Regulation of financial behavior of the population of modern Russia: regulatory context formation and personal development

Автор: Belekhova Galina V.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 3 т.13, 2020 года.

Бесплатный доступ

Making premature financial decisions can negatively affect individual households and society as a whole, so public authorities, using various management mechanisms, regulate the population’s financial behavior. The article attempts to understand how the state regulation of the population’s financial behavior presents interventions in order to “change the context” (in particular, the regulatory and procedural foundations of the financial system) and to “change cognition” (in our case - “human change”, in particular personal knowledge and attitudes). Similar research topics cover the legal basis of financial organizations, behavioral tools for managing the population’s financial behavior, the ways to improve their financial literacy, and so on. In contrast, the present study first reflects the views of alternative economic theories (rational choice theory, behavioral economics) on the possibility of regulating economic behavior, the techniques of behavioral “nudging” widely spread in foreign countries are given; second, a scheme for regulating the financial behavior of the Russian population is proposed and the main regulatory documents regulating the activities of financial organizations in the country are analyzed; third, the relation between the regulation lines of “change the context” and “human change” is estimated. It is shown that the impact on the financial behavior of the Russians is mainly devoted to the “change the context”, i.e. at building a bona fide institutional financial system. The impacts in the line of “human change” are secondary; they are implemented through improving financial literacy and introducing mass financial products. This regulation allows a bias towards the person’s “passivity”. The elimination of the identified imbalance will improve the effectiveness of management decisions regarding the citizens’ financial behavior. It is proposed to redirect interventions from the construction of an “ideal” regulatory context of the financial system to the development of a literate and financially active population, able to form the necessary financial environment for the economy and society by their behavior.

Financial behavior, government regulation, nudging, change the context, change cognition, financial literacy

Короткий адрес: https://sciup.org/147225457

IDR: 147225457 | УДК: 330.59 | DOI: 10.15838/esc.2020.3.69.8

Текст научной статьи Regulation of financial behavior of the population of modern Russia: regulatory context formation and personal development

All-Russian surveys regularly reveal actions with an increased risk of negative consequences for material well-being in the financial behavior of the Russians. For example, socially vulnerable groups of the population with low paying capacity are widely involved in credit practices: young families (spouses aged 25 to 40) with two minor children (50%), young (aged 25 to 40) single mothers with one child (45%) and two children (51%) take loans more actively than others1. There is a high percentage of the overindebted (those who pay more than 30% of their family income for loan repayments) among the low-income borrowers2, it makes up 29% compared to 10% among the better-off3. Along with this, 44% of the Russians who took out a loan over the past year are loyal to the violation of credit agreements and believe that a small payment delay is not terrible, and 25% of the borrowers think that not to repay the loan is not a crime4.

The prevalence of such financial practices has a very negative impact on both individual households and society as a whole. The state, unlike other economic agents, is not only interested in the population’s competent financial behavior, but is also able to influence it and the financial system as a whole. Over the past 20 years, the targets for this impact have been increasing the volume of the population’s organized savings, diversifying the financial instruments used by the population, and bringing the legal framework of the financial system up to modern international standards. A significant role in achieving these goals, along with social policy, labor and employment policy, education, health, and so on, is played by the policy on financial market regulation, which forms the regulatory framework for financial behavior of the population.

The problems of regulating the population’s financial behavior are reflected in a number of scientific publications of Russian researchers. Their subject matter is mainly related to the legal regulation of the financial market and the activities of credit and non-credit financial organizations, the peculiarities of law enforcement practice and changes in legislation (V.A. Pozdyshev [1], V.G. Golubtsov [2]). A significant number of papers are devoted to the problem of improving financial literacy of the population (O.E. Kuzina and D.H. Ibragimova [3], A.V. Stakhnyuk and E.A. Izmalkova [4], G.V. Tsvetova and

M.V. Erofeeva [5]). The research on the impact of cognitive, psychological, and sociocultural factors on the population’s financial behavior and their account in the practice of its regulation (T.N. Kolesnikova [6]), on the use of behavioral instruments in different areas of regulation and their possible embedding in the policy of the population’s financial behavior management (A.E. Golodnikova et al. [7]) are less presented. A separate layer consists of the review, theoretical and methodological works, where the authors consider the provisions of the new behavioral economy, its influence on state policy and the ways of manipulating economic behavior (I.N. Drogobytsky [8], A. Zlotnikov [9], A. Shmakov [10]) or analyze the advantages and failures of state paternalism in terms of its impact on the economic behavior of the population as a whole (R.I. Kapelyushnikov [11; 12], A.Ya. Rubinshtein and A.E. Gorodetskii [13]).

At the same time, there are very few works aimed at studying the conceptual foundations of the current practice of regulating financial behavior in Russia, as well as the compliance of regulatory and procedural aspects of regulation with the modern views of economic science (in particular, the provisions of behavioral economics). In our opinion, in order to identify the opportunities for improving the effectiveness of the population’s financial behavior regulation, it is important to understand what conceptual provisions of modern economic thought are used in the current regulatory system.

The purpose of our work is to systematize the regulatory and procedural aspects of the population’s financial behavior regulating, which will allow to understand how the interventions aimed at “changing the context” (the regulatory framework of the financial market) and “human change” (personal beliefs and attitudes) are used in this area of state regulation. For this purpose, the first part of the paper examines the provisions of alternative economic theories (rational choice theory, behavioral economics) regarding the ability to regulate economic behavior, and provides the techniques of behavioral “nudging”; the second part presents a scheme for regulating the Russians’ financial behavior, analyzes the main governing documents regulating the activities of the Russian financial system, shows the relation between the paradigms of “changing the context” and “human change”.

