Risk assessment in the oil and gas complex

Автор: Bogopolskiy V.O.

Журнал: Мировая наука @science-j

Рубрика: Естественные и технические науки

Статья в выпуске: 3 (96), 2025 года.

Бесплатный доступ

In recent years, the efforts of the global business community have been focused on addressing the main issue of how to ensure effective risk management in an environment of uncertainty. This problem is particularly relevant for oil and gas companies: the industry is still experiencing the effects of the largest crisis in the global economy in recent years. Currently, the oil industry is searching for new technologies and moving to the development of complex facilities that were previously considered secondary in order to maintain production at the achieved level or ensure a certain increase in production. The characteristic features of such facilities are understudy, complexity of the geological structure, and the presence of a transit well fund. The purpose of this article is to review and analyze the effectiveness of common risks, both economic, organizational and technical.

Environmental risks, environmental safety, oil and gas enterprises, risk management, environmental and economic risks, environmental protection

Короткий адрес: https://sciup.org/140310845

IDR: 140310845 | УДК: 629.039.58 | DOI: 10.5281/zenodo.15227990

Текст научной статьи Risk assessment in the oil and gas complex

A risk is any possible event or action that, if it occurs, could negatively affect the achievement of management's goals. Risk is characterized by the probability of occurrence and the scale of its consequences. It should be noted that the risk cannot be completely avoided. But it is important to set acceptable limits and risk limits correctly. Problems arise when setting limits on the risk to human life and health. When calculating the risk and setting its limits, the number of negative events is actually planned, which, according to some people is not ethical. Risk always arises with a specific action of the system for the preparation and development of oil and gas reserves, and uncertainty is inherent in the decision and implementation of this decision.

-

II. New approach to risk forecasting

Effective management can only be based on quantitative data, that is numerical risk indicators are needed. Risk indicators can be probabilistic and improbable. Probabilistic risk indicators: absolute and relative characteristics.

The probabilistic risk indicator can be calculated using the formula (1):

R = D X p

where R – the risk indicator;

D – the amount of damage;

р – the probability of an adverse event (the probability of receiving a given amount of damage).

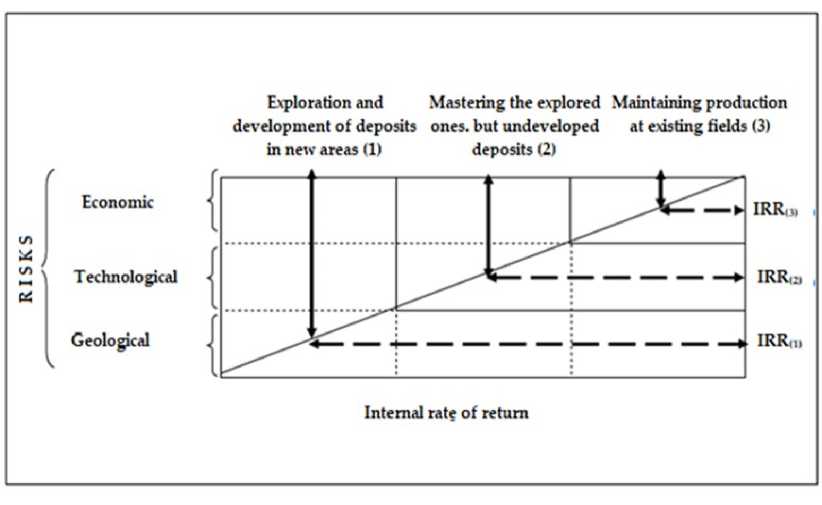

All risks in the oil and gas complex in the preparation of reserves and resources can be grouped into three large groups: economic, technological and geological

The overall cumulative risk is determined by the range of issues covered. The narrower the range of issues caused by uncertainty and affecting the investment project, the lower the overall cumulative risk will be and, therefore, the lower the required internal rate of return on the project will be.

