On the methodological approaches to the study of saving behavior of the population

Автор: Belekhova Galina Vadimovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Young researchers

Статья в выпуске: 1 (37) т.8, 2015 года.

Бесплатный доступ

The task to ensure effective functioning of all systems in the society and sustainable economic growth requires significant amounts of investment resources, which include savings of the population. This involves identification of the amount of funds accumulated by the population and studies of the characteristics of its saving behavior. The article reveals advantages and disadvantages of the main methodological approaches to the research in saving behavior and gives a comparative analysis of methods on the basis of official statistical information. As for Russia income is a key factor in saving behavior, the article also addresses the problem of assessing the degree of income differentiation of saving behavior. For this purpose we have used a method of household budgets sample surveys on the basis of which we have calculated and analyzed key performance indicators of savings behavior of households, including in the context of groups with different income levels. Unlike previous works on the topic, our study uses available resources (not money income) as a basis for the calculation of saving behavior indicators, as they more fully characterize funds of low-income households, which are mostly represented in the budget surveys sample...

Savings, households, balance of money income and expenditure (bie) tax account system (tas), household budgets sample survey, savings rate

Короткий адрес: https://sciup.org/147223695

IDR: 147223695 | УДК: 330.59(470) | DOI: 10.15838/esc/2015.1.37.16

Текст научной статьи On the methodological approaches to the study of saving behavior of the population

Over the past few decades both foreign and Russian scientific and expert communities have been actively studying and discussing the issues that deal with identifying the specifics of people’s savings behavior and determining the amounts of savings they have accumulated. This is due to several reasons. The structure and dynamics of savings are essential indicators of financial well-being of citizens and economic development of the state; they have a significant impact on the conditions of development of the banking sector, show the current level of people’s trust in financial institutions and authorities.

But, most importantly, people’s savings are a significant investment resource, which promises substantial benefits to the state. First, it will reduce dependence on foreign investment. Second, the population will be able to get a higher income from their savings, to spend more on goods and services; this will promote economic growth and development of production. Third, the money resources of the population can be used in the funding of socially-oriented projects and industries, which are now the recipients of budget funds [22, p. 165]. In addition, the savings used for investment lending of production, are a necessary condition for structural adjustment and modernization of the economy [3, p. 23]. According to the experts [6], the attraction of people’s savings into investments through bank deposits, investment funds, defined contribution pension system and other mechanisms can provide the annual GDP growth of more than 2.5%.

Economic-and-statistical and sociological methods are commonly used for the study of people’s savings and savings behavior. Sociological approaches (questionnaire polls, focus groups, interviewing, social experiment, etc.) are valuable because they help to obtain timely information about the attitudes, motives and mechanisms of decision-making concerning the formation and use of savings nationwide and across individual territories and populations. Moreover, sociological methods allow scholars to solve the problem of “feedback”: they help to trace how the preferences of financial services consumers change, how the population responds to the ongoing government activities in the field of socio-economic policy; they also help to determine the extent of the demand for adjustment of the activities of banks, insurance and investment companies, pension funds, etc.

According to the all-Russian polls conducted by VTSIOM, the level of savings activity in the Russians over last ten years has been relatively stable: after the proportion of savers increased in the early 2000s (from 22% in 2001 to 32% in 2004), it accounted for one third of the population (30% in 2010, 32% in 2014). The Russians save money for the following purposes that remain the same: the purchase of housing (27% in 2010, 33% in 2014) and the accumulation of a money reserve “for a rainy day” (26%) [18]. The vast majority of those who have savings (90–95%), prefer to keep them in rubles [12].

The weakening of the national currency and the high consumer demand at the end of 2014 were the reasons why the Russians started to spend their ruble savings and to increase savings in foreign currency [23]. However, in January 2015, compared to November 2014, there were fewer negative assessments concerning the behavior of the ruble in the next two months: now 27% of the respondents think that the national currency will continue to decline, whereas at the end of last year 46% shared this viewpoint. The share of those who believe that the exchange rate will remain approximately at the same level as it is now has increased (from 24 to 36%). While the majority of the Russians do not know for sure how they should act in case the dollar rises further; 77% will do nothing. Those who are going to do something will most likely invest money in real estate or other expensive items (6%). Part of the respondents will buy dollars (4%), and others will begin to spend their savings (3%) [12].

A sociological study carried out at the Institute of Sociology of the Russian Academy of Sciences in November 2014 points out that people have “moderately anxious expectations”: almost half of the citizens is sure that “the country will face hard times”, another quarter has no hope that the change will come [21]. Such sentiments are naturally reflected in the behavior of the Russians. According to the Levada-Center, consumer sentiment index (CSI) in September 2014 dropped below 100 points (to 97) and as of January 2015 it is 77 points, which corresponds to the values of the acute phase of the crisis in 2008–20091. Along with the “freezing” of savings activity, this can indicate the increase in inflation expectations and a negative forecast of the Russians concerning their income.

Similar trends in the savings behavior and consumer sentiment of the population are observed in the Vologda Oblast. The region’s residents show more initiative in the formation of their savings: in 2000–2013 the share of individuals who had savings ranged between 35–40% (excluding postreform and crisis periods, when it decreased to 24%). The region’s residents accumulate savings mainly for the following purposes: to buy an apartment (26–35%), to save money “for old age” (15–25%) and to help their children (14–20%). Currency preferences of the Vologda Oblast residents are the same as those in Russia as a whole [2].

The analysis of the dynamics of CSI measured by ISEDT RAS in the region with the help of the public opinion monitoring carried out since 1997 on a regular basis indicates that the consumption opportunities of the region’s population are slightly less favorable than the national average, but they are as responsive to changes in the socio-economic situation as those nationwide. This is expressed, for example, in the decrease of the index in the periods of crises of 1998 and 2008 (53.9 and 74.1 points, respectively) [5, 19].

