Low-Carbon Development of the North of Western Siberia: Climate Projects Based on Natural Solutions

Автор: Boldyreva N.B., Reshetnikova L.G., Zherebyatyeva N.V., Devyatkov A.P., Ovechkin D.V.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 56, 2024 года.

Бесплатный доступ

Active anthropogenic activity is one of the main causes of serious environmental problems that hinder the development of the Arctic zone of Western Siberia — the most important resource potential of the country. The implementation of climate projects based on natural solutions is one of the areas of environmentally oriented economic growth. The formation and development of sequestration business is possible if there are conditions ensuring its economic efficiency. The article estimates the costs of absorbing of 1 ton of greenhouse gases during the implementation of climate projects in the northern taiga of Western Siberia. To achieve the goal, the predicted values of carbon sequestered from the atmosphere were calculated for different project scenarios. The CO2 effect was measured and the costs of carbon sequestration by tree and shrub communities of willow, alder and pine were analyzed. Alder monocultures showed the largest volumes of CO2 uptake and the lowest costs per carbon unit according to the carbon discounting model. CO2 duration analysis shows the sensitivity of the cost per carbon unit of a climate project based on alder monocultures to changes in the discount rate. The break-even price of a carbon unit is substantiated, which allows comparing it with the market price and drawing conclusions about the economic efficiency of the climate project on carbon sequestration. The study results provide practical recommendations for making decisions about investing in nature-based climate projects for low-carbon development in northern Western Siberia. The methodological approaches disclosed in the article can be used in other regions of Russia.

Greenhouse gases, north of Western Siberia, climate project, sustainable development, environmental protection

Короткий адрес: https://sciup.org/148329541

IDR: 148329541 | УДК: [336.5:504.7](571.1)(045) | DOI: 10.37482/issn2221-2698.2024.56.112

Текст научной статьи Low-Carbon Development of the North of Western Siberia: Climate Projects Based on Natural Solutions

DOI:

The socio-economic development of the Russian Federation is directly related to the exploration and development of the richest reserves of natural resources in the Arctic zone of the country. Active anthropogenic activity is one of the main causes of serious environmental problems that hinder the development of the region 1.

One of the features of the Arctic zone of Western Siberia is the coexistence of industrial development of natural resources and the traditional activities of the indigenous population of the Far North. Human industrial and economic activity causes serious damage to the northern nature, including polluting the atmosphere with greenhouse gas emissions, which affects the environment and the living conditions of the indigenous peoples of the Far North. Territories with anthropogenically altered landscapes require measures not only to preserve ecosystems, but also to restore their natural state, which involves a set of appropriate investment measures 2. The Federal scientific and technical program in the field of environmental development of the Russian Federation and climate change for 2021–2030 3 provides, among other things, for the development and testing of a methodology for scientifically based determination of effective technologies for greenhouse gas absorption. Under these conditions, the ecosystem of the north of Western Siberia is of great interest from the perspective of studying the efficiency of carbon sequestration activities for the purpose of sustainable economic development while reducing greenhouse gas emissions and protecting the environment.

Federal laws 4 have laid the foundation for the formation of a new sequestration business and a carbon unit market in Russia. The carbon sequestration business is based on a climate project (hereinafter referred to as a CP). According to the Federal Law “On limiting greenhouse gas emissions”, a climate project is “a set of measures to reduce (prevent) greenhouse gas emissions (hereinafter referred to as GHG) or to increase their absorption”. At the same time, CP should meet a set of criteria 5. One of the criteria is additionality. Taking this criterion into account allows defining a CP as a set of special, additional measures, the implementation of which leads to a reduction in emissions or an increase in GHG absorption as a result of changing the conditions of the baseline scenario. Russia has high potential for implementing climate projects in the field of nature-based solutions, including afforestation and reforestation [1]. The center of our attention is the CP on carbon sequestration by tree and shrub communities in the conditions of the northern taiga of Western Siberia.

Formation and development of the sequestration business is possible under conditions ensuring its economic efficiency. Foreign researchers showed active interest in the economics of carbon sequestration back in the late 20th century. Foreign authors have published many studies of the absorption capacity of various ecosystems, including Arctic ones. Thus, Fisher J. B. et al [2] note that Arctic territories (Arctic Alaska) are characterized by increased uncertainty of the carbon cycle. It is likely that this may complicate the economic assessment of carbon sequestration. A large number of foreign studies, including reviews, are devoted to the economics of forest management for carbon deposition [3, Richards K.R., Stokes C.; 4, Boyland M.; 5, Rubin E.S., Davison J.E., Herzog H.J.; 6, Baker E.D., Khatami S.N.; 7, Friedmann S.J., Zhiyuan F., Zachary B.; 8, Lehtveer M., Emanuelsson A.; 9 Mei B., Clutter M.L. et al.]. Some authors have studied the transaction costs of carbon sequestration projects [10, McCann L., Colby B., Easter K.W.; 11, Antinori C., Sathaye J.; 12, Ruseva T.B.].