The basic scheme of the relationship between the value of the internal rate of return and the riskiness of the main types of investment projects in subsoil use is presented in Fig. 1.

Fig. 1. The fundamental relationship between the internal rate of return and the riskiness of the main types of investment oil and gas projects

Economic risks are caused by many reasons, among which the most important are stability and current state of the country's economy, imperfect economic legislation, dependence on market conditions, current policy in foreign economic activity, etc.

When assessing the economic risks of oil and gas investment projects, it is necessary to take into account the conditions of investment and profit utilisation, the possibility of imposing restrictions on foreign economic activities (on trade, supplies, transfers, etc.), fluctuations in market conditions, prices and customs duties on oil, natural gas and refined products, the uncertainty of the goals, interests and behaviour of participants in the oil and gas investment process, incompleteness and inaccuracy of information on the production and economic performance of the participants.

In order to take into account the factors of uncertainty and risk in the economic evaluation of project efficiency, all available information about the conditions of its implementation is used. The following methods can be used:

checking for stability of the decision, adjustment of investment project parameters and economic norms, and formalised description of uncertainty.

Uncertainty in the conditions of an oil and gas investment project is not permanent. As the project progresses, additional information about project conditions may become available and previously existing uncertainty is reduced or eliminated completely. With this in mind, the project implementation management system should provide for the ability to process information in the changing conditions of its implementation and make appropriate adjustments to the project.

Technological risks are the likelihood of all types of harmful effects of the results or the production process itself on human health and the natural environment associated with qualitative changes in the social and economic environment, as well as the risks of loss of profit as a result of failure to achieve the planned production volume or an increase in production costs due to the chosen production technology.

Technological risk is possible only in production systems and integrates individual, man-made and environmental risks in the sphere of human economic activity.

Man–made and environmental risks are a probabilistic measure of the occurrence of man-made and natural phenomena, accompanied by the formation and action of harmful factors and causing damage. This type of risk is determined by the formula (2):

R = R 1 X R 2 X R 3

,

where R - is the risk level (the probability of causing certain damage to humans and the environment);

R1 - is the probability (frequency) of occurrence of an event or phenomenon that causes the formation and action of harmful factors.;

R2 - is the probability of the formation of certain levels of physical fields, shock loads affecting people and other objects of the biosphere.;

R3 - is the probability that the indicated levels of fields and loads will lead to certain damage.

Risk factors include:

-

- features of the technology used – the sophistication of the technology features related to the technological process and its applicability in given conditions, the conformity of raw materials to the selected equipment, etc.;

-

- unscrupulousness of the equipment supplier – delays in the delivery of equipment, the supply of substandard equipment, etc.;

-

- lack of available service for the maintenance of purchased equipment – remoteness of service facilities can lead to significant downtime of the production process.

It is possible to minimize technological risks by eliminating these factors.

Geological risk is a geological risk or its inverse, the probability of finding a deposit, due to the uncertainties of the geological structure of the studied area and the history of its formation. The more complex the geology and the less studied, the greater the uncertainty and, consequently, the greater the geological risks.

The concepts of "geological risks", "uncertainty", and "probabilistic assessment" accompany all stages of the exploration process and play a key role in it. They must be taken into account when planning and evaluating the effectiveness of exploration activities, evaluating new licensed areas and new regions, justifying the drilling of exploration and exploration wells, and ranking exploration facilities and licenses.

The uncertainty and associated risk in the oil industry stems from the fact that oil and gas lie deep in the bowels of the earth. The discovery of oil fields, the collection of data on the occurrence of oil reservoirs, the properties of oil and related fluids, and the construction of high-quality geological models depend on the ability to interpret information obtained remotely.

