Problems and prospects of social sphere financing in Russia

Автор: Styrov Maksim Mikhailovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Young researchers

Статья в выпуске: 5 (29) т.6, 2013 года.

Бесплатный доступ

The article contains an overview of such main trends in the financial support of Russia's social sphere, as growth in funding, priority increase of pension provision, maintenance of the priority role of centralized sources and evening-out the inter-regional inequalities. The article presents a scenario forecast of the social systems funding up to 2020, according to which the solutions of the main tasks of the coming years, which include adaptation to demographic changes and the elimination of disproportions in remuneration, will require joint efforts of the government, business, citizens and employees.

Budget, health care, culture, education, region, north, social protection, social security, social expenditure, finance

Короткий адрес: https://sciup.org/147223508

IDR: 147223508 | УДК: 332.14+336.53

Текст научной статьи Problems and prospects of social sphere financing in Russia

Currently both the authorities and society start to realize that, a healthy spiritual, moral, social and physical condition of a person rather than abstract indicators of economic and technological development of the state should serve as an objective of and criterion for the correctness of all the decisions made.

Moreover, in the course of active discussions on the directions and ways of the country’s modernization, it became clear that the opportunities for moving toward a better society lie in the first place in the labour and creative potential of man rather than in the quantitative growth of economy. Academician O.T. Bogomolov expresses this thought as follows: “Intellectual, spiritual culture of the nation today, as never before, is becoming a major factor in the socio-economic progress. Modernization is impossible without sufficient cultural level of the population”1.

In this connection, Russia found the issues of social problems very significant and acute, although they had been always present, but they became especially relevant in the period of market reforms at the end of the 20th century: the critical situation concerning the family and childhood, demographic problems, poor health and low life expectancy, significant inconsistencies in material prosperity, decline in general culture, raging crime, dependency and consumerism, all kinds of addiction: alcohol, drug, tobacco, telecommunications, gambling, etc. These obstacles are now seen as a major threat to development and national security.

However, we should emphasize once again that well-being of man should not be considered only as a tool of economic growth or maintaining the country’s geopolitical importance, but it gets its real evaluation through the prism of the meaning of life of every individual. The Patriarch of Moscow and all Russia Kirill points out: “The countries and peoples that denied the importance of spiritual life, have disappeared from the historical scene. That is why, speaking about the economy and growth of well-being, it is necessary to remember their higher purpose, which consists in serving as the material basis for the spiritual growth of an individual, in serving the common good – material and spiritual, not hindering, but promoting the salvation of man”2. And not only public figures, but also economic scientists agree with that statement. “Life is valuable not because people can produce more and more material goods and services. Human needs go far beyond the economic framework, they are increasingly dominated by spiritual, aesthetic values”, says, for example, RAS Adviser N.M. Rimashevskaya3.

Proceeding from these positions, the observed increase in the attention to the social sphere4 becomes clear, because the quality of life of every person to a great extent depends on its orientation and productivity: the education system provides the citizen’s entry in society and preparation for employment; health care supports his/her normal physical condition; culture is to contribute to the spiritual and ethical development of a personality, to maintain the integrity of society and succession of generations; social protection ensures the stability of people’s material welfare in different periods of their life and in different situations.

In turn, a key condition for the efficiency of functioning of these systems is their financial support, because finance is a monetary expression of actual economic processes and an effective tool of management. The financing of the social sphere can be considered as an important indicator, a kind of “touchstone” of inner strength and health of society. In a sense, it characterizes the attitude of authorities, as well as the majority of country’s inhabitants towards their history, their present and future.

World economic history has a lot of different models of social sphere funding; almost all of them are known in Russia. In pre-revolutionary time it was an orientation toward independence, mutual assistance and patronage at a small amount of centralized financing. Then – the construction of the Soviet “welfare state” with the best possible support of the needs of citizens at the expense of the state budget. In the years of market reforms in the end of the 20th century it was the sharp reduction of social programmes due to economic slowdown and the revision of ideological objectives, when social stability was maintained mostly by inertia, existing traditions and enthusiasm of employees. However, to the threshold of the third millennium, negative consequences of ignoring the social sphere reached a critical level, therefore, since 2000, there has been a gradual return to acceptable standards of social security, and currently, as already noted in connection with wide discussions on the country’s development strategy, the search for ways of improving the society has become a priority task.

All of the above leads to the necessity of studying the state and main trends in the financing of Russia’s social sphere at the modern stage of development, and also in the forecasting of the possible directions of its improvement.

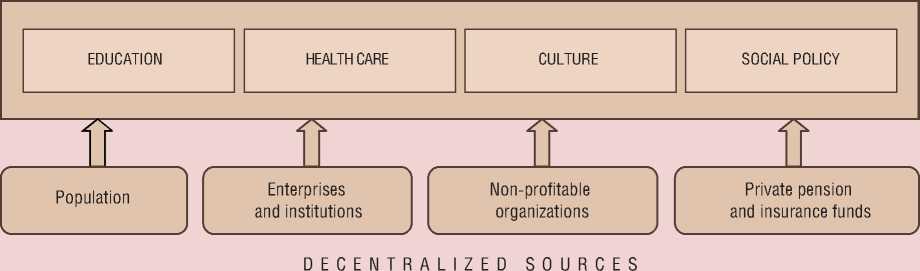

Sources of the social sphere financing. Sources of the social sphere financing are divided into centralized and decentralized (fig. 1) . The centralized sources are funds that are at the disposal of the state and local governments, they function according to the rules obligatory for the whole territory of the country and for all its economic entities, and they are formed primarily at the expense of tax revenue and social insurance contributions. These include the federal budget, regional budgets, local budgets and state extra-budgetary funds – the pension fund, social insurance fund and obligatory medical insurance fund. Centralized sources play a leading role in the financing of social expenditures, providing over 80% of their total volume.