In general, the assessment of the economic efficiency of carbon sequestration on nature solutions is based on classical approaches adopted in investment analysis. The application of these approaches requires taking into account the specifics of the nature-based climate project (the subject of the CP), which is carried out by the authors in different ways. A review of the literature on the economics of carbon sequestration on nature-based solutions showed ambiguous results. Comparability of research results is complicated by terminological uncertainty, geographical coverage, system of assumptions, level of detail of costs and benefits, etc. Studies have used different ecosystem components, different levels and forms of carbon output to estimate the flow of carbon sequestration.

Recently, there has been a growing interest in such studies in relation to Russian ecosystems [13, Morkovina S.S., Panyavina E.A., Zinovieva I.S.; 14, Nazarenko A.E., Krasnoyarova B.A.; 15, Kruk M.N., Korelskiy D.S.; 16, Korotkov V.N.; 17, Fomenko M.A., Loshadkin K.A., Klimov E.V. et al.].

However, the economic aspects of carbon sequestration by natural ecosystems of Russia have not been sufficiently studied.

The main issue in implementing the carbon sequestration CP is related to estimating the costs of deposition (sequestering and accumulating) of 1 t of CO 2 , which corresponds to the breakeven price of a carbon unit (hereinafter referred to as CU). The article estimates the costs of absorbing 1 t of CO 2 during the implementation of the CP in the conditions of the northern taiga — the southern boundary of the Arctic ecosystem of Western Siberia. We take as a basis the generally accepted approach to determining the costs of depositing 1 t of CO 2 as the ratio of the total costs of sequestration to the amount of deposited GHG. To achieve this goal, we address the following tasks:

-

• estimate the carbon deposited from the atmosphere by comparing project scenarios for different planting species — willow, alder and pine;

-

• determine the flow of costs for GHG deposition by tree and shrub communities in the conditions of the northern taiga;

-

• estimate the costs per CU and their sensitivity to changes in the discount rate.

Materials and methods

For assessment of carbon deposited from the atmosphere as a result of the implementation of the CP on the creation of tree and shrub plantations on dry sand quarries in the northern taiga of Western Siberia, the forecast data on the dynamics of the components of the carbon balance formed by tree and shrub plantations typical of the northern taiga and distinguished by the fastest growth — willow, alder and pine — were initially calculated.

According to studies on the structure of terrestrial phytomass of tundra and forest-tundra zones of Western Siberia, the largest reserve of phytomass is typical for alder shrub tundra — 5,583 g/m2. The height of shrubs can reach 2–2.5 m, the density of plantations does not contribute to the development of the ground cover. The second place in terms of distribution and phytomass reserves is occupied by willow formation — up to 4,635 g/m2 [18, Sorochinskaya D.A., Leonova N.B.]. Pine is estimated by researchers as the most productive species on sandy soils of the taiga zone. This allows distinguishing three CPs for one natural zone — the northern taiga of Western Siberia, but with different tree and shrub plantations. Published data on the course of growth and dynamics of biological productivity of forest stands of different ages [19, Shvidenko A.Z., Shchepashchenko D.G., Nelson S.] show that, on average, the productivity of these species begins to decline at different ages: willow — at 15–20 years, alder — at 20–25 years and pine — at 45-50 years, which should also affect the intensity of carbon absorption by plant phytomass. This determined the forecasting period of 20 years for willow, 25 years for alder, 50 years for pine from the conditional moment of planting of tree and shrub plantations.

