The Role of Green Islamic Sukuk in Achieving Environmental Sustainability in Indonesia: Reality, Challenges, and Future Prospects

Автор: Kahina H., Lamya B.

Журнал: Science, Education and Innovations in the Context of Modern Problems @imcra

Статья в выпуске: 3 vol.8, 2025 года.

Бесплатный доступ

This research paper aims to highlight the role of green Islamic sukuk in achieving environmental sustainability, with reference to the experience of Indonesia, one of the leading countries in the field of Islamic finance. The study adopts a descriptive-analytical approach by describing and analyzing the key concepts and procedures related to green sukuk in Indonesia. The study found that green sukuk have significantly contributed to financing sustainable projects, helped attract foreign investment, and strengthened Indonesia’s commitment to the Sustainable Development Goals. It also showed that the lack of awareness among financial institutions about environmental risks, in addition to the weak role of the government in supporting environmentally friendly projects, are among the main obstacles hindering the effective implementation of green sukuk in Indonesia. Accordingly, the study recommends developing mechanisms to monitor environmental performance and increasing financial incentives to support this sustainable financing model.

Green sukuk, Indonesia, key projects, obstacles

Короткий адрес: https://sciup.org/16010519

IDR: 16010519 | DOI: 10.56334/sei/8.3.45

Текст научной статьи The Role of Green Islamic Sukuk in Achieving Environmental Sustainability in Indonesia: Reality, Challenges, and Future Prospects

Given that most countries—especially developing ones—suffer from environmental disasters and risks, it has become necessary to shift toward environmentally friendly projects and green financing. This involves finding alternatives and financial instruments that align primarily with sustainable and environmentally conscious development.

With the emergence of what is known as green sukuk, there has been growing interest in them since their issuance by the World Bank in 2008. These sukuk represent a modern financial tool that funds climate- and nature-related projects and have attracted significant investor interest due to their compatibility with the objectives of Islamic law. Several countries have successfully adopted them, including Indonesia, which has emerged as a leading nation in this field. This marks a significant transformation in sustainable finance. This innovative approach aims to combine the principles of Islamic finance with environmental goals, offering a means to finance green projects while remaining committed to Islamic values.

Indonesia has witnessed the issuance of numerous green sukuk, with their proceeds allocated to a wide range of sustainable projects. These include renewable energy initiatives such as solar and wind power, energy efficiency improvements in buildings and infrastructure, sustainable transportation projects, and enhanced waste management initiatives. This influx of financing has significantly contributed to promoting sustainable development in Indonesia.

Looking ahead, green sukuk in Indonesia hold great potential for continued growth and impact. With rising environmental awareness and increasing demand for sustainable investments, the green sukuk market is expected to expand further. Moreover, the government can play a crucial role in supporting this growth by offering incentives, developing regulatory frameworks, and strengthening collaboration among various stakeholders.

Based on the above, the following research question can be formulated: What is the current state and future outlook of Indonesia’s experience in adopting the issuance of green Islamic sukuk amid the growing interest in green Islamic technology?

This study aims to explore the concept of green Islamic sukuk, the motivations behind the increasing interest in them, and their key advantages, with a focus on their role in achieving environmental sustainability across various countries. In addition, it analyzes Indonesia’s experience in adopting this type of sukuk, as it is considered one of the leading countries in the field of Islamic finance. To achieve these objectives, the study relies on the descriptive approach to review the theoretical literature related to the study’s concepts, along with the analytical method to examine the reality and global development of green Islamic sukuk, with particular emphasis on the Indonesian model.

-

1- The Conceptual Framework of Green Islamic Sukuk and Environmental Sustainability

This section will address the concept of green Islamic sukuk, the motivations behind the growing interest in them, and their advantages.

The Concept of Green Islamic Sukuk: Before delving into the concept of green Islamic sukuk, it is essential to first address the concept of green bonds:

The idea of green sukuk first emerged in France in 2012, and since then, it has attracted the attention of many stakeholders in the field of finance. The Islamic Development Bank has contributed significant funding—amounting to around one billion US dollars—to clean energy sectors in various countries, including Morocco, Pakistan, Egypt, Tunisia, and Syria. Malaysia also witnessed a similar issuance for the first time at the beginning of 2013, as part of a broader package of Islamic sukuk amounting to 1.5 billion dollars.

