The role of the fuel sector of subarctic regions in the Komi Republic economy

Автор: Buryi Oleg Valeryevich, Kalinina Albina Aleksandrovna, Lukanicheva Vera Pavlovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 5 (29) т.6, 2013 года.

Бесплатный доступ

The article considers the approach towards the improvement of the management of regional development, which is based on determining the character and direction of the influence of a number of factors on regional development by applying the method of principal components. The approbation of the suggested approach to the statistical data of Russian regions for 2000-2010 in terms of the region’s major subsystems indicated the absence of progressive development tendencies, as well as made it possible to determine the character and the direction of the influence of the investigated factors, which in the regional management practice permit taking the regions to the sustainable development pathway, to be determined.

Sustainable development, safe and balanced development, regional development management, method of principal components, vector of generalized influence, vector of development, factors of regional efficiency

Короткий адрес: https://sciup.org/147223518

IDR: 147223518 | УДК: 332.05

Текст научной статьи The role of the fuel sector of subarctic regions in the Komi Republic economy

Introduction. The Arctic zone of the Russian Federation is a powerful economic complex of mining enterprises, accounting for 60% of the share of added value from the worldwide Arctic zone (the remaining 40% fall on Greenland, Norway, Sweden, Finland, USA and Canada).

Oil and gas sector occupies the main place in the economy of Russia’s Arctic zone with 80% and 65% of the country’s total production respectively; mining complex (non-ferrous metallurgy, mining of diamonds, gold, bauxite, etc); six coal basins, three of which (Pechora, Lensky and South-Yakutsk coal basins) are under industrial development.

The urgent research task at this stage is to show the role of strategic economic activities of the Komi Republic in the support of the current and future development processes of the Arctic natural potential, through the conservation and use of the available production infrastructure, as well as the formation of new meridional connections across the NorthSouth border. This approach is consistent with the Declaration on cooperation in the Barents Euro-Arctic region with regard to energy development on the basis of the principle of ecological validity, infrastructure modernization and new technologies [1].

