The problem of synthesizing financial statements in reorganization during the bankruptcy process

Автор: Predrag Stojković, Maja Kovačević, Radovan Vladisavljević

Журнал: Pravo - teorija i praksa @pravni-fakultet

Рубрика: Review paper

Статья в выпуске: 3 vol.39, 2022 года.

Бесплатный доступ

The subject of the paper is solving the problems arising from the use of highly synthesized financial statements. The paper presents a model by which highly synthesized financial data can be used for the needs of reorganization in bankruptcy management. Financial and accounting data are frequently synthesized, i.e. organized in such a way that they largely hide the details of the business. The act of synthesis is needed in order a general picture of a company’s business to be created. Financial statements such as balance sheets and income statements represent typical examples. In the paper, there are used several research methods to formulate the models for the efficient use of highly synthesized financial statements. The basic method used in the research was the case study method, then the modelling method, and, as an auxiliary method, there was used the documentation analysis method. The case study analyzed the main indicators being important for the bankruptcy. We analyzed six companies which were in the process of reorganization in bankruptcy, and the analysis identified common characteristics served as the starting points for the next method. The next method used was the modelling method. This method was a logical continuation of the previous method by which a new model was formulated. As a tool in modelling, there were used the block diagrams, which graphically showed all important elements and relations. The auxiliary method used was the documentation analysis method. It is a historical method and an integral part of the previous two methods. The aim of the paper is to increase the efficiency of the use of highly synthesized financial statements in bankruptcy management.

Bankruptcy, reorganization in bankruptcy, financial reporting, information system

Короткий адрес: https://sciup.org/170202176

IDR: 170202176 | УДК: 347.736:657.6 | DOI: 10.5937/ptp2203099S

Текст научной статьи The problem of synthesizing financial statements in reorganization during the bankruptcy process

G

The paper presents a model that uses highly synthesized financial data in bankruptcy with special emphasis on reorganization. The most business decisions are based on the certain business parameters which are recorded in the financial statements. Each business transaction is recorded and entered into the accounting system from which the financial statements are later created. Due to the large amount of the generated information during the business, transformation and summarization must take place but the only way to create the financial statements is the one that gives a general picture of the business.

The subject of this paper is solving problems arising from the use of highly synthesized financial statements. Namely, making decisions based on bad assessments can further jeopardize the already shaky business.

Synthesis is an established practice and is an integral part of every financial and accounting system. Balance sheets and income statements are characterized by the fact that they give a rough picture of the business condition of an organization. A system established in this way gives good results in most cases, especially when the business is successful. The problem arises when business is threatened, especially when organizations go toward bankrupt.

The aim of this paper is to increase the efficiency of the use of highly synthesized financial statements in bankruptcy. More precisely, using highly synthesized financial statements that are accurate and up-to-date. The ultimate goal is to create a decision-making system based on the actual state of the business.

Then, rough indicators are not of much greater importance, and thus the task of the management in bankruptcy is far more complex.

Modern business requires the use of robust accounting systems based on computer technology, so that the synthesized reports can be easily interpreted and returned to their original form. Various organizational and business techniques for organizational recovery often neglect the development of the organization’s information system, which includes the accounting system. It follows from this that a lot of the financial transactions are performed outside the established system, they are shown in the final account, taxes are paid, etc. but they are recorded outside the established accounting programs. The reason for this may be, among other things, the inability of the organization to service its debts of the information system maintenance, the departure of key people who know how to use the current accounting system and similarly.

2. Bankruptcy process and reorganization

Bankruptcy itself can have two outcomes, depending on whether it is possible to reach an agreement with the creditors. One outcome of the bankruptcy goes toward closing of the company by selling the entire property and by settling the creditors. „Bankruptcy occurs when a debtor’s assets are reduced to such an extent that his debts exceed the real basis on which they are based“ (Dukić-Mijatović, 2010, p. 15). So, servicing the debts from the current operations is hardly possible, and settling creditors from the entire property is also impossible. When a company goes bankrupt, debts are often above the amount of total capital. The second outcome is the reorganization, which aims primarily at regulating the mutual relations between creditors and the bankruptcy debtor. For this outcome, it is necessary to reach an initial plan and agreement with the creditors. This outcome is also strictly defined by the law, so that it must be met through legal and organizational conditions.

