The issues of asymmetry of corporate and public interests in the food market

Автор: Usenko Natalya Ivanovna, Otmakhova Yuliya Sergeevna, Olovyanishnikov Aleksandr Gennadevich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 3 (33) т.7, 2014 года.

Бесплатный доступ

The article analyzes the present-day condition of Russia’s food market from the viewpoint of coordination of interests of population and corporate interests of producers. The author points out that the provisions of the existing legal documents regulating the quality and safety of foodstuffs facilitate the growth of asymmetry in these interests. The article considers the manifestation of imbalance and the consequences of consumption of foodstuffs, produced with the use of new technology and receipts. It proposes the ways to smooth the asymmetry of interests by enhancing the role of experts in drafting the state decisions on the development the national food market from the standpoint of complying with the principles of food products safety.

Food market, quality, corporate interests, multinational companies, food security, expert community

Короткий адрес: https://sciup.org/147223591

IDR: 147223591 | УДК: 338.439.5 | DOI: 10.15838/esc/2014.3.33.10

Текст научной статьи The issues of asymmetry of corporate and public interests in the food market

Production and distribution of food products are closely connected with such indicators as quality and food safety, physical and economic access. The tasks of expanding the range of products, creating new high-tech food products satisfying various consumer preferences are relevant for the food industry and food retailers.

However, the tasks to enlarge the food range, to creation new formulas of food products answer not only the needs of the population, but the corporate requirements of the operators of food market in the field of competitiveness of enterprises and improvement of production efficiency. The main point of corporate priorities is, first of all, to maximize the expected revenue by increasing market share, reducing costs, etc. The following questions are in focus: In what way does the realization of these corporate priorities reconcile with consumers interests? Is the balance achieved or is there asymmetry of interests? In this article the authors have attempted to answer these questions.

The main corporate segments of the Russian food market

Nowadays the Russian food market takes an important place in the economy of Russia. In the structure of retail trade turnover in 2012 the share of food products was 46.5%, or 9.9 trillion rubles.

According to the data of the Federal State Statistics Service (Rosstat), the share of food products production, including beverages and tobacco in the overall volume of manufacturing production in 2012 was 15.9%, and the dynamics of the indices of food production (Table 1) during the 2005–2012 period is characterized by stable positive values. However, we observe the decline of indices points at the end of the analyzed period.

Most of the food industry sectors are characterized by a short production cycle, fast return of investment. Due to these characteristics, the food industry represented (and represents) one of the most attractive areas of application of the world capital. As an analytical evaluation of investment attractiveness of the food sector of industry international stock indices are used, which allow to evaluate the overall change of the direction and the current state of the market, such as the Dow Jones Industrial Average (DJIA).

In the global list of companies covered by DJIA there are three top food and beverage manufacturing companies: soft drinks – Coca-Cola Co., food products – Kraft Foods Inc., food service sector – McDonald’s Corp.

Table 1. Indices of food production during the period 2000–2013

|

2000 |

2005 |

2010 |

2011 |

2012 |

2013 |

|

|

Indices of food production |

105.3 |

106.6 |

105.4 |

101.0 |

104.1 |

100.6 |

retailers). According to the data available at Foodinnovation.ru [1], the food sector companies have showed 20% growth for five years since the crisis. Such growth is only comparable with the growth of high-tech companies index NASDAQ, but with a high level of stability during the recession, related to the presence of stable cash flow caused by weak variability of consumer demand.

Nowadays the main trends of the Russian food market are the continued concentration of property, the reduction of the small and medium-sized enterprises share, the strengthening of the position of major consolidated companies. During the period of transition to the market economy model a large number of developing companies, successfully competing in the domestic food market and in the markets of the CIS (the Commonwealth of Independent States) countries, actively attracting capital for their development, have been formed in the country [2].