Theoretical views on the possibility of regulating the population’s financial behavior

The studies of the population’s economic behavior are aimed to “explain, predict and learn how to influence the behavior of the person making the choice” [10, p. 98]. Initially, economics considered human behavior from the point of view of the “rational human” model (Homo economicus), which is based on a normative, a priori analysis of rational decisionmaking. In neoclassical theories of welfare and rational choice, considering a rational person with a clear structure of preferences, direct state intervention was considered unnecessary, and individual utility was the measure of quality of the economic policy (V. Pareto, J. Hicks, P. Samuelson) [14, p. 16]. According to the theory of rational choice, a person makes a deliberate, reasonable, rational choice for his or her own benefit. While the population in general is directed by a metaphorical “invisible hand”, which is the hidden mechanism of the market economy action. In other words, market regulation is self-sufficient and can adjust individual rational behavior. Therefore, the issue of regulating the population’ economic behavior was not raised in principle, i.e. the classical view of a man as an optimally functioning Homo economicus did not require building a system of socio-economic regulation of behavior.

The emergence and development of alternative economic concepts weakening the thesis of the rationality of human behavior has led to a transformation of the view of the state’s role in regulating the population’s economic behavior. The most well-known alternative view is the behavioral concept, according to which human behavior is influenced by emotions, thinking patterns, etc., and rationality is limited by the individuals’ cognitive abilities to process incomplete and imperfect information [15].

In the economic, social, and psychological literature, there is abundant empirical evidence for deviations from rational behavior. For example, imperfect optimization: in some cases, people ignore information that would help them make the right decision [16]; in others, they initially consider poor financial decisions or for some reason refuse to choose the best options [17; 18]. Biased judgments or preferences have an impact. In particular, some people attach more importance to potential losses rather than the equivalent amount of potential benefits [19; 20]; to the current (shortterm) rather than future (long-term) results [21; 22; 23], which leads to inefficient spending, borrowing or investing. The consumers’ choice varies depending on the financial products and services, on how their offer is designed, and how their characteristics are presented [19; 24; 25]. The influence of the social context is also significant: consumers may trust financial advisors too much, not considering that the latter may be motivated by personal self-interest [26]; comparison with the success of others can make the consumer feel envy or frustrated and keep him or her from making a good choice [27].

Such observations led to the emergence of H. Simon’s theory of “bounded rationality”, the theory of perspectives by D. Kahneman and A. Tversky, R. Thaler’s new behavioral economy, and other theories allowing state’s intervention in the economic behavior of the population. Research by R. Thaler and K. Sunstein formed the basis of “Libertarian Paternalism”, the policy of minimal intervention of the state in the person’s choice [28; 29]. It is assumed that by conducting a minimally aggressive policy using special tools with psychological stuffing [30, p. 350] the paternalistic state helps people to make optimal decisions individually and socially, not hindering their achievement of subjective preferences and improving their wellbeing [14, p. 16–17; 31].

Along with the development of conceptual views of economic science, there is a transformation of “traditional” methods of regulation in politics (command-and-control, transparency-and-access), which show a decreasing effectiveness in regulating population’s behavior [7, p. 8]. Knowledge about behavioral errors and ways to influence them are increasingly taken into account when developing regulatory effects on the behavior of the population. For example, “there are currently at least 20 nudge units in the world in Europe, America, Asia, and Australia” [32].

According to R.I. Kapelyushnikov, the logic of state regulation in the behavioral economy implies effective elimination of cognitive and behavioral errors of the population, direct restrictions on current irrational behavior and broad social support for future behavior. Traditional directions of state policy, on the contrary, assume regulation and control of the current economic behavior of the population with the help of future rewards or fines [11, p. 88].

Two general paradigms for population-wide behavior change have emerged in recent years – models that aim to change cognitions5 (such as beliefs and attitudes) and models that change the context6 (environment or situation)

Figure 1. Description of MINDSPACE categories

Source: compiled by the author on the basis of [33, p. 129–133].

within which the person acts [33, p. 126–127]. Their qualitative content occurs within the framework of a behavioral concept.

“Changing cognition” involves providing a person with new information in one form or another. Such interventions trigger reflexive mental processing and attempt to train the person to make more reasonable and effective decisions. The influence of information and education is consistent with the classical model of a rational person: the more information we have, the more likely we are to accurately calculate the payoffs for each decision and choose the best one. “Changing cognition” works best for those who are most open to informing, perceiving, and understanding new knowledge, so it can widen the gap between individuals with high and low levels of education. In relation to financial behavior, such interventions are intended to improve financial literacy, facilitate people’s understanding of financial products and services, and the decision-making process itself [33, p. 127–128].

“Changing the context” takes more account of the fact that people have limited cognitive abilities. It involves influencing automatic judgment processes, focusing on correcting behavior without changing attitudes [33, p. 129–133]. In this case, a set of influences is used, which is often referred to as MINDSPACE in western practice ( Fig. 1 ).

The consequences resulting from the use of the two lines of behavior regulation – “changing cognition” and “changing the context” – are currently an urgent topic of research by foreign scientists. For example, in the works of P. Dolan and etc. [33], B.C. Madrian and etc. [34] it was found that interventions such as “changing cognition” (based on education and new information) affect the financial behavior of mostly highly educated, financially literate and receptive to new information people, and “changing the context” has a more universal effect and is suitable for people of different socio-demographic characteristics.

Generalization of behavioral economics tools (mostly interventions of the “changing the context” type) is presented in the works of K. Sunstein, R.I. Kapelyushnikov, A.E. Golod-nikova, D.B. Tsygankov, M.A. Yunusova, and others. They consider the tools of behavioral “nudging” which are the most promising for public administration: establishing “default options”7 [35, p. 19]; direct prohibitions restricting individual choice in high-risk spheres (for example, the prohibition on the abolition of state pension insurance); legislative consolidation of cooling-off periods (for example, when purchasing insurance products or expensive items); customer-oriented forms of information disclosure in case of transactions with high-risk products (mortgages, lending, etc.); sending text messages of various content8 [7, p.12-14; 11, p. 84-88; 36].