3. Accounting - financial system

Тhe accounting and financial system is an integral part of every company. Without these two parts it is difficult to imagine the business. With the advent of modern information systems, many accounting and financial functions have been automated. However, despite facilitating the work of the accounting and financial sector in terms of administration, these businesses are still heavily influenced by the human factor.

According to one of the definitions, accounting is: „The process of identifying, measuring and communicating economic information in order to assist in making decisions and decisions by information users“ (Collier, 2003, p. 3). The emphasis here is on monitoring the business process and measuring it.

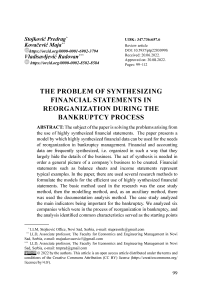

The previous picture 1. shows a rough scheme for synthesizing the final accounts. Namely, business books are formed from concrete data and information, which most often unite certain important elements of business. For example, books of suppliers, customers, etc. can be kept separately. This was done in the previous period to facilitate data processing manually. Through the process of abstraction, “superfluous” details are removed in order to finally obtain highly abstract, ie synthesized reports that can more easily monitor business. The balance sheet and income statements are perhaps the most important, but they also have the least details needed to analyse the business of a company. Namely, these reports belong to the highly synthesized reports that combine numerous categories and show only the general picture of the financial operations.

Picture 1. The problem of synthesizing final accounts.

Source: Author’s research.

Monitoring the work of the company is done with the help of various indicators, among which are the financial and accounting reports of the great importance. However, we also have shortcomings in this field, such as the emergence of the creative accounting practice. „Creative accounting implies all the actions of managers, employees or third parties that lead to the presentation of the desired, rather than the actual picture of the financial and profitable position of the company“ (Bešlić, 2013, p. 149). With bad reporting, the company’s management wants to mislead its partners, both external and internal.

“In our domestic scientific and professional literature,” Business Analysis “or” Business Analysis “has been largely replaced by the concept of” Balance Sheet Analysis “or” Financial Report Analysis “. It is indisputable that this analysis is important and unavoidable, because it is a basis for deciding on the 104

The economic and financial the reports

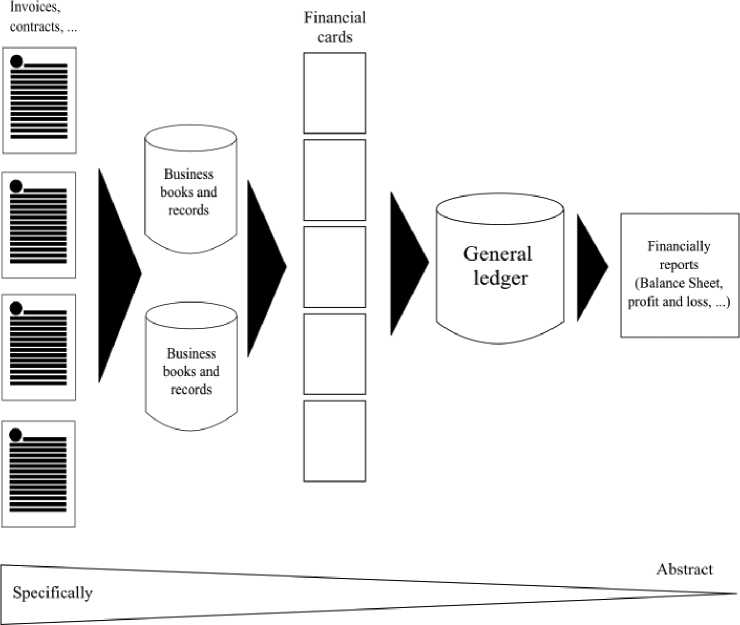

Picture 2. EFR creation.

Source: Author’s research.

The division of the financial statements according to the methods of analysis can be divided into two major groups, namely: qualitative and quantitative financial analysis. When we talk about the quantitative analyses, we mean “classical” analyses, which contain clearly and quantitatively processed data. On the other hand, qualitative analyses are related to the interpretation and elaboration of business ventures. Quantitative analyses can yield far different results than qualitative analyses, but freedom of interpretation can lead to erroneous results.

