Strategic management of development of the military-industrial complex enterprises with the use of dual technologies under the resource-based approach

Автор: Brovko Petr Mikhailovich, Petruk Galina Vladimirovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 3 (45) т.9, 2016 года.

Бесплатный доступ

The main goal of the present study is to consider the specifics of current state and strategic management of development of enterprises within the military-industrial complex in the dynamic environment of the global market and determine the most effective ways of their development on the example of Russian helicopter industry. Methodology and tools of the study are based on the comparison and comparative evaluation of major Russian and foreign corporations engaged in development and production of helicopters. The authors analyze current state and strategic management of the helicopter industry on the basis of information available in the public domain. The source of the main problems of functioning of military-industrial complex enterprises, in particular, in the helicopter industry, can be found in the specifics of strategic management of its development, which is determined by major holdings under the close supervision of the government. One of the most important ways to develop enterprises of this industry is to diversify civil production in order to increase the output and improve the financial situation and, on the other hand, to reduce the dependence of enterprises on the state defense order...

Military-industrial complex, core competencies, resources of enterprises, helicopter industry, resource-based approach, diversification

Короткий адрес: https://sciup.org/147223847

IDR: 147223847 | УДК: 338.242 | DOI: 10.15838/esc.2016.3.45.4

Текст научной статьи Strategic management of development of the military-industrial complex enterprises with the use of dual technologies under the resource-based approach

Introduction. Modern conditions of economic development in Russia, which are characterized by stochasticity and instability of socio-economic processes caused by increased competition in global markets, determine the need for new solutions in the field of strategic development of industrial enterprises. This issue is especially critical for companies within the military-industrial complex (MIC), which is the basis for the high-technology industrial sector.

A tool to improve economic efficiency of domestic industrial enterprises within the military-industrial complex is the use of the resource-based approach in the management of their strategic development.

So far, many theoretical and practical aspects of formation, selection and effective implementation of a strategy for development of defense industry enterprises with the help of the resource-based approach remain poorly tested, poorly designed, and require further research.

The goal of this study is to explore the specifics of the current state and strategic management of development of enterprises within the defense industry, in the context of dynamic environment of the global market; one more goal is to identify the most effective ways of their development taking Russian helicopter industry as a case study.

Specific features of functioning and strategic management of development of the Russian military-industrial complex were considered in works of V.L. Makarov and A.E. Varshavskii [3], B.N. Kuzyk [5], V.N. Rassadin [8], A.V. Sokolov [9] and others. However, due to the fact that the problem of strategic management of the defense industry is complex and multidimensional, there still remain numerous issues that require further elaboration. One of the theoretical approaches in the methodology for strategic management of enterprises is the resourcebased approach, the foundations of which were laid in the works of foreign researchers such as J. Schumpeter [13], E. Penrose [17], B. Wernerfelt [20] K. Prahalad and G. Hamel [18], R. Grant [15], D. Collis [14], D. Teece [19]. This approach as a way of managing enterprises was considered in the works of V.S. Kat’kalo [4], V.S. Efremov and I.A. Khanykov [1, 2] and others. However, specific features of strategic management at the military-industrial complex enterprises have a pronounced effect on the use of the resource-based approach in their management and actualize further research in this direction.

Methods and methodology. Methodology and tools of the present study are based on comparison and comparative evaluation of major corporations in Russia and foreign countries involved in the helicopter industry. The main methods of research are economic-statistical, comparative analysis (when comparing performance indicators of the companies under analysis), graphic description, economic and financial analysis (when assessing economic performance indicators of enterprises).

Current status and development trends of the military-industrial complex enterprises in modern Russia and foreign countries. In the high-tech sector of the Russian economy, the military-industrial complex is characterized by high knowledge intensity, significant capital intensity, complexity of products, good prospects in modernization of the national economy. MIC is an integral element in the national defense enhancement system, ensuring national security. The share of production of military products at MIC enterprises exceeds the production of civilian products.

Analysis shows that global companies within the military-industrial complex have the following trends in their development:

– manifold increase in recent decades in the cost of development and production of high-tech equipment, hence the need for an enterprise to have access to cheap and long-term capital, and sufficient manufacturing capacity;

– rising cost of products and enhancement of their functionality lead to a reduction in the supply of military products, which forcing producers to expand their activity in the civil market segments, which includes the use of “dual technology”;

– increase of requirements to the quality of products and the rise in their price caused the transition to the sales of a product’s life cycle rather than the separate product.

