Real options как метод стратегического планирования

Автор: Магданов П.В.

Журнал: Вестник Пермского университета. Серия: Экономика @economics-psu

Рубрика: Стратегическое планирование

Статья в выпуске: 4 (19), 2013 года.

Бесплатный доступ

Метод реальных опционов широко применяется в ведущих зарубежных компаниях при принятии стратегических решений. Однако в российских компаниях этот метод известен в малой степени и редко применяется при разработке инвестиционных проектов и в процессе стратегического планирования. В статье дается описание метода реальных опционов как одного из основных методов стратегического планирования.

Метод реальных опционов, стратегическое планирование, корпорация

Короткий адрес: https://sciup.org/147201384

IDR: 147201384 | УДК: 338.24

Текст научной статьи Real options как метод стратегического планирования

В 1973 г. Ф. Блэк и М. Шоулз разработали модель ценообразования на финансовые опционы [2]. В том же году Р. Мертон доработал модель Блэка-Шоулза и показал ее широкую применимость [14]. Благодаря открытию, сделанному М. Шоулзом и Р. Мертоном, в 1977 г. появилось понятие реальных опционов. Его ввел С. Майерс, рассуждая о том, что стоимость компании имеет два главных источника: 1) стоимость уже имеющихся активов и 2) возможность приобрести в будущем активы по приемлемой цене [18]. Второй источник назван термином real options . В общем случае реальные опционы дают возможность приобрести ( call options ) или продать активы ( put options ) в будущем по цене, привлекательной для лиц, которые не имеют таких возможностей. Главное отличие реальных опционов от финансовых опционов состоит в том, что последние означают право купить финансовые активы (базовые и производные ценные бумаги), тогда как первые подразумевают нефинансовые, т.е. материальные и нематериальные, в том числе интеллектуальные активы.

1977 год можно считать отправной точкой в возникновении и эволюции теории реальных опционов. Понятие действительных возможностей (real options) получило основополагающее значение при выработке стратегических решений в условиях неопределенности и нестабильности внешнего окружения, потрясающую силу которого мировое сообщество в полной мере испытало во второй половине 1970-х гг. С. Майерс, подчер- кивая разницу между стратегическим планированием и управлением финансами, выразился так: «Стратегическое планирование нуждается в финансах. Расчет чистой приведенной стоимости необходим для проверки результатов стратегического анализа и наоборот. Однако метод дисконтированного денежного потока не позволяет корректно оценить стоимость стратегических хозяйственных сфер, находящихся на первоначальной стадии развития. Теория корпоративных финансов требует усовершенствования путем введения понятия реальных опционов» [19].

Метод реальных опционов широко применяется в ведущих зарубежных компаниях при принятии стратегических решений. Однако в российских компаниях метод реальных опционов известен в малой степени и редко применяется при разработке инвестиционных проектов в рамках процесса стратегического планирования. Поэтому автор видит цель статьи в том, чтобы дать краткое описание методу реальных опционов и показать возможности его применения в процессе стратегического планирования.

Теория реальных опционов . В простом определении теория реальных опционов представляет собой систематизированный подход к оценке реальных (материальных и нематериальных) активов в условиях неопределенности, характеризующейся высокой степенью изменчивости и неустойчивости [16]. Теория реальных опционов является составной частью научного менеджмента и основывается на теории корпоративных финансов, финансовом, экономическом и

инвестиционном анализе, теории принятия решений, эконометрике и управлении проектами.

Теория реальных опционов позволила разрешить одну из самых важных теоретических проблем стратегического планирования: принятие стратегических, в том числе инвестиционных решений в условиях высокой нестабильности рыночной конъюнктуры. Метод реальных опционов позволил интегрировать принятие решений и оценку их последствий в длительном периоде. Появилась возможность свести в единое целое 1) предвидение будущих изменений во внешней среде, 2) неопределенность и риск стратегических решений и 3) денежное выражение стоимости избираемого курса развития организации. Метод реальных опционов позволил увидеть значительное большее число стратегических альтернатив, которые прежде отсекались методом дисконтированного денежного потока (далее – метод ДДП) ввиду низкой прибыльности и высокой неопределенности. Кроме того, метод реальных опционов установил связь между проектноориентированным анализом стратегических инвестиций и видением будущего, т.е. всей стратегией развития корпорации [1].

