтерского учета, может быть постулат справедливости – справедливости по отношению ко всем сегментам делового сообщества» [46, с. 56–57]. При рассмотрении второго проекта L. Spacek , по нашему мнению, приводит крайне уместный аргумент, говоря, что существующие принципы, в том числе изложенные в работе R. Sprouse и M. Moonitz , не могут объяснить различные проблемы, связанные с практикой бухгалтерского учета налогов на прибыль, объединения бизнеса, внутрикорпоративных инвестиций, пенсий, инфляции и т. д. [47, с. 77–79]. Как и в предыдущей рецензии,

L. Spacek считает, что принципы «на прочной и логической основе» [Там же, с. 78] должны согласовываться с выбранной целью.

Таким образом, можно утверждать следующее. Во-первых, с фундаментальной точки зрения в настоящее время у бухгалтерского учета отсутствует ясная и понятная цель (в макроэкономических масштабах). С одной стороны, многие согласны с тем, что бухгалтерский учет должен способствовать эффективному распределению ограниченных ресурсов. С другой стороны, как утверждает L. Spacek , «инструменты», которые применяются для достижения указанной цели, должны быть спра-ведливы 1 по отношению ко всем сегментам делового сообщества. Но с точки зрения этики, как считает P. Collett , разработчиков бухгалтерских стандартов необходимо освободить от ответственности перед этим же самым «деловым сообществом». Причем для того, чтобы разработчик мог качественно развивать стандарты, к решению возникающих вопросов должны подключаться ученые, чьи усилия будут направлены на то, чтобы построить логический и прочный «нормативный» фундамент, о котором говорил L. Spacek .

Во-вторых, как считают S. Kothari с коллегами [2], «конкуренция» между бухгалтерскими регуляторами может способствовать инновациям. Но, с точки зрения S. Zeff , решения, принимаемые регуляторами, должны строиться на «принципах» бухгалтерского учета, а не зависеть от политических намерений чиновников. При этом ведущую роль, по его мнению, должно играть академическое сообщество, усилия которого следует направить на построение прочной нормативной бухгалтерской теории. И именно она должна стать фундаментом для разработки бухгалтерских стандартов.

Но что такое «инновации» в бухгалтерском учете? Можно ли считать появление такого феномена, как отложенные налоги, инновацией? Или активное продвижение оценки по справедливой стоимости, научный фундамент которой в границах теории бухгалтерского учета «не успели» сформировать?

Возможно, подобно тому, как развивались физика и математика, тому, как с каждым веком совершенствовалась точность измерительных приборов, так и бухгалтерский учет должен изменяться в сторону более точного отражения фактов хозяйственной жизни. Справедливая стоимость, отложенные налоги – это пример того, как развитие частных теорий привело к более правдивому отражению операций и финансового положения компаний.

Интересно отметить, что H. A. Black в исследовании, посвященном межпериодному распределению налога на прибыль, подчеркивал: «Соблюдение строго юридического подхода к обязательствам серьезно затруднило бы справедливое представление результатов деятельности и финансового положения» [50, с. 45]. При этом фикция отложенных налогов была раскритикована рецензентами. Например, S. Davidson указал, что бухгалтерский учет должен иметь дело с реальными событиями [Там же, с. 117–119]. Спустя более чем 60 лет сущность межпериодного распределения так и осталась необоснованной.

При этом в словах H. Black есть крайне важная параллель: он делает акцент на «справедливом» представлении результатов хозяйственной деятельности, что возможно, если отходить от принятых принципов (существующих подходов).

Говорит ли это о том, что «инновации» в данном контексте – это более совершенное, правдивое и справедливое представление ин- формации внешним пользователям? Мы считаем, что да.

