What hinders the development of small businesses: the view of the Murmansk oblast entrepreneurs

Автор: Barasheva Tatyana Igorevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 3 (33) т.7, 2014 года.

Бесплатный доступ

In recent years there has been a slowdown in the growth rate of Russia's sector of small and medium entrepreneurship; this issue once again brings to the fore the search for new ways and mechanisms in the management of its subjects. A necessary condition for such a search consists in focusing on the problems that hinder the development of this sector and that can be revealed exclusively in the formation of valuable and accurate information - the collective views of its representatives. In this regard, the information base for the analysis was found in the results of several studies initiated by the all-Russian public organization “OPORA Rossii” (Moscow), its regional branch in Murmansk and the Northern Chamber of Commerce and Industry; the results were obtained in the course of the questionnaire survey, which was conducted among entrepreneurs with the purpose of revealing their assessment of the terms of doing business. The generalization of the research results and information obtained by the author in cooperation with representatives of small business and workers of the Prosecutor's Office has identified the main problems, their causes and consequences of their impact on the activity of the Murmansk Oblast business sector...

Small and medium enterprises, business climate, factors impeding the development of small and medium business

Короткий адрес: https://sciup.org/147223592

IDR: 147223592 | УДК: 334.012.64(470.21) | DOI: 10.15838/esc/2014.3.33.11

Текст научной статьи What hinders the development of small businesses: the view of the Murmansk oblast entrepreneurs

This situation is revealed in the research initiated by the all-Russian public organization “Support of Russia” (OPORA Rossii). It is aimed to identify the quality of business climate in Russian regions [7]. The participants of the research are 6000 Russian owners and managers of small and medium business in 40 Russian regions. The result is the following: the determining factor for starting business is not its low cost.

The representatives of Russian small business, survey respondents, consider such significant obstacles to set up and further develop new small and medium enterprises as a small number of qualified staff, decline of demand, low availability of financial resources, corruption, etc. (tab. 1) . And if the acuteness of the problems, associated with slump in demand and low availability of financial resources, has decreased slightly in Russia by 2012, the selection of personnel with the required qualifications is of most concern among entrepreneurs. This situation is typical for most RF subjects, including the Murmansk Oblast.

According to this survey, 37% of the representatives of small and medium enterprises in the Murmansk Oblast have mentioned the low availability of the staff, 62% of them have had problems in hiring qualified employees, 20% of them claim that it that is almost impossible to employ workers with required skills. At the same time, 56% of the respondents lack engineers and technical specialists, 18% do not try to look for them.

Table 1. Obstacles to the development of small and medium entrepreneurship in the Russian Federation (as a percentage of number of respondents)

Obstacle 2011 2012 Shortages in “the personnel of the required qualification” in the labor market 43 47 Slump in demand 33 18 Low availability of financial resources 30 22 Corruption deters development of small enterprises 13 8 High level of social payments 0 36 Compiled by the author on the basis of: Chto meshaet predprinimatelyam v Rossii [What Interferes with Entrepreneurs in Russia]. Available at:

Qualification mismatch between demand and supply of labor force in the regional labor market is longtime and acute [2, p. 76]. One of the reasons is that the vacancies structure, submitted to the employment center by employers, is not stable. So, once the greatest number of workers was required at the enterprises dealing with real estate transactions. Nowadays, the largest number of workers is required in trade and mineral resources production, a bit lesser number of employees – in enterprises dealing with property operations, institutions of the health care sector and manufacturing industries.

What is more, disparities in distribution of productive forces and specificity of economic entities’ activity can also increase the enterprises’ demand for qualified personnel with the overall labor surplus in the labor market of municipalities. For instance, in the city of Murmansk the employer announced 343 vacancies of fish processing workers, 104 people applied for it, only 39 people were hired as the rest did not have the necessary qualification [10].

