Structural upgrading measurement and optimization path of sports industry - an examination of China’s solution

Бесплатный доступ

It is of great significance to explore the level of structural upgrading and optimization path of the sports industry to promote the transformation and development of the sports industry. Taking the structure of China's sports industry as the research object, a quantitative analysis method is adopted to construct a model for measuring the structural upgrading of China's sports industry, measuring the external structure of China's sports industry from 2006 to 2023 by the index of the proportion of the sports industry in the economic structure, and the direction and rate of the internal structural upgrading of China's sports industry from 2006 to 2023 by the coefficient of the overstepping forward of the industrial structure, the value of the change of Moore's structure and the value of the average change of the industrial structure. The direction and rate of upgrading the internal structure of China's sports industry from 2006 to 2023 are measured by the coefficient of industrial structure overrun, the value of Moore's structural change, and the average change value of industrial structure. The results show that: (1) the external structure of China's sports industry is continuously optimized, and its role in China's economic development is constantly emerging, but the contribution rate to economic growth is still relatively low; (2) the over-advanced development of the sports service industry, and the lagging development trend of the sports construction industry and the sporting goods manufacturing industry conform to the law of upgrading of the industrial structure; (3) from the internal viewpoint of the sports service industry, the sports management activities, the sports fitness and leisure activities, and the sports competition and performance activities are lagging. Sports management activities, sports fitness and leisure activities, and sports competition and performance activities are lagging, which has become one of the critical obstacles restricting the transformation and upgrading of China's sports industry. (4) From the perspective of the upgrading rate, there is ample space for structural changes in China's sports industry, and the upgrading rate is in an upward trend, especially in the emerging industries.

Transformation development, sports industry structure, upgrading measurement, optimization path

Короткий адрес: https://sciup.org/170209428

IDR: 170209428 | УДК: 796:338.46(510)"2006/2023" | DOI: 10.58984/smb2501007k

Текст научной статьи Structural upgrading measurement and optimization path of sports industry - an examination of China’s solution

DOI:

The global transition to a knowledge-driven economy is forcing various industries to undergo structural adjustments, and the sports industry, as a strategic area that integrates economic vitality, technological innovation, and social well-being, has attracted much attention in terms of its upgrading path. Against the backdrop of countries responding to the need for recovery and sustainable growth in the post-epidemic era, optimizing the industrial structure has become a key focus point for enhancing productivity, fostering innovation ecosystems, and aligning with the United Nations Sustainable Development Goals (SDGs). In this context, China's practice of promoting the modernization of the sports industry provides a valuable case study for examining the structural upgrading mechanism of transition economies. From the viewpoint of industrial structure theory, upgrading industrial structure promotes resource allocation, coordinates industrial division of labor, and drives economic developmentt (Wang, 2018). The process of sports industry development is also the process of industrial structure adjustment and continuous improvement of innovation ability, shifting from resourceintensive and labor-intensive low-value-added industries to high-value-added high-tech industries and strategic emerging industries. The idea of claiming the speed and efficiency of economic development from the evolution of industrial structure is the core and essence of industrial development policy ( Liu, 2000). After years of development, China's sports industry has entered a rapid development stage, with rapid growth in the scale and added value of the sports industry and continuous optimization of the industrial structure. Still, it faces structural problems, such as weak innovation ability, small total scale, unreasonable structure, and unbalanced regional development.

Some scholars have already determined through empirical research that economic structure conversion helps to promote the rapid development of the economy and believe that the measurement and judgment of the level of industrial structure adjustment will directly affect the decision-making and implementation process of the economic growth so the assessment of the effect of industrial upgrading and the promotion of structural conversion has become an essential path for the rapid development of the economy (Liu & Ling, 2020). Through the collection and collation of relevant literature on economic structure optimization and industrial structure upgrading, the research on industrial structure upgrading by scholars at home and abroad mainly focuses on the evaluation of the optimization effect (Cheng, Sun, & Bao, 2020), influencing factors(Yu & Shen, 2020; Lei & Cai, 2019), and the relationship with related sys-tems(Zhu & Liu, 2020;