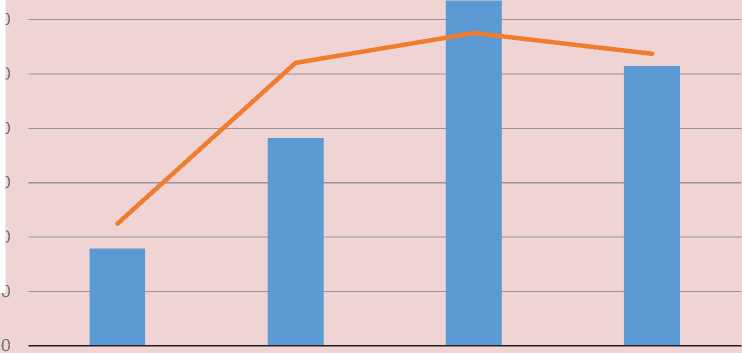

Food processing industry remains attractive to the Russian and foreign investors that is demonstrated by the amount of investments ( fig. 1 ), according to Rosstat, and the significant percentage in total investment ( tab. 2 ).

In general, during the 2010–2012 period the total amount of investment in the food industry of Russia was US $ 8796 million.

Today almost all the world’s largest food, beverage and tobacco companies have their subsidiaries in Russia. The considerable part of the modern food industry in Russia is centralized in the large multinational companies (MNCs), most of which are multifunctional corporations.

Dynamics of foreign investment by the type of economic activity, U.S. $ Million

foreign investments, total food production, including beverages and tobacco

Table 2. Foreign investment, U.S. $ Million

|

Indicator |

2005 |

2010 |

2011 |

2012 |

|

Foreign investment, Total |

53651 |

114746 |

190643 |

154570 |

|

Including the type of activity: production of food, beverages and tobacco |

1210 |

2803 |

3099 |

2894 |

|

Percentage of foreign investments by the type of activity: production of food, beverages and tobacco in total investment,% |

2.2 |

2.4 |

1.6 |

1.9 |

The foreign companies having their Russian subsidiaries are: “Unilever”, “Nestle”, “Unimilk-Dannon”, “CocaCola Company”, “PepsiCo”, “Bonduelle Group”, “Khorteks”, “Group Secab”, “Orkla Brands Russia”, “Mars”, “Kraft Foods”, “Ahmad Tea”, “SUN InBev”, “Carlsberg”, “SAB Miller RUS”, etc.

It is significant that, according to the annual ranking [3] of big companies, estimated by the journal “Expert”1, in 2013 the Russian subsidiary “PepsiCo” (PepsiCo Holdings) – the largest producer of food and beverages was ranked first among the food industry enterprises and 50 among the companies in all spheres of activity by sales revenue.

According to the official website of the multinational company PepsiCo [4] in Russia, the company has more than 40 companies and about 25,000 employees. “PepsiCo” is actively investing in their business in Russia. In 2011 the company “PepsiCo” expanded its main assortment (including carbonated and non-carbonated drinks, chips) by the acquisition of the company “Wimm-Bill-Dann” – Russia’s largest producer of dairy products, baby food and juices.

As a result, the Russian subsidiary “PepsiCo” has received the status of the leading processor of milk in Russia. This was an extraordinary deal in terms of the amount of foreign investment (5.4 billion U.S. dollars) in the non-raw-material sector of Russia.

“Baltika”, the largest beer producer in Russia, is also among the leaders of the rating “Expert-400” in 2013 and occupies the 88th position in the list and the second one among the food industry companies. In November 2012 the forced reacquisition of shares of the joint stock company “Baltika” was completed, whereby Carlsberg Group (a Danish brewing company) has owned 100% of the Company’s capital. The total staff of food company “Carlsberg” – 38.6 thousand people (2012).

It is estimated that the share of foreign capital in the food industry according to the Ministry of Agriculture of Russia is 60% [5] and has a tendency of further growth due to mergers and acquisitions in the food market. Foreign investments have provided the necessary financial leverage for the development of the food industry, and the process of mergers and acquisitions in the food industry has led to the smooth transition to an oligopoly, that is the reduction of the number of small producers in the market.

The sphere of interests of foreign investors – the segment FMCG (fast moving consumer goods) – contains consumer goods with fast turnover, its considerable part is minimally connected with the local resource base. The target at the top-income segment of the food products with a low proportion of natural raw materials gives manufacturers the possibility not to depend on the instability of properties and prices.

The relevant inflow of foreign capital has been the main factor of high growth rates in the food industry in Russia during the last 10–15 years. In addition, the successful application of system of international manufacturing control and quality assurance system, the latest equipment, logistics and advanced sales systems in the Russian subsidiaries of foreign companies has contributed to the situation when the formation of the Russian food market has largely been dependent on the strategic priorities in the development of transnational production companies or their subsidiaries.

