Trade effects in the commodity markets of the Asia-Pacific region

Автор: Izotov D.А.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 3 т.16, 2023 года.

Бесплатный доступ

The aim of the research is to assess long-term effects of trade integration in the Asia-Pacific region (APR) at the level of commodity markets - industrial and primary goods. Over the previous three decades, trade within the APR has significantly increased, thanks to the lowering of trade and economic barriers as a result of trade agreements and the WTO accession by almost all countries in the subglobal region. We show that trade between the Asia-Pacific countries greatly exceed their trade with other countries of the world, due to the increase in the exchange of goods, both primary and industrial goods including in the production chains of transnational corporations. Estimates derived from the gravity model indicate that in the long term the overall positive effect of trade integration in the APR is manifested through the complementarity of regionalization and globalization processes, with the dominance of the latter. The regionalization process stimulates an increase in most of the aggregate trade in industrial goods, while trade of primary goods is generated exclusively by globalization, which explains the motivation of a number of countries specializing in exports, including Russia, in their reluctance to expand trade agreements with other APR countries. The article points out that along with the process of regionalization, globalization in the Asia-Pacific region contributes to the expansion of trade in industrial goods, with the production chains of transnational corporations successfully functioning within the framework of trade agreements. The assessments also point to signs of the exhaustion of globalization as a source of increasing trade in industrial goods in the APR, which may be related to the fragmentation of the subglobal region as manifested in creating trade megaformats in recent years. We assume that under the current instability of foreign policy processes in the APR, the introduction of various kinds of restrictions can lead to the transformation of trade and economic relations in the sub-global region, manifesting itself in the redistribution of the accumulated benefits of integration for the Asia-Pacific countries.

Trade, integration, regionalization, globalization, direct effect of integration, accumulated effect of integration, primary goods, industrial goods, trade agreement, free trade zone, customs union, asia-pacific region

Короткий адрес: https://sciup.org/147241599

IDR: 147241599 | УДК: 339.924+339.5 | DOI: 10.15838/esc.2023.3.87.5

Текст научной статьи Trade effects in the commodity markets of the Asia-Pacific region

Integration processes in the global economy have contributed to a significant increase in trade and strengthening of economic interconnections between the world countries. Such processes have been quite clearly manifested in the Asia-Pacific region (APR)1. By 2021, this sub-global region accounted for more than 60% of the world economy2. Over the previous three decades, a global production complex has formed in the APR, which included most East Asian countries, as well as key North American countries. In this subglobal region, vertical trade between enterprises of transnational corporations (TNCs), located in different APR countries, has been actively developing. In addition to the export component of TNCs enterprises, the growth of APR economies has increased their consumption of industrial goods3 produced within the subglobal region. In turn, to increase the scale of production of various industrial goods, including the maintenance and optimization of cross-border production chains, the key APR economies begin actively importing primary goods from other countries, mostly located in the subglobal region.

Integration has promoted the expansion of intraregional trade, economic growth and increased consumption in the Asia-Pacific region4; it has greatly reduced barriers in the subglobal region and facilitated trade and economic interactions between its member countries as part of the processes of globalization and regionalization. In the 2000s, the vast majority5 of Asia-Pacific economies joined the World Trade Organization (WTO), a global trade integration format6, which created the conditions for globalization on the basis of the former General Agreement on Tariffs and Trade. Another integration process in the APR is regionalization (Arndt, 1993; Ethier, 1998), associated with the conclusion of trade and economic agreements between countries of the subglobal region. It is worth noting that APR countries failed to go beyond the initial stage of integration after unsuccessful attempts to create complex integration forms, similar to the European Union, so there is no single integration format in the subglobal region. The initial stage of integration includes partial trade agreements (PTAs)7, free trade areas (FTAs)8, and customs unions (CU)9. Since the need to further reduce barriers has still persisted, the functional component of concluded FTAs, as the most common integration format, inevitably began expanding to other areas of economic interaction, which contributed to the emergence of FTAs in an expanded format – FTA+ (Izotov, 2020a; Smirnov, Lukyanov, 2022).

Concluded trade agreements in the Asia-Pacific region were aimed at liberalizing trade in industrial products, which was especially important for reducing barriers to trade in intermediate goods in the context of production cooperation between leading countries of the subglobal region, as well as to expand the turnover of investment goods. Along with the globalization process, the lower barriers to trade in primary goods10 is also regulated in trade agreements, mainly in the extended format, especially the products of agriculture and forestry, fisheries, as well as a number of commodity groups of the mineral complex. In addition, trade agreements in an extended format can reduce barriers to foreign direct investment (FDI) inflows (Lakatos, Walmsley, 2012; Balistreri, Tarr, 2020), including in the resource sector of member countries, which can help increase commodity trade between them.

Based on the general equilibrium model, ex-ante estimates quite clearly point to the potential for increased trade in the APR in both primary and industrial goods, subject to further steps to reduce barriers (Kawasaki, 2015; Li, Whalley, 2017) that constrain trade and economic interaction among sub-global economies, which, in turn, could lead to even greater interdependence among these economies (Auer, Mehrotra, 2014).

Another issue is ex-post estimation of long-term trade effects of APR integration on commodity markets resulting from globalization and regionalization processes. Gravity models, which have high explanatory power confirmed by a large number of empirical studies (Yotov et al., 2016), are mainly used to obtain such estimates. Despite the large number of works of integration processes in the APR carried out within the framework of this methodology, estimates of trade effects in them are mainly constructed for trade as a whole (Clarete et al., 2003; Athukorala, 2012), without disaggregation into commodity groups. Episodic estimates of integration effects of trade in primary and industrial goods in the APR have been obtained for Southeast (Okabe, Urata, 2014) and East (Pomfret, Sourdin, 2009) Asia interactions, groups of countries with multilateral trade agreements (Yang, Martinez-Zarzoso, 2014; Urata, Okabe, 2010), and certain countries in the subglobal region (Purwono et al., 2022). Estimates of the integration effects of trade in specific goods, predominantly primary ones (Lee et al., 2016), of certain APR countries are also widespread: agricultural products (Xu et al., 2023; Akhmadi, 2017); raw fish (Saputra, 2022); timber (Nasrullah et al., 2020); energy (Taghizadeh-Hesary et al., 2021) and industrial goods (Siahaan, Ariutama, 2021).