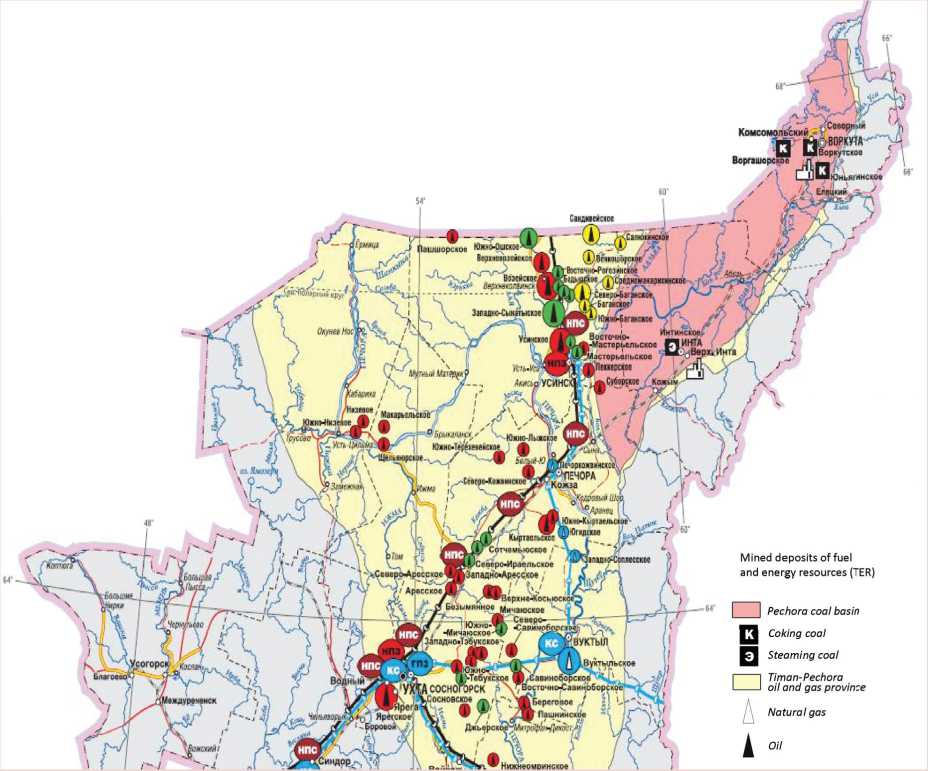

Pechora-Ural Arctic (PUA) is the NorthEastern part of the Komi Republic comprising such urban districts as Vorkuta, Inta, Usinsk, and Pechora, Ust-Tsilemsky and Izhemsky municipal districts, economically interconnected by the Timan-Pechora oil and gas province, Pechora coal basin and transport communications (trunk oil and gas pipelines, railway). The fuel and energy sector is represented in all subarctic regions (SAR) with different concentration levels, determined by the dynamics of sectoral specialization: decreasing role of the old industrial areas of energy production, an increase in the transit of hydrocarbons from the neighboring regions, the emergence of new development zones (fig. 1) .

Extreme economic environment, harsh natural conditions, the local nature of economic development are typical in the PUA. Single-industry cities, rather large for the North, which comprise almost all of its demographic and production potential, are situated there. The rest of the area is difficult to access due to the lack of transport links within the region. It is slightly populated, and has underdeveloped industrial base.

30% of the population live in subarctic regions of the Komi Republic; it comprises 44% of the total gross municipal product, 25% of which is the extraction of fuel and raw materials, and only 1% falls on refining. Predominantly raw-material nature of the manufactured products is combined with the export and consumption of them mainly outside the Republic: coking coal – 100%, energy – 44%, oil, including gas condensate – 63% and oil products – 77%.

SAR Characteristics . The territories of each subarctic region, located within the boundaries of the Timan-Pechora oil and gas province and in the Pechora coal basin, have both open and potential hydrocarbons and coal raw material reserves [3].

Oil and gas SAR:

-

1. Usinsk region , which is the primary centre of oil production in the Komi Republic, providing more than 65% of the Republic’s oil and about 15% of the gas. Considering the high degree of geological exploration of the initial total oil resources (over 77%) and the nature of localized objects (small and very small with hard to recover reserves), it can be noted that sustainable development of production is determined not by the extensive expansion of mineral resource base through greenfields, but by the intensification of works for oil recovery enhancement of producing fields and application of the newest mining technologies.

-

2. Pechora region is the second most important oil and gas extraction centre, annually producing 17% of oil and 20% of gas.

Figure 1. Fragment of the map of the fuel and energy complex of the Komi Republic within the subarctic boundaries [2]

-

3. Izhemsky and Ust-Tsilemsky regions are new centres of oil production in the Republic, being at the earliest, pioneering stage of development. The industrial exploitation of several small deposits started only in 2001 and has no significant influence upon the regional economy so far. Despite several dozens of

-

4. Vorkuta region – the main centre of coking coal production (Vorkutinsk, Vorga-shorsk, Yun-Yaginsk deposits), providing 100% of their production in the Republic and 81% of the total coal mining in the basin. Pechora basin is characterized by insufficient resources development by industry. The distributed stock of coking coal in the operating mines

-

5. Inta region is the second largest region of coal extraction, producing power-generating coal (Intinskoye Deposit), the production of which reaches 19% of the total coal production of in the basin. The distributed stock in the operating mine makes up 4.2% of the resources of the categories А+В+С1 for industrial development [4]. At the same time the region is characterized by insignificant amount of the current hydrocarbon production. It should be highlighted that due to fixed oil-and-gas bearing structures and extremely low degree of the territory’s geological exploration (6% by oil and gas) the region maintains high potential for the discovery of new deposits, on the assumption of intensified regional geological surveying and geophysical works, increasing volumes of parametric drilling .

The majority of deposits are in the initial and active stage of development, combined with a relatively low degree of exploration (29% for oil and 22% for gas) provides favourable opportunities for the development. Large volume of geological exploration and geophysical research is to be done in order to achieve the resource potential.

perspective oil-and-gas bearing structures, both regions are characterized by extremely low and unbalanced state of geological exploration, lack of infrastructure and remoteness from the existing centres of production, refining and transportation of hydrocarbons .

Coal SAR:

makes up only 8.1% of the resources of the categories А+В+С1 for industrial development [4]. Moreover, the state fund of subsurface resources accounts for 12 promising oil and gas structures, some of which have been prepared for drilling.