The 2014 surveys registered a drop in savings activity (down to 23%) and a significant deterioration in consumer sentiment (from 92.3 points in January 2014 to 82.3 points in December 2014). These data indicate that the region’s residents have mostly negative assessments of the socio-economic situation and development prospects in the region, which is connected, inter alia, with increasing concerns about the growth of prices for goods and services and the simultaneous reduction of incomes. However, only time will show what is in store for us2.

The shortcomings of sociological methods are as follows: the inaccuracy of the information provided by the respondents concerning their financial opportunities, different methodologies and sample surveys carried out by various research organizations, the difficulties of mapping the received data and, as a consequence, the lack of opportunity to use these quantitative data as the target or forecast indicators.

Economic and statistical methods provide a more balanced assessment that helps to trace the trends in savings behavior. Statistical data can be used for assessing the amount of accumulated funds (both in total and by type of savings or population groups), for assessing the state of the banking sector

(the interest rate, the amount of bank deposits of natural persons, etc.) and the role of savings in the economy (the share of people’s savings in GDP or money incomes).

This article outlines key features of statistical methods for assessing population’s savings, and also presents the results of the analysis of savings behavior based on sample surveys of household budgets. The latter is due to the fact that income is a key factor in savings behavior of the Russians, and the degree of income differentiation can be assessed according to the results of budget surveys.

Economic science and practice has several methodological approaches to the assessment of people’s savings, namely [10, 15, 25]:

-

• the use of disposable income account for the household sector in the system of national accounts;

-

• the balance of money income and expenditure (BMIE) of the population;

-

• the data from the sample survey of household budgets conducted by the Federal State Statistics Service.

Each of the presented methodologies is based on the data that simultaneously assess the incomes, expenditures and other indicators of financial well-being of the population. However, there is not enough coordination between them, and they give different and often contradictory final results.

TAS and BMIE determine income and savings on the basis of official macrostatistical, reports of the Central Bank, other financial agencies and extra- budgetary social funds. The indicators in the budget-related surveys of the population are assessed on the basis of information about expenses and savings that is obtained directly from household members [13, 24].

The calculations of the amount of savings according to TAS are most often carried out when conducting international comparisons. The specific feature of this method consists in the fact that in this case the savings can take the form of financial (cash, bank deposits, loans, securities, etc.) and tangible (purchase of houses, land) assets, and as for disposable incomes, they include not only their primary distribution (labor remuneration, business profit, property income), but non-monetary income and current transfers [10, p. 31]. However, at the regional level TAS is used in a simplified form, so its opportunities in assessing people’s savings and their savings potential within the country are limited.

The majority of researchers [9, 10, 20, 25] consider the data of BMIE to be the main source of information about incomes, expenses and savings of the population. The advantages of this approach include a relative simplicity of calculations and a possibility to use outcome indicators to compare them across the regions. However, the Balance, unlike TAS, does not make a clear division between current and capital expenditures. Thus, according to the BMIE methodology, income does not include the money obtained from the sale of property, foreign currency or securities (which are treated in TAS as the costs of capital deepening) [8, p. 509]. In addition, methodological materials of the Federal

State Statistics Service on the preparation of the Balance were published back in 1996 and they have partly lost their relevance, because since then there have been changes in the legal system, new forms of savings have emerged, the role of lending in the life of households has increased, and new investment tools have emerged (non-state pension funds, trust funds, etc.).

Some experts point out that if this methodology is applied, there is a possibility of obtaining significantly overstated or understated results for some regions. The reason is that incomes and expenses are registered at the place where they are earned and made, which may not be the same as the place of residence [24].

The third methodological approach to the assessment of people’s incomes, expenditures and savings is the sample survey of households’ budgets. It represents the state statistical observation of the standard of living, carried out by the state statistics agencies, and covers 49,175 households. The survey is based on the direct polling (interviewing) of household members and on household records on current expenditures on consumption and saving. The sampling provides for obtaining representative data on the federal and regional levels. The distribution of the survey results on the general population is accompanied by statistical weighting [10, p. 33; 14].

The drawbacks of budget surveys are as follows: the absence of members of the most well-off segments of the population in the sample and its shift to the poor and middle income groups [10, p. 40; 20, p. 336; 24];

and the influence of psychological factors – the respondents can either intentionally change (understate or overstate) the amount of their spending and savings, thus making it difficult to estimate them accurately, or they just cannot clearly identify the part of their funds as savings or expenses [24].

But since the samples are comparable, and the forms that the households are to fill in use the same indicators, it is possible to assess the changes in the savings behavior of the population on the basis of sample surveys of the budgets. Moreover, the division of household according to socio-economic characteristics, which is performed within the framework of these observations, makes it possible to carry out a differentiated assessment of savings and to identify their specifics in different groups of households.

The main characteristics of savings and savings behavior of households, which can be studied on the basis of sample surveys of budgets are: 1) the amount of savings (or increase of savings); 2) the amount of loans (borrowed funds) and spent savings (dissavings); 3) the increase of financial assets (the balance of the two previous parameters) [25, p. 16].

Savings rate (SR) is used as an indicator characterizing the dynamics of saving behavior of the population [7, p. 21]. Savings rate represents the percentage ratio of the increase of savings to their source – the amount of money income of the population for a certain period [1, p. 67]. This indicator can be calculated regardless of the methodology used for determination of income and savings. Although, according to sample surveys of budgets, savings rates usually turn out to be slightly smaller than according to the TAS and BMIE data.

Savings rate in the short-term reflects a country’s ability to cope with cyclical fluctuations: the higher the savings rate, the less the household consumption depends on a sharp decline in people’s incomes. Savings rate in the long term is a key feature of the country’s lending potential, it shows the ability of economy to finance its activities [30].

