The system of taxes and taxation is an important tool of state regulation of agricultural enterprises

Автор: Mironenko Natalia Viktorovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Young researchers

Статья в выпуске: 2 (10) т.3, 2010 года.

Бесплатный доступ

The legislative framework of taxation of agricultural producers in the Russian Federation is considered. Based on the analysis of taxation of agricultural enterprises of the Vologda region a conclusion about the imperfection of state tax regulations in the agricultural sector is made. Ways of improving the unified agricultural tax, allowing increasing the profitability of this regime are suggested.

Vologda region, taxation of agricultural enterprises, improving the practice of single agricultural tax

Короткий адрес: https://sciup.org/147223184

IDR: 147223184 | УДК: 631.1+336.221(470.12)

Текст научной статьи The system of taxes and taxation is an important tool of state regulation of agricultural enterprises

The state has an extensive set of tools to regulate the activities of agricultural goods producers. One of these tools are the taxes. The imperfection of the current tax policy in Russia and particularly in the agricultural goods producers taxation leads to a significant financial resources outflow from this industry. This is a real problem in view of the difficult financial situation in this area of economic activity. The answer to the question “How many and what taxes have agricultural good producers to pay?” is fundamental on matter of improving the agricultural enterprises taxation. In order to give correct and motivated recommendations to improve the studied issue, it is necessary to analyze the current taxation system in this industry. In this regard, it should to evaluate various parameters characterizing the taxation system of agricultural enterprises in the Vologda region. In our view, all the calculations relat- ing to taxation must be made in two versions: including the amounts of personal income tax (PIT) and excluding this tax. According to the RF legislation, personal income tax is paid not by the enterprise, but by the employees; in this case the enterprise acts only as a tax agent. However, in our opinion, because of industry characteristics, it is also necessary to consider this tax in the aggregate payments. In this case the total fund outflow from the village will be assessed. To this end, the structure of tax payments in agricultural enterprises of the region is presented (tab. 1).

The largest share in the tax payments structure (42.3% in 2008, including personal income tax and 54.1% excluding personal income tax) makes up value added tax (VAT). For five years, its share has increased by 5 percentage points (excluding personal income tax by 8.8 percentage points). The second place is taken by uni-

Table 1. The structure of the tax payments in agricultural enterprises of the Vologda region to the budgets of all levels and budgets of the territorial state non-budget funds in 2003 – 2008, %

|

Taxes |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

Basic growth rate in 2008 to 2003, percentage points |

|

The structure of payments including the amount of personal income tax (PIT) |

|||||||

|

1. VAT |

37.2 |

29.4 |

38.9 |

46,2 |

43,1 |

42,3 |

5,1 |

|

2. UST |

37.0 |

36.1 |

30.3 |

26,3 |

28,5 |

29,5 |

-7,5 |

|

3. PIT |

17.8 |

15.3 |

22.0 |

19,8 |

21,0 |

21,9 |

4,1 |

|

4. Land tax |

2.5 |

2.5 |

2.2 |

0,7 |

0,7 |

0,6 |

-1,9 |

|

5. Other taxes |

5.5 |

16.7 |

6.6 |

7,0 |

6,7 |

5,7 |

0,2 |

|

Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

х |

|

The structure of payments excluding the amount of personal income tax (PIT) |

|||||||

|

1. VAT |

45.3 |

34.7 |

49.8 |

57.7 |

54.7 |

54.1 |

8.8 |

|

2. UST |

45.0 |

42.6 |

38.9 |

32.7 |

36.1 |

37.8 |

-7.2 |

|

3. Land tax |

3.0 |

3.0 |

2.8 |

0.9 |

0.9 |

0.7 |

-2.3 |

|

4. Other taxes |

6.7 |

19.7 |

8.5 |

8.7 |

8.3 |

7.4 |

0.7 |

|

Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

х |

Source: compiled by the author on the data from Department of Agriculture of the Vologda region.

fied social tax – UST (29.5% in 2008, including personal income tax and 37.8% including personal income tax). Reducing the proportion of UST for this period is attributable to lower tax rates from 26.1 to 20%. The fifth of the tax payments makes up personal income tax, which accumulates in the regional and local budgets of the Vologda region. Land tax reducing (from 2.5 to 0.6%, including personal income tax and from 3.0 to 0.7% excluding personal income 2003 – 2008) is attributable to in 2006 changing legislation regulating land tax payment, and to increasing debt on this tax.