Green sukuk are relatively modern financial instruments that have gained increasing attention in recent years, as they are specifically directed towards supporting projects related to climate or the environment. This targeted use of funds raised to support the financing of specific projects distinguishes green sukuk from traditional sukuk. Therefore, in addition to assessing the standard financial characteristics (such as maturity, profit value, price, and credit rating of the sukuk issuer), investors also evaluate the environmental objectives of the projects that the sukuk aims to support.(Amaal et al., 2020, p. 393)

Therefore, based on the above, green bonds can be defined as bonds issued to finance projects that enhance environmental benefits and sustainability, by attracting investors interested in the environment and helping to fund green projects, etc.

Islamic green sukuk are defined as investments that comply with Islamic Sharia principles in the field of renewable energy and other environmental assets. Their proceeds are used to preserve the environment and natural resources, as well as to maintain energy usage, promote renewable technologies, and reduce global warming and gas emissions.(Touami, 2018, pp. 194-195)

Based on the above, Islamic green sukuk can be defined as financial instruments that comply with Islamic Sharia principles. They are issued in the same way as traditional Islamic sukuk, but they are used to finance environmentally friendly projects, such as renewable energy projects and energy efficiency, with a focus on sustainability and environmental responsibility.

Motivations for Interest in Islamic Green Sukuk: The motivations for interest in Islamic green sukuk are varied, with the most prominent being the increasing number of investors interested in investments that consider environmental aspects and contribute to achieving sustainable development. This is alongside the rapid growth of Islamic sukuk in global financial markets, making them a promising tool for financing environmentally oriented projects. Additionally, the reluctance of traditional banks to finance infrastructure projects due to strict capital-related restrictions and requirements is another factor driving the search for effective financing alternatives, such as Islamic green sukuk.(Touami, 2018, pp. 194-195)

Advantages of Islamic Green Sukuk: The main advantages of Islamic green sukuk are as follows:

^ Contributing to the growth and expansion of the Islamic finance market, helping to bridge the gap between the worlds of conventional and Islamic finance;

/ Utilizing the proceeds it generates in a manner aligned with risks, thus appropriately attracting traditional investors;

^ Green sukuk help fill the gap in providing fixed income for investors in environmental activities;

/ Islamic sukuk offer investors a high degree of confidence that their funds will be used for a specific purpose, in compliance with Islamic Sharia principles;

The Relationship Between Green Islamic Finance (Green Islamic Sukuk) and Sustainable Development

The foundation of green finance lies in the innovation of new, sustainable financial instruments and finding solutions to financing problems, which can help address the challenges that hinder and prevent the achievement of sustainable development. Green finance aims to achieve economic growth and development while considering the social aspect, such as achieving social welfare, and the environmental aspect, such as preserving ecological resources and protecting the environment. Therefore, green finance is considered a means to reach sustainable development in the best ways and mechanisms. The contribution of green finance to achieving sustainable development is clearly demonstrated through:(Mersli, 202, p. 57)

^ Economic Element: Green finance aims to maximize income, eliminate poverty, and optimize the use of natural resources.

^ Social Element: Green finance seeks to promote community welfare and achieve social justice by improving basic health and educational services, meeting the minimum security standards, and respecting human rights, as well as fostering the development of different cultures.

^ Environmental Element: Green finance aims to achieve environmentally sustainable development by preserving and enhancing material and biological resources and ecosystems.

-

2- Indonesia's Experience in Issuing Islamic Green Sukuk

After exploring Islamic green sukuk, their advantages, motivations for interest, and their role in environmental sustainability, this section will focus on Indonesia's experience in issuing them.

