Creation experience of startup campuses in major regions (North America, Far East, Australia and Europe)

Автор: Kovcs ., Lvai I., Nagy H.

Журнал: Региональная экономика. Юг России @re-volsu

Рубрика: Фундаментальные исследования пространственной экономики

Статья в выпуске: 2 т.11, 2023 года.

Бесплатный доступ

Startup campuses are a gathering place for local startups. On the one hand, they bring together innovative startups, and on the other hand, they offer solutions for international market entry through various incubator programmes, investment services, training networks, education, extensive networking capital, and mentoring. Startup campuses should be seen as a 21st century combination of decentralised incubators, accelerators, and business angels. The world’s leading startup and innovation campuses recognise the need to build the right environment and ecosystem for startups to grow quickly and efficiently. Among the startup campus ecosystems, the US Silicon Valley stands out, home to seven of the world’s top ten startups. Currently, five large startup ecosystems (New York, London, Beijing, Boston, and Shanghai) have the best business development capabilities, and two are trying to catch up (Los Angeles and Tel Aviv). Among startup ecosystems, the US leads the race by a significant margin, but European startup campuses are also growing steadily, while South American startup incubators are lagging behind. The study seeks to find out what services startup campuses provide in different regions, what their main activities are, and how successful they are. The topic is also important because startups most often respond to broad societal problems, such as access to basic services at affordable prices, reducing poverty and inequality, and increasing diversity and inclusiveness. On environmental issues, the most common targets are improving food supply and security, clean energy, climate change solutions, water, and sanitation.

Startup, campus, capital investment, venture capital, incubators, accelerators, business angels, silicon valley, ecosystem, development

Короткий адрес: https://sciup.org/149143845

IDR: 149143845 | УДК: 334.7+34.012.4:001.895 | DOI: 10.15688/re.volsu.2023.2.1

Текст научной статьи Creation experience of startup campuses in major regions (North America, Far East, Australia and Europe)

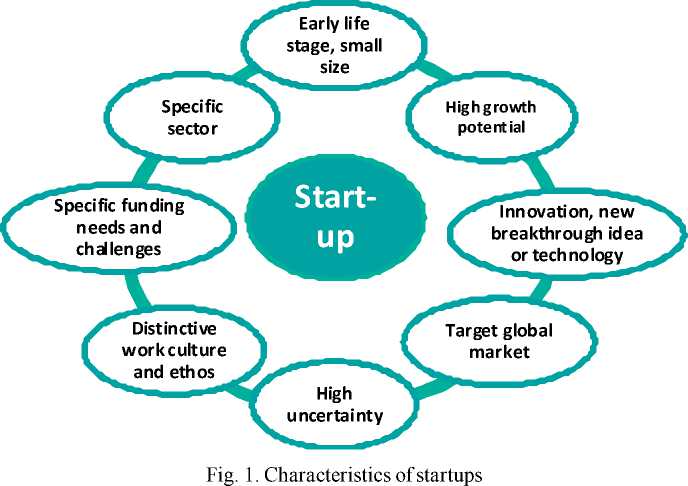

DOI:

The emergence of startups was initially linked to the United States in the 1970s, mainly to companies emerging and operating in Silicon Valley. In Europe, startups took off 15–20 years later. There is no agreed definition of the business form itself, but attempts have been made to define its characteristics. Generally speaking, startups are high-growth, fastgrowing businesses with high growth potential that have a legitimate international presence and are looking for operating models that will enable them to stay in the market [Márkus, 2016]. A startup, according to Reis, is “a business that aims to create a new product or service under conditions of extreme uncertainty” [Reis, 2013: 34]. The building blocks of these businesses are digital, and they evolve differently than the former giant companies [Zámboji, 2014]. They are typically high growth businesses because they use innovation to create problems and solutions. Their growth phase is rapid, but without a specific timing. They are often linked to a research site at a nearby university or academy and rely on technology transfer, incubation programmes, or simply the use of spare capacity in laboratories [Szakos, 2014]. In general, startups are characterised by the following features: (1) being small in size and less than 10 years old; (2) being focused on innovation in their business space; (3) being focused on growth in turnover and number of employees; (4) aiming for international (global) markets; (5) being typically dominated by a collaborative working environment; but often (6) needing external funding in the early stages; and therefore (7) having a high level of uncertainty around them; but also (8) having a dedicated environment and a unique ethos (Fig. 1).