In the context of fund recipients, this structure is presented in table 2 the largest share falls on the federal budget – about 50% during the analyzed period. However if we analyze the data excluding the amounts of personal income tax, it may be noted that 60% of all tax revenues paid by agricultural enterprises of the region are credited to the federal budget. From 20 to 25% of all tax payments go to the regional and local budgets of the Vologda region, the remaining amounts go to the budgets of the territorial state non-budget funds of the region (about 30% in 2008). If the value of personal income is excluded from the

Table 2. The structure of the taxes recipients paid by agricultural enterprises of the Vologda region in 2003 – 2008

Analysis of the data presented in table 3 makes possible to conclude that the proportion of indirect taxes in the total amount of obligatory payments paid by agricultural enterprises of the region is high. At the same time the share of VAT accounts from 70% to 92% of the total value of taxes paid by agricultural enterprises to the federal budget. If we consider the share of VAT in the structure of all tax revenues, then it is possible to identify a similar situation. So, if in 2003 it accounted 37.2% of the total tax revenue, then in 2008 this figure increased to 42.3% (see tab. 1). The reason for this situation is the growing value gains of agricultural goods producers.

The high share of indirect taxes indicates inefficient state fiscal policy in regard to agricultural goods producers.

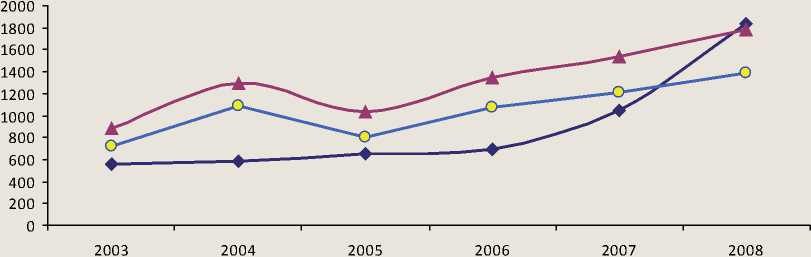

Let’s consider the situation with a ratio of public assistance sums from the budgets of various levels with the amount of tax paid by agricultural enterprises (table 4 and figure) .

Table 3. The share of indirect taxes in total tax payments from agricultural enterprises of the Vologda region, 2003 – 2008

|

Years |

The share of indirect taxes in total sum of paid taxes (including PIT), % |

The share of indirect taxes in total sum of paid taxes (excluding PIT), % |

|

2003 |

38.5 |

46.8 |

|

2004 |

29.5 |

34.8 |

|

2005 |

38.9 |

49.8 |

|

2006 |

46.2 |

57.7 |

|

2007 |

43.2 |

54.7 |

|

2008 |

42.3 |

54.1 |

|

Source: compiled by the author on the data from Department of Agriculture of the Vologda region. |

||

Table 4. Value of tax payments to the budget paid by agricultural enterprises of the Vologda region in 2003 – 2008 with the value of state assistance, mil. roub.

|

Indicators |

Years |

|||||

|

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

|

|

1. Funds received in the financial year – total |

558.8 |

591.6 |

646.6 |

697.4 |

1053.9 |

1835.5 |

|

2. Taxes paid to the budgets of all levels and of the territorial state funds – total (including PIT) |

879.3 |

1289.4 |

1033.8 |

1342.3 |

1533.9 |

1778.4 |

|

2.1. Taxes paid to the budgets of all levels and of the territorial state funds – total (excluding PIT) |

723.0 |

1092.8 |

806.6 |

1076.3 |

1210.8 |

1388.3 |

|

3. Taxes excess (including PIT) paid to the budgets of all levels and of the territorial state funds on the total amount of state assistance |