In terms of the analysis method of industrial structure change, some scholars have used the dynamic deviation-share method to study the industrial structure change; Fabricant (2009) used this method for the first time and utilized the decomposition formula to analyze the industrial structure effect; Paci et al. (1997) and Fagerberg et al. (1999) used this method to investigate the adjustment effect of industrial structure under the economic growth environment. Meanwhile, scholars at home and abroad have widely utilized Moore's structural change value, Lilien's index, and the average change value of industrial structure to determine the rate of industrial structure upgrading and the coefficient of overshoot to determine the direction of industrial structure upgrading. John H. Moore (1978) proposed Moore's structural change value to measure industrial structure change in 1978, and Robson (2006) used the Lilien index to analyze the change in industrial structure in each region of Britain. These several methods of industrial change analysis at home and abroad are more mature in their application system, with lower data requirements, simple operation, and strong interpretation, which are not only widely used in the analysis of the structural change of three industries ( Liu & Ling, 2020), but also applicable to the research of transformation and upgrading of subdivided indus-tries ( Xu, Zhuang & Chu, 2019; Zhao, Yin & Ma, 2015), but the research of using these methods of industrial structure change analysis to measure the degree of structural change of the sports industry is still in the blank in the field of sports.

Specifically for the emerging sports industry, the number of research on industrial structure is rising. There are two main perspectives in the quantitative analysis of sports industry structure optimization. Hu Hongcheng (2012) and Yang Qian et al.(2011) earlier used grey correlation analysis to quantitatively analyze the optimization of China's industrial structure, and on this basis, An Junying et al. (2017) applied grey system theory to establish a GM (1, 1) prediction model to predict and analyze the structural changes in China's sports industry from 2016 to 2020, which provided the quantitative scientific basis for the dynamic evolution of the structure of the sports industry - Huang Haiyan (2011), Zhao Fuxue(2017), Yang Qian, etc. (2011) use location entropy, industrial structure diversification index, deviation-share analysis, comparative labor productivity, and other indicators to quantitatively analyze the basic situation of China's sports industry structure, through which the dynamic optimization process of China's sports industry structure can be observed. Secondly, it studies the relationship between the optimization of sports industry structure and related systems. Dai Tenghui et al. (2019) took the contribution rate and pulling rate of economic growth of the sports industry as the indexes and used quantitative analysis to explore the macroeconomic effect in the development of China's sports industry from the perspectives of total quantity and structure. In general, the perspectives of measuring the structure of the sports industry include industry structure, investment structure, etc. There are internal and external structures from the analysis direction, and the quantitative analysis methods are also varied. In this paper, we will start from the industry structure, take the statistical data of each industry of China's sports industry from 2006 to 2023 as the support, and use the indexes such as the proportion of the added value of the sports industry to GDP to study the external structure of China's sports industry and draw on the three methods of analysis of changes in industry structure, namely, the coefficient of industrial structure overshooting, the value of changes in Moore's structure, and the value of average changes in the structure of the industry, which are used in the study of optimization of the economic structure, to measure The purpose is to propose an optimization path based on clarifying the structural level of China's sports industry.

Therefore, for the sports industry in its initial stage, how can we study the upgrading and optimization of the sports industry structure? How do we measure and evaluate the effectiveness of upgrading the previous sports industry structure? What problems exist in the structure of the Chinese sports industry? These are the questions that deserve our in-depth thinking. The innovation of this study is to scientifically observe the upgrading of the sports industry structure through 18 years of statistical data to provide a reference for other countries to examine the upgrading and transformation of their own sports industry.

Methods

External structure optimization index

The optimization of the structure of China's sports industry is reflected in the increasing proportion of the sports industry in the economic structure. This paper will use the proportion of the added value of the sports industry in GDP and the proportion of the added value of the sports service industry in the added value of the tertiary sector to measure the external structure of China's sports industry from 2006 to 2023.

Internal structural upgrading model

Coefficient of industrial structure overshooting

Industrial structure upgrading is evolving from lower form to higher form, and its direction has a certain regularity. The coefficient of industrial structure advancement can reflect the trend of industrial structure evolution and the degree of advancement and is calculated as follows.

