Methodological approach to assessing the value of the project on the development of a deposit and the creation of value added chains

Автор: Ponomarenko Tatyana Vladimirovna, Larichkin Fedor Dmitrievich, Shchetinina Kristina Vasilevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 4 (52) т.10, 2017 года.

Бесплатный доступ

Development of companies should aim to increase their value; it is provided by applying the concept of value-based management. This approach can also be the basis for the growth of the value of integrated companies or groups, strategic projects and economic sectors. The mineral resources sector is characterized by a high level of vertical integration, and its own effect of technological, economic and institutional factors that determine the value of mineral assets and products. Assessment of value of the projects of the sectoral level can be carried out with the application of the concept of added value and value chains designed on this basis. The aim of the present research is to substantiate scientifically an approach to assessing the project for establishing the tin industry in the Republic of Kazakhstan taking into account the concept of value added. We use the following research methods: comparative analysis, system approach, strategic analysis, and managerial decision-making methods...

Business processes, tin industry, portfolio of projects, value potential, technological processes, added value chain

Короткий адрес: https://sciup.org/147223956

IDR: 147223956 | УДК: 334.7 | DOI: 10.15838/esc.2017.4.52.7

Текст научной статьи Methodological approach to assessing the value of the project on the development of a deposit and the creation of value added chains

A value chain, according to M. Porter, is referred to as a coherent set of activities creating company’s value, ranging from raw materials from suppliers to finished products delivered to the consumer, including additional features such as services. A value added chain (VAC) as a model structures the process of product flow from suppliers to consumers through stages adding value to the product [19].

The concept of value added chains was greatly developed in works by R. Kaplinsky and M. Morris [22, 23] and other economists [11, 19, 24]. Such an approach is based on analysis of the process of product value formation in an integrated company (in several interrelated stages) with the aim to increase the efficiency and competitiveness of the entire system. It should also be noted that the competitiveness of the whole chain (system) is influenced by processes such as value added formation and its redistribution between participants creating the final product. Therefore, the managing entity (corporate center) in the chain needs to specify the distribution of value added among its members.

When implementing VAC in more than one company (especially institutionalized and representing a group of companies) the number of emerging effects increases and may include additional (synergistic) effects [10]. When implementing VAC at the sectoral, regional or national level, it is necessary to consider the socio-economic (external) effects at relevant levels.

The choice of solutions to exploit mineral assets should be undertaken with construction of a VAC at the industry level and based on the methodological approach to assessing the value of the project on deposit development and creation of the VAC taking into account different effects influencing an integrated company, region, national economy, and cross-border interaction. Such effects must take into account the possible government support, new products, additional revenues, fiscal revenues, etc. when designing different variants of VAC.

The purpose for the research is to scientifically justify the approach to the assessment of the project of tin industry establishment in the Republic of Kazakhstan taking into account the concept of value added chains.

Research objectives:

-

1. To justify the use of VAC to assess the sectoral project in mineral extraction and to identify the industry characteristics of VAC.

-

2. To develop an algorithm for evaluating the strategic investment project which forms the basis for an industry in the mineral sector.

-

3. To develop a methodical approach to the formation of the VAC taking into account the influence of economic, technological, and institutional factors (in the case of tin industry in Kazakhstan).

-

4. To offer institutional and economic mechanism fro implementing different variants of VAC for tin industry in Kazakhstan.

Results and discussion

The rationale for using VACs to assess the sectoral project in mineral extraction and identifying industry-specific characteristics of VAC

The technological correlation between the projects in the program determines their assessment as a single complex which determines the application of the concept of value added and the design of VAC [24]. In the sector of mineral extraction, VAC are based on mineral development projects, that is why the specific features of mining projects in the country determine the characteristics of VAC valuation [20]. These include: mining-and-geological conditions (MGC) of deposits; choice of technical and economic solutions; specific risks.

MGC of a deposit include: quality characteristics (content of useful components, mineral composition, ore preparation characteristics, ore body structure), quantitative indicators (value of reserves), mode of occurrence (mode of occurrence of geological bodies, dip and strike of bedding surfaces, contact plane, structural elements of folds, and tectonic deformations).

