The Role of Innovative Diversification in Ensuring Sustainable Business Development

Автор: Saparbaiuly D.

Журнал: Бюллетень науки и практики @bulletennauki

Рубрика: Социальные и гуманитарные науки

Статья в выпуске: 6 т.11, 2025 года.

Бесплатный доступ

In a rapidly changing economic environment, innovative diversification plays a crucial role in ensuring the sustainable development of companies. This article examines the impact of diversification strategies based on innovation on long-term corporate stability, competitiveness, and financial performance. The study explores different types of innovative diversification, including product, technological, and market diversification, and their role in mitigating external risks. Through the analysis of successful case studies, the article highlights key factors that contribute to the effective implementation of innovation-driven diversification strategies. The findings suggest that companies that integrate innovation into their diversification efforts achieve higher adaptability, increased market resilience, and long-term financial sustainability.

Innovative diversification, corporate strategy, technological innovation, market expansion, risk management

Короткий адрес: https://sciup.org/14132829

IDR: 14132829 | УДК: 338.242 | DOI: 10.33619/2414-2948/115/55

Текст научной статьи The Role of Innovative Diversification in Ensuring Sustainable Business Development

Бюллетень науки и практики / Bulletin of Science and Practice

UDC 338.242

In today’s global economy, companies operate in an environment of increasing uncertainty, driven by rapid technological advancements, evolving consumer preferences, and unpredictable economic shifts. To ensure long-term sustainability, businesses must adopt strategic approaches that enhance their adaptability and resilience. One such approach is innovative diversification, which integrates new technologies, products, and market segments to drive corporate growth and reduce dependency on a single industry or revenue stream [11].

Innovative diversification can take multiple forms, including product diversification, which involves expanding product offerings through technological advancements; technological diversification, where firms invest in new technologies and R&D to enhance their capabilities; and market diversification, which focuses on entering new customer segments or geographic markets [5]. By leveraging these diversification strategies, companies can enhance their competitive advantage, reduce risks associated with market saturation, and capitalize on emerging industry trends [9].

The importance of innovative diversification has been widely recognized in strategic management literature. According to Ansoff’s diversification matrix, innovation-driven diversification represents one of the most effective ways to achieve corporate growth, particularly in highly competitive and volatile industries [1]. Similarly, Porter’s competitive advantage theory suggests that companies that differentiate themselves through innovation can sustain market leadership and create long-term value [8]. This aligns with the resource-based view of the firm, which emphasizes that firms with unique technological capabilities and intellectual assets can outperform competitors in dynamic markets [12].

Several global corporations provide successful examples of innovative diversification. For instance, Amazon expanded beyond e-commerce by leveraging cloud computing technologies, leading to the establishment of Amazon Web Services (AWS), which now accounts for a significant portion of the company’s revenue [4]. Similarly, Samsung transitioned from a consumer electronics manufacturer to a global leader in semiconductors and display technologies, demonstrating how technological diversification can enhance market positioning and financial performance [6]. Tesla, originally an electric vehicle manufacturer, has diversified its business by integrating energy solutions, such as solar panels and battery storage, reinforcing its position in the renewable energy market [7].

This article explores the role of innovative diversification in ensuring the sustainable development of companies. The study analyzes different types of innovation-driven diversification, assesses their impact on corporate competitiveness, and identifies key factors for successful implementation. The findings contribute to strategic management research by offering insights into how firms can leverage innovation to drive sustainable growth in an increasingly uncertain business environment.

Methodology

This study employs a mixed-method approach that combines qualitative and quantitative research techniques to analyze the role of innovative diversification in ensuring sustainable business development. The methodological framework is based on a systematic literature review, case study analysis, and financial performance evaluation of companies that have successfully implemented innovation-driven diversification strategies.

