Perceived usefulness, perceived trust and ease of use in adoption of online banking services

Автор: Reepu, Rakhi Arora

Журнал: Science, Education and Innovations in the Context of Modern Problems @imcra

Статья в выпуске: 3 vol.5, 2022 года.

Бесплатный доступ

All internet transactions, including online banking, need trust before they can be adopted and used. The trustworthiness of internet banking was examined by conducting a survey of commercial banks. This research made use of an expanded version of the Technology Acceptance Model (TAM). Analysis of the data was done using Partial Least Squares (PLS) based on the results of 200 customer surveys. People are more likely to use internet banking if they think it's helpful than if they think it's easy to use, a new study has shown. The influence of perceived usefulness on the desire to utilize online banking services is also partly mediated by the perception of trust. Adoption the results of this research to help policymakers and financial institutions improve the use of online banking services.

Perceived usefulness, perceived Trust, Ease of use, Online banking services

Короткий адрес: https://sciup.org/16010201

IDR: 16010201 | DOI: 10.56334/sei/5.3.32

Текст научной статьи Perceived usefulness, perceived trust and ease of use in adoption of online banking services

Companies' interactions with consumers are changing fundamentally as a result of the prevalence and fast advancement of technology-based systems, particularly those connected to the internet. Due to an increasingly complex and competitive financial services industry, banks have had to come up with new ways of attracting clients as well as improving customer perception. It is common for banks to use Internet banking to provide their clients with a wide range of online banking options that are easier to use. Customer satisfaction and customer retention are becoming more important in e-banking success. The adoption of Internet Banking by customers is more important than the services of sellers in terms of its spread. Although client acceptance is a significant factor in influencing the pace of change in the financial industry, empirical investigations on what is holding customers back from accepting Internet banking have been sparse. There is a lack of information on how consumers perceive and assess services given through electronic means. Furthermore, recent studies have emphasized the need of further study into how customers evaluate the quality and satisfaction of eservices. Despite the fact that Internet banking has developed tremendously, there is not enough proof that people really use it. Most consumers who try out online banking services fail to stick with them, according to a recent study. Internet banking, according to another author, isn't living up to the expectations. As a result of high-profile examples involving large security breaches, people may have been more wary about using online banking.

The TAM is the most often used model to describe how new technologies are accepted by their users. To better understand how people accept new technology, researchers frequently turn to the Technology Acceptance Model (TAM), in which actual behavior (system use) is influenced by factors like perceived usefulness (PU) and perceived ease of use (PEU), all of which have an impact on how people approach using new technology. Our view is that the original TAM is insufficient for evaluating Internet baking’s adoption since the technology employed and the transaction environment are distinct from traditional IT and the usual business environment, respectively. It is crucial for people to understand the advantages and disadvantages of using Internet banking before deciding to utilize it.

“The following research hypotheses were examined in this study based on the above mentioned relationships of impact among the researched constructs”:

H1: “Usefulness will be positively correlated with ease of use”.

H2: “Bank customers are more likely to accept and utilize online banking services if they perceive them to be easy to use”.

H3: “Perceived usefulness will positively influence perceived trust in online banking services”.

Perceived Usefulness

Here, perceived usefulness is defined as the extent to which a person feels that utilizing a given system will improve their work performance. Perceived usefulness measures how much a user values a piece of software or a piece of hardware relationship of performance.

Perceived Ease of Use

In contrast, "the degree to which a person feels that utilizing a given system would be devoid of effort," is what we mean by "perceived ease of use." 'Ease' is defined as 'freedom from hardship or substantial effort.' It's up to the individual to decide how much effort he or she is willing to put into different projects (Radner and Rothschild, 1975). If all else is equal, a user will be more inclined to adopt an app that they view as being simpler to use.