Speaking about the experience of the population’s behavior regulating through “changing cognition” and “changing the context”, it is necessary to indicate those aspects that may limit their application in Russian practice. First, only a part of manifold combinations of different types of interventions and their effects have been studied, and mainly based on the experience of foreign countries. Therefore, preliminary research and experimental testing are necessary in order to avoid undesirable results and clarify the Russian specifics of “nudging” techniques. Second, specialized research should not only be conducted by scientists in limited samples. Large employers and the national government should be involved in the study of the issue, since they can work out regulatory policies for a larger population or for homogeneous categories of employees (military personnel, employees in the public sector or a certain industry). Third, for some people, the policy of external “nudging” may seem questionable in moral and ethical terms. The grounds for skepticism may be, for example, the restrictions on constitutional human rights to freedom of choice or manipulation by decision-makers in favor of their self-interest, rather than the interests of society as a whole. However, according to the methodical foundations of the “libertarian paternalism” by R. Thaler and C. Sunstein, the external “nudging” techniques do not make any restrictions in choice but create conditions for the person making decisions on a voluntary basis “so that these decisions were best for him” [28, p. 179; 35, p. 18-21]9. Moreover, as noted above, state and public “nudge units” developing “behavioral nudge technologies in different situations” have been operating since the early 2000s in foreign countries; in general, behavioral methods are used in public policy in more than 150 countries [35, p. 22].

Thus, the evolution of economic thought, management and political science and practice has indicated the limitations of the “normative” theory of rational choice (and other concepts based on it) for use in regulating the population’s economic behavior. Rational choice is increasingly seen not as maximizing utility (profit) and minimizing costs, but as the best and most satisfactory of the available options. Alternative economic trends development (in particular behavioral economics) has shown that manager’s task is to create such an environment to bring the decision made by a person to the best possible one in terms of maintaining a balance between social utility and individual well-being.

Regulation of the Russian population’s financial behavior

The formation of modern practice of regulating financial behavior of the Russians took place against the background of the transformation of public administration at the end of the twentieth century. The transition from the Soviet system of state paternalism to a liberal ideology and “insurance relations” between the state and the population caused the authorities to create conditions (including a regulatory and procedural environment) for the inclusion of the population in financial transactions and train them to work in conditions of risk, uncertainty and personal responsibility for their own material well-being.

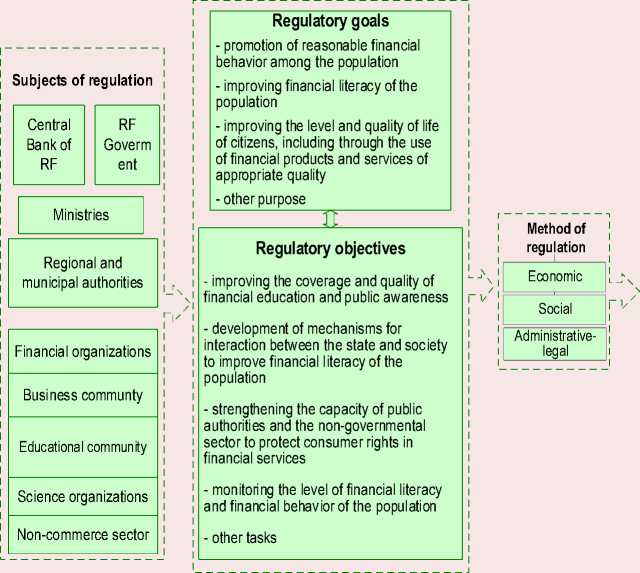

Regulation of financial behavior of the Russian population is mediated by regulation of the financial market participants’ activities. A generalized scheme of the process of regulating financial behavior of the population, which, in our opinion, is implemented in the Russian reality, is shown in Figure 2. Its main coordinators are the Government of the Russian Federation and the Central Bank of the Russian Federation. They define the “rules of the game”, develop strategic and program documents that regulate relations arising when the population, financial and credit organizations, the state and other agents interact on the formation, distribution and use of monetary and other financial resources of citizens.

The Ministry of Finance of the Russian Federation, the Federal Service for supervision of consumer protection and human well-being, the Ministry of Education and Science of the Russian Federation and other federal executive authorities, executive authorities of the subjects of the Russian Federation and local governments, financial market institutions and other interested parties also take part in regulating financial behavior of the population . Their activities are regulated by the existing policy documents (Strategy for Financial Literacy in the Russian Federation for the years of 2017-2023, Development Strategy of the National Payment System, Long-term Strategy of Development of Pension System of the Russian Federation, Strategy of Development of Insurance Activity in the Russian Federation until 2020, Main directions of development of financial market of the Russian Federation for the period of 2019-2021, etc.) and other legal acts.

One of the priority goals for the development of the financial market is “improving the life level and quality of the citizens of the Russian Federation through the use of financial market

Figure 2. Scheme of the process of regulating the Russian population’s financial behavior

Regulatory tools

By coverage (level):

-

- Federal (National strategy),

-

- regional and municipal (projects, programs),

-

- private

By the method of exposure:

-

- direct (impact directly on financial actions),

-

- indirect (impact on motives, financial knowledge and skills, awareness and responsibility)

By subject of behavior:

-

- solid (affect the population as a whole), - differentiated (by income level, by age, by the specifics of education, by profession)

By management object:

-

- General (affect behavior in general), - private (affect individual types and components of behavior)

By purpose:

-

- training,

-

- consulting

-

-information and awareness-raising, - legal

The object of regulation is the financial behavior of the population

Other types of financial behavior

Saving behavior

Credit behavior

Financial literacy

The result of regulation is the formation of reasonable financial behavior and responsible attitude to personal finances among the population

Increasing inclusion in savings practices

I________________

Decrease in the share of the population with signs of overcrediting

Diversification of financial products used by the population

Increasing the level of financial literacy (possession of basic knowledge and skills)

Source: compiled by the author.

tools”10; then, the goals and objectives are built from it in relation to the financial behavior of the population (see Fig. 2). In particular, the objectives of financial behavior regulation are :

– promotion of reasonable financial behavior among citizens;

– universal improvement of financial literacy in all socio-demographic, professional, income and other groups of the population;

– ensuring consumers’ availability of financial products and services of appropriate quality, using which contributes to improving the quality of life of the population;

– fair implementation of the legal norms established by the legislation in relation to all participants of the financial market, etc.