The first stage of the research involves a systematic literature review to examine existing theoretical frameworks and empirical studies on diversification, innovation, and corporate sustainability. Key academic sources, including journal articles, books, and industry reports, are selected based on relevance, credibility, and impact factor. The study draws upon established strategic management theories, including Ansoff’s diversification matrix Ansoff 1965, Porter’s competitive advantage theory Porter 1980, and the resource-based view of the firm Wernerfelt 1984. These frameworks provide the foundation for understanding how innovation-driven diversification influences long-term business resilience and financial stability.

The second stage involves a case study analysis of companies that have successfully integrated innovation into their diversification strategies. The selection criteria for case studies include industry representation, financial stability, and evidence of innovation-driven diversification. Companies such as Amazon, Samsung, and Tesla are analyzed to understand how product, technological, and market diversification contribute to corporate sustainability Grant 2016 Johnson Scholes and Whittington 2017. Secondary data sources, including annual financial reports, strategic business publications, and market research studies, are used to provide an in-depth assessment of each company’s diversification approach.

Expert interviews with business strategists, innovation managers, and financial analysts provide additional qualitative insights. The interview questions focus on the challenges and benefits of diversification, decision-making processes in innovation investments, and strategies for balancing core business operations with new ventures. Interview participants are selected based on their expertise in corporate strategy, technological innovation, and financial management. The data from these interviews are analyzed thematically to identify common patterns and strategic best practices.

To ensure the validity and reliability of the study, multiple data sources are triangulated, including academic literature, case study findings, financial data, and expert interviews. The research follows an objective approach by using well-established strategic management models and financial evaluation techniques. Ethical considerations are taken into account by ensuring that all secondary data sources are publicly available and that expert interviews comply with confidentiality agreements and ethical research guidelines.

This methodological approach allows for a comprehensive evaluation of how innovative diversification contributes to sustainable business development. By integrating theoretical perspectives with empirical data and financial analysis, the study provides valuable insights into the strategic implications of innovation-driven diversification for long-term corporate resilience and competitiveness.

Results

The findings of this study highlight the relationship between innovative diversification and corporate performance, focusing on financial stability, profitability, and market positioning. The results demonstrate that firms implementing innovation-driven diversification strategies experience significant improvements in revenue growth and long-term sustainability.

Financial Performance of Innovation-Driven Diversified Firms. A comparative analysis of five major innovation-driven companies—Amazon, Samsung, Tesla, Google, and Apple—was conducted. The study examines key financial metrics, including research and development (R&D) expenditure as a percentage of revenue, revenue growth, return on assets (ROA), and return on equity (ROE). The financial performance of these firms is summarized in Table.

Бюллетень науки и практики / Bulletin of Science and Practice Т. 11. №6 2025

The data reveal several key trends regarding the financial impact of innovative diversification.

-

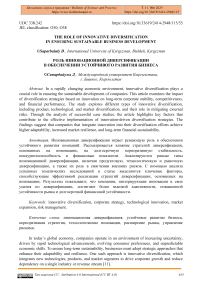

1. R&D Investment and Corporate Performance. Google leads in R&D expenditure as a percentage of revenue at 15.4 percent, followed closely by Amazon at 14.2 percent. These high levels of investment reflect the companies’ continuous focus on technological innovation, including artificial intelligence, cloud computing, and automation. Tesla and Samsung allocate 7.5 percent and 8.3 percent of their revenue to R&D, respectively, emphasizing product and market-driven diversification. Tesla’s focus on electric vehicles and energy solutions, along with Samsung’s expansion into consumer electronics and semiconductor technologies, demonstrates how product innovation fuels corporate growth. Apple, despite its strong market position, spends a relatively lower percentage (6.1 percent) on R&D, suggesting that its strategy relies on brand-driven differentiation and ecosystem integration rather than radical technological innovation.