Perceived Trust

The e-commerce environment was previously thought to be more unpredictable and riskier. As a consequence, trust is essential to the growth of e-commerce. Internet banking accounts are rife with risks for customers due to the fact that there is no physical connection between the parties involved in a transaction and the security strategy and information system given by the bank operator can only safeguard the account to a limited degree. Internet banking transactions are distinct from those made at a brick-and-mortar bank. In the event of security problems, users' rights and interests will be jeopardized while transferring sensitive or private data over the Internet. As a consequence, customers will be reluctant to utilize online banking services because they lack confidence in it. Internet banking providers must work to alleviate users' worries about the security of Internet banking, establish user confidence and trust, and further enhance their desire to utilize Internet banking. Prior research on Internet banking listed trust as one of the criteria that influenced consumers' adoption of the service. People who have a greater level of confidence in Internet banking are more likely to utilize Internet banking services. To put it another way, financial institutions may influence customer behavior by convincing them that online banking is secure.

REVIEW OF LITERATURE

Carranza et. al. (2021) Innovative business strategies centered on customer value co-creation are now possible because to the rapid advancement of information and communication technology. Banks are particularly vulnerable to this kind of problem. Competitive advantages may be gained via the use of electronic banking. Electronic banking has struggled to gain widespread acceptance among the general public. TAM is a critical tool for understanding how consumers will respond to a new technology when it is presented to them as an option. “The TAM model is used to analyze the elements that encourage bank customers to use e-banking to facilitate their banking services and promote the process of cocreation of value. Authors explore five important components of technology adoption model to better understand how consumers use e-banking services.” Customers' adoption of e-banking is evaluated using a partial least squares structural equation modeling (PLS-SEM) study. Rawal et. al (2021), Poongodi M et. al(2022), Poongodi M et. al (2021), Dhiman P et.al (2022), Sahoo S.K et.al (2022), K.A et. al(2022) , Dhanraj R.K et. al (2020), Poongodi M et. al (2019), Poongodi M et. al (2020), M. M. Kamruzzaman et. al (2014), M. M. Kamruzzaman et. al (2021), Md Selim Hossain et. al (2019), Mingju Chen et. al (2019)

Ashish Kumar (2020) Mobile banking has emerged as a significant channel for completing monetary transactions. In a growing nation like India, it has a lot of promise. “Our research examines the key factors that influence the adoption intention of Indian clients of mobile banking and presents a complete framework that extends the existing technological acceptance model (TAM).” Four customer-oriented components were also assessed in addition to the two TAM constructs. A survey of 203 potential future customers of mobile banking services helped validate the conceptual model practically. The antecedents' impact on mobile banking adoption intention was studied using the structural equation modeling (SEM) method. “With the help of TAM's constructs, namely usefulness and simplicity of use, together with all other key behavioral elements, namely subjective norms and trust and self-efficacy”, consumers' propensity to use mobile banking is statistically significantly higher. Banking and mobile service providers may utilize the study's scientific base to assist them develop their marketing strategy.

Siti Ali et al. (2020) Organizations are now able to run their operations more effectively because to the advancement and creation of technology, particularly in the area of internet banking. Online banking has been available in Malaysia from the year 2000. Users in Malaysia are still wary of internet banking because of the problems with trust they perceive. “The purpose of this research is to examine the influence of perceived ease of use and trust on the intention to utilize online banking among municipal council workers in Malaysia. When conducting this study, we employed the TAM framework.

Using a self-administered questionnaire, 265 internet banking customers in a Malaysian Municipal Council were surveyed. Pearson correlation and multiple regression were used to explore the link between perceived ease of use and trust toward the intention to utilize online banking”. The results demonstrated a substantial connection between the intention to utilize online banking and the perception of ease of use and trust. When it comes to developing online banking marketing strategies, the findings were especially useful for financial planners and policymakers.

Yaseen et. al. (2018) Customers of the Jordanian commercial banks are the focus of this study, which aims to identify the most important variables impacting their acceptance and usage of e-banking services. The unified theory of acceptance and application of technology model is adapted and modified in this work. The purpose to employ e-banking services has been clarified. Behavior intention variation was explained by 0.887 percent and e-banking service usage intention variance by 0.516 percent, respectively, in the adjusted model. EE, social influence, and perceived e-banking service quality have been proven to be good indicators. Hedonic motivation and performance expectations are not major determinants of success in the workplace. Age, on the other hand, was the only factor that had a substantial impact on any of the three predictors. A better knowledge of the elements that influence the usage of e-banking services is one of the key contributions of this research. Perceived e-banking quality is a novel variable in this study. As a result, the suggested model has a greater ability to explain than earlier studies.