320.5 |

697.8 |

387.2 |

644.9 |

480.0 |

-57.1 |

|

3.1. Taxes excess (excluding PIT) paid to the budgets of all levels and of the territorial state funds on the total amount of state assistance |

164.2 |

501.2 |

160.0 |

378.9 |

156.9 |

-447.2 |

|

4. Funds received from the federal budget |

70.7 |

89.7 |

85.1 |

133.1 |

296.7 |

622.4 |

|

5. Taxes paid to the federal budget |

438.3 |

480.4 |

482.2 |

683.4 |

729.2 |

816.6 |

|

6. Taxes excess paid to the federal budget on the amount of state assistance from the federal budget |

367.6 |

390.7 |

397.1 |

550.3 |

432.5 |

194.2 |

|

7. Funds received from consolidated budget of the Vologda region – total |

488.1 |

501.9 |

561.5 |

564.3 |

757.2 |

1213.1 |

|

8. Taxes paid from consolidated budget of the Vologda region (including PIT) |

176.5 |

190.1 |

200.6 |

261.3 |

368.6 |

445.7 |

|

9. Received funds excess on paid taxes in the region(including PIT) |

311.6 |

311.8 |

360.9 |

303.0 |

388.6 |

767.4 |

|

10. Taxes paid to the budgets of the territorial state funds |

264.5 |

618.9 |

351.0 |

397.6 |

436.1 |

516.1 |

Source: compiled by the author on the data from Department of Agriculture of the Vologda region (2003 – 2008).

Value of taxes paid by agricultural enterprises of the Vologda region with the value of state assistance, 2003 – 2008

♦ State assistance —*— Paid taxes (including PIT) Paid taxes (excluding PIT)

Analysis of the data presented in table 4 shows that the main taxes sums from agricultural enterprises of the region are sent to the federal budget (46% in 2008 including the amount of PIT and 59% excluding the amount of PIT). In regard to the regional level it can be noted that the funds received by agricultural enterprises from the budgets of different regional levels (consolidated budget) exceed the tax amounts paid to the regional budgets (in 2.7 times in 2008). If PIT is excluded, which is fully accumulated in the regional budget and local budgets of the region (consolidated budget), then such amount excess is in 22 times in 2008. Thus, the concept of “donor region” extends to the region not only because of the availability of developed industrial base, but also of the reallocation of funds through the agricultural enterprises.

These data presented in the figure show the excess of taxes paid by regional agricultural enterprises to the budgets of different levels and of the territorial state funds. This situation is typical for the period from 2003 to 2007. Only in 2008 there was a fracture of the situation in connection with the implementation of government programs for agriculture development.

Thus, we come to the following conclusions about the current taxation system of agricultural enterprises in the Vologda region:

-

1. The largest share in the tax payments structure of regional agricultural enterprises is

-

2. The amount of taxes paid by agricultural enterprises of the region to the budgets of different levels and to the budgets of the territorial state funds, often exceeds the amount of state assistance from the budgets.

-

3. The basic amount of taxes paid by agricultural enterprises of the region are sent to the federal budget and the amount of funds allocated from the federal budget to agriculture is much less than the amount of taxes paid. The contrary situation we can see in the regional level: here the amount of funds allocated from the regional and local budgets is much almost in 3 times then the amount of paid taxes that transfers the region in the level of donor regions.

VAT, but its share increases annually, what indicates about the imperfection of state tax policy.

