On the problems of Russia's way out of the economic crisis

Автор: Ivanter Viktor Viktorovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Continuing the theme of the previous issue

Статья в выпуске: 1 (13) т.4, 2011 года.

Бесплатный доступ

In the previous issue of our journal there was published an article by Jacques Sapir, the director of the Center of economic development models research of the School for Advanced Studies in the Social Sciences (Paris, France), with which he spoke at the permanent Russian-French Seminar on Monetary and Financial Problems of the Russian economy, held in Vologda in April 2010. The next meeting of the seminar held in June 2010 in Paris. The French part of the seminar participants, as before, was led by Jacques Sapir. The Russian team members worked under the guidance of Academician V.V. Ivanter, the Director of the Institute of Economic Forecasting of RAS. The abridged transcript of V.V. Ivanter’s speech at the opening and closing sessions of the seminar is published below. Are more low published, with V.V. Ivanters consent, with small reductions of the shorthand report of its performances at opening of a seminar and at final session.

Короткий адрес: https://sciup.org/147223227

IDR: 147223227 | УДК: 338.124.4(470)

Текст научной статьи On the problems of Russia's way out of the economic crisis

Oil production in Russia

The peak of oil production in Russia was reached in 1987 and was almost 570 million tons, or over 19% of world production, with an annual volume of drilling of 37.587million m/year. In order to maintain the oil production at current levels in Russia in the next two years 40.603 and 39.612 million m were drilled respectively. Volumes of drilling have been enormous in 1989. However sharp decline in oil production began – from 552.2 million tons to 302.9 million tons in 1996. The largest absolute drop in annual production was 62.6 million tons, or 13.6% in 1992. The average annual rate of decline of oil production for the period from 1989 to 1996 amounted to 31.2 million tons, despite the support of significant volume of drilling in the industry (an average of 22.5 million m/year). In the period from 1996 to 1999 oil production stabilized at a level of

302 – 307 million tons/year with the lowest average annual volume of drilling at 7.3 million m/year.

In the last decade in Russia, there was an increase in oil production with the stabilization in 2007 – 2009 at 488 – 494 million tons, accounting for 12-13% of world production. The dynamics of the rate of increase in the oil production exceeded the boldest preliminary forecasts. Particularly impressive was the significant rate of annual increase in the oil production in 2002, 2003 and 2004 – respectively 9.05, 11.00 and 8.89%, oil production with condensate amounted to 379.6; 421.4 and 458.8 million tons. This spike in oil production due to the favorable situation in world oil prices was achieved at the expense of intensification of oil production and increasing oil recovery from existing wells, as well as the development of new projects in the Timan-Pechora, East Siberia, the North Caspian Sea and Sakhalin.

With increasing volumes of oil produced in Russia for a long time (since 1994) the increase in oil reserves did not compensate its production. Only for 5 years (from 1994 to 1998) an the increase of industrial oil reserves, including gas condensate, provided the reimbursement of its production by 71.75%, i.e. unmet liquid hydrocarbon production, during this period amounted to about 436 million tons. Between 1999 and 2003 unmet liquid hydrocarbon production was 292 million tons. In subsequent years, this gap was growing: from 2004 to 2008 – more than 602 million tons. Over the fifteen-year period (from 1994 to 2008), the country lost more than 1.3 billion tons of industrial oil reserves. This volume is comparable to the 3.5 years period of oil production with 380 million tons/per year (the annual average for the period).

For the first time for such a long period the growth in oil reserves compensated its production. In 2008 – 2009 the dynamics of recovering industrial oil reserves improved and amounted to 12 and 126 million tons respectively. These indicators have been achieved through the exploration and additional exploration of new areas of oil production.

But despite the success of the past two years the quality of raw materials has worsened. The share of hard-to-extract reserves in Russia exceeded 55%. The share of reserves, the extent of production of which is more than 80%, exceeds 25% of reserves developed by oil companies and the share of reserves with more than 70% of watering is over 30%. From 1991 to 2009 in the structure of the recoverable reserves a number of small deposits increased by 40%, while the number of unique and large declined by more than 20%. Overall, 80% of the deposits on the state balance are classified as small.