-

III. Engage experts

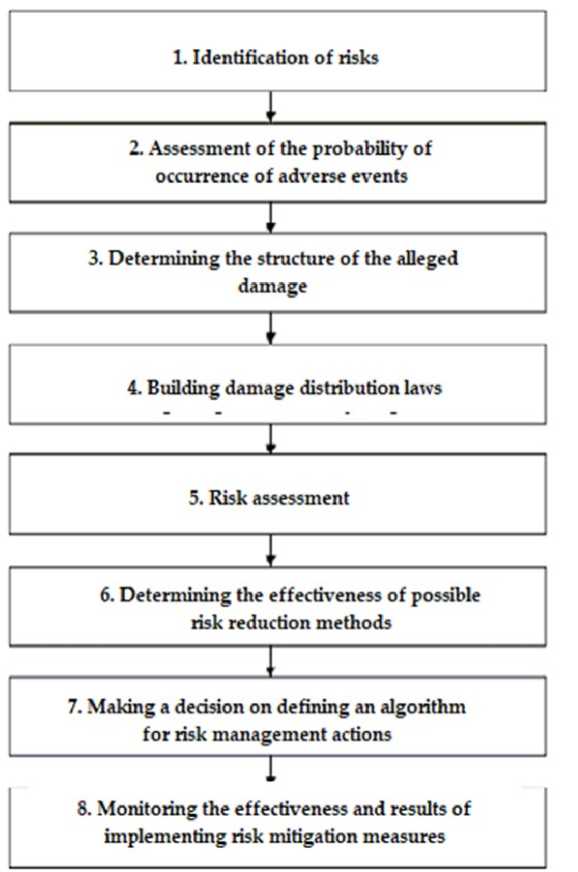

The above is possible with risk management. The entire risk analysis process can be divided into eight stages, which in turn are divided into two levels.

The first level of the study includes five consecutive stages (1-5 stages, Fig.2) and it comes down to a generalized assessment of all possible probabilities of the occurrence of adverse situations, that is, an assessment of risks.

The second level consists of stages of risk analysis (stages 6-8, Fig.2) and provides for the implementation of risk management activities, that is, the entire range of measures to prevent and reduce them [2]. The sequence of all stages of the risk management process analysis can be presented in the form of the following diagram (Fig. 2).

Fig. 2 – The sequence of stages of risk analysis

The presented algorithm for performing risk analysis is universal, but each of the stages has distinctive features depending on the scope of research. Let's consider the content of all the stages typical for the field of environmental and economic risk analysis, including at oil and gas enterprises.

-

1. Identification of risks.

-

2. Assessment of the probability of occurrence of adverse events.

This stage of risk analysis consists in forming a complete list of adverse events that entail negative environmental changes, expressed in deterioration of its quality, directly or indirectly causing economic damage to the environmental management facility.

With regard to environmental and economic risks, natural and man-made disasters and natural disasters can be characteristic adverse events. Therefore, it is necessary not only to identify the possibility of such events, but also to identify and calculate all possible consequences that can cause real damage.

To perform these tasks at the first stage of risk analysis, it is necessary to use both objective and subjective information in a complex.

The essence of the second stage is to directly assess the possibility of negative events that were included in the list at the first stage of the risk analysis. Such an assessment is made based on a certain period of time, that is, the forecast can be short-term and long-term.

There are three main methods for assessing the likelihood of adverse events. These include:

-

1. statistical - it is based on the analysis of statistical data on similar events that occurred at similar facilities in a given territory;

-

2. analytical - it is based on the study of cause-and-effect relationships in the territorial production system, which makes it possible to assess the probability of risk occurrence as a complex phenomenon;

-

3. expert - it is based on the assessment of the probability of occurrence of adverse events by analyzing the results of expert surveys.

-

3. Determining the structure of the alleged damage.

-

4. Construction of damage distribution laws.

-

5. Risk assessment.

-

6. Identification and evaluation of the effectiveness of possible risk reduction methods.

For the most qualitative and accurate assessment of the probability of adverse events, all methods are used simultaneously, comparing the data obtained by each.