In order to identify the most effective species composition in terms of sequestration potential using forecast models for calculating carbon absorption by tree and shrub plantations cre-

SOCIAL AND ECONOMIC DEVELOPMENT

Natalia B. Boldyreva, Ludmila G. Reshetnikova, Natalia V. Zherebyatyeva, Anton P. Devyatkov… ated as a result of project activities [20, Zamolodchikov D.G., Grabovskiy V.I., Kraev G.N.], data on carbon absorption (indicators of the ability of various plantations to absorb atmospheric carbon) were calculated with a step of one year for willow, alder and pine in the conditions of the northern taiga. All data were selected from tables for the sparse forests and sparse stands in Western Siberia, the northernmost ecoregion for which the tables are published 6. When selecting tables for entering data into the model, the prevailing bonitet of forest plantations, soil type and prevailing tree stand density in the area of the proposed CP for the creation of tree and shrub plantations were taken into account. When forecasting the carbon balance, soil respiration and GHG emissions during the operation of machines and equipment were also taken into account. The baseline was constructed on the basis of the ecosystem balance data of clean sands on sandy blowouts in the Nadym area in 2022 according to the archive materials of the Research Institute of Ecology and Rational Use of Natural Resources of Tyumen State University.

The Federal Law “On limiting greenhouse gas emissions” defines the CP result as an increase in GHG absorption. To assess the result, we calculate the carbon balance “with the project” ( c ^t ) and the carbon balance “without the project” (baseline) ( СВ0 ). The assessment of the CP for carbon sequestration by tree and shrub communities is made by comparing “with the project” and “without the project” situations.

We introduce the concept of “CO 2 effect”. The CO 2 effect for the t-th year achieved due to the implementation of the project (t/ha), ( Yt ) is calculated using the following formula:

Yt = - св0 (1)

Deposited CO 2 is converted into CU by the rule: 1 ton of CO 2 = 1 CU. Carbon units are formed under the condition of a positive value of the CO 2 effect, i.e. formally:

Yt = max( Yt ;0) (2)

Costs for the implementation of CP on the creation of forest plantations for carbon depositing depend on specific conditions [13, Morkovina S.S., Panyavina E.A., Zinovieva I.S.]: the period of exploitation, the main tree species, the technology of creation. From the perspective of the purpose of the study, the list of one-time cost items and current expenses for the implementation of the carbon plantation activities is of fundamental importance. One-time costs include the purchase of laboratory and testing equipment, activities on the plantation arrangement and forestry work to create a carbon plantation taking into account the species composition. Current expenses for the implementation of the carbon plantation activities include the cost of raw materials and supplies, wages, accruals for wages, costs of maintenance and operation of equipment. A distinctive feature of the considered CPs for the creation of tree and shrub plantations on dry sand quarries in the northern taiga of Western Siberia is the obligatory presence of costs for land reclamation (technical and biological), which are of a one-time nature. Transaction costs formed by interested parties are also associated with the CP [21, Boldyreva N.B., Reshetnikova L.G.].

The most common CU cost estimation models considered in the literature are the flow summation model and the carbon discounting model [22, Pearson T.R.H., Brown S., Sohngen B. et al.]. Both models involve dividing the discounted costs by the total number of CU. The fundamental difference between the models is related to the denominator. Flow summation is the simplest method for estimating the costs of CU. It divides the discounted costs by the total number of CU:

DC

CCS = (3)

V t= о Yt where CCS — the cost of CU using the flow summation method; DC — the discounted costs; Yt — the number of tons of CO2 absorbed in the t-th year; n — the planned period of CO2 sequestration.

The carbon discounting model divides the discounted costs by the present value of carbon units:

CC =

DC

DY

DC

V "

^ t~° (1+ r^

where CCd — the cost of CU using the carbon discounting method; DY — the discounted carbon;

r — the discount rate.

There are two arguments to justify the concept of carbon discounting:

-

1) current sequestered CO 2 is more valuable than prospected sequestered CO 2 . If the value of current and prospective sequestered carbon is the same, it is economically feasible to postpone the action for an indefinite period in order to avoid the costs of implementing the CP;

-

2) from a business point of view, it is not the sequestered carbon itself that is valuable, but the possibility of monetizing it through the transformation of deposited CO 2 into CU. If CO 2 is sold in the form of CU as it is absorbed, then it is included in the calculations in the monetary equivalent.

In general, the assessment of the present value of the costs of CU under different CPs allows comparing them with each other and choosing the most economical option. For economic analysis, tons of absorbed CO 2 (carbon units) are discounted in the same way as cash payments. We consider the same discount rates for both costs and carbon. The assessment of the costs of CU for a specific CP using model (3) will always give a lower result than the assessment using model (4), all other things being equal. The difference in the assessment results depends on the discount rate. At a zero value of the discount rate, the carbon discount model is transformed into a flow summation model. There are various approaches to substantiating the discount rate: based on alternative costs, investment approach, cost of capital, social, etc. In the investment approach, the discount rate is the rate of return on investment required by the investor [23, Arrow K., Cropper M., Gollier C. et al.; 24, Kamnev I.M.].