According to the methodology of the Organization for Economic Cooperation and Development (OECD), savings rate is determined as the ratio of people’s savings to the disposable income of households. The savings themselves are calculated by subtracting consumer expenditures3 from the disposable income of households4 and adding to the figure obtained the net value of assets of households in pension funds [27].

The World Bank, OECD and other international organizations calculate savings rate on the basis of SNA-93 (System of National Accounts, 1993). In this case, savings rate is the ratio of the amount of people’s savings and the net value of assets of households in pension funds to the disposable income of households [26].

Taking into consideration the existing Russian statistical base, this indicator for the Russian Federation and its regions can be assessed using either the ratio of gross savings (GS) and gross disposable incomes (GDI) of the household sector (according to SNA), or the ratio of the amounts of savings (S) and money incomes (MI) of the population (based on the Balance of money incomes and expenditures of the population) [7, p. 21]:

SR = GS- x 100% , or SR = — x 100% GDI MI .

The choice of method for calculating the index is determined by the purpose of the analysis. It is desirable to use the indicator of money incomes for assessing the investment potential. Gross disposable income is usually used as a basis for mapping in the cross-country analysis [7, p. 22].

The same method can be used for calculating dissavings rate (DR) and the growth rate of financial assets (GRFA) [7, p. 25]:

DR = ALSS x 100% and GRFA = GFAx 100%, MI MI where ALSS is the amount of loans and spent savings, GFA is the growth of financial assets.

Table 1 shows the change in the savings rate (SR) in different countries. As we can see, the range of values is quite wide. Savings rate in the majority of advanced economies has not changed significantly for several years and it remains at a rather low level of 10–12%.

Savings rate in developing countries, all other things being equal, should be higher than in developed countries. The lower savings rate is typical for countries with a relatively large accumulated wealth and relatively low interest rates. Thus, households in developed countries ceteris paribus will save a smaller proportion of disposable income than in developing countries [4, p. 9].

Savings rate in Russia has no pronounced changing trend; its noticeable upward and downward fluctuations (within 2–3%) are registered in different years. This situation is the result of concentration of savings in a limited number of households (with medium and high income), the unification of types of savings (mainly deposits in banks and cash in hand); and the development of a variety of consumer lending programs. Continuous socio-economic transformations and the changing external environment also influence this situation.

It is difficult to determine, what had the most significant influence on the differences in the values of savings rate in different countries – the real differences in people’s behavior or the differences in the methods of calculating its component indicators. Moreover, the level of savings rate is affected by institutional, demographic and socioeconomic differences between countries, the specifics of their financial-credit and tax systems, cultural traditions, etc. For example, government programs for retirement benefit, and the age structure of the population will affect the rate of savings of citizens (as a rule, after retirement, elderly people reduce their financial assets at the expense of savings). The availability and cost of loans, and an attitude to debt can also affect the decisions of citizens concerning the accumulation or spending of free cash [27, 29].

Table 1. Dynamics of savings rate of households in different countries (in % of disposable money income)

Country 2000 2005 2006 2007 2008 2009 2010 2011 2012 France 11.01 11.08 11.21 11.72 11.70 12.55 12.08 12.03 11.67 Germany 9.38 10.72 10.82 11.02 11.48 10.90 10.86 10.39 10.32 Austria 9.33 9.63 10.37 11.64 11.50 11.21 8.87 6.72 7.35 Belgium 12.46 9.91 10.67 11.34 11.53 13.17 9.93 8.43 9.62 Sweden 3.14 4.02 4.87 7.22 8.99 11.00 8.33 10.35 12.18 Mexico - 10.12 10.07 9.73 9.25 9.03 9.00 8.23 - Czech Republic 5.84 4.79 6.06 5.72 4.84 6.77 6.19 5.15 5.91 Estonia -2.95 -10.77 -13.14 -8.18 -4.13 4.74 4.44 6.03 -1.10 Finland 0.48 0.88 -1.10 -0.88 -0.26 4.24 3.56 1.26 1.07 Hungary 6.16 6.68 7.23 3.34 2.74 4.80 5.42 5.42 1.87 Norway 4.30 9.62 -0.51 0.83 3.66 6.91 5.63 7.12 8.19 Slovenia 7.85 10.6 10.81 8.99 8.56 8.05 6.12 5.23 4.70 Spain 6.14 4.75 3.90 4.03 7.76 12.19 7.86 6.79 4.42 UK 0.09 -2.29 -2.21 -3.66 -2.68 2.26 2.93 2.16 2.37 USA 4.20 2.69 3.50 3.15 5.22 6.38 5.85 5.87 5.81 Canada 4.78 2.18 3.61 2.90 4.04 4.70 4.88 - - Russia – 10.99 12.37 12.07 10.11 13.13 15.5 13.88 – For reference: Russia (according to the data of BMIE*) 7.60 10.40 10.30 9.60 5.30 13.90 14.80 10.40 9.90 * Calculated by the author on the basis of: The balance of money income and expenditures of the population of the Russian Federation. Available at: Source: National Accounts at a Glance: National Accounts at a Glance 2014. Household Savings Total. OECD. Available at: org/hha/

As noted above, income and the specifics of its use are the most significant factors contributing to the change in the amount of savings and savings behavior of households in Russia.