2-1 The Evolution of Green Bonds Worldwide

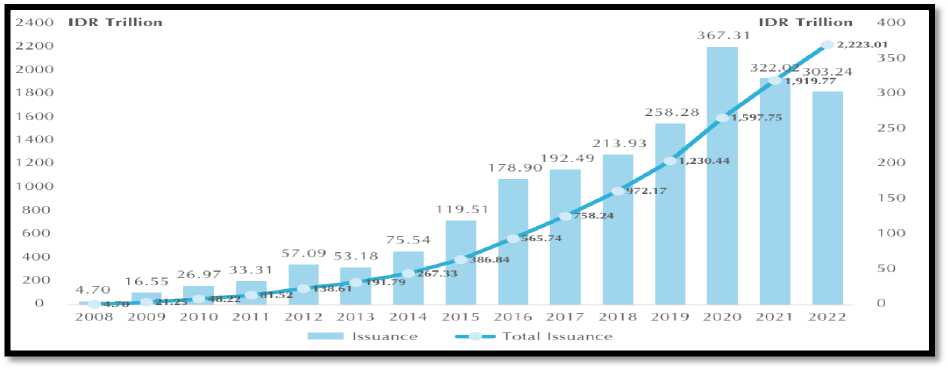

The World Bank issued the first green bond in 2008, and the World Bank and the International Finance Corporation are the largest issuers of green bonds. They mobilize the necessary funds to finance climate projects from a wide and diverse range of investors. The following figure illustrates the evolution of green bonds and sukuk worldwide:

11Ш

-

■ Year ■ Green Products ■ Mixed ■ Classified Sustainable Mixed

-

Figure 1. Volume of Green Bond and Sukuk Issuances Worldwide

Source: World Bank Blogs, available at the link:

Green bonds have witnessed significant growth, rising from $270 billion in 2020 to $700 billion in 2024. This growth is attributed to the increasing global interest in sustainable finance. In contrast, sukuk experienced modest growth, rising from $140 billion to $186 billion during the same period. This can be attributed to the need for more legislation and standardized criteria to promote their global spread. Sustainable sukuk ratings also saw a notable increase, from $4.5 billion to $15.2 billion, reflecting the growing trend towards alignment with environmental sustainability and governance standards.

-

2- The Evolution of Sukuk in Indonesia

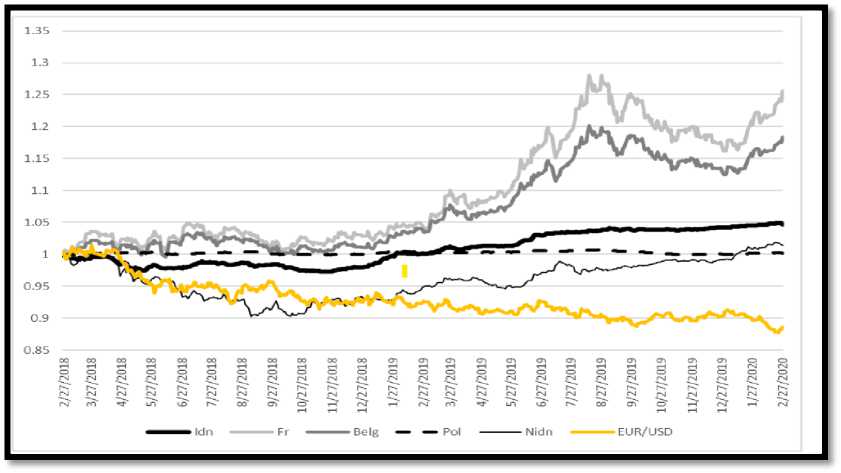

Sukuk were first issued in Indonesia by the Indonesian Satellite Company (Indosat) in September 2002, valued at 175 billion rupiahs. This was followed by other large companies, and by the end of 2008, the total value of private sukuk issuances reached approximately 4.76 trillion rupiahs. The primary structure of the sukuk issued during the period (2002-2004) relied on a Mudarabah contract valued at 740 billion rupiahs (88%), while the Ijarah contract was valued at 100 billion rupiahs (12%). By 2011, the value of the Ijarah contract had increased to 194 trillion

rupiahs (92%), while the value of the Mudarabah contract was 200 billion rupiahs (8%).(Lina Nugraha et al., 2022, pp. 43-56)

Since the enactment of Law No. 19 of 2008 concerning Sharia-compliant sovereign securities, Indonesia has experienced a significant surge in sukuk issuances, with a total value of 2,223.01 trillion rupiahs. The mechanisms for issuing these sukuk have varied, including auctions, order book registration, and private placements, making Sukuk Negara (sovereign sukuk) a key pillar in financing the country's state budget. They have also contributed to the growth of the Islamic finance sector in the country over the past fourteen years.