There are a lot of causes of the disadvantaged status of raw materials base, they are well known. The are sharply reduced regional geological exploration, due to a general reduction of public funds for these purposes, and the lack of adequate motivation of oil and gas compa- nies – subsoil users, and weak state oversight for ensuring the rational use of mineral resources and the efficiency of mining, as well as the lack of authority for state regulation of subsoil use in the federal executive authorities responsible for public policy in the field of extraction of fossil fuels. In addition, the lack of transparency, corruption, high risks, in particular, with the possibility of revocation of licenses for mineral extraction from subsoil, reduces the investment attractiveness of the industry. With the abolition of fees for reproduction of mineral resources the volume of geological prospecting in the major oil-producing regions of Russia has fallen 1.5 – 1.8 times.

Negative trends in the oil industry and the slowdown, and in some cases an absolute reduction of oil production on the largest oil and gas production units began to appear in late 2005, and in 2006 – 2007 only the intensification of oil production in KhМАО-UGRA and the increase in production under the project “Sakhalin-1” managed to compensate the stagnation of oil production in Russia. In 2008 – 2009 there was an absolute reduction in oil production in traditional areas of oil production (tab. 1) . Only due to new oil and gas producing areas the decline of Russian oil was compensated. Development of new oil and gas fields in the provinces was hampered by the lack of transport infrastructure and the organizational and economic factors. The main increase in output was shown by: Krasnoyarsk Krai, the Republic of Sakha (Yakutia), the Far East, Sakhalin Island and the south of the Tyumen region.

Fundamental causes of the slowdown in oil production were the depletion of raw materials base in large parts of producing fields in the traditional oil-producing regions of Western Siberia. This includes key oil-producing regions: KhМАО, YANAO, Tomsk, Novosibirsk, Omsk and Tyumen oblasts. And of course, the chief among them for a long time is the Khanty-Mansiysk autonomous okrug – Ugra.

Table 1. The dynamics of volumes and structures of oil production in major regions of Russia for 2008 – 2009