The severity of this problem has not been reduced even due to establishment of higher and secondary educational institutions in urban areas during the period of market transformations. Thus, the share of graduates from institutions of higher education and secondary professional education in the Murmansk Oblast exceeds 70%, primary vocational education – 30%. Eighty percent of the vacancies announced at the employment service are blue-collar occupations, 20% – white-collar. These data suggest that the system of professional education continues to increase training in unclaimed specialties [5]. The lack of efficient state policy at the stage of young personnel training leads to discrepancy between the qualification structure of graduates and the requirements of the economy and the composition of existing vacancies.

Another obstacle for the Murmansk Oblast entrepreneurs to do business is low availability of financial resources (for 34% of respondents), especially concerning “long money”. More than half of the respondents argue that long-term loans

-

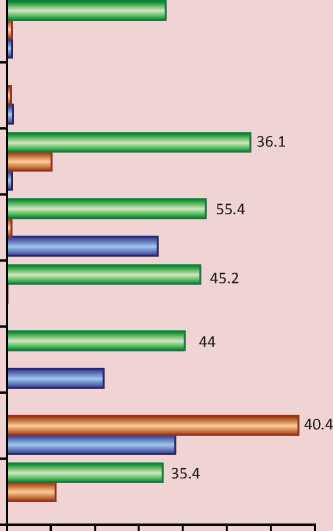

Figure 1. Investment structure and the degree of depreciation of fixed assets of small and medium enterprises of the Murmansk Oblast by types of economic activity, %

Сommercial, social services

Health and social services

]

Operations with real estate, rent

Transport and communications

Hotels and restaurants

Manufacturing

Fishing, fish farming

Agriculture, hunting and forestry

Construction

Wholesale and retail trade; repair of motor vehicles

Production and distribution of electricity, gas and water

0,0 10,0 20,0 30,0 40,0 50,0 60,0 70,0

-

□ Degree of wear of fixed assets in the NWFD, % Investments in medium enterprises, %

-

□ Investments in small enterprises, %

Sources: Regiony Rossii. Sotsial’no-ekonomicheskie pokazateli. 2011: stat. sb. [The Regions of Russia. Socio-Economic Indicators. 2011: Statistical Digest]. Rosstat. Moscow, 2011. 990 p.

are difficult to obtain, and 23% consider it almost impossible, though small business requires them. On the background of high depreciation of the active part of fixed assets of small and medium enterprises (fig. 1) (its level is critical for certain types of economic activity) [4, p. 58], the investment amount in small and medium businesses remains low. The Murmansk Oblast ranks 69th among the RF regions in terms of amount of investments in fixed capital of small enterprises, calculated per capita [8].

Due to the fact that a larger number of regional entrepreneurs are involved in the wholesale and retail trade, over 60% of the respondents mention the constant need for working capital, considering bank loans a possible source of its replenishment. However, despite the fact that a bank loan is a convenient tool to increase working capital, its high cost and limited term of use make this type of funding inaccessible for business. And the banks themselves are not actively involved in this process due to nontransparency of small business and the lack of bid security. The first statement does not give a bank an objective assessment of a potential borrower from the point of view of viability and profitability of its business, the second one raises credit risks. That is why, credit institutions prefer lending to individuals, rather than to small and medium enterprises [11].

To encourage financial institutions to extend credit to small business the authorities use various mechanisms of state regulation, such as funds of small business support, target programs developed at the regional level [1, p. 80] and other mecha-nisms, ensuring subsidizing of expenses and provision of state guarantees. State guarantees reduce banking risks and the system of subsidizing of interest rates facilitates the access of small businesses to credit resources [3].

Thus, the data of the Ministry of Economic Development of the Murmansk Oblast give an opportunity to assess the extent of implementation of the subsidy system in the region. In 2010 the largest share (82.8%) in the structure of subsidized contracts accounted for subsidizing of lending expenses (loans, credit lines). The interest rates of loans taken out to implement investment projects are refunded. However, in 2011 the share of contracts to repay loans decreased by 30%. In 2012, agreements for subsidizing of financial rent (leasing) started to prevail in terms of leasing percent payment and downpayment (advance payment) when equipment is provided under leasing agreements; the share of these contracts reached 80.5% of the total amount of concluded contracts.