Methane – the associated component of coking coal production, estimated at 2 trillion m3, is the most important resource potential for the development of production of hydrocarbons in the region [5].

Economic activity of the subarctic regions. In the field of hydrocarbon extraction, transportation and processing of raw materials, the economic activity is characterized by the diversity of types and significant territorial differentiation. The generalized characteristics of the relative importance of individual branches of the fuel and energy complex and their impact on the economic development of the Pechora-Ural Arctic is presented in the work [6].

Three of the six SAR underwent significant changes over the past few years. Thus, the raw profile of the Usinsk region, which included a cycle of hydrocarbon production and transportation, was supplemented with processing:

already operating gas processing plant (its main activity is the processing of associated petroleum gas: 35% of the recovery volume with stripped gas production, 0.2 thousand tons of liquefied gas and 3.8 thousand tons of stable natural gasoline) and the new oil refinery (0.7 million tons since 2011). The inevitable advancement of Russian vertically integrated oil and gas companies to the shelf of the Arctic seas can enhance the role of Usinsk as a major logistics center. However, the opportunity is yet rather hypothetical: firstly, the main players on the Arctic shelf are represented in the region only nominally, and the region itself is not crucial for them; secondly, it is necessary to consider the competitive factor of logistics centres, emerging in Arkhangelsk and Murmansk, and similar potential centre in Naryan-Mar. Regardless of the Arctic vector, the role of Pechora as the Northern traffic centre of the Komi Republic has been increasing.

At present, the commodity transport flows of the Northern and North-Eastern areas are concentrated in Pechora; the place is linked with the Southern, Ukhtinsk industrial-traffic centre linking the Nortwestern, Central and Eastern zones of the production activity on hydrocarbon extraction, transportation and processing. In the long view, the transit role of Pechora will be strengthening, in case the project on gathering and utilizing petroleum gas of the Northern deposits in Sosnogorsk gas processing plant is implemented successfully and the construction of the motor road Syktyvkar – Naryan-Mar is completed.

During the implementation of the gastransport project “Yamal-Europe” the Vorkuta and Inta regions complemented their carbon cycles with the new one – natural gas transit and linear structures support. However, the development of the coal sector remains priority and city-forming for these regions.

The corporate policy of the owner of JSC Vorkutaugol is directed on improving the quality of commodity products due to the increase in volumes and the improvement of processing technology in “Pechora” Central Concentrating Mill, the introduction of advan-ced equipment and technologies of coked coal extraction. Of special importance is the use of coked coalmine methane in the mini-CHP under construction with the capacity of 17.5 MW on the basis of gaspiston engines for electric and thermal energy production in “Northern” mine. At the moment Vorkutaugol enterprises have been already partially using the gas, emitted during coal mining in mine boilers.

The dynamics of the main fuel sector indicators in SAR of the Komi Republic for 2005, 2010, 2011 is presented in table 1 .

Coal. Coking coal, produced at JSC Vorkutaugol, is the most significant as per technological properties in Russia, and comparable in quality to the best world brands. Currently its technological properties are fully evaluated in the domestic market. In the long view with the introduction of pulverized coal injection technology the value of the Vorkuta coal for metallurgists will only increase.

The share of JSC Vorkutaugol in the production structure of coal concentrates of sintering basis of furnice-charge in Russia amounted to 22% in 2011, and the share in the home consumption structure (including import) made up 20%.

Output of major high-quality product (coal concentrate) in the period under review increased 1.27 times regarding the coking coal, while energy coal output decreased to 62% from 2005-level.

Table 1. The dynamics of the main fuel sector indicators in Subarctic regions of the Komi Republic for 2005, 2010, 2011