A distinctive feature of the CP is a long life cycle. Therefore, we assume that in models (3) and (4), the costs will grow annually with a constant growth rate. Discounting of annual costs is performed at a nominal rate (including the inflation premium):

£l(1±222.

D^ = Lt= о (1+r)t , (5)

where c^ — the cost of CP implementation in the t-th year; τ — the annual growth rate of costs.

To model the impact of the discount rate on CU costs, we use duration, which is the average term of the present cash flow [25, Macaulay F.R.]. This is the period of time until the full return of investments, as well as a measure of interest rate risk. In the context of the research objective, we use the term “CO 2 duration”, which is the average period of time to achieve the breakeven price of the CU, and it allows us to assess the degree of dependence of the costs of the CU on the change in the discount rate. The longer the duration, the greater the changes in the CU costs with a change in the interest rate, i.e. the higher the interest rate risk. In general, CO 2 duration characterizes:

-

• sensitivity of CU costs to changes in the discount rate;

-

• risks associated with carbon sequestration. The shorter the CO 2 duration, the faster the breakeven price of the CU is achieved, and the lower the risk of not receiving income from the CP.

To model the impact of the discount rate on the CU costs calculated using models (3) and (4), the modified CO 2 duration for models (3) and (4) were found:

d CC d

⁄CC d _ a In CCd ___1 _ уn __£∙ Ct +2_ уn __^∙ Yt dr dr =- ∑ (1+r)t+i + ∑ (1+r) (6)

d CCs

⁄CC s _ d In CC s __1 _y n ∙ Cl

dr = =- DC ∑ t=0 (1+r)t+i

We also model the effect of the discount rate on the ratio (λ) of CU costs according to model (3) to the CU costs according to model (4):

Л CC d

=CC =

∑ t=OYt

Yt

∑? „-----г

∑ (1+r) t

CCd dA ⁄ = CCs _ d In CC 1

dr dr dr

-

d In CCs 1_yn ∙ Yt__ dr = ∑ t=0 (1+r)t+i

In general, formulas (6) and (7) show the sensitivity of the CU costs to a 1% change in the discount rate using models (3) and (4), respectively. Formula (9) allows estimating how much the CU costs will change according to model (4) compared to the model (3) when the discount rate changes by 1%.

Research results

The CPs in the conditions of the northern taiga of Western Siberia were modelled. Three project scenarios are considered:

-

1. CP of CO 2 absorption by willow monocultures;

-

2. CP of CO 2 absorption by alder monocultures;

-

3. CP of CO 2 absorption by pine monocultures.

In all scenarios, the level of CO 2 absorption is estimated excluding GHG emissions from used machines and mechanisms, as well as carbon emission by soil. Estimates are calculated for different periods depending on the species of plantations — 20 years for willow, 25 years for alder, 50 years for pine. The discount rate is 15% — the rate of return required by the investor. Secondary benefits are not taken into account.

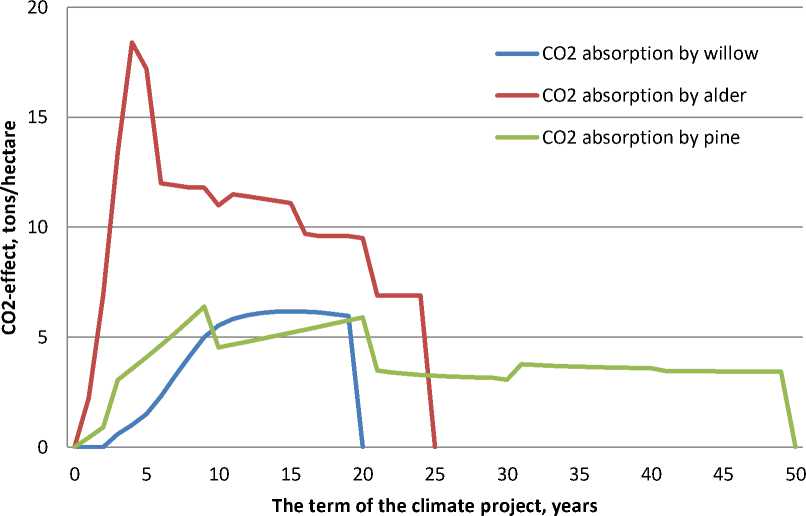

The CO 2 effect for various project scenarios is shown in Fig. 1.