The attention should be paid to the fact that there are 6934 micro-, small and medium enterprises, more than 17 thousand individual entrepreneurs, but a small number of entrepreneurs get subsidies becomes. In 2010 one hundred and three applications were processed and ninety-six of them were approved, in 2011 there were one hundred and forty applications and all of them were satisfied. Taking into account the stated above, we can conclude that the subsidy system, implemented in the region, has not become very popular among small businesses, and its limited scope is unable to change the situation with the current deficit of investment resources and significant depreciation of capital assets.

The businessmen of the region also mention such problems as: low availability of land plots, industrial and warehouse premises (according to 15% of the respondents); low availability of new energy capacities and high electricity rates (13%).

According to 39% of the respondents, it is difficult to select land plots and real estate, while 15% consider it extremely complicated or impossible due to the high cost of land, high rentals and corruption in the allocation of land plots. Seventy-five percent of enterprises find it troublesome to get connection to energy capacities; 45% state that it is practically impossible due to the high cost of operations, technological challenges, as well as the spread of corruption in this sphere.

Thus, although the region has developed and adopted the programs to support entrepreneurship and small business is aware of their implementation (according to 71% of the respondents), only 3% of the entrepreneurs have participated in state programs and 1% – in municipal programs.

The author’s personal contacts with the representatives of small and medium business have helped to indicate the reasons for entrepreneurs’ low involvement in state support programs. They are the following: uncertainty in achieving the result; a great number of documents required for participation and long duration of the process; low awareness of the infrastructure development programs; limited funds for the implementation of programs, especially municipal ones.

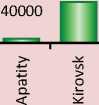

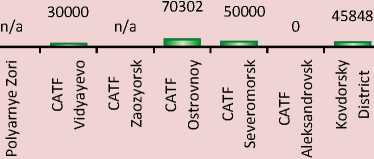

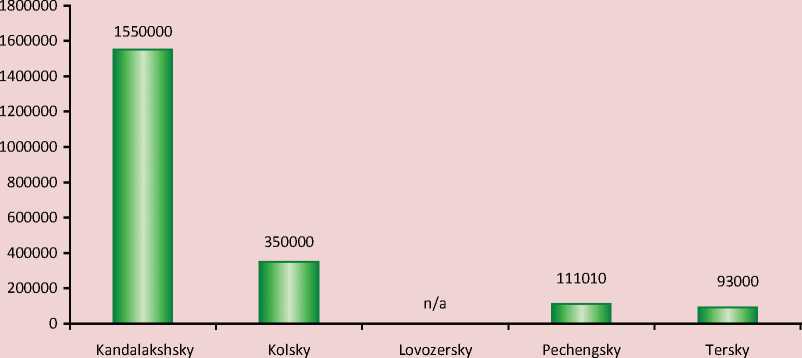

Figures 2 and 3 reveal a low level of municipal programs financing, it usually amounts to 600 thousand rubles. The amount of financing has exceeded the average only in two municipalities. At the same time in the city of Apatity that ranks second in the region by population and the scale of small business development, the level of funding is one of the lowest. What is more, funds intended for the development of small and medium businesses and included in the budgets of cities and districts of the region, can be called contingent, as their size ranges from 0 to 32 thousand rubles per 1000 people.

-

Figure 2. Amount of financing for programs in urban districts of the Murmansk Oblast in 2012, rubles

2000000 1

1800000 4

1600000 4

1400000 4

1200000 4

1000000 4

800000 4

600000 4

400000 4

200000 4

Е

Source: Rezul’taty sravnitel’nogo analiza predprinimatel’skogo klimata v munitsipal’nykh obrazovaniyakh Murmanskoi oblasti [The Results of Comparative Analysis of Business Environment in the Murmansk Oblast Municipalities]. Available at:

Figure 3. Amount of financing for programs in municipalities in 2012, rubles

Source: Rezul’taty sravnitel’nogo analiza predprinimatel’skogo klimata v munitsipal’nykh obrazovaniyakh Murmanskoi oblasti [The Results of Comparative Analysis of Business Environment in the Murmansk Oblast Municipalities]. Available at:

The respondents also express criticism at the low level of regional administrations’ activity and, consequently, given reserved estimates of it (about 80% of the respondents lack authorities’ attention to small business). And only 5% of small entrepreneurs believe that this sector is a priority for the regional administration.