This expansion has not been limited to sukuk issuance alone, but has been accompanied by a notable development in the infrastructure supporting this sector. The legal framework for issuance has been strengthened, and the structures of sukuk and their underlying assets have been improved, in addition to diversifying issuance methods and types of financial instruments. The Indonesian market has also expanded both locally and internationally, which has helped attract a large group of investors and solidified Indonesia's position as a leading global player in Islamic finance.

Figure 2. Evolution of the Total Sukuk Negara Issuances During the Period (2008-2022) Source : IIFM, (2023), Sukuk report, P 174,

The figure shows the accelerated growth of annual issuances, which increased from 4.70 trillion rupiahs in 2008 to over 300 trillion rupiahs in 2022, with significant jumps in certain years such as 2015, 2020, and 2021. The blue curve indicates an upward trend in total issuances, reaching 2,223.01 trillion rupiahs in 2022, reflecting the growing reliance on sukuk as a primary financing tool. This growth can be attributed to increased investor confidence and the Indonesian government's reliance on Islamic finance to support the budget, especially during economic crises such as the COVID-19 pandemic.

Table 1. Types of Sukuk

|

Type (in English) |

Type (in Arabic) |

Sukuk Percentage (%) |

|

PBS |

Project Support Sukuk |

The largest percentage |

|

SNI |

National Sukuk for Individuals |

15.984% |

|

SR |

Retail Sukuk |

13.171% |

|

SPNS |

Short-Term Government Sukuk |

11.667% |

|

SDHI |

Government Sukuk for Institutions |

2.796% |

|

ST |

Savings Sukuk and Green Sukuk |

1.671% |

|

IFR |

Fixed-Return Islamic Sukuk |

0.771% |

|

FRS |

Fixed-Return Sukuk |

0.746% |

|

PNSNT |

Non-Traded Government Sukuk |

0.343% |

|

PBSG |

Guaranteed Government Sukuk |

0.303% |

|

PBSNT |

Non-Guaranteed Government Sukuk |

0.292% |

|

SDPBS |

Long-Term Government Sukuk |

0.247% |

|

SW |

Endowment Sukuk |

0.014% |

|

SWR |

Renewable Endowment Sukuk |

0.003% |

Source : IIFM, (2023), Sukuk report, P 175,

The table clearly shows the diversity of Negara Sukuk issuances in Indonesia, with Project Support Sukuk (PBS) leading the way, being the most widespread by a large margin compared to other types, indicating the government's reliance on it as a primary source of funding. National Sukuk for Individuals (SNI) and Retail Sukuk (SR) come in second and third places, at 15.98% and 13.17%, respectively, reflecting the focus on involving individual investors in the Sukuk market.

Short-Term Government Sukuk (SPNS - 11.667%) stands out as an important financial tool for managing short-term liquidity. In contrast, Sukuk with lower percentages, such as Endowment Sukuk (SW and SWR), are still very limited in the market, which may reflect either a lack of demand or the recent introduction of these instruments. As part of the government's efforts to combat climate change, "Sukuk Negara" launched green Sukuk issuances in both international and domestic markets, making Indonesia a global leader, having won seven international awards specifically for green Sukuk, along with forty-four other awards for sovereign Sukuk.