Но чтобы добиться последнего, необходимо сосредоточить усилия на нормативных исследованиях. Пока не будет построен фундамент теории бухгалтерского учета, гармонизировать практику невозможно. Причина состоит в том, что, когда гипотезы «работают», они в конечном счете становятся фактом, теоремой, следствия из которых позволяют выводить другие теоремы. Аналогично должно быть и в бухгалтерском учете. Если «принцип» изначально работает, то его применение всегда будет приводить к верному следствию (правилу). В связи с чем наличие правила, выведенного из надлежащего принципа, напротив, указывает на верный путь: если ученый впоследствии сможет объяснить практикующему специалисту причинно-следственную связь между принципом (теоремой, гипотезой) и правилом, то ни о каком изобилии правил в стандартах нам говорить уже не придется.

Так должно быть и в бухгалтерской теории: «правило» – окончательный вариант теории (дедуктивный подход). И если причинноследственная связь построена объективно, то ее изложение в стандарте станет неопровержимым законом. Можем ли мы говорить об этом сегодня применительно к стандартам МСФО, или US GAAP, или любым другим стандартам? Мы считаем, что нет.

Преподносить «хаос», как это делает Совет по МСФО, в качестве «глобальной парадигмы», когда фактически она является «региональной», – в корне тупиковый подход.

Мы видим решение фундаментальной проблемы бухгалтерского учета в развитии частных нормативных теорий (рис. 6), под которыми в рамках данной работы понимаются, например, оценка и амортизация основных средств, учет налогов на прибыль, учет государственной помощи, учет запасов и т. д. Механизм того, как частные нормативные теории приведут к созданию концептуального фундамента, подробно не рассматривается.

Частная нормативная теория 1

Частная нормативная теория 2

Частная нормативная теория i

Принципы (правила) 1

> Стандарт 1

Принципы (правила) 2

> Стандарт 2

* Стандарт i

Принципы (правила) i

Нормативный концептуальный фундамент

Однако в научных исследованиях показано, как в ходе развития частных нормативных теорий возникают противоречия с действующими бухгалтерскими принципами 1 (например, при рассмотрении отложенных налогов, учет которых вступил в противоречие с юридическим подходом к признанию активов и обязательств, а также с принципом консерватизма). Мы считаем, что выявление таких противоречий и их обсуждение с научным сообществом даст возможность переосмыслить другие частные теории (как это случилось, например, с принципом консерватизма и его «эволюционированием», что было подробно рассмотрено R. R. Sterling в работе [51]).

С точки зрения конвергенции учетных систем следует понимать, что сегодня сама модель вовсе не определена, в том числе строго на институциональном уровне. Если делать акцент на «практике» бухгалтерского учета (стандартах, правилах (принципах) и т. д.), то, поскольку развитие нормативной теории учета поставлено на паузу, нет никаких адекватных предпосылок, указывающих на «глобальную» конвергенцию.

Ориентация на «режим» МСФО или US GAAP представляет собой привязку к «региональной» зоне. Как показано на рис. 4, помимо самих стандартов, должна быть создана целостная инфраструктура, включающая в себя множество других элементов системы (образование и его признание другими государствами; профессиональная аттестация; регулирование рынка труда и т. д.). В «региональной» зоне, как это делает Европейский союз, «настроить» отдельные элементы проще – путем применения директив.

Однако для выхода на глобальный уровень необходима согласованная «настройка», что в сложившихся геополитических условиях и глобального передела мира является вектором если не середины, то хотя бы конца XXI – начала XXII вв.

НЕДОСТАТКИ И ПЕРСПЕКТИВЫ ИССЛЕДОВАНИЯ

В настоящее время вопросы конвергенции и гармонизации учетных систем через призму теории бухгалтерского учета не рассматриваются. При этом указанный аспект в той или иной степени затрагивается в трудах многих исследователей. Поэтому для того, чтобы представить обозначенную тему с другой стороны, мы обращаемся к таким противоречиям:

– соотношение между принципами и правилами;

– приемлемость монопольного и конкурентного режимов разработки стандартов;

– противоречие между позитивной и нормативной составляющими теории бухгалтерского учета;

– соотношение между региональной и глобальной парадигмой гармонизации;

– противоречие между заявленными и фактическими целями конвергенции учетных систем.

Исходя из этого, очевидный недостаток данной работы – поверхностное понимание указанных противоречий, поскольку они являются предметом других научных областей.