Eight percent of the survey respondents indicate a high level of corruption as another obstacle for business development. More than 53% of the respondents face corruption when they try to get state support (subsidies, provision of premises, etc.), 53% – in case of allocation of land, 44% – in access to state and municipal orders.

To confirm the stated above, let us refer to the cases of violations in the sphere of state support which were identified during the inspection and presented by the prosecutors of the Murmansk Oblast at the “round table”, held at commercial and industrial exhibition “Imandra-2013” in the framework of the days of entrepreneurship. The violations were the following: representatives of the business incubator had imposed paid services (fee-paying documents, certificates); the surrender of premises had been carried without an auction; a public officer had prevented rent payments, which later became the reason to charge a penalty. The inspections, initiated by entrepreneurs, disclosed state bodies’ law violations, with their number having been increased more than twice in comparison with the 2011 level.

However, prosecutors noted that a less number of small and medium enterprises go to the law because of officials’ corruption. So, 49 small entrepreneurs took legal recourses in 2012, while the number of judicial recourses from citizens exceeded 8000. It can indicate that entrepreneurs put up with corruption: they believe that it occurs everyday and everywhere. Out of forty-two percent of the respondents, engaged in the discussion of the corruption issue, sixteen percent solve such problems independently, practicing informal payments to officials in the form of bribes and different kinds of “extortions”.

Although the business sector in the Murmansk Oblast does not regard corruption as one of the key obstacles to enterprises’ development, corruption in the region, especially in the sphere of state support, is more extensive than in forty regions of the Russian Federation, participants of the survey (tab. 2) .

Seventy-five percent of the respondents mention administrative barriers. For almost 30% of them the level of their incidence is high and extremely high due to under-developed legislation and inefficient public services. Only 25% of the respondents are concerned about the growing number of unscheduled inspections (according to the Prosecutor of the Murmansk Oblast, violations were revealed in the activities of the fire inspection and the Sanitary and Epidemiological Inspectorate), however, most respondents, who undergone these inspections, argue that the inspection authorities were interested not in quantity but in quality and were too zealous.

According to the survey, entrepreneurs do not face the pressure of criminal structures any longer; they are concerned about the process of interaction with law enforcement bodies.

Businessmen believe that the federal legislative initiatives play a significant role at the stage of business development. The following measures are considered efficient: introduction of the patent system of taxation; voluntary decision to transfer to unified tax on imputed income; an increase to the 60 million of the level (revenues

Table 2. Estimate prevalence of corruption and its impact on small and medium business of the Murmansk Oblast

Corruption sphere The average by 40 regions by the Murmansk Oblast Connection to the infrastructure (energy, heat, gas, etc.) 29 68 Land allocation 31 53 Obtaining state support (subsidies, premises on preferential terms, etc.) 30 53 Inspections (sanitary, fire, etc.) 32 53 Access to government orders and municipal orders 32 44 Certificates and licenses (technical regulation) 27 41 Customs procedures 17 14 Calculation and payment of taxes 17 14 Litigation 15 13 Employment of foreign labor force 9 4 Compiled by the author on the basis of: Predprinimatel'skii klimat v Rossii: indeks OPORY 2010–2011 [Business Climate in Russia: Index of OPORA 2010–2011]. Available at: from sales of products / works, services) that simplifies a taxation system; reforming property tax.

The law, tightening the conditions of alcoholic products sale, led to the closure of 38% of the stalls and reorientation of 20% of the stalls to the sale of non-food products. In 2011 small and medium enterprises experienced more serious innovation, doubling of the obligatory Pension Fund contributions, in 2013 individual entrepreneurs experienced the same. This innovation was perceived negatively by small and medium business, which resulted in the negative dynamics of their development indicators. According to the Federal Tax Service of Russia, in 2010 business was wound up by 2.4 million individual entrepreneurs, in 2011 – by 3 million, in 2012 – by 3.7 million and for the three months of 2013 – by 300 thousand.

