The influence of Covid-19 and the olimpic games on the market business of Japan

Автор: Đukić A., & Kojić V.

Журнал: Sport Mediji i Biznis @journal-smb

Статья в выпуске: 1 vol.9, 2023 года.

Бесплатный доступ

The Summer Olympics are the largest international sporting event in the world. Over 200 sports nations take part in them every 4 years and represent a real organizational challenge for the host country. The organization of the games requires large financial resources that the host country would have to allocate. The Tokyo Olympics in 2020 faced unprecedented challenges due to the COVID-19 pandemic, which increased the price of the games, which is already a record. Economists and organizers predicted that the Games in Tokyo would have an impact of as much as 292 billion dollars on the overall economy of Japan. Economists in Japan have raised expectations that the Tokyo Olympics will sharply strengthen not only the country's tourism industry, but also the construction business, while encouraging consumption, which together would increase Japan's market business. With the appearance of the corona virus, the Olympics were postponed for one year, which eventually led to a ban on watching at the venue of the postponed event. These bans, on the one hand, increased the cost of maintenance three times, and on the other hand, reduced revenues several times, which had a great impact on the Japanese market. This paper investigates the impact of covid-19 and the Olympic Games on Japan's market operations using regression and correlation analysis. Based on the analysis, the negative impact of Covid-19 on the market operations of Japan and the positive impact of the Olympics, especially in the year of maintenance, were proven, regardless of the fact that additional funds were invested.

Olympic Games, COVID-19, Japan, market business

Короткий адрес: https://sciup.org/170203612

IDR: 170203612 | УДК: 796.032.2(520)"2020" | DOI: 10.58984/smb2301007d

Текст научной статьи The influence of Covid-19 and the olimpic games on the market business of Japan

Received: 12.06.2023 DOI:

Almost all countries are applying to host the Olympics in the hope of increasing their tourism and infrastructure potential. Host countries invest tens of billions of US dollars in infrastructure, and often take on debt. Just submitting the candidacy of the host cities can cost over 50 million dollars. Tokyo spent 75 million dollars for the campaign in its candidacy for the 2020 Olympics. Debt repayment may take decades, but the economic benefits may be many times greater.

The Olympic Games improve the host country's infrastructure, communication systems, transport systems, buildings, tourism and thus have an overall effect on the market. It is especially important for host cities that offer sustainable development (Pasquale et al., 2017). In the long term, OIs provide large and significant economic benefits (Jasmand et al., 2007), and the built infrastructure improves the market (Sterken, 2006).

Some economists who claim that the economic effect lasts only during the games (Humphreys et al., 1995), however, they exclusively observed economic growth that depends on other factors as well. It is important to note that in 1984, Los Angeles was the first city to profit from organizing the games, while e.g. Montreal paid off a debt of 1.5 billion dollars for 30 years to organize the 1976 Games. It is for this reason (Schoval, 2012) that the OI is divided into several periods, and the third one starts from LA in 1984. State investments in the host cities are also large. Korea invested 1.5 billion dollars for the construction of roads, stadiums, buildings and other facilities needed to hold the games in Seoul in 1988. After LA, the economic concept of organizing the games changed, where the host countries were based on improving the existing infrastructure and seeking sponsorship, since this is an obvious method of how to profit from the organization. Those countries that respected it made profits, and countries that didn't ended up with big losses. In 2004, Athens ended the games with a loss of 14.5 billion dollars, which worsened the already difficult economic situation in Greece. The city itself increased employment by only 0.2% which was not enough to cover the losses of the rest of the country (Hotchkiss et al., 2003).

In 2016, Brazil expected that the OI organization would pull them out of recession, however, the construction of a completely new infrastructure, and the failure to use and upgrade the existing one, brought unexpected economic results. In those cases, only the host cities profit, and the citizens of the rest of the country are unfairly taxed and repay the debt (Lenskyj, 2000). It is important to note that the Olympic Organizing Committee has made a profit at every Olympics since 1972 (Preuss, 2004). Finally, in 2020, with investments and upgrading of existing infrastructure,

Tokyo expected an impact of as much as 292 billion dollars on the total economy of Japan. However, the COVID-19 pandemic has largely reduced that impact. Expected revenues from tourism and promotion of the country were missing, as the world was struggling with the biggest pandemic in the past 100 years at the time of the games. Japan, as the second largest market in the world, and the third in terms of purchasing power parity (right after the USA and China), had to allocate additional funds for the safe organization of the games. Also, it was necessary to create a mechanism in which each country must prepare for recession and set aside additional funds for special purposes (Kolluru et al., 2021).