Нами подчеркивается, что усилия Совета по международным стандартам финансовой отчетности обеспечивают преимущества в первую очередь региональной зоны Европейского союза, а заявленная глобальная цель является лишь инструментом для привлечения большего количества новых членов к использованию «режима» МСФО. При этом явного качественного развития «системы» не происходит , поскольку усилия регулятора направлены на распространение его «продукта».

Указанная проблема затрагивается в работах, посвященных влиянию транснациональных компаний, институциональных инвесторов и регуляторных посредников на процессы гармонизации [18; 52–55]. Так, S. J. Gray и со- авторы еще в 1981 г. говорили о том, что влияние транснациональных компаний (ТНК) приводит к «ограниченному единообразию, а не к гармонии» [52, с. 125], поскольку с помощью своей «власти» и «соответствующего давления» [Там же, с. 131] ТНК добиваются целей листинга на фондовых биржах и снижения затрат на составление финансовой отчетности. К аналогичному выводу пришли A. Alon и P. D. Dwyer, подчеркнув, что развивающиеся страны из-за высокой восприимчивости к транснациональному давлению были вынуждены согласиться на принятие МСФО [53, с. 366] из-за потребности в ресурсах.

S. Taylor считает, что «намерение IASC , по-видимому, состоит в том, чтобы сократить расходы ТНК на подготовку отчетности для акционеров путем стандартизации существующей практики подготовки отчетности, а не в расширении сферы охвата (и тем самым аудитории) финансовых отчетов ТНК» [18, с. 162]. Более того, автор высказывает предположение, что «глобальные или даже региональные бухгалтерские организации в таких регионах, как ЮгоВосточная Азия, скорее всего, будут созданы по указке англо-американских бухгалтерских органов» [Там же, с. 158]. Ожидания ученого сбылись: страны ACEAH активно внедряют и распространяют МСФО [56].

V. W. Fang и соавторы пришли к выводу, что на глобальную конвергенцию бухгалтерского учета влияют институциональные инвесторы, которые представляют собой «важный фактор сближения практик финансовой отчетности во всем мире» [54, с. 624–625]. При этом авторы делают акцент на институциональных инвесторах из США, которые «могут служить таким механизмом, изменяя стимулы к отчетности своих объектов инвестиций за пределами США и непосредственно влияя на сопоставимость их финансовой отчетности» [Там же].

L. Herman констатирует, что сегодня аудиторские компании «Большой четверки» вступили в картельный сговор, а это «подрывает роль аудиторов как посредников в регулировании и их независимость и объективность»

[55, с. 363]. Ключевой вывод автора состоит в том, что указанные аудиторские компании вышли за рамки функционала «регуляторных посредников», захватив влияние над разработчиками бухгалтерских стандартов (в первую очередь МСФО), в том числе за счет их финансирования. Как утверждает L. Herman , взносы «Большой четверки» составляют более трети бюджета Совета по МСФО, что говорит о его зависимости, несмотря на существование отдельного Фонда МСФО [Там же, с. 364]. Аудиторские компании, прикрываясь идеей конвергенции, достигают своих собственных целей : увеличение прибыли, расширение влияния [Там же, с. 367–368] и т. д.

Известный историк в области бухгалтерского учета, S. Zeff , в течение тридцати последних лет пытается сказать всему бухгалтерскому сообществу, что FASB потерял возможность независимо разрабатывать качественные стандарты в области бухгалтерского учета по причине захвата власти аудиторскими компаниями [32–38].

Указанные аспекты представляют иной взгляд на рассматриваемую в данной работе тему, причем вывод следует один: в настоящее время идет борьба за доминирование региональной парадигмы. Глобальная парадигма не может быть выстроена, пока не будут решены фундаментальные противоречия.

Другим недостатком работы является отсутствие четкого набора факторов (детерминант) для региональной и глобальной парадигм. Такие особенности будут более подробно изучены и рассмотрены через призму теории экологического детерминизма в будущих авторских исследованиях.