The objectives of regulating financial behavior of the Russians include:

– increasing citizens’ involvement in financial education processes;

– development and implementation of public and private programs to improve financial literacy in socio-demographic, professional, income and other groups of the population (for example, classes for minors on the basis of comprehensive educational organizations, additional financial training for students of secondary and higher professional education institutions, classes with young families or socially vulnerable groups based on social assistance centers for families and children, “educational days” for specific groups of the population in financial organizations of various levels, including regional offices of the Central Bank of the Russian Federation);

– conducting regular monitoring aimed at investigating the involvement of the population in financial behavior, measuring the current level of financial literacy of people to assess the effectiveness of the ongoing activities and their timely adjustment, etc.

An appropriate concretization of the final result of regulation of financial behavior , in our view, is a variation of a goal from the project of the Ministry of Finance and the World Bank, “Enhancing financial literacy and developing financial education in the Russian Federation”, namely the formation of prudent financial behavior and responsible attitude to personal finance among the population . The noted result can be specified for each type of behavior and financial literacy, for example:

– for saving behavior: increasing the population’s involvement in legal savings practices; increasing the share of the population having three-month money reserves (i.e., a financial “safety cushion”), and so on.;

– for credit behavior: reducing the share of the population with signs of over-crediting; increasing awareness of the “right steps” to use loans, and so on.;

– financial literacy: increasing the share of the population in general and specific groups (e.g. families with children, low- and middleincome groups, etc.), leading the family budget; increasing the proportion of the population, comparing possible financial services and conditions of their provision; reducing the share of citizens who are not aware about the signs of financial pyramids and other forms of financial fraud and so on.

Next, let us consider some of the regulatory and procedural mechanisms used in regulating financial behavior of the Russians, which will allow us to trace the correlation between the paradigms of “changing the context” and “human change”.

Savings and credit policies are the most developed areas of state regulation of the population’s financial behavior. In practice, they are implemented in a variety of forms: change of the refinancing rate by the Bank of Russia, fiscal policy, public and private safety guarantee of deposits, the establishment of rules of interaction between credit and non-credit financial organizations with individuals, the introduction of bankruptcy procedures and so on ( Table 1 ) [37; 38].

Several draft laws that may affect the financial behavior of the Russians in the future, including their decisions on savings and loans, are currently under development and preliminary consideration in the state Duma. Draft law no. 757296-7 “On amendments to certain legislative acts of the Russian Federation (in terms of improving the system of mandatory deposit insurance in banks of the Russian Federation)” proposes to increase the maximum

Table 1. Examples of mechanisms of state regulation in the field of savings and credit behavior of the population

|

Mechanism |

Content |

Regulation line |

|

Bank deposit insurance system (DIS) |

The state program for the protection of personal savings in Russian banks has been functioning since 2004, when the state Corporation “Deposit Insurance Agency” (DIA) was established. Depositors of banks who are DIS members are entitled to receive compensation up to 1.4 million rubles. (inclusive) in case of revocation of the bank’s license (occurrence of an insurance event). As of the beginning of 2020, 720 participating banks are involved in the insurance system. During the existence of the DIS, 508 insurance cases occurred, and more than 1.5 million depositors received insurance compensation. The amount of compensation for deposits was revised repeatedly (4 times over 10 years), and over the entire period it increased 14 times – from 100 thousand rubles to 1 million 400 thousand rubles11. |

Changing the context |

|

The system to guarantee the rights of insured persons in the mandatory pension insurance system |

The system started functioning since 2014; it ensures the safety of the amounts received to the pension account and used for calculating the future pension of the insured person. There are 33 non-state pension funds participating in the system. During the system operation, there were no guarantee cases related to the cancellation of the license of the participating fund12. |

Changing the context |

|

Federal Law no. 353-FZ “On consumer credit (loan)”13 |

Along with the basic rules, this law sets out additional obligations of banks that borrowers are usually unaware of, which include:

|

Changing the context |

|

The indicator of borrowers’ debt burden (IDB) |

Since October 1, 2019, the Central Bank of the RF requires banks and microfinance organizations to calculate the IDB when deciding on granting a loan in the amount of 10 thousand rubles and more, and also encouraged them to inform the borrower about the IDB value. The calculation algorithm offers a definition of the ratio of the borrower’s average monthly payments for all loans and credits to his or her average monthly income. This innovation does not prohibit creditors from issuing loans to citizens with a high IDB level. However, banks will be forced to form an additional capital reserve when lending to borrowers with IDB of more than 50 percent. This is not profitable, and consequently, the number of high-risk loans will decrease, and the growth rate of unsecured consumer lending will decrease14. |

Changing the context |

|

Prohibitions on issuance of loans |

Since October 1, 2019, a ban on providing mortgage loans to citizens by nonprofessional lenders, i.e. those who are outside the supervision of the Bank of Russia, has been introduced. Since November 1, 2019, microfinance organizations have been prohibited from issuing loans to citizens secured by housing collateral, even if it is not the only one15. |

Changing the context |

|

Regulation of the penalties amount (fine, overdue interest) |

Since January 1, 2020, according to Federal Law no. 554-FZ dated December 27, 2018 “On amendments to the Federal Law “On consumer credit (loan)” and Federal Law “On microfinance activities and microfinance organizations”, it has been prohibited to charge interest, penalties (fines, overdue interest), payments for additional services under a consumer credit (loan) agreement issued for a period of one year or less, after the fixed amount of payments reaches one and a half times the amount of the credit (loan)16. |

Changing the context |

|

Source: compiled by the author. |

||

11 See:

12 See:

13 Federal Law no. 353-FZ “ On Consumer Credit (Loan) ”, dated 21.12.2013. “Consultant Plus” reference and research system.

