Supply chain management as a driving force for generating competitive advantage for dairy companies

Автор: Poleshkina Irina Olegovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Young researchers

Статья в выпуске: 5 (47) т.9, 2016 года.

Бесплатный доступ

The study aims to uncover the reserves to generate competitive advantages for the participants of the market of perishables in the case of the dairy sector due to the formation of effective supply chains, as this category of goods is the most demanding in terms of periods and conditions of transportation and terms of preservation. The research technique is based on the concepts of value chains and supply chain management. In order to optimize the distribution of functions between the participants of the dairy chain a process-based approach has been applied. The research has revealed the main reasons for high aggregate costs and the places of their formation at each stage of the dairy supply chain. The article proposes the mechanisms to address three main problems arising from the process of building relations between the participants of the dairy supply chain in Russia. These problems are associated with a disproportionate margin distribution between the participants of the chain, with non-compliance of the quality of raw milk with the requirements for the production of specific types of dairy products, and with distrust of the supply chain participants, which increases transaction costs and forces to create reserve supplies which reduce the competitiveness of the whole dairy supply chain in general...

Competitive advantage, logistics costs, supply chain management, value chain, dairy products

Короткий адрес: https://sciup.org/147223874

IDR: 147223874 | УДК: 658.7 | DOI: 10.15838/esc.2016.5.47.14

Текст научной статьи Supply chain management as a driving force for generating competitive advantage for dairy companies

Nowadays, the world community is experiencing increased global competition, the aggravation of geopolitical problems, the declining prices of raw material, which forces the Russian economy to find new drivers of economic development, an important component of which are new management technology.

One of the main reasons for low competitiveness of Russian commodities both in the world and domestic market is their high cost which is formed in the process of production and product sales based on the manufacturing, logistics and transaction costs. Production cost management is carried out mainly at the level of an enterprise. The formation of logistics and transaction costs takes place outside an individual organization as a result of implementation of market relations. Insufficient attention has been given to the management of these components in Russia, which led to the fact that logistics costs are 2–3 times higher than those in developed countries. This is explained by the underestimation of capacity for the use of logistics as a technology of management, integration, cooperation and coordination of business processes not only at the level of individual organizations, but also, and especially, in the entire supply chain as a whole.

As a result, the share of logistics costs in Russia’s GDP is approximately 20%, while in the USA it amounts to 8.5%, and in Germany – 8.3%. The world’s average value of this indicator is 11.4%. The share of transportation costs in product price ranges from 1 to 50%, the average value is 10% of the total value of transaction. According to the World Bank estimations in 2014, the level of logistics development in Russia is low (the 90th position out of 160 in the ranking, compiled on the basis of the LPI1 calculation).

Today optimization of costs of delivery and storage of production resources and end products in Russia is one of the main reserves of cost saving, and, consequently, of reduction of product retail prices. However, according to experts, “in countries with high logistics costs, the main factor in determining their value is often the reliability of a supply chain, rather than the distance between trade partners” [4].

The share of logistics costs in Russia is particularly high in the price of perishable goods sales, as it is necessary to carefully coordinate the actions and interests of all supply chain participants in order to minimize logistics costs in this sector. Lack of such coordination forces supply chain participants to find ways of creating insurance supplies to provide the continuity in processes. However, the fact that a product is perishable makes it impossible to create insurance supplies even for a short period of time without compromising the product’s quality. As a result of creation of such supplies at least at one stage of the supply chain the product’s consumer properties are deteriorated and its cost is raised due to inevitable increase in storage losses.

It would seem, that manufacturers and resellers have to increase their end product insurance supplies to a greater extent as they are furthest from the consumer and do not have accurate information about the level of real demand. Retail chains should have a lesser need for creating insurance supplies as they are closest to the source of demand change. However, given the absence of understanding of strategic prospects from creating an effective system of supply chain management by all its participants, the situation is the opposite.

For example, even if major reliable partners such as Danon are involved in building a supply chain, retail chains are not ready to completely abandon the stocks of dairy products (DP) at their own warehouses because they are afraid of suffering losses from commodity deficiency. As a result, the consumer of a retail chain does not have access to fresh dairy products as the retailer provides them only with the three-day old supplies. The customer’s dissatisfaction leads to the decrease in consumer demand and causes distrust of the trademark which is reflected in the image and profitability of dairy producers and all participants in the supply chain.

It is possible to solve this problem through the full implementation of the strategy of supply chain management – SCM (Supply Chain Management) at all stages of production and distribution of perishable products, which will allow all participants of the supply chain to give up the creation of insurance supplies and significantly reduce logistics costs. Moreover, the use of SCM strategy will reduce transaction costs by enhancing mutual trust between chain supply participants on the basis of stable repetitive cooperation. Additional competitive advantage is created due to consistent optimization of production processes of each supply chain participant. The use of this approach makes it possible to organize production at every stage of supply chain for the received products to fully meet the requirements of the subsequent stage, in view of achieving total costs minimization of the entire supply chain. Amid economic recession, declining population’s incomes and consumer demand, reducing production costs without compromising the quality of the end product is the most preferable strategy.

Furthermore, the implementation of SCM strategy will provide additional competitive advantages to the participants due to the focus of creating the end product value during all stages of the product’s life cycle on the preferences of particular consumers.

In order to implement this strategy it is necessary to establish a system of rapid information exchange between the participants of retail and supply chains, as well as to design highly flexible supply chains able to quickly respond to the changing market conditions. Not for nothing do many experts bring management of any processes, logistics in particular, in line with information exchange management.