These trends have changed the model of management of strategic development of enterprises within the military-industrial complex: in Russia and abroad, we observe a concentration of manufacturers of high-tech defense products, particularly aircraft manufacturers. For example, Boeing, a leading U.S. aircraft corporation, acquired several helicopter companies: the Vertol Aircraft Corporation in 1960, Rockwell Corporation in 1996, and McDonnell

Douglas in 1997, which itself prior to that had taken over the Douglas Aircraft Company and an aircraft division of the Hughes Aircraft Company (developer of the AH-64 “Apache” helicopter). A similar trend is observed in Europe. For example, BAE Systems, Inc., the world’s second company in terms of sales, was founded in 1960 as the British Aircraft Corporation by combining major aircraft companies of the UK. In 1977, it was transformed into the state corporation “British Aerospace” and after privatization in 1999, it teamed up with UK corporation Marconi Electronic Systems that has assets in aviation, electronics and shipbuilding. As a result of this merger BAE Systems was formed, it absorbed a number of companies for the production of armored vehicles and artillery, and became the leading militaryindustrial corporation in the UK. Later, BAE Systems faced restructuring by selling part of its European assets, and refocused on the U.S. market.

In 2004, BAE Systems absorbed United Defense, the U.S. leading producer of artillery, and in 2007, it acquired Armor Holdings, a large manufacturer of armored vehicles. As a result, BAE Systems has taken a leading place on the U.S. arms market [6].

Similarly, by absorption of the British company Racal by the French military electronic corporation Thomson-CSF, Thales Group was created.

To retain its positions on the world market of high-tech products, and no to lose its scientific and technological potential, Russia has integrated its developers and manufacturers of high-tech defense products in public corporations. An example of integration of defense companies is the formation of Russian Helicopters JSC, which includes companies engaged in:

– helicopter development – Mil Moscow Helicopter Plant PJSC, Kamov Design Bureau JSC, Kazan Helicopters JSC;

– mass helicopter production, Kazan Helicopters JSC, Ulan-Ude Aviation Plant JSC, Rostvertol PJSC, Kumertau Aviation Production Enterprise JSC, Progress Arsenyev Aviation Company OJSC;

– production of units and components – Stupino Machine Production Plant JSC (SMPP), Reductor-PM JSC;

– helicopter service, Helicopter Service Company JSC and aviation repair plants in Novosibirsk, Saratov, Chita, Saint Petersburg and Kaliningrad.

This integration has a positive impact on the development of Russian helicopter industry, as evidenced by the increase in the output, investment in the development and production of new equipment, modernization of production facilities, attraction of additional staff to the company. However, despite the positive developments in the sector, Russian producers lag behind

Table 1. Characteristics of world helicopter manufacturers

|

Manufacturer |

Indicators |

||||

|

Machines delivered, units |

Revenue, billion US dollars |

Sales income, billion US dollars |

Expenditure on R&D, billion US dollars |

Labor productivity, thousand US dollars |

|

|

Russian Helicopters JSC |

|||||

|

2012 |

290 |

4.04 |

0.64 |

0.16 |

96.4 |

|

2014 |

271 |

4.4 |

1.02 |

0.19 |

96.7 |

|

Airbus Helicopter |

|||||

|

2012 |

475 |

7.3 |

0.4 |

0.38 |

383.6 |

|

2014 |

471 |

8.5 |

0.54 |

0.39 |

371.5 |

|

Bell |

|||||

|

2012 |

261 |

4.2 |

0.63 |

0.18 |

353.2 |

|

2014 |

249 |

4.2 |

0.52 |

0.16 |

487.9 |

Compiled with the use of: , http://www. ,

their foreign competitors in terms of productivity (tab. 1) .

The gap in labor productivity is due to the differences in the organization of production processes at Russian and foreign companies. Foreign companies specialize in performing works at the individual stages of production process, which make a significant contribution to the creation of market value (marketing, product development, final assembly and testing, after-sales service), and they passing the remaining work to external suppliers. The production cycle in Russia is almost entirely concentrated within a single enterprise, which reduces the flexibility of Russian manufacturers. It must be emphasized that practically all enterprises of the helicopter industry have a narrow product range.