Ei = ai + (ai - 1) / Rt (1 )

In the formula, the sports industry can be divided into n parts according to different criteria. Ei denotes the coefficient of structural overrun for industry i. ai represents the ratio of the share of industry i in the reporting period to the share in the base period.Rt denotes the average growth rate of the sports industry over the same period, calculated

R, = ([n(GDP№.^

as , m is the number of years, and GDP uses current prices. The base period Ei is 1; if Ei> 1, it indicates that the proportion of industry i tends to rise, and industrial development is ahead of schedule, the larger Ei is, the more significant the magnitude of ahead of schedule is; if Ei < 1, it indicates that the proportion of industry i tends to decrease, and industrial development is lagging, the smaller Ei is, the smaller the magnitude of lagging is.

Moore structural change values

Moore's structure change value determination model is based on the vector space ang. The sports industry is divided into n parts, and a set of n-dimensional vectors is constructed there. The angle between the two sets of vectors in 2 periods can be used as an indicator of the change industry's structure,y, i.e., the Moore value. The formula is as follows.

M = cos a = ]>X0 X ^)/£^ ^W^1 (2)

In the formula, M denotes the value of Moore's structural change, which is the cosine of the angle between the two vectors; W i0 denotes the share of industry i in the base period; W it denotes theshare of industry i in the reporting period. Therefore, the angle α between the two sets of vectors in the 2 time periods is: α=arccosM , the larger the value of α , the faster the change of industrial structure; the smaller α , the slower the change of industrial structure.

Average value of change in industry structure

The value of the average change in the industrial structure represents the absolute value of the change over a certain period of time and is calculated as follows.

, _ HiU -^ol)

n

In the formula, k is the average change in industrial structure; q it is the proportion of the reporting period; q i0 is the proportion of the base period; n is the number of industrial categories; t is the number of years between the base period and the reporting period; the larger the value of k , the faster the change in industrial structure; the smaller the value of k , the slower the change in industrial structure.

Statistic

The data sources are the National Sports Industry Total Scale and Value Added Data Bulletin jointly issued by the General Administration of Sport of China and the National Bureau of Statistics of China, the International Sports Industry Development Report, and the China Statistical Yearbook, with a period of 2006-2023. It is worth noting that the current Chinese sports industry has adopted three classifications: the Classification of Sports and Related Industries (Trial) (2008), the National Statistical Classification of Sports Industry (2015), and the Statistical Classification of Sports Industry (2019). Compared with the classification system of 2008, the classification system of 2015 has changed a lot, not only stripping, adjusting, and adding two significant categories (sports competition and performance activities, sports media and information services) from the original classification system but also adjusting and changing the medium and small categories. Compared with the classification system of 2015, the classification system of 2019 has made adjustments to the relevant categories, descriptions, and corresponding industry codes to keep the original classification's basic structure unchanged, and the changes are relatively small. The statistical data of the sports industry in 2006-2014 are based on the classification system of 2008. The sports industry is divided into nine categories, which can correspond to the classification system of 2015, and the correspondence of these nine categories is shown in Table 1. The correspondence is shown in Table 1 (next page).

To ensure the continuity of analysis and consistency of presentation, this paper categorizes sports competition and performance activities and sports media and information services into sports management activities and other sports services, respectively, in 2015-2023, focusing on nine types of subsectors such as sports management activities, sports fitness and leisure activities, and sports venues and facilities and management, etc., and analyzes 2015-2023 separately. The two subsectors of sports competition and performance activities and sports media and information services are examined individually. They are based on the presentation of the subsectors in the Statistical Classification of the Sports Industry (2019).

Table 1. Correspondence of Statistical Classification of Sports Industries

|

Category |

Sports and Related Industries Classification (Trial) (2008) |

National Sports Industry Statistical Classification (2015) |

Sports Industry Statistical Classification (2019) |

|

Sports Organization and Management Activities |

Sports Management Activities |

Sports Management Activities |

|

|

Sports Competition and |

Sports Competition and |

||

|

Performance Activities |

Performance Activities |

||

|

Sports Fitness and Leisure |

Sports Fitness and Leisure |

Sports Fitness and Leisure |

|

|

Activities |

Activities |

Activities |

|

|

Sports Venue Management |

Sports Venue Services |

Management of Sports |

|

|

Activities |

Facilities and Facilities |

||

|

Sports Service Industry |

Sports Intennediary Activities Sports Training Activities |

Sports Intermediary Services Sports Training and Education |

Sports Agency and Representation, Advertising and Exhibition, Performance and Design Services Sports Education and Training |