Многие исследователи полагают, что метод реальных опционов представляет собой принципиально новый взгляд на оценку неопределенности и связанного с ней риска и определение последствий альтернативных вариантов решений в управлении активами. В этом новом мышлении главными аспектами выступают 1) понимание того, что неопределенность создает возможности для инвестирования и 2) неопределенность создает условия для управления с целью повышения стоимости опционов и рентабельности инвестиций. Преимущество метода реальных опционов над любым другим методом оценки эффективности инвестиционной деятельности состоит в том, что проект рассматривается как процесс, развивающийся в заданном периоде и состоящий из последовательно связанных компонентов. Уделяя пристальное внимание факторам, влияющим на эффективность проекта, можно корректировать принятые ранее решения с учетом появившихся возможностей или угроз.

Стратегия как портфель реальных опционов . Решающий шаг в изменении взглядов на финансовую стратегию корпорации и финансовую оценку корпоративной стратегии (стратегического плана) сделал Т. Люерман в начале 1990-х гг. Он представил стратегию как портфель реальных опционов, что означает следующее [11]. При большой изменчивости ключевых параметров расчетов по методу ДДП могут быть сделаны неверные инвестиционные решения. Возьмем, к примеру, нефтегазодобывающую отрасль, в которой стоимость нефти на биржевом рынке меняется циклически. В период высоких цен решение о приобретении новой нефтеносной провинции представляется вполне обоснованным, поскольку денежные потоки максимальны, но и стоимость приобретаемого актива тоже предельно высока. Когда цена на нефть начинает понижаться, то уже принятые решения об инвестировании становятся все менее эффективными. Принимать решение об инвестировании в приобретение нефтеносных провинций следует в период низких цен, но метод ДДП может показать неэффективность такого решения.

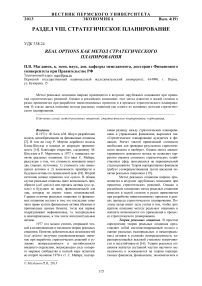

Соотношение стоимости актива и первоначальных вложений

Рис. 1. Стратегия как портфель реальных опционов [12]

Т. Люерман предложил простое решение [12-13]. Кроме классического параметра – коэффициента рентабельности инвестиций следует ввести параметр, отражающей уровень неопределенности (волатильности). Тогда стратегия как портфель реальных опционов может выглядеть так (рис. 1). Предположим, стратегия компании подразумевает принятие трех стратегических решений: вывод на рынок нового товара и двухэтапное расширение производственных мощностей. Как видно на рис. 1, решение о выводе продукта рассчитывается по методу ДДП, поскольку неоп- ределенность низкая, а чистая приведенная стоимость больше первоначальных затрат. Второе решение – опцион типа call, так как имеется неопределенность, а коэффициент рентабельности инвестиций чуть более единицы. Третий опцион тоже типа call, но реализуется только тогда, когда будет реализован второй опцион. При этом прогнозируется, что чистая текущая стоимость актива меньше затрат на его приобретение. Соответственно, стоимость стратегии – это сумма стоимостей первого решения по методу ДДП, второго опциона и третьего, двойного опциона.

Конус неопределенности как поле для поиска стратегических возможностей. Идея, заложенная в методе реальных опционов, содержит в себе значительно большее, чем простое введение кумулятивное переменной, позволяющей установить математическое соответствие между уровнем неопределенности и доходностью инвестиций. Теория реальных опционов впервые дала инструмент работы с неопределенностью, которая стала рассматриваться не как угроза, а как совокупность возможностей, неизвестных сейчас и пока нераскрытых в будущем. Благодаря данной теории стратегия стала действительно стратегической. В самом деле, если можно судить о том, что имеются проекты, дающие высокую рентабельность инвестиций, то это еще не стратегия, а лишь портфель проектов. Стратегия появляется тогда, когда предполагаются нераскрытые возможности, которые нужно найти и реализовать. Поэтому стратегическую стоимость бизнеса или портфеля проектов можно определить так [20]:

стратегическая стоимость = дисконтированная стоимость ожидаемых денежных потоков + стоимость возможностей, создаваемых стратегическим управлением.