Another feature affecting the development of domestic and foreign enterprises is the policy of government orders. For example, the Pentagon is the main customer of products developed by Lockheed Martin (58% of the sales), the company’s supplies to other U.S. governmental ministries and agencies account for 27% of the corporation’s total sales [16]. Due to the high cost of modern military equipment (for example, the cost of a fifth generation aircraft exceeds 100 million U.S. dollars, the cost of attack helicopters of the fourth generation – 20–25 million U.S. dollars), governments are cutting the purchase of military equipment. This forces companies to increase their activity in the civil market. So, in 2014, Boeing delivered 723 civilian and 184 military vehicles, respectively. In

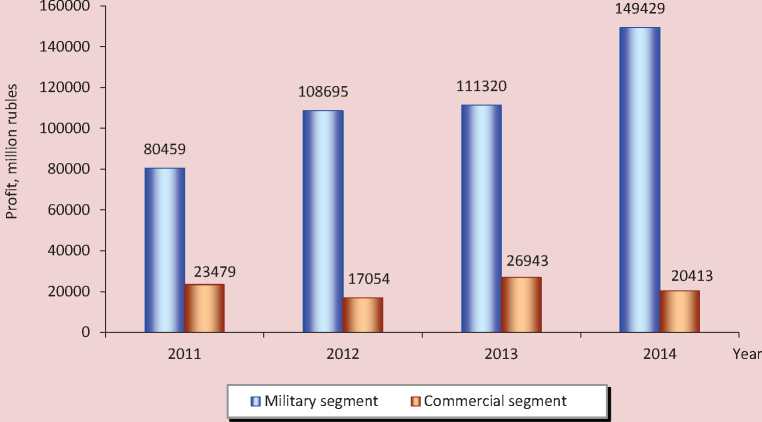

Figure 1. Dynamics of profit of Russian Helicopters JSC by segment in 2011–2014

Compiled with the use of the following source: http://www.

the portfolio of Boeing, 440 billion U.S. dollars account for the orders on civilian goods and 62.3 billion U.S. dollars – on military orders [10].

In Russia, the work of defense enterprises in general and helicopters in particular is associated with the policy of supplying military equipment under the state defense order and programs of military-technological cooperation. Thus, the program of rearmament of the army until 2020, adopted by the Government of the Russian Federation, involves the purchase of more than 1,000 helicopters for the Armed Forces [12].

Figure 1 shows the profit structure of Russian Helicopters JSC for the period 2011–2014, by segment [11].

Such profit structure is risky for Russian Helicopters JSC, because in case of state order reduction the enterprises will be on the brink of collapse. This will eventually lead to the loss of scientific and technological strength of the helicopter industry, including the loss of personnel (scientific and technical staff), organizational, informational, material and technical elements. The development of high-tech production is a very long-term, time-consuming and expensive process, for this reasons the loss of developed capacity must be minimized.

Since defense enterprises in general and helicopter manufacturers in particular are part of large integrated systems (holdings and corporations), the formation of defense enterprise development strategy takes place at the level of senior executives of the corporation and under close attention and control of the government which provides the majority of the strategy funding and defines in detail development directions of the entire corporation. In the present circumstances, individual defense enterprises, being part of integrated structures, are, as a rule, completely deprived of an opportunity to be involved in choosing their development strategy.

Thus, according to the analysis, the following correlation between the issues associated with strategic development of helicopter industry enterprises is derived:

– a strategy of individual enterprises development is formed by the holding company which is forced to focus primarily on the state defense order, because due to insufficient development of financial markets and institutions home enterprises depend directly on government funding;

– the development strategy of the holding company focuses on creating a competitive corporation with all enterprises harmoniously integrated into the production life cycle. This will give the holding company an ability to adjust production output meeting international demand. However, the integration of enterprises into a unified system in the holding company is not finished yet, and a fragmentation of various sectors of economic system still prevails, which leads to reduced capacity of the holding company in manufacturing and supplying the market with high-demand civil products. In these circumstances, the holding company management is forced to focus on well-established military production, losing ground in many segments of internal and external market and lacking additional income.

The most important economic element of Russian Helicopters JSC is the production system which includes five mass production plants (their structure includes all production stages): Kazan Helicopters PJSC, Ulan-Ude Aviation Plant JSC, Rostvertol PJSC, Kumertau Aviation Production Enterprise JSC and Progress Arsenyev Aviation Company OJSC ( tab. 2 ).

From Table 2 it can be concluded that Kazan Helicopters PJSC maintains the firmest positions in the sector in a set of dynamics indicators. It is ahead of other manufacturing enterprises in terms of revenue, productivity, and capital use efficiency.