Fig. 1. CO2 effect for different CP scenarios for the creation of a tree and shrub plantation in the northern taiga 7.

Figure 1 shows that the CO 2 effects in the northern taiga are various for different plantations. The largest absorption volumes are demonstrated by alder monocultures.

Only upcoming costs are taken into account for the CP assessment. Based on the CP features and the long term of its implementation, it is important to divide the costs into one-time and current. One-time costs for the implementation of the CP at the beginning of its life cycle include costs for technical land reclamation and biological reclamation. For technical land reclamation, costs are provided for machines and mechanisms, as well as labor costs for slope and bed planning and for mechanized area planning. For biological reclamation, costs are envisaged for disking virgin and fallow lands on light and medium soils, soil cultivation with simultaneous harrowing, mechanized loading and spreading of organic and mineral fertilizers, planting of the corresponding crops (alder, willow, pine), sowing of perennial grasses and rolling of crops. Material costs include the purchase of organic and mineral fertilizers, planting material of relevant crops and lawn grass seed mixes, as well as their delivery costs.

Current annual costs of plantation maintenance (monitoring), including CO 2 measurements, replanting of seedlings in case of excessive thinning and reseeding of perennial grasses, are incurred during the first 15 years of the life cycle of the CP. We assume that current costs grow at a constant growth rate of 4% per year (the Bank of Russia inflation target). Transaction costs and taxes are not taken into account. We forecast the costs associated with the implementation of the CP using expert estimates in this field (Table 1).

Table 1 Costs of implementing the CP for creating a tree and shrub plantation in the northern taiga under different project scenarios, thousand rubles/ha

|

Year |

Willow |

Alder |

Pine |

|||

|

One-time costs |

Current costs |

One-time costs |

Current costs |

One-time costs |

Current costs |

|

|

0 |

233 282 |

- |

233 282 |

- |

155 345 |

- |

|

1 |

- |

6 398 |

- |

6 398 |

- |

7 094 |

|

2 |

- |

6 654 |

- |

6 654 |

- |

7 378 |

|

3 |

- |

6 920 |

- |

6 920 |

- |

7 673 |

|

4 |

- |

7 197 |

- |

7 197 |

- |

7 980 |

|

5 |

- |

7 485 |

- |

7 485 |

- |

8 299 |

|

6 |

- |

7 784 |

- |

7 784 |

- |

8 631 |

|

7 |

- |

8 096 |

- |

8 096 |

- |

8 976 |

|

8 |

- |

8 419 |

- |

8 419 |

- |

9 335 |

|

9 |

- |

8 756 |

- |

8 756 |

- |

9 708 |

|

10 |

- |

9 106 |

- |

9 106 |

- |

10 097 |

|

11 |

- |

9 471 |

- |

9 471 |

- |

10 501 |

|

12 |

- |

9 850 |

- |

9 850 |

- |

10 921 |

|

13 |

- |

10 244 |

- |

10 244 |

- |

11 357 |

|

14 |

- |

10 653 |

- |

10 653 |

- |

11 812 |

|

15 |

- |

11 079 |

- |

11 079 |

- |

12 284 |

The costs of implementing the CP depend on the project scenario. When implementing the CP for CO 2 absorption by pine monocultures, the one-time costs are one third less, while the current costs are 10% more compared to the CP for CO 2 absorption by alder or willow monocultures. The one-time and current costs of implementing the CP for CO 2 absorption by alder and willow monocultures are at the same level.

The results of the cost estimate for the CU at a discount rate of 15% p.a. are presented in Table 2.

-

Table 2

Costs for the CU during the implementation of the CP for creating tree and shrub plantations in the northern taiga