Currently the state implemented a series of steps aimed at the tax burden easing for agricultural goods producers. In particular, many benefits to the traditional system of taxation are provided for them, and also a special tax system – the unified agricultural tax (UAT) is introduced. This system is controlled by Chapter 26.1 of the Tax Code, that came into effect in 2002. The rules of this chapter established a single agricultural tax at the regional level. On January, 1, 2004 UAT was transferred to the federal level, the level of special tax systems. A short comparative characteristic of existing systems of agricultural producers’ taxation, established by the Tax Code of the Russian Federation, is given in tables 5, 6 .

Table 5. Comparative analysis of taxation systems for agricultural goods producers in Russia

|

Taxes and contributions paid in various systems |

|

|

General system |

Special system for agricultural producers |

|

Corporate Profit Tax Profits from sales produced and processed their own agricultural production is taxed at the following rates (№ 110-FL from 06.08.2001 in ed. 158-FL from 22.07.2008): 2004 – 2012 – 0% 2013 – 2015 – 18% since 2016 – 20% By laws of the regions of the RF tax rate may be reduced for certain categories of taxpayers. |

Unified agricultural tax (Income - Cost) x 6% Note. The list of UAT costs, unlike the list of income tax, is closed. |

|

Corporate property tax The rate is up 2.2% from the average annual value of fixed assets. In number of major regions for agricultural goods producers have been introduced incentives for the organizations' property used in the production and processing of agricultural products. |

Exempted from corporate property tax |

|

Value added tax 0 – 18% of added value or amount to the return from the budget. The amount of the tax to be paid to the budget fluctuates around zero, because the “incoming” VAT is paid at a rate of 18%, and “outgoing” VAT for producers of most agricultural products – at a rate of 10%. In addition, the amount to repay is presented in households that acquire the basic tools and involved in construction. At such taxpayers the amount of compensation can be several tens of millions rubles. |

Value added tax 10 – 18% of material costs. Under the legislation, are exempted from this tax. In fact, VAT is paid because there is “incoming” VAT paid by the suppliers of petroleum products, raw materials, machinery, etc., which cannot be brought later to the deduction or refund from the budget and ultimately increases the cost of the taxpayer. |

|

Unified social tax For taxpayers – agricultural goods producers – maximum rate is 20% from payments to employees. However, in view of the deduction of contributions to pension insurance, which paid for all the special tax systems (maximum rate – 10.3%), total rate of UST will not exceed 9.7%. |

Exempted from unified social tax, with the exception of contributions for compulsory pension insurance for employees. |

|

Compiled by the author on the data from resources: [5, 6, 7]. |

|

Table 6. Main taxes and contributions paid by agricultural enterprises in all tax systems

Federal taxes, contributions

Premiums for compulsory pension insurance for employees. The maximum rate is 10.3% of salary payments.

In connection with the abolition of UST in 01.01.2010, agricultural companies become payers of insurance contributions 1) for the compulsory pension insurance; 2) in compulsory social insurance, temporary disability and maternity, and 3) the compulsory medical insurance. However, in 2010, agricultural producers pay fees on the aggregate rate of 20%, and payers UAT — on the rate of 10.3%. From 2011 to 2012 agricultural enterprises and payers of UAT pay contributions on the reduced rate of 20.2%; in 2013 – 2014 – 27.1%. In 2015 for both considered categories a standard rate is 34% (Law № 212-FL).

Value added tax, paid in the customs charges. For exporters rate is 0%. From 01.01.2007 to 01.01.2012 import of breeding farm animals to the RF be exempted from taxation (№ 118-FL from 05.08.2000, in ed. From 24.06.2008., art. 150 of the RF Tax Code).

State fee. If there is the object of taxation.

Tax on the extraction of commercial minerals. If there is the object of taxation.

Water tax. Water facilities for irrigation of agricultural lands destination, service and watering of livestock and poultry is not considered as a taxable object.

Fees for the use of wildlife objects and for the use of aquatic biological resources. If there is the object of taxation.

Performing duties of a tax agent to withhold personal income tax. At late tax withholding and transferring the organization pays the fines and penalties at their own expense.

Regional taxes

Transportation tax. Most of the agricultural machinery is not subject to taxation.