Иными словами, стоимость бизнеса по варианту развития организации «как есть» представляет собой чистую приведенную стоимость по утвержденным проектам, т.е. таким, которые при низком уровне риска дают наибольшую рента-

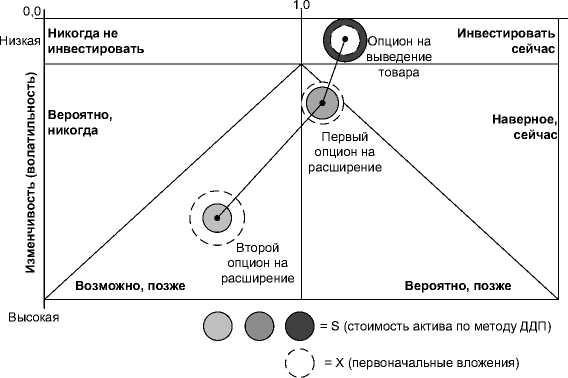

Рис. 2. Как неопределенность увеличивает стоимость [1]

бельность инвестиций. Вариант «как должно быть» увеличивается на стоимость, которую руководство должно создать путем реализации стратегии, т.е. снижения неопределенности и связанного с ней риска до приемлемого уровня.

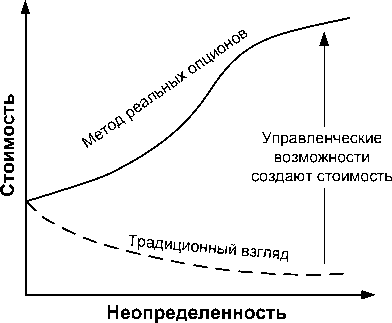

Традиционный взгляд на природу неопределенности предполагает уменьшение стоимости будущих доходов согласно геометрической прогрессии и размеру ставки дисконтирования. Метод реальных опционов, напротив, предполагает наличие неопределенности, которую можно использовать на создание новых денежных потоков, а стоимость бизнеса может увеличиваться вследствие предпринимаемых управленческих усилий по поиску и преследованию действительных возможностей. Руководителям нужно отчетливо понимать, что последствия всех их решений и действий, будущая стоимость бизнеса, будет находиться в некотором пределе – конусе неопределенности (рис. 2). Нижний предел конуса неопределенности соответствует безрисковой ставке, которая, как правило, находится ниже уровня рентабельности, позволяющего воспроизводить собственный капитал. Верхний предел конуса неопределенности определяется уровнем риска, который может оцениваться при помощи среднеквадратического отклонения. Чем выше совокупный уровень риска в стратегии, тем шире конус неопределенности. Реальный опцион – это гибкость, которую руководитель может использовать при принятии решений. Именно в гибкости состоит стратегический аспект метода реальных опционов и его огромное значение для стратегического планирования. Если руководство способно добиваться перспективных результатов, связанных с высоким уровнем неопределенности, то стратегия раз- вития становится важнейшим инструментом управления. Если руководство не проявляет гибкости в достижении стратегических целей, то любая, даже самая блестящая стратегия окажется бесполезной.

Рис. 3. Конус неопределенности [1]

Ниже представлены наиболее распро страненные виды реальных опционов (табл. 1).

Таблица 1

Примеры реальных опционов, распространенных в практике инвестиционной деятельности корпораций

|

Вид опциона |

Описание |

Сфера применения |

|

1. Опцион на отсрочку ( англ . option to defer) |

Руководство задерживает сделку по продаже или сдаче в аренду ценного участка земли. Цель: оценить последствия в виде роста цены на актив или снижения стоимости строительства завода или здания |

Все добывающие отрасли. Операции с недвижимостью. Сельское хозяйство. Переработка леса |

|

2. Опцион на последовательное инвестирование ( англ . time-to-build option) |

Организация инвестирования в виде последовательности проектов позволяет остановить бизнес в случае поступления неблагоприятных сведений. Каждый этап инвестирования рассматривается как отдельный опцион, состоящий из последующих опционов и имеющий общую стоимость |

Все высокотехнологичные отрасли, особенно фармацевтика. Долгосрочные и масштабные проекты. Венчурные предприятия |

|

3. Опцион на различные операции ( англ . option to alter operation scale) |

В случае наступления особо благоприятных рыночных условий руководство может расширить производство или увеличить использование ресурсов. И напротив, в случае ухудшения рыночной конъюнктуры возможен вариант сокращения объема операций. В наихудшем варианте допускается прекращение производства |

Добывающие отрасли. Производственное строительство. Модная одежда. Потребительские товары. Коммерческая недвижимость |

|

4. Опцион на прекращение операций ( англ . option to abandon) |

При быстром ухудшении рыночной конъюнктуры руководство может прекратить текущие операции и продать активы по частям или как действующий бизнес |

Капиталоемкие отрасли (авиаперевозки, железные дороги). Финансовый сектор |

|

5. Опцион на переключение ( англ . option to switch) |

В случае изменения уровня спроса и цен на товары руководство может гибко менять производственную программу или переналаживать производство под выпуск новых товаров |