|

Region |

Year of 2008 |

Year of 2009 |

Years of 2009/2008, % |

||

|

Mill. t |

% |

Mill. t |

% |

||

|

European part |

141.6 |

29.0 |

148.5 |

30.1 |

4.9 |

|

Ural |

43.3 |

8.9 |

45.3 |

9.2 |

4.7 |

|

Volga |

60 |

12.3 |

61.9 |

12.5 |

3.2 |

|

North Caucasus |

10.5 |

2.2 |

9.7 |

2.0 |

-7.6 |

|

Timan-Pechora |

27.8 |

5.7 |

31.6 |

6.4 |

13.7 |

|

Western Siberia |

332.5 |

68.1 |

322.8 |

65.3 |

-2.9 |

|

KhМАО |

276.7 |

56.7 |

270.4 |

54.7 |

-2.3 |

|

YANAO |

40.3 |

8.3 |

35.3 |

7.1 |

-12.4 |

|

Tomsk oblast |

10.5 |

2.2 |

10.6 |

2.1 |

1.0 |

|

Novosibirsk oblast |

2.1 |

0.4 |

2.1 |

0.4 |

0.0 |

|

Omsk oblast |

1.5 |

0.3 |

1.5 |

0.3 |

0.0 |

|

South of Tyumen oblast |

1.4 |

0.3 |

2.9 |

0.6 |

107.1 |

|

Eastern Siberia |

1.45 |

0.3 |

7.49 |

1.5 |

416.6 |

|

Krasnoyarsk Krai |

0.13 |

0.0 |

3.4 |

0.7 |

2515.4 |

|

Irkutsk oblast |

0.54 |

0.1 |

1.59 |

0.3 |

194.4 |

|

Republic of Sakha (Yakutia) |

0.78 |

0.2 |

2.5 |

0.5 |

220.5 |

|

Far East |

12.8 |

2.6 |

15.4 |

3.1 |

20.3 |

|

Sakhalin oblast |

12.8 |

2.6 |

15.4 |

3.1 |

20.3 |

|

Russia, total |

488.4 |

100.0 |

494.2 |

100.0 |

1.2 |

KhМАО-UGRA is the leading oil and gas producing region in the country

The Khanty-Mansiysk autonomous okrug – Ugra (KhМАО – UGRA) is the main oil producing region of the Russian Federation. Today KhМАО – UGRA is the donor region of Russia and leads to a number of key economic indicators (on January 01, 2010): first place for oil production 54.8% (tab. 2) and the second place for gas production – 4.5%; the first place in the production of electricity and industrial output, the second place in investment in fixed assets.

The history of deposits development in KhМАО was launched in May 1964. In the period of 1965 – 1973 volumes of hydrocarbon production in the county grew rapidly. 11 years later, in 1974, KhМАО achieved annual production exceeding 100 million tons/year, even after 3 years (in 1977) – more than 200 million tons/year, in 1980 – more than 300 million tons/year. The peak of oil production in the district was in 1985 – 360.8 million tons, or 63% of the nationwide annual production of hydrocarbons. During this period, maximum annual volume of drilling in the district was impressive: 1987 – 20.115 million m; 1988 – 20.881 million m; 1989 – 21.410 million m. But at such enormous volumes of drilling there was the recession in the oil production in KhМАО. Since 1989, there was a landslide decline in oil production until 1996. Decline stopped at the production level of 164.7 million tons or 45.65% from the production peak. For 8 years declining of oil production in KhМАО – UGRA was more than half of the previously reached maximum level. Production drilling against the maximum decreased 6.5 times – up to 3.299 million m in 1998.

Table 2. Share of KhМАО – UGRA in oil production in Russia, by years

|

Index |

Years |

|||||||||

|

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

|

|

Share of KhMAO – UGRA in oil production in Russia, % |

55.8 |

55.7 |

55.2 |

55.3 |

55.6 |

56.9 |

57.4 |

56.7 |

56.2 |

54.8 |

A sharp drop in oil production in KhМАО in 1990 was changed by its steady rise in the 2000-th, which is linked to an increase in investment, the favorable situation in world oil prices, the use of modern technologies for the extraction of hydrocarbons, as well as the introduction of major new fields, especially Priobsky.

In 2000 oil production grew more and totaled 180.5 million tons/year. Further, there was a revival of heat and power complex in KhМАО, i.e. a significant rerise in oil production, which in 2007 reached a peak in the region – 278.4 million tons/year. The volume of drilling more than doubled compared with the crisis in 1999.

Carrying out of a large complex of geological and technical measures for intensification of oil production, the use of intensive technolo- gies (including the “Western” ones in the form of limiting production “afterburning”) have led to a substantial increase in production rates of wells drilled in the operational fund of both liquid and oil. For example, if in 1999 the average oil production of wells in the region amounted to 10.4 tons per day, by 2005 – 2006 it had grown almost 1.5 times. At the same the output of new oil wells had doubled [6; p. 10].

Since 2008, in KhМАО there has been an accelerating decrease in oil production. Over the past two years, it was about 8 million tons. The fall of growth rate in oil production in 2008 was 0.61%, and in 2009 – already 2.27%.