Prevention measures and the world's fight against the pandemic required special conditions that Japan could not meet in 2020, so the games were postponed to 2021. The postponement of the Games tripled the cost of the organization, which was covered by the Government of Japan. This postponement cost Japan around $20 billion, making the games the most expensive Olympics ever. It is estimated that they cost 68 billion dollars. The games lasted 17 days and were organized without fans, which left the city and the country without foreign tourists and the expected income from tourism. Many hotels that were renovated and built to accommodate foreign tourists have been closed or converted. Economists again expect that the legacy of hosting the games and the improvement of tourist infrastructure will increase Tokyo's tourism profits after the end of the pandemic. However, in addition to the proven negative impact of hosting the games, the impact of building facilities, including the National Stadium and Sports Village, has already benefited the Japanese economy by around $27 billion.

Methods of research

In addition to descriptive and comparative analysis, the paper uses correlation and regression analysis using the SPSS 26 program. The linear regression model is represented by the regression equation: Yi=β0+β1*Xi+ ℇ i (i=1,..,n) where the index and are related on the i-th observation, while the variable x is an independent explanatory variable, because it explains the variations of the variable y.

The estimated function of the simple linear regression based on the sample reads: Ŷi= b0 + b1xi, where Ŷi is the value of the dependent variable located on the best-fit regression line, while b0 and b1 are the estimates of the unknown regression parameters of the basic set.

The main hypothesis of this work is: the impact of COVID-19 had a negative impact on the market operations of Japan, and a positive impact on the hosting of the Olympic Games. The aim of this paper is to determine the importance of holding OI for the market business of Japan, even though there was a pandemic and great opposition from the Japanese for holding them.

Preparations for the Tokyo Olympics and investment in them have been going on since 2016, so we will look at the period 2016-2021 and investment in them against the size of the Japanese market. The years 2020 and 2021, as the period of the COVID-19 pandemic, are proving to be crucial in influencing the market, although they should have had the most positive effect.

The final part of the paper is dedicated to the interpretation of the obtained results, with the aim of determining the impact of COVID-19 and OI on the Japanese market.

Research results

The analysis of the size of the Japanese market showed a steady growth rate until 2019, except for 2017, when the smallest funds were allocated for the organization. All estimates showed the highest market growth in the year the games were held. With the advent of the 2019 COVID-19 pandemic, that rate fell in 2020, while it rose in the 2021 Games year. This can be seen from Table 1, which shows the actual and expected market size for the era of the COVID-19 pandemic.

Table 1. Japan market size (actual and expected) and investment in OI for the period 2016-2021. year

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Market size (billions of dollars) |

5000 |

4930 |

5030 |

5140 |

4970 |

5100 |

|

Market size (expected according to the World Bank estimate from 2018) |

5000 |

4930 |

5030 |

5140 |

5280 |

5390 |

|

Investment in OI (billions of dollars) |

12 |

6 |

9 |

12 |

9 |

20 |

Source: World Economic Forum

The results of the regression and correlation analysis in the statistical program IBM SPSS 26 between market size and Japan's investment in OI gave the following results. The dependent variable is market size, and the independent variable is Japan's investment in organizing the Olympic Games.

|

Table 2. Descriptive |

statistics Value |

Standard deviation |

N |

|

Market size |

5028,3333 |

79,35154 |

6 |

|

Investments |

11,3333 |

4,80278 |

6 |

Source: Author's calculation in SPSS 26

Table 2 shows the standard deviation for market size and investment for the period 2016-2021. year, and in Table 3, the Pearson correlation coefficient is 0.70, which shows a high positive linear correlation. The value of the one-sided test Sig. (1tailed) which shows us statistical significance is greater than 0.05 and is 0.061.