In general, ex-post estimates indicate a positive impact of trade agreements and the WTO accession by APR countries on the expansion of trade in the subglobal region. At the same time, the conclusions, based on such assessments, should be supplemented in a number of fundamental ways. First, assessments of the trade integration effects in the Asia-Pacific region were mainly based on earlier gravity models, which traditionally included the presence/absence of a trade agreement among the independent variables, along with physical distance, economic size and other factors. However, the assessment of gravity dependence has its own features when determining integration effects (Baier et al., 2019) as, due to endogeneity, it is incorrect to include the presence/absence of trade agreements among the independent variables along with distance, size of the economy, and key institutional indicators that can be accounted for in the fixed effects. Second, if we abstract from the problem of endogeneity, the estimates, obtained on the basis of early gravity models, indicate the presence of a general integration effect reflecting the manifestation of both regionalization and globalization processes, which is often interpreted as a direct effect of creating trade agreements. Third, as a rule, estimates of integration effects in the APR covered the time period up to the mid-2010s.

We should note that studies of trade integration using modern methodology of gravity dependence assessment (Dai et al., 2014; Piermartini, Yotov, 2016) usually do not consider sub-global regions, including the APR. Nevertheless, an earlier study (Izotov, 2020b) has proved that positive integration effects in the APR were generated mainly by the globalization process. From the point of view of determining the reason for the dominance of globalization over regionalization in the manifestation of positive integration effects in the APR, such estimates need to be supplemented, especially since today’s global economy faces the risks of escalating trade barriers (Afontsev, 2020). To this end, our study will assess the effects of trade integration in the APR at the level of aggregated commodity groups, namely industrial and primary goods, for the long-term period (1996–2021). The research is particularly relevant in terms of covering the pandemic period of the early 2020s due to the spread of COVID-19, which contributed to the short-term recession in the world economy that weakened the long-term positive integration effects in the APR.

As a result, the research involves the following tasks: 1) to study the integration processes in the Asia-Pacific region, as well as analyzing the dynamics of trade in primary and industrial goods in the sub-global region; 2) to select the methodology and forming the data set to obtain quantitative estimates; 3) to obtain a decompositional assessment of APR long-term integration effects on trade in general, industrial and primary goods.

Trade in primary and industrial goods and integration processes in the APR

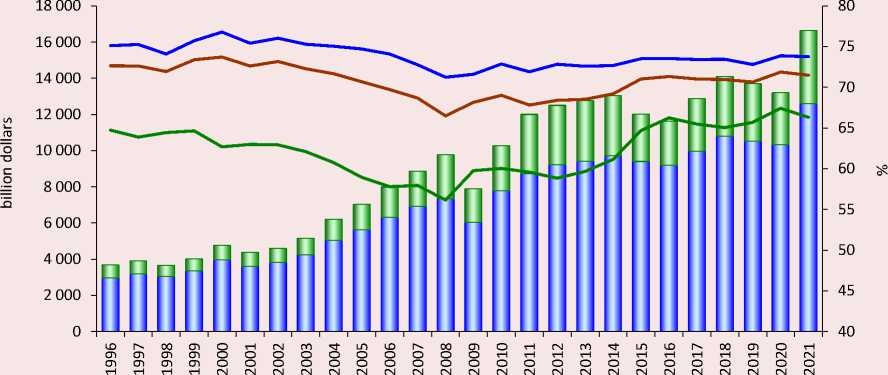

Within the period under consideration, intraregional trade in the APR increased from 3.6 trillion U.S. dollars in 1996 to 16.7 trillion U.S. dollars in 2021, markedly exceeding external trade with the rest of the world, which was 1.4 and 6.6 trillion U.S. dollars, respectively. Between 1996 and 2021, the share of APR countries’ trade with each other (intraregional trade) in their total foreign trade turnover averaged 71.0%. The share of APR intraregional trade in global trade reached 37.4% by 2021, an increase of more than 3 p.p. compared with 1996. In the long term, mutual trade in the Asia-Pacific region has been increasing at the expense of both industrial and primary goods ( Fig. 1 ).

Trade in industrial goods, as compared to primary ones, objectively prevailed in intra-regional trade in the APR, but its share declined slightly, from 75.1% in 1996 to 73.7% in 2021. However, after a period of decline in the 2000s, there has been an increase in the share of intraregional trade in manufactured goods in the APR since the early 2010s. Between 1996 and 2021, the main source of maintaining a high share of industrial goods trade among APR countries was commodity flows of intermediate goods for electronics and electrical and chemical products, indicating the leading role of trade between TNCs located in various countries of the subglobal region.

Figure 1. Industrial and primary goods: trade between APR countries, billion U.S. dollars (left axis) and trade share within the subglobal region, % (right axis)

■ ■ Industrial goods, billion dollars L J Primary goods, billion dollars

^^^^^^^» Industrial goods,% : Primary goods, %

^^^^^^^^MTrade in general, %

Source: UNCTAD and World Bank.