A group of people working towards a common goal in the initial phase of a startup with a well-defined timeframe [Iqram Magdon-Ismail, 2013] (usually after 3 years it ceases to be a startup [Natalie Robehmad, 2013]). It is often not clear whether it is a startup or a project. It is not necessary to have a corporate framework in order to achieve the objectives set. Typically, a startup becomes a corporation when the market opportunities are already outlined. The primary criterion is rapid growth, which distinguishes it from other businesses [Paul Graham, 2012].

All startups strive to create something new that did not exist before. To create this, they exploit new technological opportunities, giving them a strong competitive advantage and growth potential. Because they are experimenting with technologies that others have not yet touched, startups face a high level of business uncertainty, and success is not guaranteed [Eric Ries ... , 2010]. Startups are typically resource-constrained because of their unique and rapid growth and always want to achieve more than their financial resources allow [Pat Phelan, 2013]. This makes their work creative, and often startups are surrounded by different investors (business angels 1) with extensive experience in the sector. Once the scarcity of resources is gone, the company can no longer be called a startup. Startups have a different work culture, with much closer teamwork, a personal connection to the project, and a much stronger [Iván Kepecs, 2014] sense of commitment and enthusiasm than other forms of entrepreneurship.

Startups are defined differently, and often the concepts of startup, spin-off, and gazelle companies are confused. A spin-off is a company linked to a university or research centre that uses the knowledge transfer, incubation programme, or spare capacity labs there to implement new ideas. Almost all major universities (especially in the US) have such “incubators.” Gazelles are fast-growing and fragile businesses that try to take advantage of market opportunities very quickly [Vecsenyi, 2001]. Typically, the owners have management skills, and as a result of rapid growth, the corporate structure is constantly changing [Vecsenyi, 1999]. Growth in this type of enterprise can be as high as 20% a year [Harrison, Taylor, 1996]. We use the term “startup” as a generic term in this study because they are all characterised by innovative solutions and a market-innovating intent to respond to new challenges, whether in the form of a registered business or project work.

Material and method

Startups are characterised by innovative thinking and a willingness to innovate. Knowledge is one of the core competencies of these businesses. Knowledge flow (transfer and absorption) is most effective in education and business [Szabó, 1999]. Startups try to turn the knowledge they acquire into

Note. Source: authors’ own edits by [Márkus, 2016].

a business plan. A startup is a “startup knowledgeintensive enterprise that grows rapidly with a small investment of capital and labour” [Investing in the Future, 2013]. Typically, the Triple Helix model is used to explain the startup environment with the innovation system, where startups appear at the common intersection of (1) university, (2) government, and (3) business [Etzkowitz, Leydesdorff, 1995]. Each of these external spheres stimulates startup companies as equal and co-equal actors and views innovation not as a single set of activities but as multiple feedbacks of mutual effects and processes [Dzisah, Etzkowitz, 2008; Etzkowitz, Leydesdorff, 1995]. As these enterprises require external support (financial and professional), both market actors and public policymakers try to help them. Although many countries provide favourable loans to startups, the latter are classified as venture capital because of their uncertain environment. They are particularly vulnerable to the demand for venture capitalists, as private equity investors prefer more secure investments [Karsai, 2000].

Incubators. The first incubator organisations were built on the simplest principle of costeffectiveness. They provide office services to tenants within a building with the aim of costsharing [Almubartaki, Al-Karaghouli, Busler, 2010]. Later, in developed countries, incubators were also used for job creation [Adkins, 2002] and were mostly run by local authorities. Universities and the private sector soon found their way to creating incubator areas specialised in technologies [Bruneel et al., 2012]. By the end of the 1990s, a new model had spread, first in the United States and then in the European Union: the so-called “new economic”, “for profit” 2 or business incubators [Bajmóczy, 2007]. These organisations were not based on the sharing of services but on private investment. They were mostly set up to support high-tech 3 and Internet-related activities [Aerts, Matthyssens, Vandenbempt, 2007]. The aim of these incubators was not to create jobs but to provide financial and business services. Today, all three types of incubators are present in the market [Tornatzky, Sherman, Adkins, 2003], but the importance of the older types (cost-sharing and job creation-focused incubators) has declined while the role of technology-focused incubators has increased. Incubators are characterised by the provision of the following services:

-

– Incubation space (offices, furniture, technical equipment, etc.);

-

– Financial services (including the possibility of capital investment);

-

– Administrative services (secretarial services, computer network, mail, accounting, etc.);

-

– Networking opportunities (formation of groups, clusters);

-

– Entrepreneurial support (organisational, management, and legal advice) [Carayannis, Zedtwitz, 2005].

