Small-scale business subjects’ activity intensification as a necessary condition of the regional development

Автор: Barasheva Tatyana Igorevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Continuing the theme of the previous issue

Статья в выпуске: 4 (16) т.4, 2011 года.

Бесплатный доступ

One of the problematic issues of strengthening the positions of the small-scale and medium-scale entrepreneurship with the purpose of the regional socio-economic systems’ development is the issue of their support and stimulation. The work evaluates the contribution of the small-scale and medium-scale business into the socio-economic processes in the region under the realization of the state support measures. One of the variants for the problem’s solution is the legislation improvement in the fields of taxation and infrastructure support to entrepreneurship. The information base is taken from the Federal statistic service’s statistical data. Statistical and economic analysis’ methods are used for the results’ substantiation.

Small-scale and middle-scale business, regional measures for the small-scale business' support, tax regulation

Короткий адрес: https://sciup.org/147223275

IDR: 147223275 | УДК: 334.012.64(470.21)

Текст научной статьи Small-scale business subjects’ activity intensification as a necessary condition of the regional development

During the post-crisis period the special value is acquired by more active attraction of the small-scale business’ subjects to the decision of the regional socio-economic problems on the basis of realization of their diverse peculiar functions and carrying out active and weighed state policy on regulation and support of the small-scale and mediumscale business.

The state is interested in the consecutive business’ carrying out such functions as: satisfaction of the solvent population’s demand for goods and services, assistance to incomes’ formation in the form of interest, rents and wages, increasing innovational activity, providing and strengthening the political and social stability in the society due to the creation of new workplaces and the expansion of proprietors’ layer, financial filling of the profitable part of local budgets, providing the external economic representation of the country with business, etc. [6].

The labor market is considered to be the most significant sphere of influence from the part of the small-scale business’ subjects. It is possible to say, that the small-scale business contribution to the regulation of process of the population’s employment in the area is high enough.

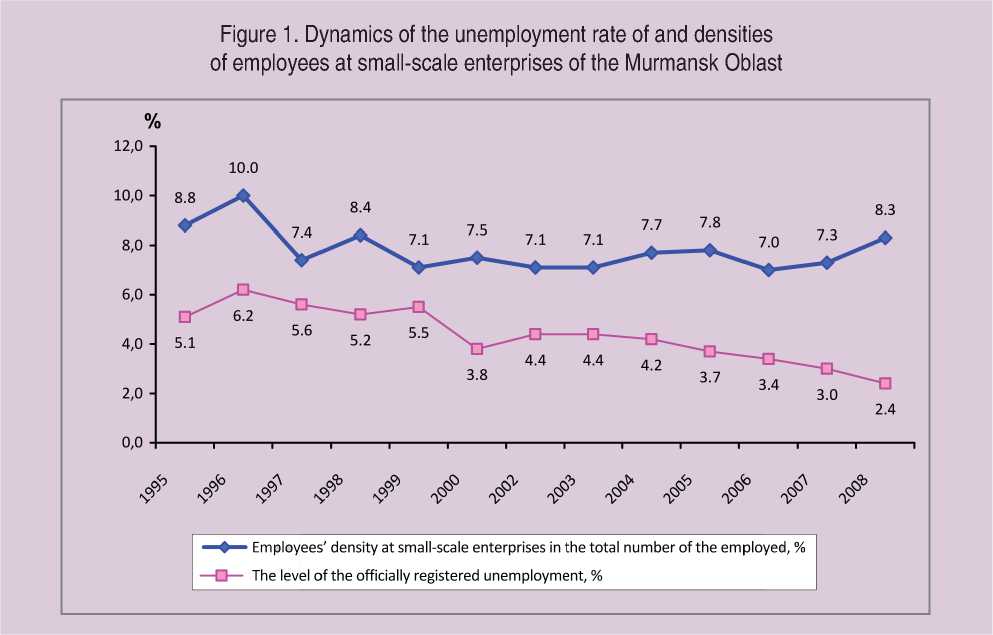

In figure 1 the dynamics of the rate of unemployment and densities of the employees at the small-scale enterprises in the aggregate number of the employees in economy is represented. It is possible to notice, that the growth of the employees’ number at the small-scale enterprises is accompanied by the reduction of the officially registered unemployment’s level.