Consideration of risks of deposit development project is ensured by modern assessment of the resource base according to the Australian code of reporting of exploration results, mineral resources and ore reserves (JORС) [1] whose advantages include the separation of each category of reserves and resources based on economic and technical factors, general principles of deposit evaluation which implies collection and evaluation of geological data, determination of ore body geometry, estimation of resources and stocks suitable for mining with simultaneous verification of the obtained data, the use of modern technological methods to more accurately design and predict the ore body structure, work out detailed tolerance analysis and detailed geological model of the deposit. JORC sets out minimum standards, recommendations, and principles of applying public reporting of exploration results, mineral resources and ore reserves. On this basis, Committee for Mineral Reserves International Reporting Standards (CRIRSCO) is working on a new set of standard international definitions for reporting on mineral resources and mineral (ore) reserves.

The range of commodity output (CO), manufacturing and sales logistics, location of manufacturing sites, value and cost of CO depend on economic (transportation conditions, prices, demand, etc.), technological (production and processing technology), and institutional factors (tax system, state control and state support, benefits and preferences, etc.).

Therefore, designing various VAC leads to different economic outcomes and noneconomic effects which have an impact on the company, region, national economy, and cross-border cooperation.

The evaluation algorithm of the strategic investment project which forms the basis for an industry in the mineral sector.

In scientific literature, there is no precise definition of a strategic project, yet its main features are defined: focus on achievement of strategic competitive advantages [12], systematic approach to the development and implementation, long-term nature. In most cases, these are large scale projects requiring significant and intensive investment, which poses high risks.

Issues of strategic project management are linked to the scope and complexity of technical and technological solutions, a significant number and interconnectedness of organization processes, large budget and long-term implementation, as well as uncertain impacts of factors and significant risks. Strategic projects often represent project or program portfolios [14, 15] implemented in an integrated company.

The extent and complexity of such projects results from several factors: major investment, new technology testing, various stakeholder interests, diverse and significant risk impact, and increased debt load. Such features and risks define problems of implementation of strategic projects. High risks of implementation of investment projects, the need for infrastructure costs, significant investments, the impact on the region’s socio-economic development, requirements to profitability from private investors and effectiveness of budget expenditures determine the need for choosing organizational, economic and financial mechanisms for their implementation. These include special mechanisms for attracting financial resources including project financing; comprehensive and rational exploitation of natural, especially mineral, resources; efficient transport and production infrastructure, primarily on the basis of public-private partnership (PPP); special production management including the use of resource-efficient and low-waste, primarily advanced (best available) technology [13].

Typically, strategic projects in mineral extraction affect the economic condition of the population and various business entities, the development of the industry, the region and the country in general; involve a lot of different interests and needs to be supplemented by mutually beneficial publicprivate partnerships including the interaction with public organizations representing the interests of industrialists and entrepreneurs. Therefore, the economic effects of mineral developers need to be complemented by the socio-economic effects for other stakeholders.

The algorithm of evaluating a strategic sectoral investment project in the mineral sector:

-

1. Identification and analysis of economic, technological and institutional factors affecting the project in the present and in the future, defining competitive advantages and the project’s investment attractiveness.

-

2. Identification of main stakeholders (company-government) and harmonization of their interests.

-

3. Construction of VAC variants and formation of VAC-based project programs.

-

4. Defining the effects for main stakeholders (company-state).

-

5. Choice of the variant of program implementation by economic effect for the company.

-

6. Justification and selection of the variant of program implementation by total socioeconomic effects for the state.

-

7. Development of institutional and economic mechanisms of VAC project implementation.

The methodological approach to VAC formation taking into account the influence of economic, technological, institutional factors (in the case of tin industry in Kazakhstan)

VAC design and analysis in integrated companies with multiple stages include: identifying the correlation of technological processes, analysis of the VAC structure for business processes, study and analysis of the effects of factors (economic, technological, and institutional), research and evaluation of business processes in terms of their potential to create value based on the anticipated impact of the external environment, choice of areas and methods of value growth by stage by increasing efficiency of operating and project activity; maximization of the effect of the entire VAC through the development of institutional and economic mechanisms of VAC implementation.

The mining industry takes one of the leading positions in the economic structure of Kazakhstan. The country possesses significant reserves and resources of tin raw materials; the country explores a unique tin deposit, the largest in the Central Asia, yet the country has not established tin industry.

