Mediation as an amicable means within the investor-state dispute settlement clause: a basic survey of Russian bilateral investment treaties

Автор: Abadikhah M., Nigmatullin R.V.

Журнал: Правовое государство: теория и практика @pravgos

Рубрика: Международно-правовые науки

Статья в выпуске: 1 (75), 2024 года.

Бесплатный доступ

In the last decade, many endeavors have been done to reform the Investor-State Dispute Settlement (ISDS) clause by International organizations such as ICSID, OECD, UNCITRAL and UNCTAD. In the case of reform, one of the discussed topics is the mediation of Investment disputes. Paying attention to mediation in international investment law has caused Bilateral Investment Treaties (BITs), including national model treaties and international ones, specifically consider mediation.

Mediation, investment arbitration, russian bilateral investment treaties, amicable means, dispute settlement

Короткий адрес: https://sciup.org/142240171

IDR: 142240171 | УДК: 341 | DOI: 10.33184/pravgos-2024.1.25

Текст научной статьи Mediation as an amicable means within the investor-state dispute settlement clause: a basic survey of Russian bilateral investment treaties

Mediation of disputes is not a new content, but investment mediation as a growing approach in present international investment law is a new one. As in line with the ongoing reforms of the Investor-state dispute settlement (ISDS) clause, mediation has also received the attention of relevant and responsible institutions such as International center for settlement of investment dispute (ICSID)1, United Nation commission on International Trade Law (UNCITRAL)2, the United Nations Conference on Trade and Development (UNCTAD)3 and General Assembly of United nation directly4. The ISDS is one of the protective clauses stipulated in the Bilateral Investment Treaties (BITs), whose reformation means the reform of the BIT in general. Therefore, BITs have also directly and officially paid attention to mediation as one of the peaceful means of settling investment disputes in line with the new reforms.

According to UNCTAD's latest statistics, 2828 Bilateral Investment Treaties (BITs)5 have been concluded so far6. One of the procedural clauses for the investor protection under BITs is the ISDS7. The first investment agreements only contained the state-state dispute settlement (SSDS) clause8. The first ever BIT was concluded between Germany and Pakistan on 25 November 1959; The BIT includes the SSDS clause but doesn’t contain the ISDS clause9. In accordance with the BIT, “ 1) In the event of disputes as to the interpretation or application of the present Treaty, the Parties shall enter into consultation for the purpose of finding a solution in a spirit of friendship. 2) If no such solution is forthcoming, the dispute shall be submitted (a) to the International Court of Justice (ICJ) if both Parties so agree or (b) if they do not so agree to an arbitration tribunal upon the request of either Party”10. As it is obvious, This article is about the dispute settlement solution between the investment host state and the investor's origin state; But gradually, the growing disputes between the investor and the host state caused ISDS clause to be contained in BITs. Exactly ten years later, in 1969, The Chad-Italy BIT as the first one addressed the ISDS clause11 and not until 1990 that a tribunal asserted its jurisdiction under such a clause12.

According to the BIT, “ Disputes between one of the Contracting Parties and an investor of the State of the other Contracting Party arising in connection with the investments of the investor in the territory of the State of the other Contracting Party, shall be settled, as far as possible, amicably through negotiations. When the dispute cannot be settled amicably through negotiations the dispute may be submitted at the choice of the investor for consideration: a) to a competent court of the host State, or b) to an ad hoc arbitration court in accordance with the arbitration rules of UNCITRAL, or c) to the ICSID”13.

As it is clear, this clause can be divided into two parts: In the first step, settling the disputes by peaceful means and in the second step, if peaceful means are not useful, referring to judicial courts and arbitration is considered. One of the means of peaceful settlement is mediation, but at first it was not considered officially and explicitly in the BITs. However, the growing investment disputes14 as well as the time-consuming and costly nature of judicial proceedings and other arbitration problems [1] has caused attention to be paid to mediation. Hence, we can consider various groups of investment treaties on considering the mediation; Some BITs only refer to peaceful settlement and do not mention specific means of settlement. In some other BITs, the specific means of amicable settlement have been mentioned such as negotiation, conciliation and mediation. Some BITs have considered mediation as an independent means at each stage of investment dispute.