|

Indicator |

2005 |

2010 |

2011 |

|

Coal |

|||

|

Extraction, million tons in total |

12.94 |

13.56 |

13.4 |

|

– coking |

8.82 |

10.82 |

10.9 |

|

– power-generating |

4.11 |

2.74 |

2.5 |

|

Coal-cleaning, million tons in total |

12.28 |

14.03 |

|

|

– coking |

8.78 |

11.29 |

|

|

– power-generating |

3.50 |

2.74 |

2.5 |

|

Clean coal production, million tons in total |

5.36 |

6.21 |

5.94 |

|

– coking |

4.04 |

5.38 |

5.12 |

|

– power-generating |

1.32 |

0.83 |

0.82 |

|

Clean coal deliveries, million tons in total |

9.18 |

12.35 |

9.44 |

|

– Komi Republic |

1.36 |

2.78 |

2.06 |

|

– other Russian regions |

7.23 |

7.99 |

6.39 |

|

– export |

0.59 |

1.58 |

0.99 |

|

– in million US dollars |

8 |

194.9 |

190.6 |

|

Average export price of coal, US dollars/ton |

97.4 |

127.8 |

189.7 |

|

Oil |

|||

|

Extraction, million tons |

8.0 |

10.9 |

11.3 |

|

Processing, million tons |

– |

– |

0.7 |

|

Export |

4.0 |

5.3 |

5.5 |

|

Average export price of oil, US dollars/ton |

340.0 |

543.5 |

556.0 |

|

Gas |

|||

|

Production, billion m3 |

1.0 |

0.9 |

0.9 |

|

Processing, billion m3 |

0.3 |

0.2 |

0.2 |

|

Note. Compiled from [7]; oil export is estimated by experts, since official statistics gives the indicator without considering the basic exporter and without breakdown by districts. |

|||

The coal, produced by Vorkutaugol company is used as concentrate in metallurgy for coke production as the core component of furnace-charge, gas fat lean coal and fat mid-coal is used in heat and electric power industry.

The export and supply of Pechora coal out of the Republic amounted to 78%. It should be noted that coal export in dollar terms increased significantly due to the growth in coal export prices (in 2011 – 1.5 times, as compared to 2010 and 2 times, in comparison to 2005). This makes coal export especially profitable for the economy of coal industry.

OAO Severstal (Cherepovets Metallurgical Plant) is the main consumer of JSC Vorkutaugol coal products.

The consumers of Inta coal are energy enterprises and municipal households, located in the Northwestern and Central Federal Districts. The consumption of coal has been decreasing in the Arkhangelsk Oblast due to gasification, and it is being reoriented, in particular, to the Vologda Oblast consumers (Cherepovets TPP).

Most of the Pechora coal (95%) consumed in the Komi Republic, falls at the regions of its production: Vorkuta and Inta (CHP and mine boilers); not more than 5% is accounted for the rest of the Republic territory. Just as much coal is delivered from other Russian regions. The analysis of the economic indicators of SAR coal industry (tab. 2) showed that the transition to the development of only cost-effective reservoirs,

Table 2. Main economic indicators of the fuel sector of the subarctic regions of the Komi Republic