The mentioned tendency has begun to be traced since 1999 (a post-crisis year) and it proves that the small-scale business in the region confidently carries out its mission in deciding the employment problems not only within the economic preference, but also during the economic instability, putting on the employees’ list unemployed and personnel fired from large city-forming enterprises. The small-scale business in the Murmansk Oblast becomes the shockabsorber of unemployment as the amount of employees at the small-scale business’ enterprises 3 times exceeds the amount of unemployed.

Recently the state has set its hope on the small-scale and medium-scale business as the potential suppliers of tax incomes to the local budgets. The reform of the local selfmanagement at which the local problems were reconsidered and concretized, demanded to realize the new approach to the tax incomes’ redistribution among the budgetary levels. The budgetary code on the constant basis fixed the receipt from two local taxes - the federal tax on personal incomes and special tax modes which payers are directly the subjects of the smallscale and the middle-scale business as profitable sources for municipalities. The statistics available for the analysis allows estimating the small-scale business’ participation in the incomes to the local budgets only on the basis of the receipts from special tax modes which densities still remain low, but in the dynamics tends to grow and to change from 2.5% in the incomes of the municipalities’ budgets, where the level of the small-scale business’ development is minimal, to 11.6% in the cities with the highest activity of the enterprise sector.

The participation of the small-scale business’ subjects becomes more significant in the regional economy. For the period from 2005 to 2008 production, works and services provided by the small-scale and the mediumscale enterprises increased more than in 1.5 times. The share of the shipped goods and services provided by the small-scale enterprises in gross national product of the area grows, having increased for four years from 10.9% to 13.3% [8]. The small-scale and the mediumscale enterprises in Murmansk area which operate in the sphere of wholesale and retail trade, of vehicles’ repairing, household products and objects of personal use, and also processing production, show a higher level of labor productivity among the regions of the NWFD (tab. 1) .

The high parameters of the labor productivity are provided by the small-scale and the medium-scale enterprises against the background of the low level of their fixed capital’s financing. The volume of investments into the small-scale enterprises’ fixed capital in the area, falling for a worker, concedes to the average indices in Russia. Now the ratio among the investments and the labor productivity in the Murmansk Oblast makes 1 to 3. For the regions of the Southern Federal District this ratio makes 6 to 5, for Siberia this ratio makes 9 to 10.

Thus, it is possible to conclude, that the subjects of the small-scale and the mediumscale business in the area show their participation in the socio-economic processes, providing socio-economic effects in the region.

At the same time the received effects are not so significant, as they are in foreign countries. If the share of the small-scale business’ subjects in the Murmansk Oblast in gross national product makes about 30%, in Great Britain, the USA, and Germany it changes from 50 to 54%, in Japan from 52 to 55%, in Italy and France it is about 60%. About 29 % of employees are involved in the small-scale business in the Murmansk Oblast (compare with Japan – over 79%) [1]. Into the budgets of economically advanced countries the small-scale and the medium-scale business brings more than 50% of the income, and in the Murmansk Oblast this parameter does not exceed 20%.

The low effect from the small-scale business’ participation in the solution of the problems of the socio-economic development of the region is caused by the existing problems, as the results of interrogation of the small-scale business’ subjects showed (it was carried out in the beginning of the year of 2008 under the decision of the Department of Economic Development) [3].