Table 3. Correlation

|

Vel. tržišta Ulaganja |

|

|

Pearson coefficient |

Market size 1,000 ,700 Investments ,700 1,000 |

|

Sig. (1-tailed) |

Market size . ,061 Investments ,061 . |

|

N |

Market size 6 6 Investments 6 6 |

Source: Author's calculation in SPSS 26

Table 4 shows the model from which we see that the value of the Durbin Watson coefficient is 1.759, that is, the correlation between the residuals is positive. The coefficient of determination is 49%, which shows that variations in market size are determined by variations in investment in the OI organization with 49%. This is somewhat logical, because the Japanese market depends on many other factors.

Table 4. Model summary

|

R Model R Square |

Change Statistics Std. Error R Adjusted of the Square F Sig. F Durbin- R Square Estimate Change Change df1 df2 Change Watson |

|

1 ,700a ,490 |

,362 63,38193 ,490 3,837 1 4 ,122 1,759 |

Source: Author's calculation in SPSS 26

Table 5 shows the coefficients from which we can derive the regression equation that reads: Y= 4897.312 + 11.561X. Also, standardized and non-standardized coefficients are shown.

Table 5 . Coefficients

Standardized

Unstandardized coefficient coefficient

|

Model |

B |

Standard error |

Beta |

t |

Sig. |

|

1 (Constant) |

4897,312 |

71,718 |

68,286 |

,000 |

|

|

Investments |

11,561 |

5,902 |

,700 |

1,959 |

,122 |

Source: Author's calculation in SPSS 26

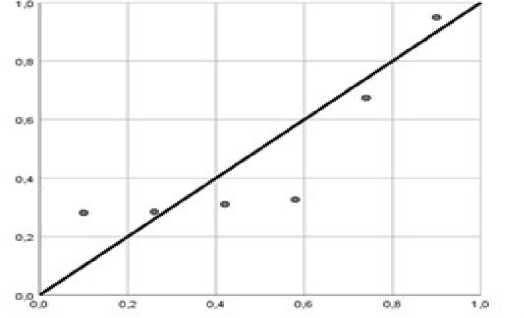

Chart 1. Scatter diagram

Source: Author's calculation in SPSS 26

From the scatter plot, we can see that there is a direct linear relationship between market size and Japan's investment in the OI organization.

Discussion

Based on the presented research results, correlational and regression analysis showed a positive correlation between the residuals. There is also a direct linear relationship between the Japanese market and investment in the OI organization. The resulting regression equation is Y= 4897.312 + 11.561X. The coefficient of determination is 49%, which shows that variations in market size are determined by variations in investment in OI organization with 49%. This can be explained by the fact that the Japanese market depends on many other factors, but that the OI also influenced them to a lesser extent. According to the World Bank's assessment, from the table of expected market growth and actual growth, we see that the COVID-19 pandemic slowed down growth, that is, it stopped it completely in 2020. In the year of the OI, the growth continued, and the Olympics, which did take place, contributed to this. Japan invested about 20 billion dollars for the additional organization itself, which started the economy and the country that was stopped by the pandemic. However, the country was left without the expected profit from fans and tourists. Many newly built restaurants and hotels are closed, so the Government of Japan has financially helped them in the hope that they will attract tourists in the postpandemic years. Based on the analysis, the negative impact of Covid-19 on Japan's market operations and the positive impact of OI, especially in the year of its maintenance, regardless of the fact that additional funds were invested, have been proven. Of course, it should be taken into account that market operations depended on other factors as well, not only the pandemic, but the paper established a correlation between the size of the market and the investment of money to host the games. From all this, we can conclude that it is positive for Japan and its economy that they decided to hold the games and that the positive effects will only be felt in the coming years.