|

Other Sports Activities |

Sports Media and Information |

Sports Media and |

|

|

Services |

Information Services |

||

|

Other Sports-Related Services |

Other Sports Services |

||

|

Sales of Sports Goods. |

Sales of Sports Goods and |

Sales of Sports Goods and |

|

|

Clothing, Footwear, and |

Related Products, Trade |

Related Products, Rental and |

|

|

Sports Goods Manufacturing Industry |

Headwear |

Agency and Rental |

Trade Agency |

|

Manufacture of Sports |

Manufacture of Sports Goods |

Manufacture of Sports Goods |

|

|

Goods, Clothing, Footwear, and Headwear |

and Related Products |

and Related Products |

|

|

Sports Construction |

Construction of Sports |

Construction of Sports Venues |

Construction of Sports |

|

Venues and Facilities |

and Facilities |

Venues and Facilities |

|

|

Industry |

Results

External structure optimization measurement

Based on the statistical data of China's sports industry from 2006 to 2023, the proportion of the added value of China's sports industry to GDP and the proportion of the added value of the sports service industry to the added value of the tertiary industry was calculated, and the results of the calculation are shown in Table 2. The data show that from 2006 to 2023, the added value of China's sports industry has increased from 98.289 billion yuan to 149.15 billion yuan, with an average annual growth rate of 17.70%, and the proportion of the sports industry in GDP grows from 0.47% to 1.18%. Meanwhile, the added value of China's sports service industry grows from 24.46 billion yuan in 2006 to 1084.6 billion yuan in 2023, with an average annual growth rate of 26.53%, and the added value of the sports industry service industry accounts for the proportion of tertiary industry added value grows from 0.30% to 1.58%. Over the past 18 years, the external structure of China's sports industry has been continuously optimized, and its role in China's economic development has constantly been revealed.

Table 2. The Share of China's Sports Industry in the Structure of the Economy, 2006-2023

Share of sports indust ry in economic struct2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 ure (year)

Share of added value of sports industry in0.47 0.51 0.52 0.55 0.56 0.57 0.60 0.63 0.63 0.81 0.87 0.94 1.12 1.14 1.06 1.07 1.08 1.18

GDP (%)

Share of added value of sports service ind 0.30 0.33 0.35 0.37 0.38 0.44 0.46 0.46 0.44 0.79 0.93 1.33 1.39 1.43 1.33 1.40 1.44 1.58