The socio-economic heterogeneity caused by the high income differentiation of the population has been the main characteristic of the Russian society for the last 10–15 years [16]. Despite the fact that, the average per capita incomes of the Russians in real terms increased significantly (2.6 times) in 2000–2012, the inequality of the population did not decrease; on the contrary, it has increased: for example, the ratio of the average income of the richest 10% to the poorest 10% (R/P 10%) in 2012 was 16.4 times, while in 2000 it was 13.9 times. The improvement of Russia’s socio-economic development in 2000–2007 and in the subsequent period had a favorable impact on the wealthiest part of the population; as for the financial situation of low-income groups, it did not change did not change significantly both in Russia and in the regions. Thus, in 2012 the average per capita income of the least well-off part of the population was 93% of the subsistence level, and more than half of consumer expenditures in every fifth Russian family was directed to the purchase of food [17, p. 94]. The structure of the total income distribution remains virtually unchanged – for almost 15 years half of money income (47–48%) has been concentrated in hands of the 20% of the most well-to-do, whereas the 20% of the least well-off have about 5% of all the money resources.

This income differentiation directly affects consumption and saving opportunities in different income groups. However, before we move on to the analysis of the data obtained from sample surveys of household budgets, it is necessary to outline two assumptions adopted in the analysis. First, we analyze the period from 2003 to 2012, because the surveys for these years are publicly available at the Rosstat database;

besides, it is by 2003 that the markets of bank deposits and retail lending have become strong enough. Second, expenditures and savings are not compared with money incomes [7, 20, 25], they are compared with the resources available, including income in kind and a variety of transfers, because they give a more comprehensive picture of households’ opportunities and allow needy groups to maintain consumption at the subsistence level.

Analysis of the income differentiation of consumer behavior (tab. 2) shows that income growth outpaces the growth in consumption when we move from groups with lower income to groups with higher income.

The largest share in the expenditures of households in all the income groups falls on consumer spending. In general, for the period of 2003–2012 we can observe the

Table 2. Ratio of costs and available resources of households in the Russian Federation depending on the amount of available resources, 2012 (%)

|

Expenditure item |

All households |

Groups of households |

R/P 10% |

|||||||||

|

1st* |

2nd |

3rd |

4th |

5th |

6th |

7th |

8th |

9th |

10th* |

|||

|

Consumer expenditures |

67.9 |

78.7 |

78.0 |

77.1 |

75.8 |

74.2 |

74.0 |

72.1 |

71.4 |

67.8 |

57.9 |

8.7 |

|

Expenditures on the purchase of real estate |

4.1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.01 |

0.0 |

0.0 |

0.2 |

0.6 |

12.6 |

16580 |

|

Taxes |

5.9 |

8.1 |

8.1 |

8.1 |

7.8 |

7.4 |

7.2 |

6.8 |

6.4 |

6.1 |

3.5 |

5.1 |

|

Growth of financial assets |

0.4 |

4.4 |

5.2 |

5.6 |

6.2 |

7.7 |

7.1 |

8.3 |

8.1 |

5.6 |

-13.3 |

-36.1 |

|

of them: - the amount of savings accumulated |

10.3 |

5.1 |

6.0 |

6.8 |

7.7 |

9.4 |

9.3 |

10.8 |

11.5 |

12.0 |

11.4 |

26.5 |

|

- the amount of loans and savings used |

9.9 |

0.7 |

0.8 |

1.2 |

1.5 |

1.8 |

2.2 |

2.4 |

3.4 |

6.4 |

24.6 |

403.2 |

* Note: 1st group has the smallest incomes (1st decile), 10th group has the largest incomes (10th decile).

Calculated by the author with the use of: Microdata of sample surveys of household budgets. Rosstat. Available at: decreasing trend in the proportion of this expenditure item (from 77 to 68%). However, the lower the household income, the more money is spent on consumer needs.

The tax burden on the representatives of different deciles also varies. The amount of taxes paid by the rich is five times higher than that of poor households (24,614 rubles per year per household member against 4,812 rubles), but the share of taxes in the income of the poorest is 8%, whereas it does not exceed 3.5–6 percentage points in the 9th and 10th deciles. In general, the proportion of this expenditure item has not changed for the period of 2003–2012 (5.6 and 5.9%, respectively).

Significant disparities (the greatest degree of differentiation) are observed in the expenditures on the purchase of real estate and in savings. Only the representatives of the top (10th) decile are able to make substantial investments in real estate (12.6% of the income or 89,304 rubles per year per household member). And the highest degree of differentiation is observed for this very expenditure item: the expenditures of the most prosperous households on the purchase of real estate are in 16,580 times higher than those of the poorest households.

One of the reasons for this situation lies in the necessity of having a certain amount of “start-up” savings, which again varies depending on the level of household income (tab. 2, 3) . In the first decile 3,030 rubles per year is deposited as savings per household member (5% of income), whereas in the

Table 3. Costs on savings depending on the amount of disposable resources of households in the Russian Federation, 2012

|

Groups of households |

The amount of savings (savings increase) |

The amount of loans and savings spent |

Growth of financial assets |

|||

|

rub. per year per person |

% to resources available |

rub. per year per person |

% to resources available |

rub. per year per person |

% to resources available |

|

|

All |

23063.1 |

10.3 |

22177.5 |

9.9 |

885.7 |

0.4 |

|

1st |

3029.8 |

5.1 |

432.0 |

0.7 |

2597.8 |

4.4 |

|

2nd |

5098.7 |

6.0 |

671.8 |

0.8 |

4426.9 |

5.2 |

|

3rd |

7070.1 |

6.8 |

1204.5 |

1.2 |

5865.7 |

5.6 |

|

4th |

9474.8 |

7.7 |

1801.3 |

1.5 |

7673.4 |

6.2 |

|

5th |

13657.3 |

9.4 |

2548.8 |

1.8 |

11108.4 |

7.7 |

|

6th |

16013.1 |

9.3 |

3809.6 |

2.2 |

12203.4 |

7.1 |

|

7th |

22727.8 |

10.8 |

5165.7 |

2.4 |

17562.1 |

8.3 |

|

8th |

30623.5 |

11.5 |

9062.3 |

3.4 |

21561.2 |

8.1 |

|

9th |

42613.2 |

12.0 |

22872.9 |

6.4 |

19740.3 |

5.6 |

|

10th |

80322.7 |

11.4 |

174205.4 |

24.6 |

-93882.7 |

-13.3 |

Calculated by the author with the use of: Microdata of sample surveys of household budgets. Rosstat. Available at: tenth decile this figure is 80,323 rubles per year (11%), which is 26.5 times more and it indicates an extremely high level of savings differentiation, greatly exceeding the level of differences in disposable income (equal to 12 times).

