Russian model of fiscal federalism: competition or cooperation?

Автор: Tomilina Natalya Sergeyevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Social finances

Статья в выпуске: 5 (29) т.6, 2013 года.

Бесплатный доступ

The article presents the characteristic of the Russian model of fiscal federalism, structurally represented by expenditure commitments, tax authorities and financial assistance. The operating effect of the Russian budget model, based on the principles of cooperation with the prevailing elements of centralized management is evaluated. It is noted that the budgets of the subjects of the Russian Federation have wide range of expenditure commitments, but they do not have sufficient financial sources to cover this liability, and the financial assistance mechanism does not even the situation. Defining the type of the Russian model of fiscal federalism as competitive or cooperative will enable the new reforming of inter-budget relations (which is objectively bound to happen) to be adequate and noncontroversial to the principles and characteristics of mature fiscal model, to bring positive results.

Fiscal federalism, competition, cooperation, inter-budget relations, expenditure commitments, tax authorities, financial assistance

Короткий адрес: https://sciup.org/147223503

IDR: 147223503 | УДК: 336.114

Текст научной статьи Russian model of fiscal federalism: competition or cooperation?

One of the most important components of the budget process, being of both economic and socio-political significance, is inter-budget relations. This is especially the case in federal states, which have, as a rule, quite complex patterns of differentiating income and expenditure commitments of the governing bodies of various levels. It is not accidental that it is the state of inter-budget relations that is characterized foremost by the stage of the implementation of fiscal federalism principles.

Inter-budget relations have been and still are one of the most rapidly reforming elements of the budget system, but, unfortunately, due to their inconsistency with the principles of the already established pattern of fiscal federalism, not all innovations have been organically incorporated into it. How can this goal be achieved?

To address the issue of the article, the author uses methods of logical, structural-functional, retrospective and comparative analysis of statistical data.

The study algorithm is presented in the following blocks: the system of inter-budget relations, which is most adequately characterized by the fiscal federalism model, is analyzed at first; then, the main model types (competitive and cooperative federalism) are considered; after that, the type, to which the Russian model of fiscal federalism gravitates to, and its specifics are determined.

Parameters of the fiscal federalism model

Different approaches to determining qualitative characteristics and the main principles of fiscal federalism models are considered in economic literature.

Most frequently, the basic principles are the following three:

-

1. Delineation of budgetary responsibility between the centre and federal subjects. This refers to the legislative delimitation of spheres of financing expenditures from the budget of one level or another.

-

2. Independence of the budgets of various levels. This principle implies the assignment of own permanent cost funding sources and the right to make decisions about the direction of budgetary funds application to each level of government.

-

3. Equality of all the subjects of the Federation in their financial relations with the centre. This statement does not imply the uniformity of such relations. The subjects may choose this or that type of relations with the centre in compliance with the statutory requirements to these relations.

The principles listed above, formed under the influence of preferences and interests of the different levels of the budget system, give concrete substance to the basic parameters, structurally forming the model of fiscal federalism.

-

• expenditure commitments – delineation of responsibility between the levels of the budget system on providing the population with public services;

-

• tax authorities – rules, enduing the conforming levels of government with financial recourses sufficient for the realization of the imposed responsibility;

-

• financial assistance – the system levelling vertical and horizontal imbalances caused by the mismatch of expenditure obligations and tax authorities through inter-budget transfers to ensure equal access of the citizens to public services throughout the country .

Two models of the system organization of inter-budget relations (competitive and cooperative) are singled out, depending on the order of identifying these parameters and interaction between them.

In the competition model “rules of the game” are determined by each party independently. The competition for mobility resources exists between the federal subjects by means of establishing the most favourable rules of the game. In the cooperation model “rules of the game” are formulated by all participants (federal and sub-federal authorities) conjointly.