Incubators have been beneficial not only for startups but also for governments because they help businesses grow, reducing the risk of market failure, boost local business development, create jobs, increase tax revenues, and contribute to regional development. For research institutes and universities, they help put theoretical knowledge into practise, put it on a business footing, and exploit the knowledge of students. They support entrepreneurship in local communities, generating local income and selfemployment by the end of the incubation programme. The international community can also benefit from technology transfer. It can promote understanding of other cultures and encourage exchanges of experience that can lead to new alliances and relationships [Lalkaka, 1997].

Accelerators. Startups operate in an uncertain environment, which is why accelerator-type organisations have proliferated in recent decades [Pauwels et al., 2016]. Accelerators provide start-ups with group support for a certain period of time in the context of various development programmes. The founders of the startups mainly receive mentoring and training. Most often, the trainers are former venture developers, venture capitalists, or corporate executives. At the end of the mentoring programme, companies are given the chance to be matched with qualified investors [Cohen, 2013; Cohen, Hochberg, 2014]. In addition to mentoring, some accelerators also provide networking opportunities and even larger guaranteed capital investments [Hochberg, 2016]. Such opportunities arise with accelerators that specialise in a particular sector (holistic, energy, or digital media). Accelerators have the advantage of being aligned with the startups’ goals, and only viable businesses undertake the development programme [Christiansen, 2009]. Funding also comes from the business sector, while the incubator activity itself is often funded by the government.

Business angels 4 are individuals driven by their own business goals. They are characterised by a higher level of wealth [Hindle, Rushworth, 1999; Osman, 1998; Shorter, 1996; Wetzel, Freear, 1996], business experience [Osnabrugge, Robinson, 2000; Wetzel, 1981], and the provision of venture capital- based finance. They usually use their own assets and savings to invest. The largest investments (in number and volume) are made to innovative startup entrepreneurs [Boyns et al., 2003]. It is typical that the investor has no prior relationship with the startups they wish to support, and this is most often achieved by excluding companies that are already listed on the stock exchange [Wetzel, 1981; Shorter, 1996; Mason, Harrison, 2000]. The criteria for investment vary, but what is common is that the company must have growth potential [Gaston, 1989; Mason, Harison, 1995]. Business angels are motivated primarily by the returns to investors, but there are also emotional reasons (responsibility to society, participation in a growing company, pleasure in investing, political or economic goals, development of a new product or service, etc.) [Baty, 1964; Wetzel, 1983]. Start-ups do not meet the normal financing criteria (through financial institutions) and can therefore only raise funds through venture capital and business angels [Pintér, 2008].

Startup campuses are a gathering place for local start-ups. On the one hand, they bring together innovative start-ups, and on the other hand, they offer solutions for international market entry through various incubator programmes, investment services, training networks, education, extensive networking capital, and mentoring. Startup campuses should be seen as a 21 st century combination of decentralised incubators, accelerators, and business angels. The world’s leading startup and innovation campuses recognise the need to build the right environment and ecosystem for start-ups to grow quickly and efficiently. It is not enough to have education and competition; they must also create a space where they can turn their innovative ideas into new products or services. In principle, competitive and innovative startup ecosystems are built on the interaction of four elements, namely (Runway 2.0.2.0) [Budapest 2.0.2.0, 2020]:

-

1. Education and training (formal and non-formal education);

-

2. Access to resources (each business life cycle has its own resource requirements);

-

3. Taxation and regulation (intellectual property, know-how, and patent protection);

-

4. Supportive environment (institutions, entrepreneurship, competition, media).

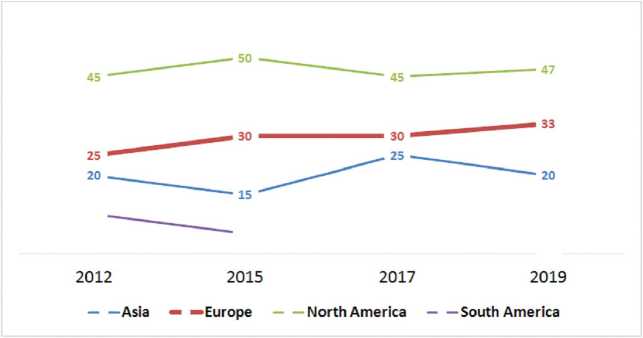

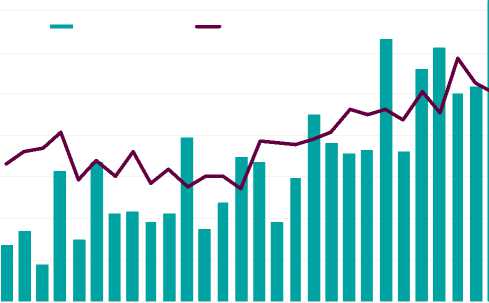

Among the startup campus ecosystems, the US Silicon Valley stands out, with seven of the world’s top ten start-ups. Currently, five large startup ecosystems (New York, London, Beijing, Boston, and Shanghai) have the best business development capabilities, and two are trying to catch up (Los Angeles and Tel Aviv). Among startup ecosystems, the US is leading the race by a significant margin, but European startup campuses are also growing steadily, while South American startup incubators are lagging behind (Fig. 2).