|

Cost estimation model |

Present value of all costs, thous. rub./ha |

Amount of CU |

Discounted amount of CU |

Costs of CU, thous. rub. |

|

Willow monocultures |

||||

|

Flow summation model (3) |

278.573 |

77.90 |

- |

3.576 |

|

Carbon discounting model (4) |

278.573 |

- |

15.21 |

18.315 |

|

Alder monocultures |

||||

|

Flow summation model (3) |

278.573 |

248.76 |

- |

1.120 |

|

Carbon discounting |

278.573 |

- |

69.21 |

4.025 |

|

model (4) |

||||

|

Pine monocultures |

||||

|

Flow summation model (3) |

205.561 |

193.95 |

- |

1.060 |

|

Carbon discounting model (4) |

205.561 |

- |

23.64 |

8.695 |

Table 2 shows that the costs of CU according to the carbon discounting model (4) exceed the costs of CU according to the flow summation model (3) by 3.6-8.2 times, depending on the crop. The lowest costs of CU according to the flow summation model are obtained when implementing the CP of CO 2 absorption by pine monocultures — 1,060 thousand rubles. The costs of CU when implementing the CP of CO 2 absorption by alder monocultures slightly exceed this indicator (by 60 rubles). At the same time, alder monocultures show the lowest costs of CU according to the carbon discounting model — 4,025 thousand rubles. The costs of CU when absorbing CO 2 by pine monocultures according to the carbon discounting model are 2.2 times higher than the costs for alder monocultures. The highest costs of CU are obtained when implementing the CP of CO 2 absorption by willow monocultures — 3,576 and 18,315 thousand rubles, depending on the cost assessment model.

The impact of increasing the discount rate from 15% to 16% on the costs of CU calculated using the models considered is shown in Table 3.

-

Table 3 Change in costs of CU when the discount rate increases by 1% using different assessment models, thousand rubles

|

Cost estimation model |

Willow monocultures |

Alder monocultures |

Pine monocultures |

|

Flow summation model |

-0.875 |

-1.999 |

-1.315 |

|

Carbon discounting model |

+8.256 |

+7.305 |

+6.931 |

Table 3 shows that alder monocultures have the highest sensitivity of CU costs calculated using the flow summation model to changes in the discount rate, while willow monocultures have the lowest sensitivity. Willow monocultures have the highest sensitivity of CU costs calculated by the carbon discounting model to changes in the discount rate, and pine monocultures — the lowest one. The CP based on alder monocultures occupies an intermediate position in terms of the sensitivity of the costs of CU calculated using the carbon discounting model to changes in the discount rate in comparison with the CP with alternative monocultures.

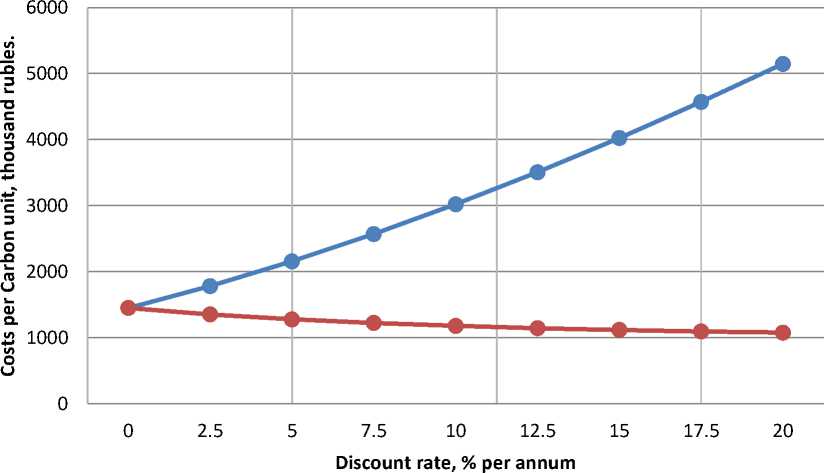

Figure 2 shows the effect of the discount rate on the costs of CU calculated using the considered models for alder monocultures.

—•-Carbon discounting model —•-Flow summation model

Fig. 2. Effect of the discount rate on the costs of CU for alder monocultures using the carbon discounting and flow summation models, thousand rubles 8.

Figure 2 shows that with an increase in the discount rate, the costs of CU increase according to the carbon discounting model, and decrease according to the flow summation model. In other words, an increase in the rate of return on investment required by the investor leads to a decrease in the costs of CU according to the flow summation model, which is economically meaningless.

Conclusion

Territories with anthropogenically altered landscapes require measures not only to preserve ecosystems, but also to restore their natural state, which implies appropriate investment activities. Such activities are associated with the implementation of climate projects. An important stage of climate project implementation is the assessment of its economic efficiency. The main issue in the implementation of the CP on carbon sequestration is related to the estimation of costs of depositing 1 t of CO 2 , which corresponds to the break-even price of a carbon unit. The article estimates the costs of absorption of 1 t of CO 2 when implementing the CP in the conditions of the northern taiga of Western Siberia. The amount of costs per unit is influenced by various factors. The primary basis is associated with the dynamics of carbon sequestration (implementation of the carbon-depositing function by forest ecosystems of the northern taiga). As a result of the study, it was found that in the conditions of the northern taiga of Western Siberia, alder monocultures show the best results in CO 2 absorption.

