The Impact of bank Concentration on Economic Growth: Comparative study between Algeria and Oman over the period: 2000 2021

Автор: Samir B., Abdelhak L., Tayeb G., Boudrama M.

Журнал: Science, Education and Innovations in the Context of Modern Problems @imcra

Статья в выпуске: 7 vol.8, 2025 года.

Бесплатный доступ

This study aims at estimating the impact of bank concentration on economic growth in Algeria and Oman during the period (2000 2021) using the multiple linear regression model. The study revealed a statistically significant negative relationship between banking concentration and economic growth i n Oman, indicating that high banking sector concentration may hinder growth due to weak competition, reduced credit allocation efficiency, or increased risks of financial instability. In other side, results showed no statistically significant relationship between banking concentration and economic growth, suggesting that other factors (particularly oil revenues) are the primary drivers of growth.

Bank Concentration, Economic Growth , Oil Rents

Короткий адрес: https://sciup.org/16010832

IDR: 16010832 | DOI: 10.56334/sei/8.7.9

Текст научной статьи The Impact of bank Concentration on Economic Growth: Comparative study between Algeria and Oman over the period: 2000 2021

RESEARCH ARTICLE The Impact of bank Concentration on Economic Growth: Comparative study between Algeria and Oman over the period: 2000-2021 Samir Benkari / Doctor Faculty of Economics, Business and Management Sciences 1, Ferhat Abbas University Setif , Algeria Email: X Abdelhak Laifa Doctor Faculty of Economics, Business and Management Sciences 1, Ferhat Abbas University Setif, Algeria Email: Tayeb Guessas X \ \ \ \ \ Professor Faculty of Economics, Business and Management Sciences 1, Ferhat Abbas University Setif, Algeria Email: / Boudrama Moustapha Professor Faculty of Economics, Business and Management Sciences 1, Ferhat Abbas University Setif, Algeria Email: Doi Serial Keywords Bank Concentration, Economic Growth , Oil Rents Abstract This study aims at estimating the impact of bank concentration on economic growth in Algeria and Oman during the period (2000-2021) using the multiple linear regression model. The study revealed a statistically significant negative relationship between banking concentration and economic growth in Oman, indicating that high banking sector concentration may hinder growth due to weak competition, reduced credit allocation efficiency, or increased risks of financial instability. In other side, results showed no statistically significant relationship between banking concentration and economic growth, suggesting that other factors (particularly oil revenues) are the primary drivers of growth. 4 Citation 4 Samir B., Abdelhak L., Tayeb G., Boudrama M. (2025). The Impact of bank Concentration on Economic Growth: ^ Comparative study between Algeria and Oman over the period: 2000-2021. Science, Education and Innovations in the X Context ofModern Problems, 8(7), 81-88; doi:10.56352/sei/8.7.9. X Licensed 4 © 2025 The Author(s). Published by Science, Education and Innovations in the context of modern problems (SEI) by ^ IMCRA - International Meetings and Journals Research Association (Azerbaijan). This is an open access article under X the CC BY license . Received: 11.01.2025 Accepted: 05.04.2025 Published: 01.06.2025 (available online)

The banking system is one of the cornerstones of the modern economy, playing a pivotal role in promoting economic growth by providing the liquidity needed to finance investments, facilitating trade transactions, and stimulating savings and consumption. The banking sector acts as a financial intermediary between savers and investors, helping direct financial resources toward productive projects that stimulate the economy and create jobs. In addition, banks contribute to the stability of the financial system by managing risks and providing credit services that support businesses and individuals alike.

Studies have shown that the efficiency of the banking system depends not only on its size but also on the degree of banking concentration—the extent to which a limited number of large banks dominate the banking market. On the one hand, banking concentration can enhance efficiency by achieving economies of scale, which lowers service costs and increases banks' ability to finance major projects. On the other hand, excessive concentration can reduce competition, limit innovation, raise borrowing costs, and thus weaken economic growth. Therefore, achieving a balance between banking concentration and competition is vital to ensuring a strong financial system that supports sustainable economic development.