-

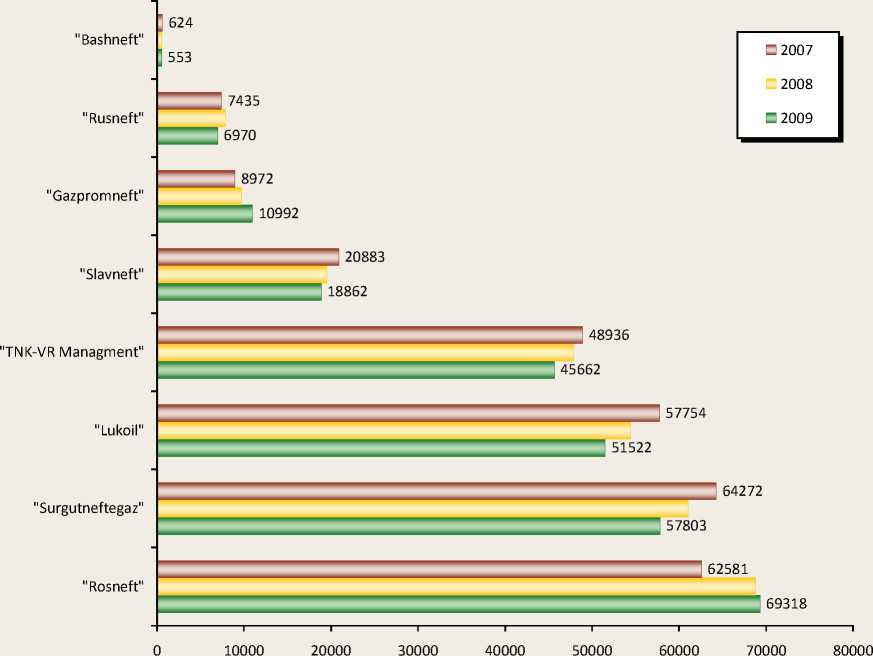

8 vertically integrated oil companies provide the main volume of oil production in KhМАО, they accounted for about 97% of the total oil production in the region (figure) . About 3% of

Oil production in the KhMAO – UGRA in the context of a vertically integrated oil companies, thousands of tons

the total oil is produced by independent producers, which are not members of the vertically integrated companies (VICs).

Only three of the major vertically integrated companies showed the positive trend for 2008: “Rosneft” – +6.246 million tons, “Gazpromneft” – +744 million tons and “Russneft”– +0.399 million tons, as for the rest of five vertically integrated companies, the oil production fell: “Lukoil” – 3.325 million tons, “Surgutneftegaz” – 3.202 million tons, “Slavneft” – 1.344 million tons, “TNK-VR Management” – 1.061 million tons, “Bashneft” – 0.056 million tons. As for independent natural resource users, main increase in oil production is achieved by “Calym Petroleum Development N.V.” (+2.072 million tons) [7].

In 2009 in comparison with 2008 the position of the major VICs in the region aggravated. A positive trend was shown only by “Gazpromneft” (+1.275 million tons) and “Rosneft” (+0.491 million tons). The production growth for these companies is not so significant, compared with 2008. As for the rest of vertically integrated companies the production even greater than in 2008, declined: “Surgutneftegaz” – 3.266 million tons, “Lukoil” – 2.907 million tons, “TNK-VR Management” – 2.213 million tons, “Russneft” –0.864 million tons, “Slavneft” – 0.678 million tons and “Bashneft” – 0.015 million tons.

During two crises years, the collapse in Ugra oil production increased. In terms of oil companies production decline is as follows: “Surgutneftegaz” lost on the basis of quantities 6.469 million tons or 10.07% of its production in 2007; “Lukoil” – 6.232 million tons or 10.79%, “TNK-VR Management” – 3.274 million tons or 6.69%; “Slavneft” – 2.021 million tons or 9.68%, “Russneft” – 0.465 million tons or 6.25%, and “Bashneft” – 0.071 million tons or 11.38%.

The main causes of reduced production growth of vertically integrated companies, leading production activity in the territory of KhМАО – UGRA, are as follows:

-

• impact of global financial crisis (volatility in world oil prices in the second half of 2008 – the first half of 2009);

-

• reduction of oil rates of new wells;

-

• reduction of the average well production of oil;

-

• increasing production watering;

-

• significant increase in the rate of decline of oil production in the rolling fund of production wells, which did not exist before.