|

Indicator |

2005 |

2010 |

2011 |

|

Coal |

|||

|

Average number of listed employees, thousand people |

13.6 |

9.3 |

8.8 |

|

Share in the total number of the employed in economy, % |

2.9 |

2.0 |

1.9 |

|

Average monthly wages of workers in the industry, thousand rubles |

17.1 |

38.8 |

45.7 |

|

Ratio to the average salary in the Komi Republic, times |

1.47 |

1.48 |

1.58 |

|

Fixed assets, billion rubles |

13.6 |

17.6 |

19.6 |

|

Share in the fixed assets of the economy, % |

2.4 |

1.4 |

|

|

Depreciation of fixed assets, % |

47.5 |

50.6 |

52.0 |

|

Fixed capital investments, billion rubles |

2.5 |

1.5 |

5.5 |

|

Share in total fixed capital investments, % |

5.3 |

1.4 |

3.0 |

|

Balanced financial result, times to 2005 |

1.0 |

12.9 |

18.0 |

|

Rate of return from sold goods, % |

27.5 |

45.7 |

59.1 |

|

Expenditures per 1 ruble of products, rubles |

0.73 |

0.61 |

0.59 |

|

Oil and gas |

|||

|

Average number of listed employees, thousand people |

17.9 |

17.7 |

17.6 |

|

Share in the total number of the employed in economy, % |

3.8 |

3.8 |

3.8 |

|

Average monthly wages of workers in the industry, thousand rubles |

26.5 |

54.7 |

58.0 |

|

Ratio to the average salary in the Komi Republic, times |

2.28 |

2.09 |

2.01 |

|

Fixed assets, billion rubles |

39.6 |

163.9 |

196.6 |

|

Share in the fixed assets of the economy, % |

6.9 |

13.2 |

|

|

Depreciation of fixed assets, % |

37.5 |

57.0 |

53.5 |

|

Fixed capital investments, billion rubles |

9.8 |

18.2 |

22.1 |

|

Share in total fixed capital investments, % |

20.9 |

18.9 |

12.0 |

|

Balanced financial result, times to 2005 |

1.0 |

3.0 |

5.7 |

|

Rate of return from sold goods, % |

26.6 |

31.3 |

21.2 |

|

Expenditures per 1 ruble of products, rubles |

0.79 |

0.76 |

0.73 |

|

Note. Compiled from [8, 9]; data on oil and gas sector was given in general throughout the Komi Republic, considering that no separate statistics by regions is available, and the share of SAR in extraction exceeds 84%. |

|||

implementation of advanced production technologies and better equipment allowed providing by 2010–2011 the financial result of 14.6 billion rubles that is unprecedented for the Pechora coal basin; profitability increase up to 59.1% and 2-fold decrease of costs per 1 ruble of marketable products in 2011, as compared to pre-crisis 2007.

Oil and gas. 30% to 40% of the produced oil has been processed on the territory of the Republic in recent years. The rest is delivered to foreign markets and in small amounts to the refineries of other Russian regions. Considering the indicators of compensating products export in 2011 (61% of gasoline, 66% of diesel fuel, 89% of residual fuel oil), one can say that the region’s self-sufficiency is at a very high level, although the requirements of the local subarctic mining regions are mainly covered by imported products (intraregional deliveries). Crude oil remains the region’s basic foreign economic commodity – 78% of the export value .

The high development degree of the Timan-Pechora oil and gas province within the Komi Republic mainly manifests itself in oil wells artificial lift. While in 2005, the development of deposits through natural energy of the reservoir accounted for a third of total hydrocarbon production, the figure dropped to 12% in five years.

Limited opportunities of companies concerning start up operations of new fields require more careful attention to non-operating wells at the existing facilities. While in 2005, their share reached 37%, in 2010 it made up only 27%. The maintenance of deteriorating assets in operating condition, due to new technological solutions combined with high tax burden, affects the return on oil and gas business, which, according to official statistics, is less than the similar indicators of the coal industry.

The share of associated petroleum gas flaring is still high in its consumption struc-ture (as light hydrocarbons resource, predominant in the SAR) – 26% in 2005 and 31% in 2010.

This fuel is used mainly to meet the needs of power industry (including municipal and regional), as well as to meet the companies’ own technology needs (reservoir pressure maintenance, oil heating for transportation). The absence of commodity products (liquefied petroleum gas) does not currently allows considering such recycling as economically efficient and environmentally effective, particularly in subarctic regions of the Republic.

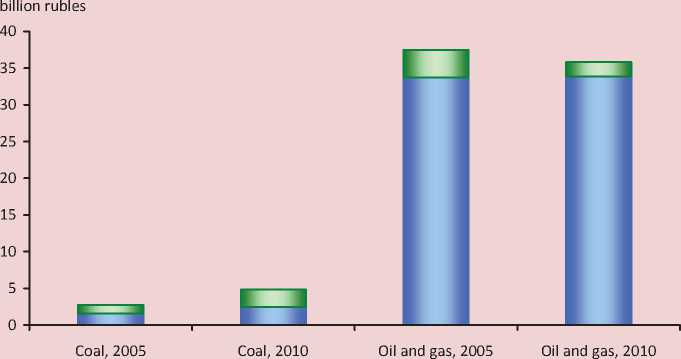

Improving condition of the coal industry and relatively stable position of oil production directly affect budget formation of all levels (fig. 2) . In accordance with this, socio-economic stability of mining and oil single-industry cities (Vorkuta, Inta, Usinsk) is maintained, i.e. three out of four major settlements on the territory of the Pechora- Ural Arctic.

The volume of tax payments to the budgetary system of the Russian Federation made by the coal industry enterprises of the Republic increased from 2.8 to 4.8 billion rubles for the 2005–2010 period, including the consolidated budget of the Komi Republic – almost twice, accounting for 6% of all tax revenues in the Republic. During this period the coal mining companies of the Komi Republic transferred more than 19 billion rubles to the budgetary system of the Russian Federation, more than 9 billion rubles of it into the consolidated budget of the region. The growth of coal production volume by 1.8 million tons in 2010, as compared to 2009, resulted in significant increase of tax revenues to the budgets of all levels.