When analyzing environmental and economic risks, it should be borne in mind that the identified possible damage may not be a direct consequence of a disaster or disaster, but may manifest itself through a negative change in the environment. Based on this, it is advisable to determine the structure of each possible damage. Usually, possible damage is considered in kind and in value.

Due to the fact that it is impossible to accurately predict the development of events in the event of a disaster, it is definitely impossible to estimate what damage will occur. Therefore, at this stage, the law of damage distribution is being built on the same type of objects for each possible adverse event. There are standard damage distribution laws used in risk analysis.

The purpose of this stage is to form quantitative risk indicators, on the basis of which the remaining stages concerning management decisions will be based. It is at this stage that the average quantitative measure of risk is calculated using formulas (1-2). In practice, for the further implementation of the necessary protective measures, not only the damage indicator obtained in the calculations is taken as the basis, but the maximum acceptable amount of damage and the maximum allowable probability of its occurrence. At environmental management enterprises, this approach is fully justified, since forecasts for environmental degradation and subsequent possible damage are indicative. There may be cases when the cost of measures to reduce such risks is higher than the estimated likely damage.

This stage consists in establishing a list of possible risk management methods. Such methods are divided into groups:

-

• methods to avoid risk;

-

• methods that reduce the likelihood of an adverse event;

-

• methods to reduce possible damage;

-

• methods, the essence of which is to transfer risk to other objects;

-

• methods based on compensation for damage received or caused.

-

7. Making a decision on defining a list of risk management actions.

-

8. Monitoring the effectiveness and results of implementing risk mitigation measures.

This stage is of great importance in the entire risk management process. Its essence boils down to the definition and implementation of an optimal set of risk management methods in the management program. These methods should ensure a reduction in total costs against the background of environmental degradation and maximize benefits at the same time.

The last stage of risk analysis is carried out when monitoring the state of the environment, examining existing hazardous facilities, in particular environmental management enterprises.

Monitoring, as a rule, consists of periodic monitoring of the state of the environment, factors and sources of impact on it. Based on the information obtained as a result of monitoring, the risk characteristics and sources of its occurrence are assessed. Environmental assessment consists in establishing the conformity of an object's activities with environmental standards and regulations, thereby preventing possible adverse effects on the environment.

An environmental certificate is used to confirm compliance with all environmental quality standards and safety standards for facilities that are sources of environmental risk.

Different forecasting approaches suggest that there are several industry models that differ from each other. In this case, it is necessary to use the opinion of experts [2]. In general, the role of experts in predicting such events is very important, as it requires a lot of knowledge and experience from an event specialist.

Some project risk management experts [9,10] suggest ranking individual risks using a risk assessment scheme that is a combination of probability and impact (table 1).

Тable 1 Сombination of probability and impact

|

DEGREE |

Probability value (Р) |

The magnitude of the impact (I) |

|

Very low (VLO) |

0,1 |

0,05 |

|

Low (LO) |

0,3 |

0,1 |

|

Average (MED) |

0,5 |

0,2 |

|

High (HI) |

0,7 |

0,4 |

|

Very high (VHI) |

0,9 |

0,8 |

The magnitude of each risk is determined by multiplying the P x I, then this score is used to rank the risks.

A risk with a medium probability and a high impact has a risk value: 0.5 x 0.4 = 0.20.

The magnitude of the low probability risk with a high degree of exposure is

0.3 x 0.8 = 0.24.

Thus, in this case, the second risk is higher than the first.

-

IV. Conclusion

-

1. The analysis has shown that as a criterion for assessing the real environmental risk, the potential characteristics of economic losses can be used which are quantitatively related to man-made factors of industrial production.

-

2. In the future, the risks in the technogenic sphere may change dramatically: technogenic risks may replace technological risks, and damages will arise due to the destruction of the technological base.

-

3. To improve risk management, a new approach to risk identification is proposed, namely a combination of existing models.

-

4. When applying risk analysis, it is allowed to use one or more methods of hazard and risk analysis at the discretion of the entrepreneur.