On average in 2012 households indicated 10% of their income as savings (in 2003 – 4.4%).

Representatives of the most well-off group are also more active in using borrowed funds and previously accumulated savings – nearly a quarter of their income or 174,205 rubles per year per household member

(compared with 22,873 rubles (6%) in the 9th decile, and 432 rubles (1%) in the 1st decile).

If the savings increase characterizes the ability of households to implement savings, then the growth of financial assets is a general characteristic of people’s savings opportunities, because it helps to take into account the current processes of accumulation, and the use of previously accumulated money and newly obtained loans [25, p. 20]. One peculiarity is traced here – there is an increase in financial assets in all income groups, except for the 10th group.

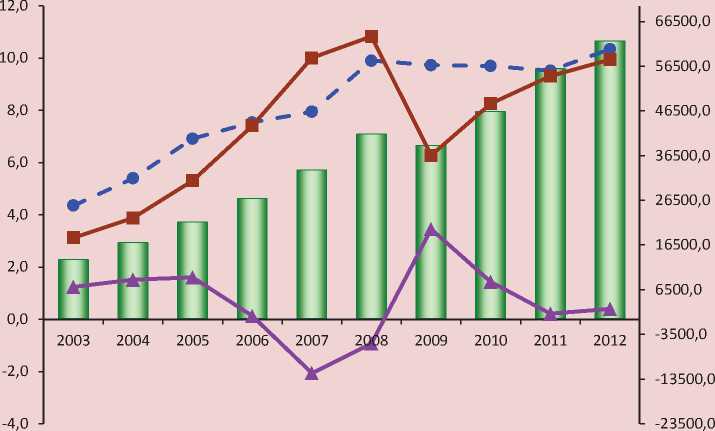

Dynamics of GDP, savings rate, dissavings rate and growth of financial assets of the RF population, 2003–2012

GDP, billion rub. (right scale)

— ^ Savings rate, %

—^^ Dissavings rate, %

Calculated by the author using the following sources: Microdata of sample surveys of household budgets. Rosstat. Available at: ; Gross domestic product. Annual data (in current prices). Rosstat. Available at: wcm/connect/rosstat_main/rosstat/ru/statistics/accounts/#

The amounts of savings and loans in the most well-off group exceed the accumulations made during the year, resulting in a decrease in financial assets of this group of households.

However, it would not be quite correct to say that they are characterized by dissaving behavior, because the amounts spent could be used for the purchase of real estate or jewelry, which they can regard as savings depending on the purposes of the household.

Therefore, the higher the level of household income, the more opportunities to make savings and dispose of other financial resources.

The figure presents the general dynamics of saving and dissaving rates and the growth of financial assets. In the period from 2003 to 2006, during which the Russian Federation witnessed economic growth and the growth of financial welfare of the population, there has been an increase in saving rates (from 4.4% in 2003 to 7.5% in 2006) and dissaving rates (from 3.1 to 7.4%, respectively).

In 2006–2008 dissavings rate (10–11%) exceeded savings rate (8–10%), which eventually led to an outflow of financial assets and the increase in borrowings in the expenditures of the population. This situation is probably related to the implementation of pent-up demand by households, which they formed during the period of stable economic growth. However, the crisis of 2008–2009 forced people to moderate their consumer desires, which resulted in a sharp reduction in the amount of lending resources and spending of previously accumulated savings. At the same time, citizens continued to accumulate money reserves “for a rainy day”, and savings rate remained at 9.7– 9.9%.

The fixation of savings rate (9–10%) that started in 2009, along with the increased use of borrowings and available savings by households (dissavings rate increased from 6.3% in 2009 to 9.9% in 2012), again reduced the growth of financial assets to a minimum (0.2–0.4%). Given the fact that these changes took place along with the aggravation of socioeconomic development problems in Russia, it is possible to speak about the decline of people’s trust in the actions of authorities in the sphere of savings and financial and credit policy, about the lack of adequate (reliable and sufficiently profitable) tools for placement of available funds and about the aspirations of the population to spend a significant share of available money resources.

It should be emphasized that the observed increase in the gap between the growth of savings and financial assets in the disposable resources of households means an increase in the public demand for credit resources and the increased use of previously accumulated funds to finance current expenditures.

Indicators of people’s savings activity differ significantly by decile groups (tab. 4) . The level of savings by years is steadily increasing as we move from one income group to another. We also observe the growth in annual values of this indicator for each income group.