ustry in tertiary indus tiy

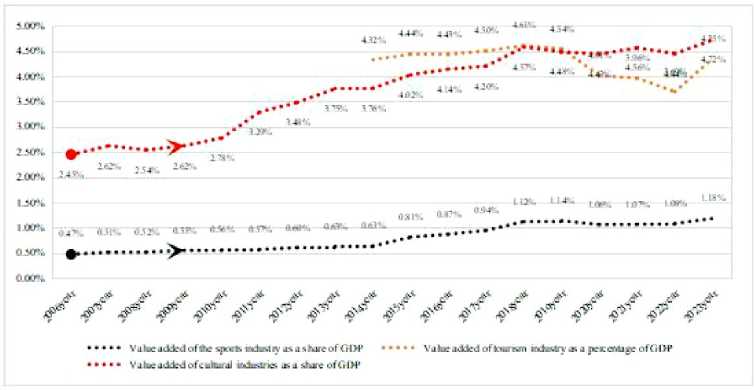

To grasp the external structure of the sports industry more clearly, this paper chooses the tourism and culture industries as references. It makes a horizontal comparison of the external structure of the three industries, and the comparison results are shown in Figure 1. Internationally, the industries that have a pivotal position in the development of the national economy account for more than 4% of the national economy in terms of added value, contribute significantly to the growth of the national economy, conform to the direction of the evolution of the industrial structure, are conducive to the optimization of the industrial structure, have a strong correlation, and can drive the development of many related industries are called the pillar industries ( Liu, 2019). As shown in Figure 1, the tourism and culture industries became the pillar industries of the national economy around 2014 and 2015, while the value added by the sports industry accounted for only 0.63% of the GDP in 2014. The value added by the sports industry accounted for a significant increase in the proportion of GDP after 2014, and it will be 1.18% by 2023. Relevant information shows that the proportion of added value of sports industry to GDP in Germany was 3.9% in 2012, the proportion of added value of sports industry to GDP in the United States was 3% in 2015, and the proportion of added value of sports industry to nGDP in South Korea reached 4.3% in 2017 ( Huang, 2020). After the above comparative analysis, it can be found that China's sports industry is still in the early stage of development, the external structure is not very reasonable, and the proportion of sports industry in the national economy and the contribution rate of the sports industry to economic growth is still relatively low.

Fig. 1 . Comparison of the external structure of the sports industry with the tourism industry and the cultural industry

Note: Tourism industry 2006-2013 statistics are missing.

Internal structure optimization measurement

-

(1) Direction of industrial structure upgrading of the three major industries

Based on the statistical data of China's sports industry from 2006 to 2023, combined with formula (1), we calculate the change value of the proportion of the three major industries in China's sports industry as well as the coefficient of overshooting to reflect the direction of structural upgrading of the sports industry. To compare the changes in the structure of the sports industry in different periods, taking the introduction time of the National Statistical Classification of the Sports Industry (2015) as the node, the development cycle of China's sports industry is divided into two time periods, T1=2006-2014 and T2=2015-2023, and the overrun coefficients of the two time periods are calculated respectively. The results of the calculations are shown in Table 3. Industries are 47.80, -46.04, and -1.77, respectively, and the overrun coefficients are 15.64, 4.61, and 3.95. The overall proportion of the sports service industry as a whole is on the rise, and the industry is overrunning; the proportion of the sporting goods manufacturing industry and the sports construction industry as a whole is on the decline, and the overrun coefficients are <1, and the industry is lagging. From 2006 to 2014, the sports service and construction industries were overdeveloped, with overdevelopment coefficients of 3.57 and 1.02, respectively, and the sporting goods manufacturing industry lagged, with an overdevelopment coefficient of <1, at 0.11. From 2015 to 2023, the

overdevelopment coefficient of the sports service industry is 5.78, the overdevelopment coefficient of the sports construction industry rises to 17.69, and the overdevelopment coefficient of the sporting goods manufacturing industry In general, the coexistence of sports service industry's over-advanced development, sports construction industry and sporting goods manufacturing industry's lagging development is in line with the law of industrial structure upgrading. However, China still needs to focus on the transformation and development of the sporting goods manufacturing industry and the sports construction industry, utilize technological innovation to explore the growth point of the sporting goods manufacturing industry and the sports construction industry, and, at the same time, ensure the efficient, reasonable and rapid development of the sports service industry.

Table 3. Changes in the proportion of the three major industries in China's sports industry and the coefficient of overshooting

|

Value of change in the share of three major industries Three industry override factors |

|

|

time period |

Sports Sports Goods Sports Sports Service Sports Goods Sports Service Manufacturing Construction Industry Manufacturing Construction Industry Industry Industry Industry Industry |

|

Ti=2006-2014year |

8.70 -8.71 0.01 3.57 0.11 1.02 |

|

T2=2015-2023year |

23.50 -24.50 1.00 5.78 -3.89 17.69 |

|

T=2006-2023year |

47.80 -46.04 -1.77 15.64 4.61 3.95 |

-

(2) The direction of upgrading the industrial structure of the sports service industry

As we all know, the development of the sports service industry plays an irreplaceable role in the structural upgrading and high-quality development of the sports industry. Therefore, this paper utilizes the 2006-2023 sports industry statistics to calculate the industry structure overrun coefficients of seven sectors of China's sports industry service industry from 2006 to 2023 and utilizes the 2015-2023 statistics to estimate the overrun coefficients of the two subsectors, namely, sports competition and performance activities, and sports media and information services. The results of the calculations are shown in Tables 4 and 5, respectively.