Competition and cooperation model of fiscal federalism

The competition model concept was firstly presented in the work of the Canadian scientist A. Breton [4]. It was noted that the participants of federal relations (centre and sub-federal governments) should adapt to the changing conditions. Labor and capital are resilient, and the owners of these production factors can choose the most favourable rules of the game, using the procedure of election (federal, regional and local), to change the place of residence or legal address of the organization, to concentrate activities in the regions with the most favorable conditions. Regional and local authorities, in turn, provide companies and population of the territory with certain public goods in exchange for collected taxes that serve as a kind of prices paid by service consumers. The task in this case is to develop the system of rules on competition between the authorities.

The main features of the competition fiscal model are the following:

– high degree of the management decentralization;

– high degree of financial independence and self-determination of the regional authorities;

– clear distinction and assignment of relevant taxes and profits to each level of the budget system;

– little interest of the central government in the policy levelling horizontal imbalances, poor development of the fiscal equalization system in general: as a rule, federal funds are provided in the form of target transfers on financing specific programmes or needy population categories.

USA is often cited as the example of the country with a competition fiscal model.

Well-known German economist Horst Siebert [1] defined the cooperation model of fiscal federalism as a negotiating model implying that each time all parties gather and come to an agreement, concerning, in particular, the division of revenue sources and expenditure obligations. According to Siebert, cooperation models have significant disadvantage: a compromise in the negotiations between the centre and the federal subjects is always achieved by infringing the interests of future generations, as they are not able to take part in these negotiations.

The main features of the cooperation fiscal model are the following:

– significant interest of the regional authorities in the functions of national income redistribution of macroeconomic stabilization, which results in greater fiscal cooperation of central and regional government institutions;

– share participation of different levels of government in major national taxes;

– active policy of horizontal fiscal equalization and, consequently, enhanced responsibility of the centre for subnational public finances (which leads to the strengthening of control on the part of the centre and certain restriction of the independence of regional authorities);

– confirmation of the territorial justice as the priority one.

The cooperation model has developed most in Germany.

The competition model largely contributes to economic efficiency, the cooperation model is aimed primarily at the fiscal equalization of regional imbalances, i.e. at the territorial justice.

The cooperation model of fiscal federalism is more appropriate for resolving national issues (national defense, nationwide infrastructure development, large-scale social projects, etc.), for levelling interregional differentiation, whereas the competition model is more preferable for ensuring sustainable economic growth, considering the local specifics, when organizing the public sector (tab. 1) .

Note that neither cooperation, nor competition models exist in pure form. On the one hand, it is impossible to establish universal uniform rules of the game, the subjects, for which certain assumptions and/or supplements are made, will always remain; hence, there will be competition for special conditions in the national regulations. On the other hand, even the federal subjects that are absolutely independent from each other and from the federal centre will have to negotiate on the establishment of the game rules, affecting the interests of the state as a whole.

Thus, speaking of the competition or cooperation model of fiscal federalism in any country, it is necessary to take into account that this refers to the prevalence of one or another principle, when building the inter-budget relations. In this regard, the representatives of the competition or cooperation model are not “pure” types, but the countries, in which these two principles are most pronounced.

Table 1. Comparative characteristic of competition and cooperation of fiscal federalism

|

Comparison element |

Competition model |

Cooperation model |

|

Distribution of authority |

Clear distribution of authority Autonomy of the federal centre and the subjects of the federation (subjects) |

Despite clear distribution of authority, the centre intervenes in the subjects’ activities Co-decision principle is often used The centre considers the subjects’ interests The subjects keep to the federal norms and standards |

|

Tax system |

The subject may impose and collect its own taxes |

Unified system of imposing and collecting taxes |

|

Budget expenditures |

The subject determines the directions of spending funds |

Spending of the subjects’ funds is based on social standards Subjects fund the obligations established by the centre |

|

Inter-budget transfers |

Low share of inter-budget transfers in the budget revenues of subjects Lack of subsidies for horizontal equalization Absence of federal mandates |

High share of inter-budget transfers in the budget revenues of subjects Import role of horizontal and vertical equalization Considerable extent of federal mandates and/or acute problem of non-financed federal mandates |

Russian model of fiscal federalism

Let us consider the Russian model of fiscal federalism in the context of the above parameters (expenditure commitments, tax authorities and financial assistance), and find out the peculiarities of its structure and functioning.