Enterprising and energetic efforts to uphold the interests of multinational companies in order to maximize the reflection of their business interests largely determine the vector direction of the Russian food policy, especially in the industrial production of food. Lobbying is carried out both in direct and indirect forms (the support of scientific conferences and exhibitions, forums and congresses), and is implemented through the various members of collegiate advisory bodies at regional and municipal authorities and public organizations.

In the regions local authorities, the degree of their influence on the tax benefits value can be rather substantial, often make decisions in favor of “understandable” business of a transnational company – a major investor and taxpayer in the region. This form of support is rarely given to “their local companies”, which are not so efficient in the competition with the titans of the food market, and that leads to a further weakening of the small and medium business.

Thus, the current structure of the Russian food industry is clearly segmented into two sectors: the domestic sector – small and medium enterprises owned by Russian citizens and the Russian sector of the subsidiaries of foreign corporations, which is the most developed part of the corporate business.

The problem of asymmetry of interests of consumers and producers of the food market under the conditions of laws and technical regulations of food quality and safety

The problem of asymmetry from the authors’ point of view is that the majority of food producers focus on a highly profitable segment of the food market with a low proportion of natural raw materials to the prejudice of the quality and nutritional value of food industrial production. In this regard, it is important to investigate whether laws and technical regulations have a moderating effect on the processes of manufacture of products with a low nutritional value.

Today Russia has the Federal Law “On the food quality and safety” [6], according to that, the quality is defined as a complex of characteristics of food products, capable of satisfying human needs for food under normal conditions of their using. In this case, there is the interpretation of the category of “quality” without taking into account the requirements of the utility consumer properties of the product.

It should be noted that technical regulations, which replaced the National State Standards, establish the minimum requirements, which provide biological, chemical and radiation food safety.

The set of international quality standards of ISO (International Organization for Standardization), applied in the creation and improvement of quality management systems of organizations, is not the standard of quality of the product itself, but, first of all, is a model or a diagram of the organization of processes for providing the highest quality of management of the organization. At the same time, when most of the largest enterprises in the food market indicate on their websites and in their brochures mention in a product label that their product quality is provided by international systems of certification, then the concept “quality of the organization” is substituted for the concept “quality of the product” in the consumer’s mind.

Thus, in reality there is a terminological “trap”. In accordance with the settings of quality control systems the quality product means standardized finished products, which meet the requirements of safety, produced under appropriate conditions and pass the necessary control procedures. This interpretation is in conflict with the associative representation of most consumers about product quality.

It should be noted that the ambiguity of interpretations of the concept of quality and efficiency in many ways has led to the illusion of perception of the activity of highly effective companies in the food market as the companies, interested in the production of qualified products which meet the interests of consumers to the fullest extent. In this regard the organization of manufacturing of certain products is only aimed at the production of standardized food products, that is, asymmetry of interests of consumers and producers of food products occurs, causing serious imbalances in the development of the food market.

“Efficiency” in the Western understanding is not not useful, that is, nobody requires that firms compete in the usefulness of their products, in the degree of satisfaction of the needs of the population” [7, p. 13].

In modern conditions the competitiveness of food products is determined to a large extent by the trade, the presence of products in retail chains makes wide publicity for them and provides recognition. However, large retail chains act as a catalyst for the formation of the deformed structure of product supply, focusing on the sale of attractive products, regardless of its nutritional value. The retailers’ task is to increase the number of customers and the average amount of the check, and in fact the product is not sold as itself, but “shelf space”.

Large retail prefers to work with large food companies, and the product policy in the major trading companies is built on the same principles as in the transnational food companies.

To establish the single economic space the Customs Union has made some serious steps to regulate the food market at the supranational level, to ensure the coherent policy regarding standards, technical regulations, food quality and safety.

Seven technical regulations in the food industry came into effect July 1, 2013. The are the following: “On Food safety”, “Food products in terms of their labelling”, “Technical regulations on juice products from fruit and vegetables”, “Technical regulations on fat-and-oil products”, “On safety of certain types of specialized food products, including dietary medical and dietary preventive nutrition”, “On security of grain”, “Safety of food additives, flavourings and processing aids”.