In the Asia-Pacific region, economies specializing in production of primary goods, whose exports were mainly oriented toward the countries of the subglobal region11, also received a boost. As a result, the share of primary goods in the total value of trade between APR countries averaged 21.0% over 1996–202112, increasing from 19.1% in 1996 to 24.0% in 2021. APR commodity trade was predominantly concentrated within the sub-global region. On average, the share of intra-regional APR commodity trade was 62.3% over the period under consideration, with an increasing trend since the early 2010s. By 2021, it reached 66.3%. The main source of growth of commodity trade within the APR was the turnover of non-food primary goods, whose share in intraregional commodity trade increased from 64.3% in 1996 to 72.9% in 2021, mainly due to energy and metal ores.

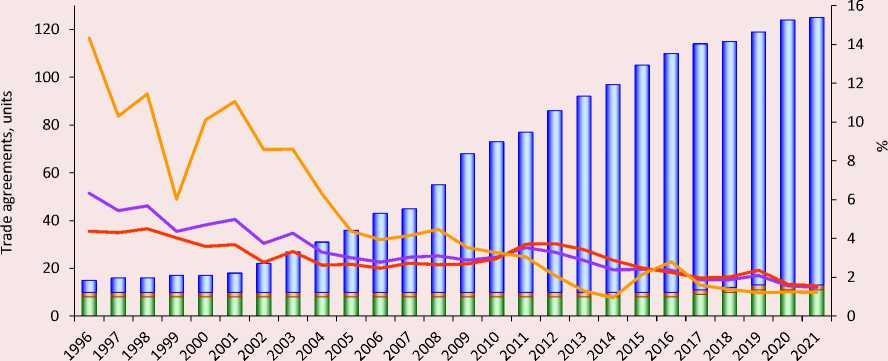

Lower trade barriers in the APR has intensified economic cooperation between the sub-global region and the global and sub-global economies since the second half of the 1990s. In the APR, trade agreements, usually FTAs in an expanded format (FTA+), began being actively concluded. As a result, 125 trade agreements were in operation in the APR by 2021: 11 FTAs, 112 FTAs, and 2 CU, of which 1, 106, and 0, respectively, were in the extended format ( Fig. 2 ).

The increase in the number of trade agreements, as well as countries’ accession to the WTO, contributed to the fact that the effective applied average weighted import duty on trade between APR

Figure 2. Number of trade agreements (left axis) and weighted average import duty in APR, % (right axis)

PTA

I-----1 FTA and FTA+

------Import duty (industrial goods), %

CU

------Import duty (total), %

------Import duty (primary goods), %

Note: we present values of effective applied weighted average import duty; the number of trade agreements is shown cumulatively

Source: WTO and World Bank.

economies decreased by more than four times by 2021 compared to 1996. In turn, in trade between Asia-Pacific countries, the value of the duty on industrial goods has fallen by almost three times, and on primary ones – more than 11 times13.

In addition to import duties, there have been concerted efforts to mitigate and limit various kinds of nontariff measures that constrain trade and economic ties between countries in the subglobal region. The APR concentrates most of the FTAs+ operating in the world (about 2/3 of their number), which regulate (Plummer, 2007) the reduction of barriers to trade flows (through clear rules of origin, accelerated customs procedures) as well as to FDI, service markets, technology; harmonization of state support measures to support competition and fair dispute resolution. These extended trade agreements complemented the WTO functions and contributed to trade and economic liberalization in the Asia-Pacific region (Kawai, Wignaraja, 2011).

Assessment methodology and data

Assessment methodology. To obtain correct assessment of long-term integration effects within the gravity model, it is necessary to estimate panel data with the method of Poisson quasi-maximum likelihood (Yotov et al., 2016), use interval panel data to adjust for changes in trade policy and other trade costs (Olivero, Yotov, 2012); and include trade in domestic market in the panel data (Anderson, Yotov, 2016). According to the recommendations (Baier, Bergstrand, 2007), time-independent variables should be accounted for in fixed affects for trading country pairs and dependent ones – for exporting/importing countries (Bacchetta et al., 2012).

As in this research with respect to aggregate trade flows (trade in general; primary goods; industrial goods), we construct the assessment for the long-term period (1996–2021), it is appropriate to identify both the direct and accumulated effects of trade agreements . The direct effect means the immediate impact of trade agreements on country’s trade. The accumulated effect makes it possible to assess the impact14 of previously concluded trade agreements on trade interactions. Decomposition of integration effects is made by separating contribution of the regionalization process (the effect of trade agreements) and contribution of the globalization process (the effect of globalization) from the overall integration process (overall integration effect).

Similar to earlier studies (Izotov, 2020b; Izotov, 2021), we use dependence to obtain estimates of the direct and accumulated effects of trade agreements (Piermartini, Yotov, 2016) as part of the overall integration process (1):

Xtj , t = exp[/? 0 + I^PkFTAti)t-u +

+ ^t + X j.t + F ij^ + ^ ij ,t , (1)

where: Xi j – export from country i to country j (this parameter also includes trade within country i, i.e. Xi j ): total value of goods, primary goods, industrial good; β 0 – constant; FTAi j – dummy variable reflecting the presence/absence of trade agreement between i and j ; n – number of lags; X P k — value of the accumulated effect of trade agreements; β 1 ( βk with zero lags) – value of the direct effect of trade agreements within overall integration process; πi – fixed effects for an export country taking into account the year; χ j – fixed effects for an import country taking into account the year; µi j – fixed effects for pairs of trading countries; t – time period.

To determine contribution of the regionalization process to the effect of the overall integration process, model (1) includes variables reflecting the presence of barriers between countries for each year (Bergstrand et al., 2015). The assessment can be obtained by including trade in domestic (internal) market in the array of data used. Then dependence (1) for assessing the accumulated effect of trade agreements within the regionalization process in transformed into the following form (2):

^ij,t = exp[/?0 + E^o&^Aj.t-n + (2) + 2r=i P-rlNTLQT^ij + 7Tj,t + Xj,t + №7] + £ij,t where: INTL(T )ij – dummy variable equal to one for international trade in each year T and zero – for internal trade; XPk — means of the accumulated effects of trade agreements and β1 ( βk with zero lags) – means of direct effects of trade agreements within the regionalization process. When assessing the INTL(T ) parameter some year is chosen as a benchmark in order to avoid correlation with other fixed effects.