Kazan Helicopters PJSC owns a strong engineering center which develops helicopters of its own design released to mass production. In addition to conducting its own development work, the company also acts as an associate contractor for the leading experimental design bureau (OKB): it conducts cooperative development work with Mil Moscow Helicopter Plant PJSC on Mi-38 helicopter development.

Table 2. Characteristics of Russian Helicopters JSC manufacturing enterprises

|

1 ^ ^ о Е g о о1 |

CD |

ГО со ОО |

со |

го СП СП го |

й |

го |

го |

▻2 |

со |

Е |

1 |

э ■g 1 Е |

||

|

CD |

го со |

со |

го |

ГО |

га |

со |

^Г |

|||||||

|

о |

го со со со |

▻2 |

Е |

СП го |

го го |

со |

го |

ОО |

со |

го со |

||||

|

СО || е В ^ "О о |

CD |

го СП со |

СП |

го го |

СП го СП СП |

го га |

Е |

го |

го со со |

го |

ОО |

|||

|

CD |

ГО го |

о |

го |

Е |

го го го |

5 |

го ОО |

О |

го |

ОО со |

5 |

|||

|

о |

со со |

ОО |

см |

Е |

го |

см |

S |

О |

го го |

го го |

О |

8 со |

||

|

СО о о сс |

CD |

ОО со СП со со |

го |

О |

го го |

га го |

го го |

об |

со |

го |

CD |

го го |

||

|

CD |

со ОО СП СП |

го |

го го |

го го |

го |

5 |

го со |

го |

2 |

со |

CD |

|||

|

о |

со ГО |

го го |

СП го |

СП СО |

ОО ОО |

ОО |

й |

го |

го |

го |

||||

|

со 5 |

CD |

ОО со со |

го |

Е |

го СП го |

СП го |

Ш |

СП со го |

Е |

го го |

i> |

|||

|

CD |

га |

О |

ГО го го го |

со |

S |

й |

СП го |

ОО со |

5 |

-б |

||||

|

о |

Е |

со |

О |

га |

го |

LO |

го го |

го |

го го |

го го |

||||

|

со |

CD |

го со го |

см |

со |

СП го СП го |

го го го го |

го |

со |

со го |

го |

го |

го ОО СП |

ю |

|

|

CD |

го со |

го го |

Е |

го го го |

го го |

го го |

го го |

го со |

го |

го |

го |

2 |

||

|

о |

со |

со |

со |

го СП го го |

го |

го го |

го |

ОО со |

ОО |

2 |

со |

со |

||

|

Ё S |

Ё 'о го |

1 Е х со |

Ё |

Ё < |

Е ^ со Е |

о Ё |

§ 5S- |

2 Ё ■5 ° ГО Ё |

Е Ё Е о к Ё ^ о о "Ё |

о. Ё 5 S |

со “ 2 § |

|||

Other manufacturing enterprises are focused on the improvement of previously produced products and applied operational processes, which reduces productive capacity of Russian Helicopters JSC.

It should be noted that helicopter engineering enterprises have developed a production model which includes almost all stages of primary and auxiliary production into a unified complex. Under this production model it is impossible to adjust cost-effective release of new products without sufficient loading of available excess capacities. But civil production market is supplied with small batches of machines, carried out according to individual customer requirements. A production model which is unable to meet modern demands results in lower (in comparison with foreign companies) labor productivity of national helicopter industry.

Furthermore, Russian industrial enterprises are not fully integrated into the system of maintaining the life cycle of a released product. During production process they pay little attention to the characteristics which define the machine’s subsequent after-sales service by the consumer. This reduces the competitiveness of Russian helicopter industry on the world market, because the customer requires a projected maintenance cost calculation and planned after-sales maintenance activities of the supplied equipment within a few years of operation.

In order to improve the competitiveness of Russian helicopter industry on the world market, enhance the output of products in demand and increase productivity at enterprises, the government developed a program “Development of Aircraft Industry for 2013–2025” [7] which involves the improvement of production model by transferring a number of secondary process stages to outsourcing. The Program also provides as a priority direction the expansion of civil production, the output of which is expected to triple by 2025. Similar challenges are pursued by other defense industry enterprises, where the share of civil production should amount to 50% of the total production output. It is very difficult to solve this problem without production diversification at defense industry enterprises. It should be noted that Russian enterprises have made several attempts of diversification and most of them failed to achieve positive results. One of the reasons for that was that they ignored scientific approaches which consider the peculiarities of production activity of defense industry enterprises and the conditions for operating business in the world market.