Banking concentration in Arab countries, particularly in the Gulf states, is characterized by the dominance of a limited number of large banks over the share of banking assets, deposits, and loans . In most Arab countries, the five largest banks hold between 60% and 90% of the banking sector's total assets, indicating high concentration. In some Gulf markets such as Qatar and Kuwait (where 3-4 major banks dominate), it is considered more concentrated than in the UAE and Saudi Arabia, which have greater banking diversity due to the size of their economies and the presence of a larger number of local and foreign banks. Compared to the aforementioned countries, the Omani banking system is characterized by a medium degree of concentration, as 6 major local banks (such as Bank Muscat and Oman Arab Bank) dominate most of the market, while competition remains present with the presence of branches of foreign banks.

Comparing banking concentration between Algeria and Oman is particularly important in understanding the performance of the banking sector and its role in supporting economic growth in both countries. While both countries share the rentier nature of their economies, reliant on oil revenues, Algeria is characterized by a high banking concentration, with state-owned banks dominating the economy, while Oman demonstrates a more balanced model with greater private sector participation.

Based on the above, we will try through this study to know the impact of bank concentration on economic growth By depending on the experiences of Algeria and Oman.

The main question that has to be asked: What is the impact of bank concentration on economic growth in the case of Algeria compared with Oman during the period 2000–2021?

In order to answer this question, the following hypothesis can be proposed:

The null hypothesis: banking concentration does not have an impact on Economic Growth in the both countries?

1-1 Review of Theoretical Literature

1-2- Review of Empirical Literature

-

* A study conducted by Boubacar Diallo, Wilfried Koch titled: “ Bank Concentration and Schumpeterian growth :Theory and International Evidence ”, it investigated the relationship between economic growth and bank concentration. There is imperfect competition within the banking system according to the Schumpeterian growth paradigm, and through theoretically and empirically show, the effects of bank concentration on economic growth depend on the proximity to the world technology frontier. The theory predicts that when a country reaches a sufficient level of financial development, bank concentration has a negative effect on development and growth and that this effect increases when the country approaches the frontier. However, for countries with credit constraints, growth depends on only financial intermediation.

-

* A study conducted by Asli Demirguc-Kunt and Ross Levine titled " Bank Concentration: Cross-Country Evidence ," by Using cross-national comparisons, this study examines the connections between (i) bank concentration and the financial system's growth and efficiency, (ii) the political economy of bank concentration, and (iii) the relationship between bank concentration and stability. The idea that bank concentration is directly related to the stability of the banking system, industrial competition, financial development, banking sector efficiency, or general institutional development is not supported by our analysis. These results imply that using cross-country comparisons to support or refute bank concentration would be challenging.

-

* A study conducted by Moses Vincent and Okowa Ezaal titled "Bank Competition, Concentration and Economic Growth: A Panal Analysis of Selected Banks in The Nigerian Banking Industry " examined the impact of competition and concentration in the Nigerian banking sector on economic growth, concentrating on the country's eight largest banks. Furthermore, the Central Bank of Nigeria's 2005 implementation of its consolidation policy influenced the study's selection of the 2005–2019 timeframe. Although the study discovered a positive concentration-growth relationship, it was unable to prove a positive competition-growth relationship in the Nigerian economy during the reviewed period. The level of concentration in the banking sector has been explained by the increase in capital base mandated by the consolidation policy, which has also made it simpler for banks to make a substantial contribution to economic growth. On the other hand, the banking industry's imperfect competition has resulted in higher loan costs, which discourage businesses from making new investments and impede their ability to expand and increase productivity.

-

* The study was conducted by EDIB SMOLO titled " Bank Concentration and Economic Growth Nexus: Evidence from OIC Countries ,". This study looks at the connection between bank concentration and economic expansion in nations that are members of the Organization of Islamic Cooperation (OIC). The system GMM estimators are applied to a panel data sample with 650 observations and 41 countries. According to our analysis, there is a non-linear relationship between bank concentration and economic growth. Additionally, it is discovered that the effect of bank concentration on economic growth depends on the nation's income but not on the degree of corruption. However, different concentration measures yield somewhat different outcomes, so policymakers should exercise caution when recommending policies. Nonetheless, it would seem logical to draw the conclusion that in order to support economic expansion in OIC nations, bank concentration should be kept to a minimum.