The main element of decentralized sources, which accounts for about 2/3 of their total amount, consists in citizens’ expenditures on paid services in education, health and culture. Enterprises and institutions are also involved in private financing of social sphere in the form of direct payment for education, medical care, voluntary medical insurance, leisure and recreation of their employees and members of their families, co-financing of temporary disablement allowances and financial aid in difficult situations. Non-profit organizations (both domestic and foreign), which include charitable foundations, public and religious associations, professional unions, etc., provide financial support to the social sphere in the form of gratuitous payments. Private pension funds and insurance companies provide citizens with the opportunity of voluntary insurance in case of unavoidable or unforeseeable hardships. Unfortunately, the information about decentralized sources, apart from the funds of the population, is given in the open statistics not fully and is, therefore, not included in the analysis.

It is obvious that besides the statistically registered cash flows, in reality there are informal payments for services and numerous transfers between the groups of people of

Figure 1. The main sources of financing of the social sphere

CENTRALIZED SOURCES

Consolidated budgets of regions

Federal budget regional budgets local budgets

Extra-budgetary funds

different age and income, which are a kind of mechanism of social equalization. Attempts are being made to evaluate these informal cash flows using indirect methods, such as sociological surveys, but the information is fragmentary and, therefore, it has not been studied by the author.

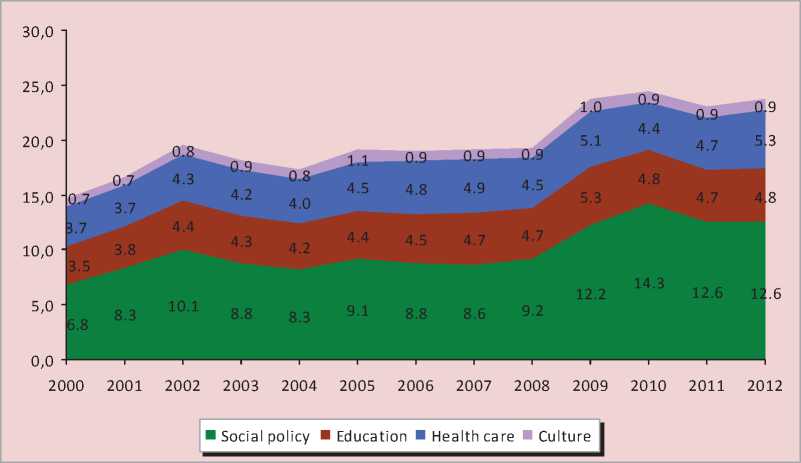

Trends in financing of social systems . The past decade saw a significant increase in social spending from all sources . The main characteristic of the social sphere financing is its share in the gross domestic product, in other words, the share in the total economic prosperity of the people, which allows estimating the degree of attention of the latter to certain sectors, comparing their importance among themselves, and making international comparisons. In the period under consideration, the dynamics of the social sphere financing significantly exceeded the rate of economic growth; as a result, the total share of public and private social expenditure in GDP increased from 14.7 to 23.6% (fig. 2) 5. An especially rapid increase in relative terms was observed in the period of financial and economic crisis of 2008–2009, when the Government of Russia, despite economic downturn, adopted the policy of complete fulfilment of social obligations. In general, it is certainly a positive trend, which confirms the thesis about the ongoing social rehabilitation of the country.

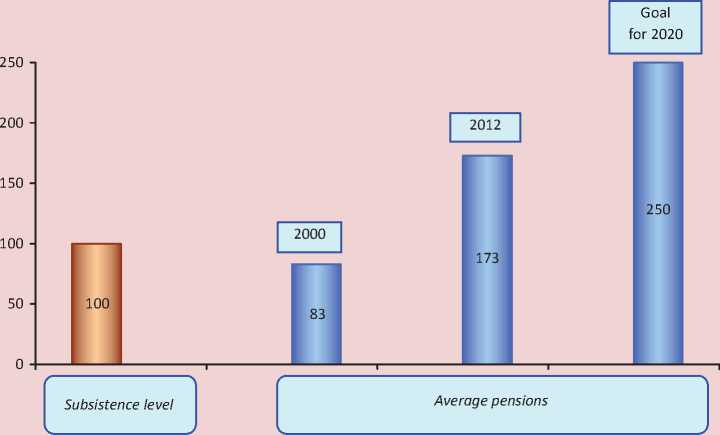

The search for the reasons for such a rapid increase in social expenditures opens the following significant tendency in the period under consideration – giving priority to increasing the financing of social policy, and, first of all, pensions. For 2000–2011, the nominal expenditures of the Pension Fund of the Russian Federation (excluding nongovernmental pension funds) increased 16-fold, and as a percentage of GDP – from 4.7 to 8.7%, which ensured an overwhelming share of the total growth of social expenditures. This considerably improved pension insurance: the ratio of the average size of pensions to the subsistence level of a pensioner has doubled over these years – from 83 to 173% (fig. 3). And indeed, the increase in the standard of living of pensioners in these years was evident. Thus, it became possible to overcome the abnormal situation of inconsistency of state pension payments even to the minimum requirements of life-support; it is a major step forward, and it simultaneously shows the real possibility of changing reality for the better with a strong and consistent political will.