Different product manufacturing includes different number of manufacturing stages, that is why it has different need for network communication. Each economic sphere requires the development of its own models of effective network interaction appropriate to sectoral characteristics of business processes organization. The longest product manufacturing chains are established in the food industry. For example, in the U.S. the longest production chain has established in meat production: from developing forage, manufacturing food additives and vitamins for cattle fattening to manufacturing a variety of end meat products and delivering supplies to supermarkets, restaurants and hotels [16]. The purpose for this study is to identify the reserves for creating competitive advantages for the participants of the market of perishable products through the formation of efficient supply chains, as this category of products puts the largest amount of requirements to transportation and storage terms and conditions.

The largest share of raw materials for food production is supplied by agriculture. Meat, fish and milk are considered to be the most perishable food products. The most stringent requirements are imposed to the terms and conditions of raw milk transportation and storage because its composition determines the possibility of producing a particular dairy product and processing costs. Moreover, from the point of view of food security in Russia the dairy sector is the one experiencing a very difficult situation. Therefore, the research subject is dairy industry which manufactures perishable dairy products. In the author’s opinion, the issue of efficient distribution of production and logistics processes and margin between the participants in the dairy chain.

Research methodology

The research is based on the use of the concept of value chain (VC) as a tool for determining the place of a company in the market and creating a competitive advantage proposed by Michael Porter in 1985 [10], and the concept of supply chain management. Nowadays, the boundaries between these two concepts are blurred, although the main difference was the concept of “margin” which initially was not considered in SCM. According to the Porter’s VC concept, the long-term company’s return is provided by the created product value, rather than by cost reduction, because, by focusing the company’s activities on reducing costs the company may lose additional profit derived from manufacturing costly products with unique properties.

The VC concept’s management object is the process of value creation, while the SCM concept considers material, financial and information flows as its management object. Recently, however, the idea of value creation has also been embodied in the SCM concept, as evidenced by the modern definition of SCM. For example, according to the definition suggested by G. Kott, supply chain management is the integration of key business processes, starting from the end-user and covering all suppliers of goods, services and information which add value for the customer and other parties concerned [5]. That is, the use of the SCM approach is aimed at increasing the level of customer satisfaction and optimizing the costs of this process.

Another difference between these concepts is the use of VC at both intra- and inter-firm levels, while the SCM concept is used only in reference to relations management at the inter-organizational level. At the intra-organizational level these ideas are implemented in the approaches of integrated logistics.

However, singling out the concept of “margin” as a management object in the VC concept is not only important for assessing the profitability of production with higher costs and more valuable consumer properties, but also absolutely necessary for the development of interfirm relations in the market, especially in long-term strategic partnership. Strategic partnership reliability is determined by the efficiency of each participant’s functioning and their competitive advantages in the market which are created due to this integration. Effective functioning of all chain participants is possible only on condition of objective margin distribution, the basis for which should be the size of the value created by each participant. From this point of view, the management of margin distribution between value chain participants is a prerequisite for the establishment of reliable strategic partnership and a supply chain. This factor was not initially considered in the SCM approaches, however, it was seamlessly integrated into the SCM concept erasing the boundaries between VC and SCM concepts. This is evidenced by the definition of SCM given by R. Handfield and E. Nichols: “...It is integration and management of all activities within the supply chain on the basis of mutual cooperation, effective business processes and extensive information sharing for establishing high-performance systems of value creation, which would provide member organizations with a significant competitive advantage” [18].

This definition ensures a more precise perception of the purpose for the creation of a supply chain system, which consists primarily in creating value for participant companies by combining efforts on manufacturing demanded goods with optimal production costs. On the basis of setting this objective, with regard to the principle of objective margin distribution between supply chain participants, the SCM system itself can be considered as the main driver in creating competitive advantages for companies in the market, especially in crisis, which helps reduce aggregate logistics costs, as well as ensure equal distribution of benefits derived from its creation among all chain participants.

In this paper, supply chain management is considered as a process of integration of participant organizations and management of all types of their activity based on mutual cooperation aimed at establishing high-performance value creation systems for meeting customer needs, achieved with optimal aggregate costs, which would provide participant organizations with a significant competitive advantage.

SCM is the main mechanism for creating competitive advantages in the market economy which, according to experts, helps the participants reduce the cost of order processing by 20–40%, reduce procurement costs by 5–15%, reduce the market entry period by 15– 30%, reduce stock reserves by 20–40%, reduce production costs and increase profits by 515% [11].

In economically developed countries, modern market competition has become kind of a competition between supply chains, rather than individual organizations. Namely, it has become impossible for an individual organization outside the supply chain to achieve a significant competitive advantage.