Table 4. Coefficient of overshooting of industrial structure within China's sports service industry

|

Sports Service Industry (1) |

Ti=2006-2014year |

T2=2015 2023year |

T=2006 2023year |

|||

|

Specific gravity change value |

Overrun factor |

Specific gravity change value |

Overrun factor |

Specific gravity change value |

Overrun factor |

|

|

Sports Management Activities |

-0.82 |

-0.09 |

3.50 |

9.44 |

-1.01 |

0.24 |

|

Sports Fitness and Leisure Activities |

1.12 |

3.38 |

6.80 |

22.19 |

-4.42 |

6.31 |

|

Management of Spoils Facilities and Facilities |

-0.14 |

0.25 |

0.30 |

1.27 |

6.74 |

21.88 |

|

Sports Agency and Representation, Advertising Exhibition, Performance and Design Services |

and 0.51 |

26.37 |

1.30 |

33.40 |

1.39 |

39.99 |

|

Sports Education and Training |

3.09 |

67.53 |

11.80 |

26.21 |

14.83 |

181.50 |

|

Other Sports Services |

1.31 |

7.09 |

7.00 |

17.36 |

8.02 |

22.09 |

|

3.63 |

5.74 |

-7.20 |

-0.90 |

13.42 |

10.92 |

|

Trade Agency

Table 5. Structural Overrun Coefficient of Sports Competition and Performance Activities, Sports Media and Information Services Industries

|

Industry |

Specific gravity change value |

Overrun factor |

|

Spoils Competition and Performance Activities |

1 |

8.48 |

|

Sports Media and Information Services |

2.70 |

29.84 |

The data in Tables 4 and 5 reflect that the overrun coefficient of sports management activities and stadium services is less than 1 in 2006-2014, which is a lagging development. At the same time, sports education and training, sports brokerage and agency, advertising and exhibition, and performance and design services were overdeveloped. Overall, the internal structure of China's sports service industry from 2006 to 2014 was unreasonable, and the core principal industry of the sports industry was in a state of lagging development. From 2015 to 2023, the sports media and information service industry has overdeveloped since its separation from other sports services in 2015, with an overdevelopment coefficient of 29.84, and the sports competition and performance activities industry has overdeveloped, with an overdevelopment coefficient of 8.48. Sporting goods and related products sales, trade agency, and rental are lagging, with an overrun coefficient of -0.90. Sports brokerage and agency, advertising and exhibition, performance and design services, sports education and training, sports fitness and leisure activities, and other sports services are overrunning, with overrun coeffi- cients of 33.40, 26.21, 22.19, and 17.36, respectively. This indicates that the National Statistical Classification of the Sports Industry (2015), the structure of the sports industry has been optimized to a certain extent since then, and the higher value-added sports management activities, sports fitness, and leisure activities have turned from lagging development to overdevelopment from 2006-2014.

Enlarging the period of observing the structure of China's sports industry from 2006 to 2023, the development trend of various subsectors of China's sports service industry shows different development trends. Although the sports service industry, in general, is ahead of its time, its internal structure is not reasonable. Sports management activities, fitness and recreational activities, and sports competitions and performances, which are of good benefits and high added values, should have been ahead of their time. Still, they have shown obvious lagging development compared with other sports service industries, which is unreasonable. However, compared with other sports service industries, they are lagging, which is absurd. The coefficients of sports management activities and sports fitness and leisure activities are 0.24 and 6.31, respectively, lagging behind the development of other industries. In sharp contrast, the sports education and training industry, with a forward coefficient of 181.50, is developing ahead of schedule by a considerable margin, which indicates that the sports education and training industry is growing faster in optimizing and upgrading the structure of China's sports industry. In addition, the coefficients of sports brokerage and agency, advertising and exhibition, performance and design services, stadium services, other sports services, and the sales, trade agency, and rental of sporting goods and related products are 39.99, 21.88, 22.09, and 10.92 respectively, indicating that these industries are also ahead of their time.