METHODOLOGY

This study employed a quantitative research technique as its design. Customers of Jordanian Banks were among the participants. Random sampling was used to choose the clients (N=200) for the research. A minimum of 100 samples are required for Structural Equation Modeling (SEM) analysis. A minimum sample size of 30 to 100 instances is recommended when utilizing smart PLS path modeling. In other words, 200 responses are deemed adequate.

There were 58.6 percent male respondents, 43.40 percent between 18 and 26 years of age, and majority of them had a bachelor's degree, according to the demographic data shown in Table 1. More than half of those surveyed had been using the Internet for more than five years.

Respondents' answers to the survey questions show that they have a high level of trust and confidence in the company. Additionally, it was discovered that every participant claimed to have a bank account. However, the data revealed that just 67.70 percent of individuals surveyed utilized internet banking.

TABLE 1: Respondents' demographic data

Gender of the respondents

|

Category |

Frequency |

Percentage |

|

Male |

117 |

58.5 |

|

Female |

82 |

41 |

|

Missing Values |

1 |

0.5 |

|

Total |

200 |

100 |

Age of the respondents

|

Category |

Frequency |

Percentage |

|

18-26 Years |

87 |

43.5 |

|

27-35 Years |

82 |

41.0 |

|

36-50 Years |

25 |

12.5 |

|

> 50 Years |

6 |

3.0 |

|

Total |

200 |

100 |

Education of the respondents

|

Category |

Frequency |

Percentage |

|

Secondary and less |

2 |

1.0 |

|

Diploma |

14 |

7.0 |

|

BSc. |

87 |

43.5 |

|

MCs |

79 |

39.5 |

|

PhD |

14 |

7.0 |

|

Total |

200 |

100 |

Internet usage of the respondents

|

Category |

Frequency |

Percentage |

|

None |

3 |

1.5 |

|

< 1 Year |

14 |

7.0 |

|

1-5 Year |

65 |

32.5 |

|

6-10 Year |

75 |

37.5 |

|

> 10 Years |

40 |

20.0 |

|

Missing Values |

1 |

0.5 |

|

Total |

200 |

100 |

Bank accounts of the respondent

|

Category |

Frequency |

Percentage |

|

Yes |

200 |

100 |

|

No |

0 |

0 |

|

Total |

200 |

100 |

Internet banking use of the respondents

|

Category |

Frequency |

Percentage |

|

Yes |

65 |

32.5 |

|

No |

135 |

67.5 |

|

Total |

200 |

100 |

Descriptive Statistics

A total of 14 questions were asked of the participants. Descriptive statistics were used to examine their answers to the 14 questions on the questionnaire, including the mean values and standard deviations. Whereas the mean value is used to describe the data's central tendency, the standard deviation is used to describe the data's spread or variability. Respondents' favorable replies to the items in Table 2 are shown by the descriptive statistics derived from a quantitative examination of the data. The standard deviation (SD) was found to be in the range of 0.886 to 1.122, which indicates that there is a restricted range of variation around the mean. There was a significant positive correlation between the mean scores obtained from all of the components that made up PEOU 1 and PEOU 3: 3.35 for PEOU 1 and 4.06 for PEOU 3.