Table 4. Dynamics of savings rate, dissavings rate and rates of growth of financial assets of the Russian population in terms of income groups in 2003–2012 (%)

|

Year |

All households |

Groups of households |

|||||||||

|

1st |

2nd |

3rd |

4th |

5th |

6th |

7th |

8th |

9th |

10th |

||

|

Savings rate, % |

|||||||||||

|

2003 |

4.4 |

2.2 |

2.4 |

2.6 |

2.9 |

3.2 |

3.7 |

3.7 |

4.5 |

4.7 |

6.0 |

|

2004 |

5.4 |

2.6 |

3.1 |

3.3 |

3.4 |

3.7 |

4.2 |

4.8 |

5.9 |

7.0 |

6.6 |

|

2005 |

6.9 |

2.3 |

3.0 |

3.3 |

4.0 |

4.7 |

5.3 |

5.9 |

6.5 |

7.2 |

10.3 |

|

2006 |

7.5 |

2.8 |

3.6 |

4.2 |

4.7 |

5.6 |

6.4 |

7.1 |

8.2 |

9.5 |

9.0 |

|

2007 |

7.9 |

3.3 |

4.3 |

5.1 |

5.6 |

6.9 |

7.3 |

7.9 |

8.8 |

10.0 |

8.5 |

|

2008 |

9.9 |

4.1 |

4.9 |

6.0 |

6.7 |

7.6 |

8.0 |

9.3 |

10.2 |

10.9 |

12.5 |

|

2009 |

9.7 |

4.0 |

5.2 |

6.1 |

6.9 |

7.9 |

8.7 |

9.8 |

10.4 |

11.8 |

11.3 |

|

2010 |

9.7 |

4.1 |

5.3 |

6.1 |

6.6 |

7.4 |

8.4 |

9.6 |

10.4 |

11.2 |

11.7 |

|

2011 |

9.5 |

4.5 |

5.5 |

6.4 |

6.9 |

7.9 |

8.8 |

9.5 |

10.4 |

11.5 |

10.6 |

|

2012 |

10.3 |

5.1 |

6.0 |

6.8 |

7.7 |

9.4 |

9.3 |

10.8 |

11.5 |

12.0 |

11.4 |

|

Dissavings rate, % |

|||||||||||

|

2003 |

3.1 |

2.1 |

1.5 |

1.3 |

1.4 |

1.5 |

1.6 |

1.5 |

1.6 |

2.1 |

7.2 |

|

2004 |

3.9 |

2.2 |

1.4 |

1.5 |

1.5 |

1.6 |

1.9 |

2.0 |

1.8 |

2.2 |

9.0 |

|

2005 |

5.3 |

1.1 |

1.2 |

1.2 |

1.3 |

1.7 |

2.0 |

2.4 |

2.2 |

3.1 |

13.0 |

|

2006 |

7.4 |

1.0 |

1.1 |

1.3 |

1.4 |

1.8 |

2.1 |

2.3 |

3.0 |

4.1 |

18.5 |

|

2007 |

10.0 |

0.9 |

1.2 |

1.2 |

1.5 |

1.8 |

2.5 |

2.9 |

3.2 |

4.3 |

25.2 |

|

2008 |

10.8 |

1.0 |

1.1 |

1.4 |

1.6 |

1.9 |

2.4 |

2.8 |

2.9 |

5.0 |

27.4 |

|

2009 |

6.3 |

1.1 |

0.9 |

1.0 |

1.2 |

1.5 |

1.8 |

2.1 |

2.4 |

3.5 |

16.7 |

|

2010 |

8.3 |

0.9 |

1.0 |

1.2 |

1.4 |

1.7 |

2.0 |

2.3 |

2.8 |

3.8 |

22.0 |

|

2011 |

9.3 |

0.8 |

1.1 |

1.2 |

1.6 |

1.8 |

2.1 |

2.7 |

3.1 |

5.0 |

23.8 |

|

2012 |

9.9 |

0.7 |

0.8 |

1.2 |

1.5 |

1.8 |

2.2 |

2.4 |

3.4 |

6.4 |

24.6 |

|

Rate of growth of financial assets, % |

|||||||||||

|

2003 |

1.2 |

0.2 |

0.9 |

1.3 |

1.5 |

1.8 |

2.1 |

2.1 |

2.9 |

2.6 |

-1.1 |

|

2004 |

1.5 |

0.4 |

1.6 |

1.8 |

1.9 |

2.1 |

2.3 |

2.8 |

4.1 |

4.8 |

-2.4 |

|

2005 |

1.6 |

1.3 |

1.8 |

2.1 |

2.7 |

3.0 |

3.3 |

3.5 |

4.3 |

4.1 |

-2.7 |

|

2006 |

0.1 |

1.7 |

2.5 |

2.9 |

3.3 |

3.8 |

4.2 |

4.9 |

5.3 |

5.4 |

-9.5 |

|

2007 |

-2.1 |

2.4 |

3.2 |

3.9 |

4.2 |

5.1 |

4.7 |

5.0 |

5.6 |

5.6 |

-16.7 |

|

2008 |

-0.9 |

3.1 |

3.8 |

4.6 |

5.1 |

5.7 |

5.6 |

6.5 |

7.3 |

5.8 |

-14.9 |

|

2009 |

3.5 |

3.0 |

4.3 |

5.1 |

5.6 |

6.4 |

6.9 |

7.7 |

8.0 |

8.3 |

-5.4 |

|

2010 |

1.4 |

3.2 |

4.3 |

4.9 |

5.3 |

5.7 |

6.4 |

7.4 |

7.6 |

7.4 |

-10.3 |

|

2011 |

0.2 |

3.7 |

4.4 |

5.2 |

5.3 |

6.1 |

6.8 |

6.8 |

7.2 |

6.6 |

-13.2 |

|

2012 |

0.4 |

4.4 |

5.2 |

5.6 |

6.2 |

7.7 |

7.1 |

8.3 |

8.1 |

5.6 |

-13.3 |

Calculated by the author using the following sources: Microdata of sample surveys of household budgets. Rosstat. Available at:

Dissavings rate among the representatives of the first seven deciles is practically the same; moreover, it remained relatively stable in 2003–2012. This can be explained by the limited financial resources of the households in these groups and by the lack of opportunities to increase excessively the amount of borrowed funds. The values of this indicator in the 8th and 9th deciles are slightly higher.