Although these languages have received some attention from the arbitration procedure15, special attention to the approach of states regarding mediation in their BITs, as a new tendency, has received less attention from the law academic community. Therefore, in line with the basic question of this article, namely: What language has been adopted by Russian BITs regarding investment mediation? This manuscript examines the BITs with a quantitative and qualitative methods. Quantitatively, all the BITs of Russia are explored in detail. Thus, the present study examines 82 BITs based on the last statistic of UNCTAD16. In line with the qualitative method, one of the important methods of data collection is textual analysis [2, p. 291]. Thus, the current study shows what are the languages within the current BITs by analyzing each one. In this regard, there are three hypotheses. First, Russia has adopted a friendly language within the BITs, and in most of the treaties, it wants the parties to settle their disputes amicably in the first step. Second, Russia does not have any requirement to use mediation in its treaties, whether the national model treaty or international one. Third, according to some Russian BITs, the parties can recourse to the domestic mediation law of Russia and settle the dispute.

Bade on the basic question and three hypotheses, the current study contains five parts; Part one examines the mediation as the amicable means of investment dispute settlement. The part divides the BITs in two categories: first, the BITs which consider the mediation as prerequisite for investment arbitration. Second, The BITS that pay attention to mediation as a stand-alone. In the second part, the article examines the Russian model BIT regarding investment mediation. In fact, the model BIT is one of the most important national laws in line with investment protection means, which can indicate the approach of states in the future. In the third part, all 82 Russian BITs are analyzed. In this section, it is quite clear that Russia has chosen a friendly language in settling disputes. In the fourth part, the manuscript refers to Russian domestic mediation considering BITs. Finally, the conclusion.

-

1. Mediation as the peaceful means of investment dispute settlement

-

2. Russian Model BIT and mediation

Before analyzing the Russian model BIT in relation to mediation, it is necessary to examine the concept of the model BIT as well as its impact on other future BITs. A model BIT is a type of default domestic law enacted by the parliament of each state to create a detailed framework for international investment agreements of the same state. In fact, this model is a guide for the negotiators of the state and it shows that in the investment negotiations to conclude a new international agreement, the approved model is the same framework that the government intends and therefore the negotiations should also be in accordance with the articles of that model. The importance of the role and impact of this model in concluding new treaties has caused states and international organizations such as the European Union (EU) to constantly modify their models or adopt a new one. As the new EU Model Clauses for BITs was adopted on 21 October2023.27 Of course, it should be noted that the existence of a model treaty does not mean that states must always act exactly according to the default model. Rather, the model is a guide and it should be like this. However, according to the conditions in the negotiation, the negotiators may not act exactly based on the model BIT. Regardless of the special conditions, in most cases, after the approval of the model agree-

- Table 2

Mediation is a consensual process in which parties negotiate their dispute directly with one another, with the help of a third party which is called mediator. The mediator’s role is to assist the disputing parties with their negotiations. Therefore, mediation is often called ‘facilitated negotiation’ or ‘facilitated dialogue’17. The third party can be a single state or a group of states, an individual, an organ of a universal or regional international organization, or a joint body18. Hence, investment Mediation is a mediation that relates to an investment and involves a State, State entity or Regional Economic Integration Organization (REIO)19.

Investment mediation has received much attention in the last decade and investment agreements have adopted different languages to refer to mediation. This article considers the attention of agreements to mediation in line with two main groups. In the table below, the sublanguages in two main groups will be analyzed.

Table 1

The main groups and languages of BITs on investment mediation (source: investigation of author)20

|

The main groups |

The sublanguages |

The instances (BITs and Articles) |

|

1. Pre-requisite means |

1. Amicable settlement in general |

ISDS Clause with an amicable settlement period. According to the Russia-Germany BIT, “disputes relating to investments between one Contracting Party and an investor of the other Contracting Party shall be settled amicably between the parties to the dispute”21; |

|

2. Permission of using special means (without time limit) |

ISDS Clause that expressly permit mediation or other specified amicable dispute settlement means prior to arbitration. In this regard, the BIT basically refers to the presence of a third-party for settlement. According to the article 24 of the Japan-Angola BIT (2023), “ in the event of an investment dispute between the contracting parties, they should initially seek to resolve the dispute through consultation and negotiation, which may include the use of non-binding, third-party procedure.”22 |

|

|

3. The “cooling off” period |

ISDS Clause affirmatively encouraging the use of mediation or other amicable dispute settlement means in the “cooling off” period 23. Based on the Russia- Zimbabwe BIT, “the dispute shall be settled if possible by way of negotiations or consultations during a period of six months” 24. |

|

|

4. Obligatory special means |

ISDS Clause mandating mediation or other amicable dispute settlement means prior to arbitration. In accordance with the article 14 of UAE-Costa-Rica BIT, “in the event that an investment dispute cannot be resolved through consultations and negotiations, within three months after the respondent receives notification of the dispute, it must submit to a third-party procedure such as conciliation or mediation before an authorized center of the Party complained against in the dispute” 25 . |

|

|

2. Stand-alone means |

5. Independent means |

ISDS Clause permitting stand-alone mediation; namely using mediation at any point in time. In accordance with the article 17 of Netherlands Model investment agreement, “Any dispute should, as far as possible, be settled amicably through negotiations, conciliation or mediation. Such settlement may be agreed at any time, including after proceedings under this Section have been commenced. A disputing party shall give favorable consideration to a request for negotiations, conciliation or mediation by the other disputing party” 26 . |

20 For more information on investment agreements see, UNCTAD, investment policy hub, most recent investment agreement, December 2023 [Electronic resource]. URL: (accessed: 17.01.2024).