In relation to the dairy industry, the issue of supply chain management and value chain is particularly relevant in connection with stringent requirements to product quality at each stage of the chain and with unequal competitive positions of participants on the market. Low consolidation of agricultural producers, limited technological development of processors (except for national leaders in dairy products manufacturing) and a favorable position of retailers leads to disproportionate margin distribution between the participants in favor of the latter. The distribution does not reflect the

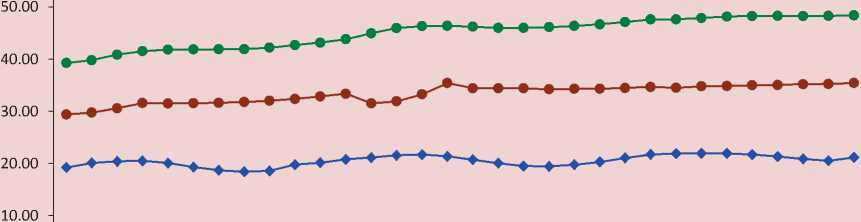

Figure 1. Price dynamics of milk sales by major dairy chain participants

60.00

0.00

—♦— Milk sales price by agricultural producers, rubles per liter

• Sales price of pasteurized milk (3.2% fat) by processors, rubles per liter

• Retail price of pasteurized milk sales (3.2% fat), rubles per liter

Source: Rosstat data.

real contribution of each chain participant in the creation of end product value. This is confirmed by a sharp stunting of procurement prices for raw milk of agricultural producers from retail sales prices of dairy products ( Figure 1 ) and, consequently, by a reduced production of organic milk in the country due to agricultural producers’ lack of funds for investing in expanded reproduction [3, 19].

The problem in the dairy market is common not only for Russian reality, as evidenced by numerous studies conducted in countries of both developed and developing economies [20, 21, 22, 23, 24, 25].

However, the profitability of the dairy industry not only affects the interests of participant enterprises, but is also a strategic objective for ensuring food security of the countries. For example, “The Food Security Doctrine of the Russian Federation” identifies a 90% or more production threshold of own milk and dairy products in the total volume of commodity resources of the domestic market to ensure food security of the country [2], which is impossible to achieve in conditions of unbalanced profits distribution among its participants. Milk and dairy products are an integral element in the menu of every Russian, however, milk self-sufficiency of the Russian population that the most important health product is at risk. Over the part 20 years this industry has experienced rather negative trends characterized by a reduced number of dairy herd, milk production and, consequently, of organic dairy products. Russia’s milk and dairy self-sufficiency in 2015 amounted to less than 60%. The main reason for such a significant milk underproduction is low agricultural production efficiency mainly caused by lack of coordination between dairy market participants’ interests and monopoly raw milk procurement prices underpricing which is easy to achieve amid low industry consolidation [9].

Producers’ and retailers’ dependence on the availability and quality of raw milk is very high. In Russia, there are about 1000 enterprises engaged in dairy products manufacturing. They annually process an average of 19.7 tons of milk [7]. Dairy products comprise more than 15% of retail turnover. Underestimation by trade and processing industry of strategic importance of raw milk producers’ stable position aggravates the situation in the industry.