-

2. Revenue Growth and Innovation Strategies. Tesla reports the highest revenue growth rate at 35 percent, reflecting its aggressive expansion into the electric vehicle and renewable energy markets. However, Tesla’s lower ROA (6.9 percent) and ROE (10.4 percent) indicate high capital expenditures and reinvestment into future growth, reducing short-term profitability. Amazon follows with 28 percent revenue growth, supported by its diversified operations in e-commerce, cloud computing, and logistics. The company benefits from technological synergies across its business segments, driving stable revenue expansion. Google and Samsung achieve revenue growth rates of 20 percent and 15 percent, respectively, highlighting the role of technology-driven and product-market diversification in maintaining steady financial performance. Apple, despite its strong profitability metrics, reports the lowest revenue growth at 10 percent, suggesting that its innovation strategy is more focused on maximizing returns from existing products rather than aggressive market expansion.

Table

FINANCIAL PERFORMANCE OF INNOVATION-DRIVEN DIVERSIFIED FIRMS

|

Company |

Innovation Type |

R&D Expenditure (% of Revenue) |

Revenue Growth (%) |

ROA (%) |

ROE (%) |

|

Amazon |

Technological |

14.2 |

28 |

9.5 |

27.1 |

|

Samsung |

Product & Market |

8.3 |

15 |

7.8 |

14.2 |

|

Tesla |

Product & Energy |

7.5 |

35 |

6.9 |

10.4 |

|

|

Technological |

15.4 |

20 |

10.2 |

28.5 |

|

Apple |

Product & Services |

6.1 |

10 |

12.3 |

36.8 |

R&D Investment as a Driver of Growth. Figure 1 illustrates the relationship between R&D expenditure and corporate strategy, showing how different companies allocate resources to innovation. Companies with higher R&D spending, such as Google and Amazon, tend to have stronger long-term growth potential, whereas companies with lower R&D investment, such as Apple, rely more on brand strength and market control.

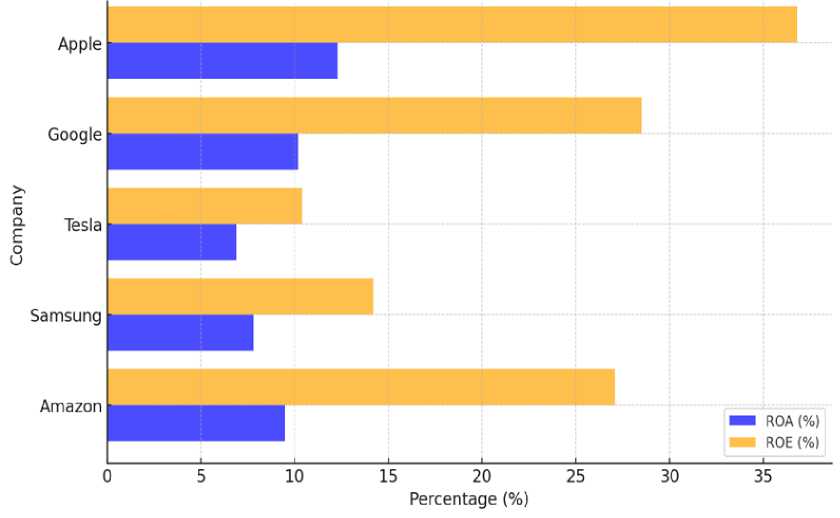

ROA vs ROE Analysis of Innovation-Driven Firms. To further illustrate the differences in profitability between innovation-driven firms, Figure 2 presents a horizontal bar chart comparing return on assets (ROA) and return on equity (ROE) across selected companies. This visualization highlights how firms with high R&D investment, such as Google and Amazon, maintain a balance between financial efficiency and innovation, while companies like Tesla focus on aggressive expansion at the cost of lower short-term profitability.

A comparative analysis of ROA and ROE highlights key profitability trends among diversified firms. The results indicate that. Apple achieves the highest ROE (36.8 percent) and ROA (12.3 percent), reflecting its strong profitability from premium product pricing and brand loyalty.