However, it is unlikely that success in pension provision can be considered perfect and final. According to the Concept for the long-term socio-economic development of Russia, the average pension in 2016–2020 should reach 2.5–3 subsistence levels of a pensioner (and, judging by the forecast, this standard under certain conditions can be achieved). It is also important to note that the increase in the share of expenditures on pensions in GDP was largely conditioned by the significant increase in the relative number of elderly people, from 262 to 283 persons per 1000 population, and the country’s economic recovery became a leading factor in the positive changes in the level of pensions and in the subsistence level. An equally important indicator like the ratio of pensions to the average size of accrued wages, which clearly characterizes the moral health of the society towards the older generation, for these years has remained almost unchanged, at about 36%. With regard to the assets of non-governmental pension funds, this figure increases to about 40%. If we focus on the best achievements of other states6, comparing them with our own

Figure 2. The share of social expenditures in Russia’s GDP for 2000–2012, %

Figure 3. The ratio of average pensions to the subsistence level of pensioners in Russia for 2000–2012 and a target for 2020, %

ideas about the material welfare of elderly people, we should at least try to reach the standard of 50–60%.

However, to elaborate a final judgment on this matter, one should also consider the data on informal cash transfers, in other words, the direct financial support to the elderly on the part of able-bodied citizens. It would be interesting to move on from the application of the concept of average pension to the study of its differentiation by professional groups, in particular, the first group – civil servants and the military; the second group – the rest of the public sector employees (doctors, teachers, workers of culture, social workers); and the third group – the non-governmental sector. Unfortunately, these data are not available to the author; besides, such a profound study is beyond the scope of this article.

Naturally, the long-term trend of the social expenditures increase could not but affect the fiscal policy. The growth of social obligations demanded in 2011 a substantial increase of tax deductions from wages, which proved to be especially sensitive for small enterprises: for them the required payments in this regard have increased by 2.5 times. In 2013 the sharp increase in taxes affected individual entrepreneurs. In this situation of a greater concern is not so much the fact of tax burden increase (as will be shown further, it can become even greater), as its abrupt and hasty nature, and also the fact that the main burden of this growth has been imposed on the most vulnerable economic entities that do not have functioning mechanisms of consolidation and protection of their interests.

If the main “point of growth” of social expenditures in the 2000s was pension provision, then with regard to funds allocated to education and health care, the growth was much more moderate. Their value as a percentage of GDP has increased by 1.3% and 1.6% respectively, the highest peak was observed in the initial phase of the period under review. In general, we can say that over the last ten years, these areas have been developing according to the whole economy of the country. Although the financial support to education and health care during this period, has actually and substantially improved (months-long wage arrears became a thing of the past, the level of wages slightly increased, gradual modernization of equipment and premises has been carried out), this improvement, however, is in line with a general recovering economic growth of Russia during this period (for the last 12 years, the material prosperity increased approximately twice). We can not observe a deep, fundamental change in the role of education and health in the list of life priorities of the society, their share in GDP remains low against the background of not only developed countries but many developing countries as well. Only starting from 2011, there has been a turn in state policy in the direction of a more rapid increase of investments in these sectors, particularly in health care (see fig. 2), which may be the first sign of shifting the points of interest from social protection as the foundation of justice and stability of society to human capital as a decisive factor in development of the country.

The significance of culture in the structure of social expenditures during the period under review has increased slightly (from 0.7% to 0.9%), and it remains stable. However, observing examples of social and moral wellbeing of the modern Russian society, one can hardly consider this share to be sufficient. The reconsideration of the role of culture in the life of the country and the efforts undertaken for its improvement are reassuring, because it is the culture that largely protects the society from moral corruption and directs the vector of its development to higher ideals.

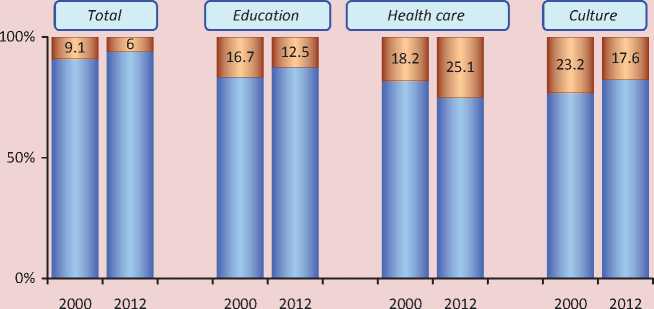

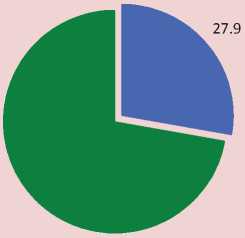

The analysis of social expenditures financing is impossible without consideration of the structure of their sources . Despite the fact that in conditions of increase in the payment for all types of services one may assume that the importance of private financing is leading and it is constantly increasing, the statistics prove otherwise. For 2000–2012 the share of decentralized funds in the total amount has even decreased from 9% to 6% (fig. 4) . Although, of course, the role of private sources is significant, it is not prevalent. Even though these estimates, due to the lack of comprehensive data, do not take into account some minor private cash flows like voluntary insurance (health, pension, life and health) and the funds of organizations that taken together, according to the author’s assessment, do not exceed 5% of all the social expenditures, the share of centralized financing is nevertheless above 80%.