The last above-mentioned technical regulation is of importance, because artificial dyes, food flavourings and conser-vants have become an indispensable feature of modern food. As it is known, the use of dietary additives is harmful for a human body. The human nutrition can be not only the source of important food and biologically active substances for the human body, but also the source of the accumulation of various metabolites of food additives, that is extremely undesirable, and in some cases it is a direct threat to human health due to cellular metabolism disorders.

In our opinion, the lists of permitted additives under conditions of growing knowledge about them and in light of the latest scientific research, should be continuously updated for the subject of their using. Of course, this is a complex process, involving a significant amount of commercial interests, but the problems of their confrontation are not always solved in favor of consumers.

There is a well-known example, when the group of experts from the University of Southampton investigated the most popular dietary additives and presented the results of the experiment at the disposal of the Food Standards Agency UK (FSA). According to these data, a number of food colourings – E102, E104, E110, E122, E129 – can cause hypersensitivity of the human body and, as a consequence, “hyperactivity” in children’s behavior. Despite the presented proofs, the “scandalous” food colourings have not been prohibited in many EU countries, and there have been only the recommendations for producers on the necessity to abandon to use these food additives.

The above-mentioned problems have been incorporated in the new technical regulations (on the nutrition labelling) of the Customs Union, but their decision is piecemeal. Thus, the Regulations states: “For food products containing food colourings (E122, E104, FCF, E110, charming AC, E129, Ponceau 4R E124 and E102) there should be a warning label: “It contains a coloring agent(s) that can have a negative effect on children’s activity and attention”. In this case, it should be noted, a lot of colorful and attractive food products (confectionery, soft drinks, ice cream), using food colourings, are directed to children.

In this connection there are very interesting conclusions, made by I.A. Martynuk [8] in his thesis research, about the evaluation of the toxicity of the above-mentioned food additives. The food colourings E102, E122, E142, E110 became the subject of this thesis research, the author developed the rapid test method of determining their integrated toxicity by using bioassays. In a short time the experiment studied the impact of substances on several generations of animal bioassays.

According to the results of experiments the following results have been obtained: the food colourings have not acute and chronic toxic effects onthe aquatic organisms (Daphnia laboratory), this indicator has proved that the investigated substances can be considered environmentally safe. However, in terms of the impact on reproduction and development of the offspring they have a significant influence on the fertility of the studied species, that is pronounced in subsequent generations.

Thus, the examined food colourings can be hazardous to health: they affect the activity of children and can cause adverse effects on the reproductive function of human beings, as they cause gonadotrophic2 effect.

Such serious data of this study, disclosing long-term consequences of the negative impact of chemical elements, should not only be considered as a part of scientific results, but also used in applied applications as an evidentiary foundation for legislative guidelines, regulations and requirements in the field of the using of food additives.

Consequences of the changes in the structure of product supply in the food market

Under market conditions, product formula is a trade secret that creates information asymmetry in the food market and real opportunities for abuses by food producers by creating a variety of recipes using natural raw material replacement. In this case similar flavor characteristics (or better) of the finished product are provided through the introduction of chemical additives and ingredients, which are identical to natural. The innovative development is carried out in the form of product formulas that achieve maximum functionality, in particular the company’s profits.

Western companies have accumulated a great experience in the development of high-tech food products. As a result, the structure of the Russian food market has implanted a serious segment of the food products, which can be characterized as artificial, synthetic to a great extent. The concept “artificial food”3 has appeared.

Today, synthetic food produced by food giants, appears under the guise of genuine, and a number of chemical ingredients used in the food industry are turned it into chemical industry. The authors wrote about the peculiarities of this metamorphosis in their previously published articles [9].

The appearance of “new products” has provided a variety of product offering in the food market, that led to information asymmetry under the conditions of high-level monopolization, when the opportunity to manipulate consumer behavior in the field of nutrition has appeared in the direction of increasing purchases of new products, cost-effective for enterprise-producers, but useless and even harmful to consumers’ health.

Z. Biktimirova noted in her article, published in 2004, that among the risks of globalization, there was a growing threat of manipulation of public consciousness. And the negative effect of this manipulation on food security can be the creation of behaviors and values that correspond to the interests of those who control the money, but are hazardous to human health and long-term prospects for the development of society [10, p. 82]. Time confirms the validity of this statement. In the context of the lack of education of the population in the sphere of food consumption, moral and psychological impact of aggressive advertising of food manufacturers which use human weakness before temptations of food market, there is a situation when consumers choose products which are harmful to their health.