Потребительская электроника. Подарки и игрушки. Автомобилестроение. Производство комплектующих. Химическая отрасль |

|

6. Опционы роста ( англ . growth options) |

Сделаны инвестиции в инфраструктуру бизнеса (приобретение запасов нефти, участка земли, НИОКР), вследствие чего появляется возможность начинать новые проекты, начинать производство товаров, добывать нефть |

Отрасли с инфраструктурой (добыча полезных ископаемых, НИОКР, высокие технологии, компьютеры). Зарубежные операции. Поглощения и приобретения |

|

7. Комбинированные опционы ( англ . multiple interacting options) |

Текущие проекты предполагают множество вариантов действий: расширение, защита, поддержка и другие. Консолидированная стоимость портфеля проектов может отличаться от суммы стоимостей отдельных проектов |

Проекты во всех перечисленных выше отраслях |

Источник: [20].

Метод реальных опционов имеет решающее значение [16]:

при определении направлений инвестиционной деятельности и формировании портфеля инвестиционных проектов в условиях переменчивой и непредсказуемой конъюнктуры рынка;

при оценке финансовых последствий отдельных стратегических решений и корпоративной стратегии в целом;

при установлении приоритетов инвестирования на основе последовательной количественной и качественной оценки проектов;

при оптимизации стоимости долгосрочных инвестиционных решений путем расчета дерева решений и определении факторов неопределенности и степени риска;

при определении времени инвестирования и срока окупаемости проектов, анализе чувствительности проектов и выявлении факторов стоимости и доходности инвестиций;

при управлении существующими и возникающими возможностями в рамках выбранных направлений стратегического развития.

Между финансовыми опционами и реальными опционами есть общие черты. При определении стоимости опционов обоих типов используют одинаковые параметры, однако им придается различный смысл (табл. 2).

Таблица 2

Сравнение финансовых опционов с реальными опционами

|

Параметр |

Опцион на финансовый актив |

Опцион на реальный актив |

|

P |

Биржевая стоимость актива |

Текущая стоимость денежных потоков от инвестиционной деятельности в нефинансовый актив |

|

X |

Цена применения |

Стоимость приобретения (продажи) актива |

|

R |

Безрисковая ставка |

Экспоненциальная безрисковая ставка; стоимость капитала |

|

a |

Мера волатильности (изменчивости) дохода |

Среднеквадратическое отклонение относительной стоимости проекта; уровень неопределенности и риска |

|

T |

Длительность в годах |

Срок жизни опциона; время, на которое может быть отложено инвестиционное решение |

Источники: [4, 5].

Реальные опционы объединяются в портфель подобно инвестиционному портфелю спекулятивного или стратегического инвестора. Инвестиционный портфель определяется как совокупность объектов инвестирования (базовых и производных активов), оцениваемая и управляемая как единое целое. К одному инвестиционному портфелю применяется только одна стратегия, определяемая сочетанием степени риска и уровня потенциального дохода. Но в случае с реальными опционами дело обстоит иначе. Реальный опцион может представлять собой последовательность других, более отдаленных во времени реальных опционов. Кроме того, реальные опционы относятся к физическим активам, таким как технологическое оборудование и объекты недвижимости, которые могут быть взаимно дополняемыми, а в ряде случаев не могут быть разделены между собой. Реальные опционы, помимо этого, означают ведение операционной деятельности, на которую влияют внешние факторы, – доступность ресурсов, ставка ссудного процента, динамика и характер спроса. Все это сильно отличает реальные опционы от финансовых опционов, стоимость которых во многом определяется действиями биржевых игроков и в меньшей степени – способностью эмитента создавать доход держателю актива.

Портфель реальных опционов, т.е. действительных возможностей управления активами, определяется как «совокупность материальных и нематериальных активов и связанных с ними реальных опционов, которая характеризуется известной степенью риска и имеет ограничения, связанные с сущностью данных активов» [3]. Различия между портфелем финансовых инструментов и портфелем реальных опционов заключается в следующем:

-

1) отношение к риску . Приобретение финансовых активов означает установление компромисса между доходностью и степенью риска, это так называемый пассивный риск. Владелец реального опциона может управлять степенью риска, к примеру, откладывая проект по строительству завода в силу отсутствия благоприятных обстоятельств. Поэтому для портфеля реальных опционов диверсификация рисков не применяется;

-

2) создание стоимости . Каждый финансовый опцион обладает строго определенной возможностью создавать стоимость, как это имеет место в случае с облигациями. Модель Блэка-Шоулза позволяет определять доходность финансовых опционов. В случае с реальными опционами наблюдается обратная ситуация: его владелец не может точно судить о том, какую именно стоимость может принести ему реальный актив в будущем, и будет ли будущая стоимость выше стоимости в текущий момент.