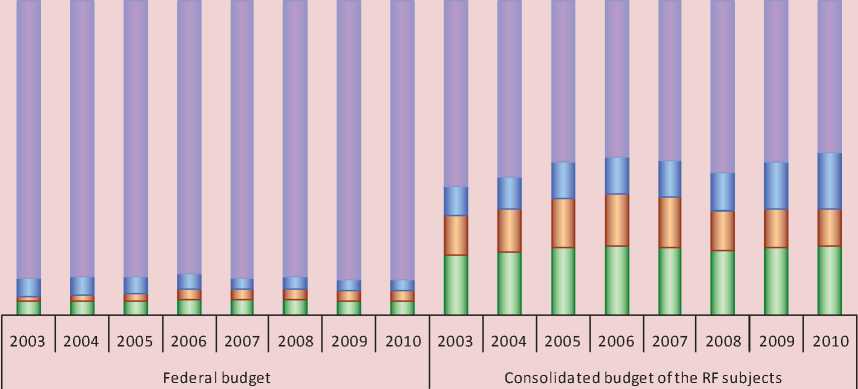

Expenditure commitments. The quantitative estimate of the distribution of expenditure commitments by the levels of the budget system points to almost equal participation of the centre and the regions in the formation of the expenditure side of the country’s consolidated budget, and this proportion remains timestable. A slight decrease in the share of expenditures of the consolidated regional budgets in the country’s consolidated budget in 2009–2010 is caused by the negative impact of the financial crisis on the budget proportions (tab. 2) .

The qualitative assessment of expenditure obligations emanating from the assumption that the entitlement to spend funds does not always imply the entitlement to administer the funds, points to the reduction in the number of functions assigned to the federal level in the chain “statutory regulation – financial support – performance of public functions”. The situation is the reverse for regional and local authorities: they are little involved in the statutory regulation, but at the stages of financial support and performance their role is proportionate to legal responsibility.

Social responsibility sphere vividly illustrates the mismatch of expenditure commitments between the levels of the budget system. The bulk of social obligations (education, health, social policy) is entrusted to sub-federal budgets that comprise half of total expenditures; furthermore, the legal regulation of social issues and standard setting in this sphere of state responsibility is the prerogative of the federal centre (fig. 1) .

The characteristics of expenditure commitments demonstrate that the Russian model of fiscal federalism gravitates to the cooperation model, emphasizing the prevalence of centralized management1:

-

• indeterminate list of expenditure commitments of each level of the budget system;

-

• prevalence of “co-decision principle”;

-

• assignment of expenditure commitments to lower levels without funds reinforcement;

-

• spending based on the centre-established standards.

1995

1996

1997

1998

50.8

52.5

55.8

50.2

1999

2000

2001

2002

52.0

52.7

55.0

49.3

2003

2004

2005

2006

50.0

50.8

43.1

43.7

2007

2008

2009

2010

44.5

45.2

39.3

39.6

* Expenditure commitments are calculated as the share of the expenses of the federal subjects’ consolidated subjects in the consolidated RF budget, %.

Sources: laws on implementing the federal budget of the Russian Federation; Rosstat: www.gks.ru [2]; author’s calculations.

Table 2. Dynamics of the share of expenditure commitments of the subjects of the Russian Federation in 1995–2010, %*

Figure 1. Structure of the distribution of social responsibility between federal and regional levels, %

□ Education □ Health care □ Social policy □ Other expenses

Source: laws on implementing the federal budget of the Russian Federation; Russia’s regions [3].

Structural incompleteness of expenditure commitments distribution – indeterminate list of expenditure powers– is expressed in the predominance of state activities that are in the joint jurisdiction of various levels of government. Under the conditions of such a vague hierarchy the responsibility is diluted between the levels of public administration, when rendering services to the population and, as a consequence, informal practices destabilizing the budget system are spreading.