Results

Characteristics of startup campuses in North America (USA and Canada): In the US, four main trends have been observed that have led to the massive expansion of startup campuses:

-

1. New technologies are giving them access to markets that were not previously possible.

-

2. The cost of technology is constantly decreasing, allowing innovative products to be developed and brought to market.

-

3. Consumer demand for ethical, sustainable products and business practises has increased.

Fig. 2. Share of the world’s most advanced startup ecosystems (%) by enterprise value between 2012 and 2019 Note. Source: authors’ own edits based on data from [Startup Genome, 2019].

-

4. Global threats and exposure have increased; without correcting the situation, large corporations face business risks that startups are exploiting.

The most prominent startup campuses in the US are: Techstars, 500 Startups (San Francisco), Capria (Seattle), AngelPad, the New York Digital Health Innovation Lab (New York), the Chicago Blockchain Centre (Chicago), and Amplify (Los Angeles).

Techstars aims to connect startup founders and leaders with other entrepreneurs, experts, mentors, investors, community leaders, and corporate partners who can help them grow their businesses. By the end of the programme, successful startups can expect to receive an investment of $120,000 and access to Techstars’ professional network.

500 Startups is a global startup campus based in San Francisco with staff in 74 countries and speaking 25 languages. The campus also acts as a venture capitalist, having helped boost more than 2,300 startups and made more than 5,000 venture capital investments.

C apria is a Seattle-based investment centre that also provides a global environment for startup entrepreneurs. Their programme is designed to help companies collaborate and develop innovative solutions to global problems, with a focus on emerging markets. The startup campus operates in 25 countries, with 19 venture capital funds and $350 million in funding available through Capria’s network. The startup campus focuses on capacity building, capital deployment, and collaboration. In capacity building, emerging markets have a competitive advantage in having an equity investment platform consisting of both intellectual property and advisory services.

AngelPad is an American startup accelerator launched in September 2010 by Thomas Korte and six former Google employees. They are now ranked among the top startup incubators in the US (they received the Platinum Plus Award for Accelerator in 2018). The company is based in New York and San Francisco. Most of the startups it has backed are also based in the US. Since its founding, it has helped launch and fund more than 153 companies.

The New York Digital Health Innovation Lab (formerly NY Digital Health Accelerator) is a startup campus that provides development opportunities for health start-ups. Their goal is to improve healthcare in New York State. The Campus is founded by both for-profit and non-profit organisations. One of the founders is the Partnership Fund, which was established in 1996 by financial executives with the purpose of supporting healthcare investment, job creation, and business creation. The fund has invested more than $170 million, but only New York-based companies are supported. The other founder is the New York eHealth Collaborative (NYec), a non-profit organisation that works with the Department of Health to manage and connect.

The Chicago Blockchain Centre is a startup campus specialising in blockchain and cryptocurrency-related technology. It is a mixed (public and private) ownership centre based in Illinois. It provides professional support for education, innovation, and development in blockchain technologies. It stands out from other blockchain centres in the US due to its unique structure (public participation). It was founded in 2015 with the support of Mattew Roszak and cofounded by the Fintech Chicago Alliance, the Digital Chamber of Commerce, the Blockchain Education Network, and the investment firm Bloq. The partnership has allowed Chicago to directly engage with the day-to-day work of the blockchain community.

Amplify is a Los Angeles-based startup campus founded in 2011 that likes to invest in early-stage startups and help companies with technologies that are expected to have high growth potential.

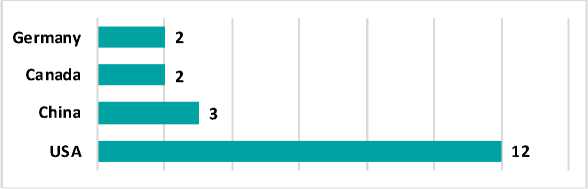

Canada is at the forefront of the competition for the world’s startup campuses, being ranked among the top 30 startup ecosystems in the world [Startup Genome, 2019]. The hubs of the highest quality startup ecosystems are emerging in global cities. This includes two Canadian metropolitan startup hubs, Toronto (13 th ) and Vancouver (24 th ) [Startup Genome, 2019], but it is predicted that within five years the city of Montreal could also be in the top 30 ecosystems (Fig. 3).