-

(3) Structural upgrading rate of China's sports industry

This paper examines the rate of structural change in China's sports industry. It determines the rate of transformation of the sports industry through the value of Moore's structural change, the average change of industrial structure, i.e., the value, and the value. Using the statistical data of China's sports industry from 2006 to 2023, combined with the two mathematical formulas of (2)(3), the Moore structural change value, the vector pinch angle, the average annual change value of the vector pinch angle, and the average annual change value of the industrial structure for the upgrading of the three major industries of China's sports industry, the subsectors, and the emerging industries in 2006-2014, 2015-2023, and 2006-2023, respectively, are computed values, to more accurately reflect the rate of structural upgrading of China's sports industry. The calculation results are shown in Table 6.

Table 6. Speed of Industrial Transformation and Upgrading of China's Sports Industry by Category, 2006-2018

|

classification |

Ti=2006 2014year |

T2=2015-2023yeai |

T=2006 2023year |

|

|

three main industries |

Moore Numeric |

0.16 |

0.83 |

0.90 |

|

Vector angle in degrees |

8.91 |

47.56 |

51.39 |

|

|

Average annual change in vector angle (degrees) |

1.11 |

2.80 |

3.02 |

|

|

Average annual change value of industr ial structure (%) |

0.06 |

0.16 |

0.32 |

|

|

niche industry |

Moore Numeric |

0.96 |

0.84 |

0.79 |

|

Vector angle in degrees |

16.79 |

32.53 |

37.73 |

|

|

Average annual change in vector angle (degrees) |

2.10 |

1.91 |

2.22 |

|

|

Average annual change value of industrial structure (%) |

0.02 |

0.05 |

0.07 |

|

|

emerging industry |

Moore Numeric |

1.00 |

0.84 |

0.91 |

|

Vector angle in degrees |

4.48 |

32.53 |

24.01 |

|

|

Average annual change in vector angle (degrees) |

0.56 |

1.91 |

1.41 |

|

|

Average annual change value of industrial structure (%) |

0.01 |

0.02 |

0.03 |

|

From 2006 to 2023, the overall development trend of China's sports industry's three major industries, subsectors, and emerging industries is accelerating. (1) The three major industries. 2006-2023, the average annual change value of the industrial structure of China's three major industries is 0.32%, the vector pinch angle is 51.39°, and the average yearly change value of the vector pinch angle reaches 3.02°. The structure of the sports industry as a whole is at a high level. Among them, the change in the structure of the sports industry in 2015-2023 is significantly faster than that in 20062014, and the average annual change value of the vector clamp angle and the average annual change value of the industry structure reached 2.52 and 2.67 times of the average change value in 2006-2014. (2) Segmented industries. From 2006-2023, the average annual change value of the industry structure of segmented industries in China is 0.07%, the vector pinch angle is 37.73°, and the average yearly change value of the vector pinch angle reaches 2.22°. The change in the structure of the sports industry is slower than that of the three major industries. Similarly, the structural change of the sports industry in 2015-2023 is less pronounced compared with 2006-2014. (3) Emerging industries. From 2006 to 2023, the average annual change value of the industrial structure of China's emerging industries is 0.03%, the average yearly change value of the vector pinch angle is 24.01°, and the average annual change value of the vector pinch angle is 1.41°, and the structural change of the sports industry is significantly slower than that of the three major industries and subsectors. However, similarly, the structure of the sports industry changes slightly faster than in 2006-2014 and

2015-2023. It can be seen that the industrial structure change of emerging industries is more significant, which indicates that the space for upgrading the industrial structure of emerging industries is expanding. In general, 2014 was a watershed in the structural change of China's sports industry, and the change in industrial structure accelerated after 2014, which also gradually tends to be reasonable. This is closely related to the State Council's issuance of Several Opinions on Accelerating the Development of the Sports Industry and Promoting Sports Consumption in 2014, which is also known as the "first year" of the development of the sports industry by relevant experts. This year, the development of China's sports industry also entered the fast lane. After this year, the national statistical classification of the sports industry was updated and adjusted in 2015. Some fast-developing emerging industries, such as the sports competition and performance industry, sports media, and information services, were included and divested, one of the reasons for the significant structural change of the sports industry from 2015 to 2023. It can be seen that the structure of China's sports industry has ample space for change, and the rate of upgrading is in an upward trend. Although the structure of China's sports industry is not reasonable, it is still in the process of accelerated optimization and adjustment.