В силу таких существенных различий между финансовыми и реальными опционами не рекомендуется объединять их в общий инвестици- онный портфель. Реальные опционы и финансовые опционы объединяет лишь то, что оба инструмента дают владельцу право, а не обязательство совершить в будущем некоторые действия [1].

Метод реальных опционов применяется при соблюдении ряда условий [17]:

наличие финансовой модели . Метод реальных опционов основывается на традиционной модели дисконтирования денежных потоков. Отсутствие финансовой модели свидетельствует о том, что все стратегические решения уже приняты, следовательно, не требуется дополнительных рассуждений;

наличие неопределенности . Стоимость опциона не должна удовлетворять стандартным требованиям метода ДДП к окупаемости инвестиций. Если все точно известно, а неопределенность отсутствует, то метод ДДП достаточен для принятия решений. Отсутствие изменчивости в ключевых параметрах модели означает нулевую стоимость реальных опционов;

внешняя неопределенность должна оказывать решающее влияние на принятие решений и финансовые результаты их реализации . Принимаемые руководством фирмы решения должны испытывать влияние неопределенности и связанного с ней риска. Детерминированные решения не попадают в область применения метода реальных опционов;

руководство должно иметь возможность влиять на ход исполнения инвестиционных решений. Если руководство фирмы может использовать неопределенность для создания будущих стоимостей, то метод реальных опционов применяется для снижения риска и увеличения стоимости инвестиционных проектов. В случае, когда имеются полностью неконтролируемые и неопре- деленные внешние факторы, которые руководство не может использовать для увеличения стоимости, метод реальных опционов не применяется;

руководители фирмы должны иметь достаточные навыки и опыт, а также доверие со стороны заинтересованных сторон, чтобы приступать к реализации опционов в подходящий для этого момент . В противном случае ни одна возможность во всем мире не станет благоприятной для фирмы.

Интересно отметить взаимосвязь метода реальных опционов и метода SWOT-анализа (рис. 4-5). Сильные стороны фирмы понижают цену приобретения и повышают цену продажи реального опциона, т.е. повышают выгоду от его реализации. Внешние угрозы существенно повышают вероятность использования опциона типа put , т.е. принуждают фирму продавать материальные или нематериальные активы [24]. Благоприятные возможности означают наличие опционов типа call , т.е. стимулируют фирму приобретать доходные активы. Имеет смысл реализовывать реальный опцион тогда, когда базовая стоимость актива существенно выше цены приобретения опциона, и наоборот, когда его стоимость ниже цены продажи опциона. Факторы, которые при традиционной логике инвестиционного проектирования уменьшают стоимость будущих денежных потоков, действуют в обратном направлении. Изменчивость конъюнктуры и длительный горизонт планирования создают возможности для увеличения стоимости реального опциона. Для того чтобы стоимость реального опциона, т.е. нефинансового актива, была высокой, требуется наличие сильных сторон, значимых для фирмы, или несущественные слабые стороны.

Внутренние

Сильные стороны

Слабые стороны

Факторы, которые понижают цену приобретения реальных опционов типа c all и повышают цену продажи реальных опционов типа put .

Факторы, которые повышают цену приобретения реальных опционов типа call и снижают цену Й продажи реальных К опционов типа put. I

§ Возможности

£

Реальные опционы типа call c наличием дивидендов в денежной форме или без них.

Угрозы J

Реальные опционы типа put c наличием дивидендов в денежной форме или без них.