Non-ferrous metallurgy occupies a significant place among other industries in

Kazakhstan, including the production of copper, lead, zinc, titanium, magnesium, rare metals and rare earth metals, rolled copper and lead [6]. Currently, Kazakhstan is the buyer of Russian tin despite the fact that for decades it has developed its own mineral resource base and planned to produce tin in volumes exceeding current production in Russia [11]. The prospects of the tin industry are based on involving the Syrymbet tin deposit in exploitation. The project will help create a new technologically advanced sub-sector of nonferrous metallurgy. The project of tin deposit development has been implemented since 2001, the beginning of ore extraction and processing was moved up from 2011 to 2018.

Deposit exploration and development license until 2028 was issued by JSC Syrymbet, the Department of Kazakhstan investment company Lancaster Group. The field was discovered in 1985, active development was started in 2004. In 2012, exploration works were completed; semiindustrial technological pilot tests were carried out; technological regulations and design documents of the deposit development project were developed.

Deposit reserves were estimated according to the international JORC classification and amount to 94.5 million tons of ore, 463.5 thousand tons with average tin value of 0.49%. The ores contain tungsten (0.172%) which is valuable as a simultaneously extracted component, silver – up to 4 grams per ton, gold –less than 0.15 grams per ton, molybdenum – 0.022%, zinc – 0.026%.

Syrymbet ore defield is located in the Northwestern part of the Kokshetau median massif with a number of other deposits including large hydrothermal uranium deposits, intrusive tin and gold formations, skarn and porphyry copper manifestations, copper-nickel manifestations in layered gabbro, etc. [8]

The project aims to establish unique tin production in Central Asia using latest efficient technology and best environmental standards. The first-prosess project was funded by the Eurasian Development Bank. The project framework implies construction of a mining and processing complex with an open quarry and a dressing plant for processing complex ores and producing tin, amorphous silica, iron concentrate, alumina, and rare metals. During project implementation, in addition to new construction it is expected to conduct metallurgical recovery at the Irtysh chemical-metallurgical plant (ICMP) in Ust-Kamenogorsk, which will annually produce 4532 tons of rare earth metals including tantalum and niobium.

Economic factors affecting VAC are: the current status, structure and development prospects of the global tin market, market situation, main products, structure of world production, finding conditions.

Analysis has shown that over the past decade the annual world consumption of tin has been rising at a rate of 4%. In the structure of world consumption, about 60% accounts for production of braze and alloys, 16–17% – tin, more than 14% – manufacture of chemicals, 2% – glass [7]. The tin industry is a strategic sector of the economy, whose role consists in providing raw materials for production of high-tech and science-intensive final products (engineering, construction, aviation, space and defense industry). Tin among all heavy metals is becoming more important due to environmental requirements and the need for replacement of toxic lead [18].

The areas of tin application have expanded considerably. Traditionally, tin is used as a safe, non-toxic, corrosion resistant coating in its pure form or in alloys with other metals. The past decade has shown that tin is necessary for introducing innovation technology and is applied in modern knowledge-intensive industries. According to a major producer of alloys, Cookson Group (London), manufacturers of electronic equipment around the world use alloys with up to 95% tin among useful components. States that made their choice in favor of development of communication and information technology had to prioritize the issues of restoring full functioning of the tin industry whose products suddenly became in demand on the global market due to its deficit. Tin market development performance depends on the output of alloys used in manufacturing electronic components and electrical and household

Table 1. Production of refined tin by leading producers (2015)

|

No. |

Company |

Production volume, thou tins |

|

1. |

Yunnan Tin (China) |

75.5 |

|

2. |

Malaysia Smelting Corp (Malaysia) |

30.3 |

|

3. |

PT Timah (Indonesia) |

27.4 |

|

4. |

Minsur (Peru) |

20.2 |

|

5. |

Yunnan Chengfeng (China) |

16.6 |

|

6. |

EM Vinto (Bolivia) |

12.1 |

|

7. |

Guangxi China Tin (China) |

11.1 |

|

8. |

Gejiu Zi-Li (China) |

11.0 |

|

9. |

Thaisarco (Thailand) |

10.5 |

|

10. |

Metallo Chimique (Belgium) |

8.9 |

equipment. The demand for tin is expected to rise by 3.5–4.0% annually, with the majority in Asian electronics markets, especially in China [2].

The common feature of the current state of exchange markets of most non-ferrous metals is excessive production and production capacity. The situation in terms of tin production is different. The tin market has gradually become very stable and favorable for producers with continued worldwide supply shortage [3]. Traditional markets of tin consumption is expected to retain good demand growth rates, which is difficult to meet due to existing production capacities. The growing Asian economies and progressive high-tech industries stimulate the demand for tin which is increasingly attractive for innovative industries.