The language of the Russian Model BIT on investment mediation (source: investigation of author)

ment, the states act in accordance with it; As Russia has approved its model BIT in 2016, two months after the approval, the BIT between Russia and Palestine was concluded, and this agreement is exactly based on the Russian model BIT in terms of the substantive and procedural rules28.

According to the chapter 5 of paragraph 39 of the Russian Model BIT, “The Agreement shall provide that the investor of one Party to the Agreement and the other Party to the Agreement shall seek to settle the disputes arising between them in relation to the investments of such investor in the territory of such other Party to the Agreement (amicably) through consultations. If consultations have not been initiated or have not resulted in a mutually beneficial resolution within 180 days from the date of receipt of the duly delivered written request for consultation by the investor of one Party to the Agreement to the other Party to the Agreement, the dispute may be submitted by the investor that is a party to the dispute to one of the specified institutions” 29. There are some points about this paragraph:

-

1. According to the Table 130, this paragraph mentions three sublanguages in line with the first group of agreements; Therefore, the para actually considers investment mediation as a prerequisite mean for investment arbitration. In the table below, the language of this paragraph is clear (Table 2).

-

2. After the approval of model BIT, Russia has concluded another BIT with Palestine in October 2016, and there, exactly based on its model BIT, it refers to amicable settlement, the cooling-off period and the use of special amicable settlement means such as negotiation and conciliation31.

-

3. Using the word "consultation" in the paragraph is a better, new, interesting and clever language; For two reasons:

-

• first, in the studies conducted by this paper, BITs generally do not use the word “consultation” and instead mention specific methods such as negotiation, conciliation or mediation; But according to present paper, this language is much better because the word “consultation” can cover other means like negotiation, conciliation and mediation.

-

• Second, this paragraph avoids a challenge by mentioning the word “consultation”; in fact, there is no uniform procedure whether the conciliation is the same as mediation or not. Because some BITs have separated conciliation and mediation and have paid attention to each one separately like Netherlands Model BIT. In accordance with the article 17 of Netherlands Model BIT, “ Any dispute should, as far as possible, be settled amicably through negotiations, conciliation or mediation” 32; while others have only mentioned conciliation and ICSID's approach in paying attention to them is as if there is no difference between conciliation or mediation. As ICSID examines the mediation in a study titled "Overview of Investment Treaty Clauses on Mediation" and wants to mention examples of mediation, but it points out to examples in which conciliation is mentioned33. This function of ICSID has two results: 1. there is no difference between conciliation and mediation. 2. The differences between them are so insignificant that it doesn’t need to be mentioned. However, it should be noted that in another study under the title of “Background Paper on Investment Mediation”, ICSID has mentioned the differences between conciliation and mediation in ICSID's procedure34.

-

3. Current BITs of Russiaand sublanguages on mediation

-

3.1. BITs and sublanguages

Also, if we refer to other treaties, we can see that they consider two separate concepts for conciliation and mediation Like the UN Watercourse Convention35. However, in line with this dual approach, one should only refer to the negotiations of the parties to the dispute and check what the parties had in mind for conciliation.

The present study focuses on this topic in two parts: firstly, a detailed examination of sublanguages under Russian BITs, and secondly, presenting the figure of Russian agreements related to investment mediation.

The present study has examined all Russian BITs in detail. The languages of Russian BIT can be considered in several sub-languages: First. Amicable settlement with permission to use special means (without time limit); Second, amicable settlement considering “cooling off” period; Third, amicably settlement with the use of special means plus a “cooling off” period.

-

• First , amicable settlement with permission to use special means (without time limit):

Under this category, only the BITs that have indicated the use of an amicably approach in the settlement of investment disputes and in addition have pointed out some examples of peaceful means of dispute settlement like negotiation or mediation. However, they do not contain the cooling off period. Only the Russia-Japan BIT falls under this category. In accordance with article 11 of the Russia-Japan BIT, “Any dispute between one Contracting Party and an investor of the other Contracting Party in the territory of the former Contracting Party will, as far as possible, be settled amicably through negotiations between the parties to the dispute”36..

