The essence of investment decisions in real estate

Автор: Zelisko P.

Журнал: International Journal of Management Trends: Key Concepts and Research @journal-ijmt

Статья в выпуске: 2 vol.4, 2025 года.

Бесплатный доступ

The purpose of this article is to examine the essence of investment decisions in real estate by integrating theoretical foundations with behavioural factors. The relevance of the research is driven by the growing complexity of investment decision-making under conditions of information asymmetry, heterogeneous market participants, and the institutional specifics of emerging economies. The paper analyses classical financial indicators (NPV, IRR, PI, ROR) and highlights their limitations when behavioural biases are not considered. Using the VIKOR method with probabilistic linguistic term sets, the study demonstrates that changes in behavioural preferences may lead to a 2–4-fold shift in the evaluation of investment alternatives.

Investment decisions, real estate, multi-criteria analysis, VIKOR, emerging markets, investor heterogeneity

Короткий адрес: https://sciup.org/170211456

IDR: 170211456 | УДК: 332.72:330.322 | DOI: 10.58898/ijmt.v4i2.23-31

Текст научной статьи The essence of investment decisions in real estate

Investment decisions in the real estate sector require balancing financial, behavioural, and institutional factors, especially in emerging markets where information asymmetry and structural limitations increase decision-making uncertainty. Unlike mature markets, developing economies such as Serbia face challenges related to data availability, regulatory stability, and heterogeneous investor behaviour, which together complicate the evaluation and selection of investment alternatives. This highlights the need for a framework that systematically integrates behavioral factors into investment decision-making.

-

*Corresponding author: D125@famns.edu.rs

© 2025 by the authors. This article is an open access article distributed under the terms and conditions of

the Creative Commons Attribution (CC BY) license .

Research problem: How do behavioural factors influence investment decisions in real estate under the conditions of emerging markets, and how can their impact be systematically integrated into decisionmaking models?

Research objective: To develop a comprehensive framework for real estate investment decision-making that incorporates behavioural characteristics of investors and a multi-criteria evaluation approach, and to assess how these elements shape project selection outcomes in emerging markets.

Research Questions:

-

1. What are the key determinants of real estate investment decision-making?

-

2. How do behavioural preferences and biases affect the evaluation of investment alternatives?

-

3. How can multi-criteria methods such as VIKOR enhance decision-making accuracy in emerging markets?

Potential contribution: This study contributes to the literature by integrating behavioural perspectives with classical financial evaluation and multi-criteria decision-making tools. It offers practical guidance for investors, banks, and policymakers seeking to improve project selection, risk assessment, and institutional support mechanisms in emerging real estate markets.

Materials and MethodsTheoretical Foundations of Investment Decisions in Real Estate(Literature review)

Investment decisions in real estate are shaped by economic, behavioural, technological, and institutional determinants. Prior research identifies several distinguishing characteristics of real estate markets. Singh et al. (2021) emphasize the high level of information asymmetry, low transparency, and strong psychological influences on investor behaviour compared to financial markets. Grabovoy and Fedorov (2019) argue that evaluating specialized real estate assets requires alignment between financial metrics and strategic investment goals.

Classical financial evaluation approaches rely on rational economic calculations using indicators such as Net Present Value (NPV), Internal Rate of Return (IRR), Profitability Index (PI), and Rate of Return (ROR). However, contemporary studies indicate that classical models often neglect behavioural biases, reducing their applicability in real-world decision-making (Özogul & Taşan-Kok, 2020; Singh et al., 2021).

Real estate as an investment asset possesses several unique characteristics. Low liquidity requires long-term planning, while strong macroeconomic sensitivity links asset performance to indicators such as GDP growth, inflation, and interest rates. In a systematic review, Kwakye and Haw (2020) found robust relationships between macroeconomic conditions and real estate market dynamics. Market segmentation further complicates evaluation: Joyce (2018) showed that liquidity and diversification are key determinants of REIT performance.

Investor heterogeneity also plays a central role. Özogul and Taşan-Kok (2020) distinguish institutional investors, speculative individual investors, rental-oriented investors, and owner-occupiers— each with distinct risk tolerance and decision-making criteria.

Emerging markets face additional constraints. Muminović et al. (2022) highlight data insufficiency in Serbia and the need for context-specific decision-making frameworks. Machala and Koelemaij (2021) argue that post-socialist institutional legacies shape investment behaviour in cities such as Belgrade and Bratislava.

Contemporary methodological approaches aim to overcome the limitations of classical models. Gareev and Akhmetgaliev (2020) propose retrospective correlation-regression modelling to incorporate historical patterns into forecasting. Zakrevskaya and Detkova (2018) argue for the relevance of realoptions analysis to improve investment timing decisions in volatile market environments.

A systematized overview of the key components of real estate investment decision-making is presented in Table 1.