Figure 4. The ratio of public sources to private sources in the financing of Russia’s social sphere in 2000 and 2012

п Public и Private

Of course, this situation should not be regarded as a complaint about the lack of private funds participation in financing social projects and as a call for their increase. And this idea is very popular in scientific publications and especially in government programmes. The intentions of researchers and officials have their rational motive, which consists mostly in enhancing the efficiency of activity of budgetary institutions, sometimes the desire to overcome the “consumer” attitude to services received free of charge. One also refers to the experience of some Western countries, where the share of private funds is sometimes quite high.

What could be said against that? The performance efficiency of budgetary institutions can be actually low and it should be raised, but it should not be done using market methods . The mechanism of commercial interest, which is often rewarding in the production sphere, can increase labour productivity in the social sphere as well, but it often leads to a decrease in its quality.

Especially it concerns the sphere of education and culture, where the driving force for specialists, in the first place, should consist in high spiritual and moral ideals of person’s education, rather than short-term success in “coaching” and “cultivation” of the population. “The transformation of commercial activity of the mass media in their main function has sharply negative consequences for the development of the state and society”, argues RAE Academician A.S. Zapesotskiy, and these words are true for the whole sphere of culture7. The decline in the quality of education, especially higher education, in the conditions of self-detachment of the state and a rapid commercialization is described in detail by Doctor of Economics I.V. Soboleva8. The viewpoint of these authors is supported by many other scientists.

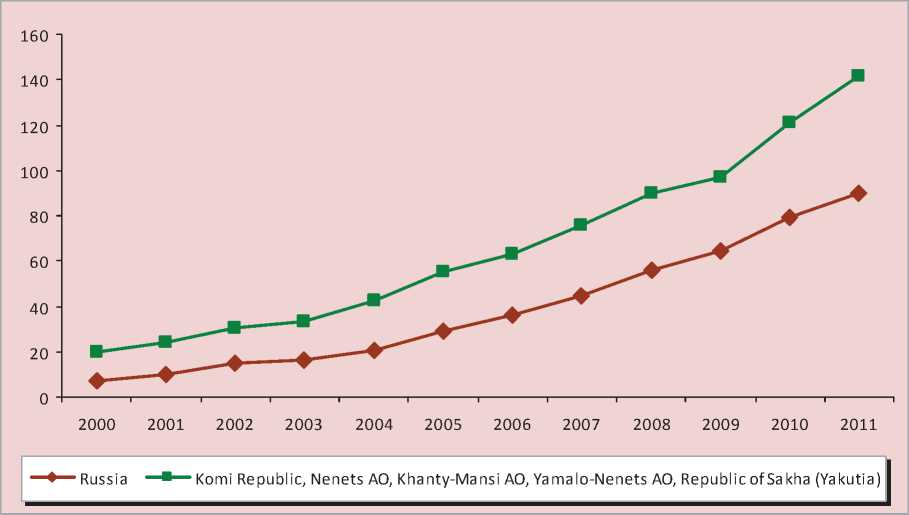

Figure 5. Per capita financing of social expenditures in Russia’s regions for 2000–2011, in current prices, thousand rubles/person

However, the presence of significant commercial component in the activity of the social sphere in other countries is not accidental; it is inextricably linked with centuries-old traditions of public control and social responsibility of business, which could not have formed in our country yet. One should not also forget the fact that budget funding in contrast to private funding is meant, inter alia, to be a powerful mechanism of social equalization, a universal guarantor of citizens’ access to the opportunities for personal development. And the experience that Russia really should learn from other countries consists in their focus on providing centralized financial support to science and education, which intensified in the post-crisis period9.

Political and economic changes of the 2000s have influenced the inter-regional differentiation of social spending. For instance, if in 2000 the most prosperous regions: Khanty-Mansi,

Yamalo-Nenets and Nenets autonomous okrugs, republics of Komi and Sakha (Yakutia), having large profits from the export of hydrocarbons and other natural resources, were ahead of other regions by 2.7 times (20 thousand against 7 thousand rubles per person), then by 2011 this figure gradually decreased to 1.6 times (141 thousand against 90 thousand rubles; fig. 5 ).

Specific social expenditures in the North are objectively higher than in other regions of the country, it is connected not only with additional rental incomes, but first of all, with price-raising factors like severe climatic conditions, poor transport and other infrastructure, low population density, necessity to preserve the culture of indigenous peoples10. However, these objective reasons should not become an excuse to the localization or excessive concentration of resource rent only within the very territories, because the natural wealth is the common heritage of the nation. Therefore, the fact that the growth in the above donor territories in the 2000s was somewhat restrained by the redistribution of funding in favour of backward territories deserves positive assessment, because it indicates the increasing consolidation of the country and the increase in the degree of solidarity between the territories.