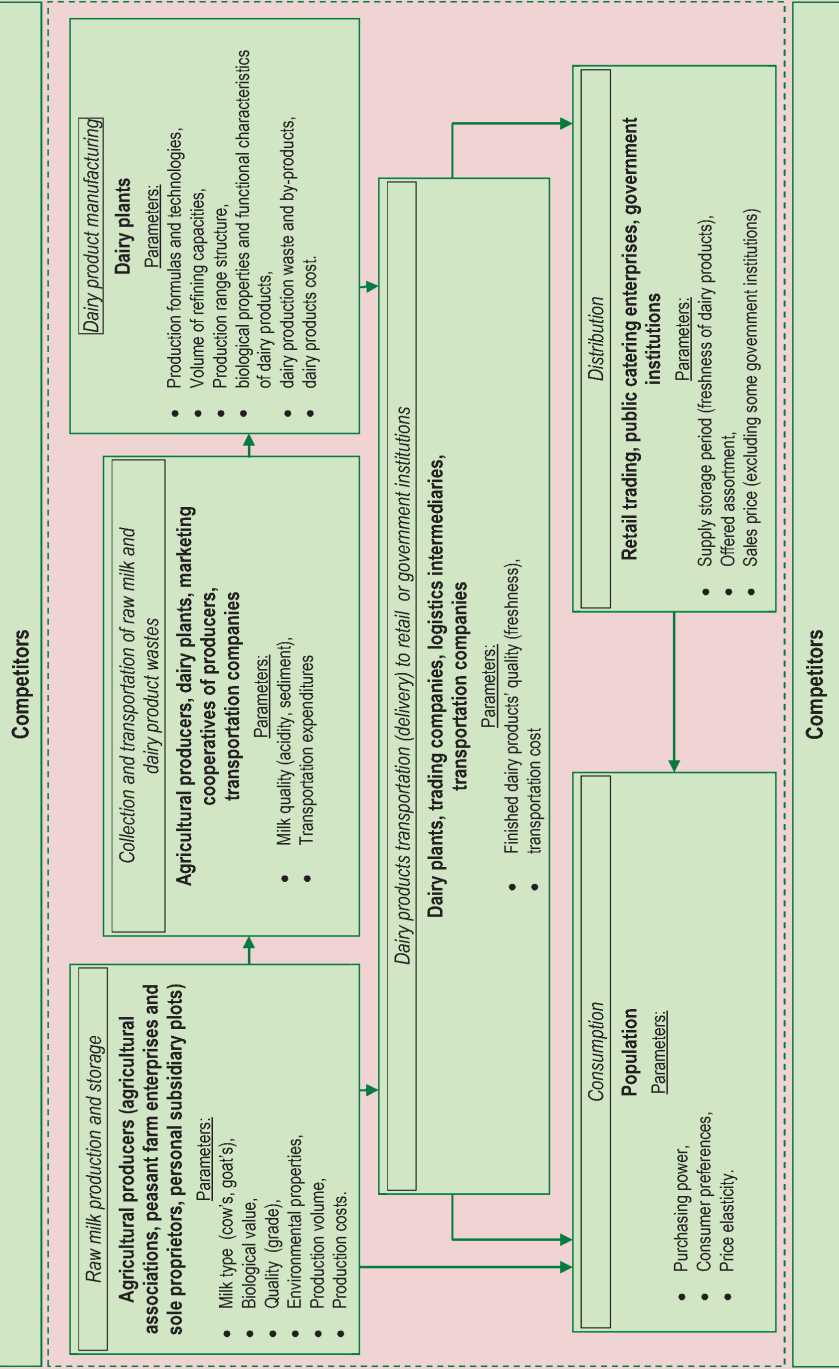

To optimize the relations in the dairy products value chain it is necessary to identify the main supply chain participants and their functions. However, the number of supply chain participants may vary depending on the number of intermediaries; at the same time, the number of operations and processes which must be implemented in order to produce a particular type of a dairy product is relatively constant. The number of supply chain participants depends on the distribution of these processes between the performers. Therefore, to improve the efficiency of a supply chain, the author proposes to use the process approach based on identifying all the necessary processes which create added value in the supply chain. Further, these processes should be optimally distributed among the performers taking into account the possibility of outsourcing some operations, added value created by each performer should be defined, and parameters underlying each process and influencing end product manufacturing should be identified.

Dairy product value chain includes four basic stages: milk production and storage in agriculture; milk collection and delivery for processing; raw milk processing and dairy products manufacturing; transportation of finished dairy products to sale points; dairy products sales to consumers (Figure 2) .

During the process of raw milk production biological value of raw materials is created, milk quality (its grade) is formed and its environmental properties2 are ensured. The performers of this process are agricultural producers which determine the volume of production and the produced milk type (cow’s, goat’s, etc.). During sэ!uedшoэ 6upjnos)no

sэ!uedшoэ бищпзиоэ

sэ!uedшoэ eouejnsui

sэ!uedшoэ ibioubuij

(saipoq Ajo)B|n6aj pue бицмэлоб) зиоцгццзи! Э)В)§

production process the cost of raw milk is identified, as well as milk procurement price and milk producers’ margin level on the basis of relations within a supply chain. Thus, milk producers’ performance may be enhanced by optimizing the cost of milk production through the improvement of production technology and determining the optimum margin level.

During the process of raw milk collection and transportation raw materials become available for reprocessing in its sites; quality parameters of milk (acidity, bacterization, sediment, etc.) are retained or worsened. Raw milk quality retention is ensured through controlling sanitary conditions of milk collection and transportation temperature requirements, as well as analyzing the collected milk from different manufacturers. The performers of this process may include milk producers themselves, marketing cooperatives of milk producers, dairy plants or transportation companies. During the process of milk collection and transportation costs are formed, which are determined by the transportation distance and depend on the location of dairy plants and their rawproduct purchase area. The efficiency of transportation can be enhanced by optimizing the conditions, volumes and routes of milk transportation. During the process of dairy products manufacturing raw milk is transformed into a wide range of finished dairy products with specified biological properties and functional characteristics. The performers of this process are milk processing plants which define production formulas and technology and dairy products assortment structure depending on the raw milk quality parameters and consumer demand. The selected production assortment and production technology affect the amount of waste and by-products, the rational use of which also influences the efficiency of the entire production process. Moreover, dairy plants often develop convenient forms of filling and packaging themselves. Production process determines the cost of dairy products and the price of dairy products delivery to retail chains is determined a supply chain.

The process of dairy products delivery to retailers or government institutions ensures the availability of finished dairy products of a particular quality (freshness) to the consumers. The performers of this process may be dairy plants, trading companies, logistics intermediaries (3PL providers, logistics centers) and transportation companies. During the transportation process of diary products the quality of finished dairy products is retained of worsened, which is determined by the temperature and time parameters of product delivery. Transportation time and temperature requirements, as well as appropriate temperature maintaining and keeping within waiting time during loading and unloading are of equal importance.

The distribution process creates added value of dairy products, which is associated with the possibility of their convenient purchase by end users. The performers of this process are various retailers, catering enterprises and government institutions (hospitals, schools, kindergartens, etc.). Retailers and catering enterprises set the price of finished dairy products, sometimes by holding demand stimulation campaigns through granting various discounts. The retailers determine the time of supply storage in their warehouses, i.e. the freshness of the product offered to the consumer and dairy products assortment available for sale.

The process of consumption determines the purchasing power, consumer preferences and price elasticity of each group of dairy products.

Thus, the retail price of finished dairy products sales is formed on the basis of production costs determined at the stages of production process, transaction and logistics costs determined during the process of building contract relations and product movement between the stages of production process in a value chain [1]. The majority if modern Russian companies in the dairy market use the supply chain management mainly to optimize transaction and logistics costs. However, the full implementation of the SCM strategic approach implies coordinated development and optimization of production processes of each supply chain participant aimed at meeting customers’ needs and optimizing aggregate costs in a value chain.

Major logistics costs in the dairy industry consist of transportation costs of raw milk and finished products delivery, costs for stockpiling and maintaining product supplies in warehouses, filling, packaging and labelling costs, order processing costs and administrative costs.