Fig. 3. World’s top startup centre ecosystem (countries with more than one top startup centre ecosystem) Note. Source: authors’ own edits based on data from [Startup Genome, 2019].

Toronto is the most populous and wealthiest city in Canada. It is also home to the seventh largest stock exchange in the world, making it a vibrant centre for entrepreneurship and innovation. The city currently has 4,100 active tech startup innovators. In Canada, the main startup incubators are Le Camp (Quebec), DMZ (Toronto), and Launch Academy (Vancouver).

Startup campuses and the innovative startup companies that gather there respond to these challenges. Most often, startups respond to broad societal problems such as access to basic services at affordable prices, reducing poverty and inequality, and increasing diversity and inclusiveness. In the area of environmental problems, the most common targets are improving food supply and security, clean energy, climate change solutions, water, and sanitation. Startup companies’ response to societal challenges is reflected in their core business models. All U.S. startup companies should align their goals with the U.N. Sustainable Development Goals, which promote sustainable development and respond to global challenges.

Characteristics of startup campuses in the Far East: Venture capital investment in Asia is less widespread t venture cap rapidly sinc down by 20

The Fa world’s top

Silicon Val London). Be startup ecos of the camp market. Am Hong Kong to foreign customers at high prices to go global. Almost all ecosystems in the world have a strong national regulatory environment that encourages international trade and investment, with the exception of Bengaluru, Beijing, and Shanghai because of low IP protection regulation.

Among the Far East campuses, Tel Aviv and Singapore have very high levels of local linkages. They place great emphasis (through frequent events and business meetings) on networking with local experts and investors. Beijing has a long history of an ecosystem that relies on strong entrepreneurial experience, while Hong Kong has a significant shortcoming in that it does not have very many startup initiatives like the other Far East campuses. Beijing, Tel Aviv, and Shanghai have the advantage of building on emerging knowledge, which is tangible in the creation of intellectual property, patents, and research.

The most prominent startup campuses in the Far East are Brinc (Hong Kong), AppWorks (Taiwan), CoWrks Foundry (Bengaluru), India Accelerator (Gurgaon), Antler, Tribe Accelerator (Singapore), Primer, SparkLabs (Seoul), and Samura Incubate (Tokyo).

startup mission ocus on ivities to lan with a result, across

Europe (see Fig. 5)5.

elatively ncreased nts have activity

Fig. 4. Growth of risk capital in Asia between 2011 and 2019 (in thousands of billions of dollars) Note. Source: [Venture Plus, 2019].

from German, French, and Swedish startup hubs (Fig. 6). Countries with strong economies and a predictable business environment attract startups. It is no coincidence that this is where new business and technology ideas in the form of startups first appear.

London is the third largest startup campus ecosystem in the world, second only to Silicon Valley and New York. In Europe, London has a prominent role in business development. This is helped by its education system, with world-class universities, a highly skilled w diversity of tal In addition, the a incentives, and a make London attr

Berlin is a fa more than 500 ne

The city stands o opportunities and high level of infrastructure. The city provides startups with a wide range of incubation facilities, community spaces, and collaborative environments. Paris and Stockholm have strengthened their positions in recent years, following the development of the Berlin ecosystem. Ireland is home to a number of world-class technology companies (Intel, Facebook, and Apple), thanks to the Irish government’s extensive support system. Ireland’s startup ecosystem includes 31 local entrepreneurship ment, and training nicipal buildings.

campuses in the London), Accel lerator (Berlin), ch Blue (Dublin), , and Almaz

Capital (Moscow).

Fig. 5. Venture capital investment in Europe between 2012 and 2019 (in millions of dollars) Note. Source: [Venture Plus, 2019].

Italy ■ Poland ■ Denmark ■ Norway ■ Belgium ■ Austria ■ Switzerland ■ Finland ■ Ireland ■ Netherlands ^™

Spain ^^^

Sweden ^^^^^^^e

France ^^^^^^^^^^^

Germany ^^^^^^^^^^^^^

United Kingdom ^^^^^^^^^^^^^^^^^^^^^^^^^^^“

O 500 1000 1500 2000 2500 3 000 3500 4000 4500 5000 5 500 6000

Fig. 6. Venture capital investments in Europe by countries in 2017 (in millions of dollars) Note. Source: compiled by the authors.