Measurement and Structural Model

All four constructs, ITU, PEOU, PT, and PU, have parameter estimates and statistical data that suggest they are valid measurements of their corresponding constructs. As indicated in Table 3, the measurement model's overall findings are reliable, convergent valid, and discriminately valid. ITU2's indication had the greatest reliability (0.967), There was no correlation between the dependability of PEOU2 and PT1's indicators, which were both at 0.873. While Intention to Use had the highest allowed AVE, PEOU had the lowest AVE (0.905). All of these figures were found to be within the allowed range of their convergent validity. Composite reliability was used as the criteria for internal consistency (CR) in this study to determine how well concept indicators correlated with a latent variable under inquiry or measurement. Research has shown that the CR value should be more than 0.70. In this study, all of the studied constructs had CR values greater than the suggested threshold. There was (0.966) intention to use and (0.929) perceived trust.

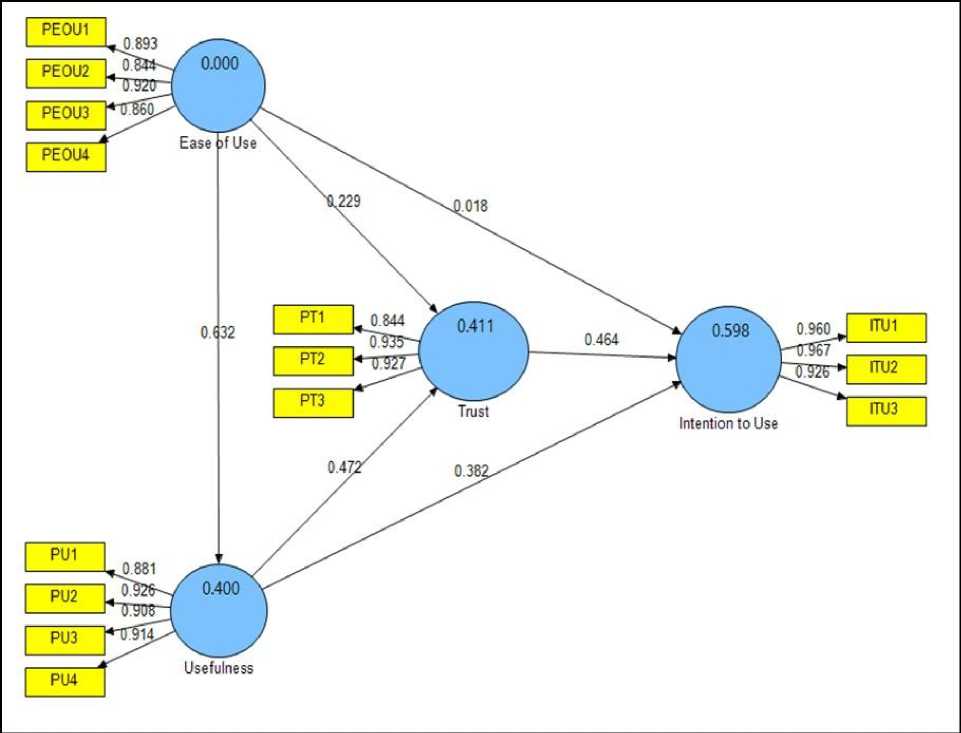

We did a route analysis in order to investigate the six research hypotheses or the study's direct impact. Figure 1 and Table 4 show that R2 was found to be 0.411, as expected. Around 41.1 percent of the difference in perceived trust may be explained by PEOU and PU. PEOU and PT were also shown to be associated with each other in the study (b = 0.229, t-value=2.486) as well as PE and PT in the control group (b = 0.472, t-value=5.845), supporting H1 and H2, respectively. R2 was 0.400, which suggests that PEOU accounts for 40 per cent of the variance in the construct of PU. Thus, PEOU was shown to be associated with PU in this way as well (p = 9.542, F(1, 9) = 0.632). The findings of this investigation, therefore, corroborate the hypothesis of H3. The ITU construct's R2 score came out to be 0.598. This shows that PEOU, PU, and PT account for 59 per cent of the variation in ITU. To put it another way, there was an association between PU and ITU (b = 0.382) and PT (b = 0.464) that was statistically significant. Despite this, researchers discovered no connection between the PEOU and ITU. The study's findings showed that PT was the component most closely associated with ITU. As the second most important predictor of ITU, PU came in second. According to this, the greater the participants' or users' ITU banking services are, the more PT they have.