Table 1 – Key components of investment decisions in the real estate sector

|

Component |

Characteristic |

Real Estate Specifics |

Source |

|

Rational Factors |

Financial indicators (NPV, IRR, PI, ROR) |

Adaptation to low liquidity and long-term nature |

[3, 12] |

|

Behavioral factors |

Cognitive biases, emotions, cultural characteristics |

High influence due to information asymmetry |

[27, 19] |

|

Macroeconomic factors |

GDP, inflation, interest rates, exchange rates |

High sensitivity of the real estate market |

[13] |

|

Institutional factors |

Legal regulation, tax policy |

Critical for developing markets |

[15, 16] |

|

Technological factors |

AVM, AI, blockchain, multicriteria methods |

Increased transparency and accuracy of valuation |

[17, 24, 25] |

|

Market segmentation |

Residential, commercial real estate, REIT |

Different performance evaluation models |

[12, 23] |

|

Types of investors |

Institutional, individual, speculative |

Different criteria and time horizons |

[19] |

Source: compiled by the author based on [30]

Thus, the theoretical foundations of investment decisions in real estate are based on integrating classical financial indicators with consideration of behavioural biases, industry-specific characteristics, investor heterogeneity, and the particularities of the institutional environment in developing markets.

The preceding review of theoretical foundations highlights the multidimensional nature of real estate investment decisions, shaped by different and sometimes conflicting factors. To examine these influences empirically, it is necessary to apply a structured analytical framework capable of capturing the effect of investor preferences on project evaluation outcomes. The following section introduces the methodological approach employed in this study.

VIKOR Methodology

This study applies the VIKOR multi-criteria decision-making framework to analyse how investorspecific behavioural preferences influence the evaluation of real estate investment alternatives. The analysis draws on previously published probabilistic linguistic VIKOR results (Xu et al., 2024), which provide precomputed rankings of investment projects under varying decision preference settings.

Parameters and Variables

The key behavioural parameter adopted from Xu et al. (2024) is θ, representing the decision maker’s relative weighting between minimizing individual dissatisfaction (regret) and maximizing collective utility. In the referenced model, θ takes values such as 0 (regret-averse/conservative), 0.5 (balanced), and 0.9 (utility-maximizing/aggressive).

Investment alternatives are evaluated across multiple attributes, including financial indicators (e.g., expected return, payback period, risk exposure) and qualitative dimensions (e.g., locational attractiveness, absorptive market capacity, construction quality). The variables are structured such that shifting θ alters the prioritization among criteria, resulting in changes in project rankings across preference types.

Data Source

The dataset applied in this interpretation originates from a PLOS ONE study that used probabilistic linguistic VIKOR to assess foreign direct investment projects under uncertainty and heterogeneous evaluator preferences (Xu et al., 2024). In that study, each alternative was evaluated under several θ scenarios, which enables the examination of how preference sensitivity influences outcomes. Although their application concerns cross-border investment risk, the underlying logic of preference-driven ranking adjustments is transferable to real estate project evaluation in emerging markets.

Application in This Study

Rather than recalculating the VIKOR algorithm, this study focuses on interpreting how different θ values affect project prioritization. The analysis illustrates that a single investment alternative may shift from most preferred to less preferred depending on the decision maker’s behavioral orientation. This reinforces the argument that investment outcomes are not solely driven by objective financial performance, but also by non-financial decision heuristics, manager characteristics, and strategic orientation.

Accordingly, integrating preference sensitivity into evaluation frameworks supports a richer understanding of investor heterogeneity. These insights extend implications for project developers, financial institutions, and policymakers by demonstrating that “optimal” investment decisions are contingent upon behavioural weighting structures, rather than universally stable.

Building on this methodological foundation, the following section illustrates how variations in behavioural preferences translate into measurable shifts in project rankings. The results present the sensitivity of investment conclusions to changes in θ, thereby empirically demonstrating the influence of investor heterogeneity.

Results

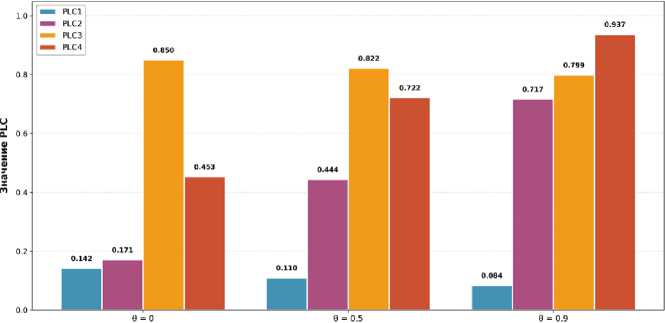

The influence of investor behavioural preferences on the final decision can be illustrated using the VIKOR method with probabilistic linguistic term sets [30]. As shown in Figure 1, when the parameter θ changes from 0 (conservative approach, focusing on minimizing individual regret) to 0.9 (aggressive approach, focusing on maximizing group utility), the Probabilistic Linguistic Compromise (PLC) values for alternatives change significantly [30]. At θ = 0, alternative PLC1 has a value of 0.142 and PLC4 — 0.453, whereas at θ = 0.9, these values are 0.084 and 0.937, respectively. This example demonstrates that investors with different risk preferences and strategic priorities can reach diametrically opposite conclusions when evaluating the same investment projects.