Local taxes

Land Tax. Has been paid since 2006 on a reduced rate – 0.3% of the cadastral value of land.

Compiled by the author on the data from resources: [5, 6, 7, 8].

Analysis of tables 5 and 6 shows that agricultural goods producers are provided with many rebates in taxation. How published data show the use of the tax system in the form of UAT can reduce the tax burden by at least 30%. This is the minimum limit of the tax costs reducing. Our calculations showed that the tax burden reducing by the transition to UAT can make more, for example 46.5%. It means that everything depends on the particular enterprise, using this system. However, comparing the advantages and disadvantages of transition to UAT indicates that the question of the appropriateness of the general or special system using remains controversial today.

The main problem hindering the transition of agricultural goods producers to this mode is the denial of amends to them for value added tax. This leads to a significant loss of financial resources [1, 3, 4, 9].

Since 2004 the agricultural enterprises of the Vologda region have been using a special tax system – the unified agricultural tax (UAT). The distribution of agricultural enterprises of the region on the using tax systems is presented in table 7 .

The data presented show the increase in the number and proportion of enterprises using UAT. In 2008 the figure was about 40%. However, for Russia as a whole the share of agricultural enterprises using this taxation system is almost 60%. This situation is explained by the fact that for many enterprises in the region this system is disadvantageous because of failure to refund VAT.

Distribution of enterprises paid UAT according to districts of the Vologda region is shown in table 8 .

The data presented in table 8 show that the proportion of enterprises using UAT from 2004 to 2008 has increased by 11.5%. However, the districts using credit resources for investment use this system in a small percentage. In particular, in the Vologda region the share of agricultural enterprises using UAT increased from 5.6% (in 2004) to 21.2% (in 2008). In the district of Cherepovets this figure is higher – 45.5% (in 2008), however, it is less than half of the total number of enterprises. The districts of Sheksna and Gryazovets do not use this taxation system.

As noted in several researches [1, 3, 4, 9], for businesses actively leading the technical reequipment (which is particularly relevant as part of the National project “Development of agroindustrial complex”, which was transformed in 01.01.2008 to the State program of agriculture development and regulation of markets for agricultural products, raw materials and food for 2008 – 2010), the use of UAT is unprofitable because of the non-adoption of VAT to offset. According to calculations, the effect of the UAT introduction for an average enterprise in 2005 lost by acquisition of fixed and current assets amounting to more than 35 million roubles. [3].

The main suggestions made by some authors to reduce this problem are addressed to two points of view. The first point of view is a rejection of the VAT liberation, it means that this tax is to delete from the list of payments, from which VAT taxpayers are realized. Thus, the enterprise is entitled to a refund this tax from the budget. The second point of view is to give the taxpayer the right to choose when he pay VAT in order to receive compensation (e.g., if building is being realized, etc.) and refuse to pay VAT, which is not expected to

Table 7. The distribution of agricultural enterprises of the Vologda region on the taxation systems in 2004 – 2008

|

Indicators |

2004 |

2005 |

2006 |

2007 |

2008 |

|||||

|

Unit |

% |

Unit |

% |

Unit |

% |

Unit |

% |

Unit |

% |

|

|

The total number of agricultural enterprises, unit |

365 |

100.0 |

342 |

100.0 |

348 |

100.0 |

317 |

100.0 |

291 |

100.0 |

|

Including: using UAT |

95 |

26.0 |

106 |

31.0 |

118 |

33.9 |

112 |

35.3 |

109 |

37.5 |

|

using other taxation systems |

270 |

74.0 |

236 |

69.0 |

230 |

66.1 |

205 |

64.7 |

182 |

62.5 |

Source: compiled by the author on the data from Department of Agriculture of the Vologda region.