The choice of the model for estimating CU costs also affects the results of calculations, which, all other things being equal, depend on the discount rate adopted. The carbon discounting model increases the cost of the project. In our opinion, given the long term of the CP implementation, this model reflects the real state of affairs more adequately. The costs of CU according to the carbon discounting model for alder monocultures amounted to 4,025 thousand rubles, which is more than 2-4 times less than the same indicator for alternative monocultures. This result shows the break-even price of CU, allows comparing it with the market price of CU and drawing conclusions about the economic efficiency of the climate project for the creation of tree and shrub plantations. The sensitivity analysis of CU costs to changes in the discount rate on the basis of CO2 duration shows the sensitivity of the economic efficiency of the CP based on alder monocultures to interest rate risk. The CP based on alder monocultures occupies an intermediate position in terms of the CU costs sensitivity calculated using the carbon discounting model to a change in the discount rate in comparison with alternative CPs.

The results of the study provide practical recommendations for making decisions on investing in nature-based climate projects for the purpose of low-carbon development of the north of Western Siberia. The methodological approaches disclosed in the article can be used in other regions of Russia.

Список литературы Low-Carbon Development of the North of Western Siberia: Climate Projects Based on Natural Solutions

- Ivanov A.Yu., Durmanov N.D. Bitva za klimat: karbonovoe zemledelie kak stavka Rossii: ekspertnyy doklad [The Battle for Climate: Carbon Farming as Russia's Stake: Expert Report]. Moscow, HSE Uni-versity Publ., UTMN Publ., 2021, 120 p. (In Russ.)

- Fisher J.B., Sikka M., Oechel W.C., et al. Carbon Cycle Uncertainty in the Alaskan Arctic. Biogeosci-ences, 2014, vol. 11 (15), pp. 4271–4288. DOI: https://doi.org/10.5194/bg-11-4271-2014

- Richards K.R., Stokes C. A Review of Forest Carbon Sequestration Cost Studies: A Dozen Years of Re-search. Climatic Change, 2004, vol. 63 (1), pp. 1–48. DOI: https://doi.org/10.1023/B:CLIM.0000018503.10080.89

- Boyland M. The Economics of Using Forests to Increase Carbon Storage. Canadian Journal of Forest Research, 2006, vol. 36 (9), pp. 2223–2234. DOI: https://doi.org/10.1139/x06-094

- Rubin E.S., Davison J.E., Herzog H.J. The Cost of CO2 Capture and Storage. International Journal of Greenhouse Gas Control, 2015, vol. 40, pp. 378–400. DOI: https://doi.org/10.1016/j.ijggc.2015.05.018

- Baker E.D., Khatami S.N. The Levelized Cost of Carbon: A Practical, if Imperfect, Method to Compare CO2 Abatement Projects. Climate Policy, 2019, vol. 19 (9), pp. 1132–1143. DOI: https://doi.org/10.1080/14693062.2019.1634508

- Friedmann S.J., Fan Z.., Byrum Z., Ochu E., Bhardwaj A., Sheerazi H. Levelized Cost of Carbon Abate-ment: An Improved Cost-Assessment Methodology for a Net-Zero Emissions World. New York, Co-lumbia University CGEP, 2020, 98 p.

- Lehtveer M., Emanuelsson A. BECCS and DACCS as Negative Emission Providers in an Intermittent Electricity System: Why Levelized Cost of Carbon May be a Misleading Measure for Policy Decisions. Frontiers in Climate, 2021, vol. 3, pp. 647276. DOI: https://doi.org/10.3389/fclim.2021.647276

- Mei B., Clutter M.L. Benefit-Cost Analysis of Forest Carbon for Landowners: An Illustration Based on a Southern Pine Plantation. Frontiers in Forests and Global Change, 2022, vol. 5, pp. 931504. DOI: https://doi.org/10.3389/ffgc.2022.931504

- McCann L., Colby B., Easter K.W., Kasterine A., Kuperan K. Transaction Cost Measurement for Evalu-ating Environmental Policies. Ecological Economics, 2005, vol. 52, pp. 527–542. DOI: https://doi.org/10.1016/j.ecolecon.2004.08.002

- Antinori C., Sathaye J. Assessing Transaction Costs of Project-Based Greenhouse Gas Emissions Trad-ing. Ernest Orglando Lawrence Berkeley National Laboratory, 2007, 134 p.