2-3- Development of Green Sukuk in Indonesia

The first sovereign green sukuk issuance in U.S. dollars was announced in March 2018, valued at $1.25 billion, either in Sukuk form or traditional format. Additionally, the Indonesian government issued its second global green sukuk in February 2019 as a demonstration of its commitment to the Paris Agreement, further strengthening Indonesia's contribution to financing global climate change mitigation efforts. Furthermore, the first-ever retail green sukuk was launched in November 2019.(Musari, 2022, pp. 133–144)

Figure 3. The performance of green bonds at the beginning of their issuance history.

Source : Siswantoro, Dodik, and Henry V. Surya. 2021. “Indonesian Green Sukuk (Islamic Bond) of Climate Change: A Revisited Analysis.” IOP Conference Series: Earth and Environmental Science 716(1), P 3.

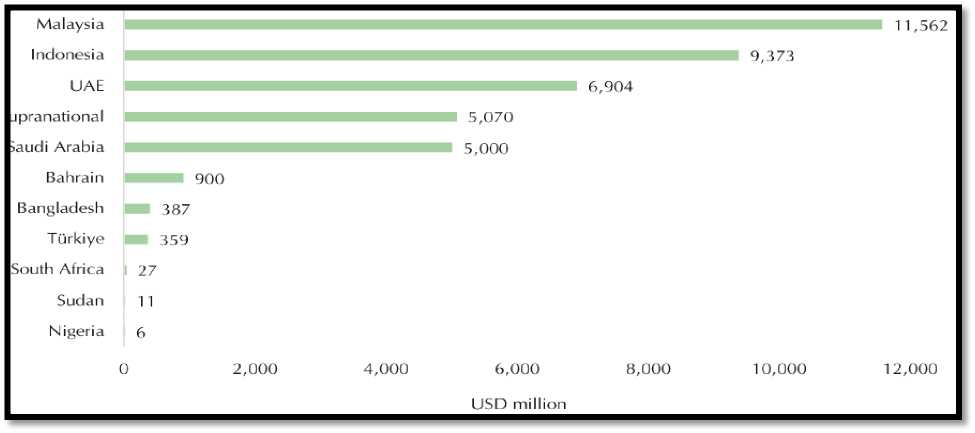

Figure 4. Total issuances of green and sustainable bonds during the period 2017 - 2023.

Source : IIFM SUKUK REPORT, 2024, 13th edition, P 132.

The graph clearly shows the unequal distribution of bond issuances globally, with Malaysia leading the list with a total of 11,562 million USD, reflecting its pioneering role in Islamic finance thanks to its advanced regulatory environment. It is followed by Indonesia with 9,373 million USD, driven by the growing demand for sukuk as a financing tool for development projects, especially green sukuk. The United Arab Emirates recorded 6,904 million USD, reflecting the expansion of its sukuk market thanks to Islamic finance initiatives in Dubai and Abu Dhabi. Saudi Arabia (5,000 million USD) also saw strong activity, indicating a growing global interest in sukuk as a sustainable financing tool. As for African markets such as South Africa, Sudan, and Nigeria, they are still in their early stages with modest issuances, despite having significant potential for the growth of Islamic finance.

-

2 -4. Basic Requirements for Issuing Green Sukuk in Indonesia and Their Types

The Ministry of Finance has outlined a set of basic requirements for issuing green sukuk, which include the following:(Aousghar, 2021, pp. 10-30)

-

^ Establishment of a framework for green bonds and green sukuk;

-

^ Compliance with Islamic Sharia principles;

-

^ A legal basis that ensures transparency, accountability, and investor protection;

-

^ Ministry of Finance regulations: technical guidelines for issuing sukuk.

Indonesia issues three distinct types of green sukuk, including global sukuk, retail sukuk, and project-supporting green sukuk. Global green sukuk is specifically issued for international

investors, while retail sukuk is aimed at domestic Indonesian investors. Project-supporting green sukuk is issued for private investors and institutions to finance specific projects carefully selected.

In 2022, Indonesia launched the fifth issuance of green sukuk, with the total accumulated value of green sukuk issuances during the period (2018-2022) reaching approximately 6.9 billion USD. This included 5 billion USD from global green sukuk, 1.495 billion USD from retail sukuk, and 450 million USD from project-supporting green sukuk. This effort strengthens Indonesia's commitment to the 2015 Paris Agreement, as well as its pursuit of national development goals.