Instability in global financial system forced the VICs to suspend activities for a variety of programs in order to accumulate funds. As a result, many low-profit projects and wells had to be conserved.

To further increase of oil production in KhМАО in the coming years, there are no any serious opportunities for oil companies. Almost all of them (except the opportunities to increase the volume of production drilling and the number of offshoot kickoff) were completely depleted during intense oil production “jump” [6, p. 11].

Impact of the global financial crisis on the economic performance of KhМАО – UGRA It is no secret that, despite all the declarations of the need to get off the “oil needle”, the Russian economy even tighter has taken to it over the past ten years. The figures speak for themselves. So, in 2003, oil and gas revenues accounted for only a quarter of the total mass of the federal revenue, in 2006 – 2008 its share rose to 50%, dropping only in 2009 to 43%, which was associated with a fall in world oil prices. Accordingly, “oil and gas” subjects of the Russian Federation continue to remain the main filling sources of the budget. The first among them, of course, is KhМАО, which provides one-seventh of the federal treasury income [1, p. 46].

For the past year in absolute terms the taxpayers of KhMAO transfered to the budget of the country 897.6 billion rubles in taxes, fees and other obligatory payments. But it is 35% less than in 2008 due to a significant reduction in severance tax revenues on hydrocarbon raw materials, Corporate Profits Tax.

Table 3. Industrial production indexes of the dynamics in KhМАО – UGRA by economic activity, %

|

Activities |

2007 to 2006 |

2008 to 2007 |

2009 to 2008 |

|

Production index |

102.4 |

101.2 |

98.6 |

|

Including: Mining operations |

101.4 |

100.2 |

97.7 |

|

Production and distribution of electricity, gas and water |

102.1 |

102.2 |

105.7 |

|

Manufacturing industries |

116.9 |

111.1 |

102.3 |

|

among them: Food products |

103.4 |

101.6 |

102.1 |

|

Processing of wood and wood production |

117.9 |

98.7 |

91.0 |

|

Publishing and printing |

106.4 |

100.0 |

97.1 |

|

Petroleum products |

100.8 |

102.7 |

98.8 |

|

Other non-metallic mineral products |

110.0 |

94.6 |

63.1 |

|

Finished metal products |

118.4 |

90.1 |

70.4 |

|

Machinery and equipment |

121.9 |

97.8 |

88.1 |

|

Electrical equipment |

117.8 |

116.1 |

106.5 |

In 2008 KhМАО – UGRA, as the donor region, provided 16.6% of tax revenues into the consolidated budget of the Russian Federation. The favorable external trade conditions for oil in the first half of 2008 contributed to this fact, these conditions had a positive impact on economic activity of oil and gas production, export-oriented enterprises. Maximum world price of crude oil “Urals” was fixed in the second quarter of 2008 at 143 USD per barrel. But in the second half of 2008 the situation changed and the level of world prices fell to record lows in December to 39 USD per barrel. Average world price for crude oil “Urals” for the year 2008 was 97.26 USD per barrel, an increase of 36.2% compared to 2007 allowed the state budget revenues increase in KhМАО. Unfavorable global conjuncture of the second half of the year influenced the oil production in Ugra. Compared with 2007, the region produced 1.7 million tons less.

In 2009, there was a sharp decline in production – by 6.3 million tons. This is largely caused by factors of instability in world oil prices and uncertainty in equity markets. Since the average price of crude oil “Urals” in 2009 accounted for 61.67 USD per barrel.

As a result, in 2009, produced goods were dispatched and works (services) for the full range of organizations - manufacturers of industrial products were performed in the amount of 1,826 billion rubles.

The overall decline in value terms of dispatched goods of own production and largely 1.3 times, in the form of “mining”, taking a dominant position in the industrial structure of Ugra (86.8%). The index of industrial production in 2009 compared to 2008 amounted to 98.6%. Production decreased in the sector “mining” by 2.3%. Development in the sector “manufacturing activities” is characterized by positive dynamics (an increase of 2.3%) and in the sector “production and distribution of electricity, gas and water” (an increase of 5.7%) (tab. 3 ).