-

• Second, Amicable settlement considering “cooling off” period:

According to this category, BITs are considered that are generally concerned with amicable settlement of disputes, but do not mention any specific examples regarding peaceful means. However, they consider a time limit to use amicable settlement. Nineteen Russian BITs fall under this category37. In accordance with the article 8 of the Russia-Algeria BIT, “For the purpose of solving disputes with respect to investments between a Contracting Party and investors of the other Contracting Party consultations will take place between the parties to the dispute with a view to solving the dispute amicably. Where these consultations do not result in a solution within six months from the date of request for consultation the investor may submit the dispute at its choice for settlement to arbitration” 38. Also, based on the article 10 of the Russia-Moldova BIT, “1. the parties in the dispute will strive to resolve such a dispute as peacefully as possible. 2. If in this way the dispute is not allowed within six months from the date of the written notice mentioned in paragraph 1 of this article, it will be submitted to arbitration” 39.

In this regard, the agreement between Russia and the Netherlands has established an interesting approach. According to the article 9 of the Russia – Netherlands BIT, “all disputes between one Contracting Party and an investor of the other Contracting Party shall if possible be settled amicably. 2) Disputes which cannot be settled amicably within a period of six months from the date either party to the dispute requested amicable settlement, may be referred by the investor to international arbitration or conciliation”40. This is a very significant language in this BIT, because on the one hand, conciliation is implicitly considered in line with an amicable settlement during the cooling-off period, and on the other hand, after the expiration of the cooling-off period, the parties can recourse to the arbitration or conciliation and mediation.

-

• Third . Amicable settlement with the use of special means plus a “cooling off” period:

-

3.2. Investment mediation sublanguages and figure

This group includes BITs that contain the peaceful settlement of disputes and also mentions some instances of amicable dispute settlement means. Of course, these BITs include a time limit for using peaceful means. The remaining 62 BITs of Russia are incorporated in this group41. Based on the article 9 of the Morocco - Russian Federation BIT, “any dispute under this Agreement relating to investments between one Contracting Party and an investor of the State of the other Contracting Party shall be settled, as far as possible, amicably through consultations and negotiations between the parties to the dispute. 2. If the dispute cannot be settled within six months from the date of the written request of any party to the dispute for consultations and negotiations, the dispute may be submitted to arbitration42. Also, in accordance with the Russia- Cambodia BIT, art 8, “disputes between one Contracting Party and an investor of the other Contracting Party shall be settled if possible by way of negotiations. 2. If a dispute cannot be settled by way of negotiations during a period of six months starting from the date of the request of any party to the dispute about settlement by way of negotiations it shall be submitted to arbitration”43.

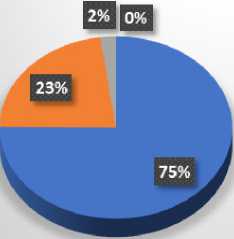

Within the Russian BITs, we observed three sublanguages regarding investment mediation. All the sublanguages are actually considered as a prerequisite for investment arbitration. It is clear that Russia has emphasized the friendly settlement of disputes in all BITs. The majority of Russian treaties are included in sublanguage III, that is, paying special attention to amicable settlement of disputes in line with some peaceful means, like negotiation, conciliation and mediation within a certain time limit. In the figure below, this position is drawn precisely.

Total number of Russian BITs: 82 treaties

-

■ Amicable settlement with the use of special means plus a "cooling off" period: 62 treaties

-

■ Amicable settlement considering "cooling off" period: 19 treaties

-

■ amicable settlement with permission to use special means (without time limit): 1 treaty

-

4. Russian BITs and domestic mediation implicitly

-

5. Conclusion

In the last decade, many endeavors were made to reform the investor-state dispute settlement by international organizations like ICSID, UNCTAD, UNCITRAL, OECD and General Assembly of United Nation. This clause is one of the significant procedural clauses within the Bilateral Investment Treaties (BITs), whose accurate modification can help to settle investment disputes better and amicably. One of the important issues in line with the reforms of the clause is the investment disputes mediation. Mediation in investment cases means the use of a third party in order to create a common atmosphere and amicable settlement of disputes at the national and international level. Russia's BITs have also properly and accurately paid attention to mediation. The attention of Russian BITs to Investment mediation can be seen in two basic realms: First, within the domestic legal system of Russia, including Russian Model BIT (2016) and Federal Law No. 382-FZ on arbitration; Second, within the International Legal system including Russian BITs.