-

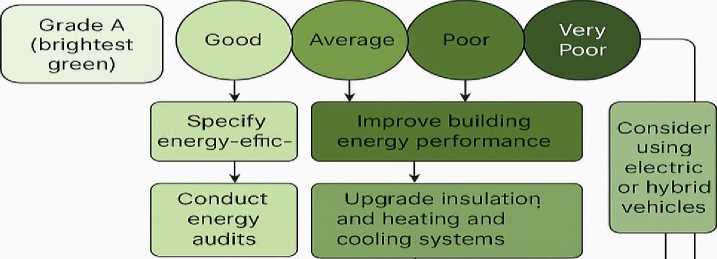

2 -5 Sectors Benefiting from Green Sukuk and Key Projects Implemented in Indonesia

According to the Green Sukuk Framework of the Republic of Indonesia, the Ministry of Finance, in collaboration with the United Nations Development Programme (UNDP, 2018), clarified in its reports for the years 2019, 2020, and 2021 that the Indonesian government has incorporated climate change issues into its planning and budgeting systems. The general framework outlines nine eligible green sectors: renewable energy, sustainable natural resource management, energy efficiency, ecotourism, climate adaptation for highly vulnerable areas and industries, disaster risk reduction, environmentally friendly buildings, sustainable transportation, sustainable agriculture, and waste-to-energy conversion and waste management.

Figure 5. Sectors Benefiting from Green Sukuk Financing in Indonesia

According to the Indonesian Ministry of Finance's 2023 report titled "Allocation of Green Sukuk and Its Impact," Indonesia has emerged as a leader in sustainable finance, achieving a significant milestone in 2022 by issuing the largest share of green sukuk globally, valued at 1.5 billion USD. Investors from various regions participated in this issuance, with Asia (excluding Indonesia and Malaysia) contributing 34%, Europe 27%, the United States 25%, the Middle East and Malaysia 8%, and Indonesia itself 6%. At the same time, Indonesia launched project-based green sukuk worth 73 trillion Indonesian rupiahs, attracting diverse investments from insurance companies (23.9%), banks (22%), Bank Indonesia (10.9%), pension funds (14.9%), mutual funds (2.67%), private investors (0.09%), foreign investors (1.92%), and other categories (23.41%).

Major Projects Completed in Indonesia Based on Green Islamic Sukuk

Indonesia has completed numerous projects based on green sukuk that contribute to mitigating climate change. Below is a summary of the most important of these projects:

-

❖ Development of New Renewable Energy Infrastructure and Enhancing Consumption Efficiency

Given the significant impact of the energy sector on total emissions in Indonesia, the government seeks to strike a balance between expanding electricity supply to isolated areas and meeting its climate commitments under the Paris Agreement. In line with this direction, the government has set an ambitious goal to increase the share of electricity generation from renewable sources to 23% by 2025.

To achieve this goal, a comprehensive project was implemented during the period (20172019), focusing on the establishment of modern renewable energy infrastructure, particularly in areas outside the coverage of the national electricity grid. This project aims to increase electricity supply rates in isolated areas, contributing to stimulating economic growth and ensuring the equitable distribution of economic opportunities.

In 2017, the project included the construction of solar power stations, diesel-powered electricity stations, small hydropower stations, and wind energy facilities, along with biogas production stations and street lighting systems using photovoltaic cells, across 17 different provinces. In 2019, the project expanded to include all provinces, with a focus on rehabilitating and maintaining existing renewable energy infrastructure.

These initiatives helped provide electricity to 15,067 new households by 2017, with a production of 7,429 kW of electrical energy. This led to a reduction in reliance on diesel generators in off-grid areas, thereby improving electricity coverage rates while minimizing harmful environmental emissions.

-

❖ Establishment of Flood Control Facilities: The National Climate Change Adaptation

Plan highlights the increasing exposure to extreme weather events as one of the major challenges facing Indonesia. With the expected rise in daily rainfall by up to 2.5 mm between 2020 and 2035, the risk of flooding is increasing in many areas.