- Ruseva T.B. The Governance of Forest Carbon in a Subnational Climate Mitigation System: Insights from a Network of Action Situations Approach. Sustainability Science, 2023, vol. 18 (1), pp. 59–78. DOI: https://doi.org/10.1007/s11625-022-01262-4

- Morkovina S.S., Panyavina E.A., Zinovyeva I.S. Management of the Implementation of Forest-Climate Projects in the Russian Federation: Prospects and Risks. Natural-Humanitarian Studies, 2022, no. 40 (2), pp. 198–203.

- Nazarenko A.E., Krasnoyarova B.A. Cost Evaluation of Ecosystem Services for Carbon Sequestration by Altai Krai Ecosystems as a Component of Transition to Sustainable Development. Geopolitics and Ecogeodynamics of Regions, 2018, no. 4 (14), iss. 3, pp. 89–99.

- Kruk M.N., Korelskiy D.S. Criteria for the Evaluation and Selection of Environmental Sequestration Projects. Russian Economic Online Journal, 2019, no. 4, 83 p.

- Korotkov V.N. Forest Climate Projects in Russia: Limitations and Opportunities. Russian Journal of Ecosystem Ecology, 2022, no. 7 (4), pp. 1–7. DOI: https://doi.org/10.21685/2500-0578-2022-4-3

- Fomenko M.A., Loshadkin K.A., Klimov E.V. et al. Forest Carbon Projects: Opportunities and Prob-lems of Implementing the ESG Principles. Part 1. Regional Environmental Issues, 2022, no. 2, pp. 91–106. DOI: https://doi.org/10.24412/1728-323X-2022-2-91-106

- Sorochinskaya D.A., Leonova N.B. Structure and Distribution of Above-Ground Phytomass of the Tundra Communities of Western Siberia. Ecology: Ecosystems and Dynamics, 2020, vol. 4, no. 3, pp. 5–33. DOI: https://doi.org/10.24411/2542-2006-2020-10063

- Shvidenko A.Z., Shchepashchenko D.G., Nel'son S., Buluys Yu.I. Tablitsy i modeli khoda rosta i produktivnosti nasazhdeniy osnovnykh lesoobrazuyushchikh porod Severnoy Evrazii. Normativno-spravochnye materialy: monografiya [Tables and Models of Growth and Productivity of Forests of Major Forest Forming Species of Northern Eurasia. Reference Materials]. Moscow, 2008, 883 p. (In Russ.)

- Zamolodchikov D.G., Grabovskiy V.I., Kraev G.N. Regional'naya otsenka byudzheta ugleroda lesov (ROBUL). Versiya 1.1 [Regional Forest Carbon Budget Assessment (RFCA). Version 1.1.]. Moscow, CEPL RAS Publ., 2011. (In Russ.)

- Boldyreva N.B., Reshetnikova L.G. Klimaticheskiy proekt po sekvestratsii ugleroda: zainteresovannye storony i riski. Rol' upravleniya riskami i strakhovaniya v obespechenii ustoychivosti obshchestva i ekonomiki [The Carbon Sequestration Climate Project: Stakeholders and Risks. The Role of Risk Management and Insurance in Ensuring the Sustainability of Society and the Economy]. In: Sbornik trudov XXIV Mezhdunarodnoy nauchno-prakticheskoy konferentsii (g. Moskva, 1 iyunya 2023 g.) [Proceedings of the 24th International Scientific and Practical Conference]. Moscow, Izdatel'stvo Moskovskogo universiteta Publ., 2023, pp. 158–163. (In Russ.)

- Pearson T.R.H., Brown S., Sohngen B., et al. Transaction Costs for Carbon Sequestration Projects in the Tropical Forest Sector. Mitigation and Adaptation Strategies for Global Change, 2013, vol. 19, pp. 1209–1222. DOI: https://doi.org/10.1007/s11027-013-9469-8

- Arrow K., Cropper M., Gollier C., et al. Determining Benefits and Costs for Future Generations. Sci-ence, 2013, vol. 341 (6144), pp. 349–350. DOI: https://doi.org/10.1126/science.1235665

- Kamnev I.M. Conceptual Approaches to Justification of a Rate of Discounting. Financial Analytics: Science and Experience, 2012, no. 20, pp. 8–16.

- Macaulay F.R. Some Theoretical Problems Suggested by the Movements of Interest Rates, Bond Yields and Stock Prices in the United States since 1856. New York, National Bureau of Economic Re-search, 1938, 591 p.