According to the International Tin Research Center (ITRI)1 the list of ten leading producers is fairly stable ( Tab. 1 ).

The analysis of production volumes showed that 4 out of 10 world’s leading tin producers are Chinese companies due to strong internal demand from automotive and electronics industries, as well as full state support.

After the improvement of world market conditions, operating mining companies began to expand their mineral resource base, in addition; new tin mining projects emerged, especially in Australia and Canada. The possibility of new competitors is low with the current leaders.

The total cost of development project in Syrymbet is estimated at more than 70 million dollars, including credit resources accounting for 48.7 million dollars for a 10-year period. The establishment of an industrial complex for production of tin, tantalum, niobium and other rare metals will provide annual revenues of 45–50 million dollars.

Technological factors include: modern technology for tin ore extraction and enrichment, the possibility of using waste-free technology, rational use of natural resources and planned useful component recovery factor, the possibility of complex use of mineral raw materials.

The Central Syrymbet mining field is expected to be subjected to surface mining as the depth of ore body formation is rather small and occurrence of ore bodies helps develop the reserves to the full depth with minimum volume of strip-mining. The operational period of the quarry according to adopted performance will be 13.4 years.

Technology developed for complex ore processing, ensures waste-free production with the extraction of more than 90% of mineral raw materials. Fine-grained valuable minerals, their close assemblage with other minerals, especially iron minerals, have a negative impact on their release from ore and complicates the enrichment and mineral recovery technology.

The main technological and economic options for Syrymbet deposit:

-

1. Production of weak (10% tin) concentrate with high recovery of 65% and further metallurgical recovery to top-quality tin;

-

2. Production of sellable concentrate (40% tin) and industrial products (4–5% tin) with lower total extraction of 50–55% and further metallurgical recovery to top-quality tin.

-

3. Production of sellable concentrate (40% tin) and industrial products (4–5% tin) with total extraction of 50–55%, further

-

4. Production of sellable concentrate (40% tin) and industrial products (4–5% tin) with total extraction of 50–55% and further sale of the resulting products to Novosibirsk Integrated Tin Works (NOK).

metallurgical recovery of industrial products to sublimates, sale of sublimates and sellable concentrate.

Evaluation of options for values of investment project efficiency indicators is presented in Table 2 .

Comparison of four technological variants of ore processing at the Syrymbet deposit suggests that the most effective is the first option. Therefore, VAC with production of weak concentrate (10% tin) with high 65% recovery and further metallurgical recovery to high-quality tin is the best option for the manufacturer.

Institutional factors include the system of state regulation for mineral resource use and industry, system of taxation, industry development strategy, innovation development, the existing and planned measures of the state support for the industry etc.

In Kazakhstan, there are scientific and technological programs for support and development of mining and metallurgy, aimed at increasing the efficiency of economic potential, improving technological and industrial production level, developing finished technology cycles with finished products [5].

Table 2. Technological and economic indicators of assessing processing efficiency of Syrymbet tin ore deposits, dollars

|

No. |

Indicator |

Measurement |

Variants |

|||

|

1 |

2 |

3 |

4 |

|||

|

1. |

Product |

|||||

|

Tin 1 |

tons |

60594.4 |

51501.9 |

|||

|

Rich concentrate (45,32% Sn) |

tons |

77726.4 |

77726.4 |

|||

|

Concentrate (4,9% Sn) |

tons |

448519.4 |

||||

|

Alloys |

tons |

27702 |

||||

|

2. |

Revenue for the whole operation period |

mln dollars |

1505.1 |

1279.3 |

1207.5 |

1074.0 |

|

3. |

Investment costs |

mln dollars |

104.8 |

102.5 |

94.4 |

76.1 |

|

4. |

Production costs |

mln dollars |

622.0 |

604.9 |

534.7 |

485.6 |

|

5. |

Income |

mln dollars |

802.3 |

595.3 |

600.0 |

529.7 |

|

6. |

Income tax |

mln dollars |

160.5 |

119.1 |

120.0 |

105.9 |

|

7. |

Net income |

mln dollars |

641.9 |

476.2 |

480.0 |

423.8 |

|

8. |

Discounted cash flow (discount rate 12 %) |

mln dollars |

190.5 |

116.2 |

125.6 |

117.0 |

|

9. |

Internal rate of return |

% |

35.5 |

27.2 |

29.5 |

31.9 |

|

10. |

Discounted payback period |

years |

4.84 |

6.26 |

6.73 |

5.29 |

The strengthening of positions of the tin industry of Kazakhstan on global markets amid unstable global economy requires measures to restore and develop the industry [17]. The country’s public policy in tin industry development is aimed at stimulating tin production and establishing production of final high value-added products. The main objective of the industry development should be gradual establishment of new processing industries in the tin industry related to manufacturing of high-value-added products, providing both growth of production of high-tech products, expanding exports to foreign markets and meeting the needs of the domestic market.