According to the concepts of VC and SCM, the purpose for implementing a supply chain management system is the balanced and coordinated development of its participants and the design of a unified strategy of creating competitive advantages in two directions:

-

1. Improving the quality of consumer satisfaction by: building strong feedback mechanisms; management of new product development taking in account the adjustment of raw milk production technology to meet the requirements of the processing industry; reducing the time of perishable product movement with in a supply chain; joint creation of by all participants of an effective continuous “cold chain” with the required temperature requirements at every stage of a supply chain. The end user of a supply chain should be regarded as the main chain participant as all the process is focused on their satisfaction.

-

2. Reducing aggregate costs of all supply chain participants: inventory optimization; consistency and optimization

of technological and logistics operations; minimization of transportation and transaction costs; reduction in the number of intermediaries in a chain; reassignment of logistics functions between chain participants; management of repayable funds which reduce the losses associated with short expiration terms of dairy products; scaling down the activities which do not add value to the goods; reducing risks of unfair cooperation.

During the process of building contract relations between dairy market participants, major logistics and transaction costs are usually borne by dairy plants which occupy an intermediate position in a supply chain. In relations with agricultural producers, this is explained by weak financial and human capacities, while in relations with retailers, refusal of there costs is associated with their dominant position in a supply chain, as they are the main sales channels of dairy products.

From the perspective of dairy plants, the distribution of logistics costs in their favor in their relations with agricultural producers is justified from the point of view of the transactional approach, as it gives them an opportunity to influence individual price and non-price parameters of raw milk or the conditions of their formation. This approach supports the theory of O. Williamson on the formation of transaction costs who believes that “... a producer rooted in the industry must invest in long-term transaction-specific assets if they want to strengthen their position on the market and successfully deter the entry of other companies” [13]. Apart from logistics costs reallocation aimed at stimulating the development of their suppliers in the dairy chain, dairy plants can use the following mechanisms: provision of advisory services, investing in technology and equipment, equipment leasing, provision of guarantees for obtaining bank loans, provision of production resources.

Distribution of logistics costs between dairy plants and retailers on the Russian dairy market cannot be called optimal as retail trading which contributes the least to the product’s added value receives an disproportionately big proportion of the profits, which results in imbalance in the entire chain performance. Optimization of margin distribution between the participants of the dairy market requires a deep study of gaining synergy potential during the integration process in this sphere.

The obtained results

As a result of the research the main reasons for the formation of high aggregate costs in dairy products manufacturing and sales in Russia have been identified. They are listed below:

-

• Disproportionate distribution of margin from dairy products sales among dairy chain participants (mainly agricultural milk producers). Income distribution from sales of 1 liter of pasteurized milk in Russia before the

announcement of sanctions was as follows: agricultural producers’ share accounted for 36.9% of retail price, the processors’ share – 36.3%, the share of retailers – 26.8%. Since the introduction of sanctions, the situation has slightly changed but there is still no optimal income distribution between dairy chain participants. Thus, for 8 months of 2016 the retail price share of agricultural producers amounted to 44.5%, of processors – 28.2%, the retailers’ share – 27.3% ( Tab. ).

These changes are associated with reducing the milk supply in the Russian market. According to experts, given the level of expenditures and the contribution of each dairy chain participant in added value of finished dairy products, the favorable ratio is: 50% – the share in retail price of sales price of raw milk manufactured by agricultural producers, 30% – the share of milk sold by processing companies, 20% – the retail share [17]. For comparison: in the UK, the producers’ share of retail price of pasteurized milk sales amounts to 55% , in the US – 56%, in Germany – 46% [8, 20, 25]. Milk producers’ low revenues hampers the investment of funds in the development and implementation of innovative production technologies which significantly hinders the reduction of production costs and the improvement of raw milk quality, thereby increasing the costs of dairy products manufacturing.

-

• Spontaneously formed distribution channels of finished products, the vast majority of which are resellers, i.e. smallscale wholesale intermediaries whose services result in the appreciation of finished products in the whole process of product distribution. Unjustified from the point of view of consumers, the

Retail price structure on the Russian dairy market in 2016*

Period

National average sales price, rubles per liter

Share of each market participant in retail price of pasteurized milk (3.2% fat), %

Raw milk of agricultural producers

3.2% fat pasteurized milk sold by processing companies

3.2% fat pasteurized milk sold by retail traders

Agricultural producers

Processing companies

Retail traders

January

21.91

34.51

47.65

46.0

26.5

27.6

February

21.93

34.78

47.88

45.8

26.8

27.4

March

21.92

34.86

48.17

45.5

26.9

27.6

April

21.71

34.99

48.26

45.0

27.5

27.5

May

21.32

35.07

48.28

44.2

28.5

27.4

June

20.86

35.21

48.25

43.2

29.7

27.0

July

20.52

35.24

48.28

42.5

30.5

27.0

August

21.15

35.41

48.40

43.7

29.5

26.8

Average price for 8 months

21.42

35.01

48.15

44.5

28.2

27.3

* Author’s calculations based on Rosstat data.

increase in retail sales prices of goods forces the consumers to reduce demand and accentuates the imbalance of profit distribution between the dairy market participants.

-

• Low development efficiency of raw materials zones of existing dairy plants (i.e., insufficient volume of milk production within the range of processing plants where the milk purchasing in terms of transportation costs is economically feasible), on the one hand, forces them to purchase raw materials in adjacent regions, creating additional transportation costs, on the other hand, results in the under-utilization of production capacities of dairy plants and the decreasing dairy production efficiency. If there is certain remoteness of dairy production from the point of sale, its fresh transportation to processing enterprises generally becomes unprofitable.