ЗАКЛЮЧЕНИЕ

Цель настоящей работы состояла в пересмотре механизма конвергенции учетных систем через призму теории бухгалтерского учета и парадигм гармонизации. Такой подход позволил увидеть, что в настоящее время глобальная парадигма фактически не сформирована.

При этом глобальная цель – эффективное распределение ограниченных ресурсов – заявляется региональными регуляторами для привлечения новых членов-участников, в основе чего лежат политические региональные намерения. Качественного же развития регионального уровня не происходит, поскольку элементы системы ограничены региональной зоной, в интересах которой метод гармонизации применяется. В частности, МСФО – это лишь один элемент учетной системы. Полная конвергенция возможна тогда, когда другие элементы (инфраструктурные) также будут гармонизированы. Последнее наиболее эффективно достигается именно в региональной зоне, такой как Европейский союз, у которой есть действенный механизм (директивы), способствующий конвергенции. Отсюда и возникает риторический вопрос: как учетная модель страны, не состоящей в Европейском союзе, но внедряющей только МСФО, может конвергироваться в модель региональной зоны?

В работе акцентируется внимание и на наборе экологических факторов, формирующих учетную модель. Но последние в рамках нашего исследования не определяются. Более того, в научной литературе также отсутствует системное понимание того, какими именно должны быть региональная и глобальная учетные модели. Отсюда вытекает еще один риторический вопрос: что предлагает «гармонизировать» Совет по международным стандартам финансовой отчетности?

Если остаться в рамках стандартов (в том числе того научного фундамента, который их определяет), то можно прийти к выводу, что никакой глобальной моделью МСФО не являются. В работе мы утверждаем, что сегодня банально отсутствует единый нормативный фундамент, в основе которого должны лежать принципы и правила бухгалтерского учета.

Отсутствие нормативного фундамента уже говорит о том, что стандарты МСФО не могут быть качественными, как это заявляет Совет по международным стандартам финансовой отчетности. На указанную проблему обращает внимание бухгалтерское научное сообщество, подчеркивая тот факт, что нормативные исследования прекратились1. Их отсутствие породило множество противоречий в стандартах, регламентирующих неадекватные правила признания и оценки объектов бухгалтерского наблюдения, в том числе в границах существующих концептуальных основ.

В качестве одного из решений обозначенных проблем мы предлагаем рассмотреть возобновление развития частных нормативных теорий с целью формирования нормативного концептуального фундамента, который и станет основной для перехода к «глобальной парадигме». Но, как нами подчеркивалось, это лишь один элемент (фактор, детерминанта). В более широком, системном представлении конвергенция учетных систем в сторону глобальной парадигмы будет возможна по мере гармонизации прочих элементов. Последнее как раз и определяет актуальность будущих исследований в области анализа таких аспектов, как бухгалтерское образование, модель регулирования бухгалтерского учета, роль бухгалтерских институтов, в том числе профессиональная аттестация бухгалтеров, бухгалтерский рынок труда и других, которые формируют инфраструктуру бухгалтерского учета в стране, или, по-другому, ее «бухгалтерскую действительность». При этом теория экологического детерминизма требует рассматривать указанные факторы с точки зрения причинно-следственных связей с учетной моделью, в том числе того, какое влияние они могут оказать на экономику.

Результаты настоящего исследования показывают, что существующие в настоящее время представления о глобальной парадигме являются несостоятельными и требуют пересмотра.

Список литературы Конвергенция учетных систем через призму теории бухгалтерского учета и парадигм гармонизации

- Ball R. International Financial Reporting Standards (IFRS): pros and cons for investors // Accounting and Business Research. 2006. Vol. 36, iss. supl. P. 527. DOI 10.1080/00014788.2006.9730040

- Kothari S. P., Ramanna K., Skinner D. J. Implications for GAAP from an analysis of positive research in accounting // Journal of Accounting and Economics. 2010. Vol. 50, iss. 1-2. P. 246-286. DOI 10.1016/j.jacceco.2010.09.003

- Lambert R. Discussion of ''Implications for GAAP from an analysis of positive research in accounting'' // Journal of Accounting and Economics. 2010. Vol. 50, iss. 2-3. P. 287-295. DOI 10.1016/j.jac-ceco.2010.09.006