-

* Rujun Wang conducted a study titled " The Relationship between Banking Concentration and Economic Growth ." The relationship between economic growth and banking concentration—a significant aspect of financial structure—is the main topic of this essay. Empirical research is required to give policymakers advice on how to fortify nations' financial systems and advance their economic development because the body of existing literature is divided on whether banking concentration fosters or impedes economic growth. The study examines the relationship between banking concentration and both overall GDP growth and the annual percentage growth of particular industries, such as manufacturing, services, and agriculture, using country-level panel data from 1998 to 2010 to estimate fixed effects regression models. Limited evidence of such an association is found in this paper. These results suggest that by changing banking structures, policymakers may be able to fortify nations' financial systems without having a negative impact on economic expansion.

-

* Khalid Najeh Al-Tanbour, and Talib Mohammad Awad-Warrad conducted a study titled, “ the

Impact of Banking Concentration on Investment and Economic Growth in Jordan “, It aimed to examine how banking concentration effects investment and economic expansion in the Jordan-ian economy. .

It makes use of an annual sample for the years 1980–2018. It examined the efficacy of the other Efficient-Structure (ES) hypothesis and the Structure- conduct –performance hypothesis in the context of Jordan. The results of the Augmented Dickey-fuller ( ADF) and cointegration test showed that the following econometric methods are : the fully modified OLS, the generalized methods of moments (GMM), and the Autoregressive Distributed Lag Bo und test (ARDL).

The estimation findings showed a negative correlation between the concentration index and the rate of real economic growth as well as investment spending.

2-Econometric Methodology:2-1 Model and Data:

Model : Basic Linear Regression

|

GDPC = во + Pi(BC) + e2(OR) + e |

|

|

Where : |

GDPC : Economic growth represented by per capita GDP.

CP : presents banking concentration.

OR: presents oil rents.

ε : résidu

2-1- Regression Model Specification ( Oman case )2-1-1- Regression Results

GDPC = 12.437 - 0.103(BC) + 0.201 (OR) + e

(0.087) (0.049) (0.002)

«2 = 512 , N=22 , Prob(F)=0.001 , DW=1.95

2-1-2- Statistical Evaluation of the Model:

.*Prob(F)=0, the model is statistically significant, there is at least one explanatory variable to reflect the relationship between economic growth and banking concentration.

*The adjusted R-squared: 0.463, it means 46.3% of changes can be explained by these variables, and 53.7% of changes due to other variables which are not used within the model

Statistical Evaluation of Variables:

|

Variable |

Coefficient |

Probability |

Statistical significance |

Observation |

|

Constant |

12.437 |

0.087 |

Significant at 5% |

Accept H0 |

|

Bank Concentration |

0.103 - |

0.049 |

Significant at 5% |

Accept H1 |

|

Oil rents |

0.201 |

0.002 |

significant at 5% |

Accept H1 |

Source: according to Eviews outputs

-

- bank concentration is correlated negatively and significantly with economic growth indictor , Whereas, increasing banking concentration by 1% leads to a decline in economic growth by an amount of -0.103 %.

-

- Oil rents is correlated positively and significantly with economic growth indictor , Whereas, increasing Oil rents by 1% leads to increase in economic growth by an amount of 0.201 %.

Oman‘s financial system is predominantly bank-centric. Since the introduction of Banking Law in 1974, the banking sector has witnessed considerable amount of changes, particularly in recent years with sizable growth in size, quality of assets, and improvement in its supervisory process. (Rath, Mishra, & Al Yahyaei, 2014). There were five important mergers that took place in the banking history of Oman up to 2000. Out of them, three mergers were during 1991-95. Two mergers were effected in 1993;

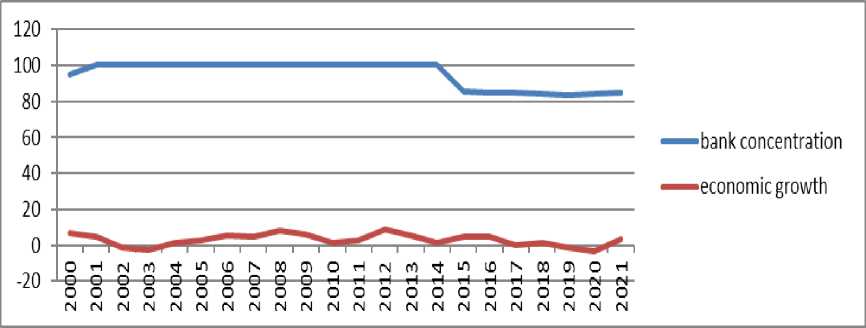

The following figure shows the development of the assets of the five largest banks in Oman with the development of economic growth.