14 Fast and contactless: the main financial surprises of the year. Rossiyskaya Gazeta. Special editorial project. Events of the year 2019. Available at: https://і iі beskontaktnoі glavnyeі finansovyeі siurprizyі (accessed: 17.01.2020).

15 Ibidem.

16 The most significant innovations in January. Available at: (accessed: 17.01.2020).

level of compensation for bank deposits to 10 million rubles for the cases of short-term (no more than 3 months) storage of these funds in the citizens’ accounts (when selling residential premises or land, receiving inheritance, receiving social payments and benefits, receiving grants in the form of subsidies, etc.)1711. Another draft law no. 843962-7 “On amendments to the Federal Law “On consumer credit (loan)” (in terms of clarifying the procedure for concluding a consumer credit agreement (loan))1812 provides for the introduction of the obligation for lenders to disclose all the terms of lending directly in the consumer loan agreement, and also provides for a ban on the lender putting in a preprinted form (in the form of “ticks” or other designations made in a typographic way) for the borrower to agree to the terms of lending without his / her own signature19.

These draft laws provide the examples of “changing the context” paradigm. One of the mechanisms that presupposes an impact on both the context and the human is the legislative consolidation of the rules on individuals’ bankruptcy. On October 1, 2015, the updated Chapter X “Bankruptcy of a citizen” of Federal Law no. 127 dated 26.10.2002 “On insolvency (bankruptcy)” came into force20. This measure was a response of the authorities to the situation with the increasing number of problem loans and insolvent debtors. Bankers received a new tool for working with such clients, and citizens became able to resolve difficult financial situations. However, the practical results are still ambiguous. According to Fedresurs (the Unified Federal register of bankruptcy information), over the four years of existence of the consumer bankruptcy mechanism, about 163 thousand Russians have used it, which is only 16% of potential bankrupts the number of which is about 1 million people in Russia. Most cases (more than 70%) end without compensation to the lender (for example, in 2019 only 8 billion rubles (or 3.5%) of claims out of 225.6 billion rubles were returned), mainly due to the fact that even at the entrance to the procedure, citizens do not have property that could be used for payments2115. The bankruptcy procedure may seem timeconsuming for the law-abiding citizens due to their insufficient financial knowledge, and it can become a way to avoid serious losses for the defaulters due to their moral characteristics. It turns out that this measure needs to be adapted to the unprepared banking organizations and the population221.

State regulation of the process of improving financial literacy of the population deserves special attention. The issue of improving the Russians’ financial literacy has begun to be addressed on a systematic basis since July 2011. Based on the results of many years of work, in

Table 2. Main provisions of the Strategy for improving financial literacy in the Russian Federation for 2017–2023

|

Provision |

Contents |

|

Strategy goal |

Creating the basis for the formation of financially literate behavior of the population as a necessary condition for improving the citizens’ level and quality of life, including through the use of financial products and services of appropriate quality |

|

Target groups for priority work |

|

|

Minimum knowledge and skills of a financially literate citizen |

|

|

Strategy implementation results |

|

Source: compiled by the author.

September 2017, the “Strategy for improving financial literacy in the Russian Federation for the period of 2017–2023”2317 was developed and approved for implementation ( Table 2 ). In many regions of Russia (Kaliningrad, Volgograd, Arkhangelsk, Kirov, Kaluga oblasts, Krasnodar, Altai, Stavropol krais, the Republic of Bashkortostan, Adygea, Tatarstan, etc.), regional strategies and programs are being implemented to improve financial literacy of the population. The Federal methodological network for financial literacy in comprehensive and secondary vocational education has been created to provide educational, methodological, informational and consulting services. Information and training events are held on a

-

23 Strategy for improving financial literacy in the Russian Federation for the period of 2017-2023: approved by the order of the Government of the Russian Federation dated 25.09.2017 no. 2039-R. Russian Government. Documents. Available at: http://government.ru/docs/29441/

regular basis, such as regional and all-Russian conferences; competitions for school, student and journalistic works; all-Russian savings week; Family financial festival, etc. the work of network resources has been organized – the “Druzhi s finansami” (“Be friends with finance”) website and newspaper, the Bank of Russia’s information and educational resource “Finansovaya kul’tura” (“Financial culture”), the financial services consumer protection portal “Khochu. Mogu. Znayu” (“I want. I can. I know”) and others.

These activities are aimed at both the “context” and the “human”, but it is necessary to understand that such work is a multi-year process, the effect of which is possible with the mass inclusion of the population in the ongoing financial education activities and an adequate change in the financial environment itself.