The use of the resource-based approach in strategic management. A resource-based concept of strategic management emerged in the early 1990s in response to increased competition in global economy. The concept is based on the principle that the company obtains a competitive advantage in the market due to its possession of unique resources and abilities, providing rent achieving. The combination of resources into sets which help perform distinctive actions forms company’s competences, the formation of which occurs within a specific organizational structure that is difficult to reproduce by competitors. This entails the unique nature of the company’s competences, protecting them from reproduction by the competitors [4, 19].

In high-tech industries with constant business environment changes the managerial ability to coordinate and move internal external competences in line with the change in business environment in order to ensure the company’s competitiveness is particularly relevant.

Using the results of the study of problems of strategic development of enterprises of national defense industry and relying on the provisions of the resourcebased approach, the authors believe that one of the most important directions of strategic development of defense industry enterprises is production diversification aimed at increasing production output and improving financial situation on the one hand, and at reducing the dependence of enterprises on state defense order. The diversification of production can be implemented through the output of dualuse products.

The suggested diversification approach is very difficult to implement, therefore the largest corporations in the world implement an associated diversification policy, the mechanism of which is described in detail in the “resource-based concept”. Companies expand through diversification by using their existing competences to create value. The competences include the knowledge, some parts of which are not easily transferred to beginners. Therefore, mastering production of products beyond the company’s competences is resourceconsuming and requires staff retraining according to new behavioral patterns.

In Russian practice of the 1980s and 1990s a diversification policy at defense industry enterprises was implemented, which failed as a result of switching to civil goods production totally different from the characteristics of primary production of defense industry enterprises. One of the main reasons for the failure of defense industry diversification was the lack of proper attention to financing of activities.

The diversification model proposed in the resource-based concept differs from the one previously used at the enterprises of home defense industry in the fact that companies need to develop not just any product, but only products that are within the range of their key competences. A success of introduction of new products depends on the enterprises’ ability to develop their value creation competence by improving existing processes and systems. In other words, defense industry enterprise can implement “dual-use technologies” that are applicable to both civil and defense products.

The goal of every organization using associated production diversification on the basis of “dual-use technologies” is to select and economically justify a specific optimal diversification strategy.

The methodology of production diversification strategy development represents a set of procedures, some of which require research of marketing and techno-economic nature. These procedures should be carried out in seriesparallel so as to reduce the time necessary for preparation of production of new types of products.

In the framework of the resource-based approach to production diversification it is necessary to develop additional tools for the preparation and organization of production at defense industry enterprises.