Based on this, flood control was considered one of the key strategies within the National Adaptation Plan. However, the existing infrastructure for flood control requires comprehensive development to ensure its effectiveness in confronting extreme climate events.

In this context, a project was launched in 2019 aimed at enhancing the capacity of communities most vulnerable to flood risks, with the goal of protecting 200,000 hectares of land from the impacts of increasing floods. The project focuses on implementing several key measures, including:

-

^ Construction and upgrading of dams;

-

^ Creation of rainwater storage basins;

-

^ Building flood channels and small dams;

-

^ Maintenance of existing infrastructure;

-

^ Enhancing natural features such as rivers and slopes.

This project represents a crucial step toward strengthening climate response, reducing flood damage, and protecting infrastructure from climate change-related risks.

-

❖ Development and Management of Railway Infrastructure and Supporting Facilities

– Expansion of the Greater Jakarta Urban Train System:

The development of railway infrastructure is one of the main activities implemented by the government to mitigate the effects of climate change, as outlined in the National Action Plan for

Greenhouse Gas Emission Reduction (RAN-GRK). In a densely populated urban area like Greater Jakarta, the share of public transportation usage was no more than 27% in 2017, making the development of mass transit systems a key policy to support the national plan’s objectives.

The Greater Jakarta Urban Train is considered one of the main solutions to achieve this goal. It operates entirely on electricity and provides mass transit services for passengers in Jakarta, Depok, Bogor, Tangerang, and Bekasi. As of June 2018, the average number of daily passengers on weekdays reached 1,001,438, with a record of 1,154,080 passengers in a single day.

The train infrastructure is managed by Kereta Commuter Indonesia (KCI), serving 79 stations across Greater Jakarta, as well as Banten and Cikarang. The network spans 418.5 kilometers. By June 2018, the company owned 900 train cars, and with growing demand for public transport, 60 new train cars were added in 2017.

Additionally, 9.6 kilometers of double-track electrified railway were constructed and expanded within the Jabodetabek railway network, including the Manggarai–Cikarang and Maja– Rangkasbitung sections. The development of these double-track railway lines has increased the transport capacity of trains, thereby encouraging a shift from private vehicle use to public transportation. This contributes to reducing traffic congestion and carbon emissions.

2-6. The Impact of the COVID-19 Pandemic on Green Sukuk

Despite the deep economic repercussions caused by the COVID-19 pandemic, green sukuk in Indonesia proved to be resilient. Their intrinsic value was not affected by the crisis; rather, the impact was limited to the issuance process, which experienced some delays due to the government's focus on addressing the health and social crisis.

On June 18, 2020, the Indonesian government reissued global sukuk with a nominal value of 2.5 billion USD (equivalent to 35 trillion Indonesian rupiah at an exchange rate of 14,000 rupiah per dollar). According to the Directorate General of Budget Financing and Risk Management (DJPPPR) at the Ministry of Finance, the sukuk were issued as follows:

-

^ Five-year sukuk worth 750 million USD;

-

^ Ten-year sukuk worth 1 billion USD;

-

^ Thirty-year sukuk worth 750 million USD.

This issuance was met with strong global demand, with subscription requests exceeding the target by 6.7 times — a clear indication of international investors’ confidence in the strength of the Indonesian economy and its commitment to the principles of sustainable Islamic finance.

2-7.Potential and Challenges of Green Islamic Sukuk in Indonesia Potential of Green Islamic Sukuk in Indonesia: Green sukuk are among the Islamic financial instruments that have recently attracted the attention of the Indonesian government, as they offer broad potential within traditional markets and the

Islamic financial sector, presenting an opportunity to enhance the influence of Islamic finance in financial markets. Compared to the development of bonds in the conventional system, green sukuk demonstrate greater potential for market expansion and can serve as a bridge between conventional and Islamic finance. Among the key potentials of green sukuk are:(Suwanan, 2021)

-

/ Indonesia plans to issue sovereign sukuk worth 419 trillion rupiahs by 2029;

-

^ The volume of green bonds is expected to increase by USD 339.38 billion by 2029;

-

^ Investment demand for green sukuk is rising annually;

-

^ The number of domestic investors reached approximately 271,179 in 2018.