Table 3. Other mechanisms of state regulation of the population’s financial behavior

|

Mechanism |

Contents |

Regulation line |

|

Withdrawing credit institutions that do not meet the supervisory requirements of the macro-regulator from the market |

Central Bank of the Russian Federation conducts a policy of discouraging organizations’ unfair behavior in the financial market. In 2014-2016, the number of annually revoked licenses for banking operations was approximately the same (86 in 2014, 93 in 2015, 89 in 2016), in 2017-2019 it significantly decreased (47 in 2017, 64 in 2018, 27 in 2019)24. The total number of operating banks has decreased more than twice over 6 years – from 923 on January 1, 2014 to 442 at the beginning of 202025. |

Changing the context |

|

Development of key information documents (KID) |

The development is carried out by the Central Bank of the Russian Federation together with financial market participants. The KIDs are the passports of financial products in the insurance segment, in the securities market, and in the banking sector. They will contain information about all conditions and possible risks for the consumer26. |

Changing the context |

|

Cancellation of commissions |

From mid-June 2020, according to Federal Law no. 434-FZ dated December 16, 2019 “On amendments to Article 29 of the Federal Law “On banks and banking activities”, the commissions for interregional transfers of funds between bank accounts of individuals within one and the same credit institution (the so-called “Bank roaming”) will be canceled in Russia27; a bill abolishing bank commissions on utility and mandatory payments is being prepared28. |

Changing the context |

|

New mass financial products |

Federal loan bonds OFZ-n (in the text); guaranteed pension plan (in the text). |

Changing the context + the human |

|

Source: compiled by the author. |

||

In addition to these interventions, other mechanisms for regulating the financial behavior of the population are being implemented, mainly related to changes in the environment (in the regulatory and procedural aspect) ( Table 3 ).

The state’s work on the development of financial products, through which it plans to gently involve the broad masses of the Russians in the capital market and simultaneously increase their financial literacy should also be mentioned. For example, federal loan bonds OFZ-n having been issued by the Ministry of Finance since 2017. “OFZ-n users are mostly middle-aged and older people. To expand the audience of OFZ-n users, the product was upgraded in 2019: the sales network was expanded up to four banks (Sberbank, VTB, Pochta Bank, Promsvyazbank), and sales via mobile and Internet applications were introduced. Experts note that attracting young people to buy “public” bonds ... will give them real working experience with investment products and train them to plan a budget for the long term”29.

The Ministry of Finance has been working on a draft law on a new product of the accumulative pension system – the guaranteed pension plan (GPP). GPP will become a new type of pension scheme within the current system of non-state pension provision. It is assumed that the GPP as a standardized protected pension product will provide citizens with the opportunity to direct personal money to finance their retirement income with the state’s incentive support, as well as protect savings from misuse. However, as first Deputy Chairman of the Bank of Russia Sergey Shvetsov noted in early January 2020, “this product will be of more interest to citizens with a monthly income of somewhere from 45 thousand rubles per person in a family. It is unlikely that those with less income will participate in this scheme, because they ... do not have many opportunities to cut their current consumption. This is a product for citizens who have sufficient financial literacy”30. It should be noted that an individual pension capital was earlier being developed which should have provided for employees’ automatic “subscription”, but it was transformed into the GPP, participation in which is voluntary, i.e. the employee should write an application to join this system. As we can see, the state has refused to use one of the methods of nudging, i.e. setting the default choice, in the new pension product.

In addition to the developing and introducing financial products and services, the Ministry of Finance and the Central Bank of the Russian Federation regulate their current offer (i.e., the “context”). A striking example was the intervention of the Bank of Russia in the implementation of investment life insurance services, which were offered under the guise of standard bank deposits. The organizations took advantage of both the “gaps” in the legislation and the inattention of the population when concluding contracts. As a result, the population did not receive increased incomes, and above that faced inconveniences with prior repayment. According to the instructions of the Bank of Russia3120, since April 1, 2019, insurers and their agents are required to warn customers about the main risks and essential terms of the contract when selling such complex products. This intervention has led to a significant reduction in the supply of deposits with investment life insurance. However, banks are currently actively promoting deposits combined with individual investment accounts and brokerage services. This situation clearly shows that in Russian society, “changing the context” is a posteriori and does not always lead to the consolidation of competent financial practices among the population.

Thus, the state regulation of financial behavior of the Russians (in the regulatory and procedural aspect) is mainly aimed at “changing the context”, namely, at building a stable, fair institutional financial environment in which competitive, law-abiding financial organizations operate, providing the population with the most open and clear products and services. However, the development and adoption of certain legislative norms that form the context of the activities of financial organizations are often the reaction of authorities to the existing problems or mistakes made by the population. The impact of the paradigm of “changing the human” (personal beliefs, attitudes and skills) is only gaining strength, mainly through the measures to improve financial literacy and the introduction of new mass financial products.

Conclusion

Most of the aspects of regulating financial behavior of Russians mentioned in the article change the financial environment (in terms of legal and procedural aspects) in which a person acts. They either limit the unfair actions of financial organizations, or try to simplify and optimize the consumer’s choice as much as possible. However, in Russia, these “interventions” are implemented in a slightly different way than behavioral “nudging” in foreign countries. It can be noticed that in Russia, a person perceives the environment passively – the “rules of the game” are changed by the legislator (i.e. the state), and a person only needs to be informed about these innovations, and not make an active choice. Even the specialists of the Center for Strategic Research, studying the regulatory policy of this country and forming proposals and specific algorithms for its improvement, only mention the use of behavioral regulation approaches, regardless of the population, while the main focus is on eliminating the “redundancy” of legislative acts and reducing legal barriers to business functioning32. Only in relation to some aspects of the regulation of the financial behavior in Russia requires the active choice of the person. For example, in the field of financial literacy and financial education, requiring the citizens’ direct involvement in the ongoing activities. Another example is the pension system: the pension schemes and tools offered by the state are always linked to the personal will of citizens in resolving the issue of pension provision.

There is no doubt that in order to effectively regulate the financial behavior of the Russians, it is not enough to solve the issue of funds for working in the financial market, i.e. to ensure a steady increase in income and material wellbeing of the population as a whole. It is also necessary to increase the loyalty and level of trust of the population to financial organizations, improve the availability and clarity of financial products themselves, and reduce possible risks in the course of interaction between the population and financial organizations.