- Ahmed K., Chalmers K., Khlif H. A Meta-analysis of IFRS Adoption Effects // The International Journal of Accounting. 2013. Vol. 48, iss. 2. P. 173-217. DOI 10.1016/j.intacc.2013.04.002

- Brown P. International Financial Reporting Standards: What are the benefits? // Accounting and Business Research. 2011. Vol. 41, iss. 3. P. 269-285. DOI 10.1080/00014788.2011.569054

- Jamal K., Sunder S. Monopoly versus Competition in Setting Accounting Standards // ABACUS. 2014. Vol. 50, iss. 4. P. 369-385. DOI 10.1111/abac.12034

- Dye R. A., Sunder S. Why Not Allow FASB and IASB Standards to Compete in the U.S.? // Accounting Horizons. 2001. Vol. 15, iss. 3. P. 257-271. DOI 10.2308/acch.2001.15.3.257

- Малофеева Т. Н. Становление и развитие процесса конвергенции двух видов стандартов: МСФО и US GAAP // Корпоративные финансы. 2016. Т. 10, № 3 (39). С. 70-83. EDN XAKQKZ

- Burke Q. L. Why haven't U.S. GAAP and IFRS on Insurance Contracts Converged? Evidence from an Unsuccessful Joint Project // Journal of Contemporary Accounting & Economics. 2019. Vol. 15, iss. 2. P. 131-144. DOI 10.1016/j.jcae.2019.04.001

- Hoarau C. International accounting harmonization: American hegemony or mutual recognition with benchmarks? // European Accounting Review. 1995. Vol. 4, iss. 2. P. 217-233. 10.1080/09638189500000012

- Saudagaran S. M., Joselito G. D. Accounting Regulation in ASEAN: A choice between the global and regional paradigms of harmonization // Journal of International Financial Management and Accounting. 1997. Vol. 8, iss. 1. P. 1-32. DOI 10.1111/1467-646X.00015

- Безбородое Ю. С. Гармонизация как метод конвергенции в международном праве // Международное публичное и частное право. 2017. № 4. С. 7-10. EDN ZBQPBV

- Третьякова О. Д. Конструкция юридической конвергенции // Юридическая техника. 2013. № 7-2. С. 777-781. EDN RBRTPP

- Толченкин Д. А., Толченкина М. Э. Юридическая свобода и правовая конвергенция: соотношение парадигм // Теория государства и права. 2019. № 2 (14). С. 107-111. EDN ZECFBS

- Doupnik T. S., Salter S. B. An empirical test of a judgmental international classification of financial reporting practices // Journal of International Business Studies. 1993. Vol. 24. P. 41-60. DOI 10.1057/palgrave.jibs.8490224

- Chand P., Patel C. Convergence and harmonization of accounting standards in the South Pacific region // Advances in Accounting. 2008. Vol. 24, iss. 1. P. 83-92. DOI 10.1016/j.adiac.2008.05.002

- Jaafar A., Mcleay S. Country effects and sector effects on the harmonization of accounting policy choice // ABACUS. 2007. Vol. 43, iss. 2. P. 156-189. DOI 10.1111/j.1467-6281.2007.00224.x

- Taylor S. L. International accounting standards: An alternative rationale // ABACUS. 1987. Vol. 23, iss. 2. P. 157-170. DOI 10.1111/j.1467-6281.1987.tb00147.x

- Van der Tas L. G. Measuring harmonisation of financial reporting practice // Accounting and Business Research. 1988. Vol. 18, iss. 70. P. 157-169. DOI 10.1080/00014788.1988.9729361

- Tay J. S. W., Parker R. H. Measuring international harmonization and standardization // ABACUS. 1990. Vol. 26, iss. 1. P. 71-88. DOI 10.1111/j.1467-6281.1990.tb00233.x

- Chen C., Lee E., Lobo G. J., Zhu J. Who benefits from IFRS convergence in China? // Journal of Accounting, Auditing & Finance. 2019. Vol. 34, iss. 1. P. 99-124. DOI 10.1177/0148558X16688115