In May 2013 the British consulting company “Maplecroft” published a new index – Obesity Risk Index (ORI), designed to evaluate the risk of obesity and overweight for 188 countries. The ranking results show the indices of 10 countries at risk. Russia is in the third place in the world among the countries where obesity is bad for the economy, the second one only to Mexico and the United States. Economic consequences include the direct expenses of health care and indirect expenses associated with the loss of economic productivity, as well as individual citizens’ expenses on drugs [11].

According to the report of the Food and Agriculture Organization (FAO), in July 2013 Mexico occupied the first place in the ranking of the “thick” countries, the United States pushed to the second place of ranking. In 1989, by the moment when the system of fast food had been widespread, only 10% of adult Mexicans had some problems with being overweight, and in 2013, according to the ranking, 32.8% of the inhabitants of Mexico were obese, most of them were young people from the poor. The United States gave way to Mexico 31.8% of the Americans had obesity diagnosis [12]. Russia occupied 19th place in the above-mentioned ranking among the 20 most “thick” countries. Almost a quarter of respondents (24.9%) were obese.

The specialists from “National Center “Healthy Eating” has carried out the investigations, the results of which show that the problem of excess weight is typical for the residents of the Siberian Federal District. The morbidity rate of obese among adult population (18 years and older) in Omsk, Novosibirsk, Kemerovo, Irkutsk oblasts, the Altai Republic and Zabaykalsky Krai, Khakassia, Altai and Buryatia is almost 1.5 times higher than the average for the country [13]. According to Novoselov’s opinion, the director of the non-governmental organization “Siberian Federal Center of health food”, given in the journal “Expert”, at least 45% noncontagious diseases are associated with Siberians malnutrition. “Every day our body faces with a huge amount of unusual elements – chemical additives, conservants, substitutes. And how they will affect us and our children, no one can say” [14].

Examples of reconciling the interests of consumers and producers of food products

Is it possible in today’s realities that food matrices are formed by manufacturing enterprises and distribution networks in accordance with the principles of healthy nutrition?

In recent years, “new shoots” are viewed in the Russian food market, there are the examples of separate companies which are ready not only to produce natural and healthy products, but also to invest efforts in creating a new market segment of “good” foods. These companies include Tomsk trading company “Lama”, which two years ago, at the initiative of the president of the company, kept a healthy lifestyle, revised its mission, designating it as follows: “We provide food security of Russia”. One of the ways to achieve this mission was to collect signatures against GMOs, including electronic voting on the official website of the company. Thus the company “Lama” is engaged in retail trading and various products manufacturing, it began to enforce an active policy to protect its own business and production against GMO products.

But in what way have the formulations change and elimination of all chemical additives from products reflected in the cost of the enterprise? In the course of this article the authors held the interview with the Deputy Director for Economics LLC “Terminal Group”, included in the group of companies “Lama”, M. Ryabykin who answered some questions. Thus, to implement the requirements in the field of quality control the company had to create its laboratory, to attract a large staff of professionals, to build business processes for receiving and checking the quality of raw materials and products, as well as to review the contracts related to the supply of defective products. As a result the increased costs of production and sales of the useful products, according to M. Ryabykin, led to the loss of a certain percentage of profits as the product price could not be increased to the level at which it was increased its cost.

In our opinion, the state support of efforts of such manufacturers to create a new market segment is necessary that in the foreseeable future they could reach the average level of profit and gain consumers’ support as a buyer is gradually reorienting to purchase more healthful products.

The role of the level of expertise in problems of equalization of asymmetry in supporting food quality

The transnational nature of the food industry has substantially changed the technology of food production. It is necessary to comprehend who wins and who loses because of ongoing transformations. It is important to understand what causes these changes and whether they are necessary.

The authors have already expressed their opinion in the press [15] on the necessity to increase the importance of the role of expert support in the development and review of regulatory documents and draft of state decisions on the development of the national food market, especially in terms of compliance with the principles of food safety.

Examination is a special type of applied research, involving a critical examination of documents (decisions and draft decisions) in order to minimize the probability of erroneous decisions.

Nowadays in Russia, in most cases the procedures of experts identification, time frames for examination, the content and quality of expert opinion, the necessity of its publication and other are not well regulated.