Social and economic development of KhМАО for the year 2009 can be assessed as satisfactory, with stable dynamics of the basic indicators showing the preservation of the results achieved in 2008. However, in the second half of the year there is a negative impact of the global financial crisis too. As a result the decline continued in the exploration, investment and construction. During of 2009, fixed asset investment fell by 14.6% according to assessment compared to the same period of last year. The greatest fall in investment was in the construction. During 2009 the volume of work on activity “Construction” decreased by 22.1% to the same period in 2008. In 2009 343.6 thousand square meters of total area of apartments were introduced or 100.1% to the same period in 2008. Retail trade turnover in comparison with 2008 was 81.8%, the volume of paid services was 99.1% with reduced rate of the dynamics of real disposable incomes and real wages, which in the end of the reporting period were 95.0% and 93.8% respectively. The index of industrial production amounted to 98.4% by 2008. By economic activities the dynamics of industrial production is characterized by the following data: mining operations – 98.1%, manufacturing industry – 98.7%, production and distribution of electricity, gas and water – 102.9%. Agricultural output amounted to 101% [7].

The main reason for reducing the numbers of industrial production is the single-industry structure of the region’s economy, tied to world prices for hydrocarbons.

Conclusion

Russian oil industry is heavily dependent on the situation in KhМАО. To date, KhМАО – UGRA, thanks to the powerful oil and gas industry is a strategic region, the guarantor of economic reforms and stable development of the Russian Federation. The crisis in the oil industry region will inevitably lead to crisis of the entire Russian economy. Any error in the strategy development of mineral resources and production strategies in Ugra will inevitably impact on the economy.

In the oil and gas complex of Ugra in recent years there have been some negative trends:

-

1. Increasing degree of dependence of VICs on exports and, consequently, on the situation in world oil prices.

-

2. The deterioration of the resource base, both in quantity (reduction of stockpiles) and quality (increased percentage of hard-to-extract stocks) related to insufficient exploration work.

-

3. Increasing degree of depreciation of fixed assets in the oil industry.

-

4. Lack of investment in oil and gas sector of the economy.

-

5. Increased proportion of idle wells.

By current trends the gradual decline of oil production from 267 million tons in 2010 to 261 million tons can be predicted.

To smooth the existing negative phenomena in oil production and conservation achievements in KhМАО it is necessary assume immediate measures. Among the priorities are the following:

-

1. Diversify the regional economy through increased processing and deep processing of hydrocarbon raw materials.

-

2. Reduce production costs by modernizing the production and introduction of new technologies.

-

3. Enhance oil recovery in older fields, by applying the latest technologies.

-

4. Increase investment in the development of high technologies in discovering, developing and using alternative sources of energy and other resources as well.

-

5. Adjust legislation in the sphere of subsoil use and taxation (the new law “On Mineral Resources”);

-

6. Actively produce geological exploration in search of new deposits, attracting not only the means of Russian companies, but investment from abroad.

The continued dependence of the russian economy on oil and as a consequence of global oil prices could lead to crises. So low oil prices in 1998 resulted to default in the Russian economy. But in some aspects crisis situations are useful for “healing” of the economy, they are the impetus for the growth and modernization. It was after the 1998 crisis, the stagnation of the economy falters, a dynamic and progressive development began.

The global financial crisis of 2008 showed preserved Russia’s economic dependence on oil exports and the global environment. This fact threatens the economic stability and independence of the Russian Federation.

In this situation, Khanty-Мansiysk autonomus okrug – Ugra, having a good infrastructure, financial, communications and other resources can become a region for implementation of pilot projects to diversify and modernize the Russian Federation, as a result provide a post-crisis economic growth in Russia, to bring it to a new level away from the proverbial “needle oil”.