Estimating (1) and (2) allows degerming changes (in %) in bilateral trade flows of countries with trade agreements based on the following formula : ([e ^FTA — 1] x 100), and reduction in the equivalent tariff burden: ([e ^тд /С!-®) - 1] x 100) 15, in which the elasticity of substitution ( θ ) is set exogenously. As a result, by subtracting the direct effect of a trade agreement from the total effect of integration, the contribution of the globalization process to the total effect of integration can be determined from the values of the effects reduced to a comparable form. Accordingly, the difference between the values of β 1 ( βk with zero lags) and XPk from (1) and (2) will reflect within the globalization process the direct and accumulated effects of trade agreements respectively.

15 For details, see (Yotov et al., 2016).

Assessment data. As we have already indicated, in order to estimate the direct effects of trade agreements, the panel should include trade in the domestic market (Anderson, Yotov, 2016). One of the ways to form an array of indicators reflecting trade in the domestic market is to calculate the difference between the value of goods produced in the national economy and exports (Bergstrand et al., 2015; Yotov et al., 2016). In our study, we have obtained the necessary components for calculating this indicator from special statistical databases: CEPII; CEIC; UNIDO, FAO (UN), as well as economic and statistical agencies of several APR countries.

The sources of statistical data of mutual export between APR countries are UNCTAD (UN) and the World Bank data base. However, a restriction to the inclusion of all APR countries and economic territories in the evaluated panel is the absence for some of them of statistics describing trade in goods in the internal market. As a result, the evaluated panel includes 36 APR economics16.

Division of the trade data set into the flows of primary and industrial goods was carried out by differentiating commodity groups within the framework of the ISIC17 (2nd version) classification, which is used to reflect the statistics of intracountry trade. APR export statistics, reflected in the SITC classification in FOB prices, have been translated in the ISIC classification, based on algorithms developed (Muendler, 2009).

Primary goods included products of agriculture (ISIC code 11); products of forestry (code 12); products of fishing (code 13); coal mining (code 21); oil, natural gas (code 22); metal ore mining (code 23); products of other mining industries (code 29). Industrial goods included products of food industry (code 31); products of light industry (code 32); products of woodworking industry (code 33); products of pulp and paper industry, printing and publishing industry (code 34); products of chemical and petrochemical industry (code 35); nonmetallic mineral products (code 36); products of metallurgical industry (code 37); products of metalworking industry, machine building and equipment manufacturing (code 38); The manufacture of electricity (code 4101) was also included under manufacturing products, since this commodity is traded between some APR countries that share a common land border.

In accordance with these recommendations, we present the final set of indicator values in the form of intervals (lag – five years): 1996, 2001, 2006, 2011, 2016 and 2021, covering 7,620 observations on APR trade, including primary and industrial goods. The value indicators of APR trade have been reported in billions of dollars and, as recommended (Bacchetta et al., 2012), in current prices.

As for the dummy variable, to assess the integration effects as trade agreements, we used only data on the presence or absence of CU, FTA, and FTA+ that have entered into force (Dai et al., 2014) based on the WTO18 database. As a result, we selected 114 APR trade agreements in FTA, FTA+, and CU formats to form dummy variables19.

Russia is one of APR countries and is considered in the panel as of the key elements of the subglobal economies. Based on the comparison with APR general trends, used in the current research, the methodology for assessing integral effects allows indirectly determining for Russian economies possible long-term benefits of lower barriers with the countries of the sub-global region within various commodity markets.

Integral processes can differently influence on trade and economic systems. All things being equal, lower barriers contribute to trade development based on positive effects of export specialization. Otherwise, if we are talking, for instance, about “closed” trade and economic block with a small market, trade diversion effect, i.e. a shift in demand for more expensive products of this association, may exceed the effect of trade creation, thereby inhibiting effective development of the foreign trade and consumer sectors of the national economy. Accordingly, the resulting estimates can indicate whether integration promotes trade among APR countries.

Assessment result

At the first stage, we assess the effect of trade agreements as part of the overall integration process (1) on trade in the APR as a whole, as well as on trade in primary and industrial goods (Tab. 1) .

As part of the overall integration process in the APR, the assessment of trade agreements indicates that trade in primary goods has generally developed more than trade in industrial goods in the sub-global economy. Moreover, direct effect of trade agreements ( FTA ) has increased over the long term through the direct effect on ongoing trade interactions of already functioning trade agreements, as reflected in the accumulated effect ( FTAcumul ) of their conclusion.

At the second stage, with the inclusion of additional dummy variables for INTL(T) crosscountry trade in the model, we estimated the direct and accumulated effects of trade agreements for

Table 1. Assessment results of the effects of trade agreements as part of overall integration process in the APR on model (1)

|

Variable |

Trade in general |

Primary goods |

Industrial goods |

|

FTA |

0.17* (0.04) |

0.21* (0.06) |

0.13* (0.04) |

|

FTA t-5 |

0.10** (0.04) |

0.002 (0.07) |

0.12* (0.05) |

|

FTA t-10 |

-0.02 (0.04) |

0.18* (0.06) |

-0.08** (0.04) |

|

FTAt-15 |

0.14* (0.04) |

0.20* (0.07) |

0.17* (0.04) |

|

FTA t-20 |

0.22* (0.05) |

0.56* (0.07) |

0.11* (0.04) |

|

FTAcumul |

0.61* (0.05) |

1.15* (0.10) |

0.44* (0.05) |

|

Constant |

-11.50* (0.45) |

-6.97* (0.37) |

-11.72* (0.42) |

|

Number of observations |

7620 |

7236 |

7620 |

|

Pseudo log-likelihood |

-5864 |

-2127 |

-5260 |

|

RESET-test (Prob > chi2) |

0.07 |

0.07 |

0.07 |

|

Pseudo R2 |

0.99 |

0.99 |

0.99 |

|

Note: * p < 0.01, ** p < 0.05, *** p < 0.1. The values of standard errors are given in parenthesis. FTAcumul corresponds ∑ β k in (1), i.e. the values of the accumulated effects of trade agreements in the overall integration process. FTA is a direct effect of trade agreements. Hereinafter, for the sake of brevity, we do not give estimates of fixed effects. Source: own compilation. |

|||

three APR trade flows as part of the regionalization process: trade in general; trade in primary goods; and trade inindustrial goods ( Tab. 2 ).