Conclusion

The development programme usually ends with a demo day, for which the campus mentors prepare weeks or months in advance. Startups are prepared to present their products (business ideas) to potential investors. The number of prospective investors can reach several hundred. After the presentation, large investments ($20–200 million) are made. The success of start-ups can be measured by various factors. You can measure how many companies have been funded in the last period. The biggest startup campuses (Techstar, AngelPad, 500 Startups) work with up to 100–300 start-ups per year and launch a development programme every 3–5 months, while the smaller capacity campuses (Founders Embassy, Amplify, India Accelerator, Andgo Partners, Almaz Capital) help a few start-ups per year.

The success of the campuses is also measured by the number of startups that have become independent in the global market. Typically, only a fraction (5–10%) of start-ups leave the attractive ecosystem (business environment) that campuses provide. Some startups spend several years in the campus ecosystem.

In addition, the number of new jobs created by new startups can be a measure of success. Because they initially employ only a few people (mainly startup founders) and aim to go global in a short time, the hard work of a campus and the innovative idea of a startup have already created thousands of new jobs around the world (400 for the New York Digital Health Innovation Lab, 2500 for Launch Academy, 1200 for SparkLabs, and tens of thousands for AppWorks).

The startup campuses also act as venture capitalists, and their success is reflected in the amount of money and contributions they make to the startups they select. Some campuses do not ask for any contribution (they operate as non-profits, such as the New York Digital Health Innovation Lab and Launch Academy) from the startup capital, while they invest in market funds (most often asking for 3–10% equity stake, such as 500 Startups, SparkLabs, and BlueChili, but some ask for 20–40%, such as Almaz Capital).

Another measure of success is how much the campus has grown into a network. The activities of the US ecosystems are spreading to other continents (Techstars is in contact with 2000 companies and mentors, Capria is active in 25 countries, and 500 Startups is active in 74 countries). Most of them are active in one or two big cities (Le Camp, DMZ, India Accelerator, SparkLabs, LaunchVi, etc.) but are also involved in the changes in the global market.

NOTES

-

1 Business angels (also known as angel investors) are investors who support innovative, high-risk business investments. Investors are typically individuals with significant wealth.

-

2 “For profit” is defined as an activity that aims to maximise profit.

-

3 By “high-tech”, we mean high-tech products with high technical standards.

-

4 There are several synonyms for “business angel” in Anglo-Saxon literature (angel investor, informal investor, private venture capitalist).

-

5 In 2019, only the data for the first quarter is shown in the graph, resulting in a decrease in the capital stock.

Список литературы Creation experience of startup campuses in major regions (North America, Far East, Australia and Europe)

- Adkins D., 2002. A Brief History of Business Incubation in the United States. Athens, Ohio, National Business Incubation Association Publ. 57 p.

- Aerts K., Matthyssens P., Vandenbempt K., 2007. Critical Role and Screening Practices of European Business Incubators. Technovation, vol. 27 (5), pp. 254-267. DOI: https://doi.org/10.1016/j.technovation.2006.12.002

- Almubartaki H.M., Al-Karaghouli W., Busler M., 2010. The Creation of Business Incubators in Supporting Economic Developments. European, Mediterranean & Middle Eastern Conference on Information Systems 2010 (EMCIS2010). URL: https://bura.brunel.ac.uk/bitstream/2438/8511/2/Fulltext.pdf

- Bajmóczy Z., 2007. A technológiai inkubáció elmélete és alkalmazási lehetőségei hazánk elmaradott térségeiben. Doktori èrtekezès tèzisei. Szeged. 18 p. URL: http://doktori.bibl.u-szeged.hu/id/eprint/553/2/PhD_T%C3%A9zis_Bajm%C3%B3cy.pdf

- Baty G.B., 1964. The Initial Financing of the New Research-Based Enterprise in New England. Boston, MA, Federal Reserve Bank of Boston. 120 p.

- Boyns N., Cox M., Spires R., Hughes A., 2003. Research into the Enterprise Investment Scheme and Venture Capital Trusts. Cambridge; London, Public and Corporate Economic Consultants. URL: http://www.inlandrevenue.gov.uk/research/report.pdf

- Bruneel J., Ratinho T., Clarysse B., Groen A., 2012. The Evolution of Business Incubators: Comparing Demand and Supply of Business Incubation Services Across Different Incubator Generations. Technovation, vol. 32 (2), pp. 110-121. DOI: https://doi.org/10.1016/j.technovation.2011.11.003

- Budapest 2.0.2.0 – Budapest HUB Publication, 2020. URL: https://docplayer.hu/2064110-Runwaybudapest-2-0-2-0-a-startup-credo.html

- Carayannis E.G., Zedtwitz M., 2005. Architecting GloCal (Global-Local), Real-Virtual Incubator Networks (G-RVINs) as Catalysts and Accelerators of Entrepreneurship in Transitioning and Developing Economies: Lessons Learned and Best Practices from Current Development and Business Incubation Practices. Technovation, vol. 25, pp. 95-110. DOI: https://doi.org/10.1016/S0166-4972(03)00072-5