Forecasting of social expenditure s. The overview of the situation allows us to proceed to the forecasting of Russia’s social sphere financing in order to identify the opportunities and hidden threats under different options of the development of economy and society. It is expedient to harmonize the time period of forecasting with the majority of the country’s strategic documents, i.e. to cover the period up to 2020, which refers the developed forecast to the category of long-term forecasts.

The main method of forecasting is modeling, under which the individual indicators are developed using extrapolation and expert assessments. The modeling is carried out within the framework of the scenario-based approach, which combines a content logical-heuristic analysis with formal research methods. The scenario is a hypothetical picture of a consistent development in time and space of events that constitute the evolution of a socio-economic object in the perspective that the researcher is interested in. The scenario-based approach provides for defining the area of what is really possible, i.e. the range of “probable paths” for the development of the studied system. For this purpose the scenarios with the best and the worst set of values of the factors affecting it are usually chosen11.

The main elements of the model are GDP, the share of social expenditures in GDP and their internal structure, parameters of demographic dynamics12.

The forecast under development should contain a search part and a normative part. The search forecast consists in the identification of possible states of the object in the future by extrapolating the development trends of the studied phenomenon in the past and in the present at abstracting from possible decisions that can influence these trends. Such forecast answers the question: what is likely to happen if the existing tendencies are maintained? The normative approach consists in identifying the ways and terms of obtaining possible desired states of the object based on pre-defined rules, ideals, incentives, and goals. In other words, it answers the question: what are the ways to achieve what is desired?13

The search forecast is carried out assuming that the ratio of public and private expenditures to GDP in the period until 2020 will be the same. This approach is passive, it does not require any specific solutions on the part of the authorities; and on the part of citizens it does not require significant changes in the usual amounts of their expenses.

In this case the social sphere financing in Russia will increase in line with general economic growth, the rate of which may reach 3–6% per year during this period, depending on the internal and external conditions14. Accordingly, the actual volume of social expenditures will increase during this period by 30% to 60%. This is no small figure. Being abstracted from other circumstances, it means, for example, the achievement of the target level “labour pension = 2.5–3 subsistence levels of a pensioner”; as for budgetary sphere workers, it means the growth of material prosperity comparable to that taking place in the period from 2000 to date.

However, such an inertial scenario of social sphere development does not take into account the need to solve two major tasks, and so it is unlikely to be acknowledged as satisfactory.

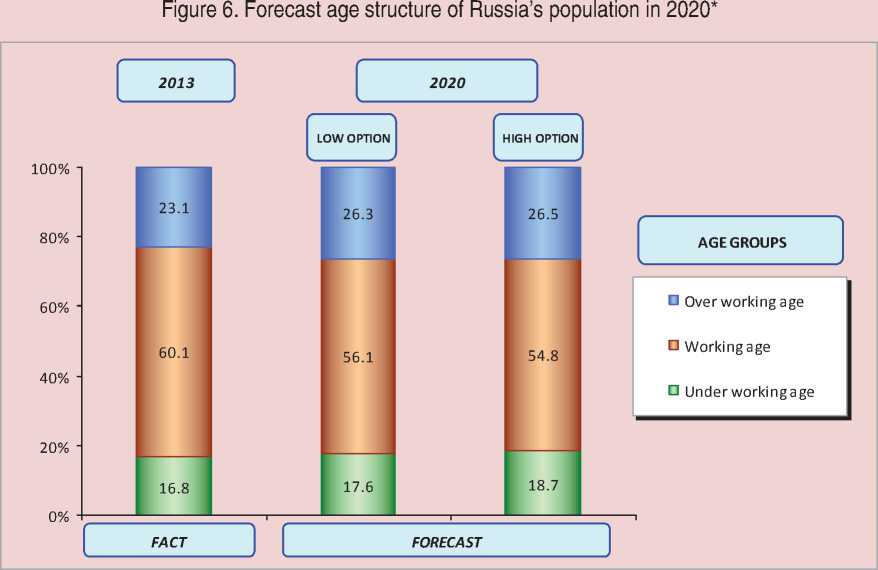

The first such task is demographic. According to the forecast of Rosstat, after the unfavorable situation in birth rate over two decades, Russia will inevitably face a significant increase in the share of the population over working age in the total population, from 23 to 26–27% (fig. 6). Therefore, under this scenario, labour pensions, due to a faster growth of the number of elderly residents, will grow much slower than the incomes of the entire population, i.e. the welfare of pensioners relative to other groups of the population will decrease, which will cause social tension. Even with regard to the fact that private funding sources in this sphere will make up for the acuteness of the problem to a sertain extent, it will be very significant and may require alternative control measures.

In addition, it is necessary to be prepared for a possible increase in the number of children. According to the low scenario of demographic forecast it will not change very much; but according to the high scenario, the moral and volitional elation of the nation and active government policy may lead to the increase in the share of children under 16 years old in the total population by almost 2%.

Therefore, the passive policy with regard to education system funding, for example, can result in an acute shortage of jobs and students in these institutions and in the excessive overload of the latter, or in shifting the state social obligations to the citizens themselves.

* Estimated population of the Russian Federation until 2030. Available at:

All this has become a negative feature of a modern life, and it is the result of the shortsighted policy of the past years.