The results of the study show that the Russian government, implementing a policy to regulate the financial behavior of citizens, affects these aspects by building the “context” (the regulatory framework of the financial system), allowing a bias towards the person’s “passivity”. Thus, we can say that it works by trial and error (a long–term reform of the pension system can provide confirmation), without a thorough study of the conceptual foundations (for example the adaptation of the provisions of behavioral economics and the “nudging” mechanisms to the Russian conditions). In this regard, among other things, the decisions taken are often not adequate to the material, cognitive and behavioral capabilities of the population (in particular, OFZ-n and GPP, according to many experts, are designed for people with high income and financial literacy), and sometimes are late (for example, instructions on complex bank deposits). Therefore, the elimination of the identified imbalance between the changes in the regulatory and procedural aspects of the financial context and the human (his/ her knowledge and attitudes) should be taken into account by decision-makers to improve the effectiveness of regulating the Russians’ financial behavior. In our opinion, the authorities should gradually change the regulatory vector from creating an “ideal” financial environment to creating a thinking and active, financially literate citizen. In this case the population will shape the demand for legitimate and competitive financial products and services on their own, and the unfair financial organizations and fraudulent schemes will be eliminated in the course of “natural economic selection”.

Список литературы Regulation of financial behavior of the population of modern Russia: regulatory context formation and personal development

- Pozdyshev V.A. Bank regulation in 2016–2017: Main changes and development prospects. Den’gi i kredit=Russian Journal of Money and Finance, 2017, no. 1, pp. 9–17. (in Russian)

- Golubtsov V.G. The mechanism of insolvency (bankruptcy) of a citizen under the laws of Russia and the USA: Comparative legal research. Vestnik Volgogradskogo gosudarstvennogo universiteta. Seriya 5. Yurisprudentsiya=Legal Concept, 2016, no. 3 (32), pp. 117–125. (in Russian)

- Kuzina O.E., Ibragimova D.Kh. Problems of measuring and ways to improve the financial literacy of Russian population. Monitoring obshchestvennogo mneniya=Monitoring of Public Opinion: Economic and Social Changes, 2008, no. 4 (88), pp. 14–25. (in Russian)

- Stakhnyuk A.V., Izmalkova E.A. Methods for improving financial literacy of the population (regional aspect). Den’gi i kredit=Russian Journal of Money and Finance, 2014, no. 8, pp. 52–56. (in Russian)

- Tsvetova G.V., Erofeeva M.V. Increase in financial literacy of the population of Russia: Review of educational projects. Vlast’ i upravlenie na Vostoke Rossii=Power and Administration in the East of Russia, 2017, no. 3 (80), pp. 71–78. (in Russian)

- Kolesnikova T.N. Impact of cognitive distortions on the behavior of economic agents. Vestnik SGSEU=Vestnik of Saratov State Socio-Economic University, 2019, no. 1 (75), pp. 31–35. (in Russian)

- Golodnikova A.E., Tsygankov D.B., Yunusova M.A. Potential of using «nudge» concept in state regulation. Voprosy gosudarstvennogo i munitsipal’nogo upravleniya=Public Administration Issues, 2018, no. 3, pp. 7–31. (in Russian)

- Drogobytsky L.N. Behavioral economics: The essence and stages of formation. Strategicheskie resheniya i riskmenedzhment=Strategic Decisions and Risk Management, 2018, no. 1, pp. 26–31. (in Russian)

- Zlotnikov A. Irrational rationality of Richard Thaler’s new behavioral economy. Nauka i innovatsii=The Science and Innovations, 2018, no. 6 (184), pp. 40–45. (in Russian)

- Shmakov A.V. The economic comprehensions of human behavior. How to influence the human choice? Shouldyou learn painting if you want to be a painter? can «buba» change economics for the better? Terra economicus=Terra Economicus, 2015, vol. 13, no. 4, pp. 96–131. (in Russian)

- Kapelyushnikov R.I. Behavioral economics and new paternalism (Part I). Voprosy ekonomiki=Voprosy Ekonomiki, 2013, no. 9, pp. 66–90. (in Russian)

- Kapelyushnikov R.I. Behavioral economics and new paternalism (Part II). Voprosy ekonomiki=Voprosy Ekonomiki, 2013, no. 10, pp. 28–46. (in Russian)

- Rubinshtein A.Ya., Gorodetsky A.E. State paternalism and paternalist failure in the theory of patronised goods. Zhurnal institutsional’nykh issledovanii=Journal of Institutional Studies, 2018, vol. 10, no. 4, pp. 38–57. (in Russian)

- Ponomareva S.I. Normative frames of behavioural economics and forms of “behavioural” policy. Upravlenets=The Manager, 2018, vol. 9, no. 3, pp. 14–19. (in Russian)

- Simon H.A. A behavioral model of rational choice. The Quarterly Journal of Economics, 1955, vol. 69, no. 1, pp. 99–118.

- Golman R., Hagmann D., Loewenstein G. Information avoidance. Journal of Economic Literature, 2017, no. 55, pp. 96–135. DOI: 10.1257/jel.20151245

- Barr M., Mullanaithan S., Shafir E. The case for behaviorally informed regulation. In: New Perspectives on Regulation. Ed. by D. Moss, J. Cistierno. Cambridge, MA: The Tobin Project. 2009. Pp. 25–61.

- Woodward S.E., Hall R.E. Diagnosing consumer confusion and sub-optimal shopping effort: Theory and mortgage-market evidence. American Economic Review, 2012, vol. 102, no. 7, pp. 3249–3276. DOI: 10.1257/aer.102.7.3249

- Kahneman D., Tversky A. Prospect theory: An analysis of decision under risk. Econometrica, 1979, vol. 47, no. 2, pp. 263–292.