- Christiansen J.D., 2009. Copying Y Combinator: A Framework for Developing Seed Accelerator Programmes, MBA Dissertation / Individual Project. Cambridge, University of Cambridge Publ. 34 p. URL: https://businessmanagementphd.files.wordpress.com/2014/11/christiansen-2009-copying-ycombinator-university-of-cambridge-mba-thesis.pdf

- Cohen S.G., 2013. What Do Accelerators Do? Insights from Incubators and Angels. Innovations. Technology, Governance, Globalization, vol. 8 (3-4), pp. 19-25. DOI: https://doi.org/10.1162/inov_a_00184

- Cohen S.G., Hochberg Y.V., 2014. Accelerating Startups: The Seed Accelerator Phenomenon. SSRN Electronic Journal. DOI: http://dx.doi.org/10.2139/ssrn.2418000

- Dzisah J., Etzkowitz H., 2008. Triple Helix Circulation: The Heart of Innovation and Development. International Journal of Technology Management and Sustainable Development, vol. 7, no. 2, p. 103. DOI: https://doi.org/10.1386/ijtm.7.2.101_1

- Etzkowitz H. Leydesdorff L., 1995. The Triple Helix – University-Industry-Government Relations: A Laboratory for Knowledge Based Economic Development. Rochester, NY. EASST Review 14, no. 1, pp. 14-19.

- Gaston R.J., 1989. Finding Private Venture Capital for Your Firm: A Complete Guide. New York, John Wiley and Sons Publ., 272 p.

- Harrison J., Taylor B., 1996. Supergrowth Companies: Entrepreneurs in Action. Oxford, Butterworth-Heinemann Publ. 219 p.

- Hindle K., Rushworth S., 1999. The Demography of Investor Heaven: A Synthesis of International Research on the Characteristics, Attitudes and Investment Behaviours of Business Angels. Paper First Presented at the Conference: ‘Financing the Future: Small Medium Enterprise Finance, Corporate Governance and the Legal System’.

- Sydney. 42 p. URL: https://typeset.io/pdf/thedemography-of-investor-heaven-a-synthesis-of-4mscsu3gwt.pdf

- Hochberg Y.V., 2016. Accelerating Entrepreneurs and Ecosystems: The Seed Accelerator Model. Innovation Policy and the Economy, vol. 16, pp. 25-51.

- Investing in the Future, 2013. Investing in the Future National Strategy for Research, Development and Innovation (2013-2020). Budapest, pp. 71-74. URL: https://2010-2014.kormany.hu/download/b/35/f0000/06_11_NGM%20KFI%20strat%C3%A9gia_Kozlonyhoz.pdf

- Karsai J., 2000. A kockázati tõke szerepe a technológiai alapú induló vállalkozások finanszírozásában.

- Zoltán R., ed. Felzárkózás és EU csatlakozás. Budapest, MTA Iparés Vállalatgazdasági Bizottság Publ., pp. 324-330.

- Lalkaka R., 1997. Lessons from International Experience for the Promotion of Business Incubation Systems in Emerging Economies. UNIDO Small and Medium Enterprises Programme. 43 p. URL: https://www.unido.org/sites/default/files/2006-10/lalkaka_0.pdf

- Márkus M., 2016. Mérlegen a hazai startupok, Lim2016, Logisztika, informatika, menedzsment. Zalaegerszeg, Budapesti Gazdaságtudományi Egyetem. URL: http://publikaciotar.uni-bge.hu/936/1/Ck_Markus.pdf

- Mason C., Harrison R.T., 1995. Developing the Informal Venture Capital Marketing the UK: Is There Still a Role for Public Sector Business Angels Networks? Published on Bygrave, W.D. Bird, B.J. Birley, N.S. Churchill, N.C. Hay, M.G. Keeley, R.H. Wetzel, W.E. Jr., eds. Frontiers of Entrepreneurship Research. Babson College, Wellesley, URL: http://www.babson.edu/entrep/fer/papers95/mason.htm

- Mason C., Harrison R.T., 2000. Informal Venture Capital and the Financing of Emergent Growth Business.

- Sexton D., Landström H., ed. The Blackwell Handbook of Entrepreneurship. Oxford, Blackwell Publ., pp. 221-239.

- Osman P., 1998. Az üzleti angyalok tevékenysége és befektetéseik szerepe a kis- és kisebb középvállalatok létrehozásában és fejlesztésében. Budapest, OMFB Publ. 60 p.