The assessment proved that the impact of trade agreements on trade in primary goods was not statistically significant in the regionalization process. It indicated that the development of trade in primary goods within the APR was not determined by the direct effect of trade agreements. In some way, this fact explains the reluctance to expand trade agreements with other countries of the sub-global economy a number of APR countries, including Russia, which exports mainly raw materials. Moreover, import of primary goods (except some agricultural products) were subject to low rates of duty in most APR countries, and their containment in some cases was explained by conjunctural and noneconomic factors.

In accordance with calculations of the regionalization process, the positive effect of trade agreements in the APR was determined for trade in industrial goods. The positive accumulated effect ( FTAcumul ) in trade in industrial goods was obtained by increasing the direct effect of trade agreements (FTA) due to lag components. This estimate for industrial goods confirms the importance of

Table 2. Assessment results of the effects of trade agreements as part of regionalization process on the model (2)

|

Variable |

Trade in general |

Primary goods |

Industrial goods |

|

FTA |

0.11** |

-0.03 |

0.14* |

|

(0.05) |

(0.07) |

(0.05) |

|

|

FTA t-5 |

-0.004 |

-0.17* |

0.04 |

|

(0.03) |

(0.07) |

(0.04) |

|

|

FTAt-10 |

-0.07** |

0.05 |

-0.09* |

|

(0.03) |

(0.07) |

(0.04) |

|

|

FTAt-15 |

0.09** |

-0.02 |

0.13* |

|

(0.04) |

(0.06) |

(0.04) |

|

|

FTA t-20 |

0.12** |

-0.01* |

0.10*** |

|

(0.06) |

(0.08) |

(0.06) |

|

|

FTAcumul |

0.25** |

-0.19 |

0.32* |

|

(0.12) |

(0.19) |

(0.11) |

|

|

INTL 1996 |

-0.49* |

-0.94* |

-0.35* |

|

(0.09) |

(0.12) |

(0.08) |

|

|

INTL 2001 |

-0.28* |

-0.89* |

-0.13*** |

|

(0.08) |

(0.10) |

(0.07) |

|

|

INTL 2006 |

-0.26* |

-1.09* |

-0.08 |

|

(0.06) |

(0.08) |

(0.05) |

|

|

INTL 2011 |

-0.31* |

-0.77* |

-0.20* |

|

(0.04) |

(0.07) |

(0.04) |

|

|

INTL 2016 |

-0.30* |

-0.25* |

-0.28* |

|

(0.02) |

(0.03) |

(0.03) |

|

|

Constant |

-11.20* |

-6.23* |

-12.01* |

|

(0.38) |

(0.46) |

(0.40) |

|

|

Number of observations |

7620 |

7236 |

7620 |

|

Pseudo log-likelihood |

-5727 |

-2084 |

-5168 |

|

RESET-test (Prob > chi2) |

0.99 |

0.90 |

0.99 |

|

Pseudo R2 |

0.99 |

0.99 |

0.99 |

|

Note: * p < 0.01, ** p < 0.05, *** p < 0.10. The values of standard errors are given in parenthesis. Base year for variable INTL is 2021. |

|||

|

FTAcumul corresponds ∑ β k in (2), i.e. the value of the accumulated effect of trade agreements within the regionalization process. FTA is a direct effect of trade agreements. Source: own compilation. |

|||

trade agreements for expanding trade in the APR in both final demand goods and intermediate goods in functioning production chains of TNCs. In addition, we can assume that the East Asian economies, as well as North America, which are the “core” economies of the APR and specialize in industrial goods, have co-developed in order to increase trade in primary goods with other countries, even outside the framework of trade agreements with them.

Before proceeding to a decompositional assessment of the effects of trade agreements, we should pay attention to the reduction of barriers to trade in the APR as a whole, judging by the values of INTL(T) dummy intercountry trade variables for the relevant years. It is likely that due to the accession of the Asia-Pacific countries to the WTO, the process of globalization has, to some extent, helped curb the growth of trade barriers to trade in the Asia-Pacific as a whole. At the same time, different trends in trade flows were observed: for primary goods, reduction of trade barriers; for industrial goods from the second half of the 2010s there was a noticeable increase in barriers, indicating rather a process of fragmentation of the APR trade and economic space, which could be caused by China’s confrontation with some countries of the sub-global region, and by the effects of the COVID-19 pandemic in 2021, which caused some transformation of production and logistics interrelations between countries (Zagashvili, 2022).

Finally, at the third step, we assessed the contribution of regionalization and globalization effects to the overall integration effect in the APR for the analyzed trade flows. The overall integration effect exceeded the regionalization effect, as revealed by the ratio of estimates (Tab. 1, 2) both for trade in general and for trade in primary and industrial goods. To decompose the effects of trade agreements in the APR, it is necessary to make them comparable. The accumulated integration effect coefficients reflected in Tables 1 and 2 for analyzed APR trade flows can be presented as changes in mutual trade, as well as in the form of the tariff equivalent of barriers to trade ( Tab. 3 ).