- Shefrin H., Statman M. The disposition to sell winners too early and ride losers too long: theory and evidence. Journal of Finance, 1985, vol. 40, no. 3, pp. 777–790.

- Hershfield H.E., Goldstein D.G., Sharpe W.F., Fox J., Yeykelis L., Carstensen L.L., Bailenson J.N. Increasing saving behavior through age-progressed renderings of the future self. Journal of Marketing Research, 2011, vol. 48, Special issue, pp. S23–S37.

- Weber E.U., Johnson E.J., Milch K.F., Chang H., Brodscholl J.C., Goldstein D.G. Asymmetric discounting in intertemporal choice: A query–theory account. Psychological Science, 2007, 18, pp. 516–523. DOI: 10.1111/j.1467-9280.2007.01932.x

- Sussman A.B., O’Brien R.L. Knowing when to spend: Unintended financial consequences of earmarking to encourage savings. Journal of Marketing Research, 2016, vol. 53, no. 5, pp. 790–803. DOI:10.1509/jmr.14.0455

- Johnson E., Haubl G., Keinan A. Aspects of endowment: A query theory. Journal of Experimental Psychology: Learning, Memory, and Cognition, 2007, vol. 33, no. 3, pp. 461–474. DOI: 10.1037/0278-7393.33.3.461

- Sussman A.B., Olivola C.Y. Axe the tax: Taxes are disliked more than equivalent costs. Journal of Marketing Research, 2011, vol. 48, Special issue, pp. S91–S101.

- Schwartz J., Luce M., Ariely D. Are consumers too trusting? The effects of relationships with expert advisers. Journal of Marketing Research, 2011, vol. 48, Special issue, pp. S163–S174.

- Beshears J., Choi J., Laibson D., Madrian B., Milkman K. The effect of providing peer information on retirement savings decisions. Journal of Finance, 2015, vol. 70, no. 3, pp. 1161–1201. DOI: 10.1111/jofi.12258

- Thaler R.H., Sunstein C.R. Libertarian Paternalism. American Economic Review, 2003, vol. 93, no. 2, pp. 175–179.

- Thaler R. Novaya povedencheskaya ekonomika. Pochemu lyudi narushayut pravila traditsionnoi ekonomiki i kak na etom zarabotat’ [Misbehaving: The Making of Behavioral Economics]. Translated from English by A.A. Prokhorova. Moscow: Eksmo, 2018. 384 p.

- Rubinstein A.Ya. Why are some theories not recognized, while others are succesful? “Meritorious Paternalism” of R. Musgrave and “Libertarian Paternalism” of R. Thaler. Ekonomicheskii zhurnal VshE=Higher School of Economics Economic Journal, 2019, vol. 23, no. 3, pp. 345–364. (in Russian)

- Thaler R., Sunstein C. Nudge. Arkhitektura vybora. Kak uluchshit’ nashi resheniya o zdorov’e, blagosostoyanii i schast’e [Nudge: Improving Decisions about Health, Wealth, and Happiness]. Translated from English by E. Petrova. Moscow: Mann, Ivanov i Ferber, 2017. 310 p.

- Yunusova M.Yu., Tsygankov D.B. Institutional trade-offs for nudge unit’s formation in public administration system. In: XIX Aprel’skaya mezhdunarodnaya nauchnaya konferentsiya po problemam razvitiya ekonomiki i obshchestva, NIU VShE, 13 aprelya 2018 g. – Sessiya Dc-15. Povedencheskoe podtalkivanie i ekonomicheskaya politika [19th April international academic conference on the issues of economic and social development, Higher School of Economics, April 13, 2018 – Session Dc-15. Behavioural stimulation and economic policy]. Available at: https://events-files-bpm.hse.ru/files/_reports/7E1AC993-47C3-4327-B173-5B675C34D8AD/NudgeUnits_full.pdf (in Russian)

- Dolan P., Elliott A., Metcalfe R., Vlaev I. Influencing financial behavior: From changing minds to changing contexts. Journal of Behavioral Finance, 2012, vol. 13, no. 2, pp. 126–142. DOI:10.1080/15427560.2012.680995

- Madrian B.C., Hershfield H.E., Sussman A.B., Bhargava S., Burke J., Huettel S.A., Jamison J., Johnson E.J., Lynch J.G., Meier S., Rick S., Shu S.B. Behaviorally informed policies for household financial decision-making. Behavioral Science & Policy, 2017, vol. 3, iss. 1, pp. 27–40.

- Belyanin A.V. Richard Thaler and behavioral economics: From the lab experiments to the practice of nudging (Nobel Memorial Prize in Economic Sciences 2017). Voprosy ekonomiki=Voprosy Ekonomiki, 2018, no. 1, pp. 5–25. (in Russian)

- Sunstein C. Nudges.gov: Behavioral Economics and Regulation. In: Oxford Handbook of Behavioral Economics and the Law. Ed. by E. Zamir, D. Teichman. Oxford University Press, 2013. Available at: https://ssrn.com/ abstract=2220022 (accessed: 13.12.2019).

- Divnenko Z.A., Ryzhkova Yu.A., Shuvainikova E.M. Accumulation of the savings in Russia: Problems and Prospects. In: Ekonomika Rossii: perspektivy postkrizisnogo razvitiya: materialy vserossiiskogo nauchnoprakticheskogo simpoziuma molodykh uchenykh i spetsialistov [Russia’s economy: Prospects of post-crisis development: Proceedings of the all-Russian research-to-practice symposium of young scientists and specialists]. St. Petersburg: Izd-vo IMTs «NVSh – Spb», 2010. Pp. 113–115. (in Russian)

- Danilova T.N. The institutional aspect of the saving decisions of the population. Finansy i kredit=Finance and Credit, 2006, no. 12, pp. 14–23. (in Russian)