- Osnabrugge M. Van, Robinson R.J., 2000. Angel Investing: Matching Startup Funds with Startup Companies – The Guide for Entrepreneurs, Individual Investors and Venture Capitalists. San Francisco, Jossey-Bass Publ. 448 p.

- Pauwels C., Clarysse B., Wright M., Van Hove J., 2016. Understanding a New Generation Incubation Model: The Accelerator. Technovation, vol. 50-51, pp. 13-24. DOI: https://doi.org/10.1016/j.technovation.2015.09.003

- Pintér Cs., 2008. A kockázati tőke-befektetés folyamata és sikerességének tényezői. Diploma Thesis. Budapest, Corvinus University of Budapest Publ. URL: https://docplayer.hu/514300-A-kockazatitokebefektetes-folyamata-es-sikeressegenek-tenyezoi.html

- Ries E., 2013. Lean Startup. Hogyan tegyük ötleteinket sikeressé és fenntarthatóvá? Budapest, HVG Publ. URL: https://hvgkonyvek.hu/resources/public/LeanStartup_web.pdf

- Shorter S.M., 1996. TECs and the Promotion of Informal Venture Capital: The Feasibility of an Informal Investor Network in East Lancashire. Harrison R.T., Mason C.M., eds. Informal Venture Capital. Evaluating the Impact of Business Introduction Services. Woodhead-Faulkner, Hemel Hempstead Publ., pp. 229-247.

- Startup Genome, 2019. URL: https://startupgenome.com/reports/global-startup-ecosystem-report-2019

- Szabó K., 1999. A tudás globális piaca és a lokális tanulás. Economic Review, vol. 46(3), pp. 278-294.

- Szakos, J. 2014. A Startup Hype-on túl az állam szerepe a gazdasági innováció támogatásában közigazgatási és közpolitikai aspektusból. Budapest, Nemzeti Közszolgálati Egyetem. 43 p.

- The Statement Comes from Eric Ries, Silicon Valley Entrepreneur and Author of Lean Startup, 2010. URL: http://www.startuplessonslearned.com/2010/06/what-is-startup.html

- The Statement Comes from Natalie Robehmad, Author of the Forbes Article “What is a Startup?”, 2013. URL: http://www.forbes.com/sites/natalierobehmed/2013/12/16/what-is-a-startup

- The Statement Comes from Pat Phelan, Co-Founder of Trustev, 2013. URL: http://www.forbes.com/sites/natalierobehmed/2013/12/16/what-is-a-startup

- The Statement Comes from Paul Graham, Founder, Programmer, Philosopher, Startup Guru, American Incubator Y Combinator, 2012. URL: http://www.paulgraham.com/growth.html

- The Statement is from Iqram Magdon-Ismail, Co-Founder of Venmo, 2013. URL: http://www.forbes.com/sites/natalierobehmed/2013/12/16/what-is-astartup/

- The Statement Is from Iván Kepecs, Founder of Kreater Social Agency, 2014. URL: http://www.piacesprofit.hu/kkv_cegblog/legyen-on-is-startup

- Tornatzky L., Sherman H., Adkins D., 2003. Incubating Technology Businesses: A National Benchmarking Study. Athens (Ohio), National Business Incubation Association. URL: https://permanent.fdlp.gov/lps34845/2003Report.pdf

- Vecsenyi J., 1999. Vállalkozási szervezetek és stratégiák. Budapest, Aula Publ. 442 p.

- Vecsenyi J., 2001. Gazellák, a gyorsan fejlődő vállalkozások. CEO Magazin, vol. 2, no. 1, pp. 7-9.

- Venture Plus, 2019. URL: https://assets.kpmg/content/dam/kpmg/xx/pdf/2019/04/venture-pulse-q1-2019.pdf

- Wetzel W.E., 1981. Informal Risk Capital in New England. Vesper K.H., ed. Frontiers of Entrepreneurship

- Research. Wellesley, Babson College Center Publ., pp. 217-245.

- Wetzel W.E., 1983. Angels and Informal Risk Capital. Sloan Management Review, vol. 24 (3), pp. 23-34.

- Wetzel W.E., Freear J., 1996. Promoting Informal Venture Capital in the United States: Reflections on the History of the Venture Capital Network.

- Harrison R.T., Mason C.M., eds. Informal Venture Capital. Evaluating the Impact of Business Introduction Services. Woodhead-Faulkner, Hemel Hempstead Publ., pp. 61-74.

- Zámboji B.P., 2014. Startup, felnőtteknek! – Az entrepreneurship szelleme és a vállalkozói szemlélet. Budapest, Underground Publishing and Distribution Ltd. 307 p.