Table 1. Production, works, and services provided by the small-scale enterprises in the basic kinds of economic activities counting for 1 worker (in NWFD) in 2008, million rubles

|

Processing production |

Construction |

Wholesale and retail trade, vehicles’ repairing, household products and objects of personal use |

Transport and communication |

Real estate operations |

|

Murmansk Oblast |

||||

|

1.4 |

1.12 |

4.84 |

1.1 |

0.52 |

|

Karelia Republic |

||||

|

0.77 |

0.82 |

3.47 |

0.95 |

0.41 |

|

Komi Republic |

||||

|

0.76 |

1.15 |

2.75 |

1.67 |

0.77 |

|

Arkhangelsk Oblast |

||||

|

0.83 |

0.6 |

2.67 |

0.75 |

0.56 |

|

Vologda Oblast |

||||

|

0.73 |

0.72 |

2.71 |

0.88 |

0.9 |

|

Russia |

||||

|

1.07 |

1.03 |

3.71 |

1.06 |

0.77 |

There are common problems, universal for all businessmen of the micro-scale, small-scale and medium-scale business: high rent; high taxes; the raise in prices for energy carriers, raw material, tariffs; shortage of the qualified personnel; competition growth. Also the problems which are peculiar for exclusively for the micro- and the small-scale enterprises were revealed. They are: the lack of money resources for development and investment projects; lack of turnaround means; difficulties at certification, licensing, receiving other documents of permission; checks of various supervising bodies.

In the year of the financial crisis the existing problems aggravated and the new ones appeared, basically of the financial character, which were caused by the reduction of demand for goods and services, both from the part of the population and enterprises-partners; the reduction of the state orders’ volumes, toughening of the conditions of credit resources’ getting, etc.

Business’ reaction towards the financial crisis’ influence began to be seen from the first quarter of the year of 2009 and was expressed in insignificant falling of the resulting parameters of the small-scale enterprises’ activity. According to the data of the Ministry of Economic Development of Murmansk area, the quantity of the small-scale enterprises decreased for 111 units, the volume of the goods sold by the small-scale enterprises in the sphere of wholesale and retail trade was reduced for 7%, in comparison with the similar period of the previous year, and also the enterprises’ productivity in the sphere of the financial activity decreased.

Positive dynamics of the volume of production, works and services (1.6%) was shown by the small-scale and medium-scale enterprises in the sphere of processing production, agricultural production and rendering public services, and also the enterprises producing and distributing electric power. There was insignificant increase in the average number of workers in the list structure.

It is necessary to pay attention to the fact, that at the gain reduction in the average employees’ number at the small-scale enterprises, the dynamics of this parameter is kept positive: in the first quarter of 2007 it was 113%, in the first quarter of 2008 it was 104%, and in the first quarter of 2009 it was 101%.

Being guided by the recommendations of the Government of the Russian Federation, for easing the consequences of the crisis phenomena and the creation of favorable conditions of managing, new approaches to the tax regulation directed on the decrease of the tax loading on the small-scale sector of managing were developed and introduced.

To realize the steps on the decrease of the tax burden became possible in the connection with the expansion of the rights of the Russian Federation subjects due to the special tax mode – the simplified system of taxation – on the basis of regulation by the rate of single tax.

The tax law of the Murmansk Oblast [2] determined the categories of tax bearers-exempts and the lowered rates of the unified tax corresponding to them. The basic categories of exempts became the small-scale business’ subjects of the following prior fields of activity: education, public health services, fishery, fish culture, municipal services, and also agriculture and food production. For such categories of tax bearers the lowest rate of 5% is established. The lowered rate of 10% is stipulated for the organizations and the individual businessmen who carry out the activity in the sphere of processing production on the territory of the Murmansk Oblast.

In a result the realization of preferences within the simplified system of taxation has not lowered the effectiveness of the mentioned tax mode (the volume of receipts from the simplified system, falling for one subject of taxation, is 2.3 times higher, than from the unified tax on the imputed income), having provided the growth of tax base and tax incomes of local budgets (fig. 2) .