Внешние

Рис. 4. Синтез метода реальных опционов и метода SWOT-анализа [24]

Слабые стороны

Стоимость возможностей увеличи вается, когда связанные с ними слабые стороны несущественны, а стартовая цена опциона низкая

Изменчивость Стоимость возможностей увеличивается, когда ожидаемые выгоды велики

Сильные стороны

Стоимость возмож- и____ ностей увеличивает/ ся, когда связанные с

\ ___ ними сильные сторо-

N ны существенны, а стартовая цена опциона низкая

Дивиденды в денежной форме

Стоимость возможностей увеличивается, когда предполагаются дивиденды в денежной форме

Фактор времени Стоимость возможностей увеличивается, когда имеется длительной горизонт планирования

Рис. 5. Оценка стратегических возможностей с позиции реальных опционов [24]

Метод реальных опционов имеет большое значение для стратегического планирования в силу следующих рассуждений. Во-первых, появление метода реальных опционов сразу привлекло внимание специалистов по стратегическому управлению [23]. Одна из важнейших проблем управления состоит в распределении ограниченных ресурсов между проектами. Классическая финансовая теория требует, чтобы в первую очередь средства вкладывались в проекты с минимальным сроком окупаемости и наибольшей отдачей на вложенный капитал. Но что делать, когда внешние обстоятельства меняются? Выгодность одних начатых проектов вызывает сомнения, а некоторые другие проекты, ранее считавшиеся бесперспективными, выглядят вполне надежными. Подход «планирова-ние-программирование-бюджетирование» предполагал полное финансирование и завершение любого начатого проекта, тогда как метод реальных опционов позволил гибко подходить к реализации проектов и управлению ресурсами фирмы. Метод реальных опционов дал возможность ответить на самый важный вопрос: как рыночные условия могут помочь фирме сэкономить ресурсы? Инвестиции в получение ресурсов, обеспечивающих конкурентные преимущества фирмы, представляют собой последовательность взаимосвязанных реальных опционов.

Одним из первых методов разработки корпоративной стратегии, в условиях относительно стабильной конъюнктуры рынка на рубеже 1960-1970-х гг., стал портфельный метод, согласно которому составлялась матрица, подразумевавшая наличие стандартных вариантов действия. Метод реальных опционов предполагает обратное: матрица отсутствует, стандартные решения в условиях неопределенности неприемлемы. Стратегическое планирование направлено на определение возможностей инвестирования и представляет собой процесс выяв- ления и оценки факторов, влияющих на инвестиционные решения в условиях неполной информации и риска. Центральную роль в этом играет установление точного соответствия между рыночными возможностями, доходностью операций и инвестиционной деятельностью фирмы [22]. В сущности, принятие портфеля проектов к исполнению еще не означает стратегического планирования; стратегическое планирование появляется тогда, как руководство действует исходя из обстоятельств, определяющих доходность каждого проекта в портфеле. Важно одновременно добиться и прибыльности бизнеса в краткосрочном периоде, и долгосрочного развития организации.

Во-вторых, теория реальных опционов оказалась очень полезной при управлении международными операциями в транснациональных корпорациях [9]. В сущности, международные операции корпораций являлись совокупностью реальных опционов, связанных с предельно высоким уровнем неопределенности и риска. Например, зарубежные проекты представляли собой опционы роста (табл. 1), а вложения в создание инфраструктуры позволяли в дальнейшем реализовывать множество других проектов [8]. Кроме того, корпорации имели портфели проектов – реальных опционов на переключение (табл. 1), позволявших гибко реагировать на изменения рыночной конъюнктуры путем изменения цепочки поставок. Вообще, идея переключения производственных программ для корпораций, ведущих операции в разных странах, оказалась ценной с точки зрения реальных опционов.

Особенно большое значение метод реальных опционов получил при разработке и реализации проектов по созданию объектов социально-экономической инфраструктуры [7]. В частности, объекты транспортной, портовой, энергетической инфраструктуры позволяют развивать операционную деятельность во многих направлениях деятельности, соответственно, возникает множество действительных возможностей для экономических субъектов. Поэтому метод реальных опционов имеет большое прикладное значение при стратегическом планировании социально-экономического развития мегаполисов и регионов.

В-третьих, теория реальных опционов помогла разрешить одну их важнейших задач стратегического планирования – создание возможностей, понимаемых как способность организации использовать материальные и нематериальные ресурсы, осуществлять заданные процессы и выполнять поставленные цели. Однако возможности фирмы не являются товаром, поскольку не предназначены для продажи и обмена, соответственно, не могут быть объектом инвестирования. Вследствие этого вложения в создание возможностей не приносят прямой выгоды, а лишь опосредованно через последующие проекты, связанные с использование создаваемых возможностей. К примеру, разрабатывая новый товар и вкладывая в НИОКР большие средства, фирма может получить серию изобретений, которые можно использовать в производстве других товаров. Опцион на последовательное инвестирование (табл. 1) позволяет оценить вновь создаваемый потенциал, который реализуется через новые проекты. Неопределенность с использованием создаваемых возможностей может пойти на благо фирмы путем реализации серии последовательных проектов.