Figure ( 01 ): the bank concentration and economic growth in Oman

Source: World Bank

We also notice an improvement in economic growth during some years, such as 2008, 2012 and 2015, This is generally due to an improvement in oil prices, The oil market has witnessed extreme volatility during 2008. The sharp increase in oil prices, which started in early 2007 and peaked in the middle of 2008, was followed by a sudden shift: crude oil (Dated Brent) went from costing 92 dollars per barrel in January 2008 to 145 dollars per barrel in July.

2-1-3- Study of Econometrical Problems:*Autocorrelation of residuals:

We usually use a Durbin Watson test in order to test the problem of autocorrelation in the residuals from a statistical model, Its value is ranging between 0 and 4 .

In our study, DW =1.95: ( DL=0.915, Dup=1.28): we accept the null hypothesis because the value of DW is found between Du= 1.284 and ( 4- Du) = 2.716

* Heteroskedasticity: The heteroskedasticity test refers to ununiform variance in a sequence of variables, according to Breusch-Pagan test we find that χ ² = 1.52 (p = 0.468) , greater than 0.05, therefore we accept the null hypothesis (There is no evidence of an asymmetric variance problem ).

*Normality of Distribution: We use Jarque-beraProbility JB = 0.92 (p = 0.631) , it is greater than 0.5, therefore we accept null hypothesis ( residues follow Gaussian distribution in the confidence field of 92%).

2-2- Regression Model Specification (The Algerian Case )2-2-1-Regression Results:

GDPC = 15.83 – 0.183(BC) + 0.193(OR) + ε ( 0.020 ) ( 0.054 ) ( 0.002 )

R2 = 0.512 , N=22 , Prob(F)=0.001 , DW=1.93

2-2-2-Statistical Evaluation of the Model:

.*Prob(F)=0, the model is statistically significant, there is at least one explanatory variable to reflect the relationship between economic growth and banking concentration.

* *The adjusted R-squared: 0.463, it means 46.3% of changes can be explained by these variables, and 53.7% of changes due to other variables which are not used within the model.

Statistical Evaluation of Variables:

|

Variable |

Coefficient |

Probability |

Statistical significance |

Observation |

|

Constant |

15.83 |

0 . 002 |

Significant at 5% |

Accept H1 |

|

Bank Concentration |

0.183 - |

0 . 054 |

Significant at 5% |

Accept H0 |

|

Oil rents |

0.193 |

0.002 |

significant at 5% |

Accept H1 |

Source: according to Eviews outputs

-

- bank concentration is correlated negatively and insignificantly with economic growth indictor ,

-

- Oil rents is correlated positively and significantly with economic growth indictor , Whereas, increasing Oil rents by 1% leads to increase in economic growth by an amount of 0.193 %.

The number of banks and financial institutions operating in Algerian banking system has exactly been 20 banks in the end of 2021, included 6 public banks , as well as national fund for saving and foresight , and 14 private banks, this later was distributed among : Domestic, foreigner and Arabic .

In addition to previous banking institutions , there are 3 financial institutions ( among them , there are 2 public ones ), 5 leasing institutions ( including 2 public ones ), 1 mutual support for agriculture insurance accredited for banking operations so that it acquired the status of financial institution at the end of 2020. (Algeria, 2021).