The government of Kazakhstan adopted a new Law “On mineral resources and mineral resource management” (2010), Mining and metallurgy development program for 2010– 2014 (approved by the Resolution of the Government of the Republic of Kazakhstan no. 1144, dated October 30th, 2010), a modernization program for operating enterprises “Productivity-2020” (approved by the Resolution of the Government of the Republic of Kazakhstan no. 254, dated March 14th, 2011). They specify investment projects whose implementation will lead to an increase in domestic consumption of metal products. The programs provide sectoral and project measures of state support; measures for improving the legislation and eliminating administrative barriers; development of innovation and promotion of technological modernization; creating conditions for investment; resource provision; tax incentives, including VAT exemption on sales exploration and geological works. A new action plan for the development of industries in the mining sector of the Republic of Kazakhstan for 2015–2019 (State program of industrial and innovative development of Kazakhstan for 2015–2019 (approved by Resolution of the Government of the Republic of Kazakhstan no. 1159, dated 30th October, 2014)) includes the development of Syrymbet rare metal, tungsten and tin deposits.

A new Concept of mining and metallurgical complex development in Kazakhstan up to 2030 takes into account best international practices in mineral resource management including state governance in the industry, introduction of new technology and standards, increasing investment attractiveness. The Concept also implies the expansion of mineral base reproduction, creation of modern system of mineral resource management, attraction of latest development technology, increasing the depth, comprehensive and rational processing of mineral raw materials [4].

In order to ensure sustainable development of the industry with the supply of tin in the internal and external market, the government can buy ready-made metal at fixed prices and also help establish stable cross-border flows of tin-containing products to the markets of Asia and Europe [3]. Kazakhstan’s accession to the Eurasian Union and to the World Trade Organization (since June 22, 2015) opens up new possibilities for the tin industry.

Having analyzed conditions which stimulate innovation development of the metallurgical complex, we found out that these conditions are as follows: mineral resource base, establishing domestic industries for raw materials processing, development of steel consuming industries in Kazakhstan, global trends of increasing consumption of high-quality metal products, existence of leading companies in Kazakhstan for the production, processing and sale of metals on the world market, introduction of modern high-tech schemes for the processing and production of high quality metal that provides an opportunity to develop new sectors in the country (rare metals, radio engineering, nano-technology, etc.), addressing the issues of employment.

A special role for large projects in the mineral sector belongs to effects that emerge in related and associated industries. Such effects can be based on the possibilities of cross-border collaboration.

The border between Russia and Kazakhstan is the longest in the world. In general, favorable landscape conditions make it quite convenient for transportation. Half of Kazakhstan’s regions have borders with Russia, they are crossed by 16 railways and about 200 roads [16]. The interests of the companies located in the border areas can be multinational. For example, the majority of Russian consumers of tin are located either in border regions or in areas with convenient transport links.

Variants of formation of the value added chain in the tin industry in Kazakhstan

Among the long-term factors influencing the nature of cross-border cooperation an important role belongs to resource potential and environmental interaction. Experts and the public are paying increased attention to environmentally hazardous cross-border facilities in Atyrau region (Tengiz field and Kashagan East field), Western Kazakhstan region (Karachaganak), Orenburg and Chelyabinsk oblasts, and East Kazakhstan (mining and processing enterprises) regions [9].

Organizational-economic mechanism for the implementation of different versions of VAC for the tin industry in Kazakhstan

According to industry experts, the investors are interested in combining exploration, mining, processing and refining units in the same chain. The high level of competition requires that companies include in their structure the elements of the whole value chain, creating a vertically integrated company and providing competitive advantage [11].