Oil and gas extracting organizations remain the main taxpayers of the region, traditionally accounting for about 55–66% of tax revenues. The economic crisis led to a decrease of share up to 44% minimum in 2010. But already next year the sum of the above mentioned taxes increased again, reaching 48% of total fees. The change in world oil prices caused the increase in tax on mineral resources extraction, as the main budget source.

Figure 2. Dynamics of tax deductions made by energy sector enterprises of the Komi Republic to the budgetary system of the Russian Federation and the Komi Republic

□ RF budget □ Komi Republic budget

According to Rosstat, in December 2011, Urals oil price was at the level of 107.6 US dollars per barrel, that is 20% higher than in the preceding year. In total, oil and gas sector of the Komi Republic accounted for almost 287 billion rubles of tax revenues for the 2005–2010 period. However, the consolidated budget of the region lost about 1.5 billion rubles since January 1, 2010, as the federal budget receives 100% of the income from oil mineral production tax (MPT).

Institutional aspect of SAR functioning. With regard to fuel sector regulation, the regions of the Pechora-Ural Arctic are strictly dependent on the level of corporate clustering. At present, the management of oil, gas, and coal territories is differentiated by two main groups. The first, “supra-regional” group comprises federal authorities, having complete power in the field of resource use, as well as vertically integrated companies directly involved in the exploitation of natural resources. The second, “subregional” group comprises public authorities of the subjects of the Russian Federation, local government and various institutions of public self-organization of the local population, according to national, cultural or territorial principle.

The weakness of the institutional forces of subregional level, facing external developed institutional forces, leads to the fact that all of the most notable organizational, economic and social changes occur only where it is profitable to extraterritorial corporations, and in the time frames, matching their strategies. Regional and local authorities have only to delegate part of their powers to these corporations (especially with regard to the realization of social initiatives, infrastructure development), as well as to respond to the situation post factum, relaying enterprise solutions for the local population and mitigating the consequences of the most sensitive ones.

The significant influence of such institution, as organized mission to local communities, indigenous peoples of the North is typical of the northern and, particularly, the arctic and subarctic regions not only in Russia but in the whole world. In the regions, characterized by headmost self-organization of citizens, corporations have to adjust its policy in order to minimize the costs of possible resistance to the company’s production activities in a specific territory and more globally to avoid reputational losses in the business community.

Public-private partnership, the notion of which is often replaced by the concept of stateprivate partnership in the context of Russian reality, is the mechanism of interaction beyond the scope of the applicable laws. Public-private partnership is regulated by the good will of the business and society seeking to improve the mutual benefits of good business reputation, while state-private partnership is regulated by the objective or subjective inertia of lawmaking, when less resources (time, financial, lobbying ones) are required for setting and following informal rules in order to change formal laws.

Problems of SAR fuel and energy sectors.

Coal. Further increase in the production and enrichment efficiency of Pechora coal is connected with a set of technological measures, such as the unification of underground workings of Vorkuta and Zapolyarnaya opening onto Pechora concentrating mill, the increase in its capacity up to 9.5 million tons of ordinary coal, and the transition to a closed water-slurry circuit, providing the increase in the output of coking coal concentrate by 30–40%.

The development of a number of technologies on the waste coal processing in Russia determines the possibility and necessity of solving this problem for the Pechora coal basin. The processing of coal slimes, the volume of which amounts to 8 million tons, will improve the environmental situation of coal mining in the region, create additional resources of quality fuel energy, allow replacing such low-quality coal with compressed fuel for the consumers of the Komi Republic. In order to resolve this problem, the following measures should be implemented in full: the participation of the Republic in purchasing appropriate equipment, the introduction of taxation privileges up to break-even point of capital investments, the decrease of credit rates.

The issue concerning the wide use of mine metane as an independent resource, based on resource capacities, can not be solved yet due to the lack of a legislative base necessary for the decontamination and recycling of mine metane. The development of the programme on the expansion of mine metane extraction not only in operating but in closed mines will give the opportunity to solve the problem of Vorkuta gas supply.