Among the negative aspects of the organization and conduct of the examination of legal and regulatory documents at the federal level, regulating industrial activity in the food market, the following can be identified:

-

1. During the preparation of the decisions the presence of expert opinions from business and from science is obligatory. For example, the State Duma has legal and linguistic expertise of laws, but not scientific. The expert may be offered by a related party that allows to establish and to maintain lobbying channels [16].

-

2. In the expertise of legal acts of federal executive authorities, held by The Depart-ment of Regulatory Impact Assessment of Ministry Economic Development of the Russian Federation, the members of the non-profit partnership “the Union of Consumer Market” are actively involved in order to identify their offers, making it unfoundedly difficult to do business and investment. The position of this non-profit partnership reflects, first of all, the consolidated policy of lobbying corporate interests of its members.

-

3. Lobbying of enterprises interests becomes politics of such public authority as the Rosstandart – Federal Agency for Technical Regulation and Metrology, which is administered by the Ministry of Industry and Trade of the Russian Federation.

The list of the participants of this nonprofit partnership includes a large number of manufacturers of food, including food giants such as “Mars”, “Nestle”, “CocaCola”, “Ferrero”, “Nutricia”, “Danon”, “Uniliver”, “Kraft foods”, etc. The main objective of the partnership is to provide the most complete account position of the partnership when developing and implementing the requirements of the Russian legislation and the Customs Union in the production and circulation of food products and other issues of the regulation in the food industry.

According to the statement of “the Union of Consumer Market” [17], it represents the interests of honest entrepreneurs in the interests of consumers. However, the list of participants of the Union and the stated objectives of the nonprofit partnership functioning give reason to doubt their interest in protecting the interests of consumers.

According to the paragraph 5.3.2 of the Provision of this department, expert examination of draft national standards is the function and the power of the Rosstan-dart. The Head of this department Grigory Elkin, in his speech in April 2013 at the meeting of the Federal inter-agency board “Business Russia” expressed his position on the target plants in the examination standards: “Our goal is lobbying our businesses, our industry, our achievements. As international standardization, as well as standardization in general is one way of lobbying” [18].

The question is: how then will the ideas presented in the Concept of national standardization system be implemented, according to which in the context of globalization the system should balance the interests of the state, business entities, public organizations and consumers? Although it is worth to mention that it is the national standards government body, in accordance with its above-mentioned concept, that fulfills the task of the development of the list of obligations mechanisms of stakeholder participation in the formation of a common policy in the field of standardization.

In this situation, the preparation at the legislative level of quality standards in relation to food products without the proper level of scientific and public examination of the impact on man’s biosafety is a dangerous policy that allows companies to realize their commercial interests to the detriment of consumers.

We propose a number of ways to improve the significance of the level of expertise in the evaluation process of unexplored consequences of using new technologies and raw ingredients in the food industry.

-

1. Under the conditions when the main motivating force of food producers and trade is profit, the modern system of normative and legislative acts in the field of regulation of the food market should be a rational system of “checks and balances” so that upcoming “bioeconomy” does not damage human nature. The formation and creation of such a regulatory system should belong to science. We consider it necessary to extend the list of priority research themes of the Russian Federation relating to proposals to develop predictive

-

2. To set the vector for the further development of scientific researches in the field of the food industry it is necessary to enlarge the list of critical technologies at the federal level which are related to biosafety man. The development of this branch of knowledge will facilitate proper prioritization in order to take appropriate measures in the future intervention in the formation and development of the national food market.

-

3. Interdisciplinary nature of the research problems of the modern food industry causes the necessity of coordination of expert advice while the preparation of documents to regulate the food market ensuring the harmonization of corporate and public interests.

-

4. The need for transparency in the preparation of solutions. The public

scenarios of the Russian food market taking into account the challenges and threats determined by new technologies in the process of food production, bio-and nanotechnology, approaches to the management the costs of holdings-food conglomerates in the food market. The results of researches should be the basis for formation of databases in the regulation of food production at the national level, which can and should be used to develop draft technical regulations as the evidence base for the principles, regulations and requirements.

It is necessary to expand the tool palette in the expert community partnership through the creation of associations of analysts and experts who could unite the various categories of specialists.

lighting will allow the population to evaluate critically the product offering in the food market and choose foods corresponded to the principles of healthy eating.