Figure 2. Cumulative income taxes (with the account of the average population’s incomes) per 1 subject of the small-scale and medium-scale business, thousand rubles

With a view of the further easing of the crisis phenomenon’s influence on the small-scale sector of the economy the Government had developed the additional measures of support on which realization it was stipulated 75.2 million rubles in the regional budget. As the Governor of the Murmansk Oblast D. Dmitrienko reported at the press conference, in 2009 the means of the regional budget were distributed in the following way: businessmen-beginners got more than 4 million rubles as grants, preferential micro loans made the sum of 15 million rubles, 100 million rubles were allocated for crediting contracts. According to the measures’ plan of the Program of the businessmen-beginners’ support “Step by step” 20 grants with the package cost of about 1 million rubles on the business development were given. With the purpose of access simplification for receiving the small-scale and mediumscale property its list including 65 objects was made, and in 2009 the basic part of property was transferred for using by the subjects of the small-scale and medium-scale business.

It is possible to notice, that the supporting measures are most actively applied towards legal persons and individuals who start the enterprise activity. However while carrying out separate actions the problems connected to the imperfection of the used support mechanisms come to light.

In particular, it concerns the grants’ distribution among the businessmen-beginners which is carried out within the framework of the realization of the Program “Step by step” in the Murmansk Oblast. Estimation of the problems’ and offers’ condition submitted in the work, is formulated on the basis of studying the summary report SEE MRIBI “About the projects’ realization in the sphere of the small-scale and medium-scale business” and on the results of interrogation of businessmen-beginners participating in the program of state subsidizing.

So, the business-incubator (SEE MRIBI), located in Apatity, together with the Ministry of Economic Development of the Murmansk Oblast carries out the competition among business-plans, by which results the businessmen-beginners can apply for getting the starting grants for their own business’ creation with the value of about 300 thousand rubles. Thus the persons who successfully passed the training “Businessman-beginner” have the right to take part in the competition and who don’t have the status of the subject of the small-scale and medium-scale business, and also the persons who was already given this status and less than one year passed from the moment of registration. Such conditions of getting grants result to the thing that businessmen don’t have enough time to pass the training course for one year, to issue all the necessary documents and to carry out the selection of the qualified personnel necessary for the project’s realization. 22 projects of 156 received the money resources at the end of a year and were not realized completely for the set date. According to the law the unused means are the subject of the return to the state. In this connection, in businessmen’s opinion, it is necessary to expand the time restriction of the status “a businessman- beginner” from 1 year to 2 years.

Besides, the businessmen’s interest touched the question on reconsideration of the position of the regional law establishing the restriction by the enterprise activity’s kinds, giving the right on the status’ reception of SEE MRIBI resident and getting grants [4]. Their offer consisted in including into the list of the residents who had the right to apply for the grant’s getting, prior for the region and perspective for the development of the kinds of activity which were ascertained in the Program of the socio-economic development of Apatity for the period from 2009 to 2011, such as construction, including repairing works, and public catering.

A very important direction of support, as businessmen consider, is also the support of the existing business. The majority of the project’s participants plan to expand their business after end of the project’s term. In this connection, and also owing to numerous applications for help to the business-incubator of the small-scale enterprises’ heads, it is offered to consider the problem at the regional level on getting the grant’s right by the existing producing enterprises, basing on the principle co-financing with the purpose of the business’ development and expansion, and also with the purpose of the increase of the small-scale enterprises’ stability at the post-crisis period.

Thus, it is possible to conclude, that the activity of the SEE MRIBI is a significant support for the development of the beginning business. However, the absence of the system approach, the lack of information, the low level of scrutiny of the incubation’s questions seriously interfere the further use of businessincubators. To reveal “the problematic” places and to provide high productivity of the support measures can be achieved by interaction between business-incubator personnel and the participants of the state subsidizing program.