The introduction of the technologies of deep processing of coal and waste coal is required to ensure the market competitiveness of coal products of promising deposits, massive environmental improvement and productivity enhancement. This will permit shifting from the simplified technological chain “coal mining – partial enrichment – energy use” to a more perfect “mining – enrichment – partial energy use, slimes and siftings pelletizing – partial use in the coal chemistry”, thus changing raw development vector of the coal region to the processing one, with the production of high value products.

Oil and gas. Effective, environmentally safe and socially oriented development of oil and gas sector (i.e. providing employment, income, access to services) on the territory of the Komi Republic directly depends on the ability of the executive authorities to position the region rightly in terms of its orientation: a) maintenance and development of the Arctic shelf resources, b) maintaining the sustainable rates of hydrocarbon extraction and processing on the continental part of the Timan-Pechora oil and gas province and the transit of the resources of the North and Western Siberia in the central regions of the country.

The expansionist policy has a number of serious limitations. Companies that are holders of licenses for the development of offshore fields (Rosneft and Gazprom) have minor production assets or other activity profile (pipeline transport) on the territory of the Komi Republic, while the owner of the well- developed infrastructure (LUKOIL) faces serious political difficulties concerning access to marine deposits. In addition, the Komi Republic does not have a single pronounced competitive advantage over other oil and gas regions and Russia’s arctic areas in order to become “a bridgehead for a dash to the North”. In case such policy is successfully implemented, Usinsk will be the only subarctic district out of six, benefiting from the expansion.

On the other hand, the same reasons can reduce the risk of investment resources withdrawal from the territory. The absence of necessity to enter the “arms race” in the development of highly capital-intensive shelf will give regional companies the opportunity to deal with problems within the province. In this case, the development vector of oil and gas sector can be directed towards the Northeast (Inta and Vorkuta regions) and Northwest (Izhemsky, Ust-Tsilemsky regions). Regional government activities should be focused on resolving the issues concerning the development of geological exploration (including the funding by the resources owner), the protection of competition, assignment of significant tax incentives for the development of small, depleted and hard-to-recover reserves. It is also a rather difficult task, which is associated with large-scale financial injections and strong lobbying of the region’s interests at the level of federal government and governing bodies of the vertically integrated oil companies.

The abandonment of arctic claims in favor of internal development will positively affect not only six subarctic, but also other regions of the Republic. Instead of unnecessary competition with the Murmansk and Arkhangelsk oblasts, Nenets and Yamalo-Nenets autonomous okrugs concerning resources development, the Komi Republic will be able to participate in the formation of the second echelon of support infrastructure. In this case, the latitudinal development of arctic regions – along the Northern sea route – is supplemented with meridional development of transport communications and processing capacities of subarctic regions, focused, primarily, on the local demand for fuel and energy resources, as well as creating the economic basis for further adaptation of the territory.

Список литературы The role of the fuel sector of subarctic regions in the Komi Republic economy

- Declaration on cooperation in the Barents Euro-Arctic region (Kirkenes, Norway, January 11, 1993), Murmansk Oblast. Official internet portal. Available at: http://gov-murman.ru/cooperation/agreements/bear.shtml

- The Komi Republic Atlas. Moscow: Feoriya, 2011.

- Automated geoinformation register system of the Komi Republic. Available at: http://www.agiks.ru

- State balance of mineral resources of the Russian Federation. Coal. Мoscow, 2009. V. 2.

- Melentiev G.B., Korotkiy V.M. On involvement in the complex use of energy chemical resources of traditional and alternative bituminous materials. Actual problems, directions and mechanisms of productive forces development in the North -2012: proceedings of III All-Russian seminar. Part I. P. 286-293.

- Buryi O.V. Business-space typology in the fuel and energy sector of the Komi Republic. Proceedings of the Komi Science Centre of RAS Ural branch. 2011. No.3(7). P. 98-105.

- Production and use of fuel and energy resources in the Komi Republic: statistical digest. Komistat. Syktyvkar, 2011.

- Industrial production in the Komi Republic. 2011: statistical digest. Komistat. Syktyvkar, 2011.

- Statistical yearbook of the Komi Republic: statistical digest. Komistat. Syktyvkar, 2012.