The Russian BITs Sublanguages on Investment disputes mediation clause

Some of the Russian BITs have implicitly prescribed referring to mediation within the domestic legal system of Russia, but this issue needs interpretation. Based on the Russian Federation -Uzbekistan BIT, art 8, “If the dispute cannot be resolved by negotiations within six months from the date of the request of any of the parties to the dispute about its resolution by negotiations, then upon choosing the investor can be submitted to the competent court or arbitration of the host state” 44. The same goes for the Russia-Bulgaria BIT, art 7, “If the dispute is not thus resolved within six months from the date of its occurrence, it may be referred to consideration by the competent court or arbitration of the Contracting Party in whose territory the investments were made”45.

The phrases "upon choosing the investor can be submitted to the competent court or arbitration of the host state" and “may be referred to consideration by the competent court or arbitration of the Contracting Party in whose territory the investments were made”

mean that in case of investment in Russian territory, the parties to the investment dispute can refer to the Russian domestic arbitration or court, and thus it is also possible to refer to domestic mediation; Because based on the 10th chapter of the domestic arbitration law of Russia, “mediation procedure may be applied at any stage of arbitration” 46. Considering this path to recourse to mediation, it can be mentioned that in this regard, mediation is not a prerequisite for arbitration, however, it cannot be said that it is an independent entity from the arbitration process, because the parties can refer to mediation at any stage of arbitration.

First, in the domestic legal system: on the one hand, the Russian model BIT can be taken into account. The Russian Model BIT is a national domestic law approved by the Russian State Duma. This law is an excellent and evolved one in order to create a regular framework for the international investment process, which shows

Russia's language in the domestic system. Based on the model, there are three basic factors regarding the investment mediation: First, the treaty requires that the parties settle their disputes in a completely amicable and peaceful means. Second, the BIT wants the parties to use the four means mentioned as examples, namely consultation, negotiation, conciliation and mediation, to settle investment disputes. Third, to create a regular framework for the amicably settlement of investment disputes, the BIT considers a certain period of time, which is principally 6 months. On the other hand, the Federal law of Russia on arbitration also a detailed and complete law that also pays attention to mediation. The Federal Law No. 382-FZ was approved by the Russian State Duma in December 2015. This law is implicitly taken into consideration by Russian BITs. As in some treaties, the parties explicitly have been referred to domestic arbitration, like the article 7 of the Russia-Bulgaria BIT. Procedural clauses are also applicable in domestic arbitration. Hence, in accordance with the paragraph 1 of article 49 of the Federal law on arbitration, the parties can refer to Russian domestic mediation at any stage of their investment dispute. Therefore, if there is an investment dispute between the Bulgarian investor and the Russia, the investor can recourse to domestic arbitration by considering the BIT between his origin state and the Russia as the investment host state, and in this regard within the domestic arbitration according to the Federal law, the dispute can be referred to mediation as amicable mean at any stage of arbitration.

Second, within the international legal system including BITs: Russian BITS are basically based on the Russian model BIT. The latest version of the Russian model BIT was adopted in 2016. This version is actually the evolved one of the 2001 model BIT. According to the research conducted by the present study, all the Russian BITs on mediation and amicable settlement of disputes have performed in accordance with the Model one. As the treaty between Russia and Palestine (2016) has taken steps, in the field of the ISDS clause and the investment disputes settlement amicably and recourse to mediation, exactly in accordance with the Russian model BIT. In this regard, three fundamental sublanguages can be observed which be used by the parties to the dispute in the prerequisite stage for the investment arbitration: First, investment disputes settlement amicably using special means such as consultation, negotiation, conciliation and mediation; Second, the investment disputes settlement amicably without considering a specific means, but by establishing a cooling-off period to create a regular framework for the peaceful settlement of disputes. Third, investment disputes settlement amicably through special means like consultation, negotiation, conciliation and mediation, and setting a cooling-off period of 5 or 6 months to establish regular base in the amicable settlement of investment disputes. It is obvious that such structure created in the Russian BITs on the domestic and international levels is a suitable one that can significantly help in the settlement disputes friendly.

Список литературы Mediation as an amicable means within the investor-state dispute settlement clause: a basic survey of Russian bilateral investment treaties

- Harten Van G. Critiques of Investment Arbitration Reform / Van G. Harten, A.Y. Vastardis // Journal of World Investment & Trade. - 2023. - № 24. - P. 363-371. URL: 10.1163/22119000-12340290 (дата обращения: 16.01.2024). DOI: 10.1163/22119000-12340290( EDN: EOMQVD

- Gill P. Methods of data collection in qualitative research: interviews and focus groups / P. Gill, K. Stewart, E. Treasure, B. Chadwick // British Dental Journal. - 2008. - № 204. - P. 291-295.