Значение параметра 6

Figure 1 – Multi-attribute risk analysis of investments (VIKOR). PLC values for alternatives at different θ

Source: compiled by the author based on [30]

The quantitative impact of behavioural preferences on project evaluation is presented in Table 2, where the results of applying the VIKOR method for different θ values are systematized.

Table 2 – Impact of parameter θ on alternative ranking (VIKOR method)

|

Parameter θ |

PLC1 |

PLC2 |

PLC3 |

PLC4 |

Optimal alternative |

|

0,0 |

0,142 |

0,171 |

0,850 |

0,453 |

PLC1 |

|

0,5 |

0,110 |

0,444 |

0,822 |

0,722 |

PLC1 |

|

0,9 |

0,084 |

0,717 |

0,799 |

0,937 |

PLC1 |

Source: compiled by the author based on [30]

Discussions

Despite it changes in the absolute values of PLC, the alternative PLC1 remains optimal across all values of θ, indicating its robustness to shifts in the investor’s strategic priorities. However, significant transformations are observed for PLC2 and PLC4: when transitioning from a conservative to an aggressive strategy, the value of PLC2 increases by a factor of 4.2 (from 0.171 to 0.717), while PLC4 increases by a factor of 2.1 (from 0.453 to 0.937). These variations demonstrate that investor behavioural preferences substantially affect the relative attractiveness of certain alternatives, even when the overall ranking appears stable for the top option.

Interpretation and comparison with literature: The observed sensitivity aligns with prior studies highlighting the influence of cognitive biases and strategic orientation on investment evaluation (Singh et al., 2023; Özogul & Taşan-Kok, 2020). Like findings in emerging market contexts, projects that may appear less attractive under a conservative approach can gain importance when decision-makers adopt a more utility-focused perspective, confirming the need to incorporate behavioural heterogeneity in assessment frameworks.

Theoretical and practical significance: The results provide empirical support for the integration of behavioural parameters into multi-criteria decision-making models, extending the theoretical understanding of how investor heterogeneity shapes real estate investment outcomes. Practically, this emphasizes the importance for investors, banks, and project developers to account for varying behavioural profiles, as strategic priorities and risk attitudes can substantially alter project evaluation, even when financial indicators remain constant.

Conclusions

The conducted research allows us to formulate several key conclusions regarding the nature of investment decisions in the real estate sector.

-

1. Classical financial indicators (NPV, IRR, PI, ROR) remain fundamental tools of evaluation; however, their application requires adaptation to the specifics of the real estate market, including low liquidity, high sensitivity to macroeconomic factors, and pronounced market segmentation.

-

2. Behavioural factors exert a critical influence on final investor decisions. The application of the VIKOR method has demonstrated that changes in behavioural preferences lead to a 2–4-fold transformation in the evaluation of alternatives, highlighting the necessity of integrating behavioural aspects into investment performance assessment models.

-

3. Developing markets, including the Balkan region, are characterized by specific challenges: insufficient data availability, the influence of post-socialist legacy on the institutional environment, and high information asymmetry.

Building upon these findings, the study offers the following implications and recommendations: Theoretical implications:

-

• Extends literature on real estate investment by quantifying behavioural effects using VIKOR.

-

• Demonstrates the importance of investor heterogeneity in project evaluation.

Practical implications:

-

• Investors and banks can use VIKOR and behavioural analysis to improve project selection.

-

• Policymakers should enhance data transparency and institutional frameworks to support efficient

investment decisions.

Limitations:

-

• Limited to hypothetical project data and Serbian market specifics.

-

• Methodological constraints include assumptions in VIKOR parameters and linguistic term assignments.

-

• Results may not generalize to all real estate segments or countries.

Recommendations:

-

• Investors should incorporate behavioural preferences in multi-criteria evaluations.

-

• Banks and financial institutions can use adaptive frameworks for credit risk assessment.

-

• Policymakers should improve regulatory and data infrastructure to facilitate informed investment decisions.

Future research directions include the development of integrated models combining quantitative and qualitative assessment methods while considering behavioural, technological, and institutional factors.

Acknowledgments

The author acknowledges all support received during the preparation of this work.

Conflict of interests

The author declares no conflict of interest.