Direct effect of trade agreements . The direct effect of trade agreements in the APR contributed to an increase in trade: overall, by 18.5%; in primary goods, by 23.6%; and in industrial goods, by 13.6%. The reduction of tariff barriers amounted to 4.2 p.p., 5.2 p.p. and 3.1 p.p., respectively.

Table 3. Decomposing integration effects on trade flows in the APR

|

Trade flow |

Integration process |

Direct effect |

Accumulated effect |

||||

|

1 |

2 |

3 |

1 |

2 |

3 |

||

|

Trade in general |

overall integration process |

18.5 |

100.0 |

-4.2 |

84.7 |

100.0 |

-14.2 |

|

regionalization process |

12.1 |

65.4 |

-2.8 |

28.3 |

33.4 |

-6.0 |

|

|

globalization process |

6.4 |

34.6 |

-1.3 |

56.4 |

66.6 |

-8.2 |

|

|

Primary goods |

overall integration process |

23.6 |

100.0 |

-5.2 |

214.4 |

100.0 |

-24.9 |

|

regionalization process |

– |

– |

– |

– |

– |

– |

|

|

globalization process |

23.6 |

100.0 |

-5.2 |

214.4 |

100.0 |

-24.9 |

|

|

Industrial goods |

overall integration process |

13.6 |

100.0 |

-3.1 |

55.3 |

100.0 |

-10.4 |

|

regionalization process |

14.9 |

109.6 |

-3.4 |

37.4 |

67.6 |

-7.6 |

|

|

globalization process |

-1.3 |

-9.6 |

0.3 |

17.9 |

32.4 |

-2.8 |

|

|

Note: 1 – change in mutual trade, %; 2 – contribution of globalization and regionalization effects to overall integration effect, %; 3 – decomposition of the tariff equivalent of barriers to trade, %, when θ = 5. Globalization effect is estimated as the difference between the overall integration effect and regionalization effect. Since the estimates (see Tab. 2) for primary goods in the regionalization process were not statistically significant, they were not used for the purpose of decomposing the trade integration effects. Source: own compilation. |

|||||||

According to the estimate, the direct effect of trade agreements was generated by different processes: for industrial goods – regionalization; for primary ones – globalization. In this case, the globalization process did not increase trade in industrial goods among APR countries, and the regionalization process did not increase trade in primary goods. To put it differently, the estimates point to the greater importance of the regionalization process precisely for countries specializing in exports of industrial goods to the APR than for countries exporting primarily primary goods. Since the analysis includes the year 2021, in which COVID-19-related restrictions were active, we can assume that the impact of the globalization process, which previously stimulated trade in industrial goods in the APR, may have been slightly distorted in estimating the direct effect of integration.

Accumulated effect of trade agreements. An assessment of the accumulated effect on trade in the APR as a whole indicated a markedly greater long-term positive effect of trade agreements on trade interactions, contributing to an increase in trade: overall, by 84.7%; for primary goods, by 214.4%; and for industrial goods, by 55.3%. Tariff barriers ended up decreasing by 14.2 p.p., 24.9 p.p., and 10.4 p.p., respectively. In contrast to the direct effect, the accumulated effect for trade in the APR as a whole was generated by the globalization process, whose contribution to the increase in trade was 2/3 and regionalization 1/3. As for primary goods, the accumulated effect of trade agreements in the APR was determined solely by the globalization process. Based on the accumulated effect values obtained, trade in manufactured goods in the APR in the long run was predominantly determined by the regionalization process (contribution of 67.6%), while the contribution of globalization was also notable at 32.4%. Despite the fact that the contribution of the globalization process to increased trade was dominant in the decomposition of the accumulated effect of trade agreements, nevertheless, in the long term, the development of commodity exchange in the APR was stimulated by lower barriers due to trade agreements in the sphere of trade in industrial goods in the context of the regionalization process. This fact has noticeably stimulated trade in primary goods, as well as some industrial goods in the APR, based on functioning globalization mechanisms that guarantee non-discrimination to importers under the most-favored-nation treatment.

Conclusion

Over the previous three decades, trade among Asia-Pacific countries has increased markedly due to the lower barriers to trade cooperation, the accession of almost all countries in the subglobal region to the WTO, and the creation of a network of concluded trade agreements, including those in an extended format. Over the long term, intra-regional trade of Asia-Pacific countries greatly exceeded their trade with the rest of the world, both in industrial and primary goods. Trade in industrial goods is fundamental to APR intraregional trade, accounting for slightly less than 3/4 of its volume on average over 1996–2021. The main role in maintaining high values of trade in industrial goods was played by intermediate commodity flows between TNC enterprises located in various APR countries. In addition, intraregional trade in primary goods received a positive impetus in the Asia-Pacific region, and its share increased markedly over the long term, mainly due to mineral products.

The resulting decomposition estimates of APR trade flows indicated that, over the long term, trade agreements stimulated the expansion of most trade in industrial goods, reinforcing the regionalization processes in the subglobal economy. In addition, trade in primary goods and partly industrial ones was generated solely by globalization, which complements earlier conclusions (Izotov, 2020b)

about the nature of the integration process in the APR. From this point of view, there is no intraregional integration effect in the APR, which, all other things being equal, would limit trade in primary goods for countries that do not enter into trade agreements in the long run. This circumstance explains to some extent the reluctance of a number of primary goods exporting countries, including Russia, to expand trade agreements with other APR states.

The globalization process associated with the accession of APR countries to the WTO also contributed to the expansion of trade in industrial goods, with the production and technological chains within the vertical trade of TNCs successfully operating mostly within the framework of concluded trade agreements. Apparently, the regionalization process in the APR, while stimulating most trade in industrial goods, has to some extent expanded opportunities for trade in commodities within the sub-global region, contributing also to the growth of exports of a certain share of industrial goods to APR countries that are not party to trade agreements. These estimates suggest that the main long-term benefits of APR integration have accrued to the countries included in the production and technological chains within the framework of trade in industrial goods.