Conclusion

The organization of the Olympic Games brings new development opportunities for the host countries. Exploiting existing infrastructure and attracting sponsors almost always brings profits, while building new ones brings losses from which countries recover for decades. The only exception is the games in Tokyo, which were organized under the conditions of the pandemic and ended with a huge loss. 68 billion dollars were invested in them, and the positive effect on the Japanese economy is 27 billion dollars. The paper confirmed the hypothesis that the OI had a positive impact on the Japanese market, thus reducing the impact of the pandemic on the economy. Also, the negative impact of the pandemic has been proven, especially its postponement in the year when the country entered recession. The contribution of this work is reflected in the fact that it proves that OI still have a positive effect on the economy of countries, in addition to global problems, i.e. the pandemic, which stops market movements. Many countries entered the candidacy for organizing the games after Tokyo with a degree of caution, so Australia applied for Brisbane in 2032 with the condition that all investments be entirely from sponsorship and private capital. A huge number of countries gave up the candidacy of their cities in fear of recession in the post-pandemic years. The candidacy process itself, which is highly likely to be unsuccessful, costs over 50 million dollars for which countries currently do not find economic justification. In the coming years, it is expected that there will be less interest in organizing games, even though they bring positive effects if certain economic rules are followed in organizing them. Tokyo, that is, Japan, expects from the built infrastructure more positive effects on its market in the coming years, hoping to reduce the loss of 41 billion dollars. Certainly, in the coming years, it will be interesting to observe the effects of this most specific Olympics ever.

Conflicts of inerests

The authors declare no conflict of interest

Список литературы The influence of Covid-19 and the olimpic games on the market business of Japan

- Barrero, J M, N Bloom and S J Davis (2020): “COVID-19 Is Also a Reallocation Shock”, NBER Working Paper 27137.

- Furrer, P. (2002): Sustainable Olympic Games: utopia or reality?. Bollettino della Societ`a Geografica Italiana,series XII, volume VII, 4. Translated by Demetrio, V.

- Hotchkiss, J.L., Moore, R.E. and Rios-Avila, F. (2015): Re-evaluation of the employment impact of the 1996 Summer Olympic Games. Southern Economic Journal 81(3): 619–632.

- Hotchkiss, J.L., Moore, R.E. and Zobay, S.M. (2003): Impact of the 1996 Summer Olympic Games onemployment and wages in Georgia. Southern Economic Journal 69(3): 691–704.

- Humphreys, J.M. and Plummer, M.K. (1995): The economic impact on the State of Georgia of hosting the 1996.

- Humphreys, J.M. and Plummer, M.K. (1995): The economic impact on the State of Georgia of hosting the 1996 Olympic Games. Selig Center for Economic Growth, Georgia.

- Jasmand, S. and Maennig, W. (2007): Regional Income and Employment Effects of the 1972 Munich Olympic Summer Games. Regional Studies, 42(7): 991–1002.

- Kolluru, D. M. K. (2021): A study of global recession recovery strategies in highly ranked gdp eu countries economics, 9(1), 85-106. https://doi.org/10.2478/eoik-2021-0011

- Koren, M and R Pető (2020): “Business Disruptions from Social Distancing”, Covid Economics, Vetted and Real-Time Papers 2, CEPR Press. Also VoxEU.org column.

- Lenskyj, H.J. (2000): Inside the Olympic Industry: Power, Politics, and Activism. Albany: State University of New York Press.

- Maliszewska, Maryla; Mattoo, Aaditya; van der Mensbrugghe, Dominique. (2020): The Potential Impact of COVID-19 on BDP and Trade : A Preliminary Assessment. Policy Research Working Paper;No. 9211. World Bank, Washington, DC. © World Bank. (available at: https://openknowledge.worldbank.org/handle/10986/33605). License: CC BY 3.0 IGO.

- Olympic Games. Selig Center for Economic Growth, Georgia.

- Pasquale, L.S. and Pierleoni M.R. (2017): Assessing the Olympic Games: the economic impact and beyond. Journal of Economic surveys 2018. https://doi.org/10.1111/joes.12213

- Policy Responses to COVID-19, IMF, (available at: https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19).

- Preuss, H. (2004): The economics of staging the Olympics: a comparison of the Games, 1972–2008. Cheltenham: Edward Elgar Publishing Ltd.

- Shoval, N. (2012): A new phase in the competition for the Olympic Gold: the London and New York Bids forthe 2012 Games. Journal of Urban Affairs 24(5): 583–599.

- Sterken, E. (2006): Growth impact of major sporting events. European Sport Management Quarterly 6(4):

- Sterken, E. (2006): Growth impact of major sporting events. European Sport Management Quarterly 6(4):375–389.