Naturally, the growth of demographic burden in connection with the increase in the relative number of children and elderly citizens will greatly expand the needs for health services and social protection (payment of “maternity” allowances, sick pays, etc.).

The second urgent task is to overcome the existing imbalances in wages of public sector employees . The scenario conditions of the inertial option make it clear that education, healthcare, culture and social protection will develop in proportion with the national economy in general. I.e., despite the growth of material prosperity of their workers in absolute terms, these sectors’ lagging behind other economic sectors in terms of wage levels and other parameters remains unchanged. The current situation concerning wage level can hardly be considered favoufable for the solution of the task of Russia’s recovery and harmonious development, stated in the beginning of the article.

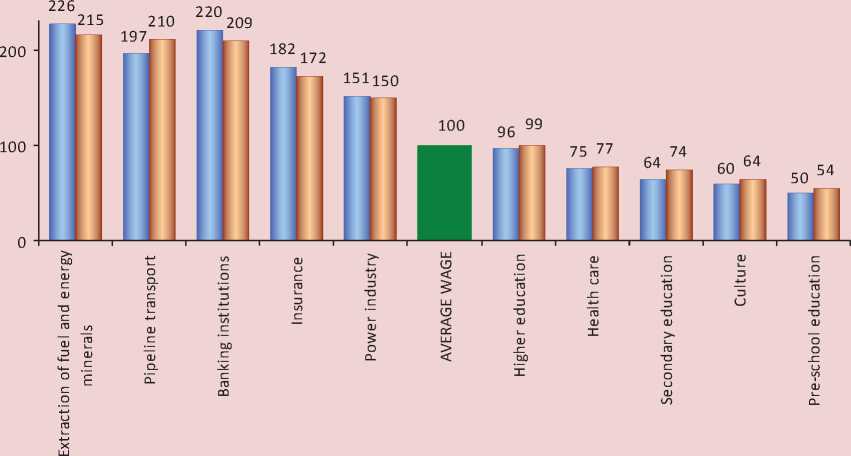

The data in figure 7 indicate that the level of wages in pre-school education is almost twice lower than the economic average. Wages in secondary education, as well as in primary vocational and secondary vocational education are below the average wages approximately by 1/4. The level of wages in higher education in Russia in general practically corresponds to the average for the economy. Wages in healthcare lag behind by 20%, and wages in cultural establishments are below the average by almost 40%. Thus, all the key elements of the social sphere suffer from low labour remuneration. However, in recent years there has already been a steady reduction in the existing wage gap, yet not sufficiently dynamic. For example, in general education over the last five years this gap has decreased by 10%, in culture and preschool education – by 4%, in health care and higher education – by 2%.

For comparison: official wages in the electric power industry amounted to 150%, in insurance companies – to 170%, and in banking institutions, in the extraction of energy resources and pipeline transport – to more than 200% of the economic average. The gap in wages between industry and transport can to some extent be explained by severe work conditions, but the dissonance between the social sector and financial institutions clearly indicates serious “faults” in the priorities of development of our society. But even here, in most cases, it is reassuring to note the gradual reduction in the income differentiation in comparison with the economic average, which leads to the levelling of the gap with regard to the social sphere, and it is considered to be the sign of movement toward the improvement of the situation in the country (fig. 7) .

Addressing these challenges requires a different scenario – the target scenario, in which the major importance would be attached not to certain growth rates of the welfare, but to justice and solidarity as a priority for socioeconomic development and the main uniting force of the society: “Economy cannot be effective if it is not based on the principles of social justice and responsibility. But the desire to increase personal wealth is not the only motive that should be the driving force of economic relations. From the viewpoint of Orthodox ethics, another motive lies in the desire to help one’s neighbour, desire to see that the results of the work bring benefits not only to the individual, but to the whole country and society”15.

On this basis, a primary objective is to overcome the existing disparities in the remuneration of workers of the sectors responsible for the preservation and development of labour

Figure 7. The ratio of labour remuneration in certain sectors to the average in Russia’s economy in 2008 and 2012, %

□ 2008 □ 2012

and creative potential of the population – i.e. education, healthcare and culture. The level of labour remuneration indicates the actual evaluation of the importance of these systems for society by the authorities and the public. Decent wages in comparison with the remuneration of those employed in other occupations creates the necessary (although still insufficient) prerequisites for the fulfilment of proper functions by the workers in these spheres, not just rendering of “social services” to the rest of the population or “the development of personnel” for the needs of the economy, but the formation of genuine intellectual and moral leadership in the movement of the whole society to productive and healthy life. Labour remuneration should allow specialists to satisfy the vital needs of their families without bearing excessive labour loads and thereby create the conditions for increasing, first of all, the quality rather than the quantity of work performed.

Besides, these propositions imply the necessity of ensuring the maintenance of the reached parameters of social security for incapacitated (elderly and young) population by taking into account population dynamics.

The first steps in the implementation of the target scenario have already been made. The Decree of the President of the Russian Federation “On the activities for the implementation of the state social policy” dated May 7, 2012, No. 597 identifies the following targets to be achieved to 2018:

– bringing the average wages of pedagogical workers of educational institutions of general and pre-school education, teachers and masters of industrial training of primary vocational and secondary vocational education, the employees of cultural institutions, junior and mediumlevel medical personnel to the average wage in the respective region ;

– increase in average wages of teachers at higher professional education institutions, scientific associates and doctors to the doubled average wage in the respective region.