In the Murmansk Oblast innovations ignored the results of the work of government bodies and public organizations to support small and medium enterprises, including the creation of 400 individual entrepreneurs due to the program “Step by Step”, and setting up of more than 700 individual entrepreneurs for only a month and a half in 2013 due to the development and adoption of the updated patent system in the region. During the first two months of 2013 after the introduction of higher rate of insurance to state non-budgetary funds, more than 1200 people wound up their business.

According to the survey respondents, business climate impact on the business sector development is estimated as follows: in the post-crisis period the situation has deteriorated. It is stated by 60% of the respondents, including 35% of them claiming that it has worsened significantly. More than 60% note that it is very difficult or almost impossible to set up new business.

Finally, despite all the drawbacks, identified in the work of regional government to develop business, small and medium enterprises do not lose hope that it is the authorities that can boost business activity and create favorable competitive environment. So, according to the Northern Chamber of Commerce and Industry, referring to the results of the survey of the Murmansk Oblast entrepreneurs, the government should focus on reducing corruption (45% of the respondents), regulation of prices and rated for energy resources (40%), decrease in tax burden (35%) and administrative barriers (30%), increasing the availability of premises (25%) and creation of transparent legislation (20%).

Sited works

Список литературы What hinders the development of small businesses: the view of the Murmansk oblast entrepreneurs

- Barasheva T.I. Perspektivy razvitiya malogo predprinimatelstva Murmanskoi oblasti v usloviyakh aktivizatsii mer gosudarstvennogo regulirovaniya // Ekonomicheskie i sotsialnye peremeny: fakty, tendentsii, prognoz. 2009. № 6. P. 78

- Barasheva T.I. Snizhenie napryazhennosti na rynke truda Murmanskoi oblasti // Север и рынок. 2011. Т. 2. № 28. С. 76.

- Efimova Yu.V. Kak klienty otsenivayut kreditnye produkty dlya malogo i srednego biznesa? . Konsul'tantPlyus .

- Кобылинская Г.В. Структурные особенности инвестиционных процессов в регионах Европейского Севера // Север и рынок. 2013. № 1. С. 57а.

- Kostyukevich V.F. O prognoze kadrovykh potrebnostei ekonomiki i sotsial'noi sfery Murmanskoi oblasti i podkhodakh k formirovaniyu kontrol'nykh tsifr priema v uchrezhdeniya professional'nogo obrazovaniya . Available at: http://www.mstu.edu.ru/news/files/doklad.pdf.

- KPMG opublikovala rezul'taty issledovaniya razvitykh i bystrorazvivayushchikhsya stran s tochki zreniya zatrat na vedenie biznesa za 2012 god . Available at: http://www.kpmg.com/RU/ru/IssuesAndInsights/ArticlesPublications/press-releases/Pages/KPMG-has-published-the-results-of-the-survey-Competitive-Alternatives-2012.aspx

- Predprinimatel'skii klimat v Rossii: indeks OPORY 2010-2011 . Available at: http://www.nisse.ru/business/article/article_1756.html?effort=

- Regiony Rossii. Sotsial'no-ekonomicheskie pokazateli. 2011: stat. sb. . Rosstat. Moscow, 2011. 990 p.

- Rezul'taty sravnitel'nogo analiza predprinimatel'skogo klimata v munitsipal'nykh obrazovaniyakh Murmanskoi oblasti . Available at: http://opora51.ru/klimatt.html

- Sotsial'nyi atlas rossiiskikh regionov . Available at: http://www.socpol.ru/atlas/portraits/Murm.shtml

- Chertoprud S. Chemodan bez ruchki Konsul'tantPlyus .

- Chto meshaet predprinimatelyam v Rossii . Available at: http://dasreda.ru/club/power/2546/