Macroeconomic determinants of competitive pressure on the credit market in Russia: an empirical study

Автор: Inalkaeva F.U.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 5-1 (51), 2019 года.

Бесплатный доступ

This article aims to conduct an econometric assessment of the impact of individual macroeconomic variables on the dynamics of the index of herd behavior of commercial banks on the example of Russia. Based on the analysis of the data on the loan portfolio of commercial banks, the number of registered credit institutions in the Russian Federation, the number of Bank credit institutions with foreign participation in the capital, the dynamics of the refinancing rate and the key rate of the Bank of Russia, as well as the weighted average exchange rate of the ruble to the us dollar for the period from the first quarter of 2009 to the fourth quarter of 2018, using the autoregressive model with distributed lags (ARDL), we established, that the elasticity of the loan portfolios of the sample banks is in co-integration with the explanatory variables.

Competition, bank, lending, regression analysis, determinant

Короткий адрес: https://sciup.org/170181679

IDR: 170181679 | DOI: 10.24411/2411-0450-2019-10705

Текст научной статьи Macroeconomic determinants of competitive pressure on the credit market in Russia: an empirical study

To test the hypothesis of the relationship between the degree of competitive pressure on the credit market, we use the index of herd behavior of commercial banks. We use a common credit channel to assess the index of herd behavior of commercial banks in the sample (Top 10 commercial banks in Russia in terms of the loan portfolio). [1] the following formula is used To build the herd behavior index:

Chb = ^(^ (1) n-1 v n is the sample size, x –monthly, annual growth rates of loans issued to borrowers of a commercial Bank; the share of overdue debt in relation to the loan portfolio for the period t, x – the arithmetic mean value of return on capital (assets); monthly, the annual growth rate of loans to borrowers of a commercial Bank; the specific weight of the overdue debt in relation to the loan portfolio of all commercial banks in the sample over the period t [1].

Then, the value of the variance of our chosen quantities for quantification is a criterion for determining the degree of "herd" behavior, reflecting the spread or concentration of values [1].

To assess the impact of sample variables on the resulting values of the index of herd behavior of sample banks, we transform the linear specification of the model into a log-linear specification. The log-linear specification provides more suitable and efficient results compared to the simple linear functional form of the model. [2] Moreover, the logarithmic form of the variables gives direct elasticities for the interpretations. Thus, we determine the computational equation in log-linear form:

L ht = ft + (in t L n t + (LftL ft + (3kt L k t 2 + p usdt Lusd t + ц t (2)

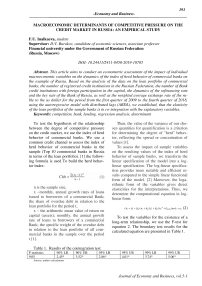

To test the variables for the existence of a long-term relationship, we use the F-test for equation 2. The boundary test results for the calculated equation are presented in Table 1.

Table 1. Results of the cointegration test

|

F-statistics |

90% LB |

90% UB |

95% LB |

95% UB |

99% LB |

99% UB |

|

9.05 |

2.45* |

3.52* |

2.86* |

4.01* |

3.74* |

5.06* |

Source: author calculations

The evaluation equation includes both dependent and independent variables. The results of the F-cointegration test show that the resulting F-statistics are above the upper limit and statistically significant at the significance level of 10%, 5% and 1%.

Given that the sample variables are cointegrated in the long term, we can move on to the next stage, which requires the evalua- tion of long-term and short-term coefficients. Given that the ADL model has been evaluated in logarithmic form, we can estimate how the shock in 1% of the explanatory variables affects the resulting variable in both the long and short term.

The results of the evaluation of the immediate effects of variable sampling on an index of herd behavior are presented in table 2.

Table 2. ARDL short-run estimates

|

Regressor |

Coefficient |

t -statistics (p-value) |

|

∆ ln n |

3.4534 |

0.2064 (0.838) |

|

∆ ln n (-1) |

-4.6390 |

-0.2548 (0.800) |

|

∆ ln f |

-23.723 |

-16.6588* (0.031) |

|

∆ ln k |

59.489 |

28.0062* (0.000) |

|

∆ ln usd |

1.295 |

1.3455 (0.189) |

|

ECMt_1 |

-0.179 |

-25.726* (0.000) |

|

Diagnostic tests results |

||

|

R2 |

0.784 |

|

|

DW-statistics |

1.92 |

|

|

F-statisics |

3.69 |

|

|

RSS |

0.01 |

|

The results of the construction of an autoregressive model with distributed lags show that there is a long-term and short-term relationship between the resulting and control variables of the sample. This suggests that the herd behavior of commercial banks in Russia is associated with a change in the number of registered and operating credit institutions in the Russian Federation, with a change in the number of Bank credit institutions with for- eign participation in the capital, with a change in the interest policy of the Central Bank of the Russian Federation, as well as with a change in the exchange rate of the national currency. As can be seen from the data in table 2, the model is statistically significant, stable and stable.

Table 2 also shows that there is a shortterm relationship between the resulting and control sample variables. The meaning of the term error correction is negative and statistically significant. The probability value p is equal to zero, which allows to reject the null hypothesis about the absence of a statistically significant relationship between the variables [3]. The imbalance in the relationship between variables is eliminated every quarter by almost 18% in the short term. Changes in the interest rate policy of the Central Bank, measured by the refinancing rate and the key rate of the Bank of Russia, have a statistically significant impact on changes in the level of herd behavior of a commercial Bank in Rus- sia. For example, a positive shock of the key rate by 1% leads to an increase in the level of dispersion in the loan portfolio of the Top 10 commercial banks in Russia by almost 60%. This result suggests that the reaction of commercial banks to changes in the interest rate policy of the Central Bank is heterogeneous [4]. In other words, the reaction of commercial banks ' credit policy to the increase in the key rate is multidirectional for banks with state participation in capital on the one hand and private commercial banks on the other.

Список литературы Macroeconomic determinants of competitive pressure on the credit market in Russia: an empirical study

- Burakov, D. V., 2014. Credit risk and herd behavior: relationships and identification methods. Risk management, 1(69), pp. 58-61.

- Cameron, S. (1994). "A review of the econometric evidence on the effects of capital punishment". Journal of Socio-Economics, 23, p. 197-214.

- Goetz, Martin R., 2018. "Competition and bank stability", Journal of Financial Intermediation, Elsevier, vol. 35(PA), p. 57-69.

- Jimenez, G., Lopez, J.A., Saurina, J., 2013. How does competition impact bank risk- taking? J. Financ. Stab. 9 (2), p. 185-196