Discusion

The external structure of China's sports industry is not reasonable enough, which is mainly reflected in the proportion of the sports industry in the national economy and the low contribution rate of the sports industry to economic growth. From the data, the proportion of the added value of the sports industry to GDP and the proportion of the sports service industry to the tertiary industry from 2006 to 2023 has shown remarkable and rapid growth. However, horizontally, there is still a big gap between it and the external structure of the tourism industry, culture industry, and sports industry in developed countries, and the rapid development of tourism and culture has boosted consumption growth and promoted the upgrading of consumption. The economic benefits of the sports industry have not been given full play to send out; that is to say, the current scale of China's sports industry is still relatively low; the main reasons are: First, the core of the sports body industry development is backward. Currently, the added value of the competition and performance industry and the fitness and leisure industry only accounts for 11.20% of the added value of the sports industry, which is not worthy of its core status. Secondly, the adequate supply is insufficient. The sports industry is underdeveloped, and the supply of exceptional venues and guidance services for popular sports such as soccer, basketball, and tennis is inadequate to meet the diversified sports needs of various sports fans. Third, the effective demand is not strong(Li et al., 2019. It is manifested in the insufficient demand for ornamental and participatory sports consumption, while the demand for physical sports consumption accounts for a high proportion of the de-mand(Ren & Huang, 2020); secondly, the consumption consciousness is weak, and sports and healthy lifestyles have not yet become an integral part of lifestyle consumption, and the residents' sports consum-ption consciousness is not strong.

The overall trend of structural upgrading in China's sports industry is in line with the law of industrial structural upgrading, and the speed of change has accelerated. Still, the level of internal structural upgrading is not high. First of all, the proportion of the sporting goods manufacturing industry in the structure of China's sports industry has been persistently high for a long time, and the proportion of the sports service industry is relatively low. The proportion of the sports service industry exceeded the sporting goods manufacturing industry for the first time in 2015, reaching 55.51%, but it was only 33.59% in 2013; the proportion of the sports service industry has improved to a certain extent, but the long-term structural problems have not been substantially improved ( Chen, 2019).

Secondly, the sports service industry is generally overdeveloped, but the internal structure of the sports service industry is not reasonable; it is still in a relatively low-end state, and the level of development of the sports service industry is not sufficient. Specifically, it is manifested in the following: sports management activities with good benefits and high added value, sports fitness and leisure activities, and sports competitions and performances show obvious lagging development, and the supply of medium and high-end sports services is insufficient. Finally, the sporting goods manufacturing industry is under more significant pressure for transformation and upgrading. After years of development, China's sporting goods manufacturing industry has developed more maturely. Still, due to the long-term reliance on production factor drive, there are problems such as more low-end and medium-end products, low product quality, a high degree of homogenization, and fewer brand-oriented enterprises. In general, the speed of internal structural upgrading of China's sports industry is accelerating, and the direc-tion is constantly being adjusted, but the level of upgrading is not high.

Conclusion

The kernel of the high-quality development of the sports industry is the optimization and upgrading of the structure of the sports industry. Through the model measurement, the following conclusions are drawn: the external structure of China's sports industry is continuously optimized, and its role in China's economic development is constantly emerging, but the contribution rate to economic growth is still relatively low; the overdevelopment of the sports service industry, the lagging development of the sports construction industry and the sporting goods manufacturing industry are basically in line with the law of upgrading of the industrial structure; from the internal point of view of the sports service industry, sports education and training, sports media and information services, sports brokerage and agency, advertising and exhibition, performance and design services, stadium services, other sports services, sporting goods and related products. From within the sports service industry, sports education and training, sports media and information services, sports brokerage and agency, advertising and exhibition, performance and design services, stadium services, other sports services, sales, trade agency, and rental of sports goods and related products are developing ahead of time. Still, sports management activities, sports fitness and leisure activities, and sports competition and performance activities are lagging, which is one of the critical obstacles restricting the transformation and upgrading of the sports industry. Regarding the upgrading rate, China's sports industry has ample space for structural change, and the upgrading rate is on an upward trend, especially in emerging industries.