-

• Low raw milk quality and its noncompliance with the requirements for certain dairy products manufacturing (whole-milk products, cheese, etc.) compels processing enterprises to increase production costs of dairy products due to the need to provide deeper raw milk processing and hampers their ability to widen the assortment of finished products. For example, coagulation period of milk optimal for manufacturing hard rennet cheese should range from 16 to 40 minutes (normal coagulating property). Milk with coagulation period less than 15 minutes

(good coagulating property) or more than 40 minutes or not coagulative at all (poor coagulating property) requires additional processing and therefore additional costs. Technological process for cheese production implies slight thermal treatment of milk by employing the pasteurization method which does not allow to get rid of spore microorganisms and a share of thermophilic microflora. Raising pasteurization temperature significantly increases the period of milk coagulation and deteriorates the quality of the finished product. Therefore, efficient organization of cheese production requires the creation of a sustainable, uniform resource base which would meet the specific requirements of technological process to the quality of raw milk.

-

• Loss of a certain part of income by the dairy industry due to low logistics efficiency (inventory management, optimization of transportation, etc.) and inefficient use of production waste. Aiming at manufacturing high-margin products, dairy plants excessively expand the assortment of whole-milk products by reducing the manufacturing of milk intensive products and almost completely renouncing the manufacturing of products of secondary raw milk extensive processing. This leads to incomplete use of milk biological value potential, increases the volume of non-recoverable waste the cost of which affects the cost of finished dairy products. Secondary raw milk (protein

and carbohydrate) or dairy industry byproducts are: skimmed milk, buttermilk and milk whey.

Worldwide, secondary raw milk is used for nutritional purposes, to feed animals and produce chemical substances. Owing to modern scientific advances another innovative area for the use of secondary dairy raw milk has emerged – development of bioactive substances used to produce pharmaceuticals and cosmetics; in Russia, however, dairy production recycle streams are practically not used.

-

• High competition in the dairy market from foreign producers with significant competitive advantages due to their effective global supply chain management based on years of experience. Since the introduction of sanctions targeting the restriction of food supplies delivery from particular European countries, dairy products supplied from Belarus became the main competitive force on the Russian market. However, a large amount of dairy products is still produced in the EU [9].

-

• A large amount of counterfeit dairy products and extremely low punitive measures for their sales lead, on the one hand, to the bankruptcy of bona fide producers of milk and dairy products, on the other hand, to the drop in consumer demand due to the consumers’ dissatisfaction with the quality of dairy products. This trend exists due to uneven distribution of information between the

participants; and dairy market functions similar to the G. Akerlof’s market for “lemons” [14]. According to the estimates of the Federal Veterinary and Phytosanitary Monitoring Service (Rosselkhoznadzor), the volume of counterfeit dairy products in the Russian market comprises 11%, and by some dairy products this proportion exceeds 50% [6]. The higher the fat content of dairy products, the greater the volume of counterfeit products in the market. This situation arises from the fact that product’s quality is not considered as a competitive advantage by most Russian producers of dairy products. The purpose for counterfeiting dairy products is to receive illegal profits by reducing production costs resulting from unauthorized replacement of high-quality, biologically valuable raw materials with less valuable ones.

-

• Creation of additional insurance supplies in the elements of logistics chain due to mutual uncertainty about the partners in the supply chain leads to the inability to satisfy the consumers’ needs to buy fresh dairy products and increases expenses related to supply maintenance and inevitable percentage of their spoilage.

The implementation of the principles of logistics management throughout the whole supply chain from producers of raw milk to dairy product sales will help the participants to mitigate the negative impact of these restrictions. In the author’s opinion, the system of supply chain management can be considered as a partial alternative of objectively necessary state regulation of the dairy market and the processes of vertical integration aimed at even profit distribution among the participants [8].

The introduction of the system of supply chain management in the dairy market in Russia is hampered, on the one hand, due to the peculiarities of milk as an asset. Milk is a perishable product which requires processing in a short time and a strictly standardized asset which imposes special requirements on the production technology, collection, cooling, storage, packaging and transportation and affects the quality properties of milk – all this puts special demands on its logistics. On the other hand, the introduction of supply chain management system in Russia is complicated because of the low level of transport infrastructure development, insufficient technical capacity of the market participants, underdeveloped culture of market relations, poor communication processes, lack of trust between the participants, lack of participants’ awareness about common goals and low degree of implementation of management strategies when building supply chains at the inter-firm level, differences in corporate cultures, partners’ distance barriers, etc. Furthermore, modern Russian logistics market has not yet completely formed and is not transparent enough, which significantly reduces the efficiency of external logistics services of different providers on the milk market.

The process of formation of an effectively operating supply chain requires a long period of time during which it is necessary to choose reliable partners assessed on the basis of the results of joint work. In Russia, however, the issue of designing an efficient supply chain is often considered by the enterprises only when they need to implement crisis management.

Analysis of the situation in the Russian dairy sector demonstrates an urgent need to implement supply chain management principles and develop a value chain when building long-term partnership relations between its participants in order to increase of level of profitability of each participant. The implementation of SCM principles in the dairy sector will help meet state objectives of ensuring the country’s food security and dairy production competitive in both global and domestic markets amid Russia’s accession to the WTO, establishment of the Customs Union and the implementation of the import substitution strategy.