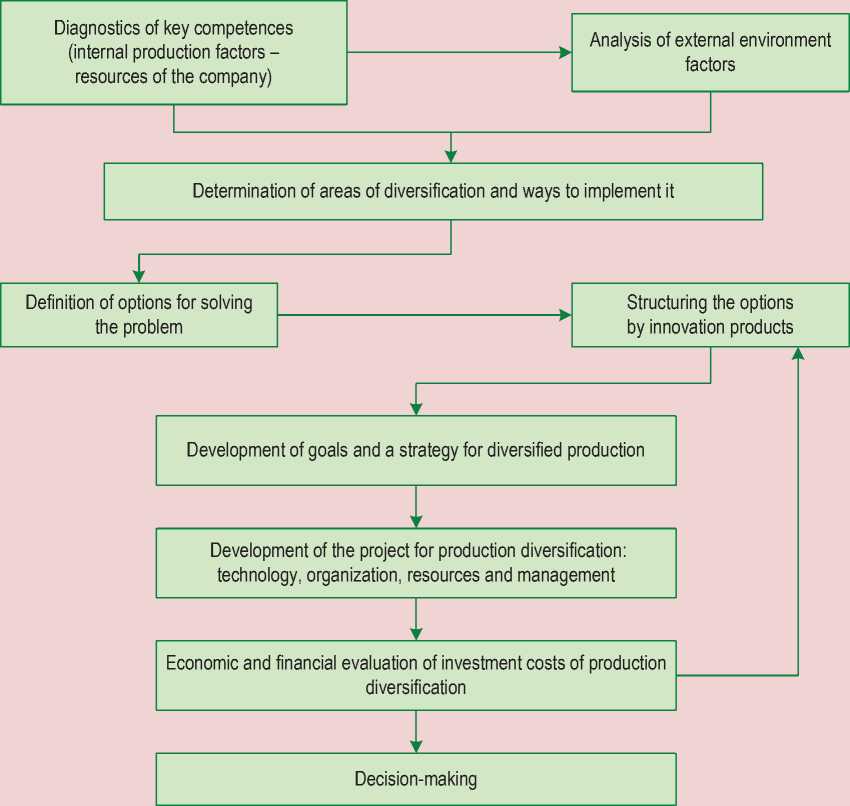

The authors propose a procedure of an optimal production diversification strategy formation ( Fig. 2 ).

The practice shows that while diversifying production it is impossible to create innovative high-quality products without sufficient investment in production capacity necessary for the process. For example, the creation of new models of aviation equipment for both defense and civil purposes requires large investments in fundamental and applied interdisciplinary research, in modern design and production technologies, in testing and certification and the establishment of an after-sales service system.

To get one ruble of finished product in the helicopter industry, it is necessary to spend 25–30 rubles in 5–10 years. The search for funding sources of financing and the distribution of financial resources are important components of the process of production diversification.

In this regard, an integral part of the methodology for diversification must handle organizational and economic issues which include the following:

– establishment of ranks of investment sources for upgrading the equipment and technologies;

– selection of a mechanism for formation of financial resources to implement diversification;

Figure 2. Flow diagram of choosing a production diversification strategy using a resource-based approach

– classification of the factors, the use of which in management helps revitalize reproductive activity in diversified production and make it more effective;

– selection of functions for managing diversification in the production of civil products;

– elaboration of methodological tools for financial calculations in reproduction processes through diversification;

– development of an algorithm to control diversification processes as a component of diversification of economic activities;

– development of an algorithm for calculating investment income in the processes of reproduction of the potential for diversification;

– development of a system of indicators and indices for assessing production and economic activities, the use of fixed assets and capital investments, market stability of an industrial enterprise in the new conditions caused by diversification;

– development of venture capital management methodology (in case venture capital is used) with the use of risk management mechanisms.

Defense companies that diversify production now, in most cases, believe that newly developed areas of activity should compensate for a possible decline in the production of defense products and thereby improve their economic situation. At the same time, it often happens that the decisions about diversification – the release of new products, entering new markets – are taken spontaneously, without the necessary study of the impact of the decision on the development strategy of the company. In fact, these decisions are extremely important for the enterprise, they are, no doubt, strategic in nature, so the planning and implementation of these solutions must be elaborated thoroughly by the management of defense industry enterprises with the use of modern scientific approaches and management tools.

The methodology proposed by the authors for the purpose of choosing a strategy for production diversification will help improve the tools of decisionmaking at defense enterprises and for helicopter manufacturers; in particular, it will enhance the effectiveness of implementation of management functions related to civilian production. It should be noted that production diversification will not be effective if no measures are taken to improve the production model of defense industry enterprises, to enhance their ability to introduce new products and technologies.

Expanding the range of civilian products manufactured by enterprises within the military-industrial complex will develop competence for creating the market value of domestic companies, which will, in turn, strengthen their positions in the global market and will become an impetus for expanding high-tech production in Russia.

Conclusion

The present study shows that the source of major problems in the functioning of Russian defense enterprises, and in particular the helicopter industry, is connected with the specifics of strategic management of its development, which is determined by major holdings under the close supervision of the government. Therefore, the strategy for development of enterprises included in the holding focuses mainly on the government defense order, which determines their direct dependence on government funding.

One of the most critical directions of development of Russian helicopter industry and enhancement of its competitiveness is to diversify its production of civil products in order to increase the output and improve the financial situation on the one hand, and on the other hand – to reduce the dependence of enterprises on the government defense order. The experience of major corporations in the world shows that the policy of related diversification is most effective. Companies grow through diversification by using their existing competencies to create value.

It is not possible to implement the related diversification strategy without theoretically substantiated methodological tools. Currently, the theory and practice of strategic management des not have a sufficiently developed methodological support of the choice of strategy diversification. The proposed method of choosing the strategy for production diversification on the basis of the resource approach will help fill this gap.