Tax authorities. In order to analyze tax authorities, let us consider the structure of the consolidated budget of the Russian Federation and its dynamics for a number of years ( tab. 3 ).

In terms of revenue powers sphere the period under review is clearly divided into three sub-periods. While in 1995–1999 the share of the consolidated budgets of the federal subjects in the consolidated budget of the Russian Federation was observed to increase, the role of sub-federal budgets in the formation

Table 3. Dynamics of the revenue powers share of the subjects of the Russian Federation, %*

1995 1996 1997 1998 Revenues** 46.7 49.1 50.4 51.5 Tax revenues 43.2 45.5 46.6 45.3 1999 2000 2001 2002 Revenues** 48.0 46.0 41.2 39.0 Tax revenues 41.0 35.4 33.0 31.3 2003 2004 2005 2006 Revenues** 39.7 40.3 29.8 30.0 Tax revenues 32.4 32.9 27.9 27.8 2007 2008 2009 2010 Revenues** 33.2 32.3 32.5 33.9 Tax revenues 24.2 28.3 28.5 30.2 * Revenue powers are estimated as the share of tax and other revenues of the consolidated budgets of the federal subjects in the consolidated budget of Russia, %. ** Without considering financial assistance from the federal budget. Sources: laws on implementing the federal budget of the Russian Federation; Rosstat of Russia: [2];author’s calculations.

of the consolidated budget has been decreasing since 2000 and the structure of the country’s consolidated budget has changed since 2008, due to the effect of the financial crisis that led to a decrease in the revenues of the federal budget. At the same time, the rate of tax authorities reduction (14%) is higher than the decline rate of expenditure burden (10%).

At present in the Russian tax system with regard to basically all taxes, both tax base and tax rates, as well as almost all the other tax elements are specified by the federal legislation. Rights of the federal subjects and local authorities are reduced to the adjustment of tax rates within the centre-established limits.

High level of centralization, particularly in the sphere of tax powers, was always characteristic of Russia. Some exception was relatively short period of the early 1990s, the negative experience of which brought forth the reversal tendency towards the intensification of the federal component in tax sphere. The effect of centralization is evaluated by using the indicator of fiscal capacity, which can be helpful when characterizing the revenue opportunities of the subjects within the existing system of tax powers distribution.

Fiscal capacity2 of the regions of the Northwestern Federal District (NWFD) at the beginning of the period of the centre whip-hand in tax powers (2000–2002) is characterized by a significant differentiation – 8 regions out of 11 are not even able to reach the average level of fiscal capacity. But since 2007, when the centralization processes have been almost completed, the model of fiscal federalism becomes more or less stable and is not subject to cardinal changes; the situation turns around: 7 subjects “step over” the border of Russia-averaged fiscal capacity indicator, so the differentiation does not seem so profound any more (tab. 4) .

Historically familiar to us centralized management, expressed in the shift of emphasis towards the Federation centre in the system of tax powers distribution, led to the narrowing of differences in the revenue opportunities of sub-federal budgets. Regulation of the rules, consistent with the developed principles of the fiscal model, had positive effect on the whole.

Table 4. Effect from tax powers centralization*

|

о |

00 -° "O >* CD o cd о g cd o) ^ — Cd 00 CT -= GO GO cd x: cd о ,2 cd cd 2 < о > 2 о о |

о ■g GO СТ g 4-1 — с 2 ^ 2 Е ^ ^ “ 5 о |

S |

О < |

о 2 Е 8 о Ё g СТ Г 5 о § о ^ S ,2 g сс S Ё 8 -2 3 S s и g О го 1 g 8 ^ -и- о * со |

||

|

CD |

о |

cd □) 2 2 о g c CT "od "o "2 o CT > ^ ^ = cd 00 GO GO GO cd -C cd cd cd cd 2 < О О О О |