Financial analysis and accounting are the universal language of economics by which information can be easily and simply shared. From the reports that come from the domain of the finance, you can learn a lot of information such as the intentions of the company, business success, direction of further development and the like.

After the inventory and assessment performed by the bankruptcy trustee, a document called “Economic and Financial Report” (EFR) is created. This document is a rough assessment of business opportunities and the bankruptcy estate. In this segment, a detailed assessment of the assets performed by a certified appraiser under the new law is still not required. The EFR is presented to creditors so that they are aware of the state of the bankrupt company.

EFI is essentially a document standardized by the Rulebook on setting national standards for bankruptcy estate management (2018). Hereinafter, the Rulebook on Determining National Standards for Bankruptcy Estate Management will be called the National Standard. The purpose of the national standard is to set the framework in which the bankruptcy estate is managed, ie the way in which bankruptcy trustees approach the bankruptcy process. The national standard prescribes the norms that must be met.

4. Research

For the needs of the work, companies that are in the process of reorganization in bankruptcy were researched, and the following research methods were used:

The case study, here we mean the Harvard variant, which serves for the development of the critical thinking, comparative analyses, classifications and the like. They give the common characteristics of the observed object of research.

Modelling method with emphasis on graphical presentation of the obtained results of the previous method, in this way the system boundaries, essential elements, relations and fields of action of the system are presented.

Documentation analysis was used as an auxiliary method, this method permeates the previous two and is one of the historical methods.

Organizations that are in the process of reorganization were researched:

-

• Akcionarsko društvo Tigar Pirot,

-

• Akcionarsko društvo fabrika hartije Božo Tomić Čačak,

-

• Ikarbus A.D. Beograd,

-

• Građevinsko preduzeće Mostogradnja A.D. Beograd,

-

• Simpo A.D. Vranje,

-

• Dunav akcionarsko društvo Smederevo.

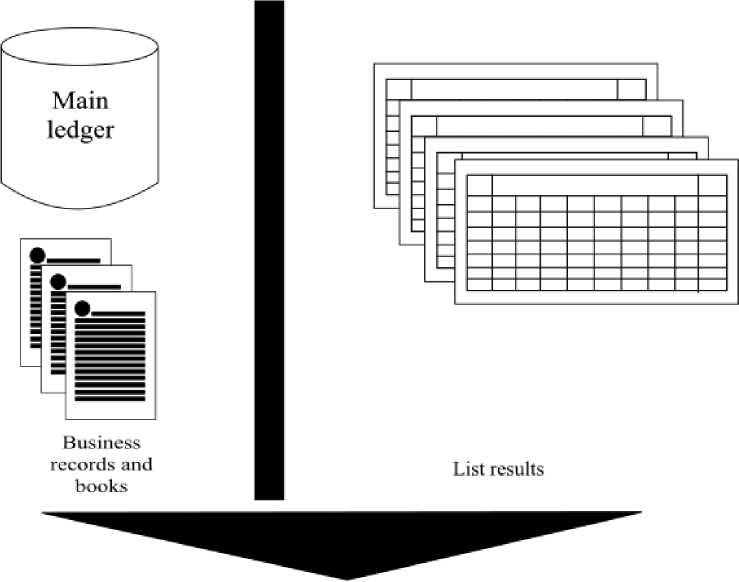

Each analyzed company will enter a certain knowledge about the reorganization process itself. Each company analyzed had its own dynamic growth, development and ultimately decline. Through the analysis of documentation, primarily reorganization plans, i.e. pre-prepared reorganization plans, then financial reports and additional documents, a comparative analysis is formed.

With the help of this analysis, it is possible to quickly see the common characteristics with the special emphasis on the financial reporting. Also, an analysis of the company's capacity in terms of collecting, processing and sharing financial information was performed.

A special focus in the research is on the interpretation of financial indicators by management, as well as the way they are presented. This analysis provides the basic elements of building the model presented in the next part of the paper.

From the previous analysis, it can be determined that the main carrier of financial information is mainly a mixture of electronic and paper forms. That is, the internal information system, in addition to the use of computers, was formed according to the system of “information archipelagos”. This means that only certain parts of the organization are covered by the information system, and it is often the case that business with external partners is conducted using a combination of paper and electronic forms.

The problem arises primarily in the insufficient efficiency of information collection as well as in the appearance of out-of-date information of a financial nature. An additional problem identified in the research process is the emergence of “creative” bookkeeping, ie making decisions based on misinformation.