Conclusions and suggestions

The main problem of the Russian dairy sector is uneven margin distribution between the participants in the dairy supply chain. Most profits are concentrated around traders and processors, which makes raw milk production a low-income business activity. Low profitability in agriculture results in a decline in production volumes and a reduction in the quality of raw milk, which, in its turn, entails an increase in dairy production costs due to insufficient loading capacities of milk processing enterprises or very high transportation and production costs. Therefore, the first way of creating a competitive advantage for dairy enterprises is to optimize total margin distribution between all elements of the value chain. Each chain participant’s cost (investment) level is used as a base for margin distribution. This distribution will help increase the level of profitability of agricultural dairy producers participating in the supply chain and thereby stimulate the increase in production volumes and milk quality. Stability of raw milk supplies creates significant competitive advantages for the whole chain in general.

The second major problem which determines high transportation and production costs in the dairy sector is associated with insufficient and disproportionate development of rawproduct areas of dairy enterprises and non-compliance of raw milk quality with the requirements of competitive dairy products. There are two ways of solving this problem.

The first is the development by milk producers together with processing enterprises of a rational standardized milk production technology (technology of maintenance, feeding, milking, etc.)

allowing to produce milk with set biological parameters (fat, protein content), required for the production of certain types of dairy products. The example of the implementation of such programs in Russia is the Pepsi-Co company.

The second way is the optimization of the range of products of dairy processing enterprises aimed at increasing its incomes through a more rational use of resources and maximum satisfaction of customers’ needs. Optimization of the product range should be carried out taking into account the main constraints on the development of the dairy sector: quality (biological composition) and quantity of milk produced in a rationally defined resource area of a dairy plant, taking into account the cost of daily transportation of both raw materials and waste from its production; seasonal changes in the qualitative composition of milk and its production volumes in the resource area of a dairy processing plant; by-products accompanying the production of each type of dairy product as they can be used as raw materials for producing other types of dairy products; fluctuations of seasonal retail price of dairy product sales and demand in the market. Given the constraints described above, the author proposes to implement the optimization of the product range of dairy processing plants on the basis of a mathematical model developed by G. Classen and J. Kampmann [17]. This model was practically tested on the example of assortment formation of an international dairy company FrieslandCampina and showed a potential significant increase in the profit of this manufacturer. An increase in profit was achieved due to optimal distribution of raw milk for manufacturing dairy products, improvement of the quality of communication between the planning centre and operational units, considering the influence of a fluctuation in the qualitative composition of milk on the cost of of dairy products, forecasting of the changes in demand on the market and the possibility to evaluate investment strategies. The distribution of income throughout the whole supply chain will significantly enhance the competitive position of its participants in the dairy sector.

This approach can be implemented by introducing the systems of supply chain management of dairy products. This model was used to optimize the profit of the supply chain of dairy products in New Zealand through the management of seasonal fluctuation in the qualitative composition of milk produced on farms, and the optimization of the range of dairy products manufactured by processing enterprises taking into account consumer demand, market prices for dairy products and qualitative composition of milk supplied for processing. The model implies the implementation of a mechanism of commodity management in a supply chain. The results of using this mechanism show that, for example, a 1% increase in casein in milk’s composition without changing other quality parameters will change the range of dairy products produced by a processing plant in terms of increasing its price. This will result in the increase in the aggregate profit in a supply chain by 1.27%, in the operating profit – by 1.57%, in inventory management costs – only by 0.3% [22].

The third problem lies is lack of trust between the participants of supply chains and their willingness to insure themselves against cooperation, which leads to increased transaction costs and the creation of insurance supplies (in the production of milk powder and vegetable fat as an alternative to raw milk, in retail – finished dairy products). The result is the loss of competitive advantages derived from management of the entire supply chain operation under the concept of “just in time” due to elimination of supplies at each production stage. In addition, the quality of finished dairy products is significantly reduced due to the use of substitutes for raw milk and the increase in period of dairy products storage in warehouses of trade enterprises. This causes the reduction in consumer demand and the decline in aggregate income of all dairy chain participants. Addressing this problem requires quite a long time, during which each participant’s approach to the assessment of their role in a value chain should be reconsidered; it also requires the awareness that it is only possible to gain significant competitive advantages amid economic crisis through coordinated efforts of all participants of this chain [12].

The implementation of the supply chain management mechanism will to some extent help solve the whole range of identified problems. Using this system, the milk processing plant Dimitar Madzarov Ltd which produces organic dairy products in Bulgaria where the situation in the dairy sector is similar to the Russian reality, managed to increase their production volumes and milk tradability on farms participation in the supply chain. The average increase in production amounted to 195.4%, and the level of tradability – 115.1%.

According to the surveys of farmers involved in the supply chain of Dimitar Madzarov Ltd, the main factors ensuring milk production volume increase are: longterm contracts with the processing plants, milk collection in sufficient proximity to the farm, good processor’s reputation, high level of trust, better milk quality control, timely payments, high purchase prices and low risks. Fifty per cent of the interviewed farmers involved in the supply chain of Dimitar Madzarov Ltd. stated that they plan to increase the production of milk, 30% reported about their intention to maintain the existing volume of production, and none of the respondents is going to shift to production of other agricultural products.