|| S ° g ст Ё -1 2 5 э |

00 |

О < |

||

|

о |

о |

о о |

CD cd CD ст ^2 1 Cd 4—1 4—1 4—1 — Cd 00 GO GO Ф -C cd cd cd 2 < О О О |

1 ° о ^ cd g — ст Е Е о ц о о ^ > ^ |

S |

О < |

|

|

g |

о О □) о 1 £ |

ст ст 2 Cd С . — Cd 00 GO Ф cd cd 2 < О О |

О |

Ё о ^ |

g ст § Ё О и S cd 5= CD > 2 <л |

о < |

|

|

□) 2 о .2 g > S Z IL |

CT S Cd 4—1 4—1 — Cd 00 GO Ф cd cd 2 < О О |

О |

Ё о ^ |

О CD cd ст > 2 |

о < |

||

|

co |

О i ст 2 о .2 g > 2 S 2 |

"cd CT S cd c 4—, 4—, — Cd 00 GO Ф -C cd cd 2 < О О |

^ 1 о о ■□ -о |

Ё о ^ |

2 |

о < |

|

|

g |

ст 2 ^ г > “ cd cd О ст ^ ^ О cd to to to о -^ cd cd cd < о о о °- |

Л ° о “8 cd "о = ст E 2 > s |

О |

Ё о ^ |

S со |

||

|

ст 2 2 о 4-^ "с ст

cd оо оо оо >

|

i ° о i Ё § 5 |

2 о |

Ё о ^ |

S со |

|||

|

О g О CT gg £ g |

1 |

1 |

1 |

1 |

oJ 1 |

< |

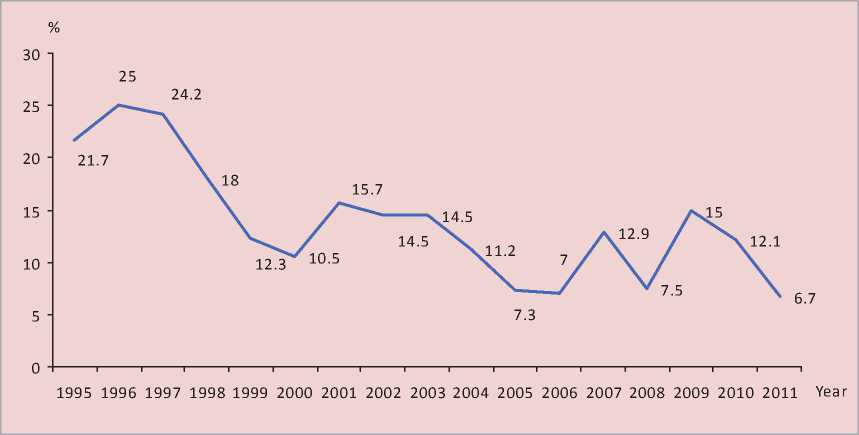

Figure 2. Characteristic of financial assistance by the compensation indicator

The systematization of tax powers characteristics provides the basis for stating the fact that the Russian model of fiscal federalism gravitates to the cooperation model3:

-

• strictly unified tax system;

-

• widespread use of split taxes;

-

• prevalence of federal taxes over regional and local taxes in the tax list.

Financial assistance. The structure of financial assistance corresponds to its notion in the cooperation model of fiscal federalism: the conduct of active state policy of the horizontal equalization, the prevalence of nontargeted federal financial support.

Large-scale centralization of tax powers and overrated obligatory commitments of the subjects provoke imbalanced state of the budget system. Financial assistance does not smooth this inconsistency, as evidenced by the compensation indicator4, which size dropped 3.2 times in seventeen years (1995– 2011) (fig. 2) .

The reduced amount of federal financial support, provided to sub-federal budgets, is not always conditioned by their improving state. For example, in 10 years (2001–2010) none of NWFD subjects showed sustainable regional budget surplus, however the volume of assistance during these years decreased (tab. 5) . The stable list of the regions, receiving federal transfers, is another evidence that the system providing financial assistance is not regulated, and the imbalance of the budget system is not smoothed via transfer mechanism.

The established functioning order of the financial assistance mechanism gave it the following substance5:

-

• assigning significant role to horizontal equilazation;

-

• sophisticated system of financial assistance;

-

• prevalence of non-targeted financial assistance.