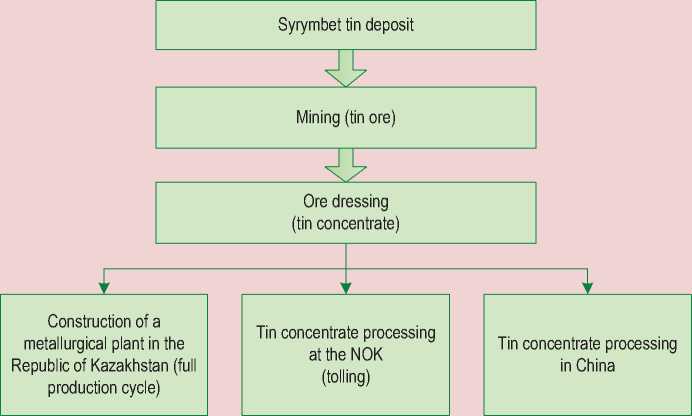

The design of VAC should be based on comparing the economic effect of independent production of a full cycle in the Republic of Kazakhstan and the effects of producing semi-finished products with options for cross-border cooperation [21] in creating the tin industry. Therefore, its creation in Kazakhstan could include the following options for an organizational-economic mechanism (Figure) .

First, establishing a mining and metallurgical vertically integrated holding, i.e. organizing a full production cycle. This variant implies significant technological and marketing risks, because such production in Kazakhstan is organized for the first time, it is very capital intensive and will require mandatory government support.

Second, full or partial integration (e.g., strategic alliances or partnerships) with the production of final products (tin solder) in Russia. The main negative factor requiring the participation of the Russian authorities is the bankruptcy of the Novosibirsk Integrated Tin Works (NOK).

In this case, the problem can be solved with the help of idle capacities of the plant (11 thousand tons), as well as the close proximity to the Chinese market. This creates a competitive advantage for such an option of VAC. For Kazakhstan it is more profitable to process concentrates on the NOC on the terms of tolling. This possibility is indicated by the lack of financial resources of the NOC and by extensive market power of tin concentrates suppliers, who can dictate the terms of payment, terms of contracts and the solvency requirements of processing plants. The alternative can be found in a strategic alliance with Russian consumers with the expansion of production in the Novosibirsk Oblast on the basis of former plants producing solders, babbit, solder wire with flux. At that, the possibilities of cross-border cooperation are implemented and the main effects are generated in the chain on the territory of the Customs Union.

The third option is processing of concentrates in China, in this case there exist certain marketing risks, a significant part of the effects of VAC will be lost for Kazakhstan’s economy and will remain with Chinese manufacturers.

Conclusions

-

1. In the minerals and raw materials complex, value added chains are based on projects for development of mineral assets, so the specifics of mining projects defines the specifics of valuation of VAC. The specifics are as follows: geological conditions of deposits; selection of technical and economic solutions on this basis; specific risks, technological interconnection of the projects.

-

2. The algorithm for assessing the strategic investment project of sectoral nature in the mineral sector include the identification and analysis of economic, technological and institutional factors affecting the project now and in the future; identifying key stakeholders (business–government) and coordination of their interests; formation of variants of VAC and formation of programs of the projects; identification of effects for key stakeholders; choosing a variant of implementation of the program on the value of economic benefit for the company and on the sum of socioeconomic effects for the state; development of organizational-economic mechanism for the implementation of projects in VAC.

-

3. Designing and analyzing VAC at the sector level includes determining the relationship of technological processes, the analysis of the structure of VAC broken down by business processes, studying and analyzing

-

4. The most effective project for ore processing of the Syrymbet tin deposit is a project of VAC with obtaining weak (10% tin)

-

5. Organizational-economic mechanism for implementing VAC in the tin industry in Kazakhstan may include the following options: the development of mining and smelting vertically integrated holding company (full production cycle), full or partial integration with the production of final products in Russia, and the processing of concentrates in China.

the effect of a set of factors (economic, technological, and institutional), research and evaluation of business processes according to the potential of value creation taking into account the anticipated impact of the external environment, the choice of directions and methods for increasing the value in stages with the help of enhancing the efficiency of operating and project activities, maximization of the effect across VAC.

concentrate with high recovery of 65% and further metallurgical upgrading with getting a top quality tin.

Список литературы Methodological approach to assessing the value of the project on the development of a deposit and the creation of value added chains

- Avstraliiskii kodeks otchetnosti o rezul'tatakh razvedki, mineral'nykh resursakh i zapasakh rudy . Available at: http://www.imcmontan.ru/eng/files/jorc.pdf.