At first glance the specified benchmarks are very high, we may say, almost unattainable: the growth of wages should be about 70%. However, it is obvious that the priority development of the social sphere should be based more on structural changes than on high rates of economic growth. In this regard, the forecast of opportunities for achieving these targets has been carried out. The calculations are based on the data concerning the present level of remuneration of employees in the relevant spheres, the share of labour costs in the total amount of budget expenditures and the share of specialized workers in the general payroll fund16. According to the calculations, elimination of existing disparities in wages requires the increase in the social budget expenditures on education on the average by 22%, on health care – by 13%, on culture – by 17% over the base rate of economic growth.

The calculated growth rate of budget expenditures makes it possible to determine the share of social expenditures in GDP that ensures financial support for increased wages – 1.9%. The obtained value is very significant; however, it is quite feasible and it can be achieved by ordinary changes in the tax system or in the list of priorities for public spending.

However, as already mentioned, the target scenario stipulates not only the achievement of the desired level of remuneration in the public sector; it also ensures that financing parameters follow the demographic changes according to the high option of the forecast. According to the author’s calculations, this will require the 2.4% increase in the share of social expenditures in GDP. Along with the increase in remuneration, the solution of this problem will lead to an overall increase in the social burden on the economy by 4.3% (fig. 8) .

Let us consider possible solutions to this problem. The first approach , the most simple and cardinal, consists in the coverage of this gap at the expense of the state with a corresponding increase in tax burden. However, such rapid growth in the tax burden on the economy would have dangerous consequences and would be difficult to implement, especially taking into account the recent increase in the rates. Therefore, the introduction of progressive taxation on super profits of citizens and enterprises should be considered as a major reserve, because the income gap between the richest 10% and the poorest 10% of Russia’s citizens is currently exceedingly high, it reaches 17 times, and it is 30 times according to unofficial estimates17. The leading economists of Russia, for example, RAS Academicians O.T. Bogomolov, S.Yu. Glazyev, D.S. Lvov, V.L. Makarov, R.I. Nigmatulin, N.Ya. Petrakov, RAS Corresponding Member N.M. Rima-shevskaya, Doctor of Economics A.I. Ageyev, Doctor of Economics A.V. Suvorov18 and many public figures hold a unanimous opinion about this issue.

The approach to solving this problem should, in our opinion, consist not so much in the hasty strengthening of administrative pressure on business and entrepreneurs, but rather in a thorough and consistent work on the development of internal responsible attitude to their Motherland and the awareness of the inseparable connection of their own well-being with social rehabilitation of the nation.

However, the increase in public funding can and should be carried out not only by increasing tax burden. The considerable reserves can be found when revising the list of priorities of budget expenditures and also by establishing order in the use of funds. Let us leave concrete decisions within the competence of the heads of state and present some figures in confirmation of this suggestion: the required volume of additional financing of the social sphere in Russia as a whole amounts to about 2.7 trillion rubles (about 1/5 of the annual federal budget), at the same time, the total amount of the Reserve Fund and the National Welfare Fund of Russia is 5.3 trillion rubles and the total cost of the recent mega projects (South Stream gas pipeline project, Sochi-2014 Winter Olympics, APEC summit) is over 4 trillion rubles. Even the most cautious assessments of the scale of state and corporate corruption in the country are comparable to this value.

The second, radical approach is also completely unacceptable in our opinion; it suggests placing the entire burden of additional funding on the citizens themselves, on private businesses and non-profit organizations, since in such a case the costs of these economic agents should increase in relative terms in about 3 times, while the current load is often very burdensome for needy population groups.

Therefore, so as not to call the set tasks absolutely impossible, it should be recognized that their solution requires searching for compromises and unification of efforts of all interested parties. After all, a simple increase in budget expenses, even if it does not disturb the balance of the budgetary system, might not lead to the achievement of the second most important goal (along with the growth of well-being) – the increase in the quality of work of social systems.

In these years the authorities should carry out a gradual and differentiated increase in tax burden; they should enhance the efficiency of expenditures, prudently improve the labour remuneration system, enhance the principle of targeting of social benefits and free services depending on the welfare of recipients, possibly involve non-governmental organizations in the execution of state tasks.

Citizens and concerned enterprises should be morally and organizationally ready to increase the degree of their participation in the financing of education, health care, culture, social protection; they should also be prepared to the development of a more active position concerning the enhancement of their performance efficiency. The public sector employees should realize that the increase in labour remuneration cannot remain “mechanical” and “external” – it should be harmoniously linked to the increase in qualification requirements and a certain increase in labour intensity.

Figure 8. The share of social expenditures in Russia’s GDP with regard to different scenarios in 2020, %

Inertial

Targeted

■ Expenditures on the social sector

In conclusion, we would like to emphasize that the spiritual and moral revival of Russia is a necessary condition and the ultimate goal of the efficiency of functioning of all other aspects of life – economic, political, scientific-technological, cultural and social. At that, the moral condition of the people is a very complex and versatile phenomenon that depends not so much on political or economic decisions of the government, as on a vector of personal energy of each individual. But its complexity and comprehensiveness implies the involvement of all the existing mechanisms of public life, including, to a very large extent, the financing of the social sphere, which is the main idea of this article.