Overcoming the imbalance of the Russian budget system should not be reduced to mere deficiency payments of regional budgets, shift of expenditure commitments from one level

Table 5. Performance effect of financial assistance, million rubles*

RF subject 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Republic of Karelia - 129.6** - 679.5 - 1368.3 - 438.3 + 280.7 - 1044.4 - 1034.4 - 365.1 - 3402.5 - 488.7 Komi Republic - 50.2 - 2064.8 - 942.6 - 12.2 + 973.7 + 672.6 + 394.1 - 421.9 - 1051.4 + 986.7 Arkhangelsk Oblast - 72.7 - 385.5 - 500.9 + 227.4 + 220.1 + 333.1 + 2574.5 - 4301.2 - 6424.3 - 219.5 Nenets AO - 17.1 - 241.7 - 6.9 + 930.2 - 612.3 + 1036.7 - 287.2 - 559.1 - 629 + 310.7 Vologda Oblast - 779.2 + 42.4 + 101.8 + 3567.9 - 1722.5 + 509.7 - 147.6 + 261 - 6456.6 - 6857.4 Kaliningrad Oblast + 29.4 - 154.3 - 394.8 - 205.9 - 21.7 - 160.6 + 744.6 + 842.6 + 2667.8 - 2956.5 Leningrad Oblast + 124.7 + 663.3 - 875.2 - 1011.8 - 1137.7 + 2503.9 + 4010.3 + 1109.9 - 4534.2 + 2196.1 Murmansk Oblast - 522.2 - 1177.8 - 1258.0 + 147.8 - 20.3 + 141.7 + 2129.4 - 300.9 - 2562.5 + 2439.6 Novgorod Oblast - 77.2 - 164.4 - 408.2 - 12.6 + 551.9 - 286.8 + 227.4 - 1085.6 - 1653.4 - 3539.1 Pskov Oblast - 15.6 + 318.8 - 519.8 - 499.6 + 529.2 + 1035.1 + 818.3 + 505.5 - 746.8 - 711.3 Saint Petersburg + 2295.9 + 1061.3 - 1092.5 + 1250.5 + 6454.1 +31961.9 +18820.1 - 16659.9 - 6393.9 - 11254 * The effect from financial assistance for the federal subject id defined here as the revenues and expenditures margin of sub-federal budgets. With positive result (budget is closed in the corresponding year with surplus) – positive effect; with negative result (budget is closed with deficit) – absence of positive effect. ** Negative effect is bolded. Sources: Rosstat [2]; author’s calculations. of the budget system to another or insignificant tax adjustments. The search for solutions to the accumulated problems should be systematic, while determining the principles (competition or cooperation ones), on which the model of fiscal federalism is built, allows for adequate and successful reforms.

Conclusion

The centripetal tendencies of the budget process, lack of subnational autonomy in financial and political aspects replaced a strange hybrid of the centralized system for allocating the funds and significant political decentralization, formed by the mid-90s, when the style of interrelations between federal and regional authorities was determined in the process of informal bargaining.

In the early 1990s the determination of our country to develop a model of fiscal federalism, based on competition principles, was not successful as the proclaimed principles were extraneous to the characteristics of the system of inter-budget relations, prevailing in the country.

Further innovations and changes resulted in the transition of a budget model to the framework of the cooperation concept at an angle to forming interrelations between the federal centre and the regions, based primarily on centralization principles. Nevertheless, this fact does not eliminate the need to improve inter-budget relations in the country that is the subject of expanding research and efficient practice.

Список литературы Russian model of fiscal federalism: competition or cooperation?

- Siebert Horst. The Cobra Effect: how to avoid mistakes in economic policy. Saint Petersburg: Publishing House SPbSUEF, 2003.

- Statistical digest of Russia. Available at: URL: www.gks.ru (access date: 02.04.13).

- Russia’s regions: socio-economic indicators. 2011: statistical digest. Rosstat. Мoscow, 2011.

- Breton A. Competitive governments: an economic theory of politics and public finance. Cambridge, 1996.