As a result, we wanted to see whether there was a substantial correlation between a mediator variable and the independent variable. In other words, “it was interested in the mediator's role in mediating the direct effect of the independent variable on the dependent variable. It was shown that PT solely mediates the association between PU and ITU with (b=0.219, t-value=5.435) according to the findings of this test”. PEOU had no direct impact on the situation. In any case, PT was able to make a difference. A complete or partial mediation was also assessed using the approach advocated by Baron and Kenny (1986). A partial mediatory relationship was found between the PU and ITU according to the findings.

TABLE 2: ITEM DETAILED STATS

|

Construct |

Items |

Mean |

Std. Deviation |

Order |

|

Perceived Usefulness (PU) |

1 |

3.87 |

1.038 |

4 |

|

2 |

4.05 |

0.937 |

1 |

|

|

3 |

4.04 |

0.972 |

2 |

|

|

Perceived Ease of Use (PEOU) |

1 |

4.08 |

0.915 |

1 |

|

2 |

3.92 |

0.962 |

4 |

|

|

3 |

4.08 |

0.886 |

2 |

|

|

Perceived Trust (PT) |

1 |

3.64 |

0.922 |

1 |

|

2 |

3.37 |

1.032 |

3 |

|

|

3 |

3.46 |

0.996 |

2 |

|

|

Intention to Use (ITU) |

1 |

3.75 |

1.086 |

2 |

|

2 |

3.72 |

1.124 |

3 |

|

|

3 |

3.97 |

1.072 |

1 |

TABLE 3: RESULTS

|

Model construct |

Measurement item |

Loading |

CRa |

Cronbach’s alpha |

AVEb |

|

Perceived Usefulness (PU) |

1 |

0.962 |

0.959 |

0.9465 |

0.902 |

|

2 |

0.965 |

||||

|

3 |

0.928 |

||||

|

Perceived Ease of Use (PEOU) |

1 |

0.895 |

0.925 |

0.9038 |

0.747 |

|

2 |

0.846 |

||||

|

3 |

0.922 |

||||

|

Perceived Trust (PT) |

1 |

0.848 |

0.939 |

0.8875 |

0.836 |

|

2 |

0.937 |

||||

|

3 |

0.929 |

|

Intention to Use (ITU) |

1 |

0.883 |

0.967 |

0.9265 |

0.846 |

|

2 |

0.928 |

||||

|

3 |

0.906 |

TABLE 4: Inquiring into the results of hypothesized direct effects of the variables on the outcomes.

|

Hypothesis |

Relationship |

Coefficient |

t-value |

Result |

|

H1 |

PEOU PU |

0.035 |

0.245 |

Not sig. |

|

H2 |

PEOU ITU |

0.257 |

2.475 |

Sig. |

|

H3 |

PEOU PT |

0.650 |

9.521 |

Sig. |

FIGURE 1: MEASUREMENT MODEL

CONCLUSION

Perceived ease of use (PEOU) and perceived usefulness (PU) were examined in this research in an effort to better understand their confidence in and usage of online banking services. To summaries the demographic features of the respondents, with the help of the responses' means, frequencies, and standard deviations, we ran a generic descriptive analysis. SmartPLS 2 software was used to perform a Partial Least Squares (PLS) analysis on the collected data, which included measurements and a structural model for assessing the study hypotheses. Online banking PT is influenced by both PEOU and PU as independent factors, according to findings of this research. “It also looked at the function of PEOU, PU and PT in the prediction of online banking intention among clients of commercial banks in the city of Irbid, which is Jordan's second-largest”. The findings of this research show that trust has a significant influence in boosting the level of PEOU among individuals who use online banking. It was also revealed that PEOU could not accurately forecast willingness to embrace and use internet banking. It was determined that PT served a role in mediating the conflict that existed between PU and ITU. This shows how much of PU's influence on ITU PT has adopted or taken. In order to increase Jordanians' use of online banking services, the findings presented in this research may be useful to policymakers, banking sectors, and financial practitioners.