Table 8. The proportion of agricultural enterprises of municipal districts in the Vologda region using the unified agricultural tax in 2004 – 2008, %

Analysis of table 9 showed that the operations which are taxable at zero rate, and operations that are exempt from taxation, VAT is not paid. However, these differences in these modes lead to the fact that the application of zero rate has significant advantages over the exemption from VAT. However, these differences in these systems lead to that fact that the use of zero rate has significant advantages over the exemption from VAT. They mean that the use of VAT zero rate allow not to pay the tax to the budget and at the same time to recover it from the budget on purchased goods, works and services (compensation of “incoming” VAT). Taxpayers who use tax privilege, are obliged to treat “incoming” VAT on the costs of production and circulation. This leads to an increase in production costs and reduce its competitiveness.

Thus, our analysis shows that the state finances the taxpayers who use a zero rate of VAT. This becomes particularly relevant for agricultural goods producers because it allows them to:

Table 9. Comparative characteristic of the value added tax calculating system under the Tax Code of the Russian Federation

|

Use of the zero rate of VAT |

Use of the VAT release (the incentives use) |

|

For operations which are taxable at zero rate, which in the preparation of invoices in the column “VAT tax rate” we indicate “0%”, is formed the tax base. Amounts of “incoming” VAT paid on goods (works, services) are deductible. |

For operations that are exempt from taxation (in the preparation of invoices in the column “VAT tax rate” we indicate “No Tax (VAT)”), the tax base is not formed. Amounts of “incoming” VAT paid on goods (works, services) are not deductible, but they are included in the production and circulation costs . |

|

Compiled by the author on the data from sources: [2, 6]. |

|

– first, to apply the privilege special system (UAT) and to reduce the tax burden by at least 30%;

– second, to receive additional working capital in the form of compensation “incoming VAT” and to use them to carry out its activities, that reduce the need for credit resources.

In the legislation may be specified the need of targeted financial resources use for the implementation of mandated activities, or a specific list of operations. However, in general, these changes in tax legislation will allow agricultural producers to release substantial financial resources (to reduce tax burden by one-third and to replenish working capital at the expense of VAT paid compensation to suppliers by 18%).

This is extremely urgent in the national policy on state regulation of the agricultural sector, as the access to credit resources for the financially unstable companies is difficult. The loss of federal budget from the VAT gap will be overridden by the productive base expansion of financially sustainable goods producers and by financial budget support of loss-making enterprises. In turn, this will increase the output of domestic agricultural production and reduce import substitution.

Список литературы The system of taxes and taxation is an important tool of state regulation of agricultural enterprises

- Bocharova, O.F. The development of the regulatory function of taxes in the taxation of agricultural goods producers (on the Krasnodar region): candidate dissertation abstract/O.F. Bocharova. -Krasnodar, 2007.

- Bryzgalin, A.V. Commentary to the Tax Code of the Russian Federation, part two. Volume 1. Value added tax/A.V. Bryzgalin, V.R. Bernik, A.N. Golovkin; ed. A.V. Bryzgalin and A.N. Golovkin. -M.: Analitika-Pressa, 2001. -448 pp.

- Zabegalova, E.L. Improve the unified agricultural tax use/E.L. Zabegalova//Economics of agricultural and processing enterprises. -2007. -№ 1.

- Kastornov, N.P. The mechanism of taxation in the system of state regulation of agro-industrial complex/N.P. Kastornov//Economics of agricultural and processing enterprises. -2007. -№ 2.

- Tax Code of the RF (part one): approved by the Federal Law from 31.07.1998 № 146-FL.

- Tax Code of the RF (part two): approved by the Federal Law from 05.08.2000 № 117-FL.

- On mandatory pension insurance in the Russian Federation: federal law from 15.12.2001 № 167-FL.

- On the insurance premiums to the Pension fund of the Russian Federation, the social insurance fund, Federal fund of obligatory medical insurance and territorial funds of obligatory medical insurance: the Federal Law from 24.07.2009 № 212-FL.

- Fedotova, E.V. Unified agricultural tax: pro and contra/E.V. Fedotova//AIC: Economics and Management. -2007. -№ 10.