As a result, the overall positive integration effect in the APR in the long run was manifested through the “synergy” of regionalization and globalization, with the latter apparently dominating. At the same time, the direct effect of trade agreements indicated the exhaustion of the globalization process as a “driver” for increasing trade in industrial goods in the APR, which has rather serious effects related to the growing competition between country groupings and the fragmentation of the sub-global region, which has begun showing in recent years when large trade and economic integration formats are created.

During the period under analysis, Russia did not implement a strategy to join the integration processes of the sub-global region by expanding trade agreements with Asia-Pacific countries. Russia’s long-term focus on the European market for its raw materials exports and strong economic ties with the European Union until 2022 have contributed to the fact that the APR market has been secondary for Russia, being limited to the largest economies of Northeast Asia (NEA): People’s Republic of China, Japan, and the Republic of Korea. There was no demand for more complex forms of trade and economic relations with APR countries on the Russian side. Exporting mainly low-value-added products to the Asia-Pacific market, the value volumes of which were small compared with exports to the European market, Russia made do with globalization mechanisms, especially in the context of its accession to the WTO, access to some trade platforms in the APR and taking a small share of the Northeast Asian commodities market20. On the other hand, due to the high risks of economic activity in Russia, there was no targeted commodity and geographic diversification of commodity exports as in Chile, Australia, New Zealand and Canada (Izotov, 2020a). This circumstance has also not contributed to the generation of demand in Russia for integration as part of a strategy to expand the scope of trade agreements concluded with APR countries. Consequently, the chance for Russia to build a more diversified economy through its neighborhood with APR countries in the analyzed period was to some extent lost, not allowing it to mitigate the current effects of the gap with the European market. As a result, it has to face monopsony on the part of China, as well as indifferent observation of the fragmentation of the Asia-Pacific trade and economic space.

An important result of this study is that there have been no attempts to create a “closed trade bloc” in the APR, the effect of which could be extended to the commodities that are the basis of Russian exports. However, it cannot be ruled out that as the contradictions between leading APR countries in trade in manufactured goods (the U.S.–Chinese confrontation) grow, a quite deliberate process of concluding long-term contracts for the supply of primary goods produced and traded within the framework of integration associations in the sub-global region may begin. From this point of view, given the current instability of foreign policy processes in the APR, the introduction of various kinds of restrictions, including in certain emergency situations, may lead to the fact that the previously seemingly rather stable structure of trade and economic relations in the subglobal region may be transformed, manifesting itself in the redistribution of previously accumulated benefits from integration for APR countries.

Список литературы Trade effects in the commodity markets of the Asia-Pacific region

- Afontsev S.A. (2020). Politics and economics of trade wars. Zhurnal novoi ekonomicheskoi assotsiatsii=Journal of the New Economic Association, 1, 193–198. DOI: 10.31737/2221-2264-2020-45-1-9 (in Russian).

- Akhmadi H. (2017). Assessment the impact of ASEAN free trade area (AFTA) on exports of Indonesian agricultural commodity. AGRARIS: Journal of Agribusiness and Rural Development Research, 3, 9–14. DOI: 10.18196/agr.3139

- Anderson J.E., Yotov Y.V. (2016). Terms of trade and global efficiency effects of free trade agreements, 1990–2002. Journal of International Economics, 99, 279–298. DOI: 10.1016/j.jinteco.2015.10.006

- Arndt H.W. (1993). Anatomy of regionalism. Journal of Asian Economics, 4, 271–282. DOI: 10.1016/1049-0078(93)90043-C

- Athukorala P. (2012). Asian trade flows: Trends, patterns and prospects. Japan and the World Economy, 24, 150–162. DOI: 10.1016/j.japwor.2012.01.003

- Auer R.A., Mehrotra A. (2014). Trade linkages and the globalization of inflation in Asia and the Pacific. Journal of International Money and Finance, 49, 129–151. DOI: 10.1016/j.jimonfin.2014.05.008

- Bacchetta M. et al. (2012). A Practical Guide to Trade Policy Analysis. WTO and UNCTAD co-publication. Available at: https://www.wto.org/english/res_e/publications_e/wto_unctad12_e.pdf

- Baier S.L., Bergstrand J.H. (2007). Do free trade agreements actually increase members’ international trade? Journal of International Economics, 71, 72–95. DOI: 10.1016/j.jinteco.2006.02.005

- Baier S.L., Yotov Y.V., Zylkin T. (2019). On the widely differing effects of free trade agreements: Lessons from twenty years of trade integration. Journal of International Economics, 116, 206–226. DOI: 10.1016/j.jinteco.2018.11.002

- Baldwin R. (2016). The world trade organization and the future of multilateralism. Journal of Economic Perspectives, 30, 95–116. DOI: 10.1257/jep.30.1.95

- Balistreri E.J., Tarr D.G. (2020). Comparison of deep integration in the Melitz, Krugman and Armington models: The case of the Philippines in RCEP. Economic Modelling, 85, 255–271. DOI: 10.1016/j.econmod.2019.05.023

- Bergstrand J.H., Larch M., Yotov Y.V. (2015). Economic integration agreements, border effects, and distance elasticities in gravity equations. European Economic Review, 78, 307–327. DOI: 10.1016/j.euroecorev.2015.06.003

- Clarete R., Edmonds C., Wallack J.S. (2003). Asian regionalism and its effects on trade in the 1980s and 1990s. Journal of Asian Economics, 14, 91–129. DOI: 10.1016/S1049-0078(02)00242-7

- Dai M., Yotov Y.V., Zylkin T. (2014). On the trade-diversion effects of free trade agreements. Economic Letters, 122, 321–325. DOI: 10.1016/j.econlet.2013.12.024

- Ethier W.J. (1998). Regionalism in a multilateral world. Journal of Political Economy, 106, 1214–1245. DOI: 10.1086/250045

- Izotov D.A. (2020). Ekonomicheskaya integratsiya Rossii so stranami ATR: problemy i perspektivy [Russia’s Economic Integration with Asia-Pacific Countries: Problems and Prospects]. Khabarovsk: IEI DVO RAN.