Thus, the main conclusions of the research are as follows:

-

• The welfare of Russia first of all, implies a thorough – spiritual, moral, physical and social – improvement of an individual.

-

• Inertial development of the social sphere will entail the conservation of existing disparities in remuneration and the reduction in the level of per capita financing of expenses due to the future increase in demographic load.

-

• Financial security is not the only, but, nevertheless, a very important factor in social development; therefore a priority goal of the social policy for the coming years consists in a significant increase in the expenses on education, health care and culture to ensure a decent level of remuneration.

-

• The main source of additional investments is to be found in the state finances through the revision of the budget policy priorities and the progressive taxation of super profits.

-

• The government policy measures are not enough for the efficient improvement of the socio-economic situation; it also requires the unification of efforts of all the interested parties.

Список литературы Problems and prospects of social sphere financing in Russia

- Bestuzhev-Lada I.V. Social forecasting. Course of lectures. Moscow: Russian Pedagogical Society, 2002.

- Bogomolov O.T. Capacity of the national culture in the renewal of the Russian society. Modernization of Russia: social-humanitarian dimensions. Ed. by Academician N.Ya. Petrakov; RHSF; RAS. Moscow; Saint Petersburg: Nestor Istoriya, 2011.

- Gurvich Ye. Principles of the new pension reform. Demoscope Weekly. 2012. No. 499-500. 20 February -4 March. Available at: http://www.demoscope.ru/weekly/2012/0499/analit01.php

- Unified Inter-Agency Information Statistical System. Available at: http://fedstat.ru/indicator/data.do

- Zapesotskiy A.S. Media as a factor of transformation of the Russian culture. Noneconomic edges of economy: unknown mutual influence. Academic and journalistic notes of social scientists. Ed. by O.T. Bogomolov. Moscow: Institute for Economic Strategies, 2010.

- Ivanov V.N., Suvorov A.V. Incomes and consumption of the Russian population in the conditions of crisis and the alternatives of the state policy in this sphere. Problemy prognozirovaniya. 2009. No. 6.

- Information of the Federal Treasury on the execution of budgets. Available at: http://www.roskazna.ru/reports/cb.html

- Kirill, Metropolitan of Smolensk and Kaliningrad, later: Patriarch of Moscow and all Russia. The economy is a type of activity initially blessed by the Creator. Real estate and investments. Legal regulation. 2008. No. 3 (36).

- Kirill, Patriarch of Moscow and all Russia. Society, economy, ethics in the service of the Russian Orthodox Church. Noneconomic edges of economy: unknown influence. Ed. by O.T. Bogomolov. Project supervisor B.N. Kuzyk. Moscow: Institute for Economic Strategies, 2010.

- Modernization of Russia: social-humanitarian dimensions. Ed. by Academician N.Ya. Petrakov; RHSF; RAS. Moscow; Saint Petersburg: Nestor Istoriya, 2011.

- Forecasted population of the Russian Federation until 2030. Available at: http://www.gks.ru/free_doc/new_site/population/demo/progn3.htm

- Forecasting of socio-economic development of the region. Ed. by V.A. Chereshnev, A.I. Tatarkin, S.Yu. Glazyev. Yekaterinburg: Institute of Economics, Ural RAS Department, 2011.

- Rimashevskaya N.M. Preservation of the people -the strategic imperative of Russia. Noneconomic edges of economy: unknown influence. Ed. by O.T. Bogomolov. Project supervisor B.N. Kuzyk. Moscow: Institute for Economic Strategies, 2010. P. 642.

- Soboleva I.V. Human and social capital -the determinant factors in the modern economic development. Economics and social environment: unconscious mutual influence. Scientific notes and essays. Ed. by O.T. Bogomolov. Moscow: Institute for Economic Strategies, 2008.

- Styrov M.M. Trends of social expenditures in the North of Russia. Economic and social changes: facts, trends, forecast. 2012. No. 2 (20).

- Styrov M.M. Financing of social systems in the Northern regions of Russia: trends and prospects. Problemy prognozirovaniya. 2013. No. 4.

- Scenario conditions for the long-term forecast of the socio-economic development of the Russian Federation until 2030. Available at: http://www.economy.gov.ru

- Kirill, Patriarch of Moscow and all Russia. Society, economy, ethics in the service of the Russian Orthodox Church. Noneconomic edges of economy: unknown influence. Ed. by O.T. Bogomolov. Project supervisor B.N. Kuzyk. Moscow: Institute for Economic Strategies, 2010. P. 107

- Zapesotskiy A.S. Media as a factor of transformation of the Russian culture. Noneconomic edges of economy: unknown mutual influence. Academic and journalistic notes of social scientists. Ed. by O.T. Bogomolov. Moscow: Institute for Economic Strategies, 2010. P. 230-260

- Bogomolov O.T. Capacity of the national culture in the renewal of the Russian society. Modernization of Russia: social-humanitarian dimensions. Ed. by Academician N.Ya. Petrakov; RHSF; RAS. Moscow; Saint Petersburg: Nestor Istoriya, 2011. P. 52-53