Challenges Facing the Issuance of Green Islamic Sukuk in Indonesia: Green sukuk have attracted the interest of many investors in Indonesia due to their Sharia-compliant nature; however, they face several challenges. According to the Financial Services Authority (OJK), there are a number of obstacles hindering the development of these sukuk, which impact the environmental sector. The most notable among these are:(Suwanan, 2021)

-

^ Weak capacity of financial institutions to assess environmental risks, due to limited

regulatory authority;

-

^ Limited awareness among financial institutions about environmental risks, along

with the government's insufficient role in supporting environmentally friendly projects;

-

^ Mismatch in repayment periods, as environmental projects typically require long

term investments;

-

^ Lack of information about sustainable and environmental projects;

-

^ Limited support from banks in financing environmental initiatives.

Conclusion:

Indonesia is one of the largest Islamic financial markets in the world, making it a fertile environment for the implementation of green Islamic sukuk—a financial instrument that actively contributes to stimulating sustainable economic growth. These sukuk have recently seen widespread adoption due to their dual nature: their proceeds are allocated to addressing climate change while simultaneously complying with Islamic Sharia principles, making them attractive to a wide range of investors. This alignment has helped expand the investor base, facilitate access to financial services, and raise public awareness about the importance of directing investments toward environmental projects.

The study concluded with a number of key findings that highlight the effectiveness of this financing tool. First, green Islamic sukuk are among the latest innovations in Islamic finance, representing a promising option for achieving the environmental dimension of sustainable development. Their issuance in Indonesia has focused on vital projects such as renewable energy, improving energy efficiency, and clean transportation—areas with a direct environmental impact.

These sukuk offer a high level of investor confidence, owing to their adherence to Sharia principles and transparency in allocating funds to clear and specific projects.

Additionally, green Islamic sukuk provide stable financing that helps reduce the likelihood of financial crises and offer an attractive opportunity for a segment of investors seeking halal earnings, whether as sukuk holders or project owners. Notably, these sukuk have demonstrated resilience during crises; despite the negative impacts of the COVID-19 pandemic, green sukuk in Indonesia maintained their core value, with the crisis affecting only issuance timelines.

However, the experience has not been without challenges, as there remains a need to develop a clearer legal and regulatory framework, along with the adoption of standardized criteria for classifying green projects. This would ensure compliance with international standards and optimize the benefits of this financial instrument. Moreover, transparency in the allocation of proceeds and disclosure of the environmental impact of funded projects are fundamental factors for the success of green sukuk, as they enhance investor confidence and ensure the achievement of environmental goals. Overall, Indonesia’s experience in issuing green Islamic sukuk represents a successful model that other Islamic countries can emulate, particularly those seeking to finance their environmental projects in a manner consistent with Sharia principles and supportive of sustainable development.

The study concluded with a set of recommendations aimed at enhancing the effectiveness of green Islamic sukuk and expanding their use. The most prominent of these recommendations was the need to establish a clear legal and regulatory framework to support the issuance of such sukuk, thereby strengthening investor confidence. It also emphasized the importance of developing unified Sharia and financial standards at the international level to facilitate issuance and trading processes. Additionally, the study recommended improving financial and environmental disclosure by issuing entities in Indonesia to ensure transparency and accountability, while also stressing the need to raise awareness about the role of green sukuk and promote them as an effective tool for financing environmental projects. The recommendations also called for broadening the scope of sukuk proceeds to include sectors beyond renewable energy, and advocated for the integration of Islamic sukuk into Algeria’s government financing structure through the adoption of legislation to regulate issuance and trading. Moreover, the study highlighted the need to encourage the private sector to use green Islamic sukuk as a means to transition toward a green economy, and to promote innovation in Islamic finance by developing green financial engineering and sustainable waqf sukuk, thereby contributing to the achievement of sustainable development goals.