- Sutton V. Harmonization of international accounting standards: Is it possible? // Journal of Accounting Education. 1993. Vol. 11, iss. 1. P. 177184. DOI 10.1016/0748-5751(93)90025-E

- Das B., Shil N. C., Pramanik A. K. Convergence of accounting standards: Internationalization of accounting // International Journal of Business and Management. 2009. Vol. 4, no. 1. P. 78-84. DOI 10.5539/ijbm.v4n1p78

- Van der Tas L. G. Harmonization of financial reporting - with a special focus on the European Community // European Accounting Review. 1992. Vol. 1, iss. 2. P. 469-473. DOI 10.1080/09638189200 000044

- Аксентьев А. А. Теория экологического детерминизма в области международного бухгалтерского учета: необходимость ее переосмысления // Международный бухгалтерский учет. 2024. Т. 27, № 3 (513). С. 278-303. DOI 10.24891/ia.27.3.278. EDN HBMPUF

- Böckem H., d'Arcy A. Evolution of (International) accounting systems critical assessment of the environmental determinism theory with an application to tax influences // Schmalenbachs Zeitschrift für betriebswirtschaftliche Forschung. 1999. Vol. 51. P. б0-7б. DOI 10.1007/BF03371559

- Li S. Does mandatory adoption of international financial reporting standards in the European Union reduce the cost of equity capital? // The Accounting Review. 2010. Vol. 85, iss. 2. P. б07-бЗб. DOI 10.2308/accr.2010.85.2.607

- Kim J.-B., Shi H., Zhou J. International Financial Reporting Standards, institutional infrastructures, and implied cost of equity capital around the world // Review of Quantitative Finance and Accounting. 2014. Vol. 42. P. 4б9-507. DOI 10.1007/s11156-013-0350-3

- Collett P. Standard setting and economic consequences: An ethical issue // ABACUS. 1995. Vol. 31, iss. 1. P. 10-30. DOI 10.111 1/j.1467-6281.1995.tb00352.x

- Königsgruber R. A political economy of accounting standard setting // Journal of Management & Governance. 2010. Vol. 14. P. 277-295. DOI 10.1007/ s10997-009-9101-1

- Dewing I., Russell P. Financial integration in the EU: The first phase of EU endorsement of international accounting standards // Journal of Common Market Studies. 2008. Vol. 46, iss. 2. P. 243-264. DOI 10.1111/j.1468-5965.2007.00776.x

- Zeff S. A. The rise of "economic consequences" // The Journal of Accountancy. 1978. Vol. 146, no. 6. P. 5б-б3.

- Littleton A. C. Value and price in accounting // The Accounting Review. 1929. Vol. 4, no. 3. P. 147154. URL: https://www.jstor.org/stable/238948 (дата обращения: 12.04.2024).

- Zeff S. A. Some historical reflections on "Have academics and the standard setters traded places?" // Accounting, Economics and Law. 2014. Vol. 4, iss. 1. P. 41-48. DOI 10.1515/ael-2013-0028

- Zeff S. A. Independence and standard setting // Critical Perspectives on Accounting. 1998. Vol. 9, iss. 5. P. 535-543. DOI 10.1006/cpac.1998.0259

- Zeff S. A. How the U.S. accounting profession got where it is today: Part I // Accounting Horizons. 2003. Vol. 17, iss. 3. P. 189-205. DOI 10.2308/ acch.2003.17.3.189

- Zeff S. A. How the U.S. accounting profession got where it is today: Part II // Accounting Horizons. 2003. Vol. 17, iss. 4. P. 267-286. DOI 10.2308/ ACCH.2003.17.4.267

- Dyckman T. R., Zeff S. A. Accounting research: Past, present, and future // ABACUS. 2015. Vol. 51, iss. 4. P. 511-524. DOI 10.1111/abac.12058

- Barker R., McGeachin A. Why is there inconsistency in accounting for liabilities in IFRS? An analysis of recognition, measurement, estimation and conservatism // Accounting and Business Research. 2013. Vol. 43, iss. 6. P. 579-604. DOI 10.1080/00014788. 2013.834811