Инвестирование в создание возможностей имеет особый термин «инвестиционная платформа» [13]. К примеру, приобретение новых видов оборудования может стать причиной роста качества и снижения производственных издержек, что, в свою очередь, может привести к появлению конкурентных преимуществ. Некоторые виды деятельности требуют наличия технологической платформы – совокупности технологий, обладание которой позволяет фирме продавать продукты и услуги, отвечающие требованиям потребителей по цене и качеству. Вложение средств в создание технологической платформы также является «инвестиционной платформой», позволяющей развивать бизнес в новых направлениях.

В-четвертых, теория реальных опционов внесла большой вклад в решение проблем, связанных с инвестированием в венчурные предприятия [6]. Венчурные предприятия широко распространены в деловой среде. К ним относятся практически все виды консорциумов, создаваемых крупнейшими корпорациями для реализации сложных проектов с неопределенными перспективами, к примеру, строительство газопроводов, освоение крупных месторождений полезных ископаемых, производство уни- кальных видов продукции. Создание венчурного предприятия происходит в условиях полной неопределенности. Ни одна из участвующих сторон не знает, какие исходы ожидают венчурное предприятие, предполагаются лишь потенциальные выгоды, весьма отдаленные от даты принятия решения о создании венчурного предприятия. Применение метода реальных опционов позволяет оценить последствия различных вариантов – ликвидация, приостановка действия, смена сторон в партнерстве, выкуп предприятий одной стороной. Каждый этап венчурного предприятия рассматривается как реальный опцион, а все этапы вместе – как последовательность реальных опционов. Управление деятельностью венчурным бизнесом приобретает, таким образом, совершенно иной смысл. Поиск и реализация действительных возможностей или прекращение операций в случае их отсутствия – в этом заключается сущность стратегического управления венчурным предприятием на основе метода реальных опционов.

В-пятых, теория реальных опционов дает взгляд на фирму как институт, создающий возможности [21]. Действительно, если стратегия предполагает инвестирование в ряд проектов, то стратегическое планирование можно рассматривать как процесс поиска и обоснования инвестиционных возможностей, т.е. реальных опционов. Следует отметить, что важна не только и не столько оценка инвестиционных возможностей, сколько осознание всей цепочки последовательно связанных возможностей, своего рода «взгляда в будущее». Метод реальных опционов – это не только оценка инвестиций, а способ мышления, направленный на использование неопределенности как источника новых возможностей создания добавочной стоимости.

Корпоративная стратегия определяет портфель стратегических хозяйственных сфер и ключевые направления развития в каждой из них. В зависимости от того, сбудутся ли прогнозные сценарии, корпорация может «переключать» стратегическое развитие с одного направления на другое, переходя от одного реального опциона к другому. Выявление и обоснование новых реальных опционов означает адаптацию стратегии к меняющимся внешним факторам. В сущности, работа высшего руководства, равно как содержание стратегического управления, сводится к поиску реальных опционов в виде проектов и ресурсов. Нужно «снабдить» организацию ресурсами и опционами, чтобы в терминах стратегий и стратегических планов они были обоснованы и приняты к действию исполнительными органами управления. От последних требуется умение отслеживать изменения во внешней среде и адаптировать к ним базовые стратегические идеи.

Реальные опционы, понимаемые как действительные возможности , тесно связаны со стратегическими намерениями. Инициативы побуждают руководителей искать возможности (ресурсы или проекты) и обосновывать их потенциальную стоимость для организации. Следует понимать, что стратегией движет не желание выбрать новую стратегическую позицию, малоуязвимую для действий конкурентов, как это предполагалось исследователями в 1980-х гг. В основе современной корпоративной стратегии лежит стремление поддерживать способность организации находить и претворять в жизнь реальные опционы, т.е. действительные возможности развития [15].

В-шестых, метод реальных опционов внес в методологию стратегического планирования новый инструмент, равный по степени обоснованности и значимости теории финансовых опционов [23]. Очевидное несоответствие метода ДДП длительному горизонту планирования и потребности в управлении инвестиционной деятельностью в течение периода реализации проекта устранено методом реальных опционов. Строгость и определенность в расчетах, присущая теории финансовых опционов, появилась и в методологии стратегического планирования благодаря методу реальных опционов. Появилась возможность совместить стратегические реалии и видение будущего, которым присуща высокая степень неопределенности, с традиционными методами расчета будущих стоимостей стратегических решений, принимаемых сегодня и в течение всего горизонта планирования. Инвестиционный анализ и стратегический анализ получили общую теоретическую базу в виде теории реальных опционов. Метод реальных опционов позволил добиться компромисса между определенностью стратегического плана и возможностью менять направления развития, используя простые и комбинированные опционы. Следовательно, стратегический план должен содержать стратегические возможности как реальные опционы, т.е. предполагать «переключение» с одного направления развития на другое. Стратегические возможности, заложенные в стратегическом плане (стратегии), должны взаимно дополнять друг друга. Организация может переходить от одного варианта действий к другому, не меняя сущности стратегии.