However, the largest amount of loans and previously accumulated savings is observed the group of the wealthiest households, and they are increasing from year to year. In general for 10 years the amount of attracted funds and savings spent by households in the tenth decile in absolute terms has increased by more than 9 times from 18,764 rubles per household member in 2003 to 174,205 rubles in 2012 (in comparable assessment), or from 7% of the resources available to 25%, respectively. As of 2012, this trend of use of financial resources more than twice exceeded the amount of savings accumulated.

Therefore, the households of the 1st – 9th deciles over the period of 2003–2012 are characterized by the increase in the rate of financial assets; as for the most well-off population group, it is characterized by its reduction. In other words, the people that have significant financial resources and make savings in the largest amounts prefer to spend them on consumer needs, rather than direct them to the investment process. At the same time, the increase in the amount of financial resources in other groups makes it impossible to cover the outflow of funds due to the similar behavior of the households of the 10th decile. Therefore, the overall growth rate of financial assets tends to zero.

Table 5. Distribution of household savings depending on the amount of available resources in 2003–2012 (%)

|

Groups of households |

Year |

|||||||||

|

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

|

All households |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

|

1st |

1.4 |

1.3 |

0.9 |

0.9 |

1.0 |

1.0 |

1.1 |

1.1 |

1.3 |

1.3 |

|

2nd |

2.2 |

2.2 |

1.6 |

1.8 |

1.9 |

1.8 |

2.1 |

2.1 |

2.2 |

2.2 |

|

3rd |

3.0 |

3.0 |

2.2 |

2.6 |

2.8 |

2.7 |

3.0 |

3.0 |

3.2 |

3.1 |

|

4th |

4.0 |

3.7 |

3.3 |

3.5 |

3.8 |

3.6 |

4.0 |

3.9 |

4.1 |

4.1 |

|

5th |

5.3 |

4.8 |

4.5 |

4.9 |

5.5 |

4.8 |

5.5 |

5.1 |

5.5 |

5.9 |

|

6th |

7.5 |

6.5 |

6.3 |

6.8 |

7.1 |

6.3 |

7.5 |

6.9 |

7.3 |

6.9 |

|

7th |

9.0 |

9.2 |

8.7 |

9.4 |

9.7 |

9.3 |

10.4 |

9.9 |

9.6 |

9.9 |

|

8th |

13.4 |

14.1 |

11.9 |

13.5 |

13.7 |

12.6 |

13.6 |

13.3 |

13.1 |

13.3 |

|

9th |

17.4 |

20.7 |

17.0 |

20.1 |

19.9 |

17.0 |

19.7 |

18.4 |

19.3 |

18.5 |

|

10th |

36.7 |

34.5 |

43.7 |

36.5 |

34.6 |

40.9 |

33.0 |

36.3 |

34.5 |

34.8 |

Calculated by the author using the following sources: Microdata of sample surveys of household budgets. Rosstat. Available at:

The structure of savings distribution by income groups, similar to the structure of income distribution, has not changed. According to the data for 2012, 10% of the richest households have more than one-third of the total amount of savings (35%), while 10% of the poorest population have slightly more than 1% (tab. 5) .

S.A. Shashnov, Ph.D., Associate at HSE, [25, p. 24] points out that such a high level of savings differentiation is a factor that will contribute to the preservation of a high level of people’s differentiation by income in the near future.

Summarizing the obtained results, it is worth noting that the methodology of sample surveys of household budgets used in the article allow us to assess not only the absolute levels of savings behavior, but also the degree of inequality in the distribution of savings in income groups. In addition, the conclusions are largely consistent with the main results of the work in earlier periods [7, 8, 15, 20, 25] and thus reflect the specifics of savings behavior of Russia’s population.

Again we emphasize that the level of income is an important factor in the differentiation of savings of the Russians; that is why only the members of the most well-off groups can accumulate savings in the amounts and forms that make it possible to use them for the purposes of economic development.

However, we should remember that the use of economic and statistical methods is limited by the incompleteness and delay of the official statistical data, and by the inability to monitor the subjective features and current changes in savings behavior. Have the form of savings changed? What incentives for savings prevail? What are people’s preferences when choosing how to dispose of available funds? What will the citizens do when the exchange rate of the national currency changes? And so on.

Ultimately, the choice of methods of analysis is determined by research objectives. Thus, in order to solve strategic issues relating to economic development and improvement of financial situation of the population, it is most appropriate to use methods based on statistics, which will help to assess the existing investment base of savings, to set target indicators for socio-economic policy and to make various forecasts. In the operational management it is recommended to use a comprehensive approach, involving the combination of economic-statistical and sociological methods for obtaining the most complete and reliable information about the phenomenon under consideration. It seems that such practice implemented by research community and public authorities will help to develop reasonable measures to address issues related to economic, fiscal and investment policy, standard of living and financial activity.

Список литературы On the methodological approaches to the study of saving behavior of the population

- The balance of money income and expenditures of the population of the Russian Federation. Available at: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/population/level/#

- National Accounts at a Glance: National Accounts at a Glance 2014. Household Savings Total. OECD. Available at: http://data.oecd. org/hha/household-savings.htm#indicator-table

- Microdata of sample surveys of household budgets. Rosstat. Available at: http://obdx.gks.ru/

- Gross domestic product. Annual data (in current prices). Rosstat. Available at: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/accounts/#

- Batrakova A.G. Sberezheniya domashnikh khozyaistv: sushchnost', gruppirovki i rol' v sovremennoi ekonomike . Den'gi i kredit , 2006, no. 11, pp. 66-72

- Belekhova G.V. Sotsial'no-demograficheskie osobennosti finansovogo povedeniya naseleniya . Problemy razvitiya territorii , 2015, no. 1 (75), pp. 100-115.

- Burlachkov V. Politika Banka Rossii: tendentsii i protivorechiya . Ekonomist , 2014, no. 12, pp. 21-26.