The development of “dual-use technologies” and the issue of dual-use products help not only maintain the powerful military-industrial complex, but also accelerate the development of the economy as a whole. The profit obtained through the sales of “dual-use technologies” will help compensate for some of the costs of military equipment development. Adaptation of the provisions of the resource management approach to the strategy for the development of defense enterprises within the framework of integrated structures can be a real source that will help solve the problems of these enterprises in the part that concerns market oriented products production.

Список литературы Strategic management of development of the military-industrial complex enterprises with the use of dual technologies under the resource-based approach

- Efremov V.S., Khanykov I.A. Razvitie kompanii na osnove ispol'zovaniya klyuchevykh kompetentsii . Menedzhment v Rossii i za rubezhom , 2003, no. 5, pp. 26-37. .

- Efremov V.S. Khanykov I.A. Klyuchevaya kompetentsiya organizatsii kak ob”ekt strategicheskogo analiza . Menedzhment v Rossii i za rubezhom , 2002, no. 2, pp. 8-33. .

- Innovatsionnyi menedzhment v Rossii: voprosy strategicheskogo upravleniya i nauchno-tekhnologicheskoi bezopasnosti: monografiya . Supervised by V.L. Makarov, A.E. Varshavskii. Moscow: Nauka, 2004. 880 p. .

- Kat'kalo V.S. Evolyutsiya teorii strategicheskogo upravleniya: monografiya . 2nd edition. Saint Petersburg: Vysshaya shkola menedzhmenta, 2008. 548 p. .

- Kuzyk B.N. Oboronno-promyshlennyi kompleks: proryv v XXI vek: monografiya . Moscow: Yuniti-Dana, 1999. 186 p. .

- Makushin M.V., Bat'kovskii A.M. Zarubezhnyi opyt integratsii predpriyatii -proizvoditelei vooruzheniya i voennoi tekhniki. Strategicheskoe planirovanie i razvitie predpriyatii. Sektsiya 1 . Materialy XV Vserossiiskogo simpoziuma, Moskva, 15-16 aprelya 2014 g. . Ed.by RAS Corresponding Member G.B. Kleiner. Moscow: TsEMI RAN, 2014. Pp. 98-101. .

- Ob utverzhdenii gosudarstvennoi programmy Rossiiskoi Federatsii “Razvitie aviatsionnoi promyshlennosti na 2013-2025 gody”: postanovlenie Pravitel'stva RF ot 15.04.2014 № 303 . Available at: https://www.consultant.ru/document/cons_doc_ LAW_162188/. .

- Rassadin V.N., Sanchez-Andres A. Tekhnologii dvoinogo naznacheniya v oboronnoi promyshlennosti i perspektivy ikh ispol'zovaniya . Problemy prognozirovaniya , no. 6, 2001, pp. 35-42. .

- Sokolov A.V., Bazhanov V.A. Vysokotekhnologichnoe i naukoemkoe proizvodstvo: problemy i neopredelennost' budushchego . EKO, 2014, no. 1, pp. 15-25. .

- Website of Boeing Company. Available at: http://www.boeing.com

- Website of Russian Helicopters Company. Available at: http://www.russiauhelicpters.aero.ru. .

- Fedorov Yu. Gosudarstvennaya programma vooruzhenii -2020: vlast' i promyshlennost' . Indeks bezopasnosti , no. 4 (107), vol. 19, pp. 41-59. .

- Schumpeter J.A. Teoriya ekonomicheskogo razvitiya . Translated by V.S. Avtonomov et al. Moscow: Direktmedia Pablishing, 2008. 401 p. .

- Collis D.J., Montgomery C.A. Competing on resources: Strategy for the 1990s. Harvard Business Review, 1995, July-August, pp. 118-128.

- Grant R.M. The resource-based theory of competitive advantage implacations for strategy formulation. California Management Review, 1991, vol. 33, pp. 114-135.

- Hartung W. Prophets of war: Lockheed Martin and the making of the military-industrial complex. New York: Nation Books, 2011.

- Penrose E.T. The growth of the firm -A case study: The Hercules Powder Company. Business History Review, 1960, vol. 34, no. 1, pp. 1-23.

- Prahalad C.K., Hamel G. The core competence of the corporation. Harvard Business Review, 1990, vol. 68, no. 3, pp. 79-91.

- Teece D.J., Pisano G., Shuen A. Dynamic capabilities and strategic management. Strategic Management Journal, 1997, vol. 18, no. 7, pp. 509-134.

- Wernerfelt B.A. Resource-based view of the firm. Strategic Management Journal, 1984, vol. 5, no. 2, pp. 171-180.