The population as a main consumer of food products could actually participate in the process of formation of the system of regulation of commodity supply “voting by ruble”. It is believed that the population is responsible for the selection of useful and quality products for their own consumption.

However, it is difficult for the average buyer to understand the diversity of the proposed portfolio under the conditions of the aggressive marketing of manufacturers, which is aimed at maintaining the policy of consumerism (excessive consumption of goods and services), and provides any innovation as an innovation in its content and in the packaging. While a mass consumer begins to understand the products, to distinguish “useful and natural” from merely “beautiful and delicious”, retail chains will opt for the latter.

It should be recognized that the majority of the population have not been ready for the perception of a healthy diet, and manufacturers took advantage of this when responsibility for product quality is placed not on the regulators but on the enterprises themselves. The population has a former way of thinking and believes that “all food products on the counter are checked, tolerated, allowed and benefit”. Thus, the population commitment to conservative model of consumption patterns in the food markets is confirmed by an ambitious research held by the marketing company “Start marketing” [19].

In order to help the population to make a conscious step in the fight for their interests, we consider it necessary to extend the functions of the expert community in the public awareness campaign to form the rational eating behavior among the population and to inform customers about the features of modern industrial production of raw materials and finished food products.

Conclusion

At the present stage of development of the food market increasing asymmetry of interests of consumers and producers of food products in terms of quality and nutritional value takes place. The analysis showed that the Federal Law “On the quality and food safety” and technical regulations do not provide the coordination of these interests and require further improvements in the public interest.

The characteristic features of modern industrial food production should include an increase in output, containing a large number of chemical ingredients that allow to reduce the costs of enterprises, to increase the terms of sales and storage products. Strategies of efficiency of production and trade, promoting food products to consumers without the regard to the requirements of utility foods are the main drivers of the innovation process in the food industry.

In these circumstances, it is necessary to strengthen the role of expertise and its public lighting in the development of new products and new food technology, regulatory and regulations to prevent the transformation of the food market in the global sphere of practical experiments. In our opinion, the presence of a competent examination will allow to develop adequate mechanisms governing the food production.

Sited works

-

1. Available at: http://foodinnovation.ru/articles/5190.html (access date: November 07, 2013).

-

2. RF Government Resolution “On Approval of the Strategy for the Development of Food and Processing Industry in the Russian Federation for the Period till 2020” of April 17, 2012 No.559-r . available at: http://base . consultant.ru/cons/cgi/online.cgi?req=doc;base=LAW;n=128940 (access date: November 07, 2013).

-

3. Available at: http://www.raexpert.ru/ratings/expert400/ (access date: November 07, 2013).

-

4. Official Website of PepsiCo . Available at: http://www.pepsico.ru/company/pepsico_in_russia/ (access date: November 07, 2013).

-

5. The Participation of Foreign Capital in the Food Industry . Available at: http://www.mcx-consult.ru (access date: November 12, 2013).

-

6. About the Quality and Safety of Food Products: the Federal Law of January 02, 2000 No.29 . Available at: http://www.flexa.ru/law/zak/zak057-3.shtml (access date: November 07, 2013).

-

7. Parshev A. Why Russia Is Not America. The Book for Those Who Remain Here . Moscow: AST: Astrel’, 2009. 350 p.

-

8. Martynyuk I.A. The Issues of Ecological Safety of Food Additives and Determining Their Toxicity by the Method of Biotesting. Ph.D. in Biology Thesis Abstract . Moscow: Moskovskaya sel’skokhozyaistvennaya akademiya imeni K.A. Timiryazeva, 2002.

-

9. Usenko N.I., Poznyakovskii V.M. Against “Junk” Food: the Transformations of the Food Industry and Food Security . EKO , 2012, no.8, pp. 175-189.

-

10. Biktimirova Z. Quality of Life: Food Security. Economist, 2004, no.2, pp. 78-84.

-

12. Available at: http://www.dailymail.co.uk/news/article-2358439/Mexico-takes-America-fattest-nation-earth.html (access date: November 10, 2013).

-

13. Available at: http://www.medlinks.ru/article.php?sid=55123 (access date: November 10, 2013).

-

14. Available at: http://expert.ru/siberia/2013/44/ochen-vrednyij-perekus/ (access date: November 08, 2013).

-

15. Usenko N.I., Poznyakovskii V.M., Olovyanishnikov A.G. Myths about the Quality (Specifics of Modern Industrial Production of Foodstuffs). EKO , 2013, no.6(9468), pp. 133-148.