Список литературы Real options как метод стратегического планирования

- Amram M., Kulatilaka N. Real Options: Managing Strategic Investment in an Uncertain World. Harvard Business School Press, 1999. 246 p.

- Black F., Scholes M. The Pricing of Options and Corporate Liabilities//Journal of Political Economy. 1973. Vol. 81. P. 637-659.

- Brosch R. Portfolios of Real Options. Springer, 2008. 156 p.

- Brydon M. Evaluating Strategic Options Using Decision-theoretic Planning//Information Technology Management. 2006. Vol. 7. P. 35-49.

- Chance D., Peterson P. Real Options and Investment Valuation//The Research Foundation of AIMR. 2002. 114 p.

- Cuypers I., Martin X. Joint Ventures and Real Options: An Integrated Perspective//Advances in Strategic Management. 2007. Vol. 24. P. 103-144.

- Herder P., Joode J., Ligtvoet A., Schenk S., Taneja P. Buying Real Options -Valuing Uncertainty in Infrastructure Planning//Futures. 2011. Vol. 43. P. 961-969.

- Kogut B., Chang S.J. Platform Investments and Volatile Exchange Rates: Direct Investment in the U.S. by Japanese Electronic Companies//Review of Economics and Statistics. 1996. Vol. 78. P. 221-231.

- Kogut B. Foreign Direct Investment as a Sequential Process/The Multinational Corporation in the 1980s. Ed. by C.P. Kindleberger and D.B. Audretsch. Boston, MA: MIT Press, 1983. P. 38-56.

- Luehrman T. Capital Projects as Real Options: An Introduction//Harvard Business School, Case №9-295-074. 12 p.

- Luehrman T. Investments Opportunities as Real Options: Getting Started on the Numbers//Harvard Business Review. 1998. July-August. P. 2-15.

- Luehrman T. Strategy as Portfolio of Real Options//Harvard Business Review. 1998. September-October. P. 89-98.

- Maritan C., Alessandri T. Capabilities, Real Options, and the Resource Allocation Process//Advances in Strategic Management. 2007. Vol. 24. P. 307-322.

- Merton R.C. Theory of Rational Option Pricing//Bell Journal of Economics and Management Science. 1973. Vol. 4. P. 141-183.

- Mouzas S. The Logic of Real Options in Strategy Implementation//Advances in Applied Business Strategy. 2005. Vol. 7. P. 79-90.

- Mun J. Modeling Risk: Applying Monte Carlo Simulation, Real Options Analysis, Forecasting, and Optimization Techniques. John Wiley & Sons, Inc., 2006. 605 p.

- Mun J. Real Options in Practice/Real Options in Engineering Design, Operations, and Management/Ed. by Black, H. and Aktan, N. CRC Press, 2010. P. 7-13.

- Myers S.C. Determinants of Corporate Borrowing//Journal of Financial Economics. 1977. Vol. 5. P. 147-175.

- Myers S.C. Finance Theory and Financial Strategy//Interfaces. 1984. Vol. 14, January-February. P. 126-137.

- Real Options in Telecommunications: the New Investment Theory and Its Implications for Telecommunications Economics/Ed. by Alleman, J. and Noam E. Kluwer Academic Publishers. 1999. 280 p.

- Scherpereel Ch. The Option-Creating Institution: A Real Options Perspective on Economic Organization//Strategic Management Journal. 2008. Vol. 29. P. 455-470.

- Smit H., Trigeorgis L. Strategic Planning: Valuing and Managing Portfolios of Real Options//R&D Management. 2006. Vol. 36, №4. P. 403-419.

- Tong T., Reuer J. Real Options in Strategic Management//Advances in Strategic Management. 2007. Vol. 24. P. 3-28.

- Zarkos S., Morgan R., Kouropalatis Y. Real Options and Real Strategies//Strategic Change. 2007. Vol. 16. November. P. 315-325.