Anti-recessionary measures’ realization continued in 2010. 361 enterprises concerning the small-scale and medium-scale business addressed for the financial support. The Committee of fish industry in the Murmansk Oblast gave grants of the sum more than 8 million rubles. The Ministry of economic development provided the financial support in the following forms: grants of more than 54 million rubles, subsidies of 11.78 million rubles, micro loans of about 25.96 million rubles, guarantees of about 93.9 million rubles. The Ministry privities transferred property to 26 small-scale and medium-scale enterprises under the contract of rent [5].

Alongside with granting the means from the regional budget the Murmansk Oblast by the results of competition received the grants from the federal budget within the framework of rendering the state support of the small-scale and medium-scale business at the rate of 215 million rubles (tab. 2) . It is possible to notice, that by 2010 the means had increased more than three times, however their volume, falling for one small-scale enterprise, considerably concedes to the size of the grant which was

Table 2. Grants from the federal budget on co-financing the actions on support of the small-scale and medium-scale enterprises [3]

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

|

|

Grant size, million rubles |

3 |

7.4 |

21.8 |

46.6 |

59.7 |

215 |

|

Grants for 1 small-scale enterprise, rubles |

995.7 |

2419 |

6883.5 |

8336.3 |

8609.7 |

31006.6 |

given to businessmen-beginners for the project realization (300 thousand rubles), and in view of all means (both the federal and the regional ones), stipulated for rendering support, a subject of the small-scale and medium-scale business can apply for the sum not exceeding 50 thousand rubles.

Thus, the policy of the Government of the Murmansk Oblast in the sphere of the smallscale business’ support promoted the growth of the small-scale, medium-scale and microenterprises. By the results of the year of 2009 their quantity increased for 8.3% and reached 6934 units.

The volume of production, works and services grew for 14.2% and made 99.5 billion rubles [3]. The greatest share in the volume of profits (64%) was provided by the smallscale enterprises. The profits’ densities from the micro-enterprises made 20%, from the medium-scale ones it was 16%.

As the global experience testifies, the major factor of the economic development is not the result which is equal to the difference between the number of the newly-created enterprises and their so-called “death rate”, but the number of the annually registered enterprises [7]. In 2009 the number of the re-created enterprises made 124 units in the Murmansk Oblast.

One of the reasons of the existing tendency of the low growth of the number of re-created small-scale and medium-scale enterprises for the recent several years is the policy of the cityforming enterprises which is directed on their disaggregating. From the structure of the basic enterprise the non-profile divisions equipped with property and personnel, with getting the status of the small-scale business’ subjects, are allocated in independent units.

They continue to carry out their activity, providing both the specific services for the cityforming enterprises, and other services, in particular, solving the problems of the city’s vital functions.

While realizing the mentioned process actually the filling the market niches by more competitive enterprise structures occurs, that limits the opportunities of the small-scale enterprises’ creation by natural market mechanisms.

At the same time, the small-scale enterprises created in such a way get under the influence of the “founder” who rigidly supervises the prices of labor and labor services. The developed situation, probably, is one of the reasons of the low enterprise activity and non-unified distribution of the small-scale business’ subjects in the area.

Another obstacle for the business’ development became the federal center’s legislative innovations. The setting of the raised tariffs on the insurance payments resulted in the growth of the level of all managing subjects’ loading, but differently. For the enterprises functioning in the conditions of the general tax mode, the loading increased in 1.3 times, and in the conditions of the special tax modes it increased in 2.4 times.

Thus the Federal Law №212-FL referred to the preferential category those ones which carry out the activity in the following directions: foodstuff production, textile and sewing production, machines’ and equipment production, construction, public health services and social services, education, etc., also provided them the lowered level of the insurance tariffs, having increased the loading of their payers in 1.8 times.

In a result the new order of the insurance payments’ calculation caused mass downsizing at enterprises and the return to the use of “grey schemes” in paying wages. According to the researches carried out by the all-Russian public organization of the small-scale and medium-scale business “SUPPORT of RUSSIA, on the average about 20% of the companies of the small-scale business, carried out downsizing. About 30% of employees were fired. However in many firms the reduction was formal: employees were not on the list of the staff, but they continued to work, receiving the salary “in envelopes”, non-officially. For instance, in December, 2010 the salary “in envelopes” was paid by 21% of businessmen. In March, 2011, after the setting of the raised insurance payments, this figure grew twice and made 41% [9].