- Grigor'ev, L., Ivashchenko A. Mirovye disbalansy sberezhenii i investitsii . Voprosy ekonomiki , 2011, no. 6, pp. 4-19.

- Dement'eva I.N. Opyt primeneniya indeksnogo metoda v sotsiologicheskikh issledovaniyakh . Monitoring obshchestvennogo mneniya , 2014, no. 4 (122). Available at: http://elibrary.ru/download/25774667.pdf

- Den'gi dlya novoi ekonomiki . RIA Novosti . Available at: http://strategy2020.rian.ru/smi/20120131/366256259.html

- Efimova M.R., Abbas N.Yu. Investitsionnyi potentsial naseleniya Rossii: osnovnye aspekty statisticheskogo izucheniya . Voprosy statistiki , 2011, no. 1, pp. 21-30.

- Ivanov Yu.N., Khomenko T.A. Problemy i metody statistiki sberezheniya naseleniya v sootvetstvii s kontseptsiyami SNS . Ekonomicheskii zhurnal VShE , 1998, no. 4, pp. 508-515.

- Kashin Yu. O monitoringe sberegatel'nogo protsessa . Voprosy ekonomiki , 2003, no. 6, pp. 100-110.

- Kondrat'eva Z.A. Primenenie osnovnykh metodologicheskikh podkhodov k otsenke sberezhenii naseleniya i individual'nykh investitsii . Finansovaya analitika: problemy i resheniya , 2013, no.20 (158), pp. 31-40.

- Kostomarova A.V. Krizisnye tendentsii v sfere sberezhenii naseleniya v stranakh s razvitoi rynochnoi ekonomikoi i Rossii . Vestnik MGIMO-Universiteta , 2012, no. 4, pp. 237-240.

- Kurs rublya: strakhi i prognozy na budushchee: press-vypusk № 2755 . VTsIOM . Available at: http://wciom. ru/index.php?id=459&uid=115123

- Metodologicheskie polozheniya po statistike (vypusk 1, 2, 3, 4, 5) . Rosstat . Available at: http://www.gks.ru/bgd/free/B99_10/Main.htm

- Metodologiya statisticheskogo obsledovaniya naseleniya. Obsledovaniya domashnikh khozyaistv. Metodologiya obsledovaniya byudzhetov domashnikh khozyaistv . Rosstat . Available at: http://www.gks.ru/bgd/free/B99_10/IssWWW.exe/Stg/d020/i020460r.htm

- Nikolaenko S.A. Lichnye sberezheniya naseleniya . Ekonomicheskii zhurnal VShE , 1998, no. 4, pp. 500-507.

- Rossoshanskii A.I., Belekhova G.V. Blagosostoyanie naseleniya kak pokazatel' modernizatsionnogo potentsiala territorii . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2014, no. 5 (35), pp. 260-275.

- Rossoshanskii A.I. K voprosu o regional'noi differentsiatsii kachestva zhizni naseleniya . Problemy razvitiya territorii , 2015, no. 1 (75), pp. 88-99.

- Sberezheniya i investitsii: vkladyvaem v nedvizhimost': press-vypusk № 2750 . VTsIOM . Available at: http://wciom.ru/index.php?id=459&uid=115115 (accessed January 26, 2015)

- Gulin K.A., Ozornina S. V., Dement'eva I.N., Kozhina T. P. Severo-Zapad Rossii: tendentsii obshchestvennykh nastroenii 2005-2010 gg. . Tendentsii i problemy razvitiya regiona: nauchnye trudy: v 4 t. T. 3: Sotsial'nyi imperativ regional'nogo razvitiya: v 2 ch. Ch. II , Vologda: ISERT RAN, 2011. 662 p.

- Surinov A.E., Shashnov S.A. Ob osnovnykh tendentsiyakh v urovne zhizni i sberegatel'nom povedenii naseleniya Rossii . Ekonomicheskii zhurnal VShE , 2002, no. 3, pp. 324-342.

- Khamraev V. Eiforiya ostavila rossiyan . Kommersant.ru . Available at: http://www.kommersant.ru/doc/2655839

- Shabunova A.A., Belekhova G.V. Investitsionnoe budushchee sberezhenii naseleniya . Eko , 2014, no. 2, pp. 165-178.

- Shapovalov A. Domokhozyaistva uzhe vse kupili . Kommersant.ru . Available at: http://www.kommersant.ru/doc/2655843

- Shashnov S.A. O sberegatel'nom povedenii domashnikh khozyaistv v Rossii i problemakh ego statisticheskogo izucheniya . Available at: http://src-h.slav.hokudai.ac.jp/publictn/92/shashnov.pdf

- Shashnov S.A. Sberezheniya domashnikh khozyaistv i problemy ikh statisticheskogo izucheniya na mikrourovne . Voprosy statistiki , 2003, no. 1, pp. 13-25.

- Harvey R. Comparison of Household Saving Ratios: Euro Area/United States/Japan. Statistics Brief. OECD, 2004, no. 8. Available at: http://www.oecd.org/std/na/32023442.pdf

- Household saving. OCED Factbook 2013. Available at: DOI: 10.1787/factbook-2013-en

- OECD Factbook 2014. Economic, Environmental and Social Statistics. Household savings. OECD. Available at: http://www.oecd-ilibrary.org/docserver/download/3013081ec023.pdf

- Sauter A.M., Stockdale Ch., McIntyre D. The 10 Countries Where People Save the Most Money. Available at: http://www.foxbusiness.com/markets/2011/08/15/10-countries-where-people-save-most-money/

- The Various Measures of the Saving Rate and Their Interpretation. Statistics directorate OECD. OECD. Available at: www.oecd.org/dataoecd/10/34/1953416.doc