- Forker J., Green S. Corporate governance and accounting models of the reporting entity // British Accounting Review. 2000. Vol. 32, iss. 4. P. 375-396. DOI 10.1006/bare.2000.0144

- Stadler C., Nobes C. Accounting for government grants: Standard-setting and accounting choice // Journal of Accounting and Public Policy. 2018. Vol. 37, iss. 2. P. 113-129. DOI 10.1016/j.jaccpubpol.2018.02.004

- Nelson M. W. Behavioral evidence on the effects of principles- and rules-based standards [Working Paper] // SSRN. 2003. 27 p. DOI 10.2139/ssrn.360441

- Nobes C. Rules-based standards and the lack of principles in accounting // Accounting Horizons. 2005. Vol. 19, iss. 1. P. 25-34. DOI 10.2308/acch.2005.19.1.25

- Schipper K. Commentary principles-based accounting standards // Accounting Horizons. 2003. Vol. 17, iss. 1. P. 61-72. DOI 10.2308/acch.2003.17.1.61

- Benston G. J., Bromwich M., Wagenhofer A. Principles- versus rules-based accounting standards: The FASB's standard setting strategy // ABACUS. 2006. Vol. 42, iss. 2. P. 165-188. DOI 10.1111/j.1468-4497.2006.00196.x

- Moonitz M. Basic postulates of accounting; Accounting research study no. 01. New York: AICPA, 1961. 61 p. URL: https://clck.ru/3CqQVj (дата обращения: 09.01.2024).

- Sprouse R. T., Moonitz M. Tentative set of broad accounting principles for business enterprises; Accounting research study no. 03. New York: AICPA, 1962. 87 p. URL: https://clck.ru/3CqQYd (дата обращения: 09.01.2024).

- Wojdak J. F. Levels of objectivity in the accounting process // The Accounting Review. 1970. Vol. 45, no. 1. P. 88-97. URL: https://www.jstor.org/stable/ 244298 (дата обращения: 09.01.2024).

- Arnett H. E. The concept of fairness // The Accounting Review. 1967. Vol. 42, no. 2. P. 291-297. URL: https://www.jstor.org/stable/243934 (дата обращения: 09.01.2024).

- Black H. Л. Interperiod allocation of corporate income taxes; Accounting research study no. 09. New York: AICPA, 1966. 123 p. URL: https://clck.ru/ 3CqQgp (дата обращения: 09.01.2024).

- Sterling R. R. Conservatism: The fundamental principle of valuation in traditional accounting // ABACUS. 1967. Vol. 3, iss. 2. P. 109-132. DOI 10.1111/j.1467-6281.1967.tb00375.x

- Gray S. J., Shaw J. C., McSweeney L. B. Accounting standards and multinational corporations // Journal of International Business Studies. 1981. Vol. 12, no. 1: Tenth Anniversary Special Issue. P. 121-136. https://www.jstor.org/stable/154422 (дата обращения: 09.01.2024).

- Alon Л., Dwyer P. D. Early adoption of IFRS as a strategic response to transnational and local influences // The International Journal of Accounting. 2014. Vol. 49, iss. 3. P. 348-370. DOI 10.1016/j.in-tacc.2014.07.003

- Fang V. W., Maffett M., Zhang B. Foreign institutional ownership and the global convergence of financial reporting practices // Journal of Accounting Research. 2015. Vol. 53, iss. 3. P. 593-631. DOI 10.1111/1475-679X.12076

- Herman L. Neither takers nor makers: The Big-4 auditing firms as regulatory intermediaries // Accounting History. 2020. Vol. 25, iss. 3. P. 349-374. DOI 10.1177/1032373219875219

- JoshiM, Yapa P. W. S., KraalD. IFRS adoption in ASEAN countries: Perceptions of professional accountants from Singapore, Malaysia and Indonesia // International Journal of Managerial Finance. 2016. Vol. 12, iss. 2. P. 211-240. DOI 10.1108/IJMF-04-2014-0040