Based on what has been said so far, a model based on feedback with the use of modern web technologies is given. The model provides a high degree of data up-to-dateness and transparency.

Table 1. Comparative analysis

Source: Author’s research.

|

O M > đ |

^ ° s S »TI

■fl c5 fl U A K O O D |

r S ° O .3 ° ^ g g « 2 Ch A 5 g 3 s j t> £ CD Q fl ^ fl £ fl |

|

Q < o o o s > |

'o cd cd 2 S |

2? O CD »5 .2 o § S 5 > ■§ a grigSrt • “ £ 1 S '« .2 I | |

|

M □ ”? 5P i 1 SŽ fl Tj cz> X i) o w C aS< |

2 S -g u § £ i U o S |

fl fl fl Q ° -S & ° S u g " S s o 2 £ g u g u “>;&■§ ° 2 o § g g ri ^ ^ ^ u 2 8 £ 3 O |

|

Q < fl fl S đ m |

° £ 2 o 5 2 2 S |

i ^ ^ 1s q§ C2 □ ^ .2 .2 oPh ^ 3 o .2 |

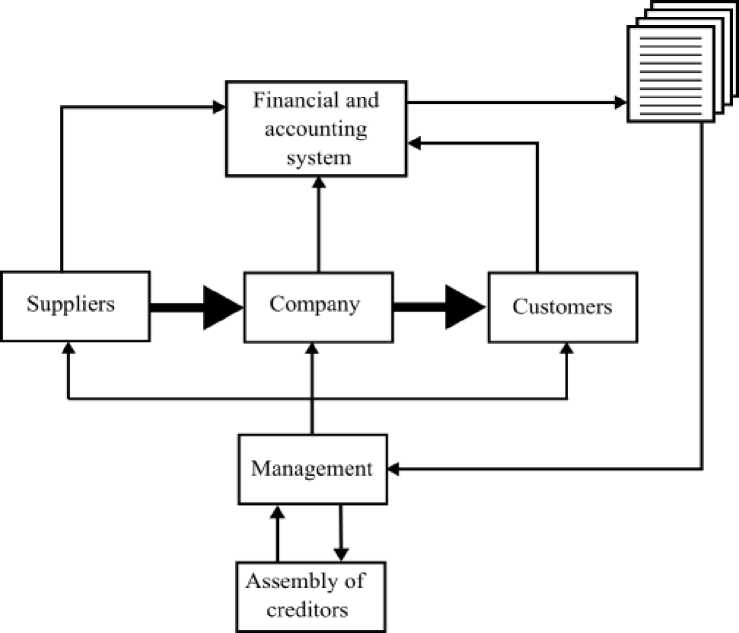

Picture 3. Model of analysis of synthesized financial information. Source: Author’s research.

The model is based on feedback and information systems inside and outside the company. Without the use of the adequate information systems, the presented model could hardly be possible. In this model, financial statements are considered outputs that are subject to detailed analysis. Bold lines between suppliers, companies and customers indicate material flow, all other flows are essentially informational.

5. Conclusion

Without constant checks of the actual state of business, companies that are in reorganization in the bankruptcy procedure must have a more realistic picture of business. The assembly of creditors can very quickly vote for bankruptcy if the debtor does not stick to the plans. In order to create the most realistic picture of the business, it is necessary to apply information technologies and respect the procedures related to information handling. A mitigating circumstance is that the technologies needed to build such a model are widely used and do not require a drastic increase in costs.