-

16. Barsukova S.Yu. Juice Market in Russia: Past, Present and Future. EKO, 2009, no.12, pp. 111-121.

-

17. Official Website of the Union of Consumer Market Participants . Available at: http://www.np-supr.ru/ (access date: November 12, 2013).

-

18. Available at: http://rostandart.ru/news/standartizaciya_odin_iz_sposobov_lobbirovaniya_interesov_ rossijskih_predpriyatij (access date: November 07, 2013).

-

19. Available at: http://www.startmarketing.ru/news/121 (access date: November 12, 2013).

11 Available at: (access date: November 10, 2013).

Список литературы The issues of asymmetry of corporate and public interests in the food market

- Available at: http://foodinnovation.ru/articles/5190.html (access date: November 07, 2013).

- Rasporyazhenie Pravitel’stva RF “Ob utverzhdenii Strategii razvitiya pishchevoi i pererabatyvayushchei promyshlennosti Rossiiskoi Federatsii na period do 2020 goda” ot 17.04.2012 g. №559-r . available at: http://base.consultant.ru/cons/cgi/online.cgi?req=doc;base=LAW; n=128940 (access date: November 07, 2013).

- Available at: http://www.raexpert.ru/ratings/expert400/(access date: November 07, 2013).

- Ofitsial’nyi sait kompanii PepsiCo . Available at: http://www.pepsico.ru/company/pepsico_in_russia/(access date: November 07, 2013).

- Uchastie inostrannogo kapitala v pishchevoi promyshlennosti . Available at: http://www.mcx-consult.ru (access date: November 12, 2013).

- O kachestve i bezopasnosti pishchevykh produktov: federal’nyi zakon ot 02.01. 2000 g. № 29 . Available at: http://www.flexa.ru/law/zak/zak057-3.shtml (access date: November 07, 2013).

- Parshev A. Pochemu Rossiya ne Amerika. Kniga dlya tekh, kto ostaetsya zdes’ . Moscow: AST: Astrel’, 2009. 350 p.

- Martynyuk I.A. Problemy ekologicheskoi bezopasnosti pishchevykh dobavok i opredeleniya ikh toksichnosti metodom biotestirovaniya: avtoreferat dis. na soiskanie uchenoi stepeni kand. biolog. nauk . Moscow: Moskovskaya sel’skokhozyaistvennaya akademiya imeni K.A. Timiryazeva, 2002.

- Usenko N.I., Poznyakovskii V.M. Protiv “musornoi” edy: metamorfozy pishchevoi industrii i prodovol’stvennaya bezopasnost’ . EKO, 2012, no.8, pp. 175-189.

- Biktimirova Z. Kachestvo zhizni: prodovol’stvennaya bezopasnost’ . Ekonomist , 2004, no.2, pp. 78-84.

- Available at: http://maplecroft.com/portfolio/new-analysis/2013/05/13/maplecrofts-new-obesity-risk-index-highlights-global-nature-obesity-epidemic/(access date: November 10, 2013).

- Available at: http://www.dailymail.co.uk/news/article-2358439/Mexico-takes-America-fattest-nation-earth.html (access date: November 10, 2013).

- Available at: http://www.medlinks.ru/article.php?sid=55123 (access date: November 10, 2013).

- Available at: http://expert.ru/siberia/2013/44/ochen-vrednyij-perekus/(access date: November 08, 2013).

- Usenko N.I., Poznyakovskii V.M., Olovyanishnikov A.G. Mify o kachestve (osobennosti sovremennogo promyshlennogo proizvodstva pishchevoi produktsii) . EKO, 2013, no.6(9468), pp. 133-148.

- Barsukova S.Yu. Rynok sokov v Rossii: proshloe, nastoyashchee i budushchee . EKO, 2009, no.12, pp. 111-121.

- Ofitsial’nyi sait NP “Soyuz potrebitel’skogo rynka” . Available at: http://www.np-supr.ru/(access date: November 12, 2013).

- Available at: http://rostandart.ru/news/standartizaciya_odin_iz_sposobov_lobbirovaniya_interesov_ rossijskih_predpriyatij (access date: November 07, 2013).

- Available at: http://www.startmarketing.ru/news/121 (access date: November 12, 2013).