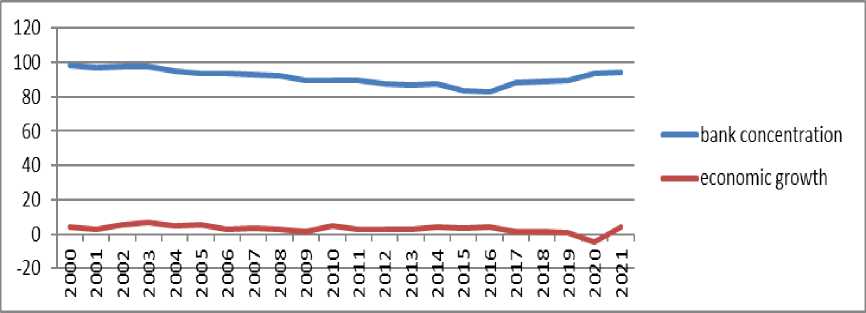

The following figure shows the development of the assets of the five largest banks in Algeria with the development of economic growth.

Figure ( 01 ): The Bank Concentration and Economic Growth in Algeria

Source: World Bank

We note from the previous figure that there is a fluctuation in banking concentration during the study period. the degree of banking concentration in the Algerian banking system is high, as public banks dominate the banking sector . (Meherhera, 2021) .According to study done by Arabic banks union organization over the period of 2011-2013, first five biggest Algerian banks was entirely public , they are arranged progressively by its assets as follows : BEA,BND,CPA, BADR,BDL, and the next following ones including: EL Baraka Banks, GULF Bank, ABC Bank, HOUSING Bank, TRUST Bank.

There is fluctuation in economic growth in Algeria throughout the study period. It reached its highest level in 2003 at a rate of 6.5%, which was as a result of 2001 economic programme which has been directed to promote economic and social situations in Algeria , but it has fallen sharply , this is mainly because of the oil prices decrease in 2009 under the 2008 crisis impact . (Matallah & Smahi, 2014), and it reached its lowest level in 2020 at a rate of -5% as a result of covid 19 and subsequent strict lockdown to contain the outbreak and the sharp decline in oil revenues. (Mekarssi, 2022).

2-2-3- Study of Econometrical Problems:*Autocorrelation of residuals:

We usually use a Durbin Watson test in order to test the problem of autocorrelation in the residuals from a statistical model, Its value is ranging between 0 and 4 .

In our study, DW =1.93 : ( DL=0.915, Dup=1.28): we accept the null hypothesis because the value of DW is found between Du= 1.284 and ( 4- Du) = 2.716

-

* Heteroskedasticity: The heteroskedasticity test refers to ununiform variance in a sequence of variables, according to Breusch-Pagan test we find that χ ² = 1.24 (p = 0.538), greater than 0.05, therefore we accept the null hypothesis (There is no evidence of an asymmetric variance problem ).

*Normality of Distribution: We use Jarque-beraProbility JB = 0.89 (p = 0.641), it is greater than 0.5, therefore, we accept null hypothesis ( residues follow Gaussian distribution in the confidence field of 95%).

Conclusion:

Despite the importance of the banking sector in supporting economic growth based on the size of this sector among countries as well as its level of development , The results of the regression analysis showed that banking concentration negatively impacts economic growth in Oman, suggesting that increased banking sector concentration may hinder economic activity there. In contrast, the results showed no significant relationship between banking concentration and economic growth in Algeria, which may reflect differences in the structure of the financial sector and the monetary policies pursued. Oil revenues also play a pivotal role in driving economic growth in both countries, given their heavy reliance on the hydrocarbon sector. These results underscore the importance of diversifying the economic base and adopting fiscal and banking policies that support growth away from total reliance on oil revenues.

Recommandation :

In Oman:

-

- Enhancing banking competition by facilitating the entry of new banks and encouraging financial technology (FinTech) to stimulate efficiency and reduce the negative effects of banking concentration on economic growth.

-

- Diversifying funding sources by relying less on the traditional banking sector and developing capital markets such as bonds and equities to finance development projects.

In Algeria:

-

- Deepening financial reforms to enhance the efficiency of the banking sector, despite the lack of a clear impact of banking concentration, with a focus on financial inclusion and adopting better governance standards.

-

- Increasing investment in non-oil sectors such as agriculture, manufacturing, and renewable energy, to reduce dependence on oil revenues and promote sustainable growth.

In both countries:

-

- Strengthening macroeconomic policies that support economic diversification, while stimulating the private sector and attracting foreign direct investment.

-

- Improving the management of oil revenues through sovereign wealth funds or long-term investments to ensure economic stability despite oil price fluctuations.