- Izotov D.A. (2020). The effects of Asia-Pacific countries’ trade integration in the context of globalization and regionalization. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 13(4), 91–107. DOI: 10.15838/esc.2020.4.70.5 (in Russian).

- Izotov D.A. (2021). Trade integration in the Asia-Pacific region: Decomposition of effects. Prostranstvennaya ekonomika=Spatial Economics, 17(1), 66–96. DOI: 10.14530/se.2021.1.066-096 (in Russian).

- Kawai M., Wignaraja G. (2011). Asian FTAs: Trends, prospects and challenges. Journal of Asian Economics, 22, 1–22. DOI: 10.1016/j.asieco.2010.10.002

- Kawasaki K. (2015). The relative significance of EPAs in Asia-Pacific. Journal of Asian Economics, 39, 19–30. DOI: 10.1016/j.asieco.2015.05.001

- Lakatos C., Walmsley T. (2012). Investment creation and diversion effects of the ASEAN–China free trade agreement. Economic Modelling, 29, 766–779. DOI: 10.1016/j.econmod.2012.02.004

- Lee S.M., Radziah A., Ku’Azam T.L. (2016). Gravity model on a single commodity: A review of literature. Management Research Journal, 6, 32–39. DOI: 10.1016/j.asieco.2009.02.001

- Li C., Whalley J. (2017). How close is Asia already to being a trade bloc? Journal of Comparative Economics, 45, 847–864. DOI: 10.1016/j.jce.2016.08.001

- Muendler M.-A. (2009). Converter from SITC to ISIC. University of California, San Diego, CESifo and NBER. Available at: https://econweb.ucsd.edu/muendler/docs/conc/sitc2isic.pdf

- Nasrullah M., Chang L., Khan K. (2020). Determinants of forest product group trade by gravity model approach: A case study of China. Forest Policy and Economics, 113, 102–117. DOI: 10.1016/j.forpol.2020.102117

- Okabe M., Urata S. (2014). The impact of AFTA on intra-AFTA trade. Journal of Asian Economics, 35, 12–31. DOI: 10.1016/j.asieco.2014.09.004

- Olivero M.P., Yotov Y.V. (2012). Dynamic gravity: Endogenous country size and asset accumulation. Canadian Journal of Economics, 45, 64–92. DOI: 10.1111/j.1540-5982.2011.01687.x

- Piermartini R., Yotov Y.V. (2016). Estimating trade policy effects with structural gravity. WTO Working Papers, 2016/10. DOI: 10.30875/2d235948-en.

- Plummer M.G. (2007). Best practices in regional trading arrangements: An application to Asia. The World Economy, 30, 1771–1796. DOI: 10.1111/j.1467-9701.2007.01061.x

- Pomfret R., Sourdin P. (2009). Have Asian trade agreements reduced trade costs? Journal of Asian Economics, 20, 255–268. DOI: 10.1016/j.asieco.2009.02.007

- Purwono R., Sugiharti L., Handoyo R.D., Esquivias M.A. (2022). Trade liberalization and comparative advantage: Evidence from Indonesia and Asian trade partners. Economies, 10. DOI: 10.3390/economies10040080

- Saputra P.M.A. (2022). Bilateral trade and spatial interdependence relevance: An analysis for tuna commodity in ASEAN+2 countries. Journal of Asia-Pacific Business, 23, 142–160. DOI: 10.1080/10599231.2022.2065565

- Siahaan M., Ariutama I.G.A. (2021). The impact of regional FTA on export of manufactured goods: The implementation of gravity model in Indonesia. Jurnal Ekonomi dan Studi Pembangunan, 13, 100–111. DOI: 10.17977/um002v13i22021p100

- Smirnov E.N., Luk’yanov S.A. (2022). International political economy of preferential trade agreements. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 66(5), 32–40. DOI: 10.20542/0131-2227-2022-66-5-32-40 (in Russian).

- Taghizadeh-Hesary F., Rasoulinezhad E., Yoshino N., Sarker T. (2021). Determinants of the Russia and Asia-Pacific energy trade. Energy Strategy Reviews, 38, 100681. DOI: 10.1016/j.esr.2021.100681

- Urata S., Okabe M. (2010). Trade creation and diversion effects of regional trade agreements on commodity trade. RIETI Discussion Paper Series, 10-E-007. Available at: https://www.rieti.go.jp/jp/publications/dp/10e007.pdf

- Xu H., Nghia D.T., Nam N.H. (2023). Determinants of Vietnam’s potential for agricultural export trade to Asia-Pacific economic cooperation (APEC) members. Heliyon, 9, e13105. DOI: 10.1016/j.heliyon.2023.e13105

- Yang S., Martinez-Zarzoso I. (2014). A panel data analysis of trade creation and trade diversion effects: The case of ASEAN-China free trade area. China Economic Review, 29, 138–151. DOI: 10.1016/j.chieco.2014.04.002

- Yotov Y.V., Piermartini R., Monteiro J.-A., Larch M. (2016). An Advanced Guide to Trade Policy Analysis: The Structural Gravity Model. United Nations and World Trade Organization, 2016. Available at: https://www.wto.org/english/res_e/booksp_e/advancedwtounctad2016_e.pdf

- Zagashvili V.S. (2022). Economic globalization and regional integration in the post-covid era. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 66(4), 5–13. DOI: 10.20542/0131-2227-2022-66-4-5-13 (in Russian).