- Aikashev A.N. Mirovoi rynok olova dvizhetsya k ustoichivomu defitsitu . BIKI , 2013, no. 50, pp. 68-77.

- Aikashev A.N. Eksportnyi potentsial rossiiskoi promyshlennosti po dobyche olova . Rossiiskii vneshneekonomicheskii vestnik , 2014, no. 6, pp. 107-119.

- Isekeshev A.O. Kontseptsiya razvitiya GMK RK do 2030 goda predusmatrivaet luchshii mezhdunarodnyi opyt nedropol'zovaniya . Available at: https://primeminister.kz/ru/news/7/kontseptsija-razvitija-gmk-rk-do-2030-goda-predusmatrivaet-luchshij-mezhdunarodnyj-opyt-nedropolzovanija-aisekeshev

- Kazakhstan -analiz osnovnykh otraslei promyshlennosti strany . Available at: http://365-tv.ru/index.php/analitika/kazakhstan/129-kazakhstan-analiz-osnovnykh-otraslej-promyshlennosti-strany

- Kudabaeva L.A. Rol' khimicheskogo kompleksa v ustoichivom razvitii ekonomiki regiona . Sbornik statei XIX Mezhdunarodnoi nauch.-prakt. konf . UrFU, 2013. Pp. 112-114.

- Lunyashin P.D. Vosstanovitsya li v Rossii dobycha olova? . Promyshlennye vedomosti , 2011, no. 2. Available at: http://www.promved.ru/articles/article.phtml?id=2041

- Mirovye tovarnye rynki . Available at: http://www.cmmarket.ru

- Mukomel' V.I., Kosach G.G., Kuz'min A.S. Rossiisko-kazakhstanskie prigranichnye svyazi: opyt trekh rossiiskikh oblastei . Vestnik Evrazii , 2001, no. 2, pp. 73-121.

- Ponomarenko T.V., Sergeev I.B. Obosnovanie strategicheskikh investitsionnykh reshenii v integrirovannykh gornykh kompaniyakh na osnove steikkholderskoi teorii firmy . Gornyi zhurnal, Izvestiya vuzov , 2012, no. 7, pp. 23-31.

- Ponomarenko T.V., Larichkin F.D., Sidorov D.V. Otsenka perspektiv sozdaniya olovyannoi otrasli v Respublike Kazakhstan . Zapiski Gornogo instituta , 2016, no. 221, pp. 742-748.

- Rukovodstvo k svodu znanii po upravleniyu proektami. (rukovodstvo PMBOK) . Fifth edition. PMI, Inc., 2013. 614 p..

- Rukovodstvo po upravleniyu proektami i programmami dlya vnedreniya innovatsii na predpriyatiyakh (rukovodstvo R2M) . PMAJ, 2005.

- Semenenko M.Yu. Sotsial'no-demograficheskie kharakteristiki stabil'nosti rossiisko-kazakhstanskogo prigranich'ya . Vestnik Yuzhno-Ural'skogo gosudarstvennogo universiteta , 2006, no. 2, pp. 217-223.

- Utegulova B.S. Modernizatsiya metallurgicheskoi otrasli Respubliki Kazakhstan v usloviyakh globalizatsii . Problemy sovremennoi ekonomiki , 2015, no. 2 (54), pp. 289-295.

- Analysts' tin price forecasts raised. Market analysis. 18 April 2012. Available at: https://www.itri.co.uk/market-analysis/news-2/analysts-tin-price-forecasts-raised

- Baker R., McKenzie J. The Companies You Keep: Global Supply Chain Management. 2013. October. P. 39.

- Buckeridge F., Gillespie B., Loadsmann S. Optimizing extended mining operations through value driver modelling. PWC, 2010. November. P. 16.

- Das T.K., Teng B.S. Trust, Control, and Risk in Strategic Alliances: An Integrated Framework. Organization Studies, 2001, vol. 22, no. 2, рр. 251-283.

- Kaplinsky R. Globalisation and Unequalization: What Can Be Learned from Value Chain Analysis. Journal of Development Studies, 2000, no. 37, рр. 117-146.

- Kaplinsky R., Morris M. Handbook for Value Chain Research. IDRS, 2001. P. 113.

- McCuish J.D. Value Management & Value Improving practices. Pinnacle results, 2011. P. 15.