The use of supply chain management mechanisms is implemented with a view to ensuring an even income distribution between the participants of the chain. Therefore, the purchasing prices of the Dimitar Madzarov Ltd are established at a significantly higher level than average prices of raw milk in Bulgaria. A longterm contract fixes the volume of milk supplies, its quality, prices and gives a detailed description of sanctions for noncompliance of the quality of supplied milk to the established requirements [15].

Building close relations between milk producers and processors in a supply chain through active communication, coordination and use of incentive mechanisms helps dairy plants to introduce new requirements for the suppliers to the quality, time and ways of raw milk delivery, which increases the supply chain’s aggregate profit which is later evenly distributed among the participants.

Список литературы Supply chain management as a driving force for generating competitive advantage for dairy companies

- Volkova T.S. Ispol'zovanie kontseptsii otraslevoi tsepochki tsennosti v upravlenii zatratami molochnoi promyshlennosti . Upravlencheskii uchet , 2013, no. 11, pp. 12-22..

- Doktrina prodovol'stvennoi bezopasnosti RF . Ministerstvo sel'skogo khozyaistva RF . Available at: www.mcx.ru..

- Dinamika ob”emov proizvodstva syrogo moloka i molochnoi produktsii v Rossiiskoi Federatsii . Natsional'nyi soyuz proizvoditelei moloka . Available at: http://www.souzmoloko.ru/news/rinok-moloka/rinok-moloka_3372.html..

- Indeks effektivnosti logistiki: razryv sokhranyaetsya . Vsemirnyi bank, 20.03.2014 . Available at: http://www.worldbank.org/ru/news/press-release/2014/03/20/logistics-performance-index-gap-persists..

- Stock J. R., Lambert D.M. Strategicheskoe upravlenie logistikoi: per. s 4-go angl. Izd . Moscow: INFRA-M, 2005..

- Nechestnoe moloko . Interfaks-Rossiya . Available at: http://www.interfax-russia.ru/print.asp?id=737871&type=view..

- Petrunya N.G. Planirovanie tsepochek postavok dlya molokopererabatyvayushchikh predpriyatii . Pererabotka moloka . Available at: http://www.milkbranch.ru/publ/view/347.html..

- Poleshkina I.O. Mekhanizmy gospodderzhki molochnogo sektora v Evropeiskom soyuze i vozmozhnost' ikh adaptatsii v usloviyakh Rossii . Mezhdunarodnyi sel'skokhozyaistvennyi zhurnal , 2014, no. 4, pp. 60-63..

- Poleshkina I.O. Osobennosti konkurentsii na rynke moloka v Rossii . Ekonomika sel'skokhozyaistvennykh i pererabatyvayushchikh predpriyatii , 2015, no. 8, pp. 24-29..

- Porter M. Konkurentnoe preimushchestvo: kak dostich' vysokogo rezul'tata i obespechit' ego ustoichivost' . Moscow: Al'pina Biznes Buks, 2005. 715 p..

- Sait kompanii IFS Applications . Available at: http://www.ifsrussia.ru/ifsgeneralscm.htm..

- Sergeev V.I. Logistika i upravlenie tsepyami postavok -antikrizisnye instrumenty menedzhmenta . Logistika i upravlenie tsepyami postavok , 2015, no. 1 (66), pp. 9-23..

- Williamson O. Ekonomicheskie instituty kapitalizma: firmy, rynki, “otnoshencheskaya” konkurentsiya: per. s angl. . Saint Petersburg: Lenizdat, 1996. 702 p..

- Akerlof G. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism. The Quarterly Journal of Economics, volume 84, August, 1970, pp. 488-500.

- Bachev H. Dairy Supply Chain Management in Bulgaria. The IUP Journal of Supply Chain Management, volume 8, no. 2, 2011, pp. 7-20.

- Backer K.D., Miroudot S. Mapping Global Value Chain. OECD Trade Policy Papers, no. 159. Available at: http://dx.doi.o 10/1787/ DOI: rg/10.1787/5k3v1trgnbr4-en

- Banaszewska A., Cruijssen F., van der Vorst J.G.A.J., Claassen G.D.H., Kampman J.L. A comprehensive dairy valorization model. Journal of Dairy Science, 2013, volume 96, issue 2, pp. 761-779.

- Handfield R., Nichols E. Supply Chain Redesign: Transforming Supply Chains into Integrated Value Systems. Financial Times Prentice Hall, 2002. 400 p.

- Kharin S. Vertical price transmission along the diary supply chain in Russia. Studies in Agricultural Economics, 2015, no. 117, pp. 80-85.

- Kleinhanb W., Offermann F., Ehrmann M. Evaluation of the Impact of Milk quota -Case Study Germany. Institute of Farm Economics. Braunschweig, 2010. Available at: http://www.econstor.eu/dspace/handle/10419/41462

- Manoj K. Lot Sizing Decision: A Case Study of an Indian Dairy Supply Chain. The IUP Journal of Supply Chain Management, 2007.

- Markovic M., L. Dries Value Chain Analysis in the Montenegrin Dairy Sector, 2013. 76 p.

- Montes de Oca O., Dake C.K.G., Dooley A.E., Clark D. A Dairy Supply Chain Model of the New Zealand Dairy Industry.

- Topolansky B. The Challenges of a Consolidated Supply Chain to British Dairy Farmers. Social Research, 2011, no 2 (23), pp. 90-99.

- Economic Effects of U.S. Dairy Policy and Alternative Approaches to Milk Pricing: Report to Congress July 2004. United States Department of Agriculture.