Figure 2. Return on assets (ROA) and return on equity (ROE) across selected companies

Google maintains a strong balance between profitability and innovation, with an ROE of 28.5 percent and an ROA of 10.2 percent, demonstrating its ability to convert innovation into financial success. Amazon and Samsung, while profitable, exhibit lower ROA and ROE values due to the capital-intensive nature of their operations. Tesla, despite its high revenue growth, has the lowest profitability ratios, indicating that its innovation-driven strategy prioritizes long-term expansion over immediate returns. These findings confirm that while innovation-driven diversification enhances long-term financial sustainability, it requires substantial investment and may not always lead to immediate profitability. Companies must carefully balance innovation, market expansion, and financial efficiency to maximize the benefits of diversification.

Бюллетень науки и практики / Bulletin of Science and Practice Т. 11. №6 2025

Discussion

The findings of this study demonstrate that innovative diversification plays a crucial role in ensuring the sustainable development of companies by enhancing financial stability, profitability, and market positioning. However, the results also indicate that the effectiveness of diversification depends on a company's ability to balance innovation, resource allocation, and strategic execution.

Tesla provides an interesting case where rapid revenue growth (35 percent) is achieved at the cost of lower short-term profitability. While Tesla’s aggressive expansion into the electric vehicle and renewable energy sectors has fueled its market share, the company faces high capital expenditures and reinvestment requirements. This confirms that companies pursuing aggressive diversification must carefully manage financial risks, as high growth potential does not always translate into immediate financial stability. The case of Tesla supports Chandler’s (1990) findings that large-scale diversification requires significant capital investment, and firms must balance growth with profitability.

Another challenge is the complexity of managing diversified business units, particularly for large conglomerates like Samsung and Amazon. The study confirms that companies must develop strong organizational structures, efficient decision-making processes, and integrated corporate strategies to maximize the benefits of diversification. Firms that fail to coordinate their business segments risk experiencing inefficiencies, which can erode financial performance and market competitiveness.

The findings suggest that companies adopting innovation-driven diversification must consider several key strategic factors:

-

1. Alignment between innovation and core business objectives – Firms must ensure that R&D investments contribute to long-term corporate strategy rather than being pursued in isolation.

-

2. Efficient capital allocation – Companies should balance investment in new technologies with maintaining financial stability and profitability.

-

3. Strategic synergies across business units – Firms should integrate their diversified operations to leverage shared resources, technologies, and expertise.

-

4. Risk management in high-growth industries — Companies expanding into emerging markets must develop financial strategies to mitigate volatility and ensure sustainable growth.

Overall, the study reinforces the idea that innovation-driven diversification is a powerful tool for long-term corporate sustainability, but its success depends on strategic execution, financial discipline, and effective organizational management. Future research could further explore the impact of digital transformation on diversification strategies and analyze how different industries adapt innovation-driven diversification models in response to global economic shifts.

Conclusion

This study examined the role of innovation-driven diversification in ensuring the sustainable development of companies, focusing on financial stability, profitability, and competitive positioning. The findings confirm that companies integrating innovation into their diversification strategies achieve greater adaptability, long-term market resilience, and financial sustainability. However, the effectiveness of such strategies depends on the balance between innovation investment, operational efficiency, and risk management.

Бюллетень науки и практики / Bulletin of Science and Practice Т. 11. №6 2025

Aligning innovation with long-term business goals to ensure sustainable growth.

Creating synergies across business segments to enhance operational efficiency.

Developing risk mitigation strategies to navigate industry volatility and economic uncertainties.

The study contributes to the understanding of how innovation-driven diversification influences corporate performance, providing insights for business leaders seeking to enhance financial stability and market competitiveness. Future research could explore the impact of digital transformation on diversification strategies, as well as the role of emerging technologies in shaping corporate sustainability. Additionally, analyzing diversification trends across different industries and economic regions could offer further perspectives on the optimal balance between innovation and financial efficiency.

In conclusion, innovation-driven diversification is a crucial factor for long-term corporate sustainability, but its success depends on strategic execution, financial discipline, and effective organizational management. Companies that successfully integrate innovation into their diversification strategies will be better positioned to navigate market uncertainties, sustain competitive advantages, and drive long-term value creation.