Stojković Predrag

Kancelarija Stojković, Novi Sad, Srbija

Kovačević Maja

Fakultet za ekonomiju i inženjerski menadžment u Novom Sadu, Srbija

Vladisavljević Radovan

Fakultet za ekonomiju i inženjerski menadžment u Novom Sadu, Srbija

PROBLEM SINTETIZACIJE FINANSIJSKIH IZVEŠTAJA U REORGANIZACIJI PRILIKOM VOĐENJA PROCESA STEČAJA

REZIME: Predmet rada je rešavanje problema koji proizilaze iz upotrebe visoko sintetizovanih finansijskih izveštaja. U radu je prikazan model kojim se visoko sintetizovani finansijski podaci mogu koristiti za potrebe reorganizacije prilikom vođenja stečaja. Finansijsko-računovodstveni podaci su najčešće sintetizovani, odnosno tako organizovani da u velikoj meri sakrivaju detalje poslovanja. Čin sintetizacije je potreban kako bi se stvorila opšta slika o poslovanju jednog preduzeća, finansijski izveštaji poput bilansa stanja i uspeha su karakteristični primeri. U radu je korišćeno nekoliko istraživačkih metoda pomoću kojih se formulisao model za efikasnu upotrebu visoko sintetizovanih finansijskih izveštaja. Osnovna metoda koja je korišćena u istraživanju jeste metoda studije slučaja zatim metoda modelovanja, a kao pomoćna metoda korišćena je analiza dokumentacije. Studijom slučaja analizirani su glavni pokazatelji koji su važni za stečaj. Analizirano je šest preduzeća koja su u procesu reorganizacije u stečaju. Analizom su utvrđene zajedničke karakteristike koje su poslužile kao početne tačke za narednu metodu. Sledeća metoda koja je korišćena jeste metoda modelovanja, ova metoda je logični nastavak prethodne metode kojom se formulisao novi model. Kao alat u modelovanju upotrebljene su blok šeme kojom su grafički prikazani svi bitni elementi i relacije. Pomoćna metoda koja je upotrebljena jeste metoda analize dokumentacije, ovo je istorijska metoda i sastavni je do prethodne dve metode. Cilj rada je usmeren na povećanje efikasnosti upotrebe visoko sintetizovanih finansijskih izveštaja prilikom vođenja stečaja.

Ključne reči: stečaj, reorganizacija u stečaju, finansijsko izveštavanje, informacioni sistem.

Список литературы The problem of synthesizing financial statements in reorganization during the bankruptcy process

- Dukić-Mijatović, M. (2010). Vodič kroz stečajni postupak: osvrt na stečajno zakonodavstvo bivših jugoslovenskih republika [A guide to bankruptcy proceedings: a review of the bankruptcy legislation of the former Yugoslav republics]. Novi Sad: Mala knjiga

- François, P., & Raviv, A. (2017). Heterogeneous beliefs and the choice between private restructuring and formal bankruptcy, The North American Journal of Economics and Finance, 41, pp. 156–167, https://doi.org/10.1016/J.NAJEF.2017.04.006

- Kale, V. (2018). Creating Smart Enterprises: Leveraging Cloud, Big Data, Web, Social Media, Mobile and IoT Technologies,New York: Auerbach Publications

- Bauer, F., Dao, M. A., Matzler, K., & Tarba, S. Y. (2017). How industry lifecycle sets boundary conditions for M&A integration. Long Range Planning, 50 (4), pp. 501–517, DOI: 10.1016/j.lrp.2016.09.002

- Dragojlović, J., Milošević, I., & Stamenković, G. (2019). Krivično delo prouzrokovanje stečaja: specifičnosti i obeležja [Criminal offense of causing bankruptcy: specifics and features]. Pravo - teorija i praksa, 36 (1/3), pp. 16–30, DOI: 10.5937/ptp1901016D

- Collier, C., P. (2003). Accounting for Managers: Interpreting accounting information for decision-making, San Francisco: John Wiley & Sons

- Turban, E., Pollard, C., & Wood, G. (2018). Information Technology for Management: On-Demand Strategies for Performance, Growth and Sustainability, Eleventh Edition, Wiley: Hoboken

- Bešlić, D., & Bešlić, I. (2013). Stečaj privrednog društva kao posledica manipulativnog finansijskog izveštavanja [Bankruptcy of the company as a consequence of manipulative financial reporting]. Škola biznisa, (3/4), pp. 148–159

- Malešević, N., Đ., & Čavlin, S., M. (2009). Poslovna analiza [Business analysis]. Novi Sad: Fakultet za ekonomiju i inženjerski menadžment u Novom Sadu

- Pravilnik o utvrđivanju nacionalnih standarda za upravljanje stečajnom masom [Ordinance on the establishment of national standards for the management of the bankruptcy estate]. Službeni glasnik RS, br. 62/18

- Nobles, T., Mattison, B., & Matsumura, M., E. (2015). Horngren’s Accounting, Tenth edition, Boston: Pearson