In connection with the fact that to the greatest degree the subjects of the small-scale and medium-scale business using special tax modes, and which initially assume sparing conditions of the taxation, suffered from innovations, it is necessary to consider the problem, if it is not planned in the future to return to the old circuit, about stage-by-stage increase of the insurance payments – it is similar to the order accepted towards the payers of the unified agricultural tax (in 2011 – 2012 – the rate of 20.2%, in 2013 – 2014 – 27.1%).

At the same time, for achieving high socioeconomic effect in the region by the small-scale and medium-scale business’ subjects it is necessary to raise the efficiency of application of the tax regulation’s mechanism. In particular, the transfer of the tax to profit of the enterprises, which payers are exclusively the subjects both of the small-scale and the medium-scale business, to the local level can be considered expedient and granting the right on managing the tax rate is given to the local authorities. It logically coordinates with points 15 and 16 of the Law (October, 6, 2003, № 131-FL) in which it is established, that the local problems include assistance to the small-scale and medium-scale business’ development which should be carried out due to own profitable sources of the local budget.

The resulted directions of tax regulation, certainly, do not cover all the spectrum of the problems of the regional socio-economic policy. But, nevertheless, such tax mechanism as fixation the profit tax from the micro-, the small-scale and medium-scale enterprises to the local budgets of the municipal formations of the Murmansk Oblast and managing the tax at the rate of 100 % fixed to the regional budget, will raise the interest of the local government in creating the conditions for the development of the small-scale and medium-scale business that will promote the growth of taxable base and tax receipts to the local budgets, and also, in turn, will allow to create the financial base of the enterprise sector subjects’ support.

Besides, the mentioned mechanism’s realization will allow to designate the special conditions of the small-scale business subjects’ taxation within the borders of the general system of the taxation, having separated them from the tax conditions of the large-scale economic subjects.

Список литературы Small-scale business subjects’ activity intensification as a necessary condition of the regional development

- Dzboyeva, D.P. Urgent problems of the development of the small-scale and medium-scale forms of business/D.P. Dzboyeva//International Accounting. -2010. -№ 11. -Pp. 15-21.

- Law of the Murmansk Oblast (03.03.2009, № 1075-01-MAL “About the setting of the differentiated tax rates depending on tax bearers’ categories under the tax raised in connection with application of the simplified taxation system” (Accepted by the Murmansk Regional Duma, 19.02.2009).

- Resolution of the Murmansk Oblast Government (15.09.2010, № 420-PP/13) “About the long-term target program “Competitiveness’ development in the Murmansk Oblast” for the period from 2011 to 2013”. Subprogram “Development of the small-scale and medium-scale business in Murmansk area”.

- Resolution of the Murmansk Oblast Government (01.07.2010, № 289-PP) “About the state support of businessmen beginners” (along with “Program of supporting actions for businessmen-beginners “Step by step”, “Order of granting to businessmen-beginners on own business’ founding”). Available at: http://www.gov-murman.ru

- The register of the small-scale and medium-scale business’ subjects in Murmansk area (support addressees for 01.01.2011, the data is given by the Ministry of Economic Development of the Murmansk Oblast).

- Shahmalov, F.I. The state and the economy: bases of interaction/F.I. Shahmalov. -M.: Publishing House “Economics”, 2000. -382 p.

- Shironin, V.M. The small-scale and medium-scale business as the subjects of the public dialogue and the state policy/V.M. Shironin . -Available at: http://lab.obninsk.ru/public/anh-sem-2004/sh02.gif.192

- Federal Service of State Statistics . -Available at: